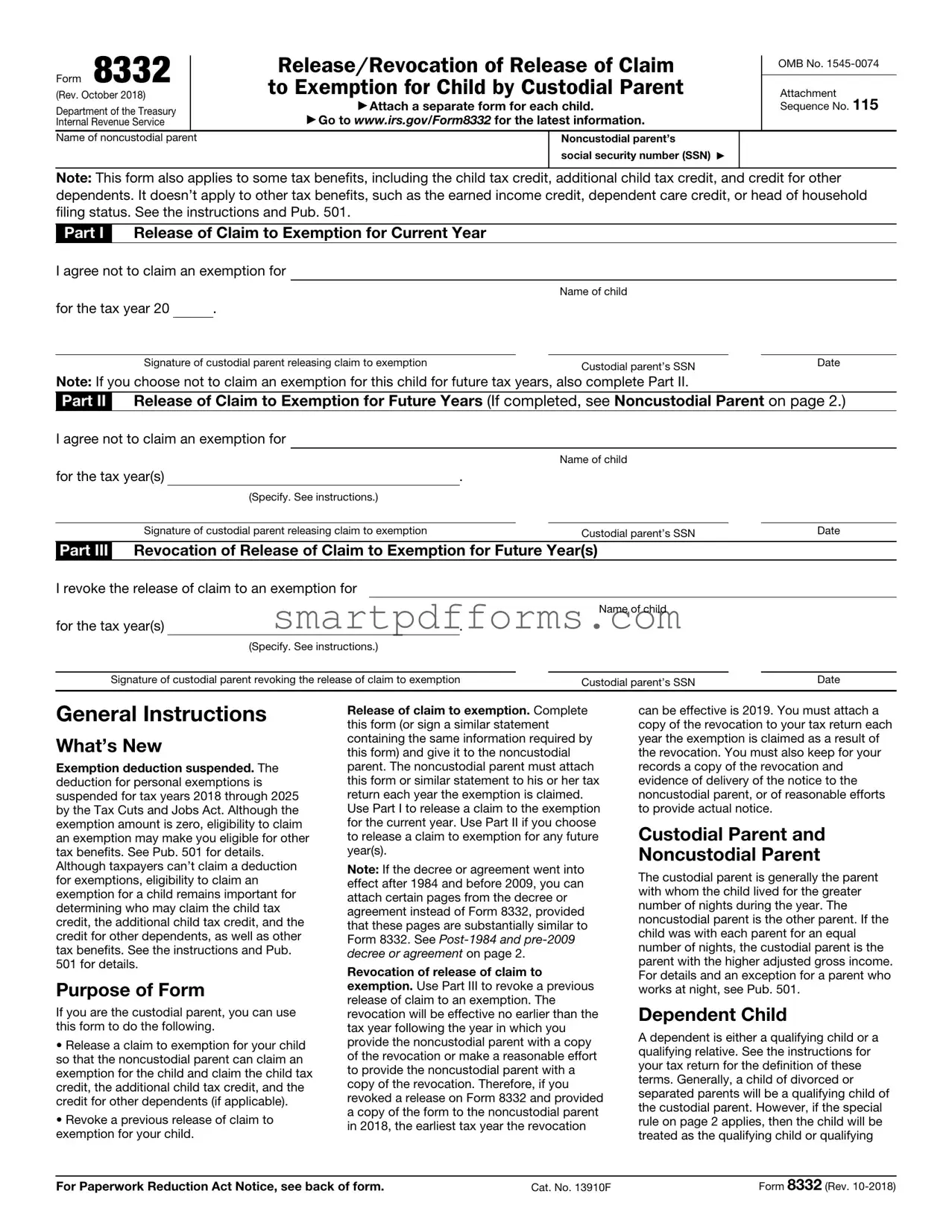

Blank IRS 8332 PDF Template

For parents navigating the ins and outs of tax deductions related to their children, understanding the nuances of the IRS 8332 form is vital. This form plays a crucial role for divorced or separated parents, as it allows one parent to transfer the tax benefits associated with a dependent child to the other parent. By filling out and submitting this form, the custodial parent essentially permits the non-custodial parent to claim the child as a dependent for tax purposes, which includes eligibility for the child tax credit among other benefits. This decision can have significant financial implications and is often part of broader custody agreements or divorce settlements. However, it's not just about ticking a box; certain requirements and conditions must be met for the form to be valid, including details about the custody arrangement and the specific tax years the agreement covers. The IRS 8332 form is the lifeline that enables this financial arrangement, underscoring the importance of understanding its purpose, how to properly fill it out, and when it needs to be submitted to ensure that tax time goes smoothly for both parents.

Preview - IRS 8332 Form

Form 8332 |

|

|

Release/Revocation of Release of Claim |

|

OMB No. |

|||

|

|

|||||||

|

|

|

|

|

|

|

||

|

|

|

to Exemption for Child by Custodial Parent |

|

|

|

||

(Rev. October 2018) |

|

|

|

Attachment |

115 |

|||

Department of the Treasury |

|

|

▶ Attach a separate form for each child. |

|

Sequence No. |

|||

|

|

▶ Go to www.irs.gov/Form8332 for the latest information. |

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

|||

Name of noncustodial parent |

|

|

|

Noncustodial parent’s |

|

|

|

|

|

|

|

|

social security number (SSN) ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: This form also applies to some tax benefits, including the child tax credit, additional child tax credit, and credit for other dependents. It doesn’t apply to other tax benefits, such as the earned income credit, dependent care credit, or head of household filing status. See the instructions and Pub. 501.

Part I Release of Claim to Exemption for Current Year

I agree not to claim an exemption for

Name of child

for the tax year 20 |

|

. |

Signature of custodial parent releasing claim to exemption |

|

Custodial parent’s SSN |

|

Date |

|

|

|

|

Note: If you choose not to claim an exemption for this child for future tax years, also complete Part II.

Part II Release of Claim to Exemption for Future Years (If completed, see Noncustodial Parent on page 2.)

I agree not to claim an exemption for

|

|

|

|

|

Name of child |

|

|

for the tax year(s) |

. |

|

|

|

|

||

|

(Specify. See instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of custodial parent releasing claim to exemption |

|

|

|

Custodial parent’s SSN |

|

Date |

|

Part III Revocation of Release of Claim to Exemption for Future Year(s)

I revoke the release of claim to an exemption for

|

|

|

|

Name of child |

|

|

for the tax year(s) |

. |

|

|

|

|

|

|

(Specify. See instructions.) |

|

|

|

|

|

|

|

|

|

|

||

Signature of custodial parent revoking the release of claim to exemption |

|

Custodial parent’s SSN |

|

Date |

||

General Instructions

What’s New

Exemption deduction suspended. The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is zero, eligibility to claim an exemption may make you eligible for other tax benefits. See Pub. 501 for details. Although taxpayers can’t claim a deduction for exemptions, eligibility to claim an exemption for a child remains important for determining who may claim the child tax credit, the additional child tax credit, and the credit for other dependents, as well as other tax benefits. See the instructions and Pub. 501 for details.

Purpose of Form

If you are the custodial parent, you can use this form to do the following.

•Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child and claim the child tax credit, the additional child tax credit, and the credit for other dependents (if applicable).

•Revoke a previous release of claim to exemption for your child.

Release of claim to exemption. Complete this form (or sign a similar statement containing the same information required by this form) and give it to the noncustodial parent. The noncustodial parent must attach this form or similar statement to his or her tax return each year the exemption is claimed. Use Part I to release a claim to the exemption for the current year. Use Part II if you choose to release a claim to exemption for any future year(s).

Note: If the decree or agreement went into effect after 1984 and before 2009, you can attach certain pages from the decree or agreement instead of Form 8332, provided that these pages are substantially similar to Form 8332. See

Revocation of release of claim to exemption. Use Part III to revoke a previous release of claim to an exemption. The revocation will be effective no earlier than the tax year following the year in which you provide the noncustodial parent with a copy of the revocation or make a reasonable effort to provide the noncustodial parent with a copy of the revocation. Therefore, if you revoked a release on Form 8332 and provided a copy of the form to the noncustodial parent in 2018, the earliest tax year the revocation

can be effective is 2019. You must attach a copy of the revocation to your tax return each year the exemption is claimed as a result of the revocation. You must also keep for your records a copy of the revocation and evidence of delivery of the notice to the noncustodial parent, or of reasonable efforts to provide actual notice.

Custodial Parent and

Noncustodial Parent

The custodial parent is generally the parent with whom the child lived for the greater number of nights during the year. The noncustodial parent is the other parent. If the child was with each parent for an equal number of nights, the custodial parent is the parent with the higher adjusted gross income. For details and an exception for a parent who works at night, see Pub. 501.

Dependent Child

A dependent is either a qualifying child or a qualifying relative. See the instructions for your tax return for the definition of these terms. Generally, a child of divorced or separated parents will be a qualifying child of the custodial parent. However, if the special rule on page 2 applies, then the child will be treated as the qualifying child or qualifying

For Paperwork Reduction Act Notice, see back of form. |

Cat. No. 13910F |

Form 8332 (Rev. |

Form 8332 (Rev. |

Page 2 |

relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit for other dependents.

Special Rule for Children of Divorced or Separated Parents

A child is treated as a qualifying child or a qualifying relative of the noncustodial parent if all of the following apply.

1.The child received over half of his or her support for the year from one or both of the parents (see the Exception below). If you received payments under the Temporary Assistance for Needy Families (TANF) program or other public assistance program and you used the money to support the child, see Pub. 501.

2.The child was in the custody of one or both of the parents for more than half of the year.

3.Either of the following applies.

a. The custodial parent agrees not to claim an exemption for the child by signing this form or a similar statement. If the decree or agreement went into effect after 1984 and before 2009, see

b. A

For this rule to apply, the parents must be one of the following.

•Divorced or legally separated under a decree of divorce or separate maintenance.

•Separated under a written separation agreement.

•Living apart at all times during the last 6 months of the year.

If this rule applies, and the other dependency tests in the instructions for your tax return are also met, the noncustodial parent can claim an exemption for the child.

Exception. If the support of the child is determined under a multiple support agreement, this special rule does not apply, and this form should not be used.

instead of Form 8332, provided that these pages are substantially similar to Form 8332. To be able to do this, the decree or agreement must state all three of the following.

1.The noncustodial parent can claim the child as a dependent without regard to any condition (such as payment of support).

2.The other parent will not claim the child as a dependent.

3.The years for which the claim is released.

The noncustodial parent must attach all of the following pages from the decree or agreement.

•Cover page (include the other parent’s SSN on that page).

•The pages that include all of the information identified in (1) through (3) above.

•Signature page with the other parent’s signature and date of agreement.

The noncustodial parent must ▲! attach the required information

even if it was filed with a return in CAUTION an earlier year.

Specific Instructions

Custodial Parent

Part I. Complete Part I to release a claim to exemption for your child for the current tax year.

Part II. Complete Part II to release a claim to exemption for your child for one or more future years. Write the specific future year(s) or “all future years” in the space provided in Part II.

To help ensure future support, you TIP may not want to release your

claim to the exemption for the child for future years.

Part III. Complete Part III if you are revoking a previous release of claim to exemption for your child. Write the specific future year(s) or “all future years” in the space provided in Part III.

The revocation will be effective no earlier than the tax year following the year you provide the noncustodial parent with a copy of the revocation or make a reasonable effort to provide the noncustodial parent with a copy of the revocation. Also, you must attach a copy of the revocation to your tax return for each year you are claiming the exemption as a result of the revocation. You must also keep for your records a copy of the revocation and evidence of delivery of the notice to the noncustodial parent, or of reasonable efforts to provide actual notice.

Example. In 2015, you released a claim to exemption for your child on Form 8332 for the years 2016 through 2020. In 2018, you decided to revoke the previous release of exemption. If you completed Part III of Form 8332 and provided a copy of the form to the noncustodial parent in 2018, the revocation will be effective for 2019 and 2020. You must attach a copy of the revocation to your 2019 and 2020 tax returns and keep certain records as stated earlier.

Noncustodial Parent

Attach this form or similar statement to your tax return for each year you claim the exemption for your child. You can claim the exemption only if the other dependency tests in the instructions for your tax return are met.

If the custodial parent released his TIP or her claim to the exemption for

the child for any future year, you must attach a copy of this form or similar statement to your tax return

for each future year that you claim the exemption. Keep a copy for your records.

Note: If you are filing your return electronically, you must file Form 8332 with Form 8453, U.S. Individual Income Tax Transmittal for an IRS

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 8332 is used by custodial parents to release their claim to a child's exemption for income tax purposes to the non-custodial parent. |

| Requirement for Non-Custodial Parent | To claim a child as a dependent, the non-custodial parent must attach a copy of the Form 8332 or its equivalent to their tax return each year the exemption is claimed. |

| Yearly or Multiple Years Option | The form allows the custodial parent to release the exemption for a single year, for a number of specified years, or for all future years. |

| Revocability | The custodial parent can revoke the decision for future tax years by providing written notice to the non-custodial parent and attaching a copy of this revocation to their tax return. |

| Impact on Tax Credits | Releasing the exemption does not affect the custodial parent's eligibility for the child tax credit, earned income credit, and other child-related tax benefits. |

| State-Specific Forms | While the IRS Form 8332 is a federal form, individual states do not have their own version; however, the impact of signing the form may vary based on state law regarding tax filings. |

| Governing Laws | The IRS Form 8332 is governed by federal tax laws, but the implications of signing the form can be influenced by state-specific family law provisions regarding the custody and support of children. |

Instructions on Utilizing IRS 8332

Filling out IRS Form 8332 is a crucial step for divorced or separated parents who are making decisions about the tax benefits related to their child or children. This form is the way that noncustodial parents can claim a child as a dependent for tax purposes, given the custodial parent agrees to release this claim. It’s straightforward but requires attention to detail to ensure all involved parties fully understand the tax implications. Here, you’ll learn how to accurately complete this form step by step. Remember, it’s always a good idea to review the completed form with a tax professional if you have any questions or concerns.

- Locate the most current version of IRS Form 8332 on the Internal Revenue Service website. Ensure it's the correct form for the tax year in question.

- Read through the form carefully to understand what information is needed. The form is divided into two parts: Part I is for releasing the exemption for the current year, while Part II is for future years.

- Begin by filling out the top section with the full name of the child or children for which the exemption is being released. If you’re releasing it for more than one child, make sure to list each child’s name.

- Enter the year or years for which the exemption is released in the designated spaces. For Part I, enter the specific tax year. For Part II, if you’re releasing exemption for more than one year, specify the range of years.

- Complete the section with the custodial parent's information. Include your name, Social Security Number (SSN), and address.

- For the noncustodial parent, fill in their name and SSN in the provided space. This ensures the IRS knows who is claiming the exemption(s).

- If you’re releasing a claim for future years, make sure Part II of the form is completed. This part requires a signature for each tax year released, affirming the agreement between both parties.

- Review the form to ensure all information is correct and complete. Mistakes could delay processing or affect tax returns for both parents.

- Sign and date the form. The custodial parent's signature is necessary to make the release valid.

- Lastly, provide the completed Form 8332 to the noncustodial parent. They’ll need to attach it to their tax return to claim the exemption for the dependent.

Once Form 8332 is accurately filled out and signed by the custodial parent, it serves as an essential document that allows the noncustodial parent to claim a dependent exemption for tax purposes, potentially leading to beneficial tax outcomes. By carefully following the steps above, you can ensure that this process is handled smoothly and efficiently, paving the way for a clearer financial arrangement between separated or divorced parents.

Obtain Answers on IRS 8332

-

What is Form 8332 and when do I need to use it?

Form 8332, titled "Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent," serves a critical function in the administration of tax benefits related to child custody arrangements. This form is deployed when a custodial parent opts to relinquish the right to claim a child as a dependent, thereby allowing the non-custodial parent to claim the child for tax purposes. The necessity for this form arises in scenarios where the custodial parent, typically the one with whom the child resides for the greater part of the year, agrees to transfer the tax benefit associated with the child to the non-custodial parent. This form is essential in instances where divorce, separation, or other custody arrangements alter the financial dynamics concerning the child's care.

-

How does completing Form 8332 affect tax credits and deductions?

Once Form 8332 is completed and filed, it directly impacts the allocation of tax benefits between the custodial and non-custodial parents. Primarily, the non-custodial parent, upon receiving the signed form, becomes eligible to claim the child as a dependent, opening the pathway to various tax advantages. These advantages include the ability to file as Head of Household, claim the Child Tax Credit, and in some instances, the Earned Income Tax Credit, dependent on the non-custodial parent's income level. It's important to note, however, that even with Form 8332, only the custodial parent can claim the child and dependent care expenses. This allocation of tax benefits underscores the importance of Form 8332 in facilitating the agreement between parents regarding the financial aspects of raising a child provided they maintain separate households.

-

What are the requirements for filing Form 8332?

To file Form 8332 effectively, the custodial parent must explicitly release their claim to the exemption for the child for a specified tax year or years. The form requires detailed information, including the name of the child, tax year(s) for which the release applies, and the Social Security numbers of both the custodial and non-custodial parent. Additionally, it mandates the signature of the custodial parent, which validates the release. It's paramount for the non-custodial parent to attach this form to their tax return to rightfully claim the exemption. Failure to include this form might result in the IRS denying the claim for the exemption and any associated tax benefits for the non-custodial parent.

-

Can the custodial parent revoke a release made with Form 8332?

A custodial parent holds the authority to revoke a previously granted release of a claim to exemption. This revocation, however, can only be applied to future tax years and cannot affect the year in which the revocation is filed, or any tax year prior. The revocation process necessitates the completion of Part III of Form 8332 or a similarly written statement that must include certain details: the name of the child, the year or years for which the revocation is intended, and the signature of the revoking parent. The crucial step in this process is for the custodial parent to notify the non-custodial parent of the revocation by the end of the year preceding the first year it takes effect. Additionally, the custodial parent must attach a copy of the revocation to their tax return for each year the revocation applies.

-

Is it mandatory to file Form 8332 every year?

No, it's not mandatory to file Form 8332 annually if the custodial parent releases the claim to exemption for more than one year. When the custodial parent signs Form 8332 or provides a similar statement releasing their claim for multiple years, the non-custodial parent can attach the original release or a copy thereof to their tax return each year for which the release applies. This provision streamlines the process, ensuring that once the form is filled out and submitted, it's not required to be completed each subsequent year unless there's a change, such as a revocation or modification of the agreement between the parents.

-

Where can I obtain Form 8332, and how should I submit it?

Form 8332 can be readily accessed and downloaded from the Internal Revenue Service (IRS) website. It provides a printable version that can be filled out manually. Once completed, the non-custodial parent must attach Form 8332 to their federal income tax return when they file it, to claim the exemption for the dependent child. It's imperative to note that electronically filed tax returns should include a PDF attachment of the signed Form 8332. If you're filing a paper return, simply attach the form to your return. This ensures that the IRS acknowledges the custodial parent's release of the exemption, allowing the non-custodial parent to utilize the tax benefits associated with the dependent exemption.

Common mistakes

Filling out the IRS 8332 form, which is used by custodial parents to release the claim to a child's exemption, can sometimes be tricky. People often make mistakes that can lead to delays or issues with their tax filings. Below are some common errors to avoid.

-

Not updating the form when circumstances change: It's important to provide current information. If your situation changes, you should complete a new form to reflect the up-to-date arrangements.

-

Forgetting to sign and date the form: The IRS considers an unsigned form incomplete. Make sure to sign and date the form before submission.

-

Entering incorrect tax years: Specifying the wrong tax year(s) can cause confusion and processing delays. Ensure you enter the correct tax years for which the exemption is being released.

-

Omitting the noncustodial parent’s information: The form requires the noncustodial parent's Social Security number and other details. Leaving this information out can invalidate the release of the claim.

-

Misunderstanding the form’s purpose: Some people mistakenly think this form is for claiming the exemption. In reality, it's for the custodial parent to release the claim to the noncustodial parent.

-

Not attaching the form to the noncustodial parent’s tax return: The noncustodial parent needs to attach the signed form to their tax return to claim the exemption. Failing to do so can result in the IRS denying the exemption claim.

-

Failing to keep a copy: It’s essential to keep a copy of the completed and signed form for your records. If any questions arise later, you’ll need a copy to reference.

-

Not reading the instructions carefully: The IRS provides instructions for filling out the form. Misunderstandings can be avoided by taking the time to read these instructions thoroughly before starting.

Brainstorming and avoiding these mistakes can make the process smoother and help ensure that the exemption claim is processed correctly and efficiently.

Documents used along the form

The IRS Form 8332 plays a critical role for divorced or separated parents who are making decisions on the tax exemption for dependent children. This form is not used in isolation. Several other documents often accompany the IRS Form 8332 to ensure compliance and clarity in tax filings. These documents support various aspects of tax filing, including proof of financial support and custody arrangements.

- Form 1040: The primary U.S. individual income tax return form, used by taxpayers to file their annual income taxes, including reporting income, deductions, and credits.

- Form 1040-SR: A version of Form 1040 designed for senior taxpayers, aged 65 and older, which has a larger font size and a simplified income reporting section.

- Custody Agreement: A legal document that outlines the terms of custody between separated or divorced parents. This agreement often includes details relevant to the eligibility for claiming a dependent.

- Child Support Orders: Official court orders that specify the financial obligations of one parent to provide support for their child. This document can influence which parent is eligible to claim the child as a dependent.

- Form W-2: An annual wage and tax statement provided by employers that shows the amount of taxes withheld from a paycheck. It is used by the taxpayer to complete Form 1040.

- Schedule EIC (Form 1040): A schedule for Form 1040 that is used to claim the Earned Income Credit, a tax credit for low to moderate-income working individuals and families, especially those with children.

- Form 1098: Mortgage Interest Statement, which individuals use to deduct mortgage interest payments from their taxable income. It illustrates financial responsibility and stability, which can be pertinent when determining dependency exemptions.

When preparing to file tax returns, especially in situations involving dependents, combining the IRS Form 8332 with these associated forms and documents will streamline the process. Each plays a distinct role in establishing eligibility, financial responsibility, and ultimately ensuring that all legal and fiscal responsibilities are met accurately and efficiently.

Similar forms

IRS Form 1040 or 1040-SR: Similar to IRS 8332, these forms are pivotal during tax season. They're used by taxpayers to file their annual income tax return, where Form 8332's information about the release or claim of a child's exemption can directly impact calculations.

IRS Schedule EIC (Form 1040): This form, tied to the earned income credit, shares similarities with the IRS 8332 in that both can affect tax savings for families. If a custodial parent signs Form 8332, it might influence the eligibility or amount of EIC a taxpayer can claim.

IRS Form 2848, Power of Attorney and Declaration of Representative: Though used for different purposes, Form 2848 and Form 8332 give someone else rights concerning personal tax matters. Form 8332 allows a non-custodial parent to claim a child's exemption, whereas Form 2848 grants broader tax representation rights to a designated individual.

IRS Form 8862, Information To Claim Earned Income Credit After Disallowance: Similar to Form 8332, Form 8862 is involved in tax credit matters, specifically used to claim the EIC again after it was previously disallowed. Both forms can influence the tax benefits a taxpayer is eligible for regarding dependents.

IRS Form 2120, Multiple Support Declaration: This form, like IRS 8332, involves agreements about dependents' claims. While IRS 8332 pertains to a custodial parent releasing a claim to an exemption, Form 2120 is for cases where multiple taxpayers support a dependent but agree that one can claim the exemption.

IRS Form 8814, Parents' Election To Report Child's Interest and Dividends: Both this form and IRS 8332 deal with tax considerations involving children. Form 8814 allows parents to include a child’s income on their return, possibly affected by the dependency exemption claims made or released on Form 8332.

IRS Form 8857, Request for Innocent Spouse Relief: Similar to IRS 8332 in the realm of special tax situations, Form 8857 involves seeking relief from joint tax liability due to actions of a spouse or former spouse, not unlike the way Form 8332 can shift tax exemption responsibilities.

IRS Form 8962, Premium Tax Credit: This form and the IRS 8332 are connected through taxpayer eligibility for certain credits. The Premium Tax Credit form is used to reconcile or claim the credit on health insurance premiums, potentially influenced by exemptions claimed via Form 8332.

IRS Form W-4, Employee's Withholding Certificate: While primarily for determining the amount of taxes to withhold from an employee's paycheck, Form W-4's relevance to exemptions and financial dependencies echoes the purpose of IRS 8332, which can affect tax withholding by altering dependent status.

Dos and Don'ts

The IRS Form 8332 is crucial for parents who are divorced, separated, or live apart for the last 6 months of the calendar year and wish to release or claim a child's exemption. Properly filling out this form ensures smooth processing and avoids potential conflicts with the IRS. Here are essential dos and don'ts to consider:

Do:- Ensure both parents' social security numbers are accurately entered on the form. This step is crucial for the IRS to process the form correctly.

- Clearly specify the tax year or years for which the claim is being released if it’s for a single year or multiple years. Providing specific years helps prevent misunderstandings and processing delays.

- Have the custodial parent sign the form. Their signature is legally necessary to release the exemption to the noncustodial parent.

- Keep a copy of the completed and signed form for your records. Having a copy ensures that you can provide proof of the agreed-upon terms if any questions come up later.

- Don’t forget to check the form for completeness and accuracy before submission. Omitting information or making errors can result in processing delays or denial of the exemption release.

- Don’t use the form for years not specified. If you wish to change the agreement or update the years, a new Form 8332 must be completed and signed.

- Don’t assume verbal agreements are sufficient for the IRS. Even if both parties agree verbally to an exemption claim, the IRS requires Form 8332 or a similar written declaration.

- Don’t file the form without the custodial parent's signature. Without it, the form is not valid, and the exemption cannot be released or claimed.

Misconceptions

Understanding the IRS Form 8332 can often be complex, and misconceptions can arise, affecting decisions and tax outcomes. Here are five common misunderstandings and clarifications to help navigate this process effectively.

The form is only for divorced parents. While it's widely believed that IRS Form 8332 is only applicable to divorced parents, it is actually used by custodial parents to release the claim to a child's exemption, allowing the non-custodial parent to claim the exemption. This can include separated parents who have never been married or are legally separated but not divorced.

Signing Form 8332 is permanent. Another common misconception is that once the custodial parent signs Form 8332, it permanently transfers the exemption claim to the non-custodial parent. In reality, the form can specify the year or years for which the claim is released. Moreover, a custodial parent can revoke the release for future tax years by providing written notice to the other parent and filing this notice with their tax return.

Form 8332 is not necessary if the divorce decree states who claims the child. Even if a divorce decree clearly states which parent can claim the child, the IRS requires Form 8332 or a similar statement containing the same information to be filed to claim the child tax credit. Without it, the IRS may disallow the claim if audited, as they do not consider divorce decrees as binding in this context unless they meet very specific criteria.

The non-custodial parent can claim other child-related tax benefits. A common misunderstanding is that by using Form 8332, the non-custodial parent can claim all the tax benefits related to the child. However, the release on Form 8332 only applies to the child tax credit and dependency exemption (when it's applicable; note that the dependency exemption is currently at $0 due to tax law changes but may come back in future years). It does not allow the non-custodial parent to claim tax benefits like the Earned Income Tax Credit, Child and Dependent Care Credit, and the Head of Household filing status, as these are reserved for the custodial parent.

Filing Form 8332 affects child support. There's a misconception that filing Form 8332 and transferring the dependency exemption can affect child support payments. While tax benefits and child support are both aspects of financial care for a child, the decision to assign the tax exemption via Form 8332 does not directly impact the calculation of child support payments. Child support payments are determined by state guidelines and consider many factors, but the assignment of tax exemptions is not typically one of them.

Key takeaways

When dealing with the IRS 8332 form, which pertains to the release of the right to claim a child as a dependent for tax purposes, understanding its proper use and implications is crucial for smooth tax filing. Here are seven key takeaways:

- Who Needs It: The IRS 8332 form is primarily used by divorced or separated parents. The parent who has custody for the greater part of the year (the custodial parent) uses this form to officially release the right to claim a child as a dependent to the non-custodial parent.

- Tax Benefits at Stake: Claiming a child as a dependent comes with significant tax benefits, such as the child tax credit and educational credits. Filling out this form correctly determines which parent can claim these benefits.

- Year-by-Year Basis: The 8332 form can be used to release the claim for a single year, multiple years, or all future years. It's essential to specify the year or years clearly on the form to prevent any misunderstandings.

- Revocation Process: Custodial parents can revoke the release of claim to exemptions. For this action to take effect, the revocation must be for tax years starting after the year of submission, and the custodial parent must provide or make reasonable efforts to provide the non-custodial parent with written notice in the tax year prior to the year of revocation.

- Attachment to Tax Return: The non-custodial parent must attach a copy of the completed IRS 8332 form or a similar statement to their tax return each year they claim the child as a dependent based on the release.

- Impact on State Taxes: While the IRS 8332 form pertains to federal tax filings, the decision to release the claim for dependency exemptions might also impact state tax obligations and benefits. It’s wise to check state-specific rules.

- It's Irrevocable for the Year: Once the custodial parent releases the claim for any specific tax year, and the non-custodial parent claims the child as a dependent for that year, the decision is irrevocable for that year. The custodial parent cannot change their mind for that particular tax year.

Understanding and properly using the IRS 8332 form can significantly affect both parents' tax situations. Therefore, it’s advisable to consult with a tax professional if you have questions or unique circumstances. This will help ensure both compliance with tax laws and the optimization of tax benefits.

Popular PDF Forms

Virginia Beach Clerks Office - Assists Virginia property transactions by ensuring all necessary legal details are formally documented and recorded.

Non Refundable Portion of Employee Retention Credit - Businesses must keep a copy of the 941-X for their records, along with the original 941 forms.

Cf 1R Alt Hvac - Mentions that all compliance forms must be registered with an approved HERS Provider for building permit applications submitted after a specific date.