Blank IRS 4852 PDF Template

When navigating the complexities of filing federal income tax returns, taxpayers sometimes encounter obstacles that impede their ability to provide precise information required by the Internal Revenue Service (IRS). Among these challenges is the situation where an individual does not receive, or receives an incorrect, Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., from their employers or distributors. To bridge this gap, the IRS offers a remedy in the form of Form 4852, a critical tool that serves as a substitute for Forms W-2, 1099-R, and other similar tax documents. This form allows taxpayers to estimate their wages and taxes withheld as accurately as possible, providing a pathway to fulfilling their tax obligations without undue penalty for circumstances beyond their control. The importance of Form 4852 extends not only to its function as a stopgap measure but also to its role in maintaining the integrity of the tax system, allowing individuals to come into compliance with tax laws in the absence of traditional documentation. Through its careful design, the form balances the need for taxpayer accountability with the realities of occasional employer oversight or administrative errors, underscoring the IRS's commitment to flexible, yet responsible tax administration.

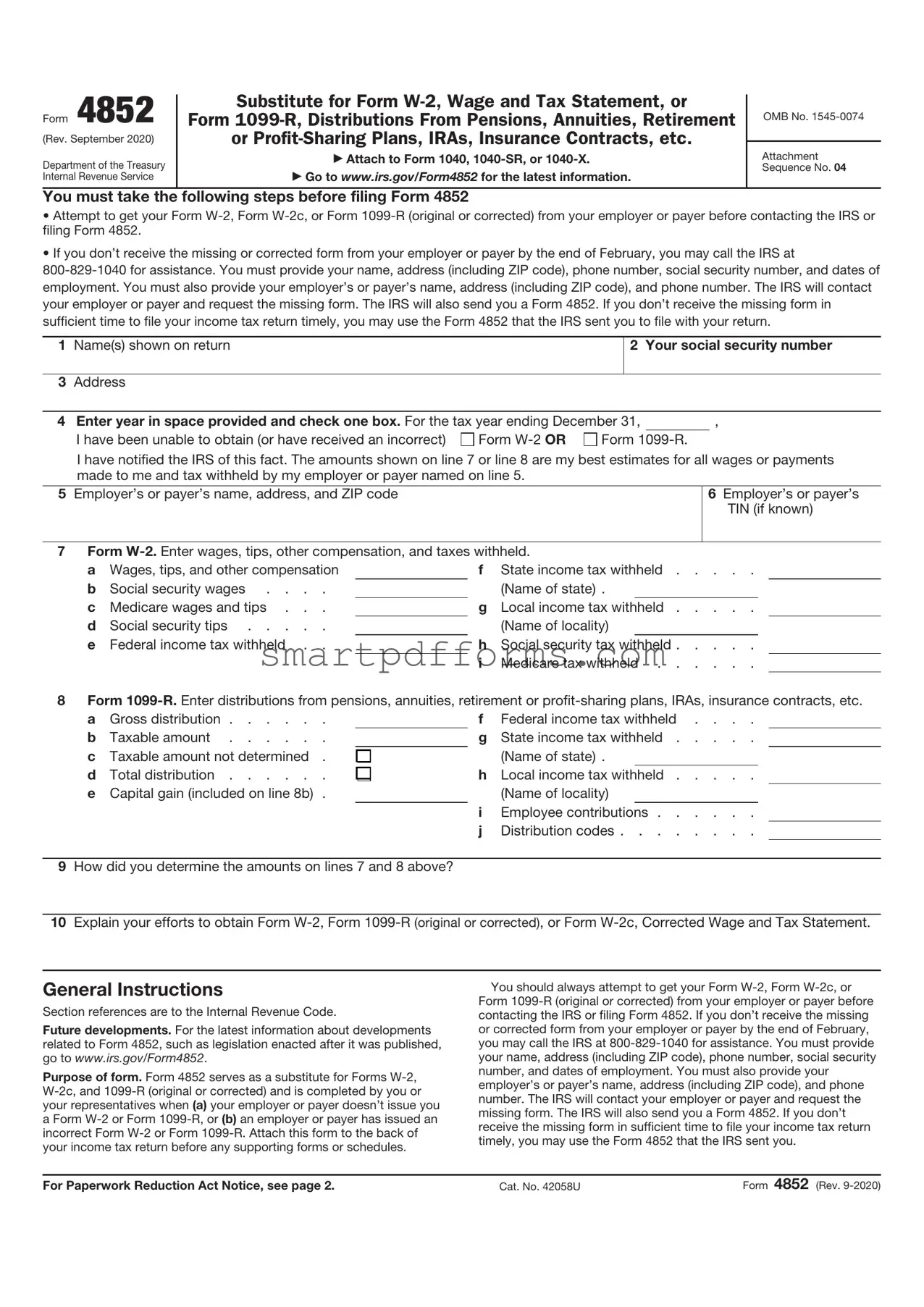

Preview - IRS 4852 Form

Form 4852

(Rev. September 2020)

Department of the Treasury Internal Revenue Service

Substitute for Form

Form

or

Attach to Form 1040,

Go to www.irs.gov/Form4852 for the latest information.

OMB No.

Attachment Sequence No. 04

You must take the following steps before filing Form 4852

•Attempt to get your Form

•If you don’t receive the missing or corrected form from your employer or payer by the end of February, you may call the IRS at

1Name(s) shown on return

3Address

2 Your social security number

4 Enter year in space provided and check one box. For the tax year ending December 31, |

|

, |

||

I have been unable to obtain (or have received an incorrect) |

Form |

Form |

|

|

I have notified the IRS of this fact. The amounts shown on line 7 or line 8 are my best estimates for all wages or payments made to me and tax withheld by my employer or payer named on line 5.

5Employer’s or payer’s name, address, and ZIP code

6Employer’s or payer’s TIN (if known)

7Form

a |

Wages, tips, and other compensation |

|

f |

State income tax withheld |

|

b |

Social security wages . . . . |

|

|

(Name of state) . |

|

c |

Medicare wages and tips . . . |

|

g |

Local income tax withheld |

|

d |

Social security tips |

|

|

(Name of locality) |

|

e |

Federal income tax withheld . . |

|

h |

Social security tax withheld |

|

|

|

|

i |

Medicare tax withheld |

|

8Form

a |

Gross distribution |

|

f |

Federal income tax withheld . . . . |

|

b |

Taxable amount |

|

g |

State income tax withheld |

|

c |

Taxable amount not determined . |

|

|

(Name of state) . |

|

d |

Total distribution |

|

h |

Local income tax withheld |

|

e |

Capital gain (included on line 8b) . |

|

|

(Name of locality) |

|

|

|

|

i |

Employee contributions |

|

|

|

|

j |

Distribution codes |

|

9How did you determine the amounts on lines 7 and 8 above?

10Explain your efforts to obtain Form

General Instructions

Section references are to the Internal Revenue Code.

Future developments. For the latest information about developments related to Form 4852, such as legislation enacted after it was published, go to www.irs.gov/Form4852.

Purpose of form. Form 4852 serves as a substitute for Forms

You should always attempt to get your Form

For Paperwork Reduction Act Notice, see page 2. |

Cat. No. 42058U |

Form 4852 (Rev. |

Form 4852 (Rev. |

Page 2 |

If you received an incorrect Form

Note: Retain a copy of Form 4852 for your records. To help protect your social security benefits, keep a copy of Form 4852 until you begin receiving social security benefits, just in case there is a question about your work record and/or earnings in a particular year. After September 30 following the date shown on line 4, you may use your Social Security online account to verify wages reported by your employers. Please visit www.SSA.gov/myaccount. Or, you may contact your local SSA office to verify wages reported by your employer.

Will I need to amend my return? If you receive a Form

Penalties. The IRS will challenge the claims of individuals who attempt to avoid or evade their federal tax liability by using Form 4852 in a manner other than as prescribed. Potential penalties for the improper use of Form 4852 include:

•

•Civil fraud penalties equal to 75% of the amount of taxes that should have been paid, and

•A $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702.

Specific Instructions

Lines 1 through 3. Enter your name, social security number, and current address including street, city, state, and ZIP code.

Line 4. Enter the year for which Form

Line 5. Enter your employer’s or payer’s name, address, and ZIP code.

Line 6. Enter your employer’s or payer’s taxpayer identification number (TIN), if known. If you had the same employer or payer in the prior year, use the employer identification number (EIN) shown on the prior year’s Form

Line

Line

Line 9. Explain how you determined the amounts on line 7 or 8. For example, tell us if you estimated the amounts, used your pay stubs, or used a statement reporting your distribution.

Line 10. Explain any attempts made to get the missing or corrected Form

Paperwork Reduction Act Notice. We ask for the information on Form 4852 to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The average time and expenses required to complete and file this form vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making Form 4852 simpler, we would be happy to hear from you. See the instructions for your income tax return.

Form Data

| Fact | Description |

|---|---|

| Form Number | IRS Form 4852 |

| Purpose | Used as a substitute for Forms W-2, W-2c, and 1099-R when the employer or payer has not provided these forms to the taxpayer, or when the provided forms are incorrect, and the taxpayer is unable to obtain the corrected forms from the employer or payer. |

| Filing Requirement | Taxpayers must attach Form 4852 to their tax return and provide an estimate of their wages and taxes withheld, if the original forms are not received or are incorrect. This is done to ensure accurate reporting of income and tax withholding to the Internal Revenue Service (IRS). |

| Governing Law | Federal tax laws as enforced by the Internal Revenue Service (IRS); there are no state-specific laws governing Form 4852 as it is a federal form. |

Instructions on Utilizing IRS 4852

When taxes season rolls around, it brings its share of headaches and paperwork. If you find yourself in a situation without a W-2 or 1099-R, the IRS 4852 form serves as a substitute. This document enables individuals to estimate their wages and taxes withheld, which is vital for accurate tax return filing. Below are the steps you'll need to complete to fill out this form correctly. Remember, while the process may seem daunting at first glance, following these guidelines can simplify it significantly.

- Gather all necessary documentation and information, including pay stubs and bank statements, to estimate the wages earned and the federal income tax withheld accurately.

- Download a copy of the IRS 4852 form from the official IRS website.

- Start by filling out your name, address, and social security number in the designated areas at the top of the form.

- Specify the tax year for which you are filing the form in the space provided.

- Enter your employer's name, address, and identification number (EIN) if you have it. For a missing 1099-R, provide the payer's information.

- In the line provided for line 7a or 7b (depending on whether you are replacing a W-2 or 1099-R), estimate your wages or distribution. Utilize your last pay stub of the tax year for this purpose.

- Calculate the total amount of federal income tax withheld during the year and enter this in the appropriate line (line 8 for W-2 replacements or line 9 for 1099-R replacements).

- Fill in the lines concerning social security wages, Medicare wages, and any withholding as applicable, based on your best estimates and the documentation you've gathered.

- Complete the certification section by signing and dating the form, thereby affirming that the information provided is your best estimate in lieu of your original documents.

- Attach Form 4852 to your tax return, placing it in front of your Form 1040 or other tax return form, and submit it to the IRS following their submission guidelines.

After submitting Form 4852 with your tax return, you've taken a critical step towards ensuring your tax responsibilities are met, even without the standard documents. The IRS may contact you for more information or documentation, so keep your records handy. Taking action to fulfill your tax obligations, despite missing documents, showcases your commitment to compliance and can help avoid potential penalties.

Obtain Answers on IRS 4852

-

What is an IRS Form 4852?

IRS Form 4852 serves as a substitute for Forms W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the employer or payer has not provided one, or when the information provided is incorrect. This form allows taxpayers to estimate their wages or distributions and the withholding amounts to correctly file their income tax return.

-

When should I use Form 4852?

Use Form 4852 if you have not received your Form W-2 or Form 1099-R by the tax filing deadline, or if the information on the forms you received is incorrect and you cannot obtain a corrected form from your employer or payer. Before using Form 4852, you should attempt to contact your employer or payer and request the missing or corrected document.

-

How do I fill out Form 4852?

To fill out Form 4852, you'll need to provide your personal information, including your Social Security Number. Then, estimate your wages, tips, and other compensation, as well as the federal income tax withheld, based on the best information you have available. You may use your final pay stub or other documentation to make these estimates. Be sure to explain how you arrived at these figures in the space provided on the form.

-

What documents do I need to support the amounts I report on Form 4852?

You should retain any documentation that supports the figures you report on Form 4852, such as pay stubs, bank statements, contracts, and any correspondence with your employer or payer. These documents will be crucial if the IRS needs to verify the accuracy of your tax return.

-

What are the consequences of using Form 4852 to file my taxes?

Filing your taxes with Form 4852 may delay the processing of your tax return and any refund you may be due. The IRS may also contact you or your employer to verify the information on the form. It's important to provide estimates that are as accurate as possible to avoid potential penalties for underreporting your income.

-

Can I file Form 4852 electronically?

Yes, Form 4852 can be filed electronically as part of your tax return. Ensure that all information provided on the form is accurate and attach any required documentation to your electronic return, if applicable.

-

What should I do if I receive my W-2 or 1099-R after I’ve already filed using Form 4852?

If you receive your W-2 or 1099-R after filing your tax return with Form 4852 and the figures differ from what you reported, you may need to amend your return using Form 1040-X, Amended U.S. Individual Income Tax Return. This step ensures your income and withholdings are accurately reported to the IRS.

-

How long should I keep a copy of Form 4852?

Keep a copy of Form 4852 and all supporting documentation for at least three years after the date you file your income tax return or two years after the tax has been paid, whichever is later. This documentation is essential in case the IRS has questions or if there is an audit.

-

What if my employer eventually sends me a corrected W-2 or 1099-R?

If your employer sends you a corrected W-2 or 1099-R after you've filed your tax return with Form 4852 and the information leads to a change in your tax obligation, you should file an amended tax return using Form 1040-X to report the correct information.

-

Where can I find more information about Form 4852?

For further details about Form 4852, including instructions on how to complete it and where to file it, visit the official website of the Internal Revenue Service (IRS) at www.irs.gov. You can download the form and its instructions directly from the site and find additional resources for filing your taxes correctly.

Common mistakes

When it comes to filling out the IRS Form 4852, which serves as a substitute for Form W-2 or Form 1099-R, individuals often encounter challenges that can lead to mistakes. This form is typically used when an employer or payer has not provided the original form or the information on the provided form is incorrect. Here are five common mistakes to be aware of:

Not verifying the accuracy of personal information: People sometimes fill in their personal details in a hurry and make simple mistakes, such as incorrect Social Security numbers or misspelled names. It's crucial to double-check these details to avoid processing delays.

Incorrectly estimating wages and taxes: If you're using Form 4852 to replace a W-2 or 1099-R, you must estimate your wages and taxes as accurately as possible. Errors here can lead to discrepancies that may require correction, potentially triggering an audit.

Failure to attach required documentation: When submitting Form 4852, you need to attach any relevant documents that support your estimates, like pay stubs or bank statements. Missing this step can lead to the IRS questioning the accuracy of your submission.

Not consulting with a tax professional: Especially for those who are unsure about how to estimate their income or taxes accurately, skipping a consultation with a tax advisor can be a significant oversight. Tax professionals can provide guidance and help avoid errors.

Submitting the form late: Time is of the essence when it comes to correcting your tax records. Delaying the submission of Form 4852 can result in penalties or interest, making it important to act quickly once you realize the original W-2 or 1099-R is missing or incorrect.

Avoiding these mistakes can help ensure that the process of using Form 4852 goes smoothly, allowing individuals to correct their tax records efficiently and accurately.

Documents used along the form

When individuals find themselves in the position of needing to complete the IRS Form 4852, it's generally because they are addressing discrepancies or absences in their income reporting documents provided by employers or payers. Form 4852 serves as a substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., when the original forms have not been received, or the information provided is believed to be incorrect. In such situations, other forms and documents often accompany Form 4852 to ensure accurate tax reporting and compliance with Internal Revenue Service (IRS) requirements.

- Form 1040 or other relevant tax return form: This primary tax form is used by individuals to file their annual income tax returns. Filing Form 1040 along with Form 4852 is essential because it allows individuals to report their total income, deductions, and credits to the IRS.

- Form 2848, Power of Attorney and Declaration of Representative: Individuals who seek assistance from a tax professional in completing and filing Form 4852 and other tax documents may need to include Form 2848. This form legally authorizes another person to represent the taxpayer before the IRS and make decisions on their behalf.

- Form 4506, Request for Copy of Tax Return: If taxpayers need to reference previous years’ returns to accurately complete Form 4852, they may use Form 4506 to request a copy from the IRS. This can be particularly useful when ensuring that income and tax reporting are consistent over multiple years.

- Form 8822, Change of Address: For individuals who have moved and are concerned that their W-2 or 1099-R forms were sent to an old address, submitting a Form 8822 ensures the IRS has the correct information on file. This helps prevent future issues with missing or incorrect documentation.

Navigating tax forms and ensuring compliance with IRS requirements can be complex. However, understanding the purpose and use of each form related to Form 4852 can make the process smoother. Whether addressing issues with income statements, authorizing a representative, or ensuring the IRS has current personal information, each document plays a crucial role in the broader context of managing and reporting one’s financial affairs accurately and efficiently.

Similar forms

W-2 Form: This form is issued by employers and reports an employee's annual wages and the amount of taxes withheld from their paycheck. The IRS 4852 form serves as a substitute for the W-2 when the original W-2 is not provided to the employee by the employer or when the information on the W-2 is incorrect.

1099 Form: Used to report various types of income other than wages, salaries, and tips. Like the IRS 4852 form, a 1099 form involves the reporting of income and federal tax withholdings, applicable to independent contractors or for interest and dividends.

W-4 Form: This form is filled out by employees to inform employers of their tax situation, such as their filing status and number of dependents, to determine how much federal income tax to withhold. While the W-4 helps to estimate tax withholdings, the IRS 4852 form helps to report what was actually withheld.

1040 Form: The primary form used by individuals to file their federal income tax returns. The information that would be reported on an IRS 4852 form, such as wages and taxes withheld, is often used to fill out parts of the 1040 form.

W-3 Form: This is a transmittal form sent by an employer to the Social Security Administration along with W-2 forms for all employees. While the W-3 summarizes total earnings and withholdings for all employees, the IRS 4852 form pertains to individual employee situations where W-2 data is missing or incorrect.

941 Form: Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. The data corrected or supplied by an IRS 4852 can correlate with the 941's reporting of overall tax withholding over a quarter.

W-9 Form: Request for Taxpayer Identification Number and Certification, used to provide the correct taxpayer identification number to entities that must file information returns with the IRS. The 4852 form shares the importance of correct taxpayer information to ensure accurate tax reporting and withholding.

8863 Form: Used for claiming education credits. While the IRS 4852 form pertains to income and tax withholdings, both forms contribute toward an individual's tax records, potentially impacting tax liability and refunds.

Schedule C: Profit or Loss from Business. Self-employed individuals use this to report earnings or losses of their business. Similar to IRS 4852, it helps in the accurate reporting of income and influences the individual’s overall tax situation.

W-7 Form: Application for IRS Individual Taxpayer Identification Number. This is necessary for individuals who are not eligible for a Social Security Number but need to file a federal tax return, ensuring they can be properly identified and taxed in lieu of having regular employment documents like a W-2, which the IRS 4852 form supplements or corrects.

Dos and Don'ts

When dealing with your taxes, specifically when needing to substitute a W-2 or 1099-R form using form 4852 with the IRS, it's important to approach this carefully. Here's a straightforward list of dos and don’ts to guide you through the process:

- Do gather all available information about your wages and taxes paid before starting the form. This can include your final pay stub or a statement from your employer.

- Do explain the efforts you've made to obtain the original form W-2 or 1099-R from your employer or issuing agency. It's important to show that you've tried to resolve this issue before resorting to form 4852.

- Do accurately estimate your wages and withholding to the best of your ability. If you’re using your last pay stub, make sure the calculations are done correctly.

- Do attach form 4852 to your return. It should follow your Form 1040 or other tax return forms, ensuring that your return is processed correctly.

- Don't leave any fields blank. If a section does not apply, it's better to put "0" or "N/A" than to leave it empty. This helps avoid processing delays.

- Don't guess or make up information. If you're unsure about certain details, it’s much better to give your 'best estimate' and explain how you arrived at those figures.

- Don't forget to sign and date your return. An unsigned return can delay processing and may even lead to it being returned to you.

Remember, the IRS 4852 form is a crucial document that should be filled out with care and accuracy. It's your responsibility to provide as accurate a report as possible based on the information available to you. These steps are not only about ensuring compliance but also about protecting yourself from potential issues down the line. Always keep copies of any documents you submit to the IRS for your records.

Misconceptions

The IRS Form 4852 serves as a substitute for Forms W-2, 1098, 1099, and other tax documents when the original forms are not available by the time you're ready to file your taxes. However, there are several misconceptions about the use and implications of Form 4852 that are vital to clear up for taxpayers.

Form 4852 Can Be Used as a First Resort: A common misconception is that taxpayers can use Form 4852 instead of waiting for the official tax documents from their employers or payers. In reality, the IRS expects taxpayers to make a diligent effort to obtain the necessary documentation before resorting to Form 4852. This form is typically used only when said documents are not received in a timely manner despite persistent efforts.

Form 4852 Guarantees No IRS Audits: Some believe filing Form 4852 exempts them from potential IRS audits regarding the information entered on the substitute form. However, using Form 4852 may actually increase the scrutiny of a tax return. The IRS may require additional evidence to verify the accuracy of the information provided, so it's crucial to maintain all records and calculations used to complete the form.

Using Form 4852 Can Speed Up Your Refund: Contrary to this belief, using Form 4852 can actually delay the processing of your tax return and any associated refunds. Since the IRS might need to validate the information on the form, additional review time can be expected, leading to potential delays in the processing of your tax return.

Form 4852 Is Only for Employment Income: While often associated with replacing the W-2 form for employment income, Form 4852 can also substitute for Forms 1099 and 1098, among others. This versatility means it can be used for reporting various types of income, such as interest, dividends, and mortgage interest, in the absence of the standard forms.

Filing Form 4852 Is a Complicated Process: While it may seem daunting to accurately report income and withholding without all the official documents, the IRS provides clear instructions for filling out Form 4852. Taxpayers need to estimate their income and withholding to the best of their ability, using their final pay stub or other relevant information. With careful attention to detail, the form can be completed accurately and submitted with confidence.

Key takeaways

Filling out and using the IRS Form 4852, which serves as a substitute for Forms W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., requires attention to detail and an understanding of its implications. Below are key takeaways to consider:

-

The IRS Form 4852 is used when an employer has not provided a Form W-2 or when the Form W-2 provided contains incorrect information, and sufficient attempts have been made to obtain a correct form from the employer.

-

Similarly, for missing or incorrect Form 1099-Rs, the Form 4852 serves as a replacement, ensuring that individuals can accurately report their income and taxes withheld to the IRS.

-

Before using Form 4852, individuals should make a reasonable effort to obtain the required form from their employer or the issuer of the Form 1099-R, including contacting the IRS if necessary.

-

To complete Form 4852, individuals will need to estimate their wage and tax information to the best of their ability, using their final pay stub or other relevant documentation as a reference.

-

Filing Form 4852 may result in a delay in the processing of your tax return, and potentially your refund, as the IRS may need to verify the information.

-

Errors or discrepancies on Form 4852 can lead to an audit or inquiries from the IRS, requiring individuals to provide additional documentation to support their estimates.

-

If an individual receives the missing or corrected Form W-2 or Form 1099-R after filing their tax return with Form 4852, they may need to amend their tax return if there are differences in the reported amounts.

-

The IRS may assess penalties against employers who fail to provide accurate Forms W-2 or Form 1099-Rs to their employees or to the IRS on time.

-

Completing and submitting IRS Form 4852 accurately is crucial for maintaining compliance with tax laws and ensuring that one's tax obligations are correctly met.

Popular PDF Forms

Heirship Affidavit Meaning - Sworn affidavit facilitating the legal transfer of a deceased overseas American's assets to their next of kin.

Masshealth - A guide for persons with disabilities applying for MassHealth, detailing the need to disclose medical, mental health, and personal information.

Uniform Support Declaration - It serves as a structured method for presenting income, expenses, and other financial details relevant to support cases.