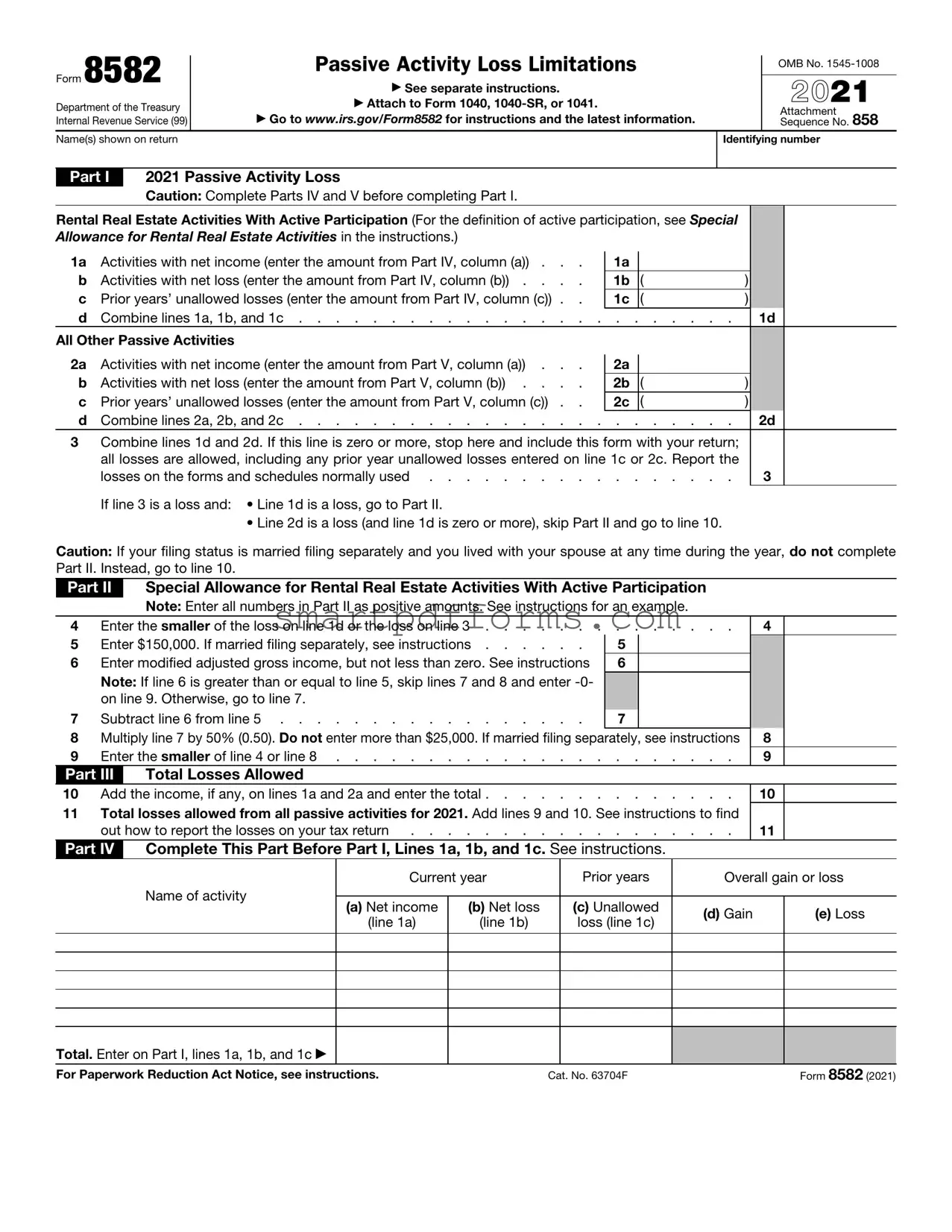

Blank IRS 8582 PDF Template

The intricacies of tax filings often bring individuals face to face with a variety of forms, each serving a unique purpose in the labyrinth of income reporting and deductions. Among these, the IRS Form 8582 stands out for its specific role in handling passive activity losses. This form is a critical tool for taxpayers with investments in activities they don't materially participate in, such as rental properties or certain business ventures. Understanding the form’s significance, its operational mechanics, and the conditions under which it must be filed can profoundly impact one's tax liability. The form effectively caps the amount of loss that can be deducted in a given year, linking it back to passive income, thus preventing taxpayers from using passive losses to offset income from active businesses or employment. This introduces a delicate balance in managing investments and understanding tax implications, emphasizing the strategic thinking required in tax planning. The form's complexity underscores the broader challenges taxpayers face in navigating the tax code, making it a subject of interest for both seasoned tax professionals and individuals striving to optimize their tax situations.

Preview - IRS 8582 Form

Form 8582 |

|

Passive Activity Loss Limitations |

|

OMB No. |

|

|

|||

|

|

|

||

|

|

|

|

|

|

▶ See separate instructions. |

|

2021 |

|

Department of the Treasury |

|

▶ Attach to Form 1040, |

|

|

|

|

▶ Go to www.irs.gov/Form8582 for instructions and the latest information. |

|

Attachment |

Internal Revenue Service (99) |

|

|

Sequence No. 858 |

|

Name(s) shown on return |

|

|

Identifying number |

|

Part I 2021 Passive Activity Loss

Caution: Complete Parts IV and V before completing Part I.

Rental Real Estate Activities With Active Participation (For the definition of active participation, see Special |

|

|

|

||||

Allowance for Rental Real Estate Activities in the instructions.) |

|

|

|

|

|

|

|

1a |

Activities with net income (enter the amount from Part IV, column (a)) . . . |

|

1a |

|

|

|

|

|

|

|

|

|

|||

b |

Activities with net loss (enter the amount from Part IV, column (b)) . . . . |

|

1b |

( |

) |

|

|

c |

Prior years’ unallowed losses (enter the amount from Part IV, column (c)) . . |

|

1c |

( |

) |

|

|

d |

Combine lines 1a, 1b, and 1c |

. . . . . . . . |

|

1d |

|

||

All Other Passive Activities |

|

|

|

|

|

|

|

2a |

Activities with net income (enter the amount from Part V, column (a)) . . . |

|

2a |

|

|

|

|

|

|

|

|

|

|||

b |

Activities with net loss (enter the amount from Part V, column (b)) . . . . |

|

2b |

( |

) |

|

|

c |

Prior years’ unallowed losses (enter the amount from Part V, column (c)) . . |

|

2c |

( |

) |

|

|

d |

Combine lines 2a, 2b, and 2c |

. . . . . . . . |

|

2d |

|

||

3Combine lines 1d and 2d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c or 2c. Report the

losses on the forms and schedules normally used |

3 |

If line 3 is a loss and: • Line 1d is a loss, go to Part II.

• Line 2d is a loss (and line 1d is zero or more), skip Part II and go to line 10.

Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part II. Instead, go to line 10.

Part II Special Allowance for Rental Real Estate Activities With Active Participation

Note: Enter all numbers in Part II as positive amounts. See instructions for an example.

4 |

Enter the smaller of the loss on line 1d or the loss on line 3 |

||

5 |

Enter $150,000. If married filing separately, see instructions |

5 |

|

6 |

Enter modified adjusted gross income, but not less than zero. See instructions |

6 |

|

|

Note: If line 6 is greater than or equal to line 5, skip lines 7 and 8 and enter |

|

|

|

on line 9. Otherwise, go to line 7. |

|

|

7 |

Subtract line 6 from line 5 |

7 |

|

8Multiply line 7 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions

9 |

Enter the smaller of line 4 or line 8 |

Part III Total Losses Allowed

4

8

9

10 |

Add the income, if any, on lines 1a and 2a and enter the total |

|

11 |

Total losses allowed from all passive activities for 2021. Add lines 9 and 10. See instructions to find |

|

|

out how to report the losses on your tax return |

|

|

Complete This Part Before Part I, Lines 1a, 1b, and 1c. See instructions. |

|

Part IV |

||

10

11

Name of activity

Current year |

Prior years |

Overall gain or loss |

|||

|

|

|

|

|

|

(a) Net income |

(b) Net loss |

(c) Unallowed |

(d) Gain |

(e) Loss |

|

(line 1a) |

(line 1b) |

loss (line 1c) |

|||

|

|

||||

Total. Enter on Part I, lines 1a, 1b, and 1c ▶ |

|

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 63704F |

Form 8582 (2021) |

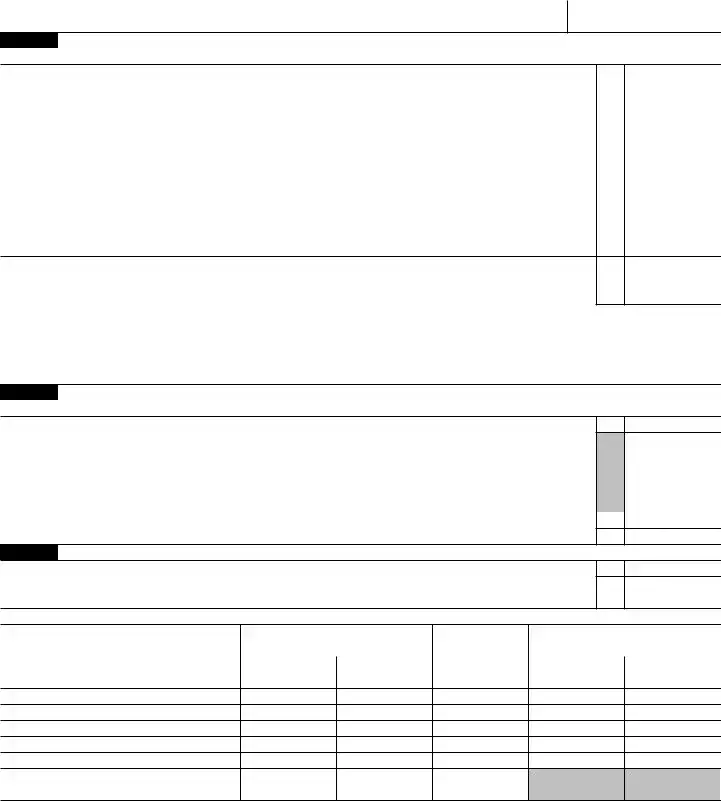

Form 8582 (2021) |

Page 2 |

Part V Complete This Part Before Part I, Lines 2a, 2b, and 2c. See instructions.

Name of activity

Current year |

Prior years |

Overall gain or loss |

|||

|

|

|

|

|

|

(a) Net income |

(b) Net loss |

(c) Unallowed |

(d) Gain |

(e) Loss |

|

(line 2a) |

(line 2b) |

loss (line 2c) |

|||

|

|

||||

Total. Enter on Part I, lines 2a, 2b, and 2c ▶

Part VI |

Use This Part if an Amount Is Shown on Part II, Line 9. See instructions. |

Name of activity

Form or schedule and line number to be reported on (see instructions)

(a)Loss

(b)Ratio

(c)Special allowance

(d)Subtract column (c) from

column (a).

Total . |

. . . . . . . . . . . . . . . . ▶ |

|

Allocation of Unallowed Losses. See instructions. |

Part VII |

1.00

Name of activity

Form or schedule and line number to be reported on (see instructions)

(a)Loss

(b)Ratio

(c)Unallowed loss

Total . |

. . . . . . . . . . . . . . . . . . ▶ |

|

Allowed Losses. See instructions. |

Part VIII |

1.00

Name of activity

Form or schedule and line number to be reported on (see instructions)

(a)Loss

(b)Unallowed loss

(c)Allowed loss

Total . . . . . . . . . . . . . . . . . . . ▶

Form 8582 (2021)

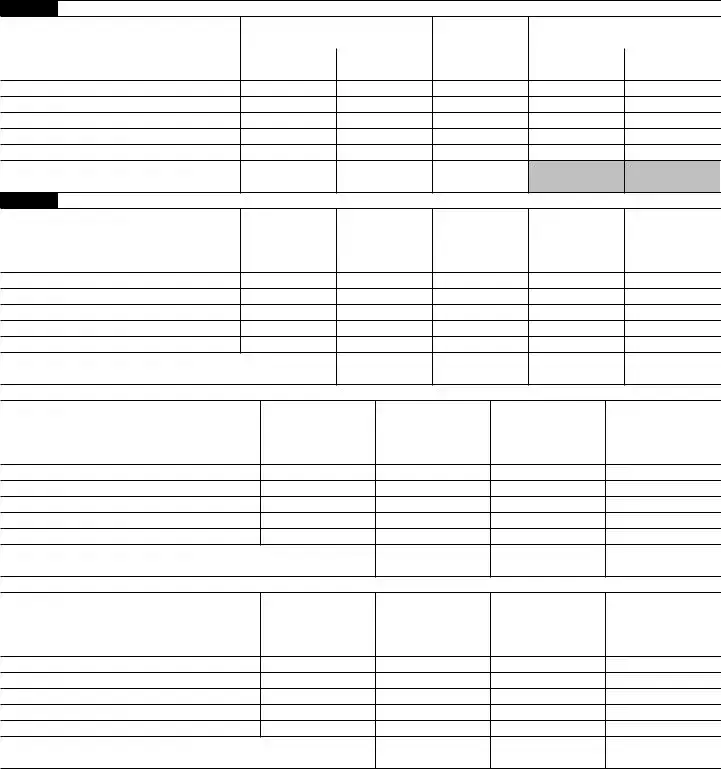

Form 8582 (2021) |

|

|

|

|

|

Page 3 |

|

Part IX |

|

Activities With Losses Reported on Two or More Forms or Schedules. See instructions. |

|

||||

Name of activity: |

(a) |

(b) |

(c) Ratio |

(d) Unallowed |

(e) Allowed |

||

|

|

|

loss |

loss |

|||

|

|

|

|

|

|

||

Form or schedule and line number to be reported on (see instructions):

1a Net loss plus prior year unallowed loss from form or schedule . . ▶

bNet income from form or schedule ▶

cSubtract line 1b from line 1a. If zero or less, enter

Form or schedule and line number to be reported on (see instructions):

1a Net loss plus prior year unallowed loss from form or schedule . . ▶

bNet income from form or schedule ▶

cSubtract line 1b from line 1a. If zero or less, enter

Form or schedule and line number to be reported on (see instructions):

1a Net loss plus prior year unallowed loss from form or schedule . . ▶

bNet income from form or schedule ▶

cSubtract line 1b from line 1a. If zero or less, enter

Total |

. . . . . . . . . . . . . . . . . ▶ |

1.00 |

Form 8582 (2021)

Form Data

| Fact Number | Description |

|---|---|

| 1 | The IRS Form 8582 is specifically designed to report passive activity loss limitations. |

| 2 | It is used by individual taxpayers, estates, and trusts to detail the amounts of passive loss and any current year income from passive activities. |

| 3 | Passive activities are defined by the IRS as activities which involve the conduct of any trade or business in which the taxpayer does not materially participate. |

| 4 | The form is utilized to calculate the allowable passive activity loss that can be deducted in the current year, helping to ensure losses are only claimed to the extent allowed by law. |

| 5 | If total net income from passive activities is positive, the form may not need to be filed, since the form primarily addresses losses. |

| 6 | Real estate professionals who meet certain criteria may bypass some of the passive activity loss rules, impacting how the Form 8582 is filled out. |

| 7 | The form does not apply to corporations; it's for use by non-corporate entities and individuals only. |

Instructions on Utilizing IRS 8582

Filling out IRS forms can often seem overwhelming due to their complexity and the detailed information required. The IRS Form 8582 is used by individuals to report passive activity loss limitations. This step-by-step guide aims to simplify the process, helping filers accurately complete their 8582 form and ensuring they comply with tax regulations. While this guide provides a structured approach to filling out the form, individuals should consider consulting with a tax professional to ensure accuracy, especially in complex cases.

- Gather all necessary documentation related to your passive activities, including income and losses from rental properties or businesses in which you do not actively participate.

- Download the latest version of IRS Form 8582 from the Internal Revenue Service website to ensure you are using the most current form.

- Start by filling out your personal information at the top of the form, including your name and Social Security Number (SSN).

- Proceed to Part I, where you will categorize passive activity losses. If you have losses from rental activities, they go in line 1. Any other passive activity losses should be recorded on line 2.

- In Part II, calculate your total losses allowed for the current tax year. This section helps determine how much of your passive activity loss can be deducted.

- Move to Part III to note any prior year unallowed losses. These are losses that were limited in previous years which can now be deducted.

- In Part IV, summarize the total losses reported and allowed. This section requires you to subtract any losses that are not permitted from your current year's passive activity loss.

- Finally, if you have any passive activity credits, fill in Part V to calculate the special allowance for rental real estate activities with active participation.

- Review the form thoroughly once completed. Look out for any mathematical errors or incomplete sections that could delay processing or result in penalties.

- Attach the completed Form 8582 to your tax return. Ensure you also include any other required forms or schedules that pertain to your passive activities.

- Keep a copy of the completed Form 8582 for your records. It’s important to have a personal record in case the IRS has questions or requires additional documentation in the future.

After completing and submitting IRS Form 8582 along with your tax return, the next steps largely depend on the complexity of your tax situation and the specifics of your passive activities. The IRS may process your return without issue, or you might receive a request for additional information if there are questions. Keeping detailed records and understanding the limitations on passive activity losses can help navigate any potential follow-up more smoothly. Remember, patience is key when dealing with tax matters, as processing times can vary.

Obtain Answers on IRS 8582

-

What is the IRS Form 8582 and who needs to use it?

The IRS Form 8582 is designed for taxpayers to report passive activity loss limitations. Essentially, if you have income from rental activities or businesses in which you do not actively participate, you might have passive activity losses. The form helps to calculate how much of these losses can be deducted in the current tax year. This form is necessary for individuals, estates, and trusts with passive losses and is a crucial step in ensuring your tax calculations are accurate.

-

How does the IRS define "passive activity" for the purposes of Form 8582?

Passive activity is defined by the IRS as any trade or business activity where you do not materially participate. This typically includes rental activities, regardless of your level of participation, except for real estate professionals who meet specific criteria. Material participation involves regular, continuous, and substantial involvement in operations. If you don't meet these criteria, your losses from these activities are usually considered passive.

-

What are passive activity loss limitations?

Passive activity loss limitations are rules set by the IRS to limit the amount of passive losses you can deduct in a given tax year. Your passive activity losses can only be deducted up to the amount of your passive activity income. If your losses exceed your income, the excess loss can be carried forward to future tax years, subject to the same limitations. Form 8582 helps you to figure out these amounts and ensure your deductions comply with IRS regulations.

-

Can passive activity losses be carried forward indefinitely?

Yes, if your passive activity losses exceed your passive income, you are not allowed to deduct the excess loss in the current tax year. However, these losses are not lost forever. You can carry them forward to offset future passive income indefinitely. Each year, you'll use Form 8582 to calculate and report these amounts until they are fully utilized.

-

Are there any exceptions to the passive activity loss rules?

There are exceptions to these rules. One significant exception is for real estate professionals. If you qualify as a real estate professional under IRS guidelines, your rental real estate activities may be considered non-passive, allowing you to deduct losses against other types of income. Additionally, there is a $25,000 allowance for passive rental real estate losses for certain active participants, subject to phase-out based on modified adjusted gross income. It's crucial to understand these exceptions to maximize your eligible deductions.

-

Where can I find IRS Form 8582, and how do I submit it?

IRS Form 8582 is available for download from the IRS website. You can also obtain a copy from a tax professional or a local IRS office. Once completed, it should be attached to your Federal income tax return (Form 1040 or its variant) and submitted by the tax filing deadline. Electronic filing is an option through IRS-approved software, which can also help in accurately completing the form and calculating any limitations.

Common mistakes

-

Not Understanding Passive Activity Losses

One common mistake is the lack of understanding of what constitutes passive activity losses. These are losses from business activities in which the taxpayer does not materially participate. Incorrectly classifying income or losses as passive when they are not (or vice versa) can lead to inaccuracies on the form.

-

Failing to Report All Passive Activities

Taxpayers often overlook some of their passive activities, failing to report them. Every passive activity should be accounted for, regardless of whether it generated a profit or loss in the tax year in question. Overlooking an activity can result in incomplete or incorrect form submission.

-

Incorrectly Calculating Adjusted Gross Income (AGI)

The form uses your adjusted gross income to determine the passive activity loss allowance. An error in calculating your AGI can lead to an incorrect loss allowance, affecting the accuracy of the form and potentially your tax liability.

-

Misusing Form 8582 with Real Estate Professionals

Real estate professionals often mistakenly believe they should not file Form 8582. However, if they have passive rental losses and meet certain conditions concerning their participation in rental activities, they need to use the form to correctly report their losses.

-

Overlooking Carryover Losses

It's not uncommon for taxpayers to forget to include carryover losses from previous years. Form 8582 requires you to report not just the current year's losses but also any losses that were not fully deductible in prior years.

To avoid these mistakes, thoroughness, and careful review are necessary. Additionally, consulting with a tax professional can provide clarity and ensure that your Form 8582 is filled out correctly. With careful attention to detail, taxpayers can navigate these common pitfalls effectively.

Documents used along the form

When dealing with passive activity losses, the IRS Form 8582 is commonly utilized to report and limit the amount of loss that can be deducted in a given tax year. It's vital to understand that this form doesn't stand alone. Various other forms and documents often accompany it, each serving its unique purpose in the broader context of managing and reporting passive income and losses. The accurate completion and submission of these forms are crucial for compliance with tax regulations and to optimize tax benefits.

- Schedule E (Form 1040): This supplement to the standard Form 1040 is used to report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It directly relates to Form 8582 as it details the passive income or losses that are subject to the passive activity loss rules.

- Form 4797: This document is used for the sale of business property and is relevant when determining gains or losses that may not be considered passive. However, certain sections of this form may intersect with passive activity loss calculations.

- Form 1040: The U.S. individual income tax return is inherently tied to any tax document or schedule reporting income, deductions, or losses. Since Form 8582 affects the taxable income reported, it's essential to reference the main tax return form for any overarching entries.

- Form 8825: Comparable to Schedule E, this form is specifically for real estate rental activities of partnerships and S corporations. The results feed into the calculation of passive activity limits on Form 8582 through those entities.

- Schedule K-1 (Form 1065): This form reports a partner's share of a partnership's income, deductions, credits, etc. It's crucial for individuals involved in partnerships since it identifies the passive income and losses that Form 8582 limits.

- Schedule K-1 (Form 1120S): Similarly, for shareholders in an S corporation, this document details the income, losses, and dividends allocated to each shareholder, including information necessary for the completion of Form 8582.

- Form 8960: Used to calculate the Net Investment Income Tax—an additional tax on certain net investment income of individuals, estates, and trusts. While not directly related, certain passive activity income reported on Form 8582 could be subject to this tax.

- Form 6198: At-Risk Limitations form is used when a taxpayer has amounts invested in certain business activities for which they are at risk. This form and its calculations can affect the loss deductions reported on Form 8582.

The interplay between Form 8582 and these associated documents underscores the complexity of tax planning and reporting. They work in tandem to ensure that taxpayers accurately report their income and losses, navigate the limitations on loss deductions, and comply with the tax code. Properly understanding and utilizing these forms can lead to an optimized tax situation, minimizing liabilities while adhering to legal requirements.

Similar forms

IRS Form 1040 (U.S. Individual Income Tax Return): Similar to IRS Form 8582, which is used for reporting passive activity losses, Form 1040 is a comprehensive document that serves as the primary tool for individuals to report their annual income. Both play pivotal roles in calculating tax liability. However, whereas Form 8582 is specifically designed to limit losses on passive activities, Form 1040 encompasses a wide array of income types, deductions, and credits, making it a broader tool for financial disclosure to the Internal Revenue Service.

IRS Schedule E (Supplemental Income and Loss): This form is directly akin to Form 8582 in that it is often used in tandem with it. Schedule E is designated for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, and trusts. Similar to Form 8582, it handles aspects of passive and non-passive income. However, the specific function of Form 8582 is to apply limitations on the loss that can be deducted, while Schedule E is more focused on the initial reporting of such income or loss.

IRS Form 4652 (At-Risk Limitations): This form shares a common purpose with IRS Form 8582 in limiting losses that can be deducted on the taxpayer’s return, specifically those under the "at-risk" rules. These rules limit the amount of loss a taxpayer can claim to the amount they have at risk in the activity. Both forms act as mechanisms to restrict deductible losses to ensure they do not exceed income, thereby maintaining equity in the tax system. Yet, they apply different criteria for the limitation, covering different scopes of tax law.

IRS Form 6251 (Alternative Minimum Tax—Individuals): Form 6251 is utilized to calculate the alternative minimum tax (AMT) for individuals, a parallel tax system designed to ensure that taxpayers with significant deductions still pay a minimum amount of tax. The likeness to Form 8582 comes from their mutual role in modifying taxable income based on certain restrictions and preferences. While Form 8582 limits the deduction of passive activity losses, Form 6251 adjusts income with different preferences and adjustments to arrive at AMT income.

IRS Form 8824 (Like-Kind Exchanges): Though its primary function relates to reporting deferral of tax on like-kind exchanges, IRS Form 8824 intersects in principle with IRS Form 8582 through the mechanism of deferral and limitation of losses or gains. In a like-kind exchange, certain gains are not recognized immediately for tax purposes, akin to the way passive activity losses may be limited and carried forward using Form 8582. Both forms thus govern the timing and recognition of taxable income or loss under particular IRS rules.

Dos and Don'ts

Filling out the IRS Form 8582, which pertains to passive activity loss limitations, requires particular attention to details and regulations. The process can be smoothly navigated by adhering to a set of do's and don'ts. This guidance is crucial for taxpayers seeking to accurately report passive income or losses and to ensure compliance with the tax code.

What to Do:- Read instructions carefully: Before you start filling out the form, thoroughly read the instructions provided by the IRS. This ensures you understand the requirements and avoid common mistakes.

- Gather all necessary documents: Before filling out the form, compile all relevant financial records related to your passive activities, such as income statements and expense receipts.

- Identify all passive activities: Ensure you correctly identify what the IRS considers passive activities. Generally, these involve rental activities or businesses in which you do not materially participate.

- Use accurate figures: Report all income and losses from passive activities accurately. Estimations or rounding off can lead to errors and potential audits.

- Separate passive and non-passive activities: It’s essential to distinguish between passive and non-passive income and losses, as they are treated differently for tax purposes.

- Consider the special $25,000 allowance: If you actively participate in a rental real estate activity, you might be eligible for a special allowance enabling you to deduct some or all of your passive activity losses against your other income.

- Carry forward unused losses: If you cannot deduct all of your passive activity losses in the current year, you can carry them forward to next year's tax return.

- Review state tax implications: Some states have different rules for passive activities, so verify any additional requirements or forms needed for state taxes.

- Seek professional advice: If you're unsure about any aspects of Form 8582, consult with a tax professional or advisor. Their expertise can prevent costly mistakes.

- Don’t ignore the form: If you have passive income or losses, filing Form 8582 is essential to meet IRS requirements. Overlooking this step can result in penalties and interest.

- Don’t mix up passive and non-passive income: Misclassifying income can lead to incorrect tax calculations and potential issues with the IRS.

- Don’t forget to report all activities: Failing to report any passive activity can be viewed as tax evasion, which carries serious penalties.

- Don’t guess or estimate figures: Always use actual numbers from your financial records. Guesswork can lead to inaccuracies and potential audits.

- Don’t overlook carryover losses: If you have losses that were not deductible in prior years, remember to carry them forward to the current year.

- Don’t use the form unnecessarily: If you don't have any passive activities, there's no need to fill out or submit Form 8582.

- Don’t forget to sign the form: An unsigned tax form is considered incomplete by the IRS and can delay processing.

- Don’t ignore IRS notices: If you receive a notice from the IRS related to your Form 8582, respond promptly to avoid further issues.

- Don’t be afraid to amend: If you realize you’ve made a mistake on Form 8582 after filing, you can always file an amended return to correct the error.

Misconceptions

The IRS Form 8582, or Passive Activity Loss Limitations, often engenders confusion among taxpayers who aim to navigate its complexities without fully understanding its purpose or implications. Dispelling some of the common misconceptions can help individuals more accurately file their taxes and plan their investments.

- It's only for real estate professionals. A significant misconception is that Form 8582 is exclusively for those who work in real estate. While real estate professionals might more frequently deal with passive activity loss rules due to rental activities, these regulations also impact taxpayers across various sectors with passive activities or sources of income.

- Any rental loss can be deducted, no matter what. Many individuals believe that all losses from rental properties can be deducted immediately. However, the ability to deduct these losses depends on one's active participation in the activity and their overall income levels. Form 8582 helps determine the extent to which these losses can be deducted in a given tax year.

- Passive activity income affects everyone the same way. The impact of passive activity gains or losses varies greatly depending on an individual's total income and participation level in their passive activities. The form serves to calculate allowable losses based on these criteria, indicating a tailored approach rather than a one-size-fits-all rule.

- You can't use the form if you're not a millionaire. This misconception likely stems from the notion that passive investments or activities are the playground of the wealthy. However, Form 8582 must be filed by anyone with passive activities, regardless of their income bracket, if they are subject to the passive activity loss rules.

- Passive Activity Loss (PAL) rules are simple and straightforward. Despite their deceptively simple aim to limit losses from passive activities, PAL rules entail a complex set of criteria for what constitutes active versus passive participation, how losses can be carried over, and when they can be fully deducted. Understanding these nuances is crucial for accurate filing.

- IRS Form 8582 applies to every type of passive income. While it's true that the form addresses income from passive activities, not all passive income is treated equally under the tax code. Certain types of passive income, such as dividends and interest, are not subject to the same rules as those from rental properties or non-active business participations.

- Filing Form 8582 is a one-time event. Another common misunderstanding is that this is a form you only have to deal with once. In reality, taxpayers need to complete Form 8582 annually if they have ongoing passive activities experiencing losses or gains that are subject to the limitations the form calculates. It is an ongoing part of tax planning and reporting for those with passive investments.

Clarifying these misconceptions is crucial for taxpayers engaged in passive activities to ensure compliance with IRS rules and to optimize their tax obligations effectively. Misunderstanding the form's requirements can lead to errors in tax reporting, resulting in potential audits or penalties. Thus, it's advised that taxpayers dealing with passive activities consult with tax professionals to navigate these rules accurately.

Key takeaways

The IRS 8582 form is crucial for taxpayers with passive activity losses, including real estate. Proper completion and understanding of this form are essential for ensuring that losses are applied correctly and in compliance with IRS rules. Here are nine key takeaways to consider:

Understand what passive activity losses are: These losses occur from business activities in which the taxpayer does not materially participate, and from rental activities regardless of participation, with certain exceptions.

Determine if you need to file Form 8582: If your passive activities resulted in a loss and you have income from other passive activities, or if you have prior year unallowed losses, you likely need to complete this form.

Know the impact on rental real estate activities: Taxpayers involved in rental activities, particularly those with moderate income, may be subject to specific rules that allow a deduction of up to $25,000 under certain conditions.

Understand the Material Participation Tests: These tests help determine if your involvement in an activity is non-passive. Material participation means you are involved in the operation of the activity on a regular, continuous, and substantial basis.

Realize the importance of accurate record-keeping: Proper documentation of time spent on activities, income, and losses is critical. This information is necessary to fill out Form 8582 accurately and to substantiate your claims if audited by the IRS.

Be aware of the form's role in limiting losses: Form 8582 helps to calculate the allowable loss that can be deducted in the current year, with disallowed losses being carried forward to future years.

Consider the impact of grouping activities: Taxpayers have the option to group multiple activities into a single activity to meet material participation tests. This decision has important implications for how losses are reported and should be made with careful consideration.

Understand when to file: This form should be filed with your annual tax return if you have passive activity losses. Failing to file can result in missed opportunities to apply losses or penalties for misreporting.

Consult with a professional: Given the complexity associated with passive activities and the IRS 8582 form, seeking advice from a tax professional knowledgeable in this area is strongly advised. They can provide guidance tailored to your specific situation.

Properly handling passive activity losses and navigating the nuances of IRS Form 8582 can have a significant impact on a taxpayer's financial situation. Awareness and diligence in following these guidelines can help in maximizing potential tax benefits and avoiding pitfalls.

Popular PDF Forms

Palm Tran Connection Application - Keep informed about Palm Tran Connection's application review period and what it means for your service commencement.

Da 3161 Example - Enables quick response to inventory needs, supporting the dynamic requirements of military operations.

Ky Cdl Self-certification Online - Completing this form involves selecting one of four operation categories that best describes the driver's expected driving activities, including interstate and intrastate distinctions.