Blank Irs 4598 Instructions PDF Template

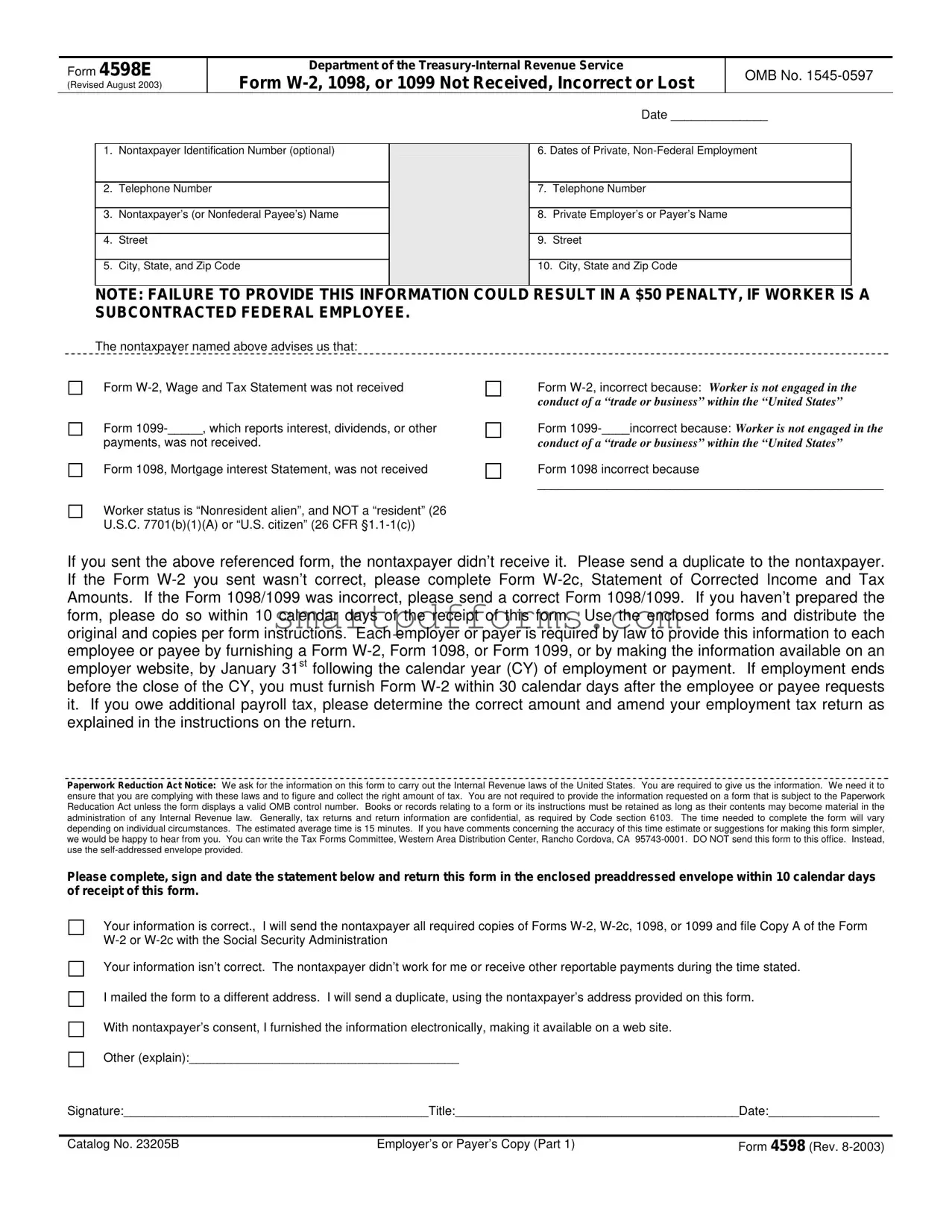

The Internal Revenue Service (IRS) Form 4598E, revised in August 2003, addresses a critical aspect of taxpayer documentation, particularly focusing on situations where individuals do not receive, lose, or are issued incorrect forms W-2, 1098, or 1099. These forms are pivotal for accurately reporting wages and tax statements, mortgage interest, and various other payments such as interest and dividends, which have significant implications for an individual's tax obligations. The form serves as a notification mechanism for the taxpayer to inform the IRS and the issuer about the discrepancy or absence of these documents. Notably, it includes provisions for correcting the record, whether that involves issuing duplicate documents or rectifying inaccurate information. The urgency of resolving these issues is underscored by the potential for a $50 penalty in cases where failure to provide the correct information involves subcontracted federal employees. Furthermore, the form acts as a safeguard for taxpayers, allowing them to estimate and report their income and withholding using Form 4852 or an amended return with Form 1040X if necessary. This process underscores the Internal Revenue laws' emphasis on accuracy and compliance while acknowledging the practical challenges taxpayers may face. The Paperwork Reduction Act Notice included within the form's instructions underscores the IRS's commitment to efficiency and public feedback, highlighting the balance between regulatory requirements and the burden on the taxpayer.

Preview - Irs 4598 Instructions Form

Form 4598E

(Revised August 2003)

Department of the

Form

OMB No.

|

|

|

|

Date ______________ |

|

|

|

|

|

1. |

Nontaxpayer Identification Number (optional) |

|

6. Dates of Private, |

|

|

|

|

|

|

2. |

Telephone Number |

|

7. |

Telephone Number |

|

|

|

|

|

3. |

Nontaxpayer’s (or Nonfederal Payee’s) Name |

|

8. |

Private Employer’s or Payer’s Name |

|

|

|

|

|

4. |

Street |

|

9. |

Street |

|

|

|

|

|

5. |

City, State, and Zip Code |

|

10. |

City, State and Zip Code |

|

|

|

|

|

NOTE: FAILURE TO PROVIDE THIS INFORMATION COULD RESULT IN A $50 PENALTY, IF WORKER IS A SUBCONTRACTED FEDERAL EMPLOYEE.

The nontaxpayer named above advises us that:

Form

Form

payments, was not received.

Form 1098, Mortgage interest Statement, was not received

Form

Form

conduct of a “trade or business” within the “United States”

Form 1098 incorrect because

__________________________________________________

Worker status is “Nonresident alien”, and NOT a “resident” (26

U.S.C. 7701(b)(1)(A) or “U.S. citizen” (26 CFR

If you sent the above referenced form, the nontaxpayer didn’t receive it. Please send a duplicate to the nontaxpayer. If the Form

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reducation Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete the form will vary depending on individual circumstances. The estimated average time is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Please complete, sign and date the statement below and return this form in the enclosed preaddressed envelope within 10 calendar days of receipt of this form.

Your information is correct., |

I will send the nontaxpayer all required copies of Forms |

|

|

||

Your information isn’t correct. The nontaxpayer didn’t work for me or receive other reportable payments during the time stated. |

||

I mailed the form to a different address. I will send a duplicate, using the nontaxpayer’s address provided on this form. |

||

With nontaxpayer’s consent, I furnished the information electronically, making it available on a web site. |

|

|

Other (explain):_______________________________________ |

|

|

Signature:____________________________________________Title:_________________________________________Date:________________ |

||

|

|

|

Catalog No. 23205B |

Employer’s or Payer’s Copy (Part 1) |

Form 4598 (Rev. |

Form 4598E

(Revised August 2003)

Department of the

Form

OMB No.

|

|

|

|

Date ______________ |

|

|

|

|

|

1. |

Nontaxpayer Identification Number (optional) |

|

6. Dates of Private |

|

|

|

|

|

|

2. |

Telephone Number |

|

7. |

Telephone Number |

|

|

|

|

|

3. |

Nontaxpayer’s (or Payee’s) Name |

|

8. |

Private Employer’s or Payer’s Name |

|

|

|

|

|

4. |

Street |

|

9. |

Street |

|

|

|

|

|

5. |

City, State, and Zip Code |

|

10. |

City, State and Zip Code |

|

|

|

|

|

NOTE: FAILURE TO PROVIDE THIS INFORMATION COULD RESULT IN A $50 PENALTY, IF WORKER IS A SUBCONTRACTED FEDERAL EMPLOYEE.

The nontaxpayer named above advises us that:

Form

Form

payments, was not received.

Form 1098, Mortgage interest Statement, was not received

Form

Form

conduct of a “trade or business” within the “United States”

Form 1098 incorrect because

__________________________________________________

Worker status is “Nonresident alien”, and NOT a “resident” (26

U.S.C. 7701(b)(1)(A) or “U.S. citizen” (26 CFR

If you don’t receive the Form

If you have already filed a return on which you estimated your wages, payments, interest, dividends, and withholdings, we will process it based upon the information it contains.

If you later receive the Form

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete the form will vary depending on individual circumstances. The estimated average time is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Catalog No. 23205B |

NONTaxpayer’s Copy (Part 2) |

Form 4598 (Rev. |

Form Data

| Fact Number | Fact Name | Fact Detail |

|---|---|---|

| 1 | Form Designation | Form 4598E (Revised August 2003) |

| 2 | Purpose | For reporting not received, incorrect, or lost Forms W-2, 1098, or 1099 |

| 3 | Issuing Authority | Department of the Treasury-Internal Revenue Service |

| 4 | OMB Number | 1545-0597 |

| 5 | Penalty Warning | Possible $50 penalty for failure to provide required information if worker is a subcontracted federal employee |

| 6 | Residency Status Consideration | Addressed worker status as "Nonresident alien" not being a "resident" or "U.S. citizen" for tax purposes |

| 7 | Replacement Procedures | Instructions for requesting duplicates of Forms W-2, W-2c, 1098, or 1099 |

| 8 | Paperwork Reduction Act Notice | Information collection complies with the Internal Revenue laws, with confidentiality mandated by Code section 6103 |

Instructions on Utilizing Irs 4598 Instructions

Filling out IRS Form 4598E, which deals with W-2, 1098, or 1099 forms not received, incorrect, or lost, involves providing specific information to address your situation. This form serves as notification to the IRS and helps them in ensuring compliance with the tax laws of the United States. It also assists taxpayers in rectifying or updating their tax records. The steps to complete this form are straightforward and designed to collect essential details regarding the taxpayer, employment, and any issues with the forms in question.

- Start by entering the current date at the top where "Date" is mentioned.

- Fill in your Identification Number in the space provided for the "Nontaxpayer Identification Number (optional)."

- Provide your Telephone Number where indicated.

- Write your Name in the field labeled "Nontaxpayer’s (or Nonfederal Payee’s) Name".

- Enter your Street Address in the space provided.

- Include your City, State, and Zip Code in the respective fields.

- Detail the Dates of Private, Non-Federal Employment as requested.

- Provide a Telephone Number for contact purposes.

- List the Name of your Private Employer or Payer where specified.

- Fill in the Street Address of your Employer or Payer.

- Include the City, State, and Zip Code of the Employer or Payer.

- Check the appropriate box(es) to indicate whether your Form W-2, 1098, or 1099 was not received, incorrect, or lost, and provide additional details as necessary in the space provided.

After completing these steps, review the statement at the bottom of the form regarding the action to be taken by the employer or payer. This statement outlines possible outcomes, such as sending duplicates of the required forms or confirming that the information is incorrect. Sign and date the form once all information has been accurately provided. Ensure you return this form within 10 calendar days of receipt using the enclosed preaddressed envelope. This prompt action assists in ensuring that your tax records are corrected in a timely manner, avoiding any possible delays or complications with your tax filings.

Obtain Answers on Irs 4598 Instructions

What is Form 4598E used for?

Form 4598E serves as a notification to the IRS when an individual has not received, lost, or received an incorrect Form W-2, 1098, or 1099, which are essential documents for reporting wage, dividend, interest income, and mortgage interest paid. This form helps in acquiring the correct documentation needed for tax filing.

Who needs to fill out Form 4598E?

This form should be completed by individuals who were supposed to receive a Form W-2, 1098, or 1099 but did not receive it, received it with incorrect information, or lost it and need a replacement for tax filing purposes.

What penalties are associated with Form 4598E?

Failure to provide the information requested on Form 4598E could result in a $50 penalty if the worker is a subcontracted federal employee. This emphasizes the importance of accurately completing and submitting the form when required.

How do recipients of Form 4598E respond to incorrect information?

Employers or payers who receive Form 4598E and find that the information regarding the employment or payments is incorrect should indicate so on the form. They may also provide the correct information, send a duplicate form to the worker's address provided, or note if the information was furnished electronically.

What are the deadlines for providing required tax documents to employees or payees?

Employers or payers are required by law to provide a Form W-2, 1098, or 1099 by January 31st following the employment or payment year. If employment ends before the year's close, the Form W-2 must be furnished within 30 calendar days after the employee requests it.

What should you do if you do not receive the W-2 or 1099 forms in time for tax filing?

If you do not receive your W-2 or 1099 forms by the time you need to file your tax return, you should file using Form 4852 as a replacement for Form W-2, or estimate the amounts to be reported on your tax return. If discrepancies are found after receiving the correct form, you must file an amended return using Form 1040X.

What should you retain for your records?

Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Specifically, keep any received Form W-2, 1098, or 1099 that confirm the information provided on your tax return.

Where should comments or suggestions about Form 4598E be directed?

Comments concerning the accuracy of the form's time estimate or suggestions for simplifying it should be sent to the Tax Forms Committee at the Western Area Distribution Center, located in Rancho Cordova, CA 95743-0001. Do not send the form itself to this address.

What is the estimated time to complete Form 4598E?

The estimated average time to complete Form 4598E is 15 minutes. This estimate may vary depending on individual circumstances.

Is providing the information requested on Form 4598E mandatory?

Yes, the information requested on Form 4598E must be provided in order to comply with Internal Revenue laws of the United States. Failure to provide this information can affect the accurate calculation and collection of taxes owed.

Common mistakes

When individuals are filling out the IRS Form 4598E, there are several common mistakes that can easily be made. It's important to avoid these errors to ensure the process goes smoothly, and potentially avoid delays or penalties. Here are eight mistakes to watch out for:

- Not providing the Nontaxpayer Identification Number when it's available. Although it's listed as optional, including it can help the IRS process your form more quickly.

- Omitting or inaccurately entering the telephone numbers in Sections 2 and 7. Correct contact information is crucial for any follow-up communication.

- Incorrectly spelling or miswriting the Nontaxpayer’s (or Nonfederal Payee’s) Name. This name should match the official documents to avoid confusion or processing delays.

- Failing to provide complete or accurate address information, including the street, city, state, and ZIP code in Sections 4 and 9. Inaccuracies can lead to forms being sent to the wrong location.

- Ignoring the dates of private, non-federal employment in Section 6. This information is essential for accurately processing the form related to non-federal work periods.

- Not clarifying the reason for the form submission, such as a W-2, 1098, or 1099 form not being received, being incorrect, or being lost. Clearly indicating the issue helps the IRS understand what corrective action needs to be taken.

- Forgetting to sign, date, and title at the bottom of the form. Unsigned or undated forms are not processed, which could lead to delays in resolving the issue.

- Not using the self-addressed envelope provided for submission. This may seem trivial, but it ensures your form goes directly to the correct processing location.

Remember, accurately completing and promptly submitting Form 4598E plays a key role in resolving issues with not received, incorrect, or lost W-2, 1098, or 1099 forms. Paying close attention to these common mistakes can lead to a much smoother process.

Documents used along the form

When handling tax-related matters, particularly those involving missing, incorrect, or lost forms like the IRS 4598 Instructions detail, individuals and organizations often require additional documentation to rectify their situation or to complete their tax filings accurately. Here is an overview of other forms and documents that might be used in conjunction with Form 4598E to ensure compliance with tax regulations and to facilitate accurate reporting.

- Form W-2c, Statement of Corrected Income and Tax Amounts: Used to correct errors on Form W-2, Wage and Tax Statement, such as incorrect name, Social Security number, wages, or tax withheld.

- Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R: If the taxpayer does not receive the original form in time to file their income tax return, this form serves as a substitute on which they can estimate wages and withholding.

- Form 1099 series: A group of forms used to report various types of income other than wages, salaries, and tips. It includes forms for reporting interest (1099-INT), dividends (1099-DIV), and miscellaneous income (1099-MISC), among others.

- Form 1040X, Amended U.S. Individual Income Tax Return: If an individual receives a W-2 or 1099 form after filing their tax return and the information differs from what was reported, this form is used to make corrections to a previously filed Form 1040.

- Form 8879, IRS e-file Signature Authorization: Allows taxpayers to electronically sign e-filed documents, verifying that the information on their tax return is accurate.

- Form 4506-T, Request for Transcript of Tax Return: Used to request a transcript of tax returns previously filed. It is helpful for taxpayers who need to verify past income and tax filing status for lending and housing purposes, among others.

- Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits): Useful for students or parents of students who are seeking to claim education credits and need to reconcile financial information from different sources.

- Form W-9, Request for Taxpayer Identification Number and Certification: Employers and financial institutions often require a completed Form W-9 to gather taxpayer identification numbers to report income paid or interest earned.

- Form W-4, Employee's Withholding Certificate: While not directly related to missing or incorrect tax forms, it's crucial for employees to ensure their withholding preferences are accurately reflected to avoid future discrepancies.

These forms collectively help taxpayers resolve issues with missing or incorrect documents, amend previously filed returns, and ensure accurate reporting to the IRS. From correcting wage and tax statement errors using Form W-2c to requesting a transcript of a past tax return with Form 4506-T, these documents are vital tools in the tax filing process. By familiarizing themselves with these forms, taxpayers can navigate the complexities of tax reporting with more confidence and efficiency.

Similar forms

The IRS Form 4598E is a specific document intended to address issues regarding non-receipt, incorrectness, or loss of important tax documents such as Form W-2, Form 1098, and various versions of Form 1099. Below is a list of similar documents and the aspects of their resemblance to Form 4598E:

- Form W-2, Wage and Tax Statement: This form is directly related to Form 4598E as the latter may be used when a taxpayer has not received, has lost, or has received an incorrect Form W-2. Form W-2 details an employee’s annual wages and the amount of taxes withheld from their paycheck.

- Form 1099-MISC, Miscellaneous Income: Similar to Form W-2 but for independent contractors, this form is mentioned in Form 4598E for situations where Form 1099-MISC, which reports payments made in the course of a trade or business to a person who’s not an employee, is not received, lost, or incorrect.

- Form 1098, Mortgage Interest Statement: This form is similar because Form 4598E also applies when a taxpayer does not receive or loses Form 1098. This form details the amount of interest and related expenses paid on a mortgage during the tax year, which are potentially deductible.

- Form W-2c, Corrected Wage and Tax Statement: Form 4598E references Form W-2c as the document to use if there's a need to correct any W-2 information previously submitted. This similarity lies in their shared focus on rectifying errors related to employment income reporting.

- Form 1099-INT, Interest Income: This form is associated with Form 4598E in situations involving the non-receipt, loss, or inaccuracies of documents that report interest income. Form 1099-INT is used by banks and other financial institutions to report the interest income a taxpayer earned during the year.

- Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.: This form serves as a substitute when taxpayers do not receive Forms W-2 or 1099-R in time for filing. The relation to Form 4598E is in its function as a stand-in document to ensure compliance and timely filing.

- Form 1040X, Amended U.S. Individual Income Tax Return: It is related to Form 4598E through the process of amendment. If a taxpayer files an estimate based on missing or incorrect forms and later receives the accurate documentation, they may need to amend their return with Form 1040X, reflecting the information initially sought through Form 4598E.

Each of these documents plays a unique role in the correction, amendment, or reporting process related to income, deductions, and taxes owed to or refundable by the IRS, highlighting their connections through functions that ensure taxpayers accurately report their financial information.

Dos and Don'ts

When dealing with the IRS 4598 Instructions form, it's imperative to navigate the process carefully to ensure compliance and accuracy. Here are nine dos and don'ts to consider:

- Do ensure you have all the necessary personal information and documents ready before you begin to fill out the form. This includes your full name, address, social security number (if applicable), and any relevant financial statements or payment records.

- Do read through the form thoroughly before starting to fill it out. Understanding each section and what is required can save you time and prevent mistakes.

- Do use black ink and write legibly if you're filling out the form by hand. Mistakes made due to illegibility can cause delays or errors in processing.

- Do ensure that you accurately estimate your wages, withholdings, and other reported amounts if the original documents were not received or were incorrect. Use your best available records to do so.

- Do check the box that correctly describes your situation (e.g., not receiving a Form W-2, 1098, or 1099, or receiving an incorrect form).

- Don't leave any required fields blank. If a section does not apply to your situation, mark it as "N/A" (not applicable) rather than leaving it empty.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Don't ignore deadlines. Submitting this form promptly can avoid penalties or delays with your tax return.

- Don't send the form without making a copy for your records. Keeping a copy can help you track the process and serve as proof of submission.

Adhering to these guidelines will help streamline the process of dealing with forms related to not receiving or correcting information on Form W-2, 1098, or 1099. Taking the time to fill out this form accurately and completely is crucial for maintaining compliance and ensuring that your tax information reflects your true financial situation.

Misconceptions

Many individuals often find themselves navigating through complexities when dealing with IRS forms. The IRS Form 4598E is no exception, often surrounded by misconceptions that can lead to confusion. Understanding these misconceptions is crucial for correct form submission and compliance with the IRS.

Misconception 1: Form 4598E is only for those who didn’t receive their W-2 or 1099 forms. While it’s true that one of the primary functions of Form 4598E is to report not receiving important tax documents like the W-2, 1099, or 1098 forms, it’s also utilized to report incorrect information provided on these forms. Moreover, individuals not engaged in a trade or business within the United States, including nonresident aliens, can use this form to report discrepancies related to their status.

Misconception 2: Filing Form 4598E replaces the need for the original tax documents. Filing Form 4598E does not eliminate the individual's responsibility to obtain the correct tax forms. If the original W-2, 1099, or 1098 forms are eventually received and there are discrepancies with what was reported on the tax return, the taxpayer may need to amend their return using Form 1040X. Form 4598E is essentially a provisional solution for when the original forms are not received in time for tax filing.

Misconception 3: The taxpayer will get penalized immediately for not providing information via Form 4598E. While the instructions note a potential $50 penalty if the information is not provided, especially for subcontracted federal employees, this penalty is not automatic. The IRS typically offers an opportunity to correct the omission or provide necessary information before imposing penalties.

Misconception 4: Submission of Form 4598E is mandatory for all taxpayers who have not received their W-2, 1099, or 1098 forms. Not all taxpayers are required to submit this form. It serves as a tool for those who need to notify the IRS about missing, incorrect, or lost documents. Taxpayers have alternative ways to report their income and estimated taxes paid, such as using Form 4852 as a substitute for a W-2.

Misconception 5: Personal tax information provided on Form 4598E can be shared or accessed by the public. Confidentiality of tax return information is a cornerstone of the U.S. tax system, safeguarded by section 6103 of the Internal Revenue Code. Information provided on Form 4598E, as with any tax form, is used strictly for the purpose of administering tax laws and cannot be disclosed to unauthorized parties.

Dispelling these myths fosters a better understanding of Form 4598E, helping taxpayers navigate their responsibilities more effectively and ensure compliance with IRS requirements.

Key takeaways

When dealing with IRS Form 4598E, it's important to understand its purpose and the steps required for correctly completing and using the form. This form addresses issues related to not receiving, losing, or getting incorrect Forms W-2, 1098, or 1099. Here are seven key takeaways to keep in mind:

- Form 4598E is specifically designed for situations where an individual has not received, has lost, or received incorrect versions of Forms W-2, 1098, or 1099. These forms are crucial for accurately reporting earnings, mortgage interest, dividends, and other payments during the tax year.

- It's essential to promptly address any discrepancies or missing forms by notifying the employer or payer as soon as possible, using Form 4598E as the communication tool. This action helps avoid potential penalties and ensures accurate tax filings.

- If you are a subcontracted federal employee, failing to provide the requested information via the Form 4598E may result in a $50 penalty. This underscores the importance of thoroughly and accurately completing the form.

- When incorrect forms are issued, the employer or payer is responsible for correcting the mistake. For instance, if a Form W-2 is incorrect, a Form W-2c (Statement of Corrected Income and Tax Amounts) must be issued.

- In cases where taxpayers do not receive the necessary tax documents in time for filing, they are advised to estimate their wages and withholding on Form 4852. Subsequently, if the actual forms are received and present different figures than what was estimated, an amended return might be necessary using Form 1040X.

- The form emphasizes the significance of addressing any provided information's corrections within 10 calendar days upon receipt of Form 4598E. Employers or payers must take swift action to correct any reporting inaccuracies or to furnish duplicates of the requested documents.

- Confidentiality and compliance terms are outlined in the Paperwork Reduction Act Notice, which establishes the premise for requesting the information on this form. The aim is to ensure adherence to tax laws and accurate tax collection. Additionally, it mentions that the average time needed to complete this form varies, with an estimated average of 15 minutes.

Understanding these key aspects of IRS Form 4598E will assist taxpayers, employers, and payers in navigating issues related to missing, lost, or incorrect tax documents, enabling more accurate and timely tax filings.

Popular PDF Forms

Buyer Guide - The guide serves as a contractual element of the vehicle sale, binding the dealer to any written promises made at the time of sale.

Whats a Net Listing - Clarifies the handling of deposits and fees in the event of buyer default.