Blank Irs 14242 PDF Template

The integrity of the tax system is maintained through the vigilant oversight of both the public and the Internal Revenue Service (IRS), a cornerstone of which is Form 14242. Released in October 2016 by the Department of the Treasury, this form is a critical tool for reporting suspicious activities that undermine the fiscal foundations of the country. It specifically targets the reporting of abusive tax avoidance schemes and the preparers who promote such strategies. The backdrop to this form's importance is the vast array of information available on the IRS's official website regarding tax scams, which underscores the agency's commitment to combating fraudulent activities. By filling out Form 14242, individuals can describe suspected tax schemes, detail their encounters with these promotions, and provide information about the promoters, including personal and contact information. Interestingly, the form also offers the possibility of a reward for the information provided, linking to Form 211 for those wishing to apply. This potential reward underscores the value placed on civic engagement in protecting the tax system. Furthermore, the form is structured to accommodate expansive details, showcasing the IRS's thorough approach to investigation. It serves not just as a means of reporting but also as a deterrent to would-be abusers of the tax code. The meticulous collection of promotional materials and detailed questions indicate a comprehensive strategy to identify, investigate, and penalize fraudulent tax activities, thereby protecting the integrity of the tax system and ensuring fairness for all taxpayers.

Preview - Irs 14242 Form

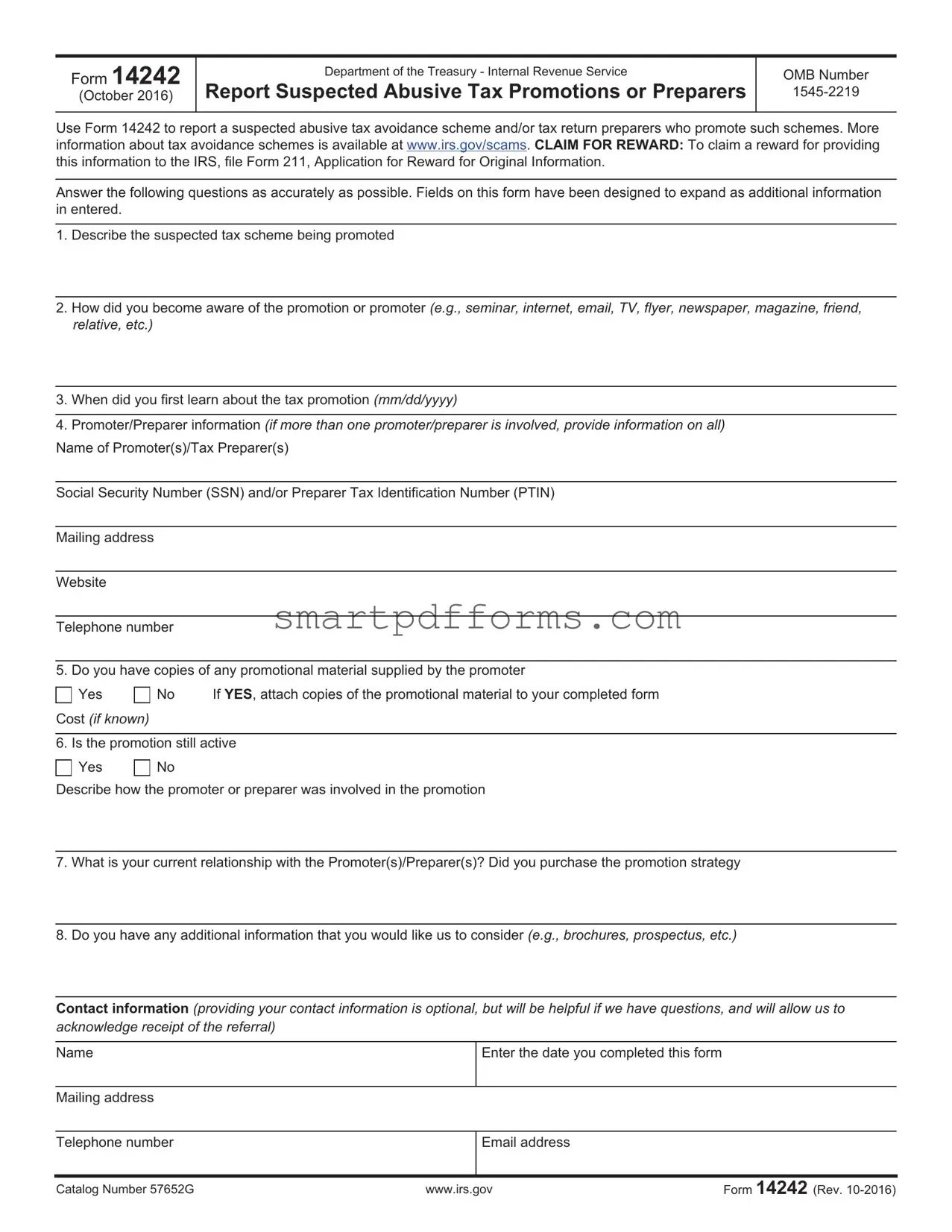

Form 14242

(October 2016)

Department of the Treasury - Internal Revenue Service

Report Suspected Abusive Tax Promotions or Preparers

OMB Number

Use Form 14242 to report a suspected abusive tax avoidance scheme and/or tax return preparers who promote such schemes. More information about tax avoidance schemes is available at www.irs.gov/scams. CLAIM FOR REWARD: To claim a reward for providing this information to the IRS, file Form 211, Application for Reward for Original Information.

Answer the following questions as accurately as possible. Fields on this form have been designed to expand as additional information in entered.

1.Describe the suspected tax scheme being promoted

2.How did you become aware of the promotion or promoter (e.g., seminar, internet, email, TV, flyer, newspaper, magazine, friend, relative, etc.)

3.When did you first learn about the tax promotion (mm/dd/yyyy)

4.Promoter/Preparer information (if more than one promoter/preparer is involved, provide information on all)

Name of Promoter(s)/Tax Preparer(s)

Social Security Number (SSN) and/or Preparer Tax Identification Number (PTIN)

Mailing address

Website

Telephone number

5. Do you have copies of any promotional material supplied by the promoter

Yes

Cost (if known)

No |

If YES, attach copies of the promotional material to your completed form |

6. Is the promotion still active

Yes

No

Describe how the promoter or preparer was involved in the promotion

7.What is your current relationship with the Promoter(s)/Preparer(s)? Did you purchase the promotion strategy

8.Do you have any additional information that you would like us to consider (e.g., brochures, prospectus, etc.)

Contact information (providing your contact information is optional, but will be helpful if we have questions, and will allow us to acknowledge receipt of the referral)

Name

Enter the date you completed this form

Mailing address

Telephone number

Email address

Catalog Number 57652G |

www.irs.gov |

Form 14242 (Rev. |

Page 2 of 2

FAX your completed form to: (877)

Mail the completed form to:

Internal Revenue Service

Lead Development Center Stop MS5040

24000 Avila Road

Laguna Niguel, CA 92677

(IRS Employees ONLY SHOULD

Privacy Act and Paperwork Reduction Act Notice

This information is solicited under authority of 5 U.S.C. 301, 26 U.S.C. 7801 and 26 U.S.C. 7803. The primary purpose of this form is to report violation of the Internal Revenue laws.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal

Providing this information is voluntary. Not providing all or part of the information will not affect you. Providing false or fraudulent information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is: Preparing and sending the form to the IRS should involve 10 minutes. If you have comments concerning the accuracy of the time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the IRS at the address listed in the Instructions.

Catalog Number 57652G |

www.irs.gov |

Form 14242 (Rev. |

Form Data

| Fact Name | Detail |

|---|---|

| Form Title | Report Suspected Abusive Tax Promotions or Preparers |

| Form Number | 14242 |

| Revision Date | October 2016 |

| Issuing Body | Department of the Treasury - Internal Revenue Service |

| Purpose | Used to report a suspected abusive tax avoidance scheme and/or tax return preparers who promote such schemes. |

| OMB Number | 1545-2219 |

| Additional Information Source | More information about tax avoidance schemes is available at www.irs.gov/scams. |

| Claim for Reward | To claim a reward for providing this information, file Form 211, Application for Reward for Original Information. |

| Privacy Act and Paperwork Reduction Act Notice | Collects information primarily to report violation of Internal Revenue laws, with potential disclosure for legal and tax treaty purposes. |

| Average Time to Complete | Estimated average time is 10 minutes for preparing and sending the form. |

Instructions on Utilizing Irs 14242

Filling out the IRS Form 14242 is an important step in reporting suspected abusive tax promotions or preparers. This form is a tool provided by the Internal Revenue Service to protect the integrity of the tax system by identifying and addressing schemes that avoid tax obligations through questionable means. As individuals take the initiative to submit this form, they contribute to the efforts of maintaining fair tax practices. Carefully providing accurate and comprehensive information can significantly assist in the investigation process. After submitting this form, it may lead to a more in-depth examination by the IRS to verify the details of the report. It's crucial to gather all relevant documentation and information beforehand to ensure the report is as detailed and helpful as possible.

- Step 1: Clearly describe the suspected tax scheme being promoted, including how it operates and the benefits it claims to offer.

- Step 2: Detail how you became aware of the promotion or the promoter. Mention the medium through which you learned about it, such as via a seminar, the internet, email, television, flyer, or personal referral.

- Step 3: Indicate the date when you first learned about the tax promotion, using the format mm/dd/yyyy.

- Step 4: Provide information about the promoter(s) or tax preparer(s) involved. If multiple parties are involved, include details for each, covering their names, Social Security Numbers (SSN) or Preparer Tax Identification Numbers (PTIN), mailing addresses, websites, and telephone numbers.

- Step 5: Answer whether you have copies of any promotional material supplied by the promoter. If you do, attach these copies to your completed form. Also, include the cost of the promotion if it is known.

- Step 6: Specify if the promotion is still active and describe how the promoter or preparer was involved in the promotion.

- Step 7: Mention your current relationship with the promoter(s) or preparer(s) and whether you purchased the promotion strategy.

- Step 8: If you have any additional information that could be relevant to the investigation, such as brochures or prospectuses, mention that you do and consider including it with your submission.

- Step 9: Provide your contact information, including name, mailing address, telephone number, and email address. Remember, providing your contact information is optional but can be helpful if the IRS has follow-up questions or needs to acknowledge receipt of your report.

- Step 10: Enter the date you completed the form. Then, decide whether to fax or mail your completed form. To fax, use the number (877) 477-9135. If mailing, send to Internal Revenue Service, Lead Development Center, Stop MS5040, 24000 Avila Road, Laguna Niguel, CA 92677.

Completing and submitting IRS Form 14242 is a significant step in combating abusive tax schemes. By providing detailed and accurate information, you assist the IRS in ensuring everyone pays their fair share of taxes. It's essential to review all the information you provide carefully and to attach any relevant documentation that could support your report. This form is more than just paperwork; it's a contribution to the fairness and integrity of the tax system.

Obtain Answers on Irs 14242

What is IRS Form 14242?

IRS Form 14242, also known as the "Report Suspected Abusive Tax Promotions or Preparers" form, is a document used to report potentially abusive tax avoidance schemes and the tax return preparers who promote such schemes to the Internal Revenue Service (IRS). It allows individuals to notify the IRS of activities that may involve fraud or significant non-compliance with tax laws.

Why should I report suspect tax schemes using Form 14242?

Reporting suspected tax avoidance schemes helps maintain the integrity of the tax system and ensures fairness for all taxpayers. By identifying promoters of abusive tax schemes, the IRS can investigate and take necessary actions to prevent tax fraud and evasion, protecting the government's revenue and taxpayer interests.

Can I claim a reward for reporting a suspected tax scheme?

Yes, individuals who report suspected tax schemes using Form 14242 can claim a reward for providing this information to the IRS. To do so, they must additionally file Form 211, Application for Reward for Original Information, detailing the information provided and the claim for a reward.

What information is required when completing Form 14242?

When completing Form 14242, you're required to provide a description of the suspected tax scheme, how you became aware of the scheme, the date you first learned about it, information about the promoter/preparer (including names, contact details, and if applicable, Social Security Number or Preparer Tax Identification Number), whether promotional material is available, and your relationship with the promoter/preparer. You may also include any additional relevant information you believe the IRS should consider.

Is it necessary to attach promotional materials to Form 14242?

While not mandatory, if you have copies of any promotional materials supplied by the promoter of the suspected abusive tax scheme, attaching these to your completed Form 14242 can provide valuable evidence for the IRS investigation. Indicate on the form whether such materials are available and have been attached.

What should I do if I don’t know all the information requested on Form 14242?

Provide as much information as possible when completing Form 14242. If certain details are unknown or unavailable, it's still important to submit the form with the information you have. The IRS can use any provided details to initiate or support an investigation. Not providing all requested information will not negatively affect you.

How can I submit Form 14242 to the IRS?

Form 14242 can be submitted to the IRS either by fax or mail. To fax, use the number (877) 477-9135. To mail, address the completed form to the Internal Revenue Service Lead Development Center, Stop MS5040, 24000 Avila Road, Laguna Niguel, CA 92677. The form ensures the information reaches the relevant department for action.

Is my information confidential when reporting a tax scheme?

Yes, information submitted on Form 14242 is kept confidential in accordance with IRS policies and regulations. The Privacy Act and Paperwork Reduction Act Notice outlines the routine uses of the information collected, including disclosures to the Department of Justice for legal actions and other federal or state agencies as needed. Your confidentiality and privacy are protected throughout the process.

What happens after I submit Form 14242?

After submission, Form 14242 is reviewed by the IRS. If further information or clarification is needed, the IRS may contact you using the details provided. The form’s submission initiates an investigation process into the reported scheme or promoter, but the IRS typically does not disclose specific actions taken or outcomes of these investigations to the individual who reported the information.

Common mistakes

When filling out IRS Form 14242 to report suspected abusive tax avoidance schemes or preparers, people often make mistakes that can impact the review process. Avoiding these common errors can help ensure the information provided is clear and useful for investigation.

Not providing specific descriptions of the abusive tax scheme being promoted. A vague overview makes it harder for the IRS to understand the issue.

Forgetting to include how they became aware of the tax promotion or preparer, which is critical for the IRS to identify the spread and reach of the scheme.

Omitting the date they first learned about the tax scheme. Knowing when a taxpayer became aware of the scheme can help in timeline reconstruction and urgency assessment.

Leaving out contact information for the promoter/preparer, including their name, SSN/PTIN, mailing address, website, and phone number, which are crucial for follow-up.

Failing to specify whether promotional material can be provided. Including copies of promotional materials can offer concrete evidence of the scheme.

Not indicating the activity status of the promotion, i.e., whether it is still active or not, which helps the IRS in prioritizing cases.

Correctly filling in as much information as possible on Form 14242 helps the IRS in the efficient processing and investigation of reported abusive tax avoidance schemes and preparers.

Documents used along the form

When addressing concerns about abusive tax practices, individuals are often guided to use form 14242, a document that facilitates the reporting of suspicious schemes to the Internal Revenue Service (IRS). As individuals navigate the intricacies of addressing potentially fraudulent activities, a set of complementary forms and documents usually comes into play, serving to augment the information provided or to claim rewards for reporting such activities.

- Form 211, Application for Reward for Original Information: This form is essential for individuals looking to claim a reward after reporting a tax scheme using Form 14242. It requires detailed information regarding the nature of the reported tax violation and the specific evidence provided.

- Form 3949-A, Information Referral: This document is used for reporting suspected tax law violations by an individual, a business, or both. It covers a broad range of misconducts, including false exemptions, deductions, or credits, and is not limited to abusive tax avoidance schemes.

- Form 8857, Request for Innocent Spouse Relief: This form might be necessary if an individual needs to seek relief from joint tax liabilities caused by a spouse (or former spouse) engaging in an abusive tax scheme. It allows the requester to be relieved of responsibility for paying tax, interest, and penalties if certain conditions are met.

- Publication 3833, Disaster Relief, Providing Assistance Through Charitable Organizations: In situations where abusive tax promotions involve charitable organization schemes, this publication offers guidelines on how to legally provide disaster relief through these organizations. It helps differentiate between legitimate charitable activities and those constructed to abuse tax laws.

These forms and documents collectively support the framework within which individuals can report, document, and potentially receive compensation for highlighting tax avoidance schemes. While Form 14242 initiates the process, the associated documents ensure that the report is comprehensive and that the reporter has access to resources that could address their particular situation or provide the relevant authorities with the necessary insight to take action.

Similar forms

Form 3949-A, Information Referral: Similar to Form 14242, Form 3949-A is used to report fraudulent activities related to taxes but focuses broadly on tax fraud or evasion, not specifically on abusive tax schemes. Both forms allow individuals to provide comprehensive information about the suspect activities, including the identification of the individuals involved and a description of the alleged fraud.

Form 211, Application for Reward for Original Information: Mentioned within the Form 14242 instructions for claiming a reward, Form 211 is directly related as it is used to apply for a reward for reporting tax law violations. While Form 14242 is for reporting suspicious activities, Form 211 is the follow-up for the reporter seeking a reward for their information.

Form 8833, Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b): This form involves disclosure related to tax treaties and could intersect with Form 14242 when an abusive tax scheme involves misinterpretation or misuse of tax treaties to avoid taxes. Both forms are part of ensuring compliance with tax laws and proper use of treaties.

Form 8275, Disclosure Statement: Similar in its purpose of promoting transparency, Form 8275 is used to disclose items or positions taken on a tax return that are not otherwise adequately disclosed on a tax return to avoid penalties. It parallels Form 14242, which aims to bring to light questionable tax avoidance schemes.

Form 8886, Reportable Transaction Disclosure Statement: Both Form 14242 and Form 8886 are concerned with disclosing questionable tax practices. However, Form 8886 is specifically used by taxpayers to disclose reportable transactions, including those that could potentially be abusive tax shelters, indicating a focus on compliance and prevention of tax avoidance schemes.

Form 4506, Request for Copy of Tax Return: While this form is primarily used to request past tax returns, it’s tangentially related to Form 14242 since individuals investigating or having reported a tax scheme may need copies of their tax returns as part of the process to provide evidence or further details regarding the abusive tax promotion or preparer.

Dos and Don'ts

When completing the IRS Form 14242, it’s crucial to approach the process with diligence and integrity. This form plays a pivotal role in identifying and reporting potentially abusive tax avoidance schemes, which are detrimental to fair tax administration. Here are some fundamental dos and don’ts to adhere to:

Dos:

Provide detailed descriptions: When describing the suspected abusive tax scheme, offer as much detail as possible. Specifics about how the scheme operates and its impact on tax obligations can significantly aid the IRS in their investigation.

Be accurate with dates: Accurately stating when you became aware of the tax scheme helps the IRS understand the timeline and potentially identify how long the scheme has been in operation.

Include promoter/preparer information: If you have names, addresses, or other contact information for the individuals promoting the tax scheme, include all of it. This information is crucial for the IRS to identify and investigate the promoters.

Attach promotional materials: If you have brochures, flyers, or other materials relating to the scheme, attach these to your report. These materials can provide invaluable evidence for the IRS.

Report active promotions: Indicate if you know the promotion to still be active. Active schemes may require swift action to prevent further tax abuse.

Provide your contact information: While optional, providing your contact details can assist the IRS if they need to follow up for more information or to clarify the information you've provided.

Don'ts:

Avoid vague descriptions: General or ambiguous descriptions of the tax scheme make it challenging for the IRS to understand and investigate your report. Be as specific and thorough as possible.

Skip details about how you discovered the scheme: The source of your awareness can be crucial in understanding the reach and method of promotion of the scheme.

Omit known costs: If you’re aware of what the promoters are charging for their tax avoidance schemes, including this information can be helpful. Costs can provide insight into the scheme's profitability and scale.

Leave out promotional material: Failure to attach promotional material, if available, misses an opportunity to give the IRS direct evidence of the scheme.

Report inaccurately: Reporting schemes that you suspect without having direct knowledge or evidence can lead to unnecessary investigations. Make sure your report is based on what you know or have personally experienced.

Forget to review your submission: Before sending in the form, review your answers to ensure accuracy and completeness. Overlooking this step may result in missed critical information.

Misconceptions

Understanding the Form 14242 and correcting common misconceptions helps ensure that the IRS receives accurate reports on abusive tax schemes. Here are six common misconceptions explained:

Only tax professionals can file Form 14242. Anyone who has information about a suspected abusive tax scheme or a tax return preparer involved in such schemes can file this form. It's not limited to professionals.

Filing Form 14242 automatically entitles you to a reward. To seek a reward, you must file Form 211, Application for Reward for Original Information, in addition to Form 14242. Filing Form 14242 alone does not guarantee a reward.

Filing this form will lead to an immediate investigation by the IRS. While filing Form 14242 is a crucial step in reporting abusive tax schemes, the IRS has a process to review each submission. Immediate action is not guaranteed, as each case is evaluated individually.

You need to have suffered a financial loss to report a scheme. You don't need to be directly affected or suffer a loss from the tax scheme to report it. The IRS welcomes information from anyone aware of such activities.

All fields in the form must be filled out in order for it to be processed. While providing as much detailed information as possible is helpful, not all fields are mandatory. If certain information is not available, the form can still be submitted. However, including contact information can be helpful if the IRS has follow-up questions.

The form can only be sent via mail. Form 14242 can also be faxed to the number provided on the form. This offers an alternative method for submitting the form more quickly than mailing it.

By understanding and correcting these misconceptions, individuals are better equipped to report questionable tax activities to the IRS effectively.

Key takeaways

Form 14242 is used to report suspicious tax avoidance schemes and the tax preparers who promote them. Understanding how and when to use this form is crucial. Here are key takeaways to remember:

- Identify Abusive Schemes: Use Form 14242 to report any suspected tax avoidance plans that may seem abusive or illegal.

- Information Required: You'll need to thoroughly describe the scheme, detail how you became aware of it, include promoter/preparer information, and specify if the promotion is still active.

- Documentation: Attach copies of promotional materials provided by the promoter if available. These materials are important for the IRS to assess the situation.

- Promoter Details: Gather as much information as possible about the promoter, including their name, contact details, and identification numbers like SSN or PTIN.

- Relationship Disclosure: Describe your relationship with the promoter/preparer, including whether you engaged with the tax avoidance strategy being offered.

- Active Promotion Status: Indicate whether the tax scheme is still being actively promoted, which helps the IRS in potential immediate action.

- Claiming a Reward: If seeking a reward for reporting the information, you must file Form 211 in addition to Form 14242.

- Voluntary Contact Information: Providing your contact details is optional but beneficial for follow-up questions and receiving an acknowledgment of your report.

- Privacy Considerations: The IRS outlines how the information you provide is used, assuring confidentiality except under certain circumstances like legal actions or enforcement of federal non-tax criminal laws.

- Submission Instructions: Completed forms can be faxed or mailed to the IRS, with specific instructions and addresses provided on the form itself.

Become familiar with the details and instructions of Form 14242 to ensure you're providing complete and helpful information to the IRS. Reporting abusive tax promotions and preparers is a significant step towards maintaining the integrity of the tax system.

Popular PDF Forms

Certificate of Appreciation Wording Samples - This form acts as a testament to a trainee's successful completion of legally required training for licensure in private security and associated professions, aligned with Illinois statutes.

Mo Tax Forms - By completing the Missouri tax return request form, you're safeguarding your financial interests with official copies of your tax history.

Florida Homeschool Requirements - The form serves as a foundational document in creating a structured, legally recognized home education program.