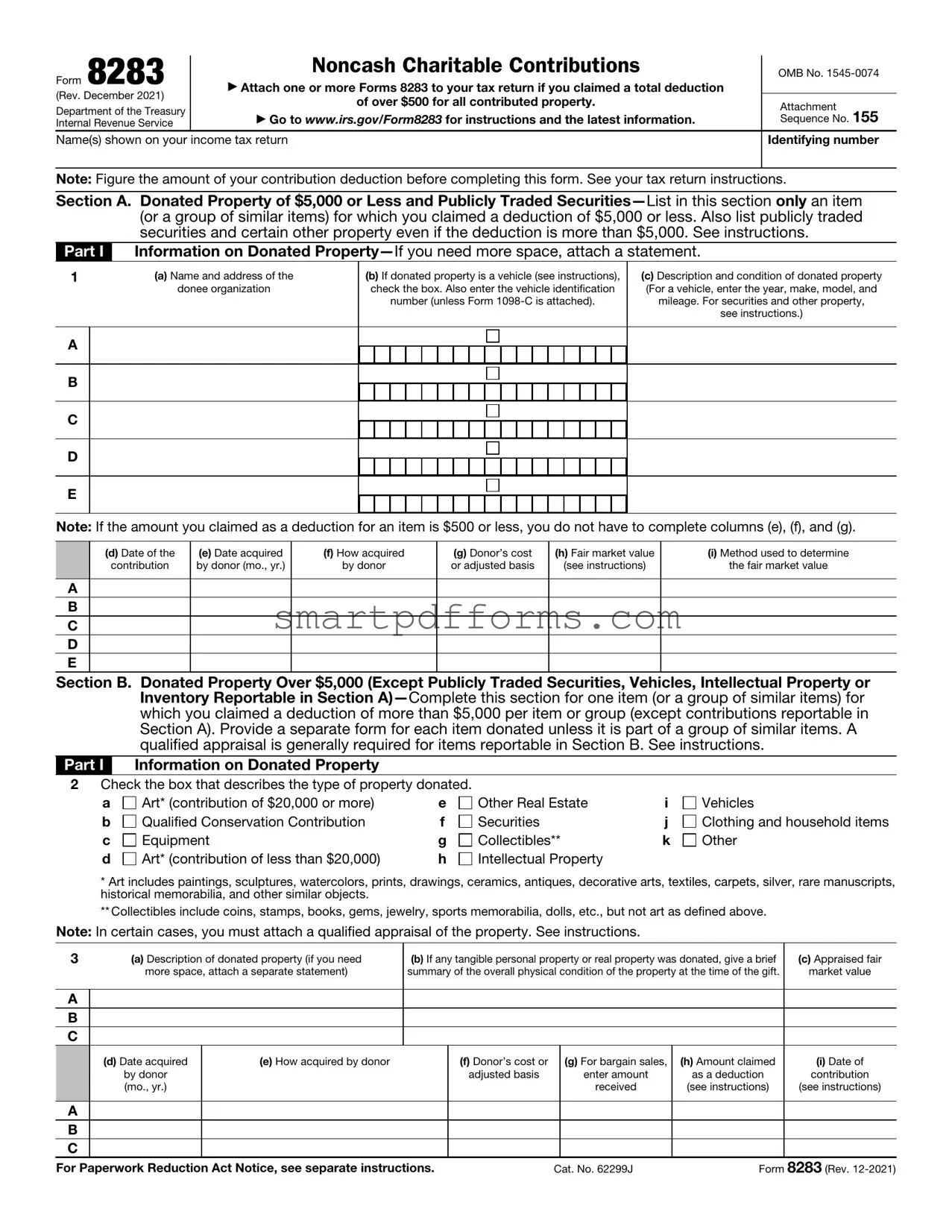

Blank IRS 8283 PDF Template

When individuals or businesses decide to contribute a piece of property or an equivalent non-cash asset to a qualified charitable organization, navigating the complexities of how such donations impact tax filings becomes paramount. Central to this process is a document known as the IRS 8283 form, an essential tool for donors to detail the information about non-cash contributions exceeding $500 in value. This form serves not only as a record of the donation but also as a validation tool for the Internal Revenue Service (IRS) to ensure transparency and honesty in charitable giving. It encompasses various sections intended to capture the full spectrum of donated assets, ranging from art and vehicles to stocks and real estate, requiring an appraisal for higher-value donations. Proper completion and filing of this document are crucial for donors aiming to secure applicable tax deductions, thereby marrying philanthropic efforts with financial prudence. The IRS 8283 form symbolizes a bridge between the generous acts of donation and the meticulous world of tax preparation, ensuring that individuals and organizations can contribute to worthy causes while remaining compliant with federal regulations.

Preview - IRS 8283 Form

Form 8283 |

|

Noncash Charitable Contributions |

|

OMB No. |

|

|

|||

|

▶ Attach one or more Forms 8283 to your tax return if you claimed a total deduction |

|

|

|

(Rev. December 2021) |

|

of over $500 for all contributed property. |

|

Attachment |

Department of the Treasury |

|

|

||

|

|

|

||

|

▶ Go to www.irs.gov/Form8283 for instructions and the latest information. |

|

Sequence No. 155 |

|

Internal Revenue Service |

|

|

||

Name(s) shown on your income tax return |

|

Identifying number |

||

|

|

|

|

|

Note: Figure the amount of your contribution deduction before completing this form. See your tax return instructions.

Section A. Donated Property of $5,000 or Less and Publicly Traded

Part I |

Information on Donated |

|||||||||||||||||||

1 |

|

(a) Name and address of the |

(b) If donated property is a vehicle (see instructions), |

(c) Description and condition of donated property |

||||||||||||||||

|

|

donee organization |

check the box. Also enter the vehicle identification |

(For a vehicle, enter the year, make, model, and |

||||||||||||||||

|

|

|

|

|

number (unless Form |

mileage. For securities and other property, |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

see instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If the amount you claimed as a deduction for an item is $500 or less, you do not have to complete columns (e), (f), and (g).

|

(d) Date of the |

(e) Date acquired |

(f) How acquired |

(g) Donor’s cost |

(h) Fair market value |

(i) Method used to determine |

|

contribution |

by donor (mo., yr.) |

by donor |

or adjusted basis |

(see instructions) |

the fair market value |

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

D |

|

|

|

|

|

|

E |

|

|

|

|

|

|

Section B. Donated Property Over $5,000 (Except Publicly Traded Securities, Vehicles, Intellectual Property or Inventory Reportable in Section

Part I Information on Donated Property

2Check the box that describes the type of property donated.

a |

Art* (contribution of $20,000 or more) |

e |

Other Real Estate |

i |

Vehicles |

b |

Qualified Conservation Contribution |

f |

Securities |

j |

Clothing and household items |

c |

Equipment |

g |

Collectibles** |

k |

Other |

d |

Art* (contribution of less than $20,000) |

h |

Intellectual Property |

|

|

*Art includes paintings, sculptures, watercolors, prints, drawings, ceramics, antiques, decorative arts, textiles, carpets, silver, rare manuscripts, historical memorabilia, and other similar objects.

**Collectibles include coins, stamps, books, gems, jewelry, sports memorabilia, dolls, etc., but not art as defined above.

Note: In certain cases, you must attach a qualified appraisal of the property. See instructions.

3 |

(a) Description of donated property (if you need |

(b) If any tangible personal property or real property was donated, give a brief |

(c) Appraised fair |

|||||

|

more space, attach a separate statement) |

summary of the overall physical condition of the property at the time of the gift. |

market value |

|||||

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

(d) Date acquired |

(e) How acquired by donor |

|

(f) Donor’s cost or |

|

(g) For bargain sales, |

(h) Amount claimed |

(i) Date of |

|

by donor |

|

|

adjusted basis |

|

enter amount |

as a deduction |

contribution |

|

(mo., yr.) |

|

|

|

|

received |

(see instructions) |

(see instructions) |

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 62299J |

Form |

8283 (Rev. |

|||||

Form 8283 (Rev. |

Page 2 |

Name(s) shown on your income tax return |

Identifying number |

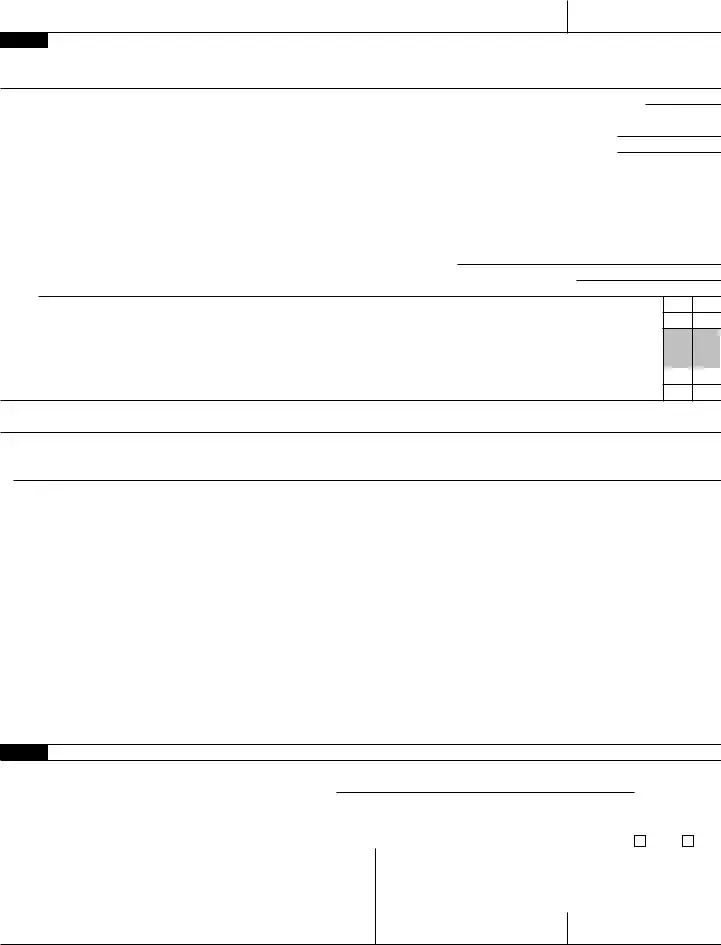

Part II Partial Interests and Restricted Use Property (Other Than Qualified Conservation Contributions)— Complete lines 4a through 4e if you gave less than an entire interest in a property listed in Section B, Part I. Complete lines 5a through 5c if conditions were placed on a contribution listed in Section B, Part I; also attach the required statement. See instructions.

4a Enter the letter from Section B, Part I that identifies the property for which you gave less than an entire interest ▶ If Section B, Part II applies to more than one property, attach a separate statement.

b Total amount claimed as a deduction for the property listed in Section B, Part I: (1) |

For this tax year . . ▶ |

(2) |

For any prior tax years ▶ |

cName and address of each organization to which any such contribution was made in a prior year (complete only if different from the donee organization in Section B, Part V, below):

Name of charitable organization (donee)

Address (number, street, and room or suite no.) |

City or town, state, and ZIP code |

|

|

dFor tangible property, enter the place where the property is located or kept ▶

eName of any person, other than the donee organization, having actual possession of the property ▶

Yes No

5a Is there a restriction, either temporary or permanent, on the donee’s right to use or dispose of the donated property?

bDid you give to anyone (other than the donee organization or another organization participating with the donee

organization in cooperative fundraising) the right to the income from the donated property or to the possession of the property, including the right to vote donated securities, to acquire the property by purchase or otherwise, or to designate the person having such income, possession, or right to acquire? . . . . . . . . . . . . .

cIs there a restriction limiting the donated property for a particular use? . . . . . . . . . . . . . .

Part III Taxpayer (Donor)

I declare that the following item(s) included in Section B, Part I above has to the best of my knowledge and belief an appraised value of not more than $500 (per item). Enter identifying letter from Section B, Part I and describe the specific item. See instructions.

▶

Signature of |

|

|

|

taxpayer (donor) ▶ |

Date ▶ |

||

Part IV |

|

Declaration of Appraiser |

|

I declare that I am not the donor, the donee, a party to the transaction in which the donor acquired the property, employed by, or related to any of the foregoing persons, or married to any person who is related to any of the foregoing persons. And, if regularly used by the donor, donee, or party to the transaction, I performed the majority of my appraisals during my tax year for other persons.

Also, I declare that I perform appraisals on a regular basis; and that because of my qualifications as described in the appraisal, I am qualified to make appraisals of the type of property being valued. I certify that the appraisal fees were not based on a percentage of the appraised property value. Furthermore, I understand that a false or fraudulent overstatement of the property value as described in the qualified appraisal or this Form 8283 may subject me to the penalty under section 6701(a) (aiding and abetting the understatement of tax liability). I understand that my appraisal will be used in connection with a return or claim for refund. I also understand that, if there is a substantial or gross valuation misstatement of the value of the property claimed on the return or claim for refund that is based on my appraisal, I may be subject to a penalty under section 6695A of the Internal Revenue Code, as well as other applicable penalties. I affirm that I have not been at any time in the

Sign |

Appraiser signature ▶ |

|

Date ▶ |

Here |

|

||

Appraiser name ▶ |

Title ▶ |

||

Business address (including room or suite no.) |

|

Identifying number |

|

|

|

|

|

City or town, state, and ZIP code

Part V Donee Acknowledgment

This charitable organization acknowledges that it is a qualified organization under section 170(c) and that it received the donated property as described in Section B, Part I, above on the following date ▶

Furthermore, this organization affirms that in the event it sells, exchanges, or otherwise disposes of the property described in Section B, Part I (or any portion thereof) within 3 years after the date of receipt, it will file Form 8282, Donee Information Return, with the IRS and give the donor a copy of that form. This acknowledgment does not represent agreement with the claimed fair market value.

Does the organization intend to use the property for an unrelated use? |

. . . . . . . . . . . |

. . . ▶ |

Yes |

No |

Name of charitable organization (donee) |

Employer identification number |

|

|

|

|

|

|

|

|

Address (number, street, and room or suite no.) |

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|

Authorized signature |

Title |

Date |

|

|

Form 8283 (Rev.

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 8283 | The form is used by individuals and organizations to report information about non-cash charitable contributions. |

| Who Must File | If you donate property worth more than $500, you need to complete and attach Form 8283 to your tax return. |

| Sections of the Form | Form 8283 is divided into two sections. Section A is for items valued at $5,000 or less, and Section B is for items valued at more than $5,000. |

| Appraisal Requirements | For donations valued at more than $5,000, except stocks, a qualified appraisal must be attached to the form, except for publicly traded securities. |

Instructions on Utilizing IRS 8283

Filling out the IRS Form 8283 is a necessary step for individuals who have made non-cash donations exceeding $500 in value during the tax year to qualified organizations. This form allows taxpayers to claim a deduction for these donations on their federal income tax return. It's important to accurately report the details of the donated property, such as its condition, fair market value, and how the value was determined, to ensure compliance with IRS regulations. By following the steps outlined below, the process can be made straightforward.

- Begin with Section A if your donated property's value does not exceed $5,000. For donations exceeding this amount, proceed to Section B.

- Provide the name and address of the organization you donated to.

- Describe the donated property. Include details such as condition, age, and how you acquired it.

- State the fair market value of the donated property and the method used to determine this value. Common methods include appraisals for valuable items or thrift store values for more common goods.

- For donations made in Section B, you are required to obtain a qualified appraisal for the donated property, which must be attached to your tax return if the value of a single item or a group of similar items exceeds $5,000.

- Fill in the date of the contribution and the date(s) you acquired the property. If the property was created, produced, or purchased specifically for the donation, indicate this accordingly.

- Detail any consideration received from the charity, such as goods or services, in exchange for the donation. This information is crucial for determining the deductible amount.

- Ensure that you sign and date the form. If filing for Section B, the recipient organization must also complete its part of the form, acknowledging receipt of the donated property and confirming that it will be used in a manner consistent with the organization's charitable purpose.

- Attach Form 8283 to your Form 1040 when you file your tax return. Remember to also include any required qualified appraisals for donations detailed in Section B.

Accurately completing the IRS Form 8283 is crucial for documenting your charitable contributions and supporting your claim for a tax deduction. Take the time to ensure all information is correct and that you have the necessary documentation to back up your claims. This will not only help you comply with tax laws but also maximize your potential tax benefits from charitable giving. If you have any doubts or questions during this process, consulting a tax professional can provide additional guidance tailored to your specific situation.

Obtain Answers on IRS 8283

-

What is an IRS Form 8283?

IRS Form 8283 is a document that taxpayers must fill out to report non-cash charitable contributions over a certain value. This form helps the IRS track the amount of deductions taxpayers claim for donating valuable items to qualified organizations.

-

When do you need to file Form 8283?

Form 8283 needs to be filed in any year you donate an item or a group of similar items to a charitable organization, and the total value of the donation exceeds $500. It must be attached to your annual tax return.

-

What information is required on Form 8283?

The form requires detailed information about the donated items, including a description of the items, the condition of the items at the time of donation, the fair market value, and how the value was determined. You also need to provide information about the receiving organization.

-

How do you determine the fair market value of donated items?

Fair market value is the price at which an item would sell in its current condition in an open and competitive market. You can determine this value by comparing the item to similar items sold in the same market. Professional appraisals are required for items over a certain value, typically $5,000.

-

Is an appraisal always required for filing Form 8283?

An appraisal is not always required. It is necessary for donations of property valued over $5,000, except for publicly traded securities. For items below this value, a detailed receipt from the charitable organization may suffice.

-

What if you donate multiple items of similar nature?

If you donate multiple similar items, you can group these items together on the form, provided their total value does not exceed $500. For groups of similar items where the total value exceeds $500, you should report each item individually.

-

Who must sign Form 8283?

The taxpayer making the donation must sign Form 8283. Additionally, if an appraisal is required, the qualified appraiser and an authorized official of the receiving charity must also sign the form.

-

What happens if you don't file Form 8283 for eligible donations?

Failing to file Form 8283 for donations requiring it can result in the denial of the deduction for those donations. Furthermore, misrepresenting the value of donated items can lead to penalties or audits.

-

Where can you find Form 8283 and instructions for completing it?

Form 8283 and its instructions are available on the IRS website. They can be downloaded for free. It's important to review the instructions carefully to ensure that you complete the form correctly and include all required information.

Common mistakes

-

Not Filling Out All Required Sections: Some people skip sections that are mandatory for their specific situation. It's important to review the form thoroughly and ensure all relevant parts are completed.

-

Incorrect Valuation of Donated Property: A common mistake is improperly assessing the value of the donated item. It's crucial to use fair market value and, when necessary, obtain an appraisal.

-

Failure to Attach Appraisals: For donations valued over a certain amount, an appraisal is required. Not attaching this document can lead to processing delays or denial of the donation claim.

-

Misspelling the Charity's Name: Getting the charity's name wrong can lead to confusion and may affect the deductibility of the donation.

-

Omitting Donor Information: Complete donor information is crucial. Leaving out details like address or taxpayer identification number can invalidate the deduction.

-

Incomplete Description of Donated Property: A vague or incomplete description of the donated items can raise questions and potentially flag your deduction for review.

-

Forgetting to Sign and Date the Form: This is a simple but critical step. An unsigned form is considered incomplete.

-

Not Keeping a Copy for Records: Always keep a copy of the completed form and any attachments for your personal records. This is important for future reference or in case of an audit.

Documents used along the form

When individuals decide to donate property valued over $500 to a charitable organization, the IRS Form 8283 becomes a crucial document in their tax preparation process. However, this form doesn't stand alone; it often requires supplementary documents to substantiate the donations claimed. Understanding these additional documents can significantly smooth the filing process, ensuring that donors meet all IRS requirements while maximizing their potential tax benefits.

- Receipt from the Charitable Organization: A formal acknowledgment from the charity receiving the donation. This receipt should detail the name of the organization, the date of the gift, and a description of the property donated. It’s vital to note that for this receipt to be valid, it must explicitly state that no goods or services were received in exchange for the donation, if that is the case.

- Form 1040: The annual income tax return most common among individual filers. When claiming a deduction for a charitable contribution of property, the taxpayer must itemize deductions on Schedule A linked to Form 1040. The total of the individual's charitable deductions, including those reported on Form 8283, is then entered onto this schedule.

- Appraisal Summary: If the donated property's value exceeds $5,000, an appraisal summary part of the Form 8283 must be completed. This summary should be attached to the form and include details from a qualified appraiser stating the value of the property donated.

- Qualified Appraisal: The detailed report from a qualified appraiser, separate from the appraisal summary, is not submitted with the tax return but must be retained by the donor. It includes a detailed description of the appraised property, the basis for valuation, and the qualifications of the appraiser. This document is critical if the IRS requests more information regarding the donation.

- Form 1098-C or Acknowledgement Letter: Specifically for donations of vehicles, including cars, boats, and airplanes, if the claimed value exceeds $500. The charitable organization must provide the donor with Form 1098-C or a similar acknowledgment letter, detailing the vehicle's condition and whether it was sold or intended for use by the charity.

- Photographs of the Donated Property: While not an official IRS document, taking photographs of the donated property, especially when it's of significant value or condition is a key factor, can provide useful support for the claimed deduction. These images serve as a visual record that complements the written documentation.

Beyond simply completing the IRS Form 8283, donors should be diligent in gathering and organizing these additional forms and documents. Being thorough in this preparation can not only facilitate a smoother tax filing process but also help substantiate the charitable contributions made, ensuring they stand up to any scrutiny from the IRS. Keeping detailed records and understanding the relationship between these documents and the Form 8283 is essential for any taxpayer making a charitable donation of property.

Similar forms

IRS Form 1040, Schedule A: This form bears similarity to IRS Form 8283 because both are used in the context of deductions. While Form 8283 is specifically focused on non-cash charitable contributions, Schedule A of Form 1040 details all itemized deductions a taxpayer can claim, including charitable donations, whether cash or non-cash.

IRS Form 1098-C: This form is directly related to Form 8283 as it is used to report a qualified vehicle donation. If a taxpayer donates a vehicle, boat, or airplane to a qualified organization and claims more than $500, Form 1098-C must be attached to Form 8283 to provide the necessary details about the donation.

IRS Form 8282: Form 8282 is the counterpart to Form 8283. It is used by the recipient organization to report information to the IRS and the donor about dispositions of certain charitable deduction property within three years after the donor contributed the property. This connection ensures transparency and accountability in the valuation of non-cash donations.

IRS Form 8824: Form 8824 is used for Like-Kind Exchanges. It requires detailed reporting of exchanges of property held for productive use or investment. While it doesn't deal directly with charitable contributions, it echoes Form 8283 in its focus on non-cash assets, requiring thorough documentation and valuation.

IRS Form 8949: This form reports sales and other dispositions of capital assets. Form 8283 and Form 8949 are similar in that both involve calculations based on the fair market value of assets. For Form 8949, it applies to assets sold or exchanged; for Form 8283, it’s about the valuation of donated property.

IRS Form 8300: This form is required for reporting cash payments over $10,000 received in a trade or business. It parallels Form 8283's focus on reporting significant transactions, though Form 8300 focuses on large cash transactions, and Form 8283 focuses on non-cash charitable donations.

IRS Schedule B (Form 1040): Schedule B is used to report interest and ordinary dividends. The relation to Form 8283 is a bit indirect but notable in the context of reporting specific transactions. Whereas Schedule B deals with income received, Form 8283 deals with the value of contributions made.

IRS Form 4562: Form 4562 is used for depreciation and amortization, including information on the depreciation of property donated to a charity, if applicable. Businesses must complete this form when they claim a deduction for property that depreciates, similar to how Form 8283 is used for deductions related to non-cash donations.

IRS Form 8863: This form is for Education Credits. When taxpayers donate to educational institutions and claim deductions on Form 8283 for those donations, there can be an interplay between the types of contributions made for educational purposes and the credits claimed on Form 8863.

Dos and Don'ts

Filling out an IRS 8283 form is important for accurately reporting non-cash charitable contributions. To ensure you complete this form correctly, here are ten do's and don'ts to keep in mind.

Do's:

- Read the instructions for the form carefully before you start filling it out. This will help you understand the requirements and reduce errors.

- Ensure you're eligible to itemize deductions on your tax return, which is a prerequisite for using Form 8283.

- Itemize and describe each non-cash donation in detail, including its condition, as this information is crucial for valuation purposes.

- Obtain and keep appraisals for donations valued over $5,000, as this is a requirement for such contributions.

- Include the name and address of the charity to which you made the donation. This information is essential for verification purposes.

- Sign and date the form if you've made a contribution that requires it. This is typically necessary for contributions valued at more than $500.

- Attach the form to your tax return if your total deduction for all non-cash contributions for the year is more than $500.

- Keep a copy of the completed form and all supporting documents for your records. It's important to have this information on hand in case of an IRS inquiry.

- Consult a tax professional if you're unsure about how to value your donation or if you have other specific questions.

- File Form 8283 electronically with your tax return if possible, for quicker processing.

Don'ts:

- Don't guess or estimate the value of your donated items without following IRS guidelines or obtaining a qualified appraisal when required.

- Don't leave any required fields blank. Incomplete forms may lead to processing delays or the denial of your deduction.

- Don't forget to report any donated property that has appreciated in value and has been in your possession for less than one year. Special rules may apply.

- Don't neglect to notify the charity if you're claiming a deduction for a single item or a group of similar items valued at more than $5,000.

- Don't underestimate the importance of keeping thorough records of your donation, including the charity's acknowledgment letter.

- Don't attach the qualified appraisal to the form unless specifically requested to do so by the IRS.

- Don't attempt to deduct the value of your time or services. The IRS only allows deductions for tangible goods and some qualified expenses.

- Don't ignore IRS rules regarding the condition of donated items. Generally, only items in good used condition or better are eligible for deduction.

- Don't forget to consult the latest IRS publications or a tax professional for recent changes to tax laws that might affect you.

- Don't file Form 8283 if you are not itemizing deductions on your tax return; instead, consider if other giving strategies might be more tax-efficient for your situation.

Misconceptions

Filing taxes can often feel overwhelming, and the multitude of forms involved doesn't help. Specifically, the IRS Form 8283, used for documenting non-cash charitable contributions over $500, tends to be surrounded by misconceptions. Understanding the truth behind these misconceptions is crucial for taxpayers seeking to claim deductions accurately and efficiently.

-

Only physical goods can be reported on Form 8283. Many believe that IRS Form 8283 is solely for physical items like clothes or furniture. In truth, it covers a wide array of non-cash contributions, including stocks, intellectual property, and other non-physical assets.

-

You don't need to fill it out for smaller donations. A common mistake is thinking that donations under a specific threshold don't need to be reported. Every non-cash donation over $500 must be detailed on Form 8283 to claim the deduction properly.

-

Appraisals are always required when filing Form 8283. While appraisals are necessary for donations valued over $5,000, not all contributions reported on Form 8283 need an official valuation. Understanding the requirements based on the donation's value is key.

-

You must itemize deductions to use Form 8283. This is generally true, as non-cash contributions are itemized deductions. However, the connection between itemizing deductions and the need to use Form 8283 is often unclear. Taxpayers must itemize their deductions on Schedule A to claim any charitable contribution.

-

Filing Form 8283 is the responsibility of the charity receiving the donation. The onus of filing Form 8283 squarely falls on the donor, not the charitable organization. The charity must only sign part of the form for certain value thresholds of donations.

-

Form 8283 must be filled out completely at the time of donation. It's a common misconception that every detail must be finalized at the time of the donation. Certain aspects, like the value of the donation, might not be fully ascertainable until later, such as when filing taxes.

-

The IRS doesn't verify the information on Form 8283. Contrary to this belief, the IRS can and does review the details provided on Form 8283, including the value of the items donated and the legitimacy of the charity. Proper documentation and honesty are crucial.

-

All charities are eligible to receive deductible donations. Not every organization qualifies as a charity under IRS rules. Before claiming a deduction with Form 8283, verify the charity's eligibility to ensure the contribution is deductible.

-

Form 8283 is only filed with your tax return if you're audited. This form must be filed with your tax return if you're claiming deductions for non-cash donations over $500, not just in the event of an audit.

-

Taxpayers can expect no follow-up from the IRS after filing Form 8283. While not everyone will hear back regarding their Form 8283, the IRS may request additional documentation or clarification about the contributions declared. Being prepared for potential follow-up can make the process smoother.

Navigating the intricacies of the IRS can be challenging, but demystifying these misconceptions about Form 8283 is a step in the right direction for taxpayers. Accurate reporting and compliance with IRS guidelines help ensure the maximum benefit from charitable contributions without undue stress during tax season.

Key takeaways

The IRS 8283 form is a crucial document for taxpayers who make non-cash charitable contributions over $500. Understanding how to correctly fill out and utilize this form can significantly impact your tax situation. Below are key takeaways that should be kept in mind:

- Identify Eligible Contributions: It's important to ascertain that the items or property you plan to deduct meet the IRS criteria for non-cash charitable contributions. Not every donation qualifies, so evaluating eligibility should be your first step.

- Understand the Two Sections: The IRS 8283 form is divided into two sections. Section A is for items with a claimed value of less than $5,000, while Section B is for those items or grouped contributions that exceed this amount. Knowing where your donation fits is crucial for accurate reporting.

- Accurate Valuation is Key: The value you assign to your donated property plays a significant role in determining your tax benefits. For items or contributions that require Section B, a qualified appraisal might be necessary. Ensuring accurate and honest valuation is paramount.

- Keep Detailed Records: Documentation is your best friend when it comes to charitable contributions. Receipts, appraisals, and records of the charity's acceptance of the donation are essential. These documents support the legitimacy and value of your contribution should the IRS inquire further.

- Know the Deduction Limits: The IRS sets limits on how much you can deduct for non-cash charitable contributions, based on a percentage of your adjusted gross income (AGI). Being aware of these limits will help you understand the potential impact on your taxes.

- File with Your Tax Return: Once completed, attach Form 8283 to your tax return. This form is a part of your overall tax documentation and must be filed alongside your return if you are claiming any non-cash charitable contributions.

Properly utilizing the IRS 8283 form can provide taxpayers with valuable tax deductions for their generosity. However, the process requires detailed attention to ensure compliance and maximize your benefit. Remember, when in doubt, consulting with a tax professional can provide clarity and confidence in your charitable contribution deductions.

Popular PDF Forms

Sample Ach Authorization Form - Clients must sign the request asserting their authority to claim the transaction as unauthorized.

Paternity Affidavit - It lays the groundwork for the emotional and financial support of the child, highlighting the significance of both parents' roles.

Medicaid Expansion Nc - Aligns patient care needs with the services provided by adult care homes, ensuring proper care placement.