Blank IRS 211 PDF Template

The IRS 211 form plays a crucial role in ensuring the integrity of our tax system, offering individuals a pathway to report potentially underreported or evaded taxes by others. This form, while not widely discussed, serves as a bridge for those willing to provide valuable information that could lead to the recovery of unpaid taxes, thereby contributing to the fairness and effectiveness of tax administration. Individuals who submit this form may also be eligible for a reward, a factor that underscores the emphasis on encouraging public participation in uncovering tax noncompliance. The process of filling out and submitting the form comes with its own set of guidelines, designed to protect the privacy of the informant while also laying out the kind of information that is deemed useful for investigation. Understanding the major aspects of the IRS 211 form is important for anyone considering reporting tax violations, as it highlights not just the potential financial incentives but also the broader impact of such actions on ensuring that all entities pay their fair share of taxes.

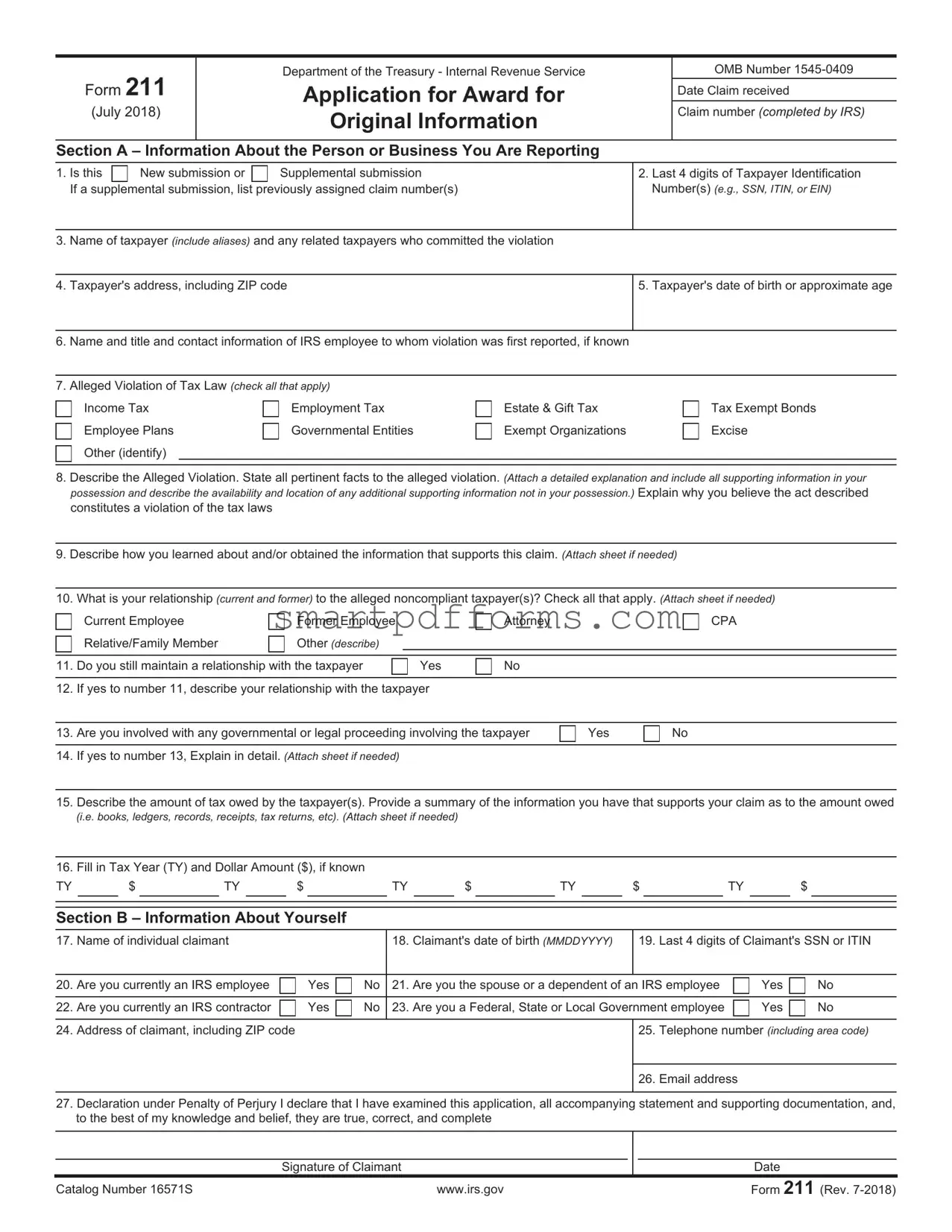

Preview - IRS 211 Form

|

Form 211 |

|

Department of the Treasury - Internal Revenue Service |

|

OMB Number |

|

|

|

Application for Award for |

|

Date Claim received |

||

|

|

|

|

|

|

|

|

(July 2018) |

|

Original Information |

|

Claim number (completed by IRS) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Section A – Information About the Person or Business You Are Reporting |

|

|

||||

1. |

Is this |

New submission or |

Supplemental submission |

2. Last 4 digits of Taxpayer Identification |

||

|

If a supplemental submission, list previously assigned claim number(s) |

Number(s) (e.g., SSN, ITIN, or EIN) |

||||

|

|

|

|

|

||

3. |

Name of taxpayer (include aliases) and any related taxpayers who committed the violation |

|

|

|||

4. Taxpayer's address, including ZIP code

5. Taxpayer's date of birth or approximate age

6.Name and title and contact information of IRS employee to whom violation was first reported, if known

7.Alleged Violation of Tax Law (check all that apply)

Income Tax |

Employment Tax |

Estate & Gift Tax |

Tax Exempt Bonds |

Employee Plans |

Governmental Entities |

Exempt Organizations |

Excise |

Other (identify) |

|

|

|

|

|

|

|

8.Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws

9.Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed)

10.What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed)

|

Current Employee |

Former Employee |

|

Attorney |

|

CPA |

|

Relative/Family Member |

Other (describe) |

|

|

|

|

|

|

|

|

|

|

|

11. |

Do you still maintain a relationship with the taxpayer |

Yes |

No |

|

|

|

|

|

|

|

|

||

12. |

If yes to number 11, describe your relationship with the taxpayer |

|

|

|

||

|

|

|

|

|||

13. |

Are you involved with any governmental or legal proceeding involving the taxpayer |

Yes |

No |

|||

14.If yes to number 13, Explain in detail. (Attach sheet if needed)

15.Describe the amount of tax owed by the taxpayer(s). Provide a summary of the information you have that supports your claim as to the amount owed

(i.e. books, ledgers, records, receipts, tax returns, etc). (Attach sheet if needed)

16.Fill in Tax Year (TY) and Dollar Amount ($), if known

TY $TY $TY $TY $TY $

Section B – Information About Yourself

17. |

Name of individual claimant |

|

|

18. |

Claimant's date of birth (MMDDYYYY) |

19. |

Last 4 digits of Claimant's SSN or ITIN |

||

|

|

|

|

|

|

|

|

|

|

20. |

Are you currently an IRS employee |

Yes |

No |

21. |

Are you the spouse or a dependent of an IRS employee |

Yes |

No |

||

|

|

|

|

|

|

|

|

||

22. |

Are you currently an IRS contractor |

Yes |

No |

23. |

Are you a Federal, State or Local Government employee |

Yes |

No |

||

|

|

|

|

|

|

|

|

||

24. |

Address of claimant, including ZIP code |

|

|

|

|

25. |

Telephone number (including area code) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

27.Declaration under Penalty of Perjury I declare that I have examined this application, all accompanying statement and supporting documentation, and, to the best of my knowledge and belief, they are true, correct, and complete

Signature of Claimant

Date

Catalog Number 16571S |

www.irs.gov |

Form 211 (Rev. |

Page 2

Instructions for Form 211, Application for Award for Original Information

General Information: The Whistleblower Office has responsibility for the administration of the whistleblower award program under section 7623 of the Internal Revenue Code. Section 7623 authorizes the payment of awards from the proceeds of amounts the Government collects as a result of the information provided by the whistleblower. A claimant must file a formal claim for award by completing and sending Form 211, Application for Award for Original Information, to be considered for the Whistleblower Program.

Send completed form along with any supporting information to: Internal Revenue Service Whistleblower Office - ICE 1973 N. Rulon White Blvd. M/S 4110

Ogden, UT 84404

Instructions for Completion of Form 211:

Question 1 If you have not previously submitted a Form 211 regarding the same or similar

If you are providing additional information regarding the same or similar

Questions 2 – 5 Information about the Taxpayer – Provide the taxpayer’s name, address, taxpayer identification number – last 4 digits (if known), and the taxpayer’s date of birth or approximate age.

Question 6 If you reported the violation to an IRS employee; please provide the employee’s name, title and the date the violation was reported. If known, provide contact information.

Questions 7 - 8 Indicate the type of tax that has not been paid or the tax liability that has not been reported and describe the alleged violation. Explain why you believe the act described constitutes a violation of the tax laws. Attach all supporting documentation (for example, books and records) to substantiate the claim. If documents or supporting evidence are not in your possession, describe these documents and their location.

Questions 9 - 14 These questions ask how and when you learned of the alleged violation and what relationship, if any, you have to the taxpayer.

Questions 15 – 16 These questions are asking for an estimate of the tax owed and the years/periods that the tax applies.

Questions 17 – 26 Information about the claimant – Provide the claimant’s name, address, date of birth, SSN or ITIN (last 4 digits), email address, and telephone number.

Question 27 Information provided in connection with a claim under this provision of law must be made under an original signed Declaration under Penalty of Perjury. For joint or multiple claimants. Form 211 must be signed by each claimant.

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the internal revenue laws of the United States. Our authority to ask for this information is 26 USC 6109 and 7623. We collect this information for use in determining the correct amount of any award payable to you under 26 USC 7623. We may disclose this information as authorized by 26 USC 6103, including to the subject taxpayer(s) as needed in a tax compliance investigation and to the Department of Justice for civil and criminal litigation. You are not required to apply for an award. However, if you apply for an award you must provide as much of the requested information as possible. Failure to provide information may delay or prevent processing your request for an award; providing false information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Generally, tax returns and return information are confidential, as required by 26 U.S.C. 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is 45 minutes. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can email us at *taxforms@irs.gov (please type "Forms Comment" on the subject line) or write to the Internal Revenue Service, Tax Forms Coordinating Committee, SE: W: CAR: MP: T: T: SP, 1111 Constitution Ave. NW,

Send the completed Form 211 to the above Ogden address of the Whistleblower Office. Do NOT send the Form 211 to the Tax Forms Coordinating Committee.

Catalog Number 16571S |

www.irs.gov |

Form 211 (Rev. |

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 211 is used for reporting alleged tax law violations by an individual or a business. |

| Eligibility for Reward | Individuals who submit information that leads to the collection of taxes, penalties, and interest may be eligible for a reward. |

| Confidentiality | The identity of individuals reporting tax law violations is kept confidential by the IRS. |

| Governing Law | The procedures and rewards related to IRS Form 211 are governed by federal tax law and regulations. |

Instructions on Utilizing IRS 211

Filling out the IRS Form 211 involves a straightforward process that aims to gather specific information required by the Internal Revenue Service (IRS). Following the correct steps ensures that the form is accurately completed, which facilitates the processing of the information provided. Once the form has been filled out and submitted, it is evaluated by the IRS for further actions. The instructions outlined below are designed to assist individuals in completing the form efficiently and correctly.

- Start by downloading the latest version of the IRS Form 211 from the official IRS website to ensure you have the most current form.

- Read through the entire form first to familiarize yourself with the type of information required.

- Enter your personal information including your full name, mailing address, and social security number or tax identification number in the designated sections.

- If applicable, fill in your daytime phone number and email address to facilitate communication.

- Provide detailed information about the alleged tax noncompliance, including the name of the person or entity, their address, and the tax years involved.

- Describe the violation you are reporting. Include specific details such as dates, the nature of the violation, how you became aware of it, and any supporting evidence you may have. Remember, clarity and detail are crucial for the IRS to assess the situation.

- Estimate the amount of tax owed, if possible. Providing a precise figure is helpful but not mandatory.

- Sign and date the form in the designated area. Your signature attests to the truthfulness and accuracy of the information provided.

- Review the form to make sure all necessary sections are completed and that the information is accurate and truthful.

- Mail the filled-out form to the IRS at the address provided on the form or in the accompanying instructions.

After the form has been submitted, it is reviewed by the IRS. The agency may contact you for additional information if needed. Note that the review process can be lengthy, so patience is required. It's important to retain a copy of the form and any correspondence for your records.

Obtain Answers on IRS 211

-

What is an IRS 211 form?

The IRS 211 form, also known as the "Award for Original Information," is a document used by the Internal Revenue Service (IRS) to gather information from individuals who wish to report tax fraud or evasion. This form allows whistleblowers to provide detailed information about individuals or entities that they believe are violating tax laws, enabling the IRS to investigate and potentially recover unpaid taxes. In return, whistleblowers may receive a financial reward if their information leads to a successful resolution.

-

Who can file an IRS 211 form?

Any individual with knowledge of tax evasion or fraud can file an IRS 211 form. There are no restrictions based on citizenship or residency. Employees, contractors, or even acquaintances of those suspected of tax evasion are eligible to file, provided they have credible and specific information about tax fraud or evasion activities.

-

How does one file an IRS 211 form?

To file an IRS 211 form, an individual must provide detailed, specific information about the alleged tax fraud or evasion, including the identity of the taxpayer involved, the tax years affected, and an estimate of the tax owed. It is important to provide as much evidence as possible to support the claim. The completed form and supporting documentation should be mailed to the IRS address specified on the form instructions.

-

Is the information provided on the form kept confidential?

Yes, the IRS is committed to protecting the confidentiality of whistleblowers. The identity of the individual submitting the IRS 211 form and the information provided are kept confidential to the fullest extent permitted by law. In most cases, the whistleblower's identity is not disclosed without their consent unless it is necessary for a judicial proceeding.

-

What types of tax fraud can be reported?

A wide range of tax violations can be reported using the IRS 211 form. This includes, but is not limited to, underreporting of income, claiming false deductions or credits, failure to withhold taxes, and engaging in abusive tax schemes. Both individuals and businesses can be reported for suspected tax violations.

-

Can a whistleblower remain anonymous?

While the IRS protects the confidentiality of whistleblowers, filing an IRS 211 form anonymously may limit the ability of the IRS to follow up for additional information or to award a financial reward. It is generally recommended that whistleblowers provide their contact information, although the IRS will make every effort to protect their identity.

-

What happens after an IRS 211 form is submitted?

After submission, the IRS reviews the provided information to determine the validity of the tax evasion or fraud claim. This process can be lengthy, often taking several years, depending on the complexity of the case. If the IRS decides to take action based on the information provided, the whistleblower may be eligible for a reward. However, the whistleblower will not receive regular updates due to confidentiality laws.

-

How is the reward for whistleblowers calculated?

The reward for whistleblowers ranges from 15% to 30% of the collected proceeds if the information provided directly results in the collection of taxes, penalties, and other amounts from the noncompliant taxpayer. The exact percentage depends on various factors, including the significance of the information provided and the degree of assistance from the whistleblower.

-

Where can I find more information about the IRS 211 form and whistleblower rewards?

More information about the IRS 211 form and the whistleblower reward program can be found on the official IRS website. This includes details on how to file, the types of tax fraud that can be reported, and guidelines for calculating rewards. Potential whistleblowers are encouraged to consult this resource or seek legal advice to understand better the process and their rights.

Common mistakes

When filling out the IRS 211 form, which is used for reporting suspected tax fraud, many people inadvertently make mistakes that can significantly impact the processing of their report. Paying attention to these common errors can help ensure that submissions are clear, complete, and correctly processed by the IRS.

Not providing enough detail: Many people submit the form with vague or incomplete information about the suspected tax fraud. The IRS needs specific details to investigate a claim, including names, dates, amounts, and types of tax issues. Without this critical information, it becomes challenging for the agency to take action.

Failing to include supporting documentation: If you have documents that support your claim, it is essential to include copies with your form. While submitting the IRS 211 without documentation does not invalidate it, providing evidence can significantly enhance the credibility and urgency of your claim.

Incorrectly identifying the parties involved: Sometimes, people make the mistake of not clearly identifying the taxpayer they are reporting or, conversely, improperly identifying themselves when anonymous reporting is preferred. It's crucial to correctly fill in the sections regarding personal information to ensure that your submission can be processed without unnecessary delays.

Forgetting to sign and date the form: One of the most common and easily avoidable mistakes is neglecting to sign and date the form. This oversight can render the submission invalid. Always make sure to sign and fill in the date at the bottom of the form to attest to the truthfulness of your report.

Avoiding these mistakes can greatly increase the effectiveness and efficiency of the IRS's investigation into your claim. Taking the time to fill out the IRS 211 form correctly and completely is crucial for those wishing to report suspected tax fraud.

Documents used along the form

When dealing with the IRS Form 211, which is used for applying for a whistleblower award, individuals often find that they require other forms and documents to ensure their application is comprehensive and correctly filed. These additional documents not only support the whistleblower claim but also help in establishing the accuracy and validity of the information provided. Let’s explore a few of these essential forms and documents that are frequently used alongside the IRS Form 211.

- Form 1040: This is the U.S. Individual Income Tax Return form. Whistleblowers might need to provide their own tax returns to prove their financial status or to clarify any discrepancies that might arise during the investigation of the claim.

- Form 3949-A: Used to report alleged tax law violations by an individual, a business, or both. It provides detailed information about the violation, which can be useful for a whistleblower case.

- Form 14039: Identity Theft Affidavit is used if the whistleblower believes their personal information was used fraudulently, impacting their tax records or the information pertaining to their whistleblower claim.

- Bank Statements: These are crucial for establishing the financial transactions that may be at the heart of the tax evasion or fraud claim. They can provide evidence of unreported income or illicit financial activities.

- Employment Records: In cases where the whistleblower is reporting tax violations related to an employer, employment records such as pay stubs, W-2 forms, or other payroll information can be essential in proving the claim.

- Emails and Correspondence: Any written communication that supports the whistleblower's claim, including emails or letters between the parties involved in the tax violation, can be vital evidence in the case.

- Legal Representation Documents: If a whistleblower has legal representation, documents such as the power of attorney or representation agreement are necessary to authorize the attorney to act on behalf of the whistleblower in matters related to the claim.

The process of filing a whistleblower claim with the IRS requires careful documentation. Each of these documents plays a crucial role in strengthening the whistleblower's case by providing additional evidence and context. Filing a comprehensive claim with all the necessary supporting documents can significantly increase the chances of a successful outcome. It’s important for whistleblowers to gather and organize these documents early in the process to avoid delays in the review and investigation of their claim.

Similar forms

The IRS Form 211, also known as the Application for Reward for Original Information, is not an isolated document in the realm of legal and financial reporting. It's part of a larger ecosystem of forms and applications used to report various types of information, often related to financial matters, to authorized entities. Here are seven documents that share similarities with the IRS Form 211:

- Form 3949-A (Information Referral): This form is used to report suspected tax law violations by an individual, a business, or both. Like the IRS 211, it serves as a means for citizens to report information, but it's primarily focused on potential tax violations without the reward mechanism that Form 211 includes.

- FinCEN Form 114 (FBAR): The Foreign Bank and Financial Accounts Report is required for U.S. persons to report foreign financial accounts exceeding certain thresholds. Similar to the IRS 211, it deals with financial reporting, though its focus is on foreign account holdings rather than rewarding information on tax evasion.

- Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business): Businesses use this form to report the receipt of more than $10,000 in cash from a single transaction or series of related transactions. It shares with Form 211 the principle of reporting financial activities to authorities, focusing on cash transactions specifically.

- Form 843 (Claim for Refund and Request for Abatement): Though fundamentally different in purpose, as it's used to request a tax refund or abatement, there's a similarity in the sense that individuals provide specific information to the IRS to adjust financial records, akin to reporting through Form 211.

- Form 14039 (Identity Theft Affidavit): This form is used to report identity theft to the IRS, which might affect one's tax records. Like the 211, it involves an individual providing information to the IRS, but for the purpose of protecting oneself against fraud rather than reporting someone else's wrongdoing.

- Form 1099-MISC (Miscellaneous Information): Independent contractors and others use this form to report income from various sources not covered by traditional employment. The connection to Form 211 lies in its role in ensuring accurate financial reporting and tax compliance.

- SAR (Suspicious Activity Report): Filed by financial institutions to report suspicious activities that might indicate money laundering, fraud, or other illegal activities. Though more specific to financial institutions, it, like the IRS 211, is integral to anti-fraud and compliance efforts.

Each of these documents plays a distinct role in the financial and legal ecosystems, ensuring transparency, compliance, and accountability. They require individuals or entities to report specific information to authorities, dovetailing with the IRS 211's objective to uncover and address non-compliance or fraudulent activities through citizen reporting.

Dos and Don'ts

When filling out the IRS Form 211, which is used for reporting information about suspected tax fraud, it's important to follow these guidelines to ensure the submission is complete, accurate, and can be effectively processed by the IRS. Here are seven key dos and don'ts:

- Do provide as much detailed information as possible about the person or business you are reporting. The more specific you are, the more effectively the IRS can investigate the alleged tax fraud.

- Do include any documentation that supports your claim. This could be receipts, records, or any correspondence that may substantiate your report.

- Do remember to sign and date the form. An unsigned form may not be processed.

- Do use a separate Form 211 for each taxpayer you are reporting. Mixing information about different taxpayers on a single form can lead to confusion and delays in investigation.

- Don't leave sections blank. If a section does not apply to your report, indicate with “N/A” (not applicable) rather than leaving it empty. This helps in ensuring that you've considered all relevant sections of the form.

- Don't guess or assume information. If you're unsure about certain details, it's better to leave them out than to provide inaccurate information which could undermine the credibility of your report.

- Don't attempt to contact the taxpayer you're reporting about regarding the submission. This could interfere with any potential IRS investigation and potentially put you at risk.

Misconceptions

Filing taxes can often seem overwhelming, and the multitude of forms involved doesn't help. The IRS Form 211, also known as the Application for Award for Original Information, is one such document that is frequently misunderstood. Here, we aim to clarify some common misconceptions about this form to help you navigate it with more confidence.

- Misconception 1: The IRS Form 211 is for reporting your annual income.

Contrary to popular belief, the IRS Form 211 is not used for reporting annual income. Instead, it is designed for individuals to report information about violations of the tax laws to the IRS, potentially leading to an award for the whistleblower.

- Misconception 2: Filing Form 211 guarantees a reward.

While it's true that reporting valuable information might result in a monetary award, not every submission leads to a reward. The information provided must lead to a successful recovery of taxes, penalties, or other amounts from the noncompliant taxpayer.

- Misconception 3: The process is quick.

Many think filing a Form 211 means a swift conclusion to their claim. However, the process of reviewing submissions, conducting investigations, and potentially awarding the whistleblower can be lengthy, often taking several years.

- Misconception 4: You must be an employee of the company you are reporting on.

Any individual, not just employees, can submit a Form 211 if they have concrete information about tax law violations. This form encourages a culture of accountability by empowering everyone to report wrongdoing.

- Misconception 5: The information you provide has to lead to a conviction.

While impactful, the information provided through Form 211 doesn't necessarily need to lead to a criminal conviction. The key is that it helps the IRS collect taxes, penalties, or fines from a taxpayer.

- Misconception 6: Anonymous submissions are accepted.

Although you can request confidentiality, the IRS generally requires you to identify yourself when submitting Form 211. This requirement is vital for the award process and potential follow-up queries.

- Misconception 7: There’s no risk in filing a false report.

Filing a report with false information can have serious consequences. It's crucial to submit genuine information to avoid possible legal ramifications.

- Misconception 8: Only individuals can submit Form 211.

Not only individuals but also entities can file a Form 211 if they have information on tax evasion or fraud. This broad eligibility helps ensure that the IRS receives tips from a wide range of sources.

- Misconception 9: You can file Form 211 for any kind of tip.

The IRS is specifically interested in substantial and credible information regarding significant federal tax issues. Not all tips may meet the criteria necessary for an award under the whistleblower program.

Understanding what the IRS Form 211 entails can empower individuals to make informed decisions about reporting tax law violations. Dispelling these misconceptions is a step toward fostering a better-informed public, capable of contributing to the integrity of the tax system.

Key takeaways

The IRS Form 211, also known as the "Application for Award for Original Information," serves as a key tool for individuals who wish to report tax law violations. Below are six essential takeaways regarding the application process and use of Form 211 that can guide individuals through the submission process effectively:

- Confidentiality: When you submit Form 211, your identity remains confidential. The IRS goes to great lengths to ensure the information provided by whistleblowers is kept secure, honoring the promise of anonymity to encourage the reporting of tax evasion or fraud.

- Completeness is crucial: To avoid delays or the potential rejection of your claim, it is important to fill out Form 211 completely and accurately. Missing or incorrect information can hinder the investigation process.

- Evidence matters: When submitting Form 211, attaching compelling evidence of the alleged tax violation significantly enhances the credibility of your claim. Detailed documentation supports the IRS in assessing and pursuing the case more efficiently.

- Award eligibility: Individuals who report tax law violations may be eligible for a financial award. This reward is contingent upon the recovery of taxes, penalties, and other amounts as a result of the information provided. The determination of eligibility and the amount awarded are at the discretion of the IRS, based on specific criteria outlined in the tax code.

- Patience is required: The review and investigation process following the submission of Form 211 can be lengthy. The complexity and scope of the alleged tax violation, coupled with the IRS's caseload, influence the duration of the investigation. It is not uncommon for it to take several years before a case is resolved.

- Legal representation: While individuals can submit Form 211 without legal representation, consulting with a tax attorney or a professional knowledgeable about whistleblower claims may enhance the effectiveness of the submission. Professionals can provide valuable advice on how to compile evidence and navigate the complexities of tax law.

Popular PDF Forms

What Must Be Included on the Cd If You Have an Other? - The Closing Disclosure not only outlines the immediate costs of closing but also provides insight into the long-term financial implications of your mortgage.

W2 Forms - It helps ensure accurate tax reporting by allowing corrections to be made to previously submitted data.

Police Vehicle Inspection Form Template - Avoid roadside emergencies by verifying the presence and condition of lockout kits, glass break tools, and other essential equipment.