Blank IRS 433-A PDF Template

Facing financial difficulties can lead individuals to one of the most significant interactions with the Internal Revenue Service (IRS), especially when it comes to resolving outstanding tax liabilities. In these instances, the IRS 433-A form, otherwise known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, becomes a critical tool. This document is designed to provide the IRS with a detailed snapshot of an individual's financial situation, encompassing income, expenses, assets, and liabilities. It serves as the foundational block for negotiating payment plans or settlements with the IRS, aiming to establish a feasible payment strategy that corresponds with the taxpayer's current financial capacity. The form demands thoroughness and accuracy, as the information it gathers directly influences the resolution terms. As taxing as the process may seem, understanding the major aspects of the form—what information is required, how it affects negotiations, and the potential outcomes it can lead to—can significantly ease the burden for taxpayers striving to navigate their way through challenging financial circumstances.

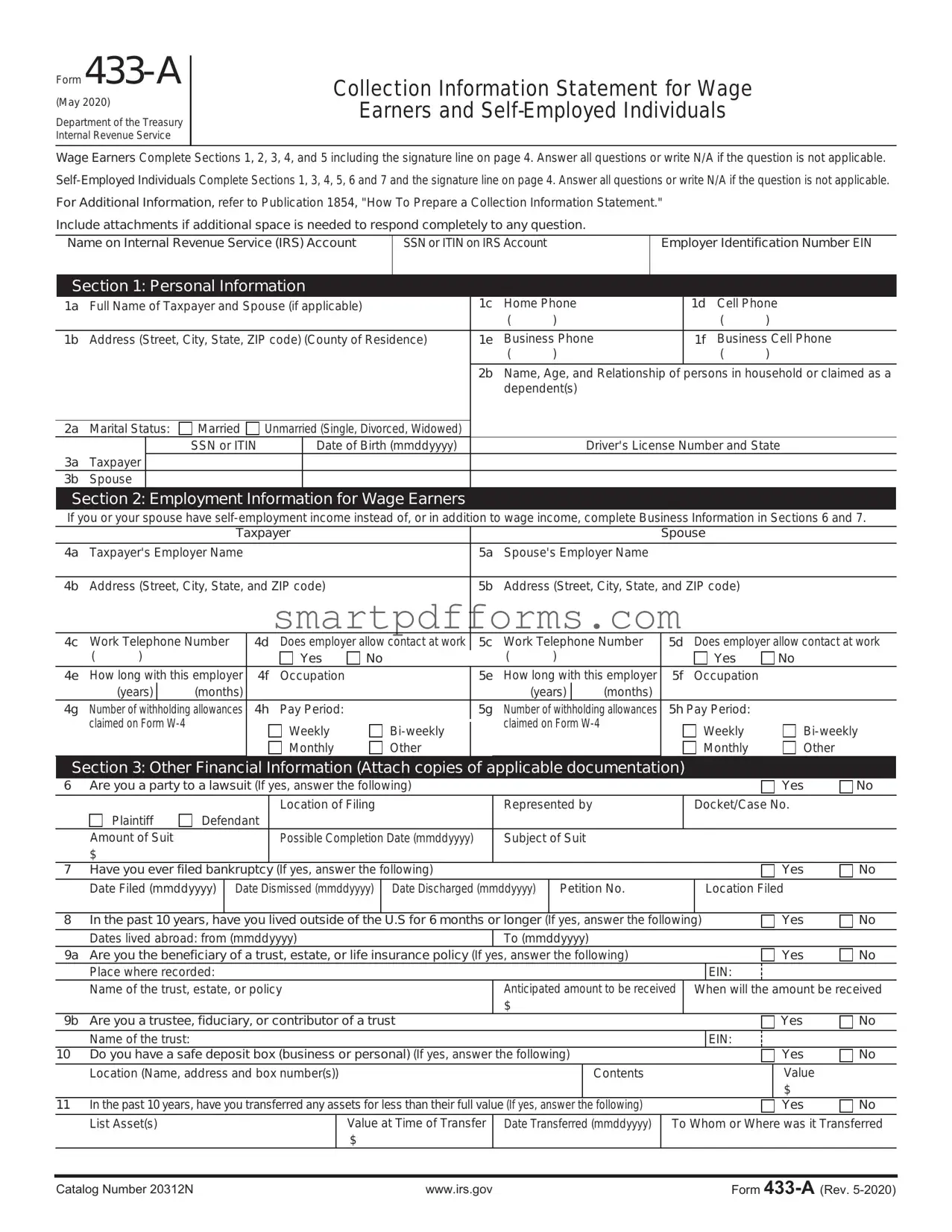

Preview - IRS 433-A Form

Form

(May 2020)

Department of the Treasury Internal Revenue Service

Collection Information Statement for Wage

Earners and

Wage Earners Complete Sections 1, 2, 3, 4, and 5 including the signature line on page 4. Answer all questions or write N/A if the question is not applicable.

For Additional Information, refer to Publication 1854, "How To Prepare a Collection Information Statement."

Include attachments if additional space is needed to respond completely to any question.

Name on Internal Revenue Service (IRS) Account |

SSN or ITIN on IRS Account |

Employer Identification Number EIN |

|

|

|

Section 1: Personal Information

1a |

Full Name of Taxpayer and Spouse (if applicable) |

1c |

Home Phone |

1d |

Cell Phone |

|||||||

|

|

|

|

|

|

|

( |

) |

|

( |

) |

|

1b |

Address (Street, City, State, ZIP code) (County of Residence) |

1e |

Business Phone |

1f |

Business Cell Phone |

|||||||

|

|

|

|

|

|

|

( |

) |

|

( |

) |

|

|

|

|

|

|

|

2b |

Name, Age, and Relationship of |

persons in household or claimed as a |

|

|||

|

|

|

|

|

|

|

dependent(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a |

Marital Status: |

Married |

Unmarried (Single, Divorced, Widowed) |

|

|

|

|

|

|

|

||

3a |

Taxpayer |

|

SSN or ITIN |

|

Date of Birth (mmddyyyy) |

|

|

Driver's License Number and State |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

3b |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

Section 2: Employment Information for Wage Earners

If you or your spouse have

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

Spouse |

|

|

||

4a |

Taxpayer's Employer Name |

|

|

|

5a |

Spouse's Employer Name |

|

|

|

|||||||

|

|

|

|

|

|

|

||||||||||

4b |

Address (Street, City, State, and ZIP code) |

|

5b |

Address (Street, City, State, and ZIP code) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||

4c |

Work Telephone Number |

4d |

Does employer allow contact at work |

5c |

Work Telephone Number |

5d Does employer allow contact at work |

|

|||||||||

|

( |

) |

|

|

|

Yes |

No |

|

|

( |

) |

|

|

Yes |

No |

|

4e |

How long with this employer |

4f |

Occupation |

|

5e |

How long with this employer |

5f Occupation |

|

|

|||||||

|

|

(years) |

|

(months) |

|

|

|

|

|

|

(years) |

|

(months) |

|

|

|

4g |

Number of withholding allowances |

4h |

Pay Period: |

|

5g |

Number of withholding allowances |

5h Pay Period: |

|

|

|||||||

|

claimed on Form |

|

|

Weekly |

|

|

claimed on Form |

|

Weekly |

|||||||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Monthly |

Other |

|

|

|

|

|

|

Monthly |

Other |

|

Section 3: Other Financial Information (Attach copies of applicable documentation)

6 |

Are you a party to a lawsuit (If yes, answer the following) |

|

|

|

|

|

|

|

Yes |

No |

||||||

|

Plaintiff |

Defendant |

Location of Filing |

Represented by |

|

|

Docket/Case No. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Amount of Suit |

|

|

Possible Completion Date (mmddyyyy) |

Subject of Suit |

|

|

|

|

|

|

|

||||

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Have you ever filed bankruptcy |

(If yes, answer the following) |

|

|

|

|

|

|

|

Yes |

No |

|||||

|

Date Filed (mmddyyyy) |

Date Dismissed (mmddyyyy) |

Date Discharged (mmddyyyy) |

Petition No. |

|

|

|

Location Filed |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8 |

In the past 10 years, have you lived outside of the U.S for 6 months or longer (If yes, answer the following) |

|

Yes |

No |

||||||||||||

|

Dates lived abroad: from (mmddyyyy) |

To (mmddyyyy) |

|

|

|

|

|

|

|

|||||||

9a |

Are you the beneficiary of a trust, estate, or life insurance policy (If yes, answer the following) |

|

|

|

|

Yes |

No |

|||||||||

|

Place where recorded: |

|

|

|

|

|

|

|

|

|

|

EIN: |

|

|

||

|

Name of the trust, estate, or policy |

Anticipated amount to be received |

|

When will the amount be received |

||||||||||||

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

9b |

Are you a trustee, fiduciary, or contributor of a trust |

|

|

|

|

|

|

|

Yes |

No |

||||||

|

Name of the trust: |

|

|

|

|

|

|

|

|

|

|

|

EIN: |

|

|

|

10 |

Do you have a safe deposit box (business or personal) (If yes, answer the following) |

|

|

|

|

Yes |

No |

|||||||||

|

Location (Name, address and box number(s)) |

|

|

Contents |

|

|

|

|

Value |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

11 |

In the past 10 years, have you transferred any assets for less than their full value (If yes, answer the following) |

|

|

|

|

Yes |

No |

|||||||||

|

List Asset(s) |

|

|

|

Value at Time of Transfer |

Date Transferred (mmddyyyy) |

To Whom or Where was it Transferred |

|||||||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Catalog Number 20312N |

|

|

|

|

www.irs.gov |

|

|

|

|

|

|

Form |

|

|||

Form |

Page 2 |

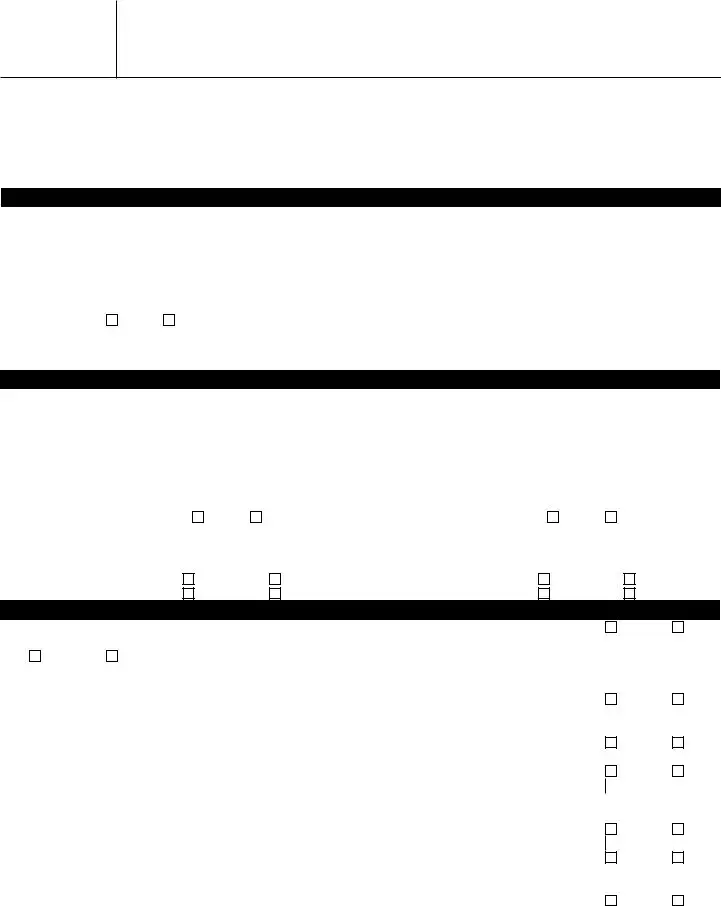

Section 4: Personal Asset Information for all Individuals (Foreign and Domestic)

12 CASH ON HAND Include cash that is not in a bank |

Total Cash on Hand |

$

PERSONAL BANK ACCOUNTS Include all checking, online and mobile (e.g., PayPal etc.) accounts, money market accounts, savings accounts, and stored value cards (e.g., payroll cards, government benefit cards, etc.).

|

Type of Account |

Full Name & Address (Street, City, State, ZIP code) of Bank, |

Account Number |

Account Balance |

||

|

As of |

|

|

|||

|

Savings & Loan, Credit Union, or Financial Institution |

|

|

|||

|

mmddyyyy |

|||||

|

|

|

|

|

||

13a |

|

|

|

$ |

|

|

13b |

|

|

|

$ |

|

|

13c |

Total Cash (Add lines 13a, 13b, and amounts from any attachments) |

|

$ |

|

|

|

INVESTMENTS Include stocks, bonds, mutual funds, stock options, certificates of deposit, and retirement assets such as IRAs, Keogh, 401(k) plans and commodities (e.g., gold, silver, copper, etc.). Include all corporations, partnerships, limited liability companies, or other business entities in which you are an officer, director, owner, member, or otherwise have a financial interest. Include attachment(s) if additional space is needed to respond.

Type of Investment |

Full Name & Address |

Current Value |

Loan Balance (if applicable) |

Equity |

|||

As of |

|||||||

or Financial Interest |

(Street, City, State, ZIP code) of Company |

Value minus Loan |

|||||

|

|

|

|

mmddyyyy |

|

|

|

14a |

|

|

|

|

|

|

|

|

Phone |

$ |

$ |

|

|

$ |

|

14b |

|

|

|

|

|

|

|

Phone

$

$

$

VIRTUAL CURRENCY (CRYPTOCURRENCY) List all virtual currency you own or in which you have a financial interest. (e.g., Bitcoin, Ethereum, Litecoin, Ripple, etc.) If applicable, attach a statement with each virtual currency’s public key.

|

|

|

|

Name of Virtual Currency Wallet, |

Email Address Used to |

Location(s) of Virtual Currency |

Virtual Currency |

|||||||||||

Type of Virtual Currency |

|

Amount and Value in |

||||||||||||||||

|

Exchange or Digital Currency |

With the Virtual Currency |

(Mobile Wallet, Online, and/or |

US dollars as of |

||||||||||||||

|

|

|

|

|

Exchange (DCE) |

Exchange or DCE |

|

External Hardware storage) |

today (e.g., 10 Bitcoins |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$64,600.00 USD) |

||

14c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14e |

Total Equity (Add lines 14a through 14d and amounts from any attachments) |

|

|

|

|

|

|

$ |

|

|

||||||||

AVAILABLE CREDIT Include all lines of credit and bank issued credit cards. |

|

|

|

|

|

|

|

|

|

|||||||||

|

Full Name & Address (Street, City, State, ZIP code) of Credit Institution |

|

Credit Limit |

|

Amount Owed |

Available Credit |

||||||||||||

|

|

|

As of |

As of |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mmddyyyy |

|

|

mmddyyyy |

|

15a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. No |

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

15b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. No |

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

15c |

Total Available Credit (Add lines 15a, 15b and amounts from any attachments) |

|

|

|

|

|

|

$ |

|

|

||||||||

16a |

LIFE INSURANCE Do you own or have any interest in any life insurance policies with cash value (Term Life insurance does |

not have a cash value) |

||||||||||||||||

|

Yes |

No |

|

If yes, complete blocks 16b through 16f for each policy. |

|

|

|

|

|

|

|

|

||||||

16b |

Name and Address of Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Company(ies): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16c |

Policy Number(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16d |

Owner of Policy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16e |

Current Cash Value |

|

|

|

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

16f |

Outstanding Loan Balance |

|

$ |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|||

16g |

Total Available Cash (Subtract amounts on line 16f from line 16e and include amounts from any attachments) |

$ |

|

|

||||||||||||||

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

|

|

|

|

|

|

|

|

|

Page 3 |

||

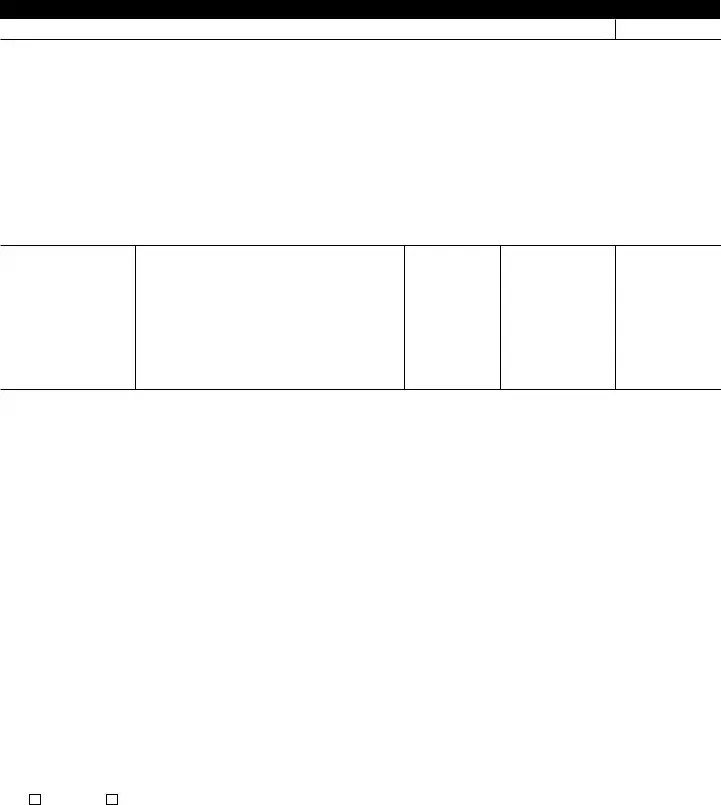

REAL PROPERTY Include all real property owned or being purchased |

|

|

|

|

|

|||||||

|

|

|

|

Purchase Date |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

||

|

|

|

|

(mmddyyyy) |

|

Market Value |

Balance |

Monthly Payment |

Payment |

FMV Minus Loan |

||

|

|

|

|

|

(FMV) |

(mmddyyyy) |

||||||

17a |

Property Description |

|

$ |

|

|

$ |

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

||||

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Contract Holder Name, Address (Street, City, State, ZIP code), and Phone |

|||||||||

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

17b |

Property Description |

|

$ |

|

|

$ |

$ |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

||||

|

Location (Street, City, State, ZIP code) and County |

|

Lender/Contract Holder Name, Address (Street, City, State, ZIP code), and Phone |

|||||||||

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

17c Total Equity (Add lines 17a, 17b and amounts from any attachments) |

|

|

|

$ |

|

|||||||

PERSONAL VEHICLES LEASED AND PURCHASED Include boats, RVs, motorcycles, |

||||||||||||

Description (Year, Mileage, Make/Model, |

Purchase/ |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

|||||

Lease Date |

|

Market Value |

Payment |

|||||||||

Tag Number, Vehicle Identification Number) |

(mmddyyyy) |

|

(FMV) |

Balance |

Monthly Payment |

(mmddyyyy) |

FMV Minus Loan |

|||||

18a Year |

|

Make/Model |

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||

|

Mileage |

|

License/Tag Number |

Lender/Lessor |

Name, Address |

(Street, City, State, |

ZIP code), and Phone |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

|

|

|

|

|

Phone |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

18b Year |

|

Make/Model |

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||

|

Mileage |

|

License/Tag Number |

Lender/Lessor |

Name, Address |

(Street, City, State, |

ZIP code), and Phone |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

|

|

|

|

|

Phone |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

18c Total Equity (Add lines 18a, 18b and amounts from any attachments)

$

PERSONAL ASSETS Include all furniture, personal effects, artwork, jewelry, collections (coins, guns, etc.), antiques or other assets. Include intangible assets such as licenses, domain names, patents, copyrights, mining claims, etc.

|

Purchase/ |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

|||

|

Lease Date |

|

Market Value |

Payment |

||||||

|

(mmddyyyy) |

|

(FMV) |

Balance |

Monthly Payment |

(mmddyyyy) |

FMV Minus Loan |

|||

19a Property Description |

|

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

||||

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor Name, Address (Street, City, State, ZIP code), and Phone |

||||||||

|

|

|

|

|

|

|

Phone |

|

|

|

19b Property Description |

|

|

$ |

|

|

$ |

$ |

|

|

$ |

|

|

|

|

|

|

|

||||

Location (Street, City, State, ZIP code) and County |

|

Lender/Lessor Name, Address (Street, City, State, ZIP code), and Phone |

||||||||

|

|

|

|

|

|

|

Phone |

|

|

|

19c Total Equity (Add lines 19a, 19b and amounts from any attachments) |

|

|

|

$ |

|

|||||

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

Page 4 |

|

If you are |

Section 5: Monthly Income and Expenses

Monthly Income/Expense Statement (For additional information, refer to Publication 1854.)

|

Total Income |

|

|

|

Total Living Expenses |

|

IRS USE ONLY |

|

Source |

|

Gross Monthly |

|

Expense Items 6 |

Actual Monthly |

Allowable Expenses |

20 |

Wages (Taxpayer) 1 |

$ |

|

35 |

Food, Clothing and Misc. 7 |

$ |

|

21 |

Wages (Spouse) 1 |

$ |

|

36 |

Housing and Utilities 8 |

$ |

|

22 |

Interest - Dividends |

$ |

|

37 |

Vehicle Ownership Costs 9 |

$ |

|

23 |

Net Business Income 2 |

$ |

|

38 |

Vehicle Operating Costs 10 |

$ |

|

24 |

Net Rental Income 3 |

$ |

|

39 |

Public Transportation 11 |

$ |

|

25 |

Distributions |

$ |

|

40 |

Health Insurance |

$ |

|

26 |

Pension (Taxpayer) |

$ |

|

41 |

Out of Pocket Health Care Costs 12 |

$ |

|

27 |

Pension (Spouse) |

$ |

|

42 |

Court Ordered Payments |

$ |

|

28 |

Social Security (Taxpayer) |

$ |

|

43 |

Child/Dependent Care |

$ |

|

29 |

Social Security (Spouse) |

$ |

|

44 |

Life Insurance |

$ |

|

30 |

Child Support |

$ |

|

45 |

Current year taxes (Income/FICA) 13 |

$ |

|

31 |

Alimony |

$ |

|

46 |

Secured Debts (Attach list) |

$ |

|

|

Other Income (Specify below) 5 |

|

|

47 |

Delinquent State or Local Taxes |

$ |

|

32 |

|

$ |

|

48 |

Other Expenses (Attach list) |

$ |

|

33 |

|

$ |

|

49 |

Total Living Expenses (add lines |

$ |

|

34 |

Total Income (add lines |

$ |

|

50 |

Net difference (Line 34 minus 49) |

$ |

|

1Wages, salaries, pensions, and social security: Enter gross monthly wages and/or salaries. Do not deduct tax withholding or allotments taken out of pay, such as insurance payments, credit union deductions, car payments, etc. To calculate the gross monthly wages and/or salaries:

If paid weekly - multiply weekly gross wages by 4.3. Example: $425.89 x 4.3 = $1,831.33

If paid biweekly (every 2 weeks) - multiply biweekly gross wages by 2.17. Example: $972.45 x 2.17 = $2,110.22

If paid semimonthly (twice each month) - multiply semimonthly gross wages by 2. Example: $856.23 x 2 = $1,712.46

2Net Income from Business: Enter monthly net business income. This is the amount earned after ordinary and necessary monthly business expenses are paid. This figure is the amount from page 6, line 89. If the net business income is a loss, enter “0”. Do not enter a negative number. If this amount is more or less than previous years, attach an explanation.

3Net Rental Income: Enter monthly net rental income. This is the amount earned after ordinary and necessary monthly rental expenses are paid. Do not include deductions for depreciation or depletion. If the net rental income is a loss, enter “0.” Do not enter a negative number.

4Distributions: Enter the total distributions from partnerships and subchapter S corporations reported on Schedule

5Other Income: Include agricultural subsidies, unemployment compensation, gambling income, oil credits, rent subsidies, sharing economy income from providing

6Expenses not generally allowed: We generally do not allow tuition for private schools, public or private college expenses, charitable contributions, voluntary retirement contributions or payments on unsecured debts. However, we may allow the expenses if proven that they are necessary for the health and welfare of the individual or family or the production of income. See Publication 1854 for exceptions.

7Food, Clothing and Miscellaneous: Total of food, clothing, housekeeping supplies, and personal care products for one month. The miscellaneous allowance is for expenses incurred that are not included in any other allowable living expense items. Examples are credit card payments, bank fees and charges, reading material, and school supplies.

8Housing and Utilities: For principal residence: Total of rent or mortgage payment. Add the average monthly expenses for the following: property taxes, homeowner’s or renter’s insurance, maintenance, dues, fees, and utilities. Utilities include gas, electricity, water, fuel, oil, other fuels, trash collection, telephone, cell phone, cable television and internet services.

9Vehicle Ownership Costs: Total of monthly lease or purchase/loan payments.

10Vehicle Operating Costs: Total of maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls for one month.

11Public Transportation: Total of monthly fares for mass transit (e.g., bus, train, ferry, taxi, etc.)

12Out of Pocket Health Care Costs: Monthly total of medical services, prescription drugs and medical supplies (e.g., eyeglasses, hearing aids, etc.)

13Current Year Taxes: Include state and Federal taxes withheld from salary or wages, or paid as estimated taxes.

Certification: Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities, and other information is true, correct, and complete.

Taxpayer's Signature

Spouse's signature

Date

After we review the completed Form

IRS USE ONLY (Notes)

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

|

Page 5 |

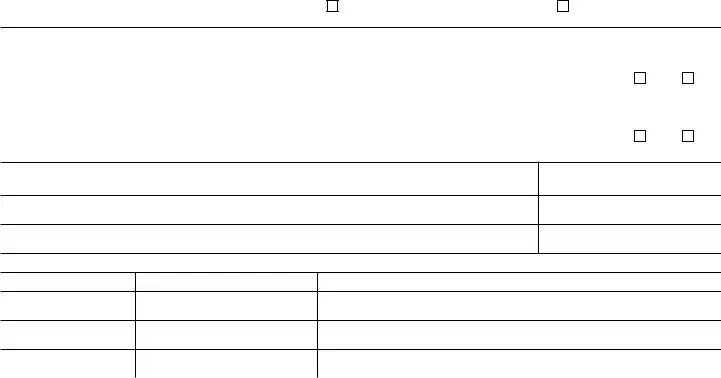

Sections 6 and 7 must be completed only if you are |

||

Section 6: Business Information |

|

|

51 Is the business a sole proprietorship (filing Schedule C) |

Yes, Continue with Sections 6 and 7. |

No, Complete Form |

All other business entities, including limited liability companies, partnerships or corporations, must complete Form

52Business Name & Address (if different than 1b)

53 |

Employer Identification Number |

54 Type of Business |

|

|

55 |

Is the business a |

Yes |

No |

|

|

|

|

|

|

Federal Contractor |

||

56 |

Business Website (web address) |

57 |

Total Number of Employees |

58 |

Average Gross Monthly Payroll |

|

||

|

|

|

|

|

|

|

||

59 |

Frequency of Tax Deposits |

60 |

Does the business engage in |

Yes |

No |

|||

|

|

|

|

(Internet sales) If yes, complete lines 61a and 61b |

||||

PAYMENT PROCESSOR (e.g., PayPal, Authorize.net, Google Checkout, etc.) Include virtual currency wallet, exchange or digital currency exchange.

Name & Address (Street, City, State, ZIP code). Name & Address (Street, City, State, ZIP code) |

Payment Processor Account Number |

61a

61b

CREDIT CARDS ACCEPTED BY THE BUSINESS

Credit Card

Merchant Account Number

Issuing Bank Name & Address (Street, City, State, ZIP code)

62a

62b

62c

63 BUSINESS CASH ON HAND Include cash that is not in a bank. |

Total Cash on Hand |

$ |

BUSINESS BANK ACCOUNTS Include checking accounts, online and mobile (e.g., PayPal) accounts, money market accounts, savings accounts, and stored value cards (e.g., payroll cards, government benefit cards, etc.). Report Personal Accounts in Section 4.

|

Type of Account |

Full name & Address (Street, City, State, ZIP code) |

Account Number |

Account Balance |

||

|

As of |

|

|

|||

|

of Bank,Savings & Loan, Credit Union or Financial Institution. |

|

|

|||

|

mmddyyyy |

|||||

|

|

|

|

|

||

64a |

|

|

|

$ |

|

|

64b |

|

|

|

$ |

|

|

64c |

Total Cash in Banks (Add lines 64a, 64b and amounts from any attachments) |

|

$ |

|

|

|

ACCOUNTS/NOTES RECEIVABLE Include

Accounts/Notes Receivable & Address (Street, City, State, ZIP code) |

Status (e.g., age, |

Date Due |

Invoice Number or Government |

Amount Due |

factored, other) |

(mmddyyyy) |

Grant or Contract Number |

||

65a |

|

|

|

$ |

65b |

|

|

|

$ |

65c |

|

|

|

$ |

65d |

|

|

|

$ |

65e |

|

|

|

$ |

65f Total Outstanding Balance (Add lines 65a through 65e and amounts from any attachments) |

|

$ |

||

Catalog Number 20312N |

www.irs.gov |

Form |

Form |

Page 6 |

BUSINESS ASSETS Include all tools, books, machinery, equipment, inventory or other assets used in trade or business. Include a list and show the value of all intangible assets such as licenses, patents, domain names, copyrights, trademarks, mining claims, etc.

|

|

Purchase/ |

|

Current Fair |

Current Loan |

Amount of |

Date of Final |

Equity |

|

|

|

Lease Date |

|

Market Value |

Payment |

||||

|

|

(mmddyyyy) |

|

(FMV) |

Balance |

Monthly Payment |

(mmddyyyy) |

FMV Minus Loan |

|

66a |

Property Description |

|

$ |

|

|

$ |

$ |

|

$ |

|

|

|

|

|

|

||||

|

Location (Street, City, State, ZIP code) and Country |

|

|

Lender/Lessor/Landlord |

Name, Address (Street, |

City, State, ZIP code), and Phone |

|||

|

|

|

|

|

|

|

Phone |

|

|

66b |

Property Description |

|

$ |

|

|

$ |

$ |

|

$ |

|

|

|

|

|

|

||||

Location (Street, City, State, ZIP code) and Country

Lender/Lessor/Landlord Name, Address (Street, City, State, ZIP code), and Phone

Phone

66c Total Equity (Add lines 66a, 66b and amounts from any attachments)

$

Section 7 should be completed only if you are

Section 7: Sole Proprietorship Information (lines 67 through 87 should reconcile with business Profit and Loss Statement)

Accounting Method Used:

Cash

Accrual

Use the prior 3, 6, 9 or 12 month period to determine your typical business income and expenses.

Income and Expenses during the period (mmddyyyy) |

|

|

to (mmddyyyy) |

|

||

Provide a breakdown below of your average monthly income and expenses, based on the period |

of time used above. |

|

||||

|

Total Monthly Business Income |

|

Total Monthly Business Expenses (Use attachments as needed) |

|||

|

Source |

Gross Monthly |

|

Expense Items |

Actual Monthly |

|

67 |

Gross Receipts |

$ |

77 |

Materials Purchased 1 |

$ |

|

68 |

Gross Rental Income |

$ |

78 |

Inventory Purchased 2 |

$ |

|

69 |

Interest |

$ |

79 |

Gross Wages & Salaries |

$ |

|

70 |

Dividends |

$ |

80 |

Rent |

$ |

|

71 |

Cash Receipts not included in lines |

$ |

81 |

Supplies 3 |

$ |

|

|

Other Income (Specify below) |

|

82 |

Utilities/Telephone 4 |

$ |

|

72 |

|

$ |

83 |

Vehicle Gasoline/Oil |

$ |

|

73 |

|

$ |

84 |

Repairs & Maintenance |

$ |

|

74 |

|

$ |

85 |

Insurance |

$ |

|

75 |

|

$ |

86 |

Current Taxes 5 |

$ |

|

76 |

Total Income (Add lines 67 through 75) |

$ |

87 |

Other Expenses, including installment payments |

$ |

|

|

(Specify) |

|||||

|

|

|

88 |

Total Expenses (Add lines 77 through 87) |

$ |

|

|

|

|

89 |

Net Business Income (Line 76 minus 88) 6 |

$ |

|

Enter the monthly net income amount from line 89 on line 23, section 5. If line 89 is a loss, enter "0" on line 23, section 5.

1Materials Purchased: Materials are items directly related to the production of a product or service.

2Inventory Purchased: Goods bought for resale.

3Supplies: Supplies are items used in the business that are consumed or used up within one year. This could be the cost of books, office supplies, professional equipment, etc.

4Utilities/Telephone: Utilities include gas, electricity, water, oil, other fuels, trash collection, telephone, cell phone and business internet.

5Current Taxes: Real estate, excise, franchise, occupational, personal property, sales and employer’s portion of employment taxes.

6Net Business Income: Net profit from Form 1040, Schedule C may be used if duplicated deductions are eliminated (e.g., expenses for business use of home already included in housing and utility expenses on page 4). Deductions for depreciation and depletion on Schedule C are not cash expenses and must be added back to the net income figure. In addition, interest cannot be deducted if it is already included in any other installment payments allowed.

IRS USE ONLY (Notes)

Privacy Act: The information requested on this Form is covered under Privacy Acts and Paperwork Reduction Notices which have already been provided to the taxpayer.

Catalog Number 20312N |

www.irs.gov |

Form |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of IRS 433-A | The IRS 433-A form is used to collect financial information from individuals to set up payment plans or determine tax relief eligibility. |

| Who Must File | Individuals who owe income tax to the federal government and are seeking to arrange a payment plan or compromise must file this form. |

| Sections Included | The form includes sections on personal information, employment details, bank accounts, assets, credit cards, and monthly income and living expenses. |

| Governing Law | This form is governed by federal law, as it pertains to federal income tax obligations. |

Instructions on Utilizing IRS 433-A

Filling out the IRS Form 433-A is a critical step for individuals who need to provide the Internal Revenue Service (IRS) with detailed information about their financial situation. This form helps the IRS assess an individual's ability to pay outstanding tax liabilities. Nevertheless, the process can be complex and demands careful attention to detail. After completing this form, you may expect further communication from the IRS regarding payment plans, compromise offers, or other steps to address your tax situation. The following instructions aim to simplify the process and ensure you fulfill all requirements accurately.

- Begin by gathering all necessary financial documents, including bank statements, pay stubs, bills, and any other information related to your income, expenses, assets, and liabilities.

- Download the latest version of Form 433-A from the official IRS website to ensure you're using the most current form.

- Provide personal information including your full name, address, Social Security Number (SSN), and contact details. If applicable, include similar information for your spouse.

- Detail your employment information. If you are employed, list your employer's name, address, and your occupation. Self-employed individuals should provide details about their business.

- Fill out the section on other financial information. This includes non-wage household income such as rental income, dividends, and any form of public assistance.

- Document your assets thoroughly. Include all bank accounts (checking and savings), investments, life insurance with a cash value, available credit, and physical assets like properties and vehicles.

- List all your monthly necessary living expenses. This includes rent or mortgage payments, utilities, food, transportation, and health care costs.

- Include a detailed account of your liabilities and expenses. Be sure to list all credit card debts, loans, taxes due, and other financial obligations.

- Review the form carefully to ensure accuracy. Providing false information on a federal document can lead to significant consequences.

- Sign and date the form. If you're filing jointly, make sure your spouse also signs the document.

- Submit the form to the IRS through the mail or electronically, as indicated in the form's filing instructions.

Once the IRS Form 433-A has been successfully submitted, the waiting process begins. The IRS will review the provided information to understand your financial situation better and determine the most appropriate action regarding your tax liability. This could involve setting up a payment plan, adjusting current payment plans, or even considering a compromise on the total amount owed. It’s essential to respond promptly to any requests from the IRS for additional information during this period.

Obtain Answers on IRS 433-A

-

What is the IRS Form 433-A?

The IRS Form 433-A, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document used by the Internal Revenue Service (IRS) to collect financial information. This form helps the IRS determine how individuals can settle their outstanding tax liabilities. This comprehensive document requests details about income, expenses, assets, and debts, allowing the IRS to assess an individual's ability to pay.

-

Who needs to file the IRS Form 433-A?

Individuals who are unable to pay their tax debt in full might be requested by the IRS to complete Form 433-A. This often includes wage earners, self-employed individuals, and those who are involved in partnerships. Filling out this form is usually one of the steps involved in setting up a payment plan or negotiating an offer in compromise with the IRS.

-

What information is required on Form 433-A?

The form requires detailed personal and financial information. This includes, but is not limited to, your employment details, bank account balances, average monthly income and expenses, assets such as real estate and vehicles, and liabilities such as outstanding loans or credit card debts. Accuracy in providing all required information is critical to ensuring that the IRS has a clear picture of your financial situation.

-

How does the IRS use the information provided in Form 433-A?

The IRS uses the information on Form 433-A to evaluate your financial situation and determine your ability to pay your tax debt. The detailed financial data helps in establishing payment plans, such as an installment agreement, or in considering other tax relief options like an offer in compromise. Understanding your financial capacity ensures that any arrangement is sustainable and within your means.

-

Can I fill out Form 433-A online?

As of the last update, the IRS does not offer the option to submit Form 433-A electronically. Individuals must complete the form on paper and then mail it to the IRS. However, the form itself can be downloaded and printed from the IRS website. It is important to follow the instructions carefully and ensure that all information is complete before submission.

-

What should I do if I need help filling out Form 433-A?

If you find the process of filling out Form 433-A overwhelming, consider seeking assistance. Many individuals benefit from consulting with a tax professional, such as a certified accountant or a tax attorney. These professionals can provide valuable guidance, ensuring that the form is filled out accurately and that all relevant financial information is provided to support your situation.

-

Is there a penalty for providing false information on Form 433-A?

Yes, it is vital to provide accurate and truthful information on Form 433-A. Falsifying information on this, or any IRS form, is considered fraud and can lead to penalties, including fines or criminal prosecution. The IRS conducts thorough verifications of all information, so honesty is paramount to avoid legal consequences.

-

How long does it take for the IRS to process Form 433-A?

The processing time for Form 433-A can vary depending on the IRS’s current workload and the complexity of your financial situation. Generally, it may take several weeks for the IRS to review the form and contact you regarding the next steps. It’s important to respond promptly to any requests from the IRS for additional information or clarification during this time.

-

What happens if my financial situation changes after submitting Form 433-A?

If your financial situation changes significantly after you have submitted Form 433-A, it is important to inform the IRS as soon as possible. Changes might include a job loss, a decrease or increase in income, or unexpected expenses. Keeping the IRS informed helps to adjust any existing payment plans or tax relief strategies to better suit your new financial circumstances.

-

Can Form 433-A impact my credit score?

Filling out Form 433-A itself does not impact your credit score. However, the information you provide may lead to actions by the IRS that could affect your credit, such as filing a tax lien against you if you're unable to arrange payment for your tax liability. Engaging in a payment plan or other resolutions with the IRS can prevent such actions and protect your credit score.

Common mistakes

Not providing complete information: Every section of the form 433-A needs to be completed. Omitting information can lead to the IRS requesting additional details, resulting in delays.

Inaccurate expense reporting: It's essential to accurately report your monthly living expenses. Underestimating or overestimating can affect your payment plan.

Incorrect income information: Similarly, entering incorrect income information, whether over or under, can have severe implications on the repayment plan the IRS sets for you.

Failing to include all sources of income: All income must be reported, including part-time jobs, dividends, or any side gigs.

Not listing all liabilities and assets: The IRS needs a full picture of your financial situation. Not listing all your liabilities and assets can be seen as withholding information.

Misclassifying assets: It’s crucial to correctly classify your assets. For example, a personal vehicle used for work might be listed in a different category than a purely personal use vehicle.

Forgetting to sign and date the form: An unsigned or undated form is not valid. This mistake can easily delay processing.

Avoiding these mistakes isn't just about ensuring the form is accepted but also about building a realistic repayment plan with the IRS. The goal is to give a truthful and complete picture of your financial situation.

Keep in mind that accuracy, completeness, and honesty are your best tools when filling out form 433-A. If you are ever in doubt, consulting with a professional who can provide guidance can be invaluable. Remember, the aim is to move towards resolving your tax issues in the most straightforward and stress-free manner possible.

Documents used along the form

When dealing with the Internal Revenue Service (IRS), especially in situations that require an understanding of an individual's financial situation, the IRS Form 433-A is often not the only document needed. This form, which details a person's income, expenses, and assets, is usually part of a larger collection of documents used to either negotiate payment plans or settle tax disputes. Below are six commonly used forms and documents that are often required alongside Form 433-A.

- Form 1040: This is the U.S. individual income tax return form. It's used by taxpayers to file their annual income tax returns with the IRS. This form provides the IRS with information about the taxpayer’s income, deductions, and credits, which is essential for calculating the correct tax liability.

- Form W-2: The Form W-2, Wage and Tax Statement, is used by employers to report the annual income and taxes withheld from their employees. For those filling out Form 433-A, this document helps substantiate the income figures reported.

- Bank Statements: Bank statements are crucial for corroborating the cash on hand and expenditures listed on Form 433-A. They provide a detailed record of a person's financial transactions over a specific period.

- Pay Stubs: Pay stubs serve as proof of current income and are essential for individuals who need to demonstrate their earnings and any payroll deductions accurately.

- Form 1099: The 1099 form series is used to report various types of income other than wages, salaries, and tips. It’s essential for individuals who have alternative sources of income, such as self-employment, interest, dividends, or government payments, to support the information provided in Form 433-A.

- Documentation of Assets: This can include a variety of documents, such as vehicle registration, property deeds, or investment account statements. They are used to prove the value of assets owned, supporting details entered in the assets section of Form 433-A.

These forms and documents play a critical role in providing a comprehensive financial snapshot of an individual to the IRS. To accurately assess a person’s ability to pay taxes, the IRS often requires these documents in addition to Form 433-A. Ensuring that all the relevant forms and supporting documents are correctly filled out and submitted can significantly impact the outcome of negotiations with the IRS, such as establishing a feasible payment plan or successfully contesting a tax liability. It’s advisable for individuals dealing with the IRS to maintain organized and up-to-date records to facilitate smooth processing.

Similar forms

The IRS 433-F form is similar in purpose and content to the IRS 433-A form, as both are used to collect financial information from individuals to determine their ability to pay tax debt. The major difference lies in their application; the IRS 433-F is a simpler, more streamlined form designed for less complex financial situations.

The Schedule C (Form 1040), or "Profit or Loss From Business," parallels the IRS 433-A by requiring detailed financial information, particularly from self-employed individuals or sole proprietors. Both documents are pivotal for assessing the taxpayer’s income and expenses, thereby influencing their tax obligations and payment capabilities.

A Means Test Form (Official Form 122A-2), used in bankruptcy filings, resembles the IRS 433-A as it assesses an individual's financial status to determine eligibility for filing Chapter 7 bankruptcy. It examines income, expenses, and the ability to pay debts, much like the IRS 433-A form evaluates a person's financial capacity to settle tax debts.

The Financial Statement for Businesses (IRS 433-B) form shares similarities with the IRS 433-A, as both require detailed financial information for the purpose of tax resolution. However, the IRS 433-B is specifically designed for businesses, collecting data on the entity’s assets, liabilities, income, and expenditures to understand the business’s ability to address tax liabilities.

Dos and Don'ts

Filling out the IRS 433-A form, a collection information statement for wage earners and self-employed individuals, is a critical step in managing your tax obligations. To help ensure you complete this form accurately and effectively, here are essential dos and don'ts to bear in mind:

- Do gather all necessary financial documents before starting, including pay stubs, bank statements, and bills. This ensures the information you provide is accurate.

- Do review the entire form first to understand what information is required, which can help you avoid mistakes and ensure completeness.

- Do use black or blue ink if filling out the form by hand to ensure that the information is legible and can be scanned properly.

- Do be honest and thorough in all your disclosures. Inaccurate or incomplete information can lead to serious consequences.

- Do sign and date the form where required. An unsigned form is considered incomplete and can lead to processing delays.

- Don't leave any fields blank. If a particular section does not apply to you, it's advisable to enter "N/A" (not applicable) instead of leaving it empty.

- Don't guess or estimate figures. Precision is crucial, and all numbers should be based on your documentation.

- Don't ignore instructions or footnotes. These often contain important information about how to fill out the form correctly.

- Don't forget to update your contact information if it has changed. The IRS needs accurate and current information to contact you regarding your form.

By adhering to these guidelines, you can help streamline the process of completing the IRS 433-A form, avoid common pitfalls, and ensure that your submission is both timely and accurate.

Misconceptions

The IRS 433-A form, commonly associated with the collection information statement for individuals, is often misunderstood in various ways. These misconceptions can lead to errors in filing, overestimation of one's financial obligations, or the underutilization of potential relief avenues. Below, we elucidate five common misunderstandings surrounding this form:

Only individuals with businesses need to file Form 433-A: This is a misconception. While Form 433-A is often used by self-employed individuals or those with business income, it's also necessary for individuals who need to arrange a payment plan or offer in compromise with the IRS based on personal financial difficulties. This form helps the IRS assess an individual's ability to pay back taxes, considering all sources of income and expenses.

Filling out Form 433-A will automatically lead to wage garnishment or asset seizure: Quite the contrary, the purpose of the Form 433-A is to prevent such drastic measures. By submitting this form, individuals communicate their current financial status to the IRS, exploring manageable ways to fulfill their tax obligations without resorting to garnishment or seizure. However, ignoring tax liabilities or failing to accurately complete the form can indeed lead to enforced collection actions.

The information provided on Form 433-A has no expiration: Information regarding one's financial situation is fluid and can change. The IRS is aware of this reality; thus, the information provided on Form 433-A is not regarded as permanent. The IRS may request updated information periodically, especially if your financial situation significantly changes or if you enter into a long-term payment agreement.

Form 433-A is only for disclosing assets: This belief does not capture the full scope of the form. Besides assets, the form also requires detailed information about one’s monthly income and living expenses. This comprehensive overview allows the IRS to gauge the individual's ability to pay and to work out an appropriate payment plan that considers their overall financial health, not just their assets.

The IRS uses Form 433-A to determine eligibility for all relief programs: Although Form 433-A is critical in determining eligibility for certain tax relief programs, such as an offer in compromise, it is not the sole criterion. Other factors, including one's tax history, the type of tax owed, and compliance with other tax filings, also play crucial roles. It's part of a broader analysis conducted by the IRS to understand the taxpayer's situation and what relief, if any, should be granted.

Understanding the purpose and requirements of Form 433-A can significantly impact an individual's approach to resolving outstanding tax liabilities. Misconceptions can lead to unnecessary worry or missed opportunities for achieving tax compliance through more favorable terms. Taxpayers are encouraged to gain clarity on these points, possibly seeking professional advice to navigate their specific circumstances effectively.

Key takeaways

Understanding the IRS 433-A form is pivotal for individuals looking to navigate the complex waters of tax resolution. Often, this form serves as a cornerstone document required by the Internal Revenue Service (IRS) to assess a taxpayer's financial situation. This allows the IRS to make informed decisions on payment plans, offers in compromise, or other tax relief options. Here are seven key takeaways to consider when filling out and using the IRS 433-A form:

- Gather Comprehensive Financial Data: Before even beginning the form, compile all relevant financial information. This includes, but is not limited to, income details, bank account balances, investment accounts, life insurance policies, assets (such as vehicles and real estate), and monthly living expenses.

- Accuracy is Key: It's imperative to ensure that all the information provided on the form is accurate and truthful. The IRS uses this information to understand your financial situation thoroughly, and any discrepancies can lead to delays or issues in your case.

- Document Organization: Supporting documentation is often required to verify the information entered on the form. Organize and prepare these documents in advance for a smoother process. This could include bank statements, pay stubs, bills, or other financial statements.

- Understand the Purpose of Each Section: The IRS 433-A form is divided into sections, each designed to capture a specific aspect of your financial situation. Understanding the purpose behind each section can aid in providing the most relevant information.

- Consider Future Changes: If you anticipate any changes to your financial situation, consider how these might affect the information you provide. For example, a pending job loss, medical expenses, or a significant life event could impact your ability to pay.

- Professional Help Can Be Beneficial: Given the form's complexity and the significance of its role in resolving tax issues, seeking assistance from a tax professional can be very beneficial. They can provide guidance, ensure accuracy, and often negotiate with the IRS on your behalf.

- Timeliness Matters: Once you are required to fill out the IRS 433-A form, there is typically a deadline by which it must be submitted. Adhering to this deadline is crucial to avoid further complications or delays in resolving your tax matters.

Filling out the IRS 433-A form can be a daunting task, but it's a critical step in addressing and resolving tax liabilities. Taking the time to carefully prepare and understand the form's requirements can ultimately save individuals time and stress in their dealings with the IRS. Remember, when in doubt, consulting with a tax resolution specialist can provide clarity and direction during the process.

Popular PDF Forms

Florida Uc Fund - Employers must ensure all details on the RT-6 form are correct to avoid processing delays.

14242 - Form 14242 is your go-to document for reporting tax scams and scheming preparers to the IRS.

What Is a Wage Theft Prevention Notice - The LS 59 form plays a key role in administrative compliance, helping employers adhere to New York State's stringent labor laws.