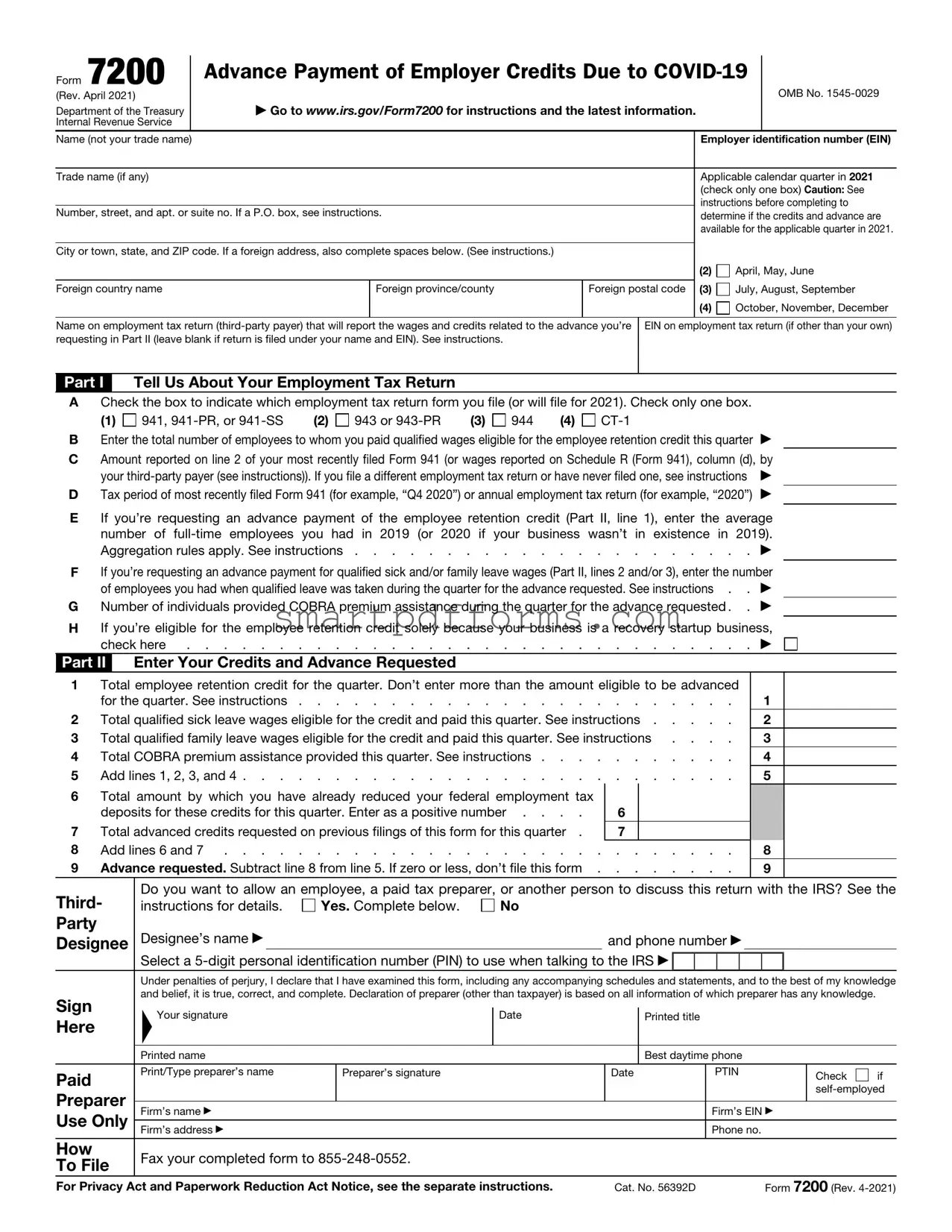

Blank IRS 7200 PDF Template

In managing employee tax credits, businesses face a myriad of complex processes, one of which involves the IRS 7200 form. This crucial document plays a pivotal role for employers looking to claim advance payments of employer credits. It serves as a bridge for businesses anticipating relief through credits such as the sick and family leave credits and the employee retention credit. The form allows for the advance payment of these credits before the end of the tax quarter, providing much-needed financial support to businesses in real-time. Navigating through the requisites of filling out the form, understanding the eligibility criteria, and knowing the precise timing for submission are essential steps in leveraging this financial tool effectively. Accurate completion and timely submission of the IRS 7200 form can significantly assist businesses in managing their cash flow and sustaining operations during challenging times. Through this lens, the IRS 7200 form emerges as a critical component in the financial planning toolkit for employers, enabling them to capitalize on available tax credits efficiently and expediently.

Preview - IRS 7200 Form

Form 7200

(Rev. April 2021)

Department of the Treasury

Internal Revenue Service

Advance Payment of Employer Credits Due to

▶Go to www.irs.gov/Form7200 for instructions and the latest information.

OMB No.

Name (not your trade name) |

Employer identification number (EIN) |

|

|

|

|

Trade name (if any) |

Applicable calendar quarter in 2021 |

|

|

(check only one box) Caution: See |

|

|

instructions before completing to |

|

Number, street, and apt. or suite no. If a P.O. box, see instructions. |

||

determine if the credits and advance are |

||

|

||

|

available for the applicable quarter in 2021. |

City or town, state, and ZIP code. If a foreign address, also complete spaces below. (See instructions.)

|

|

(2) |

April, May, June |

|

|

|

|

|

|

Foreign country name |

Foreign province/county |

Foreign postal code (3) |

July, August, September |

|

|

|

(4) |

October, November, December |

|

|

|

|

|

|

Name on employment tax return

Part I Tell Us About Your Employment Tax Return

ACheck the box to indicate which employment tax return form you file (or will file for 2021). Check only one box.

(1) |

941, |

(2) |

943 or |

(3) |

944 |

(4) |

BEnter the total number of employees to whom you paid qualified wages eligible for the employee retention credit this quarter ▶

CAmount reported on line 2 of your most recently filed Form 941 (or wages reported on Schedule R (Form 941), column (d), by

your

DTax period of most recently filed Form 941 (for example, “Q4 2020”) or annual employment tax return (for example, “2020”) ▶

EIf you’re requesting an advance payment of the employee retention credit (Part II, line 1), enter the average number of

Aggregation rules apply. See instructions . . . . . . . . . . . . . . . . . . . . . . ▶

FIf you’re requesting an advance payment for qualified sick and/or family leave wages (Part II, lines 2 and/or 3), enter the number

of employees you had when qualified leave was taken during the quarter for the advance requested. See instructions . . ▶

GNumber of individuals provided COBRA premium assistance during the quarter for the advance requested . . ▶

HIf you’re eligible for the employee retention credit solely because your business is a recovery startup business,

|

check here |

. . . . . |

|

. . . |

▶ |

|

|||||||||||||||

Part II |

|

Enter Your Credits and Advance Requested |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1 |

Total employee retention credit for the quarter. Don’t enter more than the amount eligible to be advanced |

|

|

|

|

|

|||||||||||||||

|

for the quarter. See instructions |

. . . . . |

|

. . |

|

|

1 |

|

|

|

|||||||||||

2 |

Total qualified sick leave wages eligible for the credit and paid this quarter. See instructions . . . |

. . |

|

|

2 |

|

|

|

|||||||||||||

3 |

Total qualified family leave wages eligible for the credit and paid this quarter. See instructions . . |

. . |

|

|

3 |

|

|

|

|||||||||||||

4 |

Total COBRA premium assistance provided this quarter. See instructions . . . . |

. . . . . |

|

. . |

|

|

4 |

|

|

|

|||||||||||

5 |

Add lines 1, 2, 3, and 4 |

. . . . . |

|

. . |

|

|

5 |

|

|

|

|||||||||||

6 |

Total amount by which you have already reduced your federal employment tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

deposits for these credits for this quarter. Enter as a positive number . . . . |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7 |

Total advanced credits requested on previous filings of this form for this quarter . |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

8 |

Add lines 6 and 7 |

. . . . . |

|

. . |

|

|

8 |

|

|

|

|||||||||||

9 |

Advance requested. Subtract line 8 from line 5. If zero or less, don’t file this form . |

. . . . . |

|

. . |

|

|

9 |

|

|

|

|||||||||||

Third- |

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the |

||||||||||||||||||||

instructions for details. |

Yes. Complete below. |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Party |

|

|

Designee’s name ▶ |

|

|

|

|

and phone number ▶ |

|

|

|

|

|

||||||||

Designee |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Select a |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Under penalties of perjury, I declare that I have examined this form, including any accompanying schedules and statements, and to the best of my knowledge |

||||||||||||||||||

Sign |

|

|

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

|||||||||||||||||

|

|

▲ |

|

|

Date |

|

Printed title |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Here |

|

|

Your signature |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Printed name |

|

|

|

|

|

Best daytime phone |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Paid |

|

|

Print/Type preparer’s name |

|

Preparer’s signature |

|

|

Date |

PTIN |

|

|

|

Check |

if |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Firm’s name ▶ |

|

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|||||||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Firm’s address ▶ |

|

|

|

|

|

|

|

|

Phone no. |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How |

|

|

Fax your completed form to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

To File |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 56392D |

|

|

|

|

|

Form 7200 (Rev. |

||||||||||||||

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 7200 | This form is used by employers to request an advance payment of tax credits for qualified sick and family leave wages and the employee retention credit. |

| Eligibility | Employers, including tax-exempt organizations, who are eligible for the credits under the Families First Coronavirus Response Act (FFCRA) or the Coronavirus Aid, Relief, and Economic Security (CARES) Act may file Form 7200. |

| Filing Deadline | The form can be filed before the end of the month following the quarter in which the qualified wages were paid. The IRS may adjust this deadline, so it's crucial to check for the most current information. |

| Governing Law | The FFCRA and CARES Act are the primary laws governing the use of Form 7200, establishing eligibility, use, and benefits of filing. |

Instructions on Utilizing IRS 7200

Completing the IRS 7200 form is a crucial step for employers seeking to advance claim credits for certain employee leaves. The process involves providing detailed information about your business and the credits you're claiming. Accuracy and attention to detail are key to ensuring the form is filled out correctly, which will facilitate smoother processing and potentially expedite any credits due. The steps outlined below offer a guide on how to fill out this form correctly and efficiently.

- Start by entering your Employer Identification Number (EIN) at the top of the form. This unique number is critical for identifying your business to the IRS.

- Next, fill in your legal name or the name of your business entity as recognized by the IRS, followed by your trade name if it's different from your legal name.

- Provide your address, including the street address, city, state, and ZIP code. Ensure this information is accurate to prevent any delays in correspondence from the IRS.

- Select the quarter for which you are filing the form by checking the appropriate box. This indicates the period for the claimed credit.

- Enter your contact information, including your telephone number and, if available, your fax number. This ensures the IRS can reach you with any questions or updates about your form.

- Detail the credits you are claiming. This section requires you to calculate the total credits for qualified sick leave wages, qualified family leave wages, and employee retention credits you are entitled to. Make sure your calculations are precise and based on current guidelines.

- If you are adjusting a previously filed Form 7200, indicate this by checking the appropriate box and providing the Adjusted Employer Identification Number (EIN), if applicable.

- Sign and date the form at the bottom. The signature certifies that the information provided is accurate to the best of your knowledge. It is crucial that an authorized individual, such as the business owner or a principal officer, signs the form.

After completing the IRS 7200 form, review it carefully to ensure all information is accurate and no required fields have been missed. Following submission, the IRS will process your form. Keep a copy for your records, and be prepared to provide additional information if contacted by the IRS. By following these detailed steps and ensuring all information is correct, you can smooth the path for your advance credit claims.

Obtain Answers on IRS 7200

-

What is the IRS 7200 form, and who needs to file it?

The IRS 7200 form, also known as the "Advance Payment of Employer Credits Due to COVID-19," is utilized by employers to request an advance payment of tax credits for qualified sick and family leave wages and the employee retention credit. Employers eligible to claim these credits, and who desire to receive an advance payment, should file this form. Typically, these involve businesses and tax-exempt entities that have been financially impacted by the COVID-19 pandemic and are compensating their employees for leave related to COVID-19.

-

How can one obtain the IRS 7200 form?

The IRS 7200 form is accessible through the Internal Revenue Service’s official website. Employers can download the form from the IRS site. They also have the option to order it by phone or pick it up from available local IRS offices. However, the fastest and most convenient method is downloading the form from the IRS website, which ensures they get the most current version of the form.

-

What periods does the IRS 7200 cover?

This form covers advance payments for employer credits throughout a specific tax year. It pertains to wages paid for COVID-19 related sick and family leave and for employee retention during specified periods that are impacted by the pandemic. Employers should file for each quarter in which they are eligible to claim advance payments. It's essential to check current IRS guidance for the specific periods eligible under the latest tax laws and provisions.

-

Is it mandatory to file Form 7200?

Filing Form 7200 is optional for eligible employers seeking advance payment of the credits. It's designed for employers who wish to receive the benefit of the credits before filing their employment tax returns. If an employer does not need the advance payment, they can claim the credits on their employment tax returns without submitting Form 7200.

-

Can Form 7200 be filed electronically?

As of the most current information, Form 7200 cannot be filed electronically; it must be faxed to the number provided by the IRS for this specific purpose. The IRS updates its procedures periodically, so it is advisable to check the latest guidance on the IRS website or consult with a tax professional to confirm the current filing methods.

-

What information is needed to complete Form 7200?

To fill out Form 7200 accurately, employers must have several pieces of information on hand. This includes their EIN (Employer Identification Number), the total amount of qualified sick and family leave wages, and the employee retention credit for which they are claiming advances. Additionally, they must calculate the amount of advances received for these credits in the current quarter and for the year, alongside other identification details and relevant tax information.

-

How often can Form 7200 be filed?

Employers can file Form 7200 multiple times throughout a qualifying quarter. However, it's critical to not exceed the total amount of the eligible credits. Employers must accurately track the amounts requested and received to avoid requesting more than what is available to them in tax credits.

-

What happens after filing Form 7200?

After filing Form 7200, the IRS will process the request. If approved, the advance payment of the credits will be sent to the employer. It's crucial for employers to keep a record of the filed form and the received payment. Employers must reconcile the advance payment with the total credits claimed on their employment tax returns, ensuring the claimed amounts on the returns are decreased by the amount of any advance payments received.

-

Are there penalties for incorrect filing of Form 7200?

Yes, inaccuracies in filing Form 7200 can result in penalties or the need to repay advance payments. If errors are found, the IRS may request additional information or adjust the amount of advance payments. Employers should exercise due diligence to ensure the accuracy of the information provided on the form to avoid penalties and the necessity to repay amounts improperly claimed.

Common mistakes

Filling out the IRS 7200 form requires attention to detail and a clear understanding of its requirements. Some common mistakes can lead to delays in processing or even the rejection of the form. Here are six errors to watch out for:

-

Not double-checking the identification numbers: Employers often mistakenly enter incorrect Employer Identification Numbers (EINs) or Social Security Numbers (SSNs). This error can cause significant delays in the processing of the form.

-

Incomplete form: Sometimes, sections of the form are left blank because they're deemed not applicable. However, every required field must be completed; if something doesn't apply, it’s crucial to indicate this appropriately rather than leaving it blank.

-

Miscalculating credits: The IRS 7200 form is used to request an advance payment of employer credits. Errors in calculation can result in requesting too much or too little, affecting the financial outcomes for a business.

-

Using the wrong form version: The IRS periodically updates forms. Using an outdated version can lead to a rejection. Always check the IRS website for the most current version of the form.

-

Illegible handwriting: If the form is not filled out online and instead is handwritten, poor legibility can be a significant hurdle. It’s best to fill out the form digitally or ensure handwriting is clear and legible.

-

Forgetting to sign and date: An unsigned or undated form is considered incomplete. The IRS cannot process a form without the taxpayer's signature and the date it was signed.

Avoiding these mistakes can streamline the process, ensuring that the request for advance payment of employer credits is processed efficiently and without unnecessary delays.

Documents used along the form

When businesses engage in navigating the complexities of tax credits and advances related to employee retention and sick leave, the IRS Form 7200 plays a crucial role. This form allows employers to request an advance payment of tax credits due to them because of the COVID-19 pandemic. However, understanding and filling out the Form 7200 often requires gathering and completing additional documents and forms. Below is a list of other forms and documents frequently used alongside IRS Form 7200, each playing a vital role in ensuring compliance and maximizing potential tax benefits.

- IRS Form 941: Employers use this quarterly tax return to report income taxes, as well as Social Security and Medicare taxes withheld from employee's paychecks. It's also used to pay the employer's portion of Social Security or Medicare tax.

- IRS Form 943: This is specifically for agricultural employers. It reports federal income tax withheld from employees and the employer and employee's share of Social Security and Medicare taxes.

- IRS Form 944: Designed for smaller employers, this form allows them to file and pay these taxes annually instead of quarterly.

- IRS Form 940: This form is used to report and pay the federal unemployment tax (FUTA), which provides funds for paying unemployment compensation to workers who have lost their jobs.

- IRS Form W-2: The Wage and Tax Statement form is issued by employers to report annual wages and the amount of taxes withheld from their employees' paychecks.

- IRS Form W-3: This transmittal form is used to send W-2 forms to the Social Security Administration.

- IRS Form W-4: Employees provide this form to their employer to determine the amount of federal income tax to withhold from their pay.

- IRS Form 1094-C: Applicable large employers (ALEs) use this form to report health insurance coverage offered to full-time employees under the Affordable Care Act.

- IRS Form 1095-C: This form, tied to the 1094-C, is provided to employees to report the insurance coverage offered to them and their dependents, including whether or not they participated in the coverage.

Fulfilling tax obligations and taking advantage of available tax credits require detailed attention to these and other relevant documents. Each form contains unique information that contributes to a comprehensive understanding of an employer's fiscal responsibilities. While the process may seem daunting, proper organization and consultation with a tax professional can streamline the preparation, ensuring compliance and optimizing financial outcomes.

Similar forms

IRS Form 941: This form, used by employers to report quarterly tax returns, is similar to IRS 7200 as both deal with employer tax obligations. While Form 941 is a quarterly report, Form 7200 allows for the advance payment of employer credits.

IRS Form 944: Designed for small employers to file annual tax returns, Form 944 shares a purpose with Form 7200 in managing employer tax responsibilities. The distinction lies in the frequency of filing, with Form 7200 focusing on advance payments.

IRS Form 940: This form is utilized for reporting annual Federal Unemployment Tax Act (FUTA) tax. Similar to Form 7200, it addresses employer's tax liabilities, albeit specifically for unemployment contributions.

IRS Form W-2: Form W-2 is used by employers to report wages, tips, and other compensation paid to employees. Its connection to Form 7200 lies in the employer's role in reporting and possibly advancing certain employee-based credits.

IRS Form W-4: Employees use Form W-4 to indicate their tax withholding preferences. While distinct in its use, it correlates with Form 7200's focus on employer tax activities, particularly in managing how much tax to advance or withhold based on anticipated credits.

IRS Form 1099: Used to report various types of income other than wages, this form has a link to Form 7200 through the broader theme of tax reporting. Both forms are integral in the accurate reporting and payment of taxes, though 1099 caters to non-employee compensation.

IRS Form 945: Form 945 is for reporting federal income tax withheld from nonpayroll payments, including gambling winnings and retirement accounts. Its similarity to Form 7200 is in the focus on withholding and pre-paying taxes, though 945 does not deal with employment taxes.

IRS Form 1040: The primary individual income tax return form, Form 1040, is connected to Form 7200 as both are instrumental in the tax process. While Form 1040 pertains to individual taxpayers, Form 7200 allows employers to claim advances on certain credits that may affect the deductions and calculations on an individual’s Form 1040.

Dos and Don'ts

Completing the IRS Form 7200 can be an integral step for many businesses seeking to receive advance payments of employer credits. It's important to approach this task with a clear understanding and attention to detail. Below are essential do's and don'ts to keep in mind when filling out this form:

Do:- Verify your eligibility for the credit before you start the form. Certain qualifications and conditions must be met to be eligible for advance payment credits, such as those related to employee retention and health premiums.

- Use accurate and up-to-date information for your business and employees. Double-check Employee Identification Numbers (EINs), contact information, and credit amounts to ensure correctness.

- Clearly specify the quarter for which you are claiming the advance. Miscommunication here could delay processing or affect the amount of your credit.

- Consult the instructions provided by the IRS for Form 7200. These instructions contain vital details on how to properly complete and submit your form, helping to avoid common mistakes.

- Keep a copy of the completed Form 7200 for your records. This is crucial for future reference, especially if you need to reconcile advance payments with the credits claimed on your employment tax returns.

- Consider seeking guidance from a tax professional if you're uncertain about any aspect of the form. Their expertise can provide clarity and mitigate errors.

- Submit the form in a timely manner. Adhering to submission deadlines is critical to receiving your advance payment without unnecessary delay.

- Attempt to claim credits for which you're not eligible. Doing so could result in delays, audits, or penalties.

- Overlook the need to reconcile advance credits received with the credits claimed on your employment tax return. Accurate reconciliation is mandatory to ensure compliance with IRS regulations.

- Fill in the form by hand if you can avoid it; typed forms are easier to read and less likely to be misinterpreted by the IRS.

- Forget to sign and date the form. An unsigned form is considered incomplete and will be rejected by the IRS.

- Ignore IRS notices regarding corrections or additional information requests. Prompt attention to these communications is essential for processing your advance payment request.

- Assume the process is complete once you submit Form 7200. Monitor the status and be prepared to provide additional information if requested by the IRS.

- Risk making errors by rushing through the form. Take your time to review all entries for accuracy and completeness.

Misconceptions

Filing taxes can seem overwhelming, especially when dealing with the intricacies of IRS forms. A common example of confusion lies with the Form 7200, which is filled with misconceptions. Here, we aim to clear up some of those misunderstandings.

Only large businesses need to file Form 7200: This is incorrect. Both small and large employers can use Form 7200 to request an advance payment of employer credits due to COVID-19. The size of the business doesn't exempt it from utilizing this form if it meets other qualifying criteria.

Form 7200 is used for employee withholding taxes: Actually, Form 7200 is not used for withholding taxes from employees. It's specifically designed for employers to claim an advance payment of employer credits, such as those for sick leave and family leave related to COVID-19.

You can file Form 7200 anytime during the year: There's a common belief that you can file this form at any point in the year. However, there are specific deadlines for filing Form 7200, which are tied to the quarter in which you are claiming the advance. Missing these deadlines can result in the denial of the advance payment.

The IRS automatically processes all Form 7200 submissions: While the IRS does process submissions of Form 7200, there's a review process involved. The IRS evaluates each submission to ensure eligibility before advancing any payments. Automated processing does not mean automatic approval.

If you file Form 7200, you don't need to report the credits on your employment tax return: This is a major misconception. Employers must still report the total credits they are entitled to on their employment tax returns, even if they received an advance payment using Form 7200. The advance simply helps with cash flow until the credits are claimed on the tax return.

Filing Form 7200 can delay your tax return: Some think that filing this form will slow down their overall tax return processing. However, Form 7200 is processed separately from your tax return, so it doesn't delay your tax filings. The purpose of the form is to provide financial relief ahead of filing your tax return.

There's no deadline to correct errors on Form 7200: If you make a mistake on Form 7200, it's essential to correct it promptly. There are specific time frames within which you need to correct any errors to ensure your advance payment is not affected. Leaving errors uncorrected can lead to complications with your employment tax return.

Understanding the details of Form 7200 can significantly impact an employer's ability to navigate tax obligations effectively, especially those related to COVID-19 tax credits. Clarifying these misconceptions helps employers take full advantage of available benefits while ensuring compliance with IRS rules.

Key takeaways

Business owners grappling with pandemic-related challenges have a critical ally in IRS Form 7200. This form is pivotal for claiming advance payment of employer credits due to COVID-19. Understanding its nuances can smooth the path for financial relief. Here are five key takeaways about filling out and using the IRS Form 7200:

Purpose: IRS Form 7200 allows employers to request an advance payment of tax credits for qualified sick and family leave wages and the employee retention credit. This form is instrumental for businesses looking to manage cash flow while supporting their workforce during challenging times.

Eligibility: Before reaching out for Form 7200, ensure your business qualifies for the credits. This eligibility extends to those providing qualified sick and family leave under the Families First Coronavirus Response Act and those eligible for employee retention credits under the CARES Act. Keeping abreast of the changing eligibility criteria, given the evolving nature of pandemic-related legislation, is crucial.

Timing: Timing is everything. Employers should submit Form 7200 for an advance payment after determining they are eligible and calculating the size of the credit, but before they file the applicable employment tax returns. Strategic timing can optimize cash flow and ensure timely financial support.

Accuracy Counts: The IRS emphasizes accuracy in completing Form 7200 to avoid processing delays. This includes double-checking the employer identification number (EIN), the credit amounts being claimed, and the quarter in which the credits are claimed. Mistakes can lead to delays or denial of the advance payment.

Reconciliation and Documentation: Employers must reconcile advance credit payments with the credits claimed on their employment tax returns. This reconciliation is vital to comply with IRS requirements and to ensure proper accounting practices. Employers should also maintain thorough documentation of wages paid under the qualified leave and retention programs, as this information may be required by the IRS for verification purposes.

Popular PDF Forms

Madison County Al Probate Records - By capturing key transaction details, the form plays a crucial role in property sale transparency and legality.

Nvar Forms - It addresses pet ownership requirements and restrictions, mandating prior landlord approval and adherence to specific rules and regulations.

Imm1444e - Documentation such as passports, court judgments, and police certificates must be attached as required.