Blank IRS 3911 PDF Template

When taxpayers face the issue of a missing refund, the IRS 3911 form becomes an indispensable tool. This form is specifically designed to initiate a trace for refunds that were not received by the taxpayer, addressing concerns such as undelivered, lost, or stolen checks. Engaging with this form invites a review from the Internal Revenue Service to investigate the whereabouts of the expected funds. Taxpayers must accurately complete and provide detailed information about their refund, including when the refund was expected and any direct deposit information if applicable. The process set forth by the IRS for this situation ensures that taxpayers are guided step by step, making it easier to potentially recover their missing funds. The IRS 3911 form acts as a formal request, engaging the agency's resources to track down the missing money, providing a crucial bridge between taxpayers' concerns and resolution. Tailored to address individual cases, the form reflects the IRS's commitment to assisting taxpayers in safeguarding their returns and ensuring that they receive what is rightfully theirs.

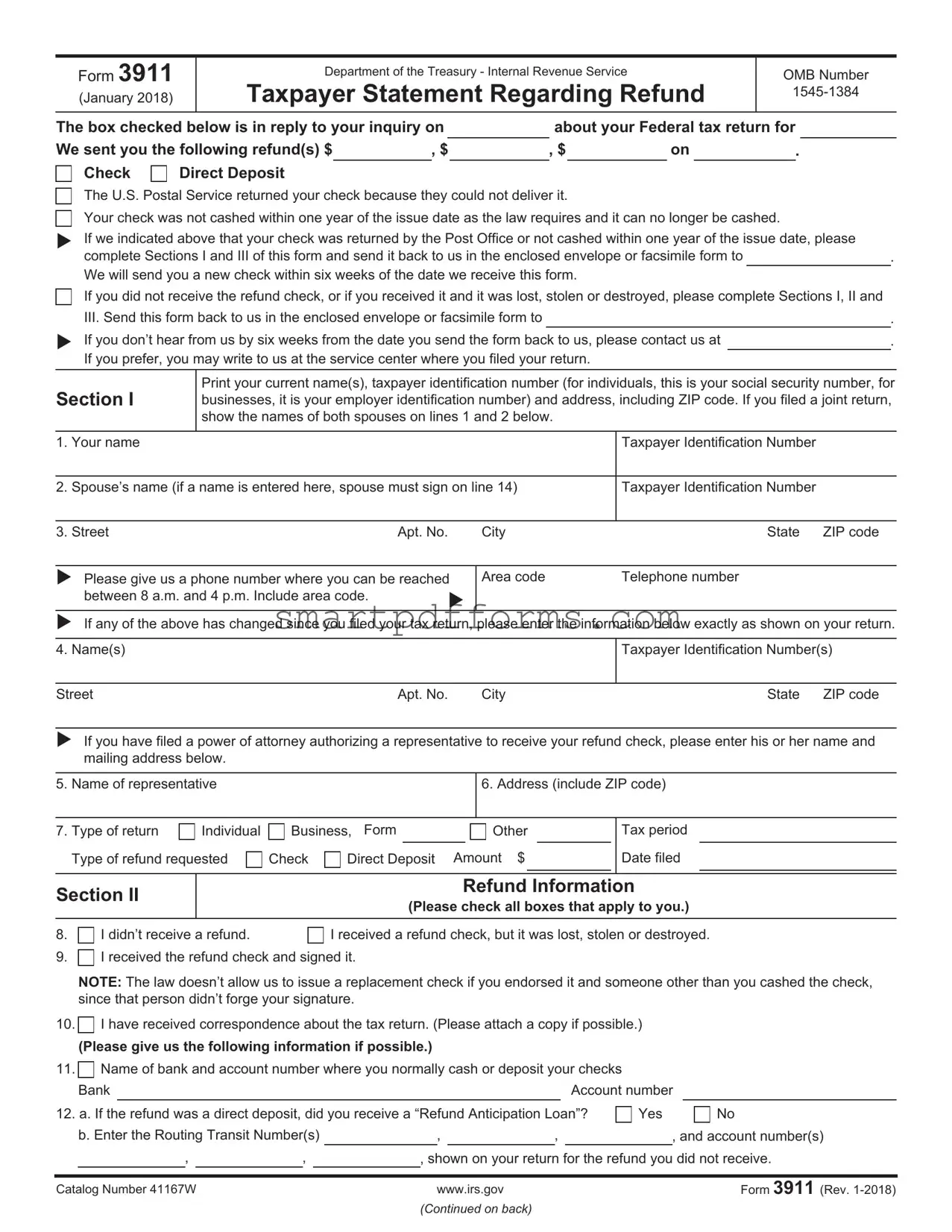

Preview - IRS 3911 Form

Form 3911

(January 2018)

Department of the Treasury - Internal Revenue Service

Taxpayer Statement Regarding Refund

OMB Number

The box checked below is in reply to your inquiry on |

|

|

about your Federal tax return for |

|||||||

We sent you the following refund(s) $ |

, $ |

, $ |

|

on |

. |

|||||

Check |

Direct Deposit |

|

|

|

|

|

|

|

|

|

The U.S. Postal Service returned your check because they could not deliver it.

Your check was not cashed within one year of the issue date as the law requires and it can no longer be cashed.

XIf we indicated above that your check was returned by the Post Office or not cashed within one year of the issue date, please complete Sections I and III of this form and send it back to us in the enclosed envelope or facsimile form to

We will send you a new check within six weeks of the date we receive this form.

If you did not receive the refund check, or if you received it and it was lost, stolen or destroyed, please complete Sections I, II and III. Send this form back to us in the enclosed envelope or facsimile form to

XIf you don’t hear from us by six weeks from the date you send the form back to us, please contact us at If you prefer, you may write to us at the service center where you filed your return.

.

.

.

Section I

Print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including ZIP code. If you filed a joint return, show the names of both spouses on lines 1 and 2 below.

1. Your name

Taxpayer Identification Number

2. Spouse’s name (if a name is entered here, spouse must sign on line 14)

Taxpayer Identification Number

3. Street |

Apt. No. |

City |

State |

ZIP code |

XPlease give us a phone number where you can be reached

between 8 a.m. and 4 p.m. Include area code. |

X |

Area code |

Telephone number |

XIf any of the above has changed since you filed your tax return, please enter the information below exactly as shown on your return.

4. Name(s)

Taxpayer Identification Number(s)

Street |

Apt. No. |

City |

State |

ZIP code |

XIf you have filed a power of attorney authorizing a representative to receive your refund check, please enter his or her name and mailing address below.

5. Name of representative

7. Type of return |

Individual |

Business, Form |

|

|

Other |

|

Type of refund requested |

Check |

Direct Deposit |

Amount $ |

|||

Tax period

Date filed

Section II

Refund Information

(Please check all boxes that apply to you.)

8. |

I didn’t receive a refund. |

I received a refund check, but it was lost, stolen or destroyed. |

9. I received the refund check and signed it.

I received the refund check and signed it.

NOTE: The law doesn’t allow us to issue a replacement check if you endorsed it and someone other than you cashed the check, since that person didn’t forge your signature.

10. I have received correspondence about the tax return. (Please attach a copy if possible.)

I have received correspondence about the tax return. (Please attach a copy if possible.)

(Please give us the following information if possible.)

11.

Name of bank and account number where you normally cash or deposit your checks

Name of bank and account number where you normally cash or deposit your checks

|

Bank |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|||||

12. a. If the refund was a direct deposit, did you receive a “Refund Anticipation Loan”? |

Yes |

|

No |

||||||||||||||||

|

b. Enter the Routing Transit Number(s) |

, |

|

, |

|

|

|

, and account number(s) |

|||||||||||

|

, |

|

, |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

, shown on your return for the refund you did not receive. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Catalog Number 41167W |

|

|

|

|

www.irs.gov |

|

|

|

|

|

|

Form 3911 (Rev. |

|

||||||

(Continued on back)

Page 2

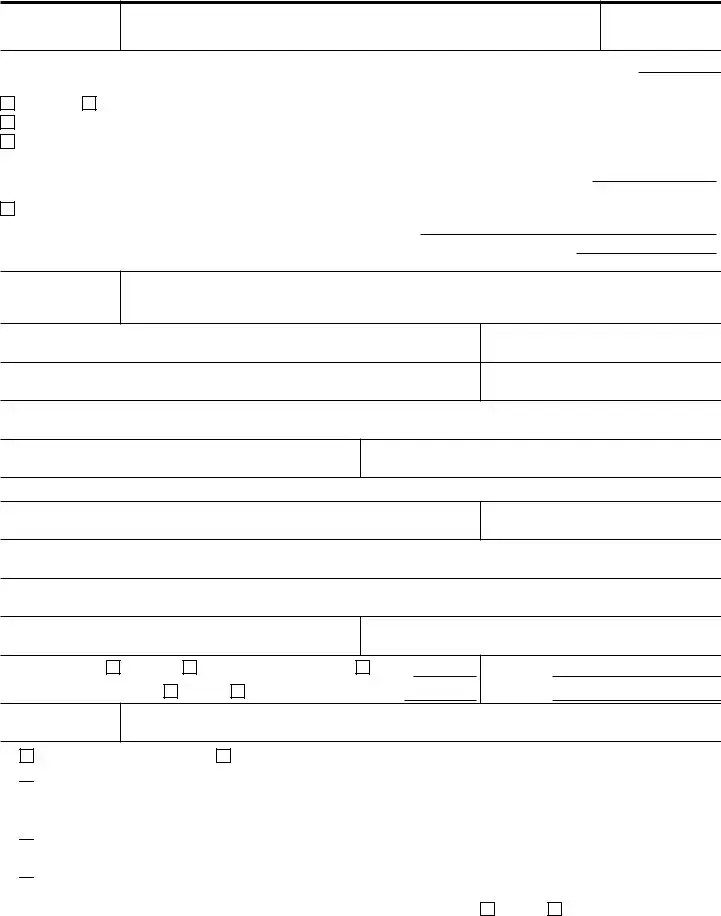

Section III

Certification

XPlease sign below, exactly as you signed the return. If this refund was from a joint return, we need the signatures of both spouses before we can trace it.

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, the information is true, correct, and complete. I request that you send a replacement refund, and if I receive two refunds I will return one.

13. Signature (For business returns, signature of person authorized to sign the check)

Date

14. Spouse’s signature, if required (For businesses, enter the title of the person who signed above.)

Date

Section IV |

Description of Check |

|

(For Internal Revenue Service use only) |

||

|

||

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States.

You aren’t required to give us the information since the refund you claimed has already been issued. However, without the information we won’t be able to trace your refund, and may be unable to replace it. You may give us the information we need in a letter.

We need the information to ensure that you are complying with these laws and to allow us to determine the correctness of your refund or the right amount of payment. Your Social Security Number and the other information are being requested in order that the Department of the Treasury can process your refund. The authority of requesting your social security number is 26 United States Code, section 6109. If you cannot or will not furnish the information, the tracing of your refund may be delayed.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or record relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. The time needed to compete and file this form will vary depending on individual circumstances. The estimated average time is less than 5 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Attention: Tax Products Coordinating Committee, Western Area Distribution Center, Rancho Cordova, CA

Do not send this form to this office. Instead, please use the envelope provided or mail the form to the Internal Revenue Service center where you would normally file a paper tax return.

Catalog Number 41167W |

www.irs.gov |

Form 3911 (Rev. |

Form Data

| Fact Name | Detail |

|---|---|

| Purpose of Form | The IRS 3911 form is used by taxpayers to inquire about a missing refund or to report that a refund check was either not received, lost, stolen, or destroyed. |

| Who Should Use It | Any taxpayer who has not received their refund within the expected timeframe, or believes their refund check may have been compromised, should use this form. |

| Processing Time | Once submitted, it can take up to six weeks for the IRS to investigate and respond to a query made with the 3911 form. |

| Form Availability | The IRS 3911 form is available on the IRS website and can be downloaded for free. It can be printed for mailing or faxing back to the IRS. |

| Required Information | Taxpayers need to provide personal information, tax year, and details about the expected refund, including the amount and the date the original refund was expected. |

| How to Submit | The completed form can be either mailed or faxed to the IRS, depending on the taxpayer's location and the instructions provided by the IRS. |

| Follow-up | If no response is received within six weeks, taxpayers are encouraged to follow up with the IRS directly to inquire about their case. |

| Governing Laws | The procedures and use of the IRS 3911 form are governed by federal tax law, as the IRS is a federal agency. State-specific laws do not apply to the processing of this form. |

Instructions on Utilizing IRS 3911

When you're wondering where your tax refund is, you might be guided to fill out Form 3911. This form helps the IRS trace a refund that hasn't arrived as expected. By providing the necessary information, you're essentially asking the IRS to look into what happened to your refund. Filling out this form might seem daunting, but it's actually straightforward when you break it down step by step. Here's how to do it:

- Find the form: First, you need to download Form 3911 from the IRS website.

- Check the box: At the top of the form, you'll see three boxes - check the one that says "Refund." This indicates that you're inquiring about a refund.

- Fill in your personal information: Section 1 asks for your name, social security number, and your spouse's information if you filed jointly. Make sure the details match what you submitted on your tax return.

- Address details: Provide your current address. If you've moved since you filed your return, you also need to include your old address.

- Tax form and tax year: Indicate the tax form you filed (for example, 1040, 1040-SR) and the tax year you're inquiring about.

- Refund information: Enter the exact amount of the refund you were expecting, as shown on your tax return.

- Sign and date: If you filed jointly, both spouses need to sign and date the form.

- Contact information: Provide the best phone number(s) at which the IRS can reach you during the day.

- Mail or fax: Finally, send your completed Form 3911 to the address or fax number provided by the IRS. This might vary depending on your state, so it's important to check the latest instructions on the IRS website.

After sending in Form 3911, the ball is in the IRS's court. They will conduct a trace of your refund and should provide you with updates on their findings. Keep in mind, it may take some time for them to process your request, so patience is key. However, completing this form accurately can help speed things along and bring you closer to resolving the mystery of your missing refund.

Obtain Answers on IRS 3911

-

What is an IRS 3911 form, and when is it used?

The IRS Form 3911, Taxpayer Statement Regarding Refund, is a form that the Internal Revenue Service (IRS) requires taxpayers to complete if there is a question regarding the status of a federal tax refund. It is typically used when a taxpayer hasn't received their refund within the expected timeframe, and the IRS needs additional information to trace the missing refund. This form allows the taxpayer to provide the IRS with the necessary details to help locate or issue the refund.

-

How does one fill out the IRS 3911 form?

To fill out the IRS 3911 form, taxpayers must include personal information such as their name, address, social security number, and the specific tax return details like the tax year and the exact amount of the expected refund. It's crucial to fill in all required sections accurately to assist the IRS in efficiently processing the form and resolving any issues with the refund. Additionally, there are sections for the taxpayer to describe the issue and indicate whether the refund was expected in the form of a check or direct deposit.

-

What happens after submitting Form 3911 to the IRS?

Once Form 3911 is submitted to the IRS, the agency will initiate a trace of the taxpayer's refund. This process can take up to six weeks. During this time, the IRS will attempt to determine what happened to the missing refund and take the necessary steps to resolve the issue. This could involve reissuing a refund check or confirming the deposit information if it was a direct deposit transaction. Taxpayers may be updated on the status of their case and informed of any findings or additional steps they need to take.

-

Can Form 3911 be submitted electronically?

As of the last update, the IRS does not allow the Form 3911 to be submitted electronically. Taxpayers must complete the form manually and mail it to the appropriate IRS address. This address can vary depending on the taxpayer's location and the specifics of their tax situation. It is advised to check the official IRS website or consult with a tax professional to ensure the form is sent to the correct address.

-

Is there a deadline for filing Form 3911?

There is no specific deadline for filing Form 3911. However, it is in the taxpayer's best interest to submit the form as soon as possible after realizing that their refund has not been received within the expected timeframe. Prompt action will help expedite the resolution of the issue. Be mindful, though, that claims for refunds have a statute of limitations, generally three years from the date the original return was filed or two years from the date the tax was paid, whichever is later.

-

Should I hire a tax professional to help with Form 3911?

Hiring a tax professional to assist with Form 3911 is not required but may be advisable for taxpayers who feel overwhelmed by the process or have complex tax situations. A tax professional can provide guidance on filling out the form accurately, ensuring that it is sent to the correct IRS office, and potentially communicating with the IRS on behalf of the taxpayer. In complicated cases or when significant amounts of money are involved, having professional assistance can be beneficial.

Common mistakes

When filling out the IRS 3911 form, people often make a variety of mistakes. It's important to complete this form correctly to make sure the process of resolving tax issues is smooth and accurate. Here are some of the common errors:

Not checking the box to specify if the inquiry is about a refund, notice, or payment. This is essential for directing the form to the appropriate department.

Entering incorrect personal information, such as a wrong Social Security number or address. This mistake can lead to significant delays in processing the form.

Failing to sign and date the form. A signature is required to validate the inquiry and proceed with the processing.

Omitting details about the tax year or period in question. Precise information helps the IRS to locate your records quickly.

Not providing a clear explanation of the issue. The more specific you can be about what you believe the problem is, the easier it is for the IRS to address it.

Leaving the section regarding the type of tax form filed (e.g., 1040, 1040-SR) blank. Identifying the type of form helps in tracing the document in the IRS system.

Forgetting to include details about any previous communications with the IRS related to the issue. This information can help avoid redundant processes.

Incorrect calculations or not attaching necessary documentation when relating to a specific financial discrepancy. Proper documentation is crucial for verifying your claim.

By being mindful of these common mistakes, you can ensure that your IRS 3911 form is filled out correctly, which helps in resolving your tax issues more efficiently.

Documents used along the form

When dealing with the Internal Revenue Service (IRS), particularly in cases where there's a concern about a missing tax refund or a stimulus check, the IRS Form 3911, Taxpayer Statement Regarding Refund, plays a critical role. However, it's often just one piece of the puzzle. To effectively manage such concerns or inquiries, several other forms and documents may accompany Form 3911. These forms serve to provide the IRS with the necessary information to process inquiries, update taxpayer information, or investigate complaints fully.

- Form 8822 – Change of Address: It's essential that the IRS has your current address on file. Form 8822 is used to notify the IRS of a change in address. Timely updating your address ensures that any refunds, notices, or correspondence reach you without unnecessary delays.

- Form 1040 – U.S. Individual Income Tax Return: This form is the standard federal income tax form used to report an individual's income, calculate taxes owed, or claim refunds. If there's a query related to your tax refund, having a copy of your filed Form 1040 can help the IRS address your concerns more swiftly.

- Form 4506-T – Request for Transcript of Tax Return: If you need to provide proof of your income or verify the information filed in your tax returns, Form 4506-T allows you to request a transcript of your tax return. This can be particularly useful if discrepancies are suspected, or further clarification is needed regarding your income or tax liabilities.

- Form 2848 – Power of Attorney and Declaration of Representative: This form grants an individual or an organization the authority to represent you before the IRS. If you're utilizing the services of a tax professional to handle issues related to a missing refund or other tax matter, Form 2848 will enable them to receive information and communicate with the IRS on your behalf.

Navigating tax matters, especially those involving missing refunds or the need to update personal information, can be daunting. Fortunately, the IRS provides a suite of forms designed to streamline these processes, ensuring your concerns are addressed efficiently. While the IRS Form 3911 is a good starting point for resolving issues related to refunds, combining it with relevant forms like the ones listed above can significantly enhance your ability to communicate effectively with the IRS and resolve issues promptly.

Similar forms

IRS Form 1040X (Amended U.S. Individual Income Tax Return): This form is used by individuals who need to correct or amend a previously filed Form 1040, 1040-A, or 1040-EZ. Like IRS Form 3911, the 1040X allows taxpayers to communicate with the IRS regarding changes to their tax filings, ensuring accuracy and compliance.

Form 8822 (Change of Address): When individuals need to notify the IRS of a change in address, they use Form 8822. Similar to Form 3911, it's a communication tool between the taxpayer and the IRS, designed for updating personal information to ensure all correspondence and potential refunds reach the correct location.

Form 4506 (Request for Copy of Tax Return): Taxpayers utilize Form 4506 to request a copy of previously filed tax returns. It shares similarities with Form 3911 in the sense that both forms are used to request information or documents from the IRS, albeit for different purposes.

Form 9465 (Installment Agreement Request): When taxpayers cannot pay their due taxes in full, they can request a payment plan using Form 9465. Like Form 3911, it's a form of negotiation and agreement with the IRS, allowing for flexibility in paying taxes owed.

Form 843 (Claim for Refund and Request for Abatement): This form is used to request a refund or ask for an abatement of certain taxes, interest, penalties, fees, and additions to tax. Similar to Form 3911, Form 843 is used for rectifying issues related to tax payments or charges that a taxpayer believes are incorrect or should be waived.

Form 2848 (Power of Attorney and Declaration of Representative): Taxpayers use Form 2848 to authorize an individual, such as a lawyer or accountant, to represent them before the IRS. Analogous to Form 3911, it involves formalizing a request with the IRS, although in this case, it pertains to representation rather than direct taxpayer inquiry or correction.

Form 8857 (Request for Innocent Spouse Relief): This form allows a taxpayer to request relief from joint tax liability under certain conditions. Like Form 3911, Form 8857 is a specialized request to the IRS seeking relief or correction based on specific circumstances affecting tax liability or refunds.

Dos and Don'ts

Filling out the IRS 3911 form, which is used for taxpayer inquiries regarding refunds or payments, requires attentiveness and accuracy. Below are essential do's and don'ts to consider while completing this form.

- Do ensure that all the information provided is accurate and current. Incorrect details can lead to delays in processing.

- Do write legibly if filling out the form by hand or use a typewriter or digital means to ensure clarity.

- Do include your full name, address, and social security number as these are critical for identification purposes.

- Do specify the type of tax and the tax period for the refund or payment inquiry to help the IRS correctly identify your case.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Don't overlook the detailed instructions provided by the IRS for filling out the form. These instructions are there to guide you through each part of the process.

- Don't hesitate to seek clarification or assistance if there is any part of the form or instructions that is unclear. It is better to ask for help than to submit incorrect information.

- Don't use the form to inquire about issues not related to refunds or payments. The IRS 3911 is specific in purpose and using it inappropriately can lead to confusion and delays.

Misconceptions

When dealing with the IRS, particularly concerning missing or unclear tax refund information, taxpayers often encounter Form 3911, "Taxpayer Statement Regarding Refund." Nevertheless, several misconceptions surround this form, leading to confusion and misunderstandings. Below, we clarify some common misconceptions.

- Form 3911 is only for identity theft cases. While it's true that Form 3911 can be used in identity theft situations to provide information to the IRS, its use is not limited to such scenarios. It serves a broader purpose, helping taxpayers communicate with the IRS about a refund that was not received, was received in the wrong amount, or was improperly issued.

- Filing Form 3911 guarantees a quick resolution. Submitting Form 3911 is a critical step in resolving issues with undelivered or incorrect refunds. However, the resolution time can vary significantly, based on the complexity of the issue and the IRS's workload. It is a step in the right direction, but patience is often required.

- Form 3911 is the initial step in reporting a missing refund. Before reaching out to the IRS with a Form 3911, it's advised to check the status of the refund using the "Where's My Refund?" tool on the IRS website. The form is typically used if the tool indicates the refund was sent, but it has not been received, or if instructed by the IRS to do so.

- Only the taxpayer can fill out Form 3911. While the taxpayer is indeed responsible for the information provided on Form 3911, it can be filled out by someone else on their behalf, such as a tax preparer or legal representative. All information must be accurate and reflect the taxpayer's situation regarding the refund.

- Form 3911 is mandatory whenever there's an issue with a tax refund. Although Form 3911 is a valuable tool for addressing refund problems, it's not always mandatory. The IRS may resolve some issues without the need for this form, especially if they detect a mistake or need additional information that can be provided in another manner.

Understanding these points clarifies the purpose and process of using Form 3911, facilitating smoother communications with the IRS regarding refund issues.

Key takeaways

The IRS Form 3911, Taxpayer Statement Regarding Refund, is used when a taxpayer has not received their refund and the IRS requires more information to trace the payment. Here are some critical aspects of filling out and using this form:

Understanding the Purpose: Know when to use Form 3911. It's specifically for situations where your refund hasn't arrived as expected, and the IRS needs your help to track it down.

Completing the Form: Provide thorough information about your tax return and the expected refund. This includes your name, address, Social Security number, the tax form you used, and the amount of refund expected.

Accurate Details Matter: Ensure all the information you provide is accurate and matches what was submitted on your tax return. Discrepancies can lead to delays.

Joint Returns: If you filed jointly, both signatures are required on the form for the IRS to process it.

Timing is Key: Wait for a reasonable period (typically more than 21 days for an e-filed return or six weeks for a mailed return) before submitting Form 3911, as refunds often take time to process.

Contact the IRS First: Before sending Form 3911, it's a good idea to reach out to the IRS. Sometimes, they can provide an update on your refund status over the phone or online, saving you the extra step.

Double-Check the Mailing Address: The IRS has different addresses based on the state you're filing from. Ensure you send Form 3911 to the correct place by checking the latest instructions on the IRS website.

Keep Records: Make a copy of the completed Form 3911 for your records. This helps if there are any questions or follow-up needed later.

Be Patient: Even after submitting Form 3911, it can take the IRS several weeks to trace your refund and provide an update. Keep an eye on your mail or the IRS website for any responses.

Additional Steps May Be Required: In some cases, the IRS may need more information or documentation after you submit Form 3911. Be ready to provide this to expedite your refund trace.

Remember, while dealing with the IRS can sometimes feel daunting, resources are available to help you through the process. Don't hesitate to seek out official IRS guidance or consult with a tax professional if you have questions or need assistance.

Popular PDF Forms

Fsis Form 7234-1 - Particularly emphasizes the identification and approval of any geographical, undefined style claims on labels.

What to Bring to K1 Visa Interview - IMBRA necessitates petitioners to disclose criminal convictions for certain specified crimes when applying for a K-1 or K-3 visa.

Security Deposit Return Letter Pdf - Designed to enhance accountability by requiring detailed documentation of each deduction from a tenant’s deposit.