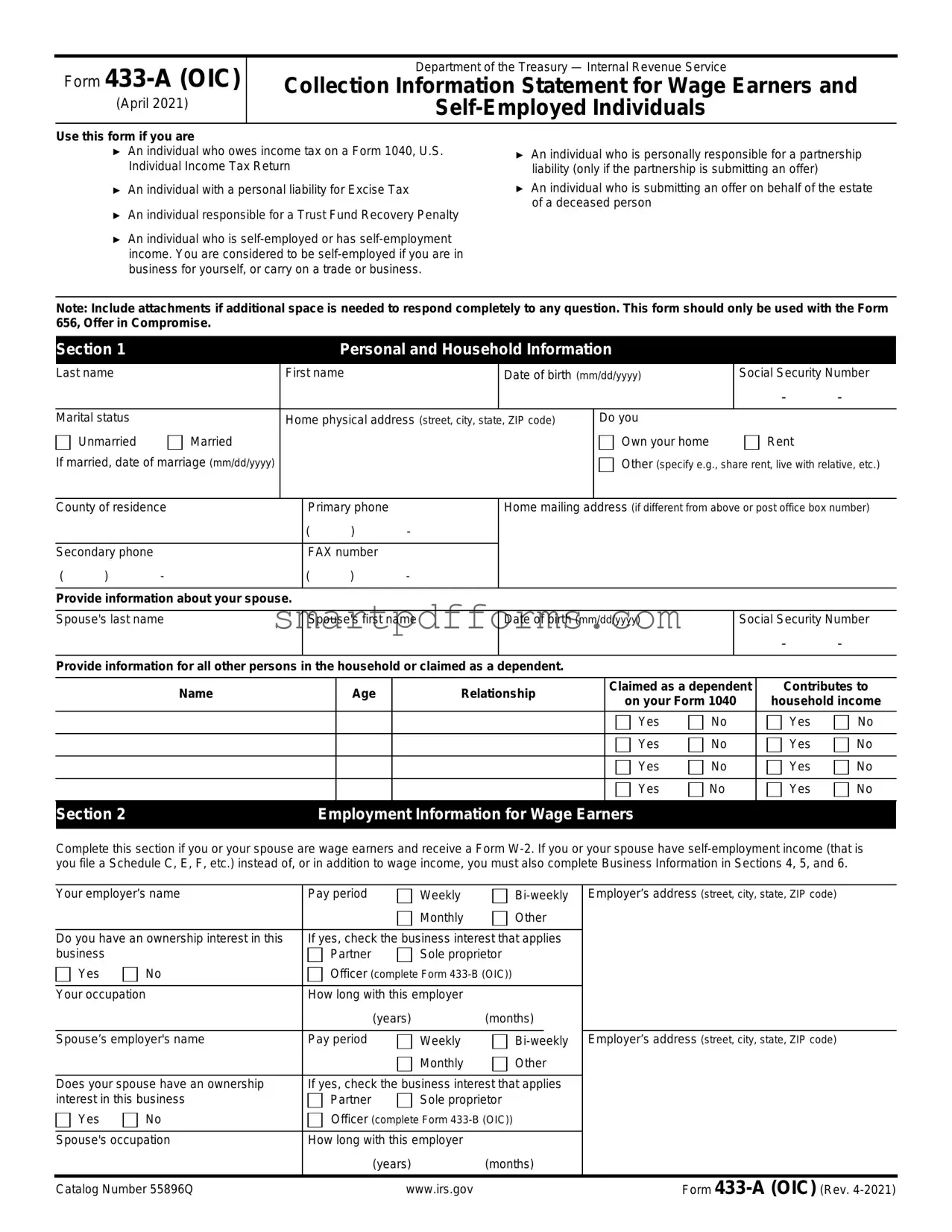

Blank IRS 433-A (OIC) PDF Template

When individuals find themselves facing financial challenges that make it difficult to meet their tax obligations, the Internal Revenue Service (IRS) provides a pathway for resolution through the 433-A (OIC) form. This document is essential for taxpayers who are considering an Offer in Compromise (OIC), a program that allows them to settle their tax debts for less than the full amount owed. The form aims to give the IRS a detailed view of the applicant's financial situation, including income, expenses, asset equity, and liabilities. By carefully reviewing this information, the IRS assesses whether the taxpayer qualifies for relief, ensuring that the process is fair and accessible to those who genuinely need assistance. Completing the form accurately is crucial, as it plays a significant role in determining the feasibility of the proposed offer, thus, individuals are encouraged to approach this task with thoroughness and precision. In essence, the 433-A (OIC) form embodies the IRS's commitment to providing pathways for taxpayers to overcome financial hurdles and achieve compliance.

Preview - IRS 433-A (OIC) Form

Form

(April 2021)

Department of the Treasury — Internal Revenue Service

Collection Information Statement for Wage Earners and

Use this form if you are

►An individual who owes income tax on a Form 1040, U.S. Individual Income Tax Return

►An individual with a personal liability for Excise Tax

►An individual responsible for a Trust Fund Recovery Penalty

►An individual who is

►An individual who is personally responsible for a partnership liability (only if the partnership is submitting an offer)

►An individual who is submitting an offer on behalf of the estate of a deceased person

Note: Include attachments if additional space is needed to respond completely to any question. This form should only be used with the Form 656, Offer in Compromise.

Section 1 |

|

|

|

|

Personal and Household Information |

|

|

|

|

|

||||||

Last name |

|

First name |

|

|

Date of birth (mm/dd/yyyy) |

|

|

Social Security Number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

Marital status |

|

Home physical address (street, city, state, ZIP code) |

Do you |

|

|

|

|

|

||||||||

|

Unmarried |

Married |

|

|

|

|

|

|

|

|

Own your home |

|

|

|

Rent |

|

If married, date of marriage (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

Other (specify e.g., share rent, live with relative, etc.) |

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||

County of residence |

|

Primary phone |

|

|

Home mailing address (if different from above or post office box number) |

|||||||||||

|

|

|

|

( |

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Secondary phone |

|

|

FAX number |

|

|

|

|

|

|

|

|

|

|

|||

( |

) |

- |

|

( |

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Provide information about your spouse. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Spouse's last name |

|

Spouse's first name |

|

Date of birth (mm/dd/yyyy) |

|

|

Social Security Number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

Provide information for all other persons in the household or claimed as a dependent. |

|

|

|

|

|

|

|

|||||||||

|

|

Name |

|

|

|

Age |

|

Relationship |

|

Claimed as a dependent |

Contributes to |

|||||

|

|

|

|

|

|

|

on your Form 1040 |

|

household income |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Section 2 |

|

|

|

Employment Information for Wage Earners |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete this section if you or your spouse are wage earners and receive a Form

Your employer’s name |

Pay period |

Weekly |

Employer’s address (street, city, state, ZIP code) |

|||

|

|

|

Monthly |

Other |

|

|

|

|

|

|

|||

Do you have an ownership interest in this |

If yes, check the business interest that applies |

|

||||

business |

|

Partner |

Sole proprietor |

|

||

Yes |

No |

Officer (complete Form |

|

|||

|

|

|

|

|

||

Your occupation |

How long with this employer |

|

|

|

||

|

|

|

(years) |

(months) |

|

|

|

|

|

|

|

|

|

Spouse’s employer's name |

Pay period |

Weekly |

Employer’s address (street, city, state, ZIP code) |

|||

|

|

|

Monthly |

Other |

|

|

|

|

|

||||

Does your spouse have an ownership |

If yes, check the business interest that applies |

|

||||

interest in this business |

Partner |

Sole proprietor |

|

|||

Yes |

No |

Officer (complete Form |

|

|||

|

|

|

|

|

||

Spouse's occupation |

How long with this employer |

|

|

|

||

|

|

|

(years) |

(months) |

|

|

|

|

|

|

|

|

|

Catalog Number 55896Q |

|

www.irs.gov |

|

|

Form |

|

Page 2

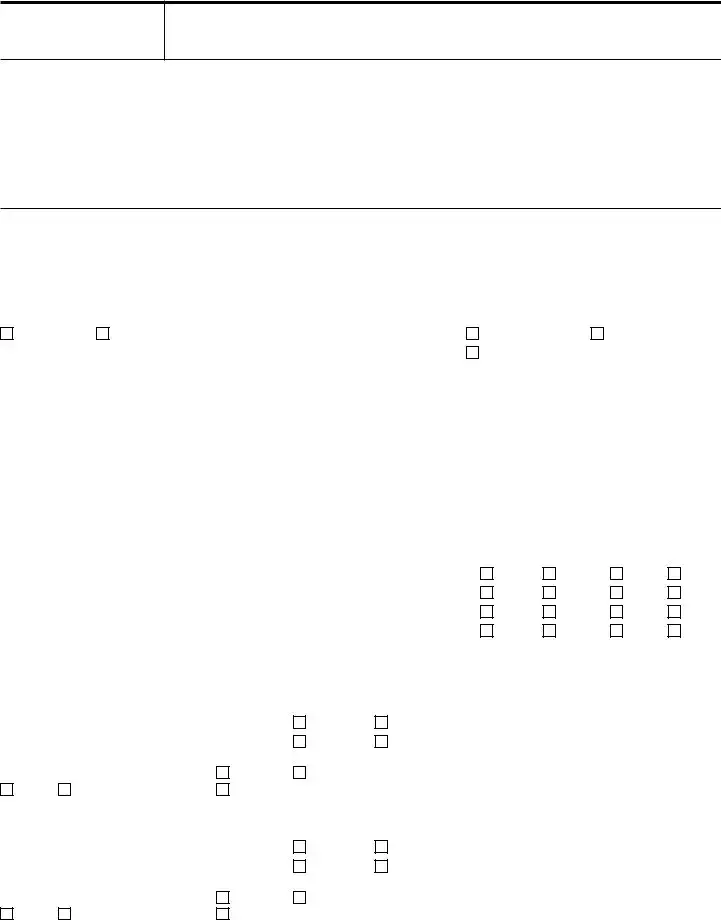

Section 3 |

Personal Asset Information |

|

|

Use the most current statement for each type of account, such as checking, savings, money market and online accounts, stored value cards (such as a payroll card from an employer), investment, retirement accounts (IRAs, Keogh, 401(k) plans, stocks, bonds, mutual funds, certificates of deposit) and virtual currency (such as Bitcoin, Ripple, Ethereum, etc.), life insurance policies that have a cash value, and safe deposit boxes. Asset value is subject to adjustment by IRS based on individual circumstances. Enter the total amount available for each of the following (if additional space is needed include attachments).

Round to the nearest dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

Cash and Investments (domestic and foreign)

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1a) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Checking |

|

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1b) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of bank accounts from attachment |

(1c) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (1a) through (1c) minus ($1,000) = |

(1) |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment account |

|

|

Stocks |

|

|

Bonds |

|

Other |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of Financial Institution |

|

|

|

|

|

Account number |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

|

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

– $ |

|

|

|

= |

(2a) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Investment account |

|

|

Stocks |

|

|

Bonds |

|

Other |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name of Financial Institution |

|

|

|

|

|

Account number |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Current market value |

|

|

|

|

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

– $ |

|

|

|

= |

(2b) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Virtual currency |

|

|

Name of virtual currency |

|

Email address used to |

Location(s) of virtual |

|

|

|

|||||||||||||

|

|

|

|

|

wallet, exchange or digital |

currency |

|

|

|

||||||||||||||

Type of virtual currency |

|

|

|

|

|||||||||||||||||||

|

currency exchange (DCE) |

currency exchange or DCE |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Current market value in U.S. dollars as of today |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

$ |

|

|

|

|

|

|

X .8 = $ |

|

|

|

|

|

|

|

|

|

|

|

= |

(2c) |

$ |

||

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

Total investment accounts from attachment. [current market value minus loan balance(s)] |

(2d) |

$ |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (2a) through (2d) =

(2) $

Retirement account |

401K |

IRA |

Other |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution |

|

|

|

Account number |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

|

|

Minus loan balance |

|

|

|

|||

$ |

|

|

X .8 = $ |

|

|

|

– $ |

|

= |

(3a) |

$ |

|

|

|

|

|

|||||||||

|

Total of retirement accounts from attachment. [current market value X .8 minus loan balance(s)] |

(3b) |

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (3a) through (3b) =

(3) $

Note: Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties.

Cash value of Life Insurance Policies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Insurance Company |

Policy number |

|

|

|

||

|

|

|

|

|

|

|

Current cash value |

Minus loan balance |

|

|

|

||

$ |

|

– $ |

|

= |

(4a) |

$ |

|

|

|

|

|

||

Total cash value of life insurance policies from attachment |

Minus loan balance(s) |

|

|

|

||

$ |

|

– $ |

|

= |

(4b) |

$ |

|

|

|

|

|

|

|

|

|

|

Add lines (4a) through (4b) = |

(4) |

$ |

|

|

|

|

|

|||

Catalog Number 55896Q |

www.irs.gov |

|

Form |

|||

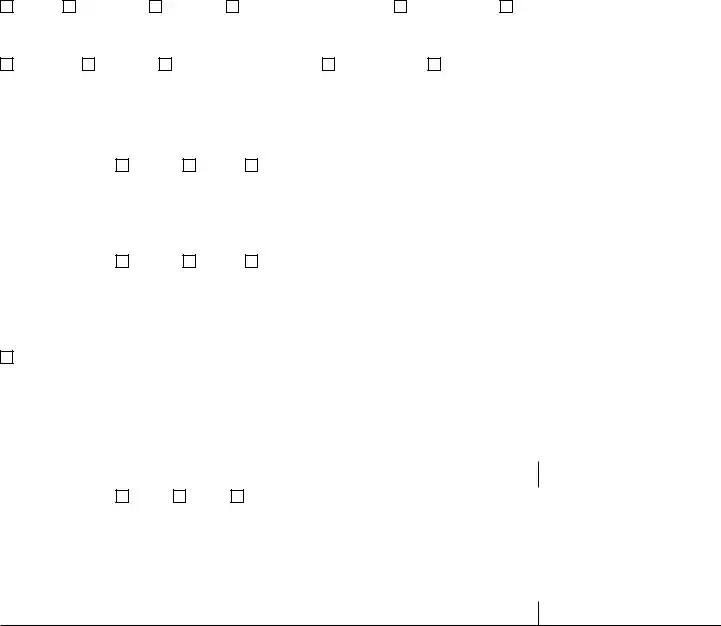

Page 3

Section 3 (Continued) |

Personal Asset Information |

|

|

Real property (enter information about any house, condo,

Is your real property currently for sale or do you anticipate selling your real property to fund the offer amount

|

Yes |

(listing price) |

|

No |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property description (indicate if personal residence, rental property, vacant, etc.) |

Purchase date (mm/dd/yyyy) |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

Amount of mortgage payment |

Date of final payment |

How title is held (joint tenancy, etc.) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Location (street, city, state, ZIP code, county, and country) |

|

Lender/Contract holder name, address (street, city, |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

state, ZIP code) and phone |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

Current market value |

|

Minus loan balance (mortgages, etc.) |

|

|

||||||||||

$ |

|

|

X .8 = $ |

|

|

|

– |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

(total value of real estate) = |

(5a) |

$ |

||||||

|

|

|

|

|

||||||||||

Property description (indicate if personal residence, rental property, vacant, etc.) |

Purchase date (mm/dd/yyyy) |

|

|

|||||||||||

|

|

|

|

|

|

|||||||||

Amount of mortgage payment |

Date of final payment |

How title is held (joint tenancy, etc.) |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||||

Location (street, city, state, ZIP code, county, and country) |

|

Lender/Contract holder name, address (street, city, |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

state, ZIP code) and phone |

|

|

||

|

|

|

|

|

|

|

||||||||

Current market value |

|

Minus loan balance (mortgages, etc.) |

|

|

||||||||||

$ |

|

|

X .8 = $ |

|

|

|

– |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

(total value of real estate) = |

(5b) |

$ |

||||||

|

|

|

|

|

|

|||||||||

|

|

Total value of property(s) from attachment [current market value X .8 minus any loan balance(s)] |

(5c) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (5a) through (5c) =

(5) $

Vehicles (enter information about any cars, boats, motorcycles, etc. that you own or lease)

Vehicle make & model |

Year |

|

|

Date purchased |

|

Mileage |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease |

|

Name of creditor |

|

|

|

Date of final payment |

|

Monthly lease/loan amount |

|

|

|||

|

Loan |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

Minus loan balance |

|

|

|

|

||||||||

$ |

|

|

|

X .8 = $ |

|

|

– $ |

Total value of vehicle (if the vehicle |

(6a) |

$ |

||||

|

|

|

|

|

is leased, enter 0 as the total value) = |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtract $3,450 from line (6a) |

(6b) |

$ |

|

|

|

|

|

|

|

|

|

(If line (6a) minus $3,450 is a negative number, enter "0") |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||

Vehicle make & model |

Year |

|

|

Date purchased |

|

Mileage |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Lease |

|

Name of creditor |

|

|

|

Date of final payment |

|

Monthly lease/loan amount |

|

|

|||

|

Loan |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

||||||

Current market value |

|

Minus loan balance |

|

|

|

|

||||||||

$ |

|

|

|

X .8 = $ |

|

|

|

– $ |

|

Total value of vehicle (if the vehicle |

(6c) |

$ |

||

|

|

|

|

|

is leased, enter 0 as the total value) = |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

If you are filing a joint offer, subtract $3,450 from line (6c) |

|

|

|||

|

|

|

|

|

|

|

|

|

(If line (6c) minus $3,450 is a negative number, enter "0") |

(6d) |

$ |

|||

|

|

|

|

|

|

|

If you are not filing a joint offer, enter the amount from line (6c) |

|

|

|||||

|

|

|

|

|

||||||||||

|

|

Total value of vehicles listed from attachment [current market value X .8 minus any loan balance(s)] |

(6e) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total lines (6b), (6d), and (6e) =

(6) $

Catalog Number 55896Q |

www.irs.gov |

Form |

Page 4

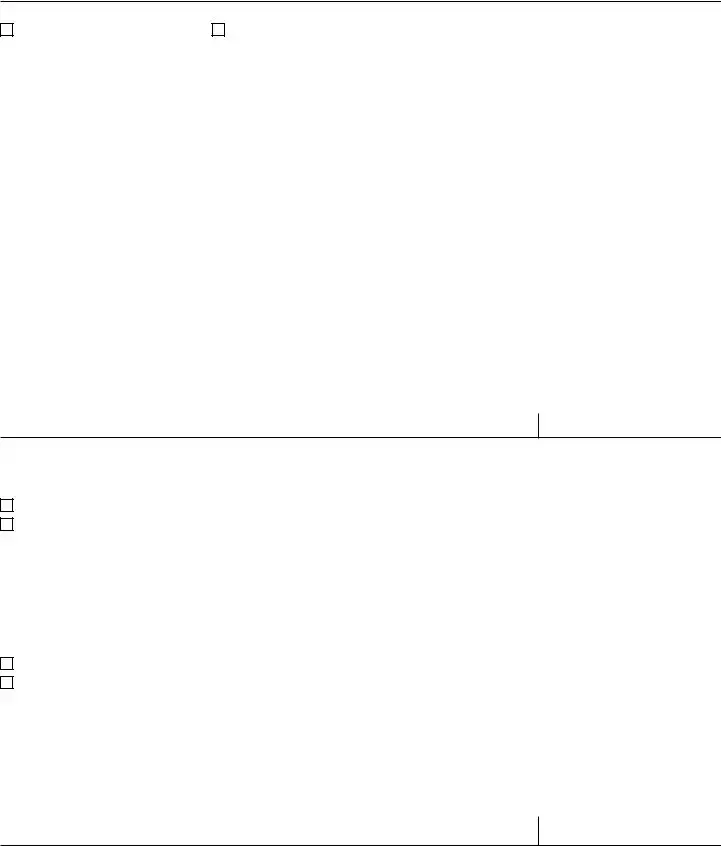

Section 3 (Continued) |

Personal Asset Information |

Other valuable items (artwork, collections, jewelry, items of value in safe deposit boxes, interest in a company or business that is not publicly traded, etc.)

Description of asset(s)

Current market value |

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|

|||||||||||||||

$ |

|

|

|

|

|

X .8 = $ |

|

|

|

|

– $ |

|

|

|

= |

|

|

(7a) |

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Value of remaining furniture and personal effects (not listed above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Description of asset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Current market value |

|

|

|

|

|

|

|

Minus loan balance |

|

|

|

|

|

|||||||||||||||

$ |

|

|

|

|

|

X .8 = $ |

|

|

|

|

– $ |

|

|

|

= |

|

|

(7b) |

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total value of valuable items listed from attachment [current market value X .8 |

|

minus any loan balance(s)] |

(7c) |

$ |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Add lines (7a) through (7c) minus IRS deduction of $9,790 = |

|

(7) |

$ |

|

|||||||||||||||||

|

|

Do not include amount on the lines with a letter beside the number. Round to the nearest whole dollar. |

|

|

Box A |

|||||||||||||||||||||||

|

|

|

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

|

|

Available Individual Equity in Assets |

|||||||||||||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

Add lines (1) through (7) and enter the amount in Box A = |

|

|

|

|

|

||||||||||||||

NOTE: If you or your spouse are |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Section 4 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

If you or your spouse are |

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Is your business a sole proprietorship |

|

|

|

|

Address of business (if other than personal residence) |

|||||||||||||||||||||||

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Business telephone number |

|

|

|

|

Employer Identification Number |

|

Business website address |

|

|

|

|

Trade name or DBA |

||||||||||||||||

( |

|

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Description of business |

|

|

|

|

Total number of employees |

|

Frequency of tax deposits |

Average gross monthly |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

payroll $ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Do you or your spouse have any other |

business interests? Include any |

|

Business address (street, city, state, ZIP code) |

|

|

|||||||||||||||||||||||

interest in an LLC, LLP, corporation, partnership, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Yes |

(percentage of ownership: |

|

) Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Business name |

|

|

|

|

|

|

|

|

|

|

|

Business telephone number |

|

|

Employer Identification Number |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Type of business (select one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Partnership |

LLC |

|

|

|

Corporation |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Section 5 |

|

|

|

|

|

|

Business Asset Information (for |

|

|

|

|

|

||||||||||||||||

List business assets such as bank accounts, virtual currency (cryptocurrency), tools, books, machinery, equipment, business vehicles and real property that is owned/leased/rented. If additional space is needed, attach a list of items. Do not include personal assets listed in Section 3.

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0".

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

Account number |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(8a) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

Checking |

Savings |

Money Market Account/CD |

Online Account |

Stored Value Card |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank name |

|

|

|

|

|

|

|

Account number |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(8b) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Virtual currency |

Name of virtual currency |

|

Email address used to |

Location(s) of virtual |

|

|

|

|||||

|

|

|

wallet, exchange or digital |

currency |

|

|

|

||||||

Type of virtual currency |

|

|

|

||||||||||

currency exchange (DCE) |

currency exchange or DCE |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Current market value in U.S. dollars as of today |

|

|

|

|

|

|

|

|

|||||

$ |

|

|

|

X .8 = $ |

|

|

|

|

|

= |

(8c) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total bank accounts from attachment |

(8d) |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines (8a) through (8d) = |

(8) |

$ |

||

Catalog Number 55896Q |

|

|

|

|

www.irs.gov |

|

|

Form |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 5 |

Section 5 (Continued) |

|

Business Asset Information (for |

|

|

|

||||||||

Description of asset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current market value |

|

|

|

Minus loan balance |

|

Total value (if leased or used |

|

|

|

||||

$ |

|

X .8 = $ |

|

|

|

– $ |

|

|

|

in the production of income, |

= |

(9a) |

$ |

|

|

|

|

|

|

enter 0 as the total value) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of asset: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Current market value |

|

|

|

Minus Loan Balance |

|

Total value (if leased or used |

|

|

|

||||

$ |

|

X .8 = $ |

|

|

|

– $ |

|

|

|

in the production of income, |

= |

(9b) |

$ |

|

|

|

|

|

|

enter 0 as the total value) |

|||||||

|

|

|

|

||||||||||

|

Total value of assets listed from attachment [current market value X .8 minus any loan balance(s)] |

(9c) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Add lines (9a) through (9c) = |

(9) |

$ |

||

|

|

|

|

|

IRS allowed deduction for professional books and tools of trade – |

(10) |

$ |

||||||

|

|

|

|

|

|||||||||

|

|

Enter the value of line (9) minus line (10). If less than zero enter zero. = |

(11) |

$ |

|||||||||

Notes Receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have notes receivable |

|

Yes |

No |

|

|

|

|

|

|

||||

If yes, attach current listing that includes name(s) and amount of note(s) receivable |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts Receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have accounts receivable, including |

Yes |

|

No |

|

|

|

|||||||

companies, and any bartering or online auction accounts |

|

|

|

|

|||||||||

If yes, provide a list of your current accounts receivable |

|

|

|

|

|

|

|||||||

|

|

Do not include amounts from the lines with a letter beside the number [for example: (9c)]. |

Box B |

||||||||||

|

|

|

|

|

|

|

|

|

Round to the nearest whole dollar. |

Available Business Equity in |

|||

|

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

Assets |

||||||||||

|

|

|

|

||||||||||

|

|

|

|

|

Add lines (8) and (11) and enter the amount in Box B = |

$ |

|

||||||

Section 6 |

|

Business Income and Expense Information (for |

|

|

|||||||||

If you provide a current profit and loss (P&L) statement for the information below, enter the total gross monthly income on line 17 and your monthly expenses on line 29 below. Do not complete lines (12) - (16) and (18) - (28). You may use the amounts claimed for income and expenses on your most recent Schedule C; however, if the amount has changed significantly within the past year, a current P&L should be submitted to substantiate the claim.

Period provided beginning |

through |

|

|

|

|

|

|||

Round to the nearest whole dollar. Do not enter a negative number. If any line item is a negative number, enter "0". |

||||

|

|

|

|

|

Business income (you may average |

|

|

|

|

|

|

|

|

|

Gross receipts |

|

|

(12) |

$ |

|

|

|

|

|

Gross rental income |

|

|

(13) |

$ |

|

|

|

|

|

Interest income |

|

|

(14) |

$ |

|

|

|

|

|

Dividends |

|

|

(15) |

$ |

|

|

|

|

|

Other income |

|

|

(16) |

$ |

|

|

|

|

|

|

Add lines (12) through (16) = |

(17) |

$ |

|

Business expenses (you may average |

|

|

|

|

|

|

|

|

|

Materials purchased (e.g., items directly related to the production of a product or service) |

|

(18) |

$ |

|

|

|

|

|

|

Inventory purchased (e.g., goods bought for resale) |

|

|

(19) |

$ |

|

|

|

|

|

Gross wages and salaries |

|

|

(20) |

$ |

|

|

|

|

|

Rent |

|

|

(21) |

$ |

|

|

|

|

|

Supplies (items used to conduct business and used up within one year, e.g., books, office supplies, professional equipment, etc.) |

|

(22) |

$ |

|

|

|

|

|

|

Utilities/telephones |

|

|

(23) |

$ |

|

|

|

|

|

Vehicle costs (gas, oil, repairs, maintenance) |

|

|

(24) |

$ |

|

|

|

|

|

Business insurance |

|

|

(25) |

$ |

|

|

|

|

|

Current business taxes (e.g., real estate, excise, franchise, occupational, personal property, sales and employer's portion of |

|

(26) |

$ |

|

employment taxes) |

|

|

||

Secured debts (not credit cards) |

|

|

(27) |

$ |

|

|

|

|

|

Other business expenses (include a list) |

|

|

(28) |

$ |

|

|

|

|

|

|

Add lines (18) through (28) = |

(29) |

$ |

|

|

Round to the nearest whole dollar. |

Box C |

||

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

Net Business Income |

|||

|

||||

Subtract line (29) from line (17) and enter the amount in Box C = |

$ |

|

||

Catalog Number 55896Q |

www.irs.gov |

Form |

||

Page 6

Section 7 |

Monthly Household Income and Expense Information |

Enter your household's gross monthly income. Gross monthly income includes wages, social security, pension, unemployment, and other income. Examples of other income include but are not limited to: agricultural subsidies, gambling income, oil credits, rent subsidies, Uber & Lyft driver income, and Airbnb rentals etc. The information below is for yourself, your spouse, and anyone else who contributes to your household's income. The entire household includes spouse,

Monthly Household Income

Note: Entire household income should also include income that is considered not taxable and may not be included on your tax return.

Round to the nearest whole dollar.

Primary taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross wages |

Social Security |

|

Pension(s) |

Other income (e.g. unemployment) |

|

|

|||||||

$ |

|

+ $ |

|

+ $ |

|

|

+ $ |

|

Total primary |

(30) |

$ |

||

|

|

|

|

|

taxpayer income = |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross wages |

Social Security |

|

Pension(s) |

Other Income (e.g. unemployment) |

|

|

|||||||

$ |

|

+ $ |

|

+ $ |

|

|

+ $ |

|

Total spouse |

(31) |

$ |

||

|

|

|

|

|

income = |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Additional sources of income used to support the household, e.g., |

|

|

|||||||||||

contribute to the household income, etc. List source(s) |

|

|

|

|

(32) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest, dividends, and royalties |

|

|

|

|

|

|

|

|

(33) |

$ |

|||

|

|

|

|

|

|

|

|

||||||

Distributions (e.g., income from partnerships, |

|

|

|

|

(34) |

$ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net rental income |

|

|

|

|

|

|

|

|

|

|

(35) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Net business income from Box C |

|

|

|

|

|

|

|

|

(36) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|||

Child support received |

|

|

|

|

|

|

|

|

(37) |

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alimony received |

|

|

|

|

|

|

|

|

|

|

(38) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round to the nearest whole dollar. |

Box D |

|||

|

|

|

|

|

|

|

|

|

Total Household Income |

||||

|

|

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

||||||||||

|

|

|

$ |

|

|||||||||

|

|

|

|

Add lines (30) through (38) and enter the amount in Box D = |

|

||||||||

Monthly Household Expenses

Enter your average monthly expenses.

Note: For expenses claimed in boxes (39) and (45) only, you should list the full amount of the allowable standard even if the actual amount you pay is less. For the other boxes input your actual expenses. You may find the allowable standards at

|

|

|

|

|

|

|

Round to the nearest whole dollar. |

|

Food, clothing, and miscellaneous (e.g., housekeeping supplies, personal care products , minimum payment on credit card). |

|

(39) |

$ |

|||||

A reasonable estimate of these expenses may be used |

|

|||||||

Housing and utilities (e.g., rent or mortgage payment and average monthly cost of property taxes, home insurance, |

|

|

|

|||||

maintenance, dues, fees and utilities including electricity, gas, other fuels, trash collection, water, cable television and internet, |

|

|

|

|||||

telephone, and cell phone) |

|

|

monthly rent payment |

|

(40) |

$ |

||

|

|

|

|

|

|

|

|

|

Vehicle loan and/or lease payment(s) |

|

|

|

|

|

(41) |

$ |

|

|

|

|

|

|

|

|||

Vehicle operating costs (e.g., average monthly cost of maintenance, repairs, insurance, fuel, registrations, licenses, |

|

(42) |

$ |

|||||

inspections, parking, tolls, etc.). A reasonable estimate of these expenses may be used |

|

|||||||

Public transportation costs (e.g., average monthly cost of fares for mass transit such as bus, train, ferry, taxi, etc.). A |

|

|

|

|||||

reasonable estimate of these expenses may be used |

|

(43) |

$ |

|||||

Health insurance premiums |

|

|

|

|

|

(44) |

$ |

|

|

|

|

|

|

|

|||

|

(45) |

$ |

||||||

eyeglasses, hearing aids, etc.) |

|

|

|

|

|

|||

|

(46) |

$ |

||||||

|

|

|

|

|

|

|||

Child/dependent care payments (e.g., daycare, etc.) |

|

(47) |

$ |

|||||

|

|

|

|

|

|

|

|

|

Life insurance premiums |

|

|

|

|

|

(48) |

$ |

|

|

|

|

|

|

|

|||

Current monthly taxes (e.g., monthly cost of federal, state, and local tax, personal property tax, etc.) |

|

(49) |

$ |

|||||

|

|

|

|

|

|

|||

Secured debts/Other (e.g., any loan where you pledged an asset as collateral not previously listed, government guaranteed |

|

|

|

|||||

student loan, employer required retirement or dues) |

List debt(s)/expense(s) |

|

(50) |

$ |

||||

|

|

|

|

|

|

|

|

|

Enter the amount of your monthly delinquent state and/or local tax payment(s) . Total tax owed |

|

|

(51) |

$ |

||||

|

|

|

|

|

|

|

||

|

|

|

|

Round to the nearest whole dollar. |

|

Box E |

||

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

|

Total Household Expenses |

|||||

|

Add lines (39) through (51) and enter the amount in Box E = |

|

$ |

|

||||

|

|

|

|

Round to the nearest whole dollar. |

|

Box F |

||

|

Do not enter a negative number. If any line item is a negative, enter "0" on that line. |

|

Remaining Monthly Income |

|||||

|

Subtract Box E from Box D and enter the amount in Box F = |

|

$ |

|

||||

Catalog Number 55896Q |

|

www.irs.gov |

|

Form |

||||

Page 7

Section 8 |

Calculate Your Minimum Offer Amount |

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount. Paying over a shorter period of time will result in a smaller minimum offer amount.

Note: The multipliers below (12 and 24) and the calculated offer amount (which included the amount(s) allowed for vehicles and bank accounts) do not apply if the IRS determines you have the ability to pay your tax debt in full within the legal period to collect.

Round to the nearest whole dollar.

If you will pay your offer in 5 or fewer payments within 5 months or less, multiply "Remaining Monthly Income" (Box F) by 12 to get "Future Remaining Income" (Box G). Do not enter a number less than $0.

Enter the total from Box F

$

X 12 =

Box G Future Remaining Income

$

If you will pay your offer in 6 to 24 months, multiply "Remaining Monthly Income" (Box F) by 24 to get "Future Remaining Income" (Box H). Do not enter a number less than $0.

Enter the total from Box F

$

X 24 =

Box H Future Remaining Income

$

Determine your minimum offer amount by adding the total available assets from Box A and Box B (if applicable) to the amount in either Box G or Box H.

Enter the amount from Box A plus Box B (if applicable)

$

+

Enter the amount from either Box G or Box H

$

=

Offer Amount

Your offer must be more than zero ($0). Do not leave blank. Use whole dollars only.

$

If you cannot pay the Offer Amount shown above due to special circumstances, explain on the Form 656, Offer in Compromise, Section 3, Reason for Offer, Explanation of Circumstances. You must offer an amount more than $0.

Section 9 |

Other Information |

Additional information IRS needs to consider settlement of your tax debt. If you or your business are currently in a bankruptcy proceeding, you are not eligible to apply for an offer.

Are you a party to or involved in litigation (if yes, answer the following) |

|

|

|

|

|

|

|

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

||||

Plaintiff |

Location of filing |

|

Represented by |

|

|

|

|

Docket/Case number |

|||||

Defendant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Amount of dispute |

Possible completion date (mmddyyyy) |

|

Subject of litigation |

|

|

|

|

|

|

|

|||

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Have you filed bankruptcy in the past 7 years (if yes, answer the following) |

|

|

|

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date filed (mmddyyyy) |

|

Date dismissed (mmddyyyy) |

Date discharged (mmddyyyy) |

Petition no. |

|

Location filed |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the past 10 years, have you lived outside of the U.S. for 6 months or longer (if yes, answer the following) |

|

|

|

Yes |

No |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

Dates lived abroad: From (mmddyyyy) |

|

To (mmddyyyy) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||

Are you or have you ever been party to any litigation involving the IRS/United States (including any tax litigation) |

|

|

|

Yes |

No |

||||||||

|

|

|

|

|

|

|

|

||||||

If yes and the litigation included tax debt, provide the types of tax and periods involved |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||

Are you the beneficiary of a trust, estate, or life insurance policy (if yes, answer the following) |

|

|

|

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

Place where recorded |

|

|

|

|

|

|

|

|

EIN |

|

|||

|

|

|

|

||||||||||

Name of the trust, estate, or policy |

|

Anticipated amount to be received |

When will the amount be received |

||||||||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Are you a trustee, fiduciary, or contributor of a trust |

|

|

|

|

|

|

|

Yes |

No |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of the trust |

|

|

|

|

|

|

|

|

EIN |

|

|||

|

|

|

|

|

|

|

|

||||||

Do you have a safe deposit box (business or personal) (if yes, answer the following) |

|

|

|

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

||||

Location (name, address and box number(s)) |

|

|

|

Contents |

|

|

|

Value |

|

||||

|

|

|

|

|

|

|

|

|

|

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the past 10 years, have you transferred any assets, including real property, for less than their full value (if yes, answer the following)

Yes

No

List asset(s) |

Value at time of transfer |

Date transferred (mmddyyyy) |

To whom or where was it transferred |

|

$ |

|

|

|

|

|

|

Catalog Number 55896Q |

www.irs.gov |

|

Form |

Section 9 (Continued)Other Information

Do you have any assets or own any real property outside the U.S.

If yes, provide description, location, and value

Do you have any funds being held in trust by a third party

If yes, how much $ |

Where |

Section 10 |

Signatures |

Page 8

Yes

No

No

Yes

No

No

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best of my knowledge it is true, correct, and complete.

►Signature of Taxpayer

►Signature of Spouse

Remember to include all applicable attachments listed below.

Copies of the most recent pay stub, earnings statement, etc., from each employer.

Copies of the most recent statement for each investment and retirement account.

Copies of the most recent statement, etc., from all other sources of income such as pensions, Social Security, rental income, interest and dividends (including any received from a related partnership, corporation, LLC, LLP, etc.), court order for child support, alimony, royalties, and rent subsidies.

Copies of individual complete bank statements for the three most recent months. If you operate a business, copies of the six most recent complete statements for each business bank account.

Copies of the most recent statement from lender(s) on loans such as mortgages, second mortgages, vehicles, etc., showing monthly payments, loan payoffs, and balances.

List of Accounts Receivable or Notes Receivable, if applicable.

Verification of delinquent State/Local Tax Liability showing total delinquent state/local taxes and amount of monthly payments, if applicable.

Copies of court orders for child support/alimony payments claimed in monthly expense section.

Copies of Trust documents if applicable per Section 9.

Documentation to support any special circumstances described in the “Explanation of Circumstances” on Form 656, if applicable.

Attach a Form 2848, Power of Attorney, if you would like your attorney, CPA, or enrolled agent to represent you and you do not have a current form on file with the IRS. Make sure the current tax year is included.

Completed and signed current Form 656.

Catalog Number 55896Q |

www.irs.gov |

Form |

Form Data

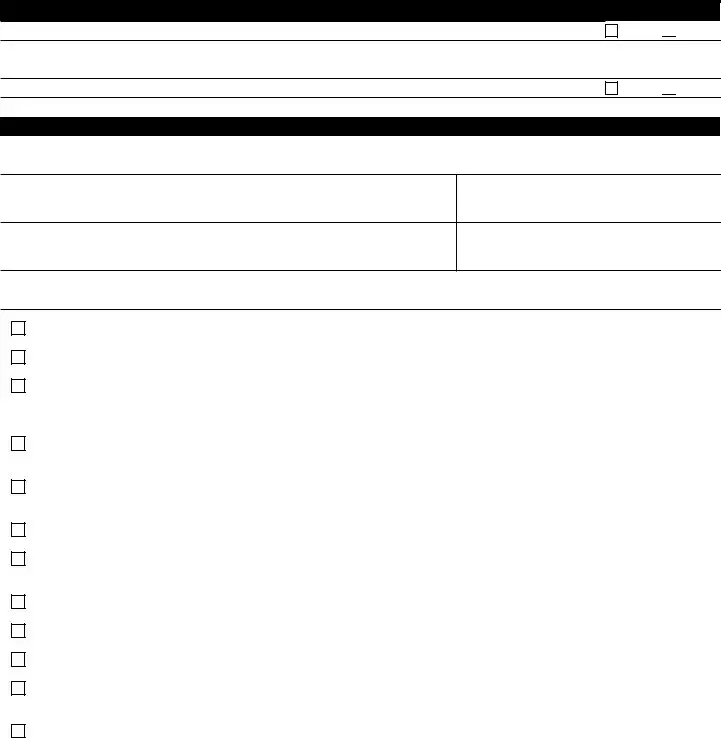

| Fact Name | Description |

|---|---|

| Purpose | The IRS 433-A (OIC) form is used to apply for an Offer in Compromise, allowing taxpayers to settle their debt for less than the full amount owed. |

| Eligibility | Eligibility is based on the taxpayer's ability to pay, income, expenses, and asset equity. |

| Sections | This form is divided into several sections, including personal information, employment details, personal asset information, and monthly household income and expenses. |

| Supporting Documentation | Applicants must provide supporting documentation, such as pay stubs, bank statements, and property valuations, to substantiate the information provided. |

| Application Process | Filing the form starts the evaluation process by the IRS to determine if an Offer in Compromise is appropriate based on the provided information. |

| Fees | A non-refundable application fee and initial payment are generally required when submitting the form, except for qualifying low-income taxpayers. |

| Governing Laws | The process and criteria for an Offer in Compromise, including the use of the IRS 433-A (OIC) form, are governed by federal tax laws and IRS regulations. |

Instructions on Utilizing IRS 433-A (OIC)

Filling out the IRS 433-A (OIC) form is a critical step for individuals seeking to settle their tax debts with the IRS under more manageable terms. This document provides the IRS with detailed information about the applicant’s financial situation, helping the agency to determine an appropriate offer in compromise. The process can be intricate, requiring careful attention to detail to ensure that all information is accurate and complete. Below are the steps to fill out the form effectively, aiming to make the process as straightforward as possible for those who are navigating this pathway toward resolving their tax obligations.

- Gather required documentation: Before starting the form, collect all necessary financial documents. This includes bank statements, pay stubs, investment accounts, property valuations, and information on all debts and expenses.

- Section 1 - Personal Information: Fill in your full name, social security number (SSN), and contact information. If applicable, also provide the SSN, name, and contact information for your spouse.

- Section 2 - Employment Information for Wage Earners: Provide details about your employer or your spouse's employer if you are married. Include the employer's name, address, and the length of employment.

- Section 3 - Self-Employed Individuals: If self-employed, complete this section with your business information, such as the type of business, address, and gross monthly income.

- Section 4 - Other Financial Information: This section demands thorough detail about your monthly living expenses, including housing, utilities, food, transportation, and healthcare. Also, report any assets, such as real estate, vehicles, and personal belongings of significant value.

- Section 5 - Business Information: If you own a business, provide the required information regarding business assets, such as cash on hand, accounts receivable, and inventory.

- Section 6 - Additional Information: Answer all additional questions, which can include inquiries about previous offers in compromise, bankruptcy filings, and other relevant financial details.

- Review and Sign: Carefully review all the information provided to ensure accuracy. Inaccuracies may lead to delays or denial of your offer. After reviewing, sign and date the form. If you are married and filing jointly, your spouse must also sign.

- Compile Supporting Documentation: Attach all required documentation that supports the financial information you’ve outlined in the form. This can include pay stubs, bank statements, and bills.

- Submit the Form: Once the form and all supporting documents are complete, submit them to the appropriate IRS address. This information can be found in the instructions for the IRS 433-A (OIC) form or on the IRS website.

After submitting the IRS 433-A (OIC) form, the waiting period begins. The IRS reviews your offer, a process that can take several months. During this time, it's crucial to maintain current tax compliance and respond promptly to any requests from the IRS for additional information. Successfully navigating the complexities of this form puts you one step closer to resolving your tax debt and moving forward with financial stability.

Obtain Answers on IRS 433-A (OIC)

-

What is the purpose of the IRS Form 433-A (OIC)?

The IRS Form 433-A (OIC) is used to apply for an Offer in Compromise (OIC), allowing individuals to settle their tax debt for less than the full amount they owe. It provides the IRS with detailed financial information about the taxpayer's income, expenses, assets, and liabilities. This form is essential for demonstrating to the IRS that paying the full amount of tax owed would create financial hardship or be unjust or inequitable.

-

Who needs to fill out the IRS Form 433-A (OIC)?

Individuals who are unable to pay their full tax liability, or doing so would create a financial hardship, should complete the IRS Form 433-A (OIC). It's specifically designed for those seeking an Offer in Compromise and is a critical step in that process. Before submitting this form, taxpayers should ensure they have filed all required tax returns and made any required estimated payments.

-

What information do I need to complete the Form 433-A (OIC)?

To complete the Form 433-A (OIC), individuals will need comprehensive information about their financial situation. This includes, but is not limited to:

- All sources of income, such as wages, business income, and investment income.

- Monthly living expenses, including rent or mortgage, food, utilities, and transportation.

- Assets, including cash, bank accounts, real estate, vehicles, and personal belongings with significant value.

- All liabilities and debts, such as credit cards, loans, and other outstanding obligations.

-

Is there a fee to submit the IRS Form 433-A (OIC)?

Yes, there is generally a fee to submit the IRS Form 433-A (OIC), along with the Offer in Compromise. The application fee may change, so it’s recommended to check the latest IRS guidelines. However, some individuals may qualify for a low-income certification, potentially waiving this fee. The application package should include information on whether you might be eligible for such a waiver.

-

How long does it take for the IRS to decide on an Offer in Compromise after submitting Form 433-A (OIC)?

After submitting Form 433-A (OIC), the IRS takes on the rigorous task of carefully reviewing the provided information to make a decision. This process can be lengthy, typically taking anywhere from four to six months. However, processing times can vary based on the complexity of the offer, the completeness of the submitted form, and the IRS's current backlog. Taxpayers should remain patient but also proactive, ensuring they respond promptly to any requests for additional information from the IRS to avoid further delays.

Common mistakes

When dealing with the IRS 433-A (OIC) form, which is a crucial document for proposing an Offer in Compromise to the IRS, people often find themselves tripped up by common pitfalls. Though navigating tax forms can be daunting, being aware of these mistakes can simplify the process significantly. Here’s a close look at the five mistakes to avoid for a smoother experience:

Not double-checking personal information: One of the simplest yet most frequent errors is entering incorrect personal information. This includes wrong Social Security numbers, misspelled names, or outdated addresses. Accuracy in these details is crucial for the IRS to process your form.

Overlooking income sources: All income must be reported on the IRS 433-A (OIC) form. This includes not only your primary job but also any side gigs, investments, or rental incomes. People often forget to include part-time jobs or freelance work, which can lead to discrepancies and issues with your offer.

Underestimating expenses: Accurately reporting your monthly expenses is key to making a realistic offer to settle your tax debt. Commonly, individuals underestimate or forget to include certain living expenses, which can lead to an unrealistic portrayal of their financial situation. Make sure to include all relevant expenses to ensure a fair offer is made.

Failing to provide documentation: The IRS requires documentation for nearly everything claimed on the 433-A (OIC) form. This includes proof of income, expenses, asset valuations, and more. Failure to attach the necessary supporting documents can lead to a rejection of your offer.

Ignoring tax liabilities: Sometimes, people submit the IRS 433-A (OIC) without fully understanding their tax liabilities. It is essential to review your tax history and include all liabilities, regardless of how insignificant they might seem. Overlooking any taxes owed can complicate the process or lead to the dismissal of your offer.

While filling out tax forms can feel overwhelming, taking the time to avoid these common errors can lead to a more favorable outcome with your Offer in Compromise. Always remember, thoroughness and accuracy are your best tools in this process.

Documents used along the form

When dealing with the IRS, particularly in attempts to settle tax debts through an Offer in Compromise (OIC) using Form 433-A (OIC), it's essential to have a comprehensive understanding of the associated forms and documents required for a successful submission. These additional documents play a crucial role in providing the IRS with a complete financial picture of the applicant, thereby facilitating the review process. Below is a list of some of the most commonly required forms and documents that accompany Form 433-A (OIC).

- Form 656: Known as the Offer in Compromise form, it serves as the actual proposal for the settlement amount you’re willing to pay to the IRS. It complements Form 433-A (OIC) by outlining the terms of your offer and the basis for its acceptance.

- Form 1040: The U.S. Individual Income Tax Return form is often required for the most recent tax year if the applicant has not already filed. This document provides the IRS with the latest snapshot of the taxpayer’s annual income and tax liability.

- Form W-2 and/or 1099: These forms report income from employment (W-2) or other sources such as independent contracting work (1099). They verify the income reported on your tax return and in your OIC application.

- Bank Statements: Typically, the last three to six months' worth of statements are needed to verify income, expenses, and the ability to pay. These documents are crucial for substantiating the financial information provided on Form 433-A (OIC).

- Pay Stubs: Recent pay stubs (usually the last three months) are required to provide a current and accurate measure of your income. This information helps the IRS determine your ability to fulfill the terms of the offer.

- Proof of Expenses: Receipts, bills, and other documentation of monthly living expenses such as rent, utilities, insurance, and transportation costs. These documents are essential to validate your claimed allowable living expenses on Form 433-A (OIC).

Effectively navigating the complexities of an Offer in Compromise requires careful attention to detail and a thorough understanding of the required documentation. By successfully compiling and submitting these forms and documents in concert with Form 433-A (OIC), applicants significantly improve their chances of reaching a favorable resolution with the IRS. Seeking professional guidance can also provide invaluable assistance through this intricate process, ensuring that all paperwork is in order and accurately reflects the applicant's financial situation.

Similar forms

IRS 433-F (Collection Information Statement for Wage Earners and Self-Employed Individuals): This document is akin to the IRS 433-A (OIC) because it gathers financial information from individuals, focusing on those who are wage earners or self-employed. Both forms are used by the IRS to assess an individual's ability to pay outstanding taxes, but the 433-F is generally utilized for setting up payment plans rather than for offer in compromise cases.