Blank IRS 3520 PDF Template

Understanding the complexities of US tax obligations involves a deep dive into various forms, one of which is the IRS 3520 form. This particular document plays a crucial role for taxpayers who engage in transactions with foreign trusts or receive certain types of gifts from foreign individuals, estates, or corporations. It serves as a tool for reporting relevant transactions and gifts, ensuring compliance with US tax laws and regulations. The form not only details the information needed to accurately report the amounts involved but also outlines the penalties for failure to file or for filing incorrect information. Given the potential legal and financial repercussions of not adhering to these requirements, it's imperative for individuals and entities involved in such international transactions to familiarize themselves with the form's nuances. By doing so, taxpayers can sidestep potential pitfalls and ensure their financial affairs are in order, maintaining a good standing with tax authorities.

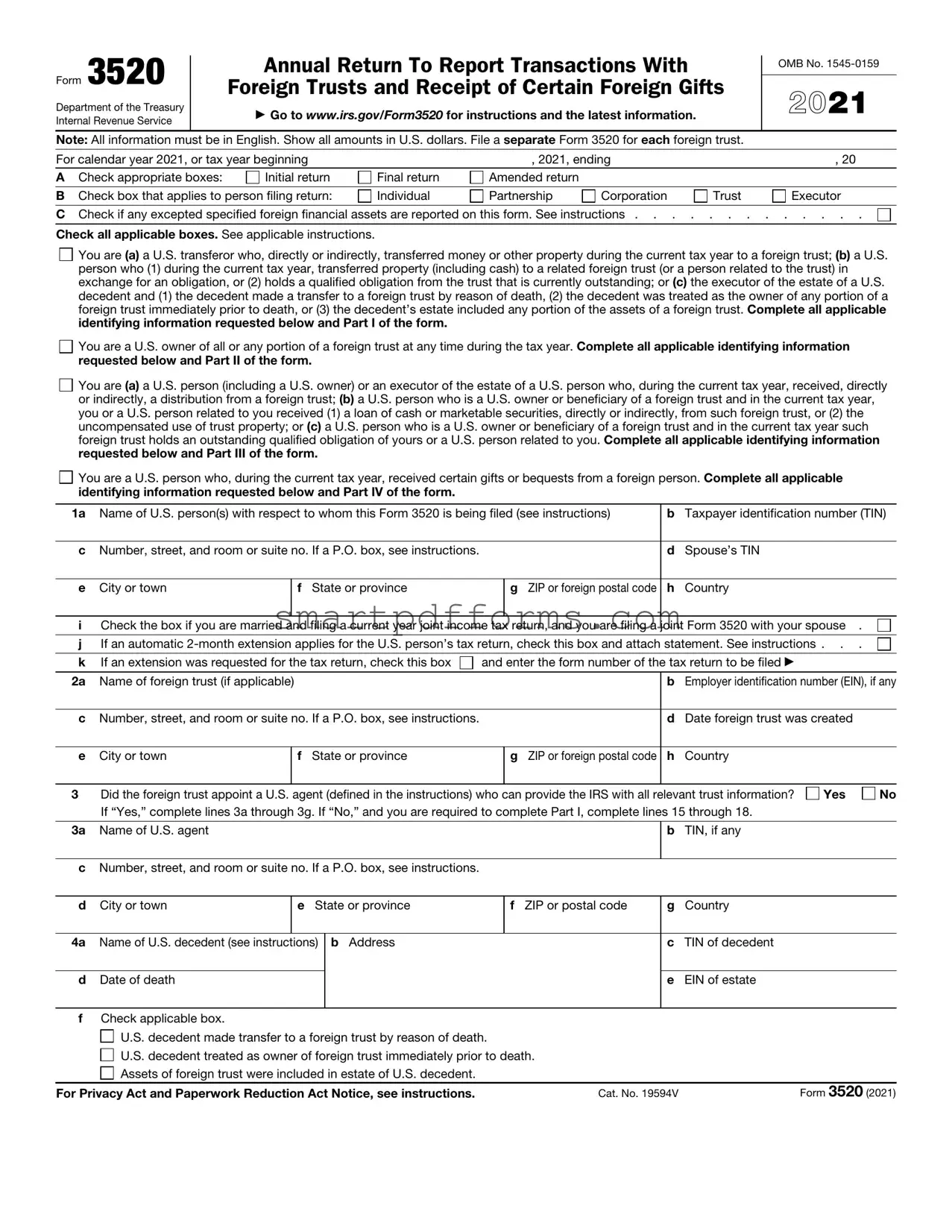

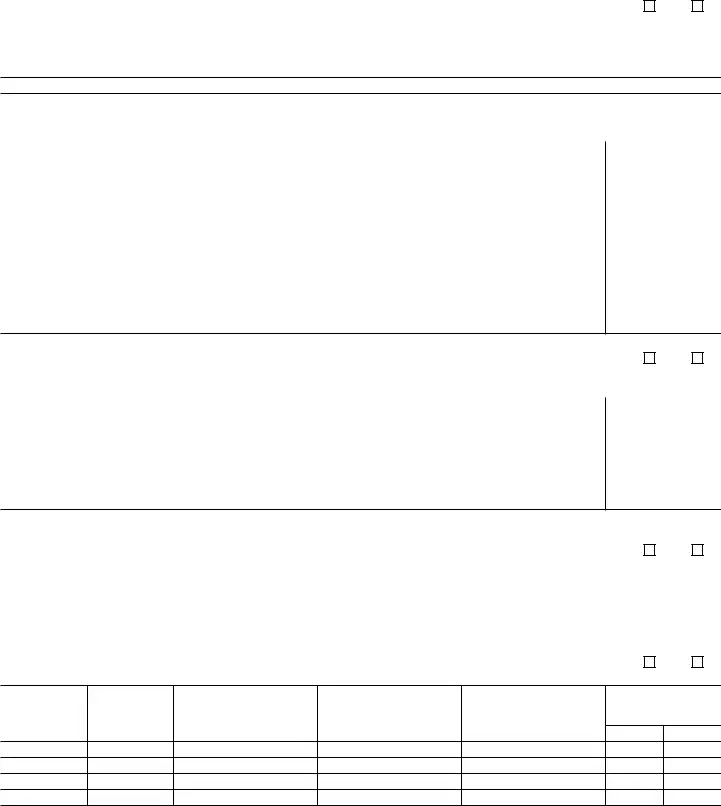

Preview - IRS 3520 Form

Form 3520

Department of the Treasury Internal Revenue Service

Annual Return To Report Transactions With

Foreign Trusts and Receipt of Certain Foreign Gifts

▶Go to www.irs.gov/Form3520 for instructions and the latest information.

OMB No.

2021

Note: All information must be in English. Show all amounts in U.S. dollars. File a separate Form 3520 for each foreign trust.

For calendar year 2021, or tax year beginning |

|

, 2021, ending |

|

, 20 |

|||

A |

Check appropriate boxes: |

Initial return |

Final return |

Amended return |

|

|

|

|

|

|

|

|

|

|

|

B |

Check box that applies to person filing return: |

Individual |

Partnership |

Corporation |

Trust |

Executor |

|

|

|

||||||

C |

Check if any excepted specified foreign financial assets are reported on this form. See instructions |

||||||

Check all applicable boxes. See applicable instructions.

You are (a) a U.S. transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust; (b) a U.S. person who (1) during the current tax year, transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation, or (2) holds a qualified obligation from the trust that is currently outstanding; or (c) the executor of the estate of a U.S. decedent and (1) the decedent made a transfer to a foreign trust by reason of death, (2) the decedent was treated as the owner of any portion of a foreign trust immediately prior to death, or (3) the decedent’s estate included any portion of the assets of a foreign trust. Complete all applicable identifying information requested below and Part I of the form.

You are (a) a U.S. transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust; (b) a U.S. person who (1) during the current tax year, transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation, or (2) holds a qualified obligation from the trust that is currently outstanding; or (c) the executor of the estate of a U.S. decedent and (1) the decedent made a transfer to a foreign trust by reason of death, (2) the decedent was treated as the owner of any portion of a foreign trust immediately prior to death, or (3) the decedent’s estate included any portion of the assets of a foreign trust. Complete all applicable identifying information requested below and Part I of the form.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year. Complete all applicable identifying information requested below and Part II of the form.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year. Complete all applicable identifying information requested below and Part II of the form.

You are (a) a U.S. person (including a U.S. owner) or an executor of the estate of a U.S. person who, during the current tax year, received, directly or indirectly, a distribution from a foreign trust; (b) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year, you or a U.S. person related to you received (1) a loan of cash or marketable securities, directly or indirectly, from such foreign trust, or (2) the uncompensated use of trust property; or (c) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year such foreign trust holds an outstanding qualified obligation of yours or a U.S. person related to you. Complete all applicable identifying information requested below and Part III of the form.

You are (a) a U.S. person (including a U.S. owner) or an executor of the estate of a U.S. person who, during the current tax year, received, directly or indirectly, a distribution from a foreign trust; (b) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year, you or a U.S. person related to you received (1) a loan of cash or marketable securities, directly or indirectly, from such foreign trust, or (2) the uncompensated use of trust property; or (c) a U.S. person who is a U.S. owner or beneficiary of a foreign trust and in the current tax year such foreign trust holds an outstanding qualified obligation of yours or a U.S. person related to you. Complete all applicable identifying information requested below and Part III of the form.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person. Complete all applicable identifying information requested below and Part IV of the form.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person. Complete all applicable identifying information requested below and Part IV of the form.

1a |

Name of U.S. person(s) with respect to whom this Form 3520 is being filed (see instructions) |

b |

Taxpayer identification number (TIN) |

||||

|

|

|

|

|

|

|

|

c |

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

d |

Spouse’s TIN |

||

|

|

|

|

|

|

|

|

e |

City or town |

|

f State or province |

|

g ZIP or foreign postal code |

h |

Country |

|

|

|

|

|

|||

i |

Check the box if you are married and filing a current year joint income tax return, and you are filing a joint Form 3520 with your spouse . |

||||||

|

|

||||||

j |

If an automatic |

||||||

|

|

|

|||||

k |

If an extension was requested for the tax return, check this box |

and enter the form number of the tax return to be filed ▶ |

|||||

|

|

|

|

|

|

||

2a |

Name of foreign trust (if applicable) |

|

|

|

b Employer identification number (EIN), if any |

||

cNumber, street, and room or suite no. If a P.O. box, see instructions.

dDate foreign trust was created

eCity or town

fState or province

gZIP or foreign postal code

hCountry

3 |

Did the foreign trust appoint a U.S. agent (defined in the instructions) who can provide the IRS with all relevant trust information? |

Yes |

No |

|||||

|

If “Yes,” complete lines 3a through 3g. If “No,” and you are required to complete Part I, complete lines 15 through 18. |

|

|

|||||

|

|

|

|

|

|

|

|

|

3a |

Name of U.S. agent |

|

|

|

b |

TIN, if any |

|

|

|

|

|

|

|

|

|

|

|

c Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

d |

City or town |

e State or province |

f ZIP or postal code |

g |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

4a |

Name of U.S. decedent (see instructions) |

b Address |

|

c |

TIN of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

d |

Date of death |

|

|

|

e |

EIN of estate |

|

|

|

|

|

|

|

|

|

|

|

fCheck applicable box.

U.S. decedent made transfer to a foreign trust by reason of death. |

|

|

U.S. decedent treated as owner of foreign trust immediately prior to death. |

|

|

Assets of foreign trust were included in estate of U.S. decedent. |

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 19594V |

Form 3520 (2021) |

Form 3520 (2021) |

Page 2 |

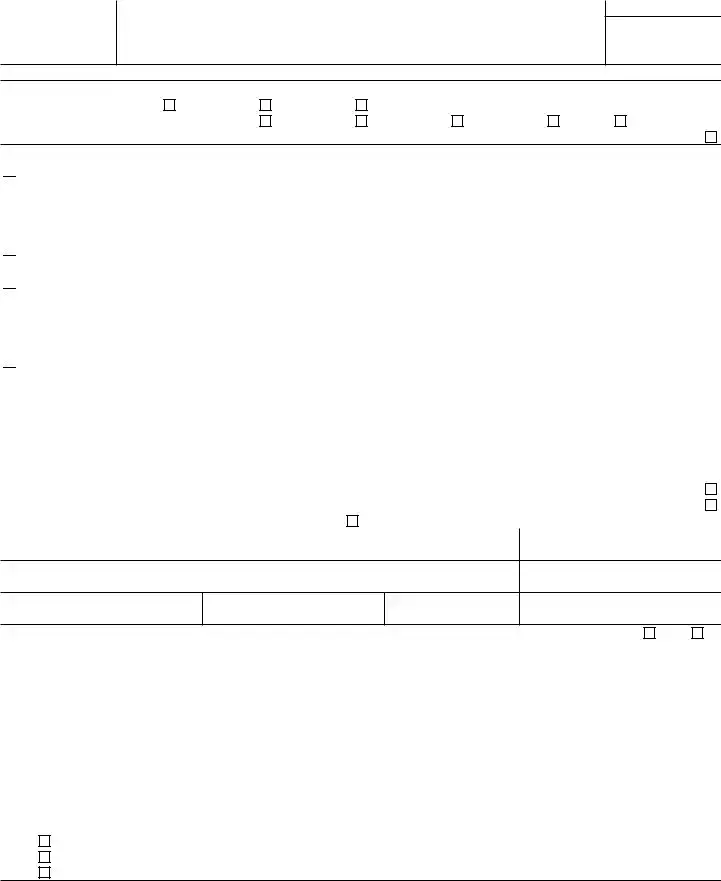

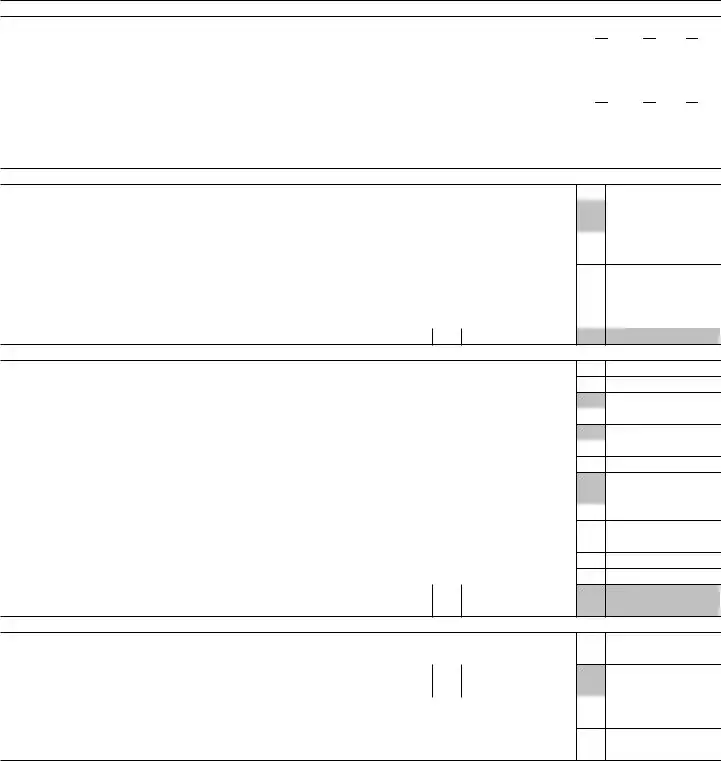

Part I Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year (see instructions)

5a Name of trust creator

bAddress

cTIN, if any

6a Country code of country where trust was created

bCountry code of country whose law governs the trust

cDate trust was created

7a Will any person (other than the foreign trust) be treated as the owner of the transferred assets after the transfer? . . . . |

Yes |

No |

b(i)

Name of foreign

trust owner

(ii)

Address

(iii)

Country of residence

(iv)

TIN, if any

(v)

Relevant Code

section

8 |

Was the transfer a completed gift or bequest? If “Yes,” see instructions |

|

Yes |

|

No |

9a |

Now or at any time in the future, can any part of the income or corpus of the trust benefit any U.S. beneficiary? . . . . |

|

Yes |

|

No |

b |

If “No,” could the trust be revised or amended to benefit a U.S. beneficiary? |

|

Yes |

|

No |

10 |

Reserved for future use |

|

Yes |

|

No |

|

|

Schedule

11a During the current tax year, did you transfer property (including cash) to a related foreign trust in exchange for an obligation of the trust or an obligation of a person related to the trust? See instructions . . . . . . . . . . . . . .

If “Yes,” complete the rest of Schedule A, as applicable. If “No,” go to Schedule B.

bWere any of the obligations you received (with respect to a transfer described in line 11a above) qualified obligations? . .

If “Yes,” complete the rest of Schedule A and attach a copy of each loan document entered into with respect to each qualified obligation reported on line 11b. If these documents have been attached to a Form 3520 filed within the previous 3 years, attach only relevant updates.

If “No,” go to Schedule B.

Yes

Yes  No

No

Yes

Yes  No

No

(i)

Date of transfer giving rise to obligation

(ii)

Maximum term

(iii)

Yield to maturity

(iv)

FMV of obligation

12With respect to each qualified obligation you reported on line 11b, do you agree to extend the period of assessment of any income or transfer tax attributable to the transfer, and any consequential income tax changes for each year that the

obligation is outstanding, to a date 3 years after the maturity date of the obligation? |

Yes |

No |

Note: You have the right to refuse to extend the period of limitations or limit this extension to a mutually |

|

|

issue(s) or mutually |

|

|

each qualified obligation you reported on line 11b, then such obligation is not a qualified obligation and you cannot check |

|

|

“Yes” to the question on line 11b. |

|

|

Schedule

13During the current tax year, did you make any transfers (directly or indirectly) to the trust and receive less than FMV, or no

consideration at all, for the property transferred? |

. . . . . . . . . . . . . |

. . . . . . . . . |

Yes |

No |

||||||

If “Yes,” complete columns (a) through (i) below and the rest of Schedule B, as applicable. When completing columns (a) |

|

|

||||||||

through (i) with respect to each nonqualified obligation, enter |

|

|

|

|

||||||

If “No,” go to Schedule C. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

(a) |

(b) |

(c) |

(d) |

|

(e) |

(f) |

(g) |

(h) |

(i) |

|

Date of |

Description |

FMV of property |

U.S. adjusted |

Gain recognized |

Excess, if any, |

Description |

FMV of property |

Excess of |

|

|

transfer |

of property |

transferred |

basis of |

|

at time of |

of column (c) |

of property |

received |

column (c) over |

|

|

transferred |

|

property |

|

transfer, |

over the sum of |

received, |

|

column (h) |

|

|

|

|

transferred |

|

if any |

columns (d) and (e) |

if any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals ▶ |

|

|

|

|

|

$ |

|

|

$ |

|

14If you have a sale or loan document in connection with a transfer reported on line 13, complete 14a through 14c and attach the relevant document(s). If these documents have been attached to a Form 3520 filed within the previous 3 years, attach only relevant updates.

|

|

|

|

Attached |

Year |

|

Are you attaching a copy of any of the following? |

Yes |

No |

Previously |

Attached |

a |

Sale document |

|

|

|

|

b |

Loan document |

|

|

|

|

c |

Subsequent variances to original sale or loan documents |

|

|

|

|

Form 3520 (2021)

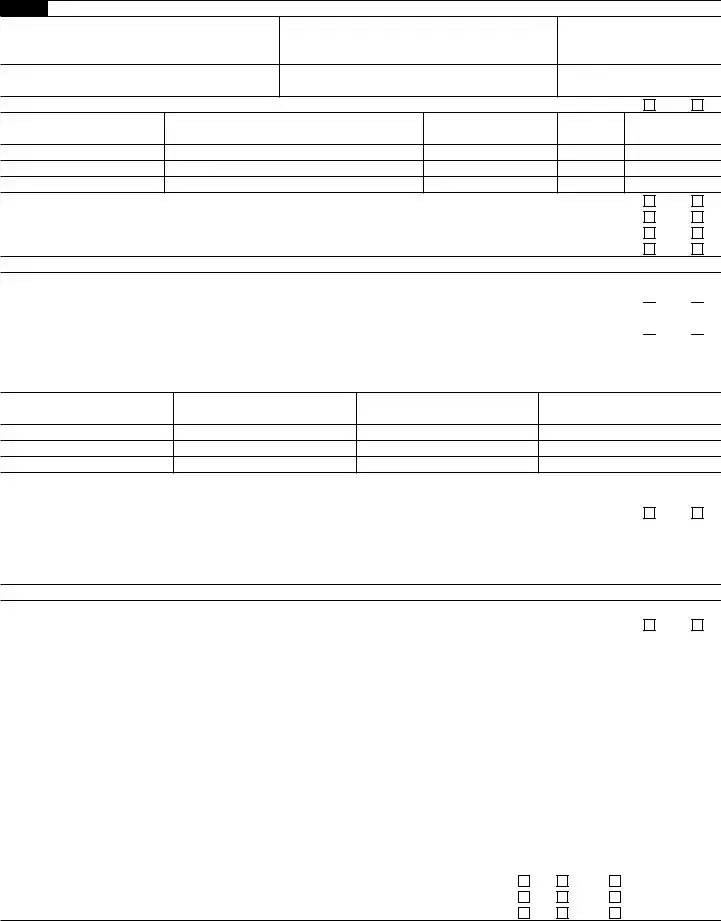

Form 3520 (2021) |

Page 3 |

Part I Schedule

Note: Complete lines 15 through 18 only if you answered “No” to line 3, acknowledging that the foreign trust did not appoint a U.S. agent to provide the IRS with all relevant trust information.

15 |

(a) |

(b) |

|

(c) |

|

(d) |

|

|

Name of beneficiary |

Address of beneficiary |

|

U.S. beneficiary? |

TIN, if any |

||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

(a) |

(b) |

|

|

|

|

(c) |

|

Name of trustee |

Address of trustee |

|

|

|

|

TIN, if any |

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

17 |

(a) |

(b) |

(c) |

|

(d) |

||

|

Name of other person |

Address of other person with trust powers |

Description of powers |

|

TIN, if any |

||

|

with trust powers |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18If you checked “No” on line 3, you are required to attach a copy of all trust documents as indicated below. If these documents have been attached to a Form

|

|

|

|

Attached |

Year |

|

Are you attaching a copy of any of the following? |

Yes |

No |

Previously |

Attached |

a |

Summary of all written and oral agreements and understandings relating to the trust . . . . |

|

|

|

|

b |

Trust instrument |

|

|

|

|

c |

Memoranda or letters of wishes |

|

|

|

|

d |

Subsequent variances to original trust documents |

|

|

|

|

e |

Trust financial statements |

|

|

|

|

f |

Organizational chart and other trust documents |

|

|

|

|

Schedule

19Did you, at any time during your tax year, hold an outstanding obligation of a related foreign trust (or a person related to the

trust) that you reported as a qualified obligation in the current tax year? |

Yes |

No |

If “Yes,” complete columns (a) through (f) below for each obligation. |

|

|

(a)

Date of original

obligation

(b)

Tax year qualified

obligation first reported

(c)

Amount of principal

payments made during

your tax year

(d)

Amount of interest

payments made during

your tax year

(e)

Balance of the outstanding

obligation at the end

of the tax year

(f)

Does the obligation

still meet the criteria for a qualified obligation?

Yes |

No |

Form 3520 (2021)

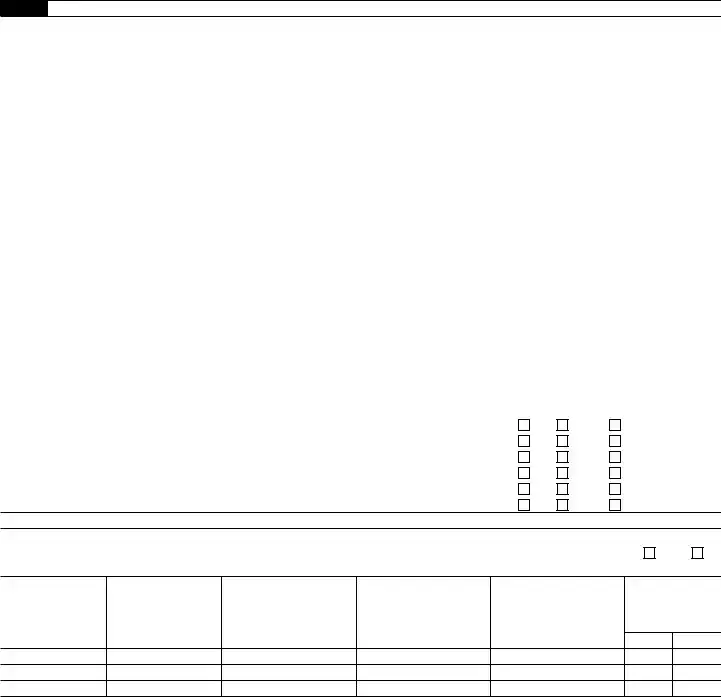

Form 3520 (2021) |

|

|

|

|

|

|

Page 4 |

|||

Part II |

U.S. Owner of a Foreign Trust (see instructions) |

|

|

|

|

|

||||

20 |

|

(a) |

|

|

(b) |

(c) |

(d) |

|

(e) |

|

|

|

Name of foreign |

|

Address |

Country of tax residence |

TIN, if any |

|

Relevant Code |

||

|

|

trust owner |

|

|

section |

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

21a |

Country code of country where foreign trust was created |

|

b Country code of country whose law governs the trust |

c Date foreign trust was created |

||||||

|

|

|

|

|

|

|||||

22 |

Did the foreign trust file Form |

. . . . . |

Yes |

No |

||||||

|

If “Yes,” attach the Foreign Grantor Trust Owner Statement you received from the foreign trust. |

|

|

|

|

|||||

|

If “No,” to the best of your ability, complete and attach a substitute Form |

|

|

|

|

|||||

|

See instructions for information on penalties for failing to complete and attach a substitute Form |

|

|

|

|

|||||

23Enter the gross value of the portion of the foreign trust that you are treated as owning at the end of your tax year . ▶ $

Part III Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (see instructions)

Note: If you received an amount from a portion of a foreign trust of which you are treated as the owner, only complete lines 24 and 27.

24Enter cash amounts or FMV of property received, directly or indirectly, during your current tax year, from the foreign trust (exclude loans and uncompensated use of trust property included on line 25).

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Date of distribution |

Description of property received |

FMV of property received |

Description of property |

FMV of property |

Excess of column (c) |

|

|

(determined on date |

transferred, if any |

transferred |

over column (e) |

|

|

of distribution) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ $ |

25During your current tax year, did you (or a person related to you) receive a loan or uncompensated use of trust property from a

related foreign trust (including an extension of credit upon the purchase of property from the trust)? |

Yes |

No |

If “Yes,” complete columns (a) through (g) below for each such loan or use of trust property. |

|

|

Note: See instructions for additional information, including how to complete columns (a) through (g) for use of trust property.

(a) |

(b) |

(c) |

(d) |

|

(e) |

(f) |

(g) |

|

Is the obligation a |

Amount treated as |

|||||||

FMV of loan proceeds |

Date of original |

Maximum term of |

Interest rate |

qualified obligation? |

FMV of qualified |

distribution from the trust |

||

or property |

transaction |

repayment of |

of obligation |

|

|

|

obligation |

(subtract column (f) |

|

|

obligation |

|

Yes |

|

No |

|

from column (a)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ $ |

26With respect to each obligation you reported as a qualified obligation on line 25, do you agree to extend the period of assessment of any income or transfer tax attributable to the transaction, and any consequential income tax changes for each

year that the obligation is outstanding, to a date 3 years after the maturity date of the obligation? . . . |

. |

. |

. |

. . . |

Yes |

No |

|

Note: You have the right to refuse to extend the period of limitations or limit this extension to a mutually |

|

|

|||||

or mutually |

|

|

|||||

that you reported as a qualified obligation on line 25, then such obligation is not a qualified obligation and you cannot check |

|

|

|||||

“Yes” in column (e) of line 25. |

|

|

|

|

|

|

|

27 Total distributions received during your current tax year. Add line 24, column (f), and line 25, column (g) . |

. |

. |

. |

▶ $ |

|

|

|

|

|

|

|

|

|

|

|

28Did the trust, at any time during the current tax year, hold an outstanding obligation of yours (or a person related to you) that

you reported as a qualified obligation? |

Yes |

No |

If “Yes,” complete columns (a) through (f) below for each obligation. |

|

|

(a) |

(b) |

(c) |

(d) |

Date of original |

Tax year qualified |

Amount of principal payments |

Amount of interest payments |

loan transaction |

obligation first |

made during your tax year |

made during your tax year |

|

reported |

|

|

(e)

Balance of the outstanding

obligation at the end

of the tax year

(f)

Does the loan still

meet the criteria of a qualified obligation?

Yes |

No |

Form 3520 (2021)

Form 3520 (2021) |

Page 5 |

Part III Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (continued)

29Did you receive a Foreign Grantor Trust Beneficiary Statement from the foreign trust with respect to a distribution? If “Yes,” attach the statement and do not complete the remainder of Part III with respect to that distribution.

If “No,” complete Schedule A with respect to that distribution. Also, complete Schedule C if you enter an amount greater than zero on line 37.

30Did you receive a Foreign Nongrantor Trust Beneficiary Statement from the foreign trust with respect to a distribution?

If “Yes,” attach the statement and complete either Schedule A or Schedule B below. See instructions. Also, complete Schedule C if you enter an amount greater than zero on line 37 or line 41a.

If “No,” complete Schedule A with respect to that distribution. Also, complete Schedule C if you enter an amount greater than zero on line 37.

Yes

Yes

Yes

Yes

No

No  N/A

N/A

No

No  N/A

N/A

Schedule

31 |

Enter amount from line 27 |

. . . . . . . . . |

|

31 |

|

32 |

Number of years the trust has been a foreign trust (see instructions) . . . ▶ |

32 |

|

|

|

33Enter total distributions received from the foreign trust during the 3 preceding tax years (or during the number

|

of years the trust has been a foreign trust, if fewer than 3 years) |

33 |

34 |

Multiply line 33 by 1.25 |

34 |

35Average distribution. Divide line 34 by 3.0 (or the number of years the trust has been a foreign trust, if fewer

|

than 3 years) and enter the result |

35 |

|

36 |

Amount treated as ordinary income earned in the current year. Enter the smaller of line 31 or line 35 . . . |

36 |

|

37 |

Amount treated as accumulation distribution. Subtract line 36 from line 31. If zero, do not complete the rest of Part III |

37 |

|

38 |

Applicable number of years of trust. Divide line 32 by 2.0 and enter the result here ▶ |

38 |

|

Schedule

39 |

Enter amount from line 27 |

|||

40a |

Amount treated as ordinary income in the current tax year |

|||

b |

Qualified dividends |

. . . . . . . . . . . ▶ |

40b |

|

41a |

Amount treated as accumulation distribution. If zero, do not complete Schedule C below |

|||

b |

Amount of line 41a that is tax exempt . |

. . . . . . . . . . . ▶ |

41b |

|

42a |

Amount treated as net |

|||

b |

Amount treated as net |

|||

c |

28% rate gain |

. . . . . . . . . . . ▶ |

42c |

|

d |

Unrecaptured section 1250 gain . . |

. . . . . . . . . . . ▶ |

42d |

|

43 |

Amount treated as distribution from trust corpus |

|||

44Enter any other distributed amount received from the foreign trust not included on lines 40a, 41a, 42a, 42b,

|

and 43. (Attach explanation.) |

45 |

Amount of foreign trust’s aggregate undistributed net income |

46 |

Amount of foreign trust’s weighted undistributed net income |

47Applicable number of years of trust. Divide line 46 by line 45 and enter the result

here . . . . . . . . . . . . . . . . . . . . . . ▶ |

47 |

Schedule

39

40a

41a

42a

42b

43

44

45

46

48 |

Enter accumulation distribution from line 37 or line 41a, as applicable |

48 |

49 |

Enter tax on total accumulation distribution from line 28 of Form 4970. (Attach Form |

49 |

50Enter applicable number of years of foreign trust from line 38 or line 47, as

|

applicable (round to nearest half year) . . . . . . . . . . . . ▶ |

50 |

|

|

51 |

Combined interest rate imposed on the total accumulation distribution (see instructions) |

|

51 |

|

52 |

Interest charge. Multiply the amount on line 49 by the combined interest rate on line 51 |

52 |

||

53Tax attributable to accumulation distributions. Add lines 49 and 52. Enter here and as “additional tax” on your

income tax return |

53 |

Form 3520 (2021)

Form 3520 (2021) |

Page 6 |

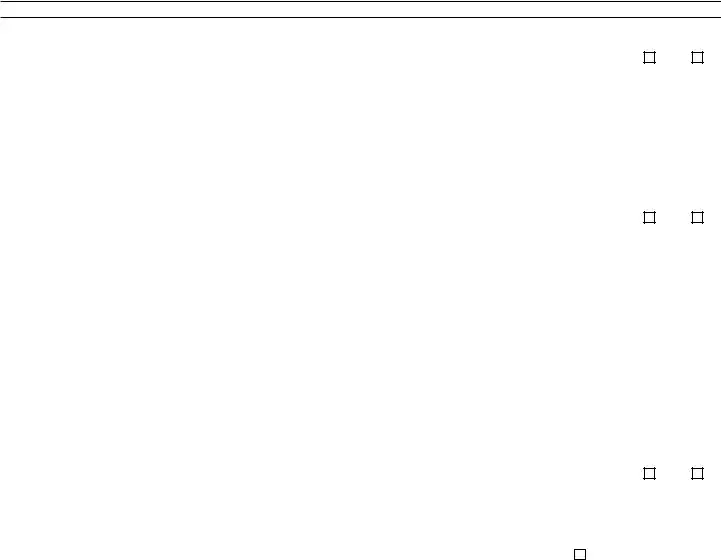

Part IV U.S. Recipients of Gifts or Bequests Received During the Current Tax Year From Foreign Persons (see instructions)

54During your current tax year, did you receive more than $100,000 that you treated as gifts or bequests from a nonresident

alien (including a distribution received from a domestic trust treated as owned by a foreign person) or a foreign estate? See |

Yes |

No |

|||||||||||||

instructions for special rules regarding related donors |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. . . |

|||||

If “Yes,” complete columns (a) through (c) with respect to each such gift or bequest in excess of $5,000. If more space is |

|

|

|||||||||||||

needed, attach a statement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

|

|

|

|

|

|

|

|

|

(c) |

|

Date of gift or bequest |

|

Description of property received |

|

|

|

|

|

|

|

|

|

|

FMV of property received |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

. |

. |

. |

. |

. |

. |

. |

. |

. |

▶ |

$ |

|

|

||

55During your current tax year, did you receive amounts from a foreign corporation or a foreign partnership that you treated as

|

|

gifts in excess of the amount provided in the instructions? See instructions regarding related donors |

. . . . |

. . . |

Yes |

No |

||||||||||||

|

|

If “Yes,” complete columns (a) through (g) with respect to each such gift. If more space is needed, attach a statement. |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

|

|

|

(c) |

|

|

|

|

(d) |

|

|||

|

Date of gift |

|

Name of foreign donor |

|

|

|

|

Address of foreign donor |

|

|

|

|

TIN, if any |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) |

|

|

|

|

|

|

(f) |

|

|

|

|

(g) |

|

||

Check the box that applies to the foreign donor |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Description of property received |

|

|

|

FMV of property received |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Corporation |

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

56 |

|

Do you have any reason to believe that the foreign donor, in making any gift or bequest described in lines 54 and 55, was |

|

|

||||||||||||||

|

|

acting as a nominee or intermediary for any other person? If “Yes,” see instructions |

. . . . |

. . . |

Yes |

No |

||||||||||||

|

|

Under penalties of perjury, I declare that I have examined this return, including any accompanying reports, schedules, or statements, and to the best of my |

|

|||||||||||||||

Sign |

|

knowledge and belief, it is true, correct, and complete. |

|

|

|

|

|

|

|

|

|

|

||||||

Here |

▲ |

|

|

|

|

|

|

|

▲ |

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Signature |

|

|

|

|

|

Title |

|

|

Date |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Paid |

|

|

Print/Type preparer’s name |

Preparer’s signature |

|

|

|

Date |

|

Check |

if |

PTIN |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Firm’s name |

▶ |

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|

||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

||||||||

Firm’s address ▶ |

|

|

|

|

|

|

|

Phone no. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 3520 (2021) |

|

Form Data

| Fact Name | Description |

|---|---|

| Purpose of the Form | The IRS Form 3520 is used to report certain transactions with foreign trusts and receipt of certain large gifts or bequests from certain foreign persons. |

| Filing Requirement | It is required for U.S. persons to file this form if they receive more than $100,000 from a non-U.S. person or estate, or if they have received more than $15,601 (for 2022) from foreign corporations or foreign partnerships. |

| Due Date | The form must be filed by the 15th day of the 4th month following the end of the taxpayer's taxable year. For most individuals, this date is April 15th of the following year. |

| Penalties for Non-Compliance | Failure to file Form 3520 on time can result in significant penalties, including a penalty of 35% of the gross value of any property transferred to a foreign trust or 5% of the gross value of the portion of a foreign trust's assets treated as owned by a U.S. person. |

| Governing Law | The requirements for Form 3520 are governed by federal tax laws and regulations set forth by the Internal Revenue Service (IRS). |

| State-Specific Forms | There are no state-specific forms directly related to IRS Form 3520. Tax obligations with foreign trusts and gifts are handled at the federal level. |

Instructions on Utilizing IRS 3520

Filling out the IRS Form 3520 can appear daunting at first glance. However, it is a crucial document for reporting transactions with foreign trusts and the receipt of certain foreign gifts. By proceeding methodically, one can accurately complete the form, thereby ensuring compliance with U.S. tax laws and regulations. Below, you'll find a simplified guide meant to help you through each step of the process. Remember, accuracy in reporting is key to avoiding unnecessary scrutiny or penalties from the IRS.

- Begin by gathering all necessary documentation related to the foreign trust, if applicable, or the information on the foreign gift you have received. This documentation will include the trust's formation details, any distributions received, and the value of any gifts.

- Next, access the IRS Form 3520 on the Internal Revenue Service's official website. Ensure you are using the most current version of the form for the tax year in question.

- Fill out Part I with your personal information, including your full name, address, and Taxpayer Identification Number (TIN), such as your Social Security Number (SSN) or Employer Identification Number (EIN).

- In Part II, if reporting a transaction with a foreign trust, provide details about the trust and any transactions, including transfers to the trust and distributions received. If you are the trust owner, provide the ownership portion applicable.

- For those reporting the receipt of large gifts or bequests from foreign persons, complete Part III. Here, you will need to list the names of the donors, describe the gifts, and specify the monetary value of each gift in U.S. dollars.

- If applicable, complete Part IV to report specific trust distributions. This section is usually filled out by U.S. beneficiaries of foreign trusts receiving distributions in the reported tax year.

- Review all the information provided for accuracy. IRS Form 3520 is comprehensive and requires attention to detail. Ensure that all applicable sections are filled out and all necessary information is accurately reported.

- Sign and date the completed form. By signing the form, you are certifying under penalty of perjury that all information provided is complete and accurate to the best of your knowledge.

- Finally, mail the completed form to the address specified in the form's instructions. Make sure to keep a copy of the form and all relevant documentation for your records.

By meticulously following these steps, you will be better positioned to complete IRS Form 3520 correctly. Remember, this form is an important part of fulfilling your reporting obligations under U.S. tax law, particularly for transactions involving foreign trusts and the receipt of sizeable foreign gifts. Should you have any doubts or require assistance, consulting with a tax professional who is experienced with international tax matters is advisable. Their expertise can help ensure your compliance with the complex rules governing these types of transactions.

Obtain Answers on IRS 3520

-

What is the IRS 3520 form, and who needs to file it?

The IRS Form 3520, officially titled “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts,” is a document required by the Internal Revenue Service (IRS). U.S. persons must file this form if they are involved in transactions with foreign trusts or if they receive certain large gifts or bequests from foreign entities or individuals. This includes receiving gifts or bequests valued at more than $100,000 from a nonresident alien individual or foreign estate, or more than $16,649 (for 2022) from foreign corporations or partnerships. Filing this form helps the IRS track the flow of foreign assets into the country and ensures compliance with U.S. tax laws.

-

When is the deadline to file Form 3520?

The deadline for filing Form 3520 aligns with the filer's income tax return deadline, including extensions. This typically means April 15th of the year following the transaction or receipt of the gift. If an extension is granted for your income tax return, the same extension applies to your Form 3520. However, it's crucial to note that if you fail to file on time, the IRS can impose penalties, so it's important to keep track of the deadline and file promptly.

-

What are the penalties for not filing or late filing of Form 3520?

The IRS imposes significant penalties for failing to file Form 3520 on time or for incomplete or incorrect filings. The penalty for not reporting a foreign gift or trust transaction can be as high as 35% of the gross value of the transaction for foreign trusts and 5% per month (up to 25%) of the foreign gift's value for gifts from foreign entities. Moreover, if the failure to file is deemed intentional, additional penalties, including criminal charges, could apply. The IRS emphasizes compliance, so it's crucial to file accurately and timely to avoid these penalties.

-

Are there any exceptions to filing Form 3520?

Yes, there are a few exceptions to the requirement to file Form 3520. For instance, if you are a beneficiary of a foreign trust but did not receive any distributions during the tax year, you might not be required to file. Additionally, certain fair market value transactions between a U.S. person and a foreign trust might be exempt. Due to the complexity and nuances of these exceptions, it's advisable to consult with a tax professional who can provide guidance based on your specific situation and ensure that you comply with all applicable IRS rules and regulations.

-

How can one file Form 3520, and can it be filed electronically?

Form 3520 must be filed separately from your annual income tax return, and as of now, it cannot be filed electronically. The form should be completed in accordance with IRS instructions and mailed to the address provided by the IRS for Form 3520 submissions. It's essential to retain a copy of the filed form and any supporting documentation for your records. As the IRS continues to modernize its processes, electronic filing options may become available in the future. For the most current filing instructions and addresses, always refer to the latest version of the form and the IRS website.

Common mistakes

Filling out the IRS 3520 form, required for reporting transactions with foreign trusts and the receipt of certain foreign gifts, can be a daunting task. Folks often find themselves tangled in the complex IRS guidelines, leading to mistakes. This form serves as a critical tool in maintaining transparency and adherence to tax obligations for transactions that cross international borders. Here’s a breakdown of common errors to avoid:

Not filing on time: One of the most straightforward yet frequently overlooked mistakes is missing the filing deadline. The IRS 3520 form is due on the same date as your income tax return, with extensions available. Late filings can result in severe penalties.

Incorrectly reporting the value of gifts or bequests from foreign entities: People often underreport or fail to report the accurate value of the gifts or bequests they receive from non-U.S. persons. It's crucial to assess the fair market value correctly and report all transactions in U.S. dollars, using the appropriate exchange rate.

Omitting required information: Failing to provide all the necessary details, such as the name of the foreign trust, the value of transactions, or the identity of the foreign donor, can lead to processing delays and possible penalties. Every question on the form must be answered unless explicitly stated as optional.

Misunderstanding who must file: There's often confusion about who is required to file this form. Generally, any U.S. person who receives a gift or bequest from a foreign individual exceeding a certain value threshold or has transactions with a foreign trust must file. This includes individuals, trusts, estates, and corporations.

Not properly reporting distributions from foreign trusts: Distributions include, but are not limited to, money, property, or certain loans and uncompensated use of trust assets. The failure to accurately report these distributions can result in significant penalties.

Attempting to file without professional help: Given the form's complexity, attempting to complete and file it without seeking assistance from a tax professional experienced in international taxation can increase the risk of errors. Professional advice is crucial to ensure compliance and minimize tax liabilities.

While the IRS 3520 form is intricate, understanding these common pitfalls can help you approach the filing process with more confidence. Taking the time to ensure accuracy and seeking professional guidance when needed is vital for meeting your reporting obligations and avoiding issues with the IRS.

Documents used along the form

The IRS Form 3520, "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," is often accompanied by various other forms and documents. These supplementary forms and documents are necessary for individuals to comply fully with the reporting requirements set by the Internal Revenue Service (IRS). The list provided below includes some of the most commonly used forms and documents in conjunction with Form 3520.

- Form 3520-A – "Annual Information Return of Foreign Trust With a U.S. Owner": This form is used by foreign trusts with at least one U.S. owner. It provides information about the trust, its U.S. beneficiaries, and any U.S. person who is treated as an owner of any portion of the foreign trust.

- Form 8938 – "Statement of Specified Foreign Financial Assets": Individuals must file this form to report specified foreign financial assets if the total value exceeds the applicable reporting threshold.

- Form 8621 – "Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund": This form is filed by shareholders of Passive Foreign Investment Companies (PFICs) and provides information about the PFIC.

- Form 5471 – "Information Return of U.S. Persons With Respect to Certain Foreign Corporations": Required from U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, detailing the corporation's activities and shareholders.

- Form 8865 – "Return of U.S. Persons With Respect to Certain Foreign Partnerships": Filed by U.S. persons who have an interest in a foreign partnership according to the IRS guidelines, providing details about the partnership and its partners.

- Form 8833 – "Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)": This form is used to disclose a treaty-based return position, wherein a taxpayer claims a treaty benefit to reduce the taxable amount as per the U.S. tax treaty agreements.

- Form 1040 Schedule B – "Interest and Ordinary Dividends": Part III of Schedule B specifically relates to the reporting of foreign accounts and trusts, linking it to Form 3520 requirements.

- Form W-8BEN – "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding": This form is provided by foreign individuals to assert their foreign status and, if applicable, claim any benefits under an income tax treaty.

- Form 926 – "Return by a U.S. Transferor of Property to a Foreign Corporation": Filed when a U.S. person transfers property to a foreign corporation, this form reports the transfer and any related information.

- Form 709 – "United States Gift (and Generation-Skipping Transfer) Tax Return": Required whencertain gifts to or from foreign individuals, trusts, or estates exceed the annual exemption limit, necessitating the filing of this form.

Each of these forms and documents plays a specific role in ensuring compliance with U.S. tax laws and regulations, especially when dealing with foreign trusts, gifts, or financial accounts. Understanding the purpose and requirements of each can help taxpayers accurately report their foreign financial transactions to the IRS.

Similar forms

IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return: Similar to IRS Form 3520, Form 709 is used to report transfers of property. Where Form 3520 focuses on reporting transactions with foreign trusts and receipt of certain foreign gifts, Form 709 is concerned with the reporting of gifts exceeding the annual exclusion amount, and certain generation-skipping transfers, regardless of whether they are domestic or international. Both forms help the IRS track the movement of wealth which could evade taxation without proper reporting.

IRS Form 8938, Statement of Specified Foreign Financial Assets: Like Form 3520, Form 8938 is aimed at combatting tax evasion by requiring the disclosure of assets held in foreign accounts and foreign assets. Both forms require U.S. taxpayers to provide detailed information on their international financial dealings to the IRS, though Form 8938 specifically focuses on foreign financial assets rather than transactions with or trusts.

FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR): Comparable to IRS Form 3520, the FBAR requires the disclosure of foreign financial accounts exceeding certain thresholds. While FBAR is filed with the Financial Crimes Enforcement Network (FinCEN) rather than the IRS, and focuses on bank and financial accounts specifically, both forms work in tandem to prevent tax evasion by making foreign financial activities more transparent.

IRS Form 1040, U.S. Individual Income Tax Return: Although IRS Form 1040 is a broad tax return form for individuals, it relates to IRS Form 3520 through the requirement to report worldwide income, including from foreign trusts and gifts, which might also need to be reported on Form 3520. Reporting such income on Form 1040 without corresponding reporting on Form 3520, when required, can lead to issues of non-compliance.

IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations: This form, like the IRS 3520, is used to provide information about certain transactions with foreign entities. While Form 5471 specifically addresses transactions and relationships with foreign corporations, Form 3520 is used for reporting dealings with foreign trusts. However, both are essential for the IRS to monitor international financial activity and ensure proper taxation.

IRS Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund: Similar to Form 3520, Form 8621 is intended for taxpayers with certain foreign investments, specifically in passive foreign investment companies (PFICs). Both forms require detailed information about foreign entities, aiming to prevent tax evasion through offshore investments.

Dos and Don'ts

Filling out IRS Form 3520, a crucial document required for reporting transactions with foreign trusts and the receipt of certain foreign gifts, demands careful attention to detail. Missteps can lead to unnecessary scrutiny from the IRS and potentially substantial penalties. Below are guidelines to assist taxpayers in accurately completing this form:

Do:- Check the IRS website for the most current version of Form 3520. Tax laws and form requirements can change, ensuring you have the latest version is critical.

- Read the instructions carefully. The IRS provides detailed instructions for Form 3520. Understanding these guidelines is essential to correctly fill out the form.

- Gather all necessary documentation before starting. This includes information on foreign trusts, receipts of large gifts or bequests from foreign entities, and other relevant financial information.

- Provide accurate information. Ensure all data, including dates, amounts, and identifying information, is correct and matches your records.

- Use additional sheets if necessary. If there is not enough space on the form to provide complete information, attach additional sheets and clearly label them as part of your Form 3520 submission.

- Ignore the filing deadline. Submit Form 3520 by the due date to avoid penalties. This is generally April 15, with an extension option available until October 15.

- Omit information or provide incomplete answers. Failing to fully disclose all required information can lead to penalties and increased scrutiny from the IRS.

- Sign the form without reviewing it. Once the form is complete, review it thoroughly to ensure all information is accurate and complete. Mistakes can lead to processing delays or audits.

Misconceptions

Filing taxes and understanding IRS forms can sometimes feel overwhelming due to the complex regulations and misconceptions surrounding them. One such form that is often misunderstood is the IRS 3520, also known as the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. Let's clarify some of the common misconceptions about this form to help individuals navigate their tax responsibilities more effectively.

Only the wealthy need to file Form 3520. It's a common belief that Form 3520 is only applicable to the wealthy or those with significant foreign transactions. However, this form must be filed by anyone who receives certain large gifts or bequests from foreign individuals, estates, or entities. This requirement can apply regardless of the taxpayer’s overall financial situation.

Filing Form 3520 means you will be taxed on foreign gifts or inheritances. While it's true that Form 3520 must be filed to report significant foreign gifts or bequests, filing the form does not automatically subject these amounts to tax. The purpose of the form is to provide information to the IRS, and not all reported amounts will result in additional taxes owed.

If you didn’t receive a gift or inheritance, you don't need to file. Another misconception is that Form 3520 only relates to gifts or inheritances. However, taxpayers involved with foreign trusts, including those who have created, transferred assets to, or received distributions from a foreign trust, are also required to file.

You can file Form 3520 separately from your tax return. While Form 3520 is filed separately from your annual tax return and has a different submission address, it is indeed part of your overall tax reporting obligation. Failing to file it properly can result in significant penalties.

There's no deadline for filing Form 3520. Like most tax forms, Form 3520 has a specific filing deadline. Generally, it must be submitted by the 15th day of the 4th month following the end of the taxpayer's tax year, which for most individuals is April 15. Extensions for filing your tax return also extend the deadline for filing Form 3520.

Penalties for not filing Form 3520 are minimal. In reality, the penalties for failing to file Form 3520, filing late, or filing an incomplete or inaccurate form can be severe. The penalties can include a percentage of the foreign gift or trust transaction involved, which can amount to substantial sums.

Understanding the IRS Form 3520 requirements and the misconceptions around it can significantly ease the filing process, ensuring that individuals remain compliant with their tax reporting obligations without undue stress. Always seek professional advice when dealing with complex tax forms and obligations to ensure accurate and timely filing.

Key takeaways

When it comes to handling international gifts or trusts, the IRS Form 3520, "Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts," plays a crucial role. Here are key takeaways to guide you through filling out and using this form:

- Know When to File: Taxpayers must submit Form 3520 if they receive large gifts or bequests from foreign entities, are beneficiaries of foreign trusts, or if they have transactions with foreign trusts. Specifically, if the aggregate value of gifts from a non-resident alien individual or estate exceeds $100,000, or if gifts from foreign corporations or partnerships exceed $16,815 for 2023, a Form 3520 must be filed.

- Understand the Definitions: It's crucial to grasp what the IRS considers a "foreign trust" and a "reportable event", as these determine your filing obligations.

- Separate from Your Tax Return: Although related to your annual tax filings, Form 3520 is not filed with your tax return. It should be sent to the IRS at the address specified in the form’s instructions, ensuring it's received by the due date.

- Annual Due Dates are Key: For most taxpayers, Form 3520 is due on April 15, with an extension available until October 15. However, those who live outside the U.S. or Puerto Rico are given an automatic two-month extension.

- Penalties for Non-compliance Can Be Steep: Failing to file or inaccurately filing Form 3520 can result in substantial penalties, sometimes as high as 35% of the gross value of any transfers to a foreign trust or receipts from a foreign trust.

- Documentation is Critical: Keep detailed records of all transactions with foreign trusts and receipts of foreign gifts. These documents are essential both for filing Form 3520 and for potential IRS inquiries.

- Professional Guidance is Advisable: Given the complexity of the tax rules surrounding foreign trusts and gifts, seeking advice from a tax professional experienced in international tax matters is recommended.

- Review Annually for Changes in Circumstances: Taxpayers' obligations can change with their financial situation or if tax laws are amended. Reviewing the need to file Form 3520 each tax year is wise.

- Electronic Filing Is Not Available: Unlike many tax forms, Form 3520 must be printed and mailed to the IRS. As of the last update, electronic filing is not an option for this form.

Popular PDF Forms

Report Illegal Handicap Parking - Use this document to request a special parking permit if you have a disability, making it easier to find parking near your destination in NYC.

Albertsons Companies Foundation - By requiring a detailed description of the proposed acknowledgment for Safeway's donation, the form highlights the importance of public recognition.