Blank IRS 5472 PDF Template

Navigating the complexities of the United States tax code can be a daunting task, especially for those involved in international business dealings. Among the myriad forms to be aware of, the IRS Form 5472 stands out as particularly significant for certain foreign-owned and related United States corporations. This critical document, designed to report transactions between a 25% foreign-owned U.S. corporation or a foreign corporation engaged in a U.S. trade or business and a related party, serves as a tool for the Internal Revenue Service (IRS) to ensure compliance with tax laws and to prevent transfer pricing abuse and tax evasion. Its completion requires meticulous detail about the transactions it covers, including monetary exchanges, loans, and any transfers of tangible or intangible property. Failure to correctly file Form 5472 can result in substantial penalties, emphasizing the importance of understanding and adhering to its requirements. As international businesses strive to maintain their compliance with U.S. taxation regulations, grasping the nuances of Form 5472 becomes not just beneficial but essential for their financial and legal well-being.

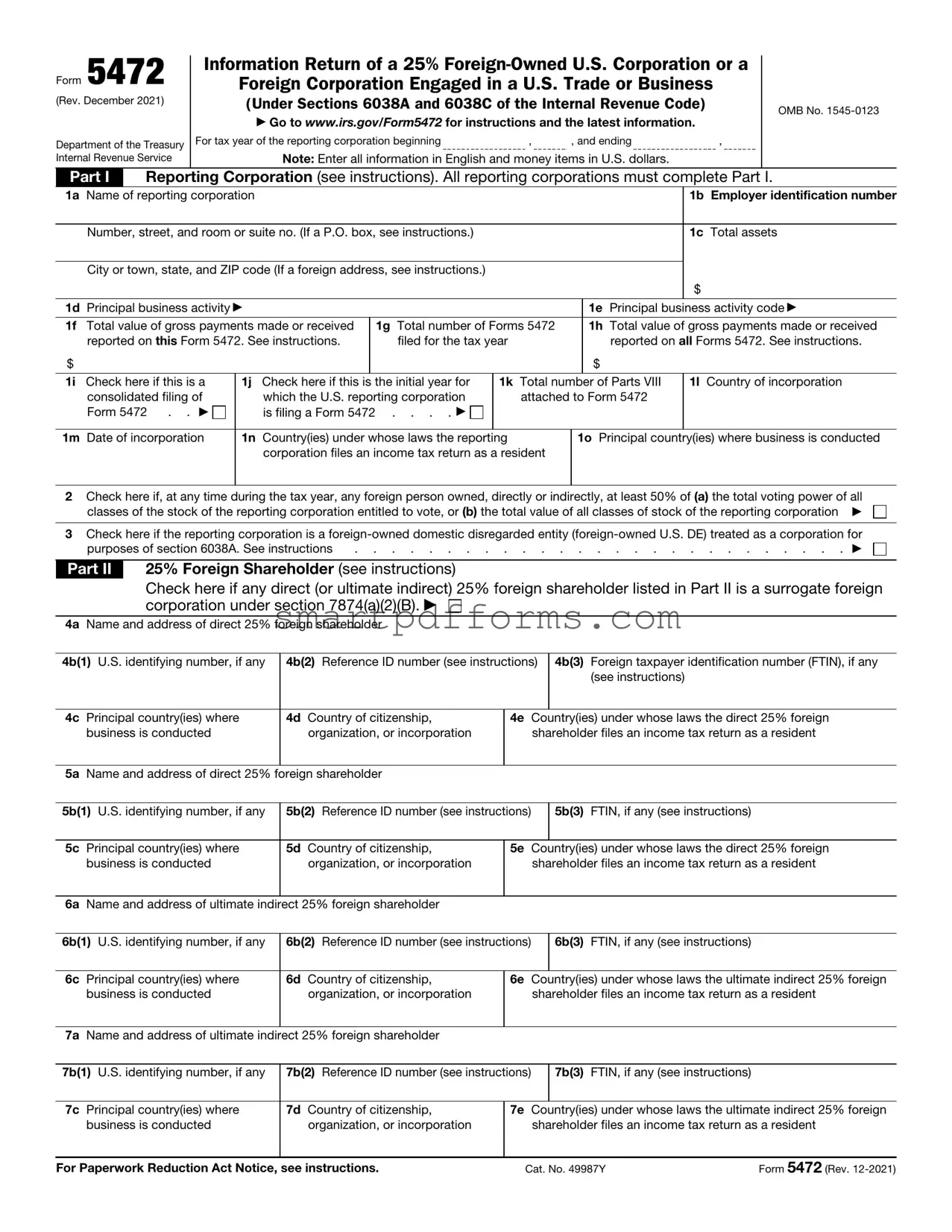

Preview - IRS 5472 Form

Form 5472 |

Information Return of a 25% |

|

Foreign Corporation Engaged in a U.S. Trade or Business |

|

|

(Rev. December 2021) |

(Under Sections 6038A and 6038C of the Internal Revenue Code) |

OMB No. |

|

|

▶Go to www.irs.gov/Form5472 for instructions and the latest information.

Department of the Treasury |

For tax year of the reporting corporation beginning |

, |

, and ending |

, |

Internal Revenue Service |

Note: Enter all information in English and money items in U.S. dollars. |

|

||

Part I Reporting Corporation (see instructions). All reporting corporations must complete Part I.

1a Name of reporting corporation |

|

|

|

|

|

1b Employer identification number |

||

|

|

|

|

|

|

|

|

|

Number, street, and room or suite no. (If a P.O. box, see instructions.) |

|

|

|

|

1c Total assets |

|||

|

|

|

|

|

|

|

|

|

City or town, state, and ZIP code (If a foreign address, see instructions.) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

1d Principal business activity ▶ |

|

|

|

|

1e Principal business activity code ▶ |

|||

|

|

|

|

|

|

|

||

1f Total value of gross payments made or received |

|

1g Total number of Forms 5472 |

|

1h Total value of gross payments made or received |

||||

reported on this Form 5472. See instructions. |

|

filed for the tax year |

|

|

reported on all Forms 5472. See instructions. |

|||

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

1i Check here if this is a |

1j Check here if this is the initial year for |

1k |

Total number of Parts VIII |

1l Country of incorporation |

||||

consolidated filing of |

which the U.S. reporting corporation |

|

attached to Form 5472 |

|

||||

Form 5472 . . ▶ |

is filing a Form 5472 |

. . . . ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

1m Date of incorporation |

1n Country(ies) under whose laws the reporting |

|

1o Principal country(ies) where business is conducted |

|||||

|

corporation files an income tax return as a resident |

|

|

|

||||

|

|

|

|

|

|

|

|

|

2Check here if, at any time during the tax year, any foreign person owned, directly or indirectly, at least 50% of (a) the total voting power of all

classes of the stock of the reporting corporation entitled to vote, or (b) the total value of all classes of stock of the reporting corporation ▶

3Check here if the reporting corporation is a

purposes of section 6038A. See instructions |

. . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

Part II 25% Foreign Shareholder (see instructions)

Check here if any direct (or ultimate indirect) 25% foreign shareholder listed in Part II is a surrogate foreign corporation under section 7874(a)(2)(B). ▶

4a Name and address of direct 25% foreign shareholder

4b(1) U.S. identifying number, if any |

4b(2) Reference ID number (see instructions) |

4b(3) Foreign taxpayer identification number (FTIN), if any |

||||

|

|

|

|

|

(see instructions) |

|

|

|

|

|

|

|

|

4c |

Principal country(ies) where |

4d Country of citizenship, |

4e |

Country(ies) under whose laws the direct 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|

|

|

5a |

Name and address of direct 25% foreign shareholder |

|

|

|

|

|

|

|

|

|

|

||

5b(1) U.S. identifying number, if any |

5b(2) Reference ID number (see instructions) |

|

5b(3) FTIN, if any (see instructions) |

|

||

|

|

|

|

|

|

|

5c |

Principal country(ies) where |

5d Country of citizenship, |

5e |

Country(ies) under whose laws the direct 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|

|

|

6a |

Name and address of ultimate indirect 25% foreign shareholder |

|

|

|

|

|

|

|

|

|

|

||

6b(1) U.S. identifying number, if any |

6b(2) Reference ID number (see instructions) |

|

6b(3) FTIN, if any (see instructions) |

|

||

|

|

|

|

|

|

|

6c |

Principal country(ies) where |

6d Country of citizenship, |

6e |

Country(ies) under whose laws the ultimate indirect 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|

|

|

7a |

Name and address of ultimate indirect 25% foreign shareholder |

|

|

|

|

|

|

|

|

|

|

||

7b(1) U.S. identifying number, if any |

7b(2) Reference ID number (see instructions) |

|

7b(3) FTIN, if any (see instructions) |

|

||

|

|

|

|

|

|

|

7c |

Principal country(ies) where |

7d Country of citizenship, |

7e |

Country(ies) under whose laws the ultimate indirect 25% foreign |

||

|

business is conducted |

organization, or incorporation |

|

shareholder files an income tax return as a resident |

||

|

|

|

|

|||

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 49987Y |

Form 5472 (Rev. |

||||

Form 5472 (Rev. |

Page 2 |

Part III Related Party (see instructions). All reporting corporations must complete this question and the rest of Part III. Check applicable box: Is the related party a

foreign person or

foreign person or

U.S. person?

U.S. person?

8a Name and address of related party

8b(1) U.S. identifying number, if any |

8b(2) |

Reference ID number (see instructions) |

|

8b(3) FTIN, if any (see instructions) |

|

|||

|

|

|

|

|

|

|

|

|

8c |

Principal business activity ▶ |

|

|

|

|

|

8d Principal business activity code ▶ |

|

|

|

|

|

|

|

|||

8e |

Related to reporting corporation |

Related to 25% foreign shareholder |

25% foreign shareholder |

|||||

|

|

|

||||||

8f |

Principal country(ies) where business is conducted |

8g Country(ies) under whose laws the related party files an income tax return as a |

||||||

|

|

|

|

resident |

|

|

|

|

Part IV |

Monetary Transactions Between Reporting Corporations and Foreign Related Party (see instructions) |

|||||

|

|

Caution: Part IV must be completed if the “foreign person” box is checked in the heading for Part III. |

||||

|

|

If estimates are used, check here. ▶ |

|

|

|

|

|

|

|

|

|

||

9 |

Sales of stock in trade (inventory) |

9 |

|

|||

10 |

Sales of tangible property other than stock in trade |

10 |

|

|||

11 |

Platform contribution transaction payments received |

11 |

|

|||

12 |

Cost sharing transaction payments received |

12 |

|

|||

13a |

Rents received (for other than intangible property rights) |

13a |

|

|||

b |

Royalties received (for other than intangible property rights) |

13b |

|

|||

14 |

Sales, leases, licenses, etc., of intangible property rights (for example, patents, trademarks, secret formulas) . . |

14 |

|

|||

15 |

Consideration received for technical, managerial, engineering, construction, scientific, or like services . . . . |

15 |

|

|||

16 |

Commissions received |

16 |

|

|||

17 |

Amounts borrowed (see instructions) a Beginning balance |

|

b Ending balance or monthly average ▶ |

17b |

|

|

18 |

Interest received |

18 |

|

|||

19 |

Premiums received for insurance or reinsurance |

19 |

|

|||

20 |

Loan guarantee fees received |

20 |

|

|||

21 |

Other amounts received (see instructions) |

21 |

|

|||

22 |

Total. Combine amounts on lines 9 through 21 |

22 |

|

|||

23 |

Purchases of stock in trade (inventory) |

23 |

|

|||

24 |

Purchases of tangible property other than stock in trade |

24 |

|

|||

25 |

Platform contribution transaction payments paid |

25 |

|

|||

26 |

Cost sharing transaction payments paid |

26 |

|

|||

27a |

Rents paid (for other than intangible property rights) |

27a |

|

|||

b |

Royalties paid (for other than intangible property rights) |

27b |

|

|||

28 |

Purchases, leases, licenses, etc., of intangible property rights (for example, patents, trademarks, secret formulas) |

28 |

|

|||

29 |

Consideration paid for technical, managerial, engineering, construction, scientific, or like services |

29 |

|

|||

30 |

Commissions paid |

30 |

|

|||

31 |

Amounts loaned (see instructions) a Beginning balance |

|

b Ending balance or monthly average ▶ |

31b |

|

|

32 |

Interest paid |

32 |

|

|||

33 |

Premiums paid for insurance or reinsurance |

33 |

|

|||

34 |

Loan guarantee fees paid |

34 |

|

|||

35 |

Other amounts paid (see instructions) |

35 |

|

|||

36 |

Total. Combine amounts on lines 23 through 35 |

36 |

|

|||

Part V |

Reportable Transactions of a Reporting Corporation That Is a |

DE |

(see instructions) |

|||

|

|

Describe on an attached separate sheet any other transaction as defined by Regulations section |

||||

|

|

such as amounts paid or received in connection with the formation, dissolution, acquisition, and disposition |

||||

|

|

of the entity, including contributions to and distributions from the entity, and check here. ▶ |

||||

|

|

|||||

Part VI |

Nonmonetary and |

|||||

and the Foreign Related Party (see instructions)

Describe these transactions on an attached separate sheet and check here. ▶

Form 5472 (Rev.

Form 5472 (Rev. |

Page 3 |

|

Part VII |

Additional Information. All reporting corporations must complete Part VII. |

|

37 |

Does the reporting corporation import goods from a foreign related party? |

38a |

If “Yes,” is the basis or inventory cost of the goods valued at greater than the customs value of the imported goods? . |

bIf “Yes,” attach a statement explaining the reason or reasons for such difference.

Yes Yes

No No

cIf the answers to questions 37 and 38a are “Yes,” were the documents used to support this treatment of the imported

goods in existence and available in the United States at the time of filing Form 5472? . . . . . . . . . . .

39During the tax year, was the foreign parent corporation a participant in any cost sharing arrangement (CSA)? . . . .

40a |

During the tax year, did the reporting corporation pay or accrue any interest or royalty for which the deduction is not |

|

allowed under section 267A? See instructions |

b |

If “Yes,” enter the total amount of the disallowed deductions . . . . . . . . . . . . . . . . . $ |

41a |

Does the reporting corporation claim a |

|

to amounts listed in Part IV? |

bIf “Yes,” enter the amount of gross income derived from sales, leases, exchanges, or other dispositions (but not licenses) of property to the foreign related party that the reporting corporation included in its computation of

deduction eligible income (FDDEI). See instructions . . . . . . . . . . . . . . . . . . . . $

cIf “Yes,” enter the amount of gross income derived from a license of property to the foreign related party that the reporting

corporation included in its computation of FDDEI. See instructions . . . . . . . . . . . . . . . . $

dIf “Yes,” enter the amount of gross income derived from services provided to the foreign related party that the reporting

corporation included in its computation of FDDEI. See instructions . . . . . . . . . . . . . . . $

42Did the reporting corporation have any loan to or from the related party, to which the

43a Did the reporting corporation make at least one distribution or acquisition (as defined by Regulations section

bIf the answer to question 43a is “Yes,” provide the following.

(1) |

The amount of such distribution(s) and acquisition(s) |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

$ |

(2) |

The amount of such related party indebtedness . . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

$ |

Yes |

No |

Yes |

No |

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

Yes |

No |

Yes |

No |

Part VIII |

Cost Sharing Arrangement (CSA) |

Note: Complete a separate Part VIII for each CSA in which the reporting corporation was a participant during the tax year. Report all amounts in U.S. dollars. (See instructions.)

44Provide a brief description of the CSA with respect to which this Part VIII is being completed.

45During the course of the tax year, did the reporting corporation become a participant in the CSA? . . . . . . .

46 Was the CSA in effect before January 5, 2009? . . . . . . . . . . . . . . . . . . . . . .

47What was the reporting corporation’s share of reasonably anticipated benefits for the CSA? . . . . . . . . .

48a Enter the total amount of

bEnter the total amount of deductions for the tax year for

and, at date of grant, is directly identified with, or reasonably allocable to, the intangible development activity under the CSA $

cWas there any

49a Enter the total amount of intangible development costs for the CSA . . . . . . . . . . . . . . . $

Yes |

No |

Yes |

No |

%

Yes |

No |

bEnter the amount of intangible development costs allocable to the reporting corporation based on the reporting corporation’s

|

reasonably anticipated benefits share |

$ |

|

|

|

|

|

|

|||

Part IX |

Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A (see instructions) |

||||

50 |

Amounts defined as base erosion payments under section 59A(d) |

$ |

|

|

|

51 |

Amount of base erosion tax benefits under section 59A(c)(2) |

$ |

|

|

|

52 |

Amount of total qualified derivative payments as described in section 59A(h) made by the reporting corporation . . |

$ |

|

|

|

53 |

Reserved for future use |

|

|

|

|

|

|

|

|||

Form 5472 (Rev.

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 5472 is a requirement for certain U.S. corporations that engage in transactions with foreign or related parties. |

| 2 | This form serves the purpose of reporting transactions between a 25% foreign-owned U.S. corporation or a foreign corporation engaged in a U.S. trade or business with a related party. |

| 3 | Entities required to file Form 5472 must do so annually, attaching it to their income tax return. |

| 4 | Failing to file Form 5472 can result in significant penalties, with the IRS imposing a $25,000 penalty for each reporting period. |

| 5 | Information required on Form 5472 includes the reporting corporation's name, identifying number, and the details of each reportable transaction with a related party during the tax year. |

| 6 | Transactions reported on Form 5472 can range from sales and purchases of inventory to loans and rent payments between the reporting corporation and the related foreign party. |

| 7 | Form 5472 underwent significant changes in 2017, broadening the definition of a reportable transaction and increasing the categories of corporations that must file it. |

| 8 | While primarily a federal form, the filing of Form 5472 may have state-specific implications, although there are no governing laws that directly correlate state requirements with the federal Form 5472 filing requirements. |

Instructions on Utilizing IRS 5472

Fulfilling the requirements for the IRS 5472 form is a vital step for certain entities operating within the United States. This process necessitates precision, as it pertains to reporting transactions between a U.S. corporation or a foreign corporation engaged in a U.S. trade or business and a related party. Diligent completion of this form is not just about compliance; it’s also a safeguard against possible penalties. The following steps are designed to guide taxpayers through this essential process, ensuring clarity and accuracy.

- Begin by gathering all necessary information on the reporting corporation, including its name, employer identification number (EIN), and the reference ID number, if applicable.

- Identify the related party with whom the reporting corporation had the reportable transactions. Collect pertinent data such as the name of the foreign entity, its country under whose laws it is created or organized, and the nature of the foreign entity’s relationship to the reporting corporation.

- Accurately document the monetary value of each reportable transaction. This involves listing the type of transaction, such as sales, rents, royalties, or interest, and specifying the amount paid or received during the fiscal year.

- For each reportable transaction, determine the primary income-producing activity associated with it. This requires an analysis of the transactions to classify them correctly.

- Complete the relevant sections concerning the reporting corporation's balance sheet. This may involve translating foreign currency into U.S. dollars, applying the appropriate exchange rate as per IRS regulations.

- If there were any changes in the reporting corporation’s ownership percentage or if any part of the corporation's stock is not vested by the end of the tax year, report these details accurately.

- Review the form for completeness and accuracy. Ensure that all necessary schedules and attachments are included. This is crucial to providing a clear picture of the transactions and avoiding potential scrutiny or penalties from the IRS.

- Sign and date the form. If a paid preparer completes the form, ensure they also sign and provide their information in the designated section.

- Finally, submit the form to the IRS by the prescribed deadline, taking into account the specific instructions for mailing addresses or electronic submission, as applicable.

Filing the IRS 5472 is a meticulous process that underscores the importance of precise record-keeping and an understanding of the interplay between U.S. corporations and their foreign counterparts. By following these steps meticulously, entities can navigate through this procedural necessity, ensuring compliance and contributing to a transparent financial reporting environment. The attention to detail and accuracy in this process is not just about fulfilling a requirement but protecting the integrity of the entity's financial dealings.

Obtain Answers on IRS 5472

-

What is the IRS Form 5472, and who needs to file it?

IRS Form 5472 is a requirement for certain U.S. entities that engage in transactions with foreign owners or related parties. Specifically, this form must be filed by any U.S. Corporation or a foreign corporation engaged in U.S. trade or business that has a 25% foreign shareholder at any point during the tax year, or that enters into transactions with a related party. This serves as a way for the IRS to track transactions that might otherwise be used to shift income out of the United States, thereby reducing taxable income. It's an essential part of ensuring compliance with international tax obligations.

-

When is the deadline to file Form 5472?

The filing deadline for Form 5472 aligns with the tax return of the reporting corporation. For most corporations, this means the form must be filed by April 15, following the close of the fiscal year. However, if the corporation has a different fiscal year-end, the deadline would be the 15th day of the fourth month following the end of their fiscal year. Extensions for filing the corporation's tax return also extend the deadline for Form 5472.

-

What information is required on Form 5472?

To complete Form 5472, a variety of information is needed. This includes identification of the reporting corporation, details about the foreign or related party (such as name, address, and relationship to the reporting corporation), and comprehensive details of all reportable transactions during the tax year in question. Reportable transactions may include, but are not limited to, sales, rents, royalties, commissions, loans, and other forms of payment or transactions between the parties.

-

Are there any penalties for not filing or late filing of Form 5472?

Yes, the IRS imposes significant penalties for failure to file, late filing, or providing incomplete information on Form 5472. The penalty is $25,000 for each tax year for which the form was not filed, and an additional $25,000 if the failure continues more than 90 days after the IRS notifies the corporation. Given these steep penalties, timely and accurate filing is crucial.

-

How can one file Form 5472?

Form 5472 must be attached to the reporting corporation's income tax return and filed by the due date of the return, including any extensions. It is not filed separately but as part of the tax return package. Electronic filing is available and recommended for many taxpayers, as it can be more convenient and provides confirmation of receipt.

-

Can adjustments be made after filing Form 5472?

If a corporation discovers errors or omits information on a previously filed Form 5472, it should file an amended return as soon as possible, including a corrected Form 5472. This proactive approach can help minimize potential penalties and ensures compliance with the IRS regulations. It's advisable to seek professional tax advice to navigate this process effectively.

Common mistakes

Failing to properly report all relevant transactions between the reporting corporation and the foreign or related party. This can include, but is not limited to, loans, sales, and services. All monetary transactions need to be accurately reported to avoid penalties.

Incorrectly identifying the reporting entity. It's crucial to understand the entity's status as it dictates the reporting requirements. Misidentifying can lead to the submission of inaccurate or incomplete forms, possibly resulting in penalties.

Omitting necessary information about the foreign related party. Detailed information regarding the foreign related party involved in the transactions with the reporting entity must be provided. This includes names, addresses, and the nature of the relationship.

Not maintaining adequate records. The IRS requires entities that file Form 5472 to keep detailed records of the transactions reported. Lack of proper records can lead to issues if the IRS requests more detailed information or decides to audit.

Misunderstanding the filing deadline and penalty consequences. The form must be filed along with the income tax return of the reporting entity, adhering to the same deadline. Late filings can result in significant penalties, starting at $25,000 per form.

Common Mistakes Summary:

- Not reporting all relevant transactions

- Misidentifying the reporting entity

- Omitting foreign related party information

- Failing to maintain adequate records

- Misunderstanding filing deadlines and penalties

Documents used along the form

When a business or individual in the United States engages in transactions with a foreign entity, it often triggers the need to file IRS Form 5472. However, this is not the only document required to ensure compliance with U.S. tax laws. A variety of other forms and documents often accompany Form 5472, each serving a distinctive role in the reporting process. Understanding these accompanying documents can help streamline tax reporting, avoid penalties, and maintain a clear record of international business operations.

- Form 1120: Also known as the U.S. Corporation Income Tax Return, it is used by corporations to report their income, gains, losses, deductions, and credits to the IRS.

- Form 1065: This form is used by partnerships for tax filing. It helps to report the income, deductions, gains, losses, etc., of a partnership.

- Form 8865: Required for U.S. persons who are partners in certain foreign partnerships, this form reports the income and financial position of the partnership.

- Form 8938: Statement of Specified Foreign Financial Assets, it is used to report certain foreign financial assets if the total value exceeds the applicable reporting threshold.

- Form W-8BEN: It is used by foreign individuals to certify their non-U.S. status and claim any applicable treaty benefits.

- Form SS-4: Application for Employer Identification Number (EIN), necessary for any entity required to file Form 5472, as an EIN is needed for identification purposes.

- Form 1040: The U.S. Individual Income Tax Return, which might be relevant if the individual has personal financial ties to the foreign entity involved in the transactions.

- Form 8832: This form is used to classify a business entity's tax status. It might be necessary if the entity’s classification affects how transactions are reported.

- Form 8992: U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI), required for U.S. shareholders of certain foreign corporations.

- Form 3520: Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. This document is necessary for transactions that involve trusts or are considered gifts from foreign entities.

Together, IRS Form 5472 and these accompanying documents provide a comprehensive framework for reporting international transactions and foreign activities. Understanding the purpose of each form can significantly aid in navigating the complexities of tax reporting. Filing the correct documents timely is critical to avoiding penalties and maintaining good standing with the IRS. Always consult with a tax professional to ensure compliance with the current tax laws and reporting requirements.

Similar forms

IRS Form 1120: Like the IRS 5472, Form 1120 is used by corporations. It details the income, gains, losses, deductions, and credits of the corporation. Both forms are integral to a corporation's annual tax filings, but while Form 1120 focuses on the broader financial activities, the IRS 5472 zeroes in on transactions with foreign shareholders.

IRS Form 8865: This form reports the foreign partnerships of U.S. persons. Similar to the IRS 5472, which tracks transactions with foreign entities, Form 8865 provides the IRS with information on the foreign partnership's income, deductions, and financial operations. Both forms help in disclosing international financial activities to the IRS.

IRS Form 8938: Form 8938 is required for reporting specified foreign financial assets if the total value exceeds the applicable reporting threshold. Like IRS 5472, it is designed to report foreign financial activities but from the perspective of individual taxpayers or entities, focusing on asset ownership rather than transactions.

FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR): Though administered by the Financial Crimes Enforcement Network (FinCEN), not the IRS, the FBAR is similar to Form 5472 in its aim to combat tax evasion. Both require disclosure of foreign financial accounts and transactions, but FBAR specifically targets individual and entity accounts held at foreign financial institutions.

IRS Form 1042: This form relates to the withholding of tax on non-resident aliens and foreign entities. Similar to the IRS 5472, Form 1042 focuses on international transactions, specifically those that require withholding tax from payments made to foreign persons, engaging the filer in the global tax reporting system.

IRS Form 926: Filed by U.S. transferors of property to foreign corporations, Form 926 shares its international reporting character with Form 5472. Both forms are part of the measures to ensure transparency in cross-border transactions and prevent tax evasion by tracking transfers and transactions of assets abroad.

IRS Form 3520: Similar to the IRS 5472 in its international focus, Form 3520 is required for reporting transactions with foreign trusts and receipt of certain foreign gifts. Both forms play a crucial role in disclosing international financial ties and activities to prevent tax avoidance and evasion.

IRS Form 8300: This form reports cash payments over $10,000 received in a trade or business. Although IRS 5472 focuses on international transactions with related parties, both Form 8300 and IRS 5472 serve to inform the IRS of potentially taxable activities, ensuring the proper reporting of substantial transactions.

Dos and Don'ts

Filing IRS Form 5472 is an essential task for certain corporations with foreign shareholders or foreign corporations engaged in U.S. businesses. To ensure accuracy and compliance, here are critical do's and don'ts to consider:

Do:Provide complete information on all foreign shareholders, including their names, addresses, and countries of citizenship.

Report each related party transaction accurately, ensuring the amounts match your financial records.

Use the exchange rate in effect on the date of each transaction when converting foreign currency transactions to U.S. dollars.

Attach Form 5472 to the reporting corporation’s income tax return and file by the due date, including extensions.

Keep copies of the form and all related documentation for at least seven years, as required by law.

Forget to file Form 5472 if you engage in transactions with a related party that’s a foreign person or entity; failure to file can lead to significant penalties.

Omit any required information. Incomplete forms can lead to processing delays or penalties.

Underestimate the importance of filing on time. Late filings can result in penalties, which increase over time.

Attempt to file Form 5472 separately from the tax return of the reporting corporation; it should always be filed together.

Misconceptions

Understanding the IRS Form 5472 is essential for entities and individuals involved in international transactions with U.S. businesses. However, several misconceptions cloud its purpose and requirements. Here, we aim to clarify these misunderstandings and provide accurate information about Form 5472.

Only large companies need to file Form 5472. This is a common misconception. In reality, any U.S. entity that is 25% foreign-owned and engaged in a reportable transaction with a related party needs to file Form 5472, regardless of its size.

Form 5472 is only concerned with monetary transactions. While monetary transactions are a focus, Form 5472 also requires information on non-monetary or part-monetary transactions, such as contributions to capital and distributions.

Personal transactions do not need to be reported on Form 5472. Actually, if a foreign individual has a reportable transaction with a U.S. business entity they own, it must be reported on Form 5472, even if the transaction is personal in nature.

Filing Form 5472 is a once-off requirement. This is incorrect. Form 5472 must be filed annually by the due date of the income tax return, including extensions, for every taxable year in which the reporting corporation has reportable transactions.

All foreign owners must be reported on Form 5472. Form 5472 requires the reporting of transactions with related parties, which may include foreign owners, but the form is not a comprehensive list of all foreign owners.

Only direct transactions with foreign related parties must be reported. Indirect transactions, such as those conducted through intermediaries, may also need to be reported on Form 5472 if they meet the substantive requirements of a reportable transaction.

If a U.S. entity is owned by a foreign individual, it automatically needs to file Form 5472. While ownership by a foreign individual can trigger the need to file, the requirement actually hinges on whether there were any reportable transactions during the tax year.

Failing to file Form 5472 isn’t a big deal. The Internal Revenue Service takes non-compliance seriously. Failure to file can result in substantial penalties, starting at $25,000 for each tax year in which the form was not filed or was incorrectly filed.

It's crucial for those involved in international business transactions with the U.S. to understand the requirements, exceptions, and significances of IRS Form 5472 to ensure compliance and avoid potential penalties.

Key takeaways

The IRS Form 5472 is a critical tax document used by certain U.S.-based companies that engage in transactions with foreign individuals or entities. Navigating this form can be complex, but understanding its key aspects can greatly simplify the process. Below are nine essential takeaways pertaining to filling out and using the IRS 5472 form:

- Form 5472 should be filed by any U.S. Corporation or foreign corporation engaged in U.S. business that has at least 25% foreign ownership and has reportable transactions with a foreign or related party.

- Deadline: The form must be filed alongside the company’s income tax return by the return’s due date, including extensions.

- Reportable transactions include, but are not limited to, sales, rents, royalties, commissions, and loans with the foreign related party.

- Each foreign or related party that a company conducts transactions with requires a separate Form 5472.

- Failure to file, incomplete filing, or late filing of Form 5472 can result in a penalty of $25,000 for each reporting period. Additional penalties may accrue if noncompliance continues beyond 90 days after notification by the IRS.

- Required information includes the identity of the foreign or related party, the nature and amount of transactions, and a detailed description of the business purpose for each transaction.

- If the IRS issues a request, a corporation must provide all the documentation necessary to establish the accuracy of the filed Form 5472, including books, work papers, and other records.

- A significant change in reporting requirements occurred with the Tax Cuts and Jobs Act of 2017, expanding the definition of who must file Form 5472, including certain foreign-owned single-member LLCs.

- For corporations filing Form 5472, it's crucial to maintain detailed records of all transactions with foreign related parties for at least three years after the original due date or the date the return was filed, whichever is later.

Filing the IRS Form 5472 accurately and on time is essential for compliance with U.S. tax law and to avoid substantial penalties. For entities involved in international transactions under the purview of this form, consulting with a tax professional is highly recommended to ensure proper adherence to all reporting requirements.

Popular PDF Forms

Are Irs Whistleblower Anonymous - The form assists the IRS in identifying offenders who use sophisticated means to evade taxes, making the tax system more robust.

Special Olympics Certificate Template - An official document championing the remarkable accomplishments in events inspired by the spirit of the Olympics.