Blank IRS 3800 PDF Template

Navigating the complexities of tax credits can feel like an intricate dance, particularly when dealing with the diverse incentives offered by the United States tax code. Among the vast array of forms and documents, the IRS 3800 form emerges as a crucial tool for individuals and businesses striving to capitalize on these incentives. This form, officially known as the General Business Credit, serves as a collective umbrella for numerous tax credits, designed to encourage various types of economic activities and investments. Through the IRS 3800, entities can claim credits for activities ranging from environmental conservation efforts to research and development. The significance of this form cannot be overstated, as it not only facilitates the actual claiming process but also illuminates the potential tax savings that might otherwise go unnoticed. For taxpayers aiming to reduce their liabilities while also contributing positively to targeted sectors, understanding and accurately completing this form is a pivotal step towards financial efficiency and societal benefit.

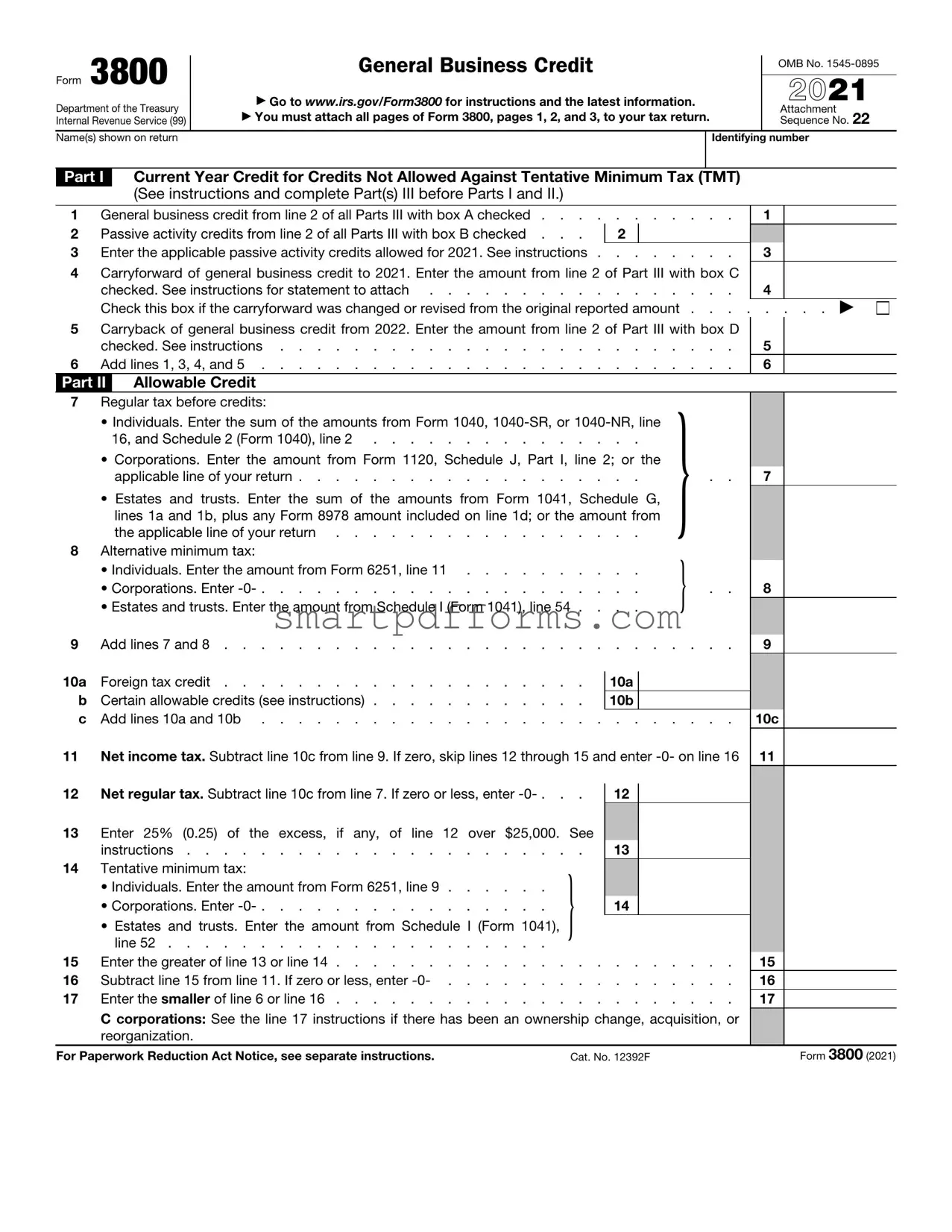

Preview - IRS 3800 Form

Form 3800 |

General Business Credit |

|

OMB No. |

|

|

||

|

|

|

|

|

|

|

|

Department of the Treasury |

▶ Go to www.irs.gov/Form3800 for instructions and the latest information. |

2021 |

|

▶ You must attach all pages of Form 3800, pages 1, 2, and 3, to your tax return. |

|

Attachment |

|

Internal Revenue Service (99) |

|

Sequence No. 22 |

|

Name(s) shown on return |

|

Identifying |

number |

Part I Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

(See instructions and complete Part(s) III before Parts I and II.)

1 |

General business credit from line 2 of all Parts III with box A checked . . . . |

. . . . . . . |

1 |

|

|

2 |

Passive activity credits from line 2 of all Parts III with box B checked . . . |

2 |

|

|

|

3 |

Enter the applicable passive activity credits allowed for 2021. See instructions . |

. . . . . . . |

3 |

|

|

4Carryforward of general business credit to 2021. Enter the amount from line 2 of Part III with box C

checked. See instructions for statement to attach |

|

4 |

Check this box if the carryforward was changed or revised from the original reported amount . . . |

. . . . . ▶ |

|

5Carryback of general business credit from 2022. Enter the amount from line 2 of Part III with box D

|

checked. See instructions |

. . . . |

. . . . |

5 |

|

||||

6 |

Add lines 1, 3, 4, and 5 |

. . . . |

. . . . |

6 |

|

||||

Part II |

Allowable Credit |

|

|

|

|

|

|

|

|

7 |

Regular tax before credits: |

|

|

|

} |

|

|

|

|

|

• Individuals. Enter the sum of the amounts from Form 1040, |

|

|

|

|||||

|

|

16, and Schedule 2 (Form 1040), line 2 |

|

|

|

||||

|

• Corporations. Enter the amount from Form 1120, Schedule J, Part I, line 2; or the |

|

|

|

|||||

|

|

applicable line of your return |

. . . |

|

. . |

7 |

|

||

|

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G, |

|

|

|

|||||

|

|

lines 1a and 1b, plus any Form 8978 amount included on line 1d; or the amount from |

|

|

|

||||

8 |

|

the applicable line of your return |

. . . |

|

|

|

|

||

Alternative minimum tax: |

|

|

|

} |

|

|

|

||

|

• Individuals. Enter the amount from Form 6251, line 11 |

|

|

|

|||||

|

• Corporations. Enter |

. . . |

|

. . |

8 |

|

|||

|

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 54 . |

. . . |

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

9 |

Add lines 7 and 8 |

. . . . |

. . . . |

9 |

|

||||

|

|

|

|

|

|

|

|

||

10a |

Foreign tax credit |

|

10a |

|

|

|

|

|

|

b |

Certain allowable credits (see instructions) |

|

10b |

|

|

|

|

|

|

c |

Add lines 10a and 10b |

. . . . |

. . . . |

10c |

|||||

11 |

Net income tax. Subtract line 10c from line 9. If zero, skip lines 12 through 15 and enter |

11 |

|

||||||

12 |

Net regular tax. Subtract line 10c from line 7. If zero or less, enter |

12 |

|

|

|

|

|

||

13Enter 25% (0.25) of the excess, if any, of line 12 over $25,000. See

|

instructions |

. |

13 |

|

|

|

|

14 |

Tentative minimum tax: |

} |

|

|

|

|

|

|

• Individuals. Enter the amount from Form 6251, line 9 |

|

|

|

|

|

|

|

• Corporations. Enter |

14 |

|

|

|

|

|

|

• Estates and trusts. Enter the amount from Schedule I (Form 1041), |

|

|

|

|

|

|

|

line 52 |

|

|

|

|

|

|

15 |

Enter the greater of line 13 or line 14 |

. . . . . . . . . |

|

15 |

|

||

16 |

Subtract line 15 from line 11. If zero or less, enter |

. . . . . . . . . |

|

16 |

|

||

17 |

Enter the smaller of line 6 or line 16 |

. . . . . . . . . |

|

17 |

|

||

|

C corporations: See the line 17 instructions if there has been an ownership change, acquisition, or |

|

|

||||

|

reorganization. |

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 12392F |

|

Form 3800 (2021) |

||||

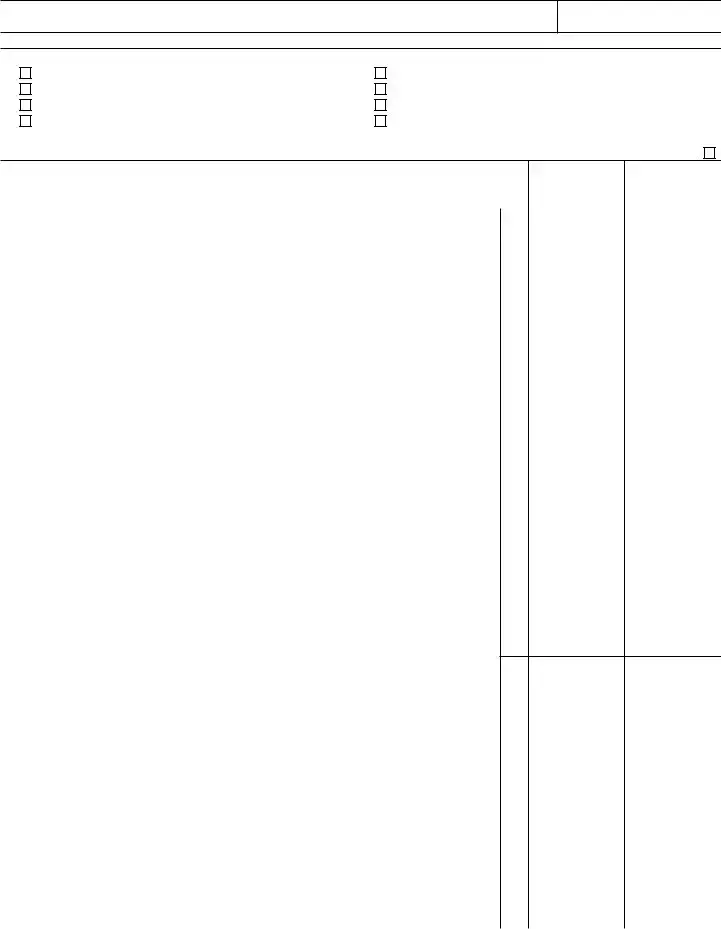

Form 3800 (2021) |

Page 2 |

Part II Allowable Credit (continued)

Note: If you are not required to report any amounts on line 22 or 24 below, skip lines 18 through 25 and enter

18 |

Multiply line 14 by 75% (0.75). See instructions |

. . . . . . . . |

18 |

|

||

19 |

Enter the greater of line 13 or line 18 |

. . . . . . . . |

19 |

|

||

20 |

Subtract line 19 from line 11. If zero or less, enter |

. . . . . . . . |

20 |

|

||

21 |

Subtract line 17 from line 20. If zero or less, enter |

. . . . . . . . |

21 |

|

||

22 |

Combine the amounts from line 3 of all Parts III with box A, C, or D checked . |

. . . . . . . . |

22 |

|

||

23 |

Passive activity credit from line 3 of all Parts III with box B checked . . . |

|

23 |

|

|

|

|

|

|

|

|||

24 |

Enter the applicable passive activity credit allowed for 2021. See instructions |

. . . . . . . . |

24 |

|

||

25 |

Add lines 22 and 24 |

. . . . . . . . |

25 |

|

||

26Empowerment zone and renewal community employment credit allowed. Enter the smaller of line 21

|

or line 25 |

. . . . . . . |

26 |

|

||

27 |

Subtract line 13 from line 11. If zero or less, enter |

. . . . . . . |

27 |

|

||

28 |

Add lines 17 and 26 |

. . . . . . . |

28 |

|

||

29 |

Subtract line 28 from line 27. If zero or less, enter |

. . . . . . . |

29 |

|

||

30 |

Enter the general business credit from line 5 of all Parts III with box A checked . |

. . . . . . . |

30 |

|

||

31 |

Reserved |

. . . . . . . |

31 |

|

||

|

||||||

32 |

Passive activity credits from line 5 of all Parts III with box B checked . . . |

|

32 |

|

|

|

|

|

|

|

|||

33 |

Enter the applicable passive activity credits allowed for 2021. See instructions . |

. . . . . . . |

33 |

|

||

34Carryforward of business credit to 2021. Enter the amount from line 5 of Part III with box C checked

and line 6 of Part III with box G checked. See instructions for statement to attach |

|

34 |

Check this box if the carryforward was changed or revised from the original reported amount . . . |

. . . . . ▶ |

|

35Carryback of business credit from 2022. Enter the amount from line 5 of Part III with box D checked.

|

See instructions |

. . |

35 |

|

|

36 |

Add lines 30, 33, 34, and 35 |

. . |

36 |

|

|

37 |

Enter the smaller of line 29 or line 36 |

. . |

37 |

|

|

38 |

Credit allowed for the current year. Add lines 28 and 37. |

|

|

|

|

|

Report the amount from line 38 (if smaller than the sum of Part I, line 6, and Part II, lines 25 and 36, |

|

|

||

|

see instructions) as indicated below or on the applicable line of your return. |

} |

|

|

|

|

• Individuals. Schedule 3 (Form 1040), line 6 |

|

|

|

|

|

• Corporations. Form 1120, Schedule J, Part I, line 5c |

. . |

|

|

|

|

• Estates and trusts. Form 1041, Schedule G, line 2b |

|

38 |

|

|

Form 3800 (2021)

Form 3800 (2021) |

Page 3 |

Name(s) shown on return

Part III General Business Credits or Eligible Small Business Credits (see instructions)

Identifying number

Complete a separate Part III for each box checked below. See instructions.

A |

General Business Credit From a |

E |

|

Reserved |

|

||||

B |

General Business Credit From a Passive Activity |

F |

|

Reserved |

|

||||

C |

General Business Credit Carryforwards |

G |

|

Eligible Small Business Credit Carryforwards |

D |

General Business Credit Carrybacks |

H |

|

Reserved |

|

IIf you are filing more than one Part III with box A or B checked, complete and attach first an additional Part III combining amounts from

all Parts III with box A or B checked. Check here if this is the consolidated Part III . . . . . . . . . . . . . . . . ▶

|

(a) Description of credit |

|

(b) Enter EIN if |

(c) Enter the |

Note: On any line where the credit is from more than one source, a separate Part III is needed for each |

|

claiming the credit |

appropriate |

|

|

from a |

amount. |

||

|

||||

|

entity. |

|

||

1a |

Investment (Form 3468, Part II only) (attach Form 3468) |

1a |

|

|

b |

Reserved |

1b |

|

|

c |

Increasing research activities (Form 6765) |

1c |

|

|

d |

1d |

|

||

e |

Disabled access (Form 8826)* |

1e |

|

|

f |

Renewable electricity, refined coal, and Indian coal production (Form 8835) . . |

1f |

|

|

g |

Indian employment (Form 8845) |

1g |

|

|

h |

Orphan drug (Form 8820) |

1h |

|

|

i |

New markets (Form 8874) |

1i |

|

|

j |

Small employer pension plan startup costs and |

1j |

|

|

k |

1k |

|

||

l |

Biodiesel and renewable diesel fuels (attach Form 8864) |

1l |

|

|

m |

Low sulfur diesel fuel production (Form 8896) |

1m |

|

|

n |

Distilled spirits (Form 8906) |

1n |

|

|

o |

Nonconventional source fuel (carryforward only) |

1o |

|

|

p |

Energy efficient home (Form 8908) |

1p |

|

|

q |

Energy efficient appliance (carryforward only) |

1q |

|

|

r |

Alternative motor vehicle (Form 8910) |

1r |

|

|

s |

Alternative fuel vehicle refueling property (Form 8911) |

1s |

|

|

t |

Enhanced oil recovery credit |

1t |

|

|

u |

Mine rescue team training (Form 8923) |

1u |

|

|

v |

Agricultural chemicals security (carryforward only) |

1v |

|

|

w |

Employer differential wage payments (Form 8932) |

1w |

|

|

x |

Carbon oxide sequestration (Form 8933) |

1x |

|

|

y |

Qualified |

1y |

|

|

z |

Qualified |

1z |

|

|

aa |

Employee retention (Form |

1aa |

|

|

bb |

General credits from an electing large partnership (carryforward only) . . . . |

1bb |

|

|

zzOther. Oil and gas production from marginal wells (Form 8904) and certain other

|

credits (see instructions) |

1zz |

||

2 |

Add lines 1a through 1zz and enter here and on the applicable line of Part I . . |

2 |

|

|

3 |

Enter the amount from Form 8844 here and on the applicable line of Part II . . |

3 |

|

|

4a |

Investment (Form 3468, Part III) (attach Form 3468) |

4a |

||

b |

Work opportunity (Form 5884) |

4b |

||

c |

Biofuel producer (Form 6478) |

4c |

||

d |

4d |

|||

e |

Renewable electricity, refined coal, and Indian coal production (Form 8835) . . |

4e |

||

f |

Employer social security and Medicare taxes paid on certain employee tips (Form 8846) |

4f |

||

g |

Qualified railroad track maintenance (Form 8900) |

4g |

||

h |

Small employer health insurance premiums (Form 8941) |

4h |

||

i |

Increasing research activities (Form 6765) |

4i |

||

j |

Employer credit for paid family and medical leave (Form 8994) |

4j |

||

z |

Other |

4z |

||

5 |

Add lines 4a through 4z and enter here and on the applicable line of Part II . . |

5 |

|

|

6 |

Add lines 2, 3, and 5 and enter here and on the applicable line of Part II . . . |

6 |

|

|

* See instructions for limitation on this credit. |

|

|

Form 3800 (2021) |

|

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 3800 | Form 3800, also known as the General Business Credit form, is used by taxpayers to calculate and claim various business credits under a wide range of programs. |

| Eligible Taxpayers | Individuals, corporations, partnerships, and other entities may use Form 3800 to claim applicable business credits. |

| Types of Credits Included | Form 3800 encompasses multiple credits such as the Investment Credit, Work Opportunity Credit, and Renewable Electricity Production Credit, among others. |

| Carryback and Carryforward Rules | Certain credits not utilized in the current tax year can be carried back one year and forward up to 20 years to offset tax liability. |

| Limitations | The form includes limitations based on tax liability and can restrict the amount of credit that can be claimed in a single tax year. |

| Required Attachments | Taxpayers need to attach form(s) that detail the specific credits being claimed in addition to completing Form 3800. |

| Filing Deadline | Form 3800 is filed with the taxpayer's annual tax return by the tax return’s due date, including extensions. |

| Governing Laws | The Internal Revenue Code (IRC) provides the legal basis for the credits claimed on Form 3800. |

| Audits and Adjustments | Credits claimed on Form 3800 may be subject to audit. Taxpayers should retain all related documentation for at least three years. |

Instructions on Utilizing IRS 3800

After completing your main tax forms, the next step for individuals and businesses with certain credits is to tackle the IRS 3800 form, also known as the General Business Credit form. This document is essential for compiling various credits from different sources into one comprehensive claim. Proper completion is critical for maximizing potential tax benefits. Below are the steps to efficiently and accurately fill out the IRS 3800 form.

- Gather all necessary documents and information regarding business credits eligible for the current tax year. This may include energy credits, small employer health insurance premiums, and investment credits.

- Access the latest version of the IRS 3800 form. Ensure you are using the form for the correct tax year to comply with current tax laws and guidelines.

- Begin by entering your name, or your business's name if filing for a company, and your taxpayer identification number (Social Security Number for individuals or Employer Identification Number for businesses) at the top of the form.

- Follow the instructions on the form to report each type of business credit. This includes filling in amounts for each eligible credit in the designated lines. Be sure to use the specific line assigned to each credit to avoid processing errors.

- Carefully calculate the total of all individual credits to determine your general business credit. Enter this total in the section provided near the end of the form.

- If necessary, complete any additional sections relevant to your situation, such as carryback or carryforward of unused credits. Detailed instructions provided on the form will guide you through this process.

- Review the entire form for accuracy and completeness. Errors or omissions can delay processing and possibly affect the amount of credit you are eligible to receive.

- Attach the IRS 3800 form to your main tax return. Ensure all other necessary schedules and documents are included with your tax return package.

- Submit your tax return by the appropriate deadline. For most taxpayers, this is April 15. If you are unable to meet this deadline, you may file for an extension to avoid potential penalties.

Completing the IRS 3800 form accurately is crucial for claiming all eligible business credits. Taking time to double-check your work can prevent mistakes and help ensure you receive the maximum benefit available. Remember, when in doubt, consult with a tax professional experienced in handling business credits and tax forms.

Obtain Answers on IRS 3800

-

What is the IRS 3800 form, and who needs to file it?

The IRS 3800 form, commonly referred to as the General Business Credit form, is a document used by individuals and businesses to calculate and claim various business-related tax credits. These credits are incentives provided by the government to encourage certain behaviors, such as investing in research or using renewable energy. If you have incurred expenses that qualify for any of these credits during the tax year, you would need to complete and file Form 3800 along with your tax return.

-

What kinds of credits can be claimed with Form 3800?

The Form 3800 consolidates various tax credits into one universal form. Credits you can claim include, but are not limited to, the Investment Credit, Work Opportunity Credit, Renewable Electricity Production Credit, and the Research Credit. Each of these credits serves to reduce the amount of tax owed by a business or individual, thereby lowering overall taxable income for the year they are claimed.

-

How does one fill out the IRS 3800 form?

Filling out the IRS 3800 form requires detailed financial information regarding the credits you're claiming. You'll need to identify each credit you are eligible for and gather the documentation supporting the expenses or investments made. The form guides you through calculating the total credits for which you are eligible. It is vital to read the instructions provided by the IRS for Form 3800 carefully, as they offer step-by-step guidance, including how to transfer these credits to your main tax return form.

-

Are there any tips for ensuring the process goes smoothly?

Make sure you thoroughly understand the eligibility requirements for each credit you plan to claim. Incorrectly claimed credits can result in audits or penalties.

Keep detailed records of all qualifying expenditures and investments. Documentation is key when it comes to substantiating your claims should the IRS have any questions.

Consider using a tax professional or software that is familiar with Form 3800 and the various business credits. This can help avoid common mistakes and ensure that you maximize your potential credits.

Common mistakes

Understanding the intricacies of IRS forms can often feel like navigating a labyrinth with ever-changing walls. Among these, Form 3800, which is used to calculate and claim the General Business Credit, is particularly notorious for its complexity. Even the most conscientious taxpayers can stumble when attempting to conquer its dense landscape. Here are seven common errors to avoid:

-

Not checking for updates. Tax regulations and forms evolve. An often-overlooked mistake is using an outdated version of Form 3800. The IRS frequently updates its forms to reflect changes in tax law, making it essential to use the most current version available.

-

Misunderstanding the eligibility criteria. Credits have specific requirements. A widespread error is assuming a business qualifies for a credit without thoroughly understanding its eligibility requirements. Each credit included in Form 3800 comes with its set of rules that must be met.

-

Inaccurate calculations. Numbers must add up. A common pitfall is incorrect calculations. Whether it’s a result of manual errors or misinterpretation of the credits, such mistakes can significantly impact the total business credit claimed.

-

Failing to attach required forms. Every credit has its story. Often, businesses neglect to attach the specific forms or schedules that substantiate the credits they are claiming. Each credit part of Form 3800 often needs a supporting document or form that verifies the claim.

-

Overlooking carryback and carryforward rules. The timeline matters. Taxpayers sometimes miss opportunities because they don't apply carryback and carryforward provisions correctly. These rules allow businesses to apply their current year’s unused credits to past and future tax years, optimizing tax savings.

-

Mixing up credits. Each credit has its place. Merging credits, such as applying a credit intended for one business activity to a different activity, is a slip-up that can lead to the IRS questioning your entire Form 3800.

-

Improper documentation. Documentation is key. Not maintaining proper records or sufficient documentation to support each credit claim is a risk no taxpayer should take. Comprehensive documentation ensures that, if questioned, the taxpayer has the necessary information to validate every credit claimed on Form 3800.

In summary, while tackling Form 3800 can indeed be daunting, a meticulous and informed approach can greatly reduce errors. Avoiding these common mistakes can not only streamline the process but also maximize the potential benefits of the credits claimed. In the end, an ounce of preparation is worth a pound of cure, especially when navigating the complexities of tax credits and deductions.

Documents used along the form

When individuals or businesses prepare their taxes, particularly when claiming credits, the Internal Revenue Service (IRS) Form 3800, known as the General Business Credit, is often a crucial document. This form consolidates various credits to lower the amount of tax owed. Accompanying the IRS 3800, there are a number of other forms and documents that are commonly required to fully support the claim for credits. Below is a list that encapsulates these essential forms, each serving its unique purpose in the context of tax preparation and submission.

- Form 3468: Investment Credit - This form is used to calculate and claim the investment credit, which includes credits for rehabilitation, energy, qualifying advanced coal project, qualifying gasification project, and qualifying advanced energy projects.

- Form 8844: Empowerment Zone Employment Credit - Employers use this form to claim the empowerment zone employment credit, a benefit for hiring qualified employees who work in a designated empowerment zone.

- Form 8826: Disabled Access Credit - Businesses that make accessible improvements for persons with disabilities can claim a credit for these expenditures through Form 8826.

- Form 8874: New Markets Credit - Investors or businesses that provide capital to qualified community development entities can claim a credit for these investments using Form 8874.

- Form 6765: Credit for Increasing Research Activities - This form is for businesses to claim credit for expenses related to research and development activities aimed at improving products, processes, or software.

- Form 5884: Work Opportunity Credit - Employers filling out this form can claim a credit for hiring individuals from certain groups that have significant barriers to employment.

- Form 3800V: Payment Voucher – While technically an accompanying document rather than a form for claiming credits, Form 3800V is used to submit payment specifically related to the General Business Credit when owed.

Together, these forms encapsulate a wide range of credits that businesses and employers can claim, supporting a variety of investments and policy objectives, from enhancing accessibility for the disabled, encouraging investment in underprivileged areas, to stimulating research and development. Each form serves as a critical component in the tax filing process, providing structured pathways for claiming specific credits. Properly completing and submitting these forms in conjunction with IRS Form 3800 ensures that taxpayers accurately claim their entitled benefits and comply with tax laws.

Similar forms

IRS Form 1040: Similar to the IRS 3800 form, which is primarily concerned with General Business Credit, Form 1040 is a fundamental document used by individuals in the United States to file their annual income tax returns. Both forms require detailed financial information and are crucial for fulfilling tax obligations. However, while Form 3800 is specific to businesses seeking to claim various business credits, Form 1040 is for individual taxpayers reporting their income, deductions, and credits.

IRS Form 8863: This form, titled "Education Credits (American Opportunity and Lifetime Learning Credits)," shares similarities with the IRS 3800 form in that it allows taxpayers to claim specific credits, in this case, for education expenses. Taxpayers use both forms to calculate and report credits that reduce their tax liability, based on qualifying expenses--business-related for Form 3800 and education-related for Form 8863.

IRS Form 5695: Used to calculate and claim residential energy credits, Form 5695 is akin to the IRS 3800 form in its focus on tax credits. While Form 3800 covers a broad spectrum of business credits, Form 5695 is specialized, offering homeowners incentives for making energy-efficient improvements to their homes. Both forms facilitate the process of claiming tax benefits for specific expenditures, albeit in different sectors.

IRS Form 8911: This form pertains to the Alternative Fuel Vehicle Refueling Property Credit, similar to IRS 3800 in that it involves the calculation of tax credits. Form 8911 is designed for taxpayers who have installed alternative fuel vehicle refueling equipment. The parallel between these forms lies in their purpose to provide financial incentives, through tax credits, for certain types of investments—business investments in the case of Form 3800, and environmental sustainability for Form 8911.

IRS Form 4562: Form 4562, dealing with Depreciation and Amortization, is like the IRS 3800 form, as both involve detailed calculations related to business investments. While Form 3800 focuses on credits for a wide range of business activities, Form 4562 is specifically concerned with the depreciation or amortization of property. Taxpayers use both forms to navigate complex financial aspects of their business operations and to take advantage of tax benefits accordingly.

Dos and Don'ts

The IRS Form 3800, General Business Credit, can be a crucial piece for many businesses seeking tax credits. While filling it out, it's essential to keep certain guidelines in mind to ensure the process is smooth and error-free. Below are the things to do and not to do when tackling this form:

- Do: Gather all necessary information beforehand. This includes gathering records of business income, expenses, and any applicable tax credits eligible for your business.

- Do: Double-check eligibility for each credit. The form covers various credits, and not every business will qualify for each. Ensure you're only applying for credits applicable to your situation.

- Do: Use the IRS guidelines and instructions for Form 3800. These instructions provide detailed steps and can resolve many common questions you may encounter.

- Do: Seek professional help if needed. Tax professionals can provide valuable advice and ensure your form is filled out correctly, maximizing your potential credits.

- Do: Keep a copy of the submitted form and all supporting documentation. This can be critical if the IRS has questions or if there’s a need for a future audit.

- Don’t: Rush through the process. Errors can delay your credits or result in penalties, so take the time to carefully review each section of the form.

- Don’t: Ignore smaller credits. Even small credits can add up and significantly reduce your tax liability, so take the time to assess all possible credits.

- Don’t: Forget to update your information. If your business structure or income has changed since the last tax year, update these details to reflect your current situation accurately.

- Don’t: Submit without reviewing. A final check for accuracy and completeness can save you from complications down the road.

Filling out IRS Form 3800 with due diligence and care will ensure that your business takes full advantage of available tax credits while complying with federal tax regulations. This not only helps in maximizing your benefits but also in maintaining a good standing with the IRS.

Misconceptions

Understanding the IRS Form 3800, General Business Credit, can be challenging, and there are several misconceptions about its use and benefits. Here's a clarification of some common misunderstandings:

Only large corporations can benefit from the IRS Form 3800. This is not true. Businesses of all sizes, including small businesses, can take advantage of the tax credits available through IRS Form 3800, provided they meet the qualifying criteria for specific credits.

Form 3800 is only for energy-related credits. While the form does include energy-related credits, such as the Investment Tax Credit (ITC) and the Renewable Electricity Production Credit, it actually encompasses a wide range of tax credits from different areas, including research, employment, and environmental improvements.

IRS Form 3800 can only be filed with annual tax returns. Businesses can indeed file Form 3800 with their annual tax returns. However, taxpayers can also amend past returns to claim credits they previously missed, showing the form's flexibility in filing options.

If your business didn't owe taxes this year, there's no point in filing Form 3800. This misconception overlooks the fact that many of the credits on Form 3800 can be carried back or forward to other tax years. If your business didn't owe any taxes in the current year, you might still benefit from these credits in a future year when you do owe taxes or even apply them to past years where taxes were owed.

Filing for credits using IRS Form 3800 is not worth the effort. While compiling the necessary documentation and calculations for Form 3800 can be labor-intensive, the financial benefits of the claimed credits can significantly outweigh the initial effort. Detailed record-keeping and a good understanding of the available credits can make the filing process smoother and more beneficial.

Accurate information and a clear understanding of tax forms like IRS Form 3800 are essential in maximizing potential tax benefits for businesses. When in doubt, consulting with a tax professional knowledgeable about business credits can provide valuable guidance and peace of mind.

Key takeaways

The IRS Form 3800, also known as the General Business Credit form, plays a crucial role in the tax filing process for individuals and businesses looking to claim various business-related tax credits. Proper understanding and completion of this form can significantly impact an entity's tax liabilities. Here are key takeaways regarding the filling out and use of the IRS Form 3800:

- Eligibility Determination: Before completing Form 3800, taxpayers must determine their eligibility for any of the credits that the form encompasses. These credits cover a wide range of business activities and investments, including but not limited to, energy efficiency, employment, and research and development.

- Accurate Information Collection: Taxpayers should gather and accurately report all necessary information for each credit being claimed. This includes ensuring that all income and expenses related to the credits are properly documented and calculated, as errors can lead to delays or audits.

- Credit Limitations and Carryovers: Form 3800 helps taxpayers calculate the general business credit's total amount and includes sections for understanding any limitations based on tax liability, as well as instructions for carrying over unused credits to other tax years or back to previous years, if applicable.

- Multiple Credits Handling: When claiming more than one business credit, Form 3800 serves as a consolidated form where taxpayers can aggregate all the business credits they're eligible for. This simplifies the process and ensures that the overall impact of these credits on their tax liability is correctly calculated and applied.

- Comprehensive Instructions: The IRS provides detailed instructions for Form 3800, which guide taxpayers through the complexities of each section. It is critical to follow these instructions carefully to ensure the form is completed accurately and that all relevant credits are properly claimed.

Filing Form 3800 requires careful attention to detail and a thorough understanding of tax laws related to business credits. Taxpayers are encouraged to consult with a tax professional or accountant to ensure that they are maximizing their potential tax benefits while complying with all applicable laws and regulations.

Popular PDF Forms

Form 8332 Pdf - Filing Form 8332 without the consent of the custodial parent is considered tax fraud and can lead to legal consequences.

Ama Mean - A form used to acknowledge a patient's decision to go against the medical advice given, after being fully informed about the potential risks.

What Is a Dwc 1 Form - Accuracy in completing the form is critical to avoid delays or disputes in the claim process.