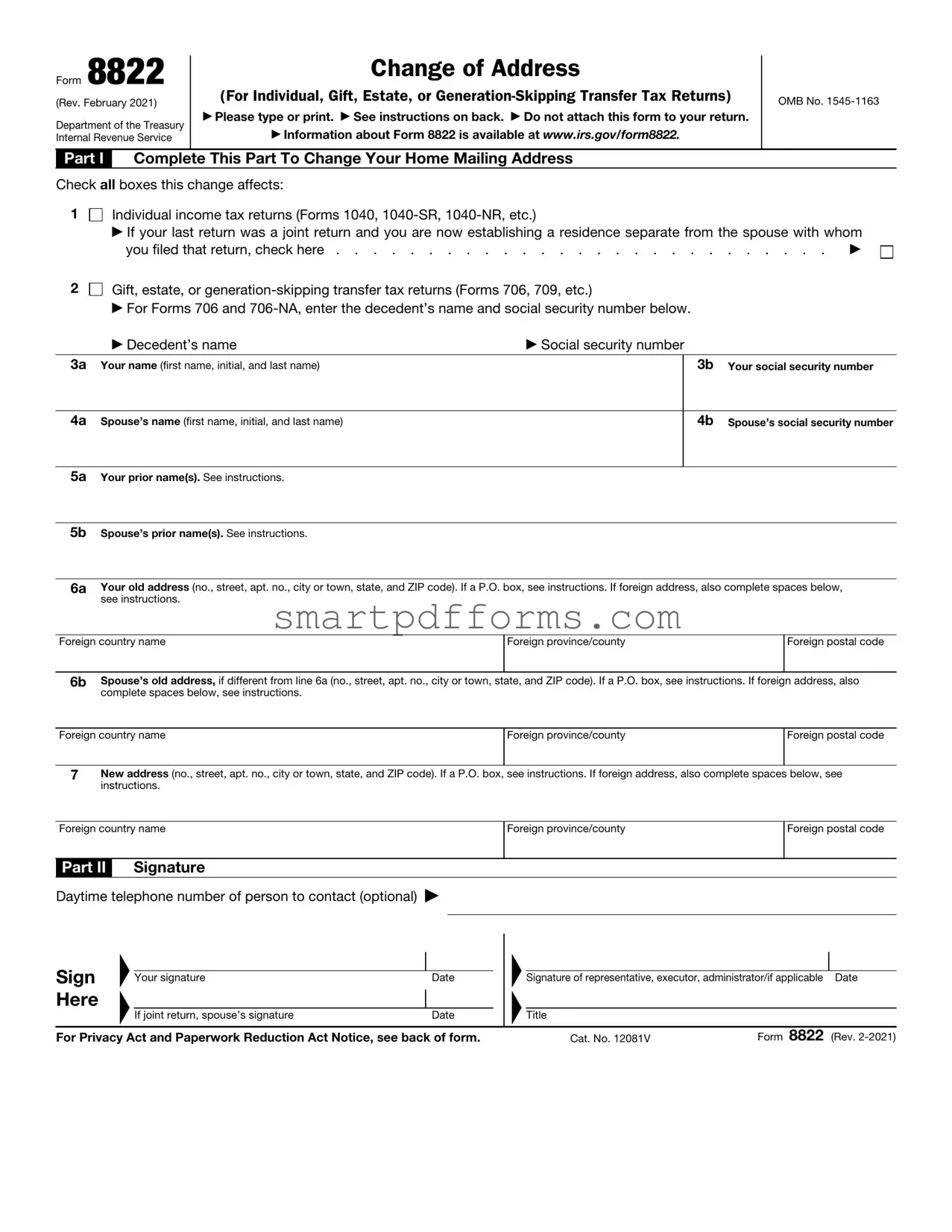

Blank IRS 8822 PDF Template

When individuals move, ensuring that the Internal Revenue Service (IRS) is updated with their new address is a crucial step often overlooked amidst the chaos of relocation. The IRS 8822 form plays a pivotal role in this process, serving as the official channel through which taxpayers notify the IRS of their change of address. This form is not just about keeping mail delivery consistent; it's integral to maintaining clear, direct communication with the IRS, avoiding delays in receiving important notices or refunds. Furthermore, by updating their address promptly, taxpayers can avert potential issues related to unclaimed refunds or notices. The process of completing and submitting the form is straightforward, yet it is embedded with nuances that are important to understand to ensure that the update is processed smoothly and effectively. Given the implications of delayed or missed communications from the IRS, the significance of the IRS 8822 form cannot be understated, making it a critical step for taxpayers during any move.

Preview - IRS 8822 Form

Form 8822 |

Change of Address |

|

(Rev. February 2021) |

(For Individual, Gift, Estate, or |

|

|

||

Department of the Treasury |

▶ Please type or print. ▶ See instructions on back. ▶ Do not attach this form to your return. |

|

▶ Information about Form 8822 is available at www.irs.gov/form8822. |

||

Internal Revenue Service |

Part I Complete This Part To Change Your Home Mailing Address

OMB No.

Check all boxes this change affects:

1

Individual income tax returns (Forms 1040,

▶If your last return was a joint return and you are now establishing a residence separate from the spouse with whom

you filed that return, check here |

▶ |

2

Gift, estate, or

▶For Forms 706 and

▶ Decedent’s name |

▶ Social security number |

3a Your name (first name, initial, and last name)

3b Your social security number

4a Spouse’s name (first name, initial, and last name)

4b Spouse’s social security number

5a Your prior name(s). See instructions.

5b Spouse’s prior name(s). See instructions.

6a |

Your old address (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, |

|

see instructions. |

Foreign country name

Foreign province/county

Foreign postal code

6b |

Spouse’s old address, if different from line 6a (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also |

||

|

complete spaces below, see instructions. |

|

|

|

|

|

|

Foreign country name |

Foreign province/county |

Foreign postal code |

|

|

|

|

|

7New address (no., street, apt. no., city or town, state, and ZIP code). If a P.O. box, see instructions. If foreign address, also complete spaces below, see instructions.

Foreign country name

Part II |

Signature |

Foreign province/county

Foreign postal code

Daytime telephone number of person to contact (optional) ▶

Sign |

▲▲ |

|

|

|

Your signature |

Date |

|||

|

||||

Here |

|

|

|

|

|

|

If joint return, spouse’s signature |

Date |

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

▲▲

Signature of representative, executor, administrator/if applicable Date

Title |

|

Cat. No. 12081V |

Form 8822 (Rev. |

Form 8822 (Rev. |

Page 2 |

Future Developments

Information about developments affecting Form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822.

Purpose of Form

You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address. If this change also affects the mailing address for your children who filed income tax returns, complete and file a separate Form 8822 for each child. If you are a representative signing for the taxpayer, attach to Form 8822 a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process a change of address.

Changing both home and business addresses? Use Form

Prior Name(s)

If you or your spouse changed your name because of marriage, divorce, etc., complete line 5. Also, be sure to notify the Social Security Administration of your new name so that it has the same name in its records that you have on your tax return. This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits.

Addresses

Be sure to include any apartment, room, or suite number in the space provided.

P.O. Box

Enter your box number instead of your street address only if your post office does not deliver mail to your street address.

Foreign Address

Follow the country’s practice for entering the postal code. Please do not abbreviate the country.

“In Care of” Address

If you receive your mail in care of a third party (such as an accountant or attorney), enter “C/O” followed by the third party’s name and street address or P.O. box.

Signature

The taxpayer, executor, donor, or an authorized representative must sign. If your last return was a joint return, your spouse must also sign (unless you have indicated by checking the box on line 1 that you are establishing a separate residence).

|

|

▲ |

If you are a representative signing |

! |

on behalf of the taxpayer, you |

must attach to Form 8822 a copy |

|

CAUTION |

of your power of attorney. To do |

this, you can use Form 2848. The Internal Revenue Service will not complete an address change from an “unauthorized” third party.

Where To File

•If you checked the box on line 2, send Form 8822 to: Department of the Treasury, Internal Revenue Service Center, Kansas City, MO

•If you did not check the box on line 2, send Form 8822 to the address shown here that applies to you:

IF your old home mailing |

THEN use this |

address was in . . . |

address . . . |

|

|

Alabama, Arkansas, |

Department of the |

Delaware, Georgia, Illinois, |

Treasury |

Indiana, Iowa, Kentucky, |

Internal Revenue |

Maine, Massachusetts, |

Service |

Minnesota, Missouri, New |

Kansas City, MO |

Hampshire, New Jersey, |

|

New York, North Carolina, |

|

Oklahoma, South Carolina, |

|

Tennessee, Vermont, |

|

Virginia, Wisconsin |

|

|

|

Florida, Louisiana, |

Department of the |

Mississippi, Texas |

Treasury |

|

Internal Revenue |

|

Service |

|

Austin, TX |

|

|

|

|

Alaska, Arizona, California, |

Department of the |

Colorado, Connecticut, |

Treasury |

District of Columbia, |

Internal Revenue |

Hawaii, Idaho, Kansas, |

Service |

Maryland, Michigan, |

Ogden, UT |

Montana, Nebraska, |

|

Nevada, New Mexico, |

|

North Dakota, Ohio, |

|

Oregon, Pennsylvania, |

|

Rhode Island, South |

|

Dakota, Utah, Washington, |

|

West Virginia, Wyoming |

|

|

|

A foreign country, |

Department of the |

American Samoa, or |

Treasury |

Puerto Rico (or are |

Internal Revenue |

excluding income under |

Service |

Internal Revenue Code |

Austin, TX |

section 933), or use an |

|

APO or FPO address, or |

|

file Form 2555, |

|

or 4563, or are a dual- |

|

status alien or non bona |

|

fide resident of Guam or |

|

the Virgin Islands. |

|

|

|

Guam: |

Department of |

bona fide residents |

Revenue and |

|

Taxation |

|

Government of |

|

Guam |

|

P.O. Box 23607 |

|

GMF, GU 96921 |

Virgin Islands: |

V.I. Bureau of |

bona fide residents |

Internal Revenue |

|

6115 Estate |

|

Smith Bay, |

|

Suite 225 |

|

St. Thomas, VI 00802 |

|

|

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. Our legal right to ask for information is Internal Revenue Code sections 6001 and 6011, which require you to file a statement with us for any tax for which you are liable. Section 6109 requires that you provide your social security number on what you file. This is so we know who you are, and can process your form and other papers.

Generally, tax returns and return information are confidential, as required by section 6103. However, we may give the information to the Department of Justice and to other federal agencies, as provided by law. We may give it to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The use of this form is voluntary. However, if you fail to provide the Internal Revenue Service with your current mailing address, you may not receive a notice of deficiency or a notice and demand for tax. Despite the failure to receive such notices, penalties and interest will continue to accrue on the tax deficiencies.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 16 minutes.

Comments. You can send comments from www.irs.gov/FormComments. Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Form Data

| Fact Number | Description |

|---|---|

| 1 | The IRS 8822 form is used for notifying the Internal Revenue Service of a change in address. |

| 2 | It applies to both individual taxpayers and businesses wanting to report a new address. |

| 3 | There is no fee associated with filing Form 8822 with the IRS. |

| 4 | Filing this form promptly ensures that any tax refunds or correspondence from the IRS reaches the taxpayer without delay. |

| 5 | Form 8822 cannot be submitted electronically; it must be mailed to the address provided on the form. |

| 6 | The IRS recommends sending Form 8822 before filing a tax return if you have moved or plan to move soon. |

| 7 | There are no state-specific versions of IRS Form 8822, as it is a federal form used nationwide. |

Instructions on Utilizing IRS 8822

When life throws you a curveball, like a big move, letting the IRS know your new address is crucial to ensure you don't miss any important mail regarding your taxes. The IRS Form 8822 is your golden ticket to updating your address with the taxman. This might sound like a chore, but it's pretty straightforward once you get down to it. Below, you'll find a step-by-step guide to breeze through filling out this form. So, grab your pen, pull up a chair, and let's get started.

- First things first, download a current copy of IRS Form 8822. Ensure it's the most up-to-date version by checking the IRS website.

- Start with the basics: fill in your full name. If you filed your last tax return with a different name, make sure to also include your previous name.

- Next, write your Social Security Number (SSN). If you're filing this form with your spouse, include their SSN right next to yours.

- Specify your old address. This is the address currently on file with the IRS.

- Fill in your new address. If you're moving to a place without a traditional mailing address, provide a clear description of its location.

- If your form of mail delivery has changed (for instance, if you're switching from a street address to a P.O. Box), you'll need to mention this in the space provided.

- In case you're also updating your address for your spouse, and their last name or SSN is different from yours, there's a section to include their information too. Repeat steps 2 and 3 for your spouse in this section.

- Checking the box for the type of form you used for your last return helps the IRS handle your update more efficiently. Options include individual, gift, or estate tax returns.

- Sign and date the form. If you're filing together with your spouse, both need to sign.

- Finally, mail the completed Form 8822 to the IRS. The specific mailing address can be found in the instructions for the form, which vary depending on your new location.

Once you've sent off Form 8822, pat yourself on the back for staying on top of your tax responsibilities. The IRS typically takes about four to six weeks to process address changes, so give it some time. Keep an eye on your mail (both old and new addresses, if possible) for any correspondence from the IRS. This proactive step ensures that you stay in the loop, avoiding any potential mix-ups or delays with future tax filings or notifications.

Obtain Answers on IRS 8822

-

What is the IRS 8822 form used for?

The IRS 8822 form is designed to notify the Internal Revenue Service (IRS) of a change in address for an individual, a couple, or a business. By submitting this form, taxpayers ensure that the IRS updates their records, aiding in the accurate delivery of refund checks and correspondence.

-

Who needs to file the IRS 8822 form?

Any taxpayer who has moved and wants the IRS to update their address records should file the 8822 form. This includes both individuals and businesses that have recently changed their location and need the IRS to know their new mailing address for official communications.

-

When should I file the IRS 8822 form?

It's advised to file the IRS 8822 form as soon as possible after moving to a new address. Timely filing ensures that the IRS mail, including refund checks, notices, and other official communications, reaches you without delay.

-

How can I file the IRS 8822 form?

The form can be mailed to the IRS. You should download the form from the IRS website, fill it out with the necessary information, and send it to the address provided in the form's instructions. Ensure you review the form's instructions for specific details about where to send it, as the address may vary depending on your location.

-

Is there a deadline for filing the IRS 8822 form?

There is no specific deadline for filing the IRS 8822 form. The key is to submit it promptly after you move. This action helps maintain uninterrupted communication with the IRS.

-

What information do I need to provide on the IRS 8822 form?

To complete the IRS 8822 form, you'll need to provide your full name, your old address, your new address, your social security number (SSN), or your employer identification number (EIN) if you're filing for a business. If you're filing jointly, you'll also need to include your spouse's SSN.

-

Can I file the IRS 8822 form online?

As of the last update to this content, the IRS does not offer an option to file the 8822 form online. The form must be filled out manually and mailed to the address provided in the form's instructions.

-

Is there a fee to file the IRS 8822 form?

No, there is no fee to file the IRS 8822 form. Taxpayers can submit this form free of charge to update their address with the IRS.

-

How long does it take for the address change to take effect?

After submitting the IRS 8822 form, it generally takes four to six weeks for the address change to be fully processed. During this period, it's important to closely monitor both your old and new addresses for any correspondence from the IRS.

-

What should I do if I move again?

If you move to another address after filing the IRS 8822 form, you should submit a new form with your most current information. This ensures that your records with the IRS are always up to date, and all communications are directed to the right place.

Common mistakes

Filling out IRS Form 8822, which is used for reporting a change of address, seems straightforward, but errors can easily be made. These mistakes can delay the update of your address with the IRS, potentially leading to missed important tax documents or notices. Here are four common errors people often make when completing this form:

-

Not using the correct form version. The IRS updates its forms periodically, and using an outdated version can lead to processing delays or even having the form returned to you.

-

Incorrect or incomplete information. Every section of Form 8822 serves a purpose, and failing to fill out any part or providing inaccurate information can result in the IRS being unable to process the change. This includes misspelling addresses or not providing the full nine-digit ZIP code if known.

-

Omitting previous address details. To accurately process your address change, the IRS needs to verify your identity based on your previous address. Leaving this crucial information out can prevent the success of your address update.

-

Not signing the form. As with most official documents, your signature is required to validate the form. An unsigned Form 8822 is likely to be considered incomplete and will not be processed by the IRS.

By avoiding these common mistakes, your address change with the IRS can be processed smoothly, ensuring that you continue to receive all necessary correspondence related to your tax filings.

Documents used along the form

When individuals or businesses need to update their address with the Internal Revenue Service (IRS), they use IRS Form 8822. This form is critical for ensuring that important tax documents and notifications are sent to the correct location. However, the Form 8822 often forms part of a larger set of documents that are used to manage one’s tax responsibilities efficiently. Here are seven additional forms and documents that are frequently used alongside Form 8822, each serving a unique purpose in the tax filing and management process.

- Form 1040: The U.S. Individual Income Tax Return is the standard form that individuals use to file their annual income tax returns. It provides the IRS with information about the filer’s income, tax deductions, and applicable credits.

- Form 8863: This form is used for claiming education credits. It helps taxpayers apply for two major credits—the American Opportunity Credit and the Lifetime Learning Credit—to save money on higher education expenses.

- Form 4868: The Application for Automatic Extension of Time To File U.S. Individual Income Tax Return allows individuals to request an additional six months to file their tax return. It's especially useful if more time is needed to gather documents or resolve discrepancies.

- Form W-2: The Wage and Tax Statement is issued by employers. It reports an employee’s annual wages and the amount of taxes withheld from their paycheck. This form is essential for accurately completing the Form 1040.

- Form 1099: Various types of 1099 forms report income other than wages, salaries, and tips. This includes independent contractor income (1099-NEC), interest and dividends (1099-INT, 1099-DIV), and other types of payments.

- Form 8821: Tax Information Authorization gives another person or entity permission to access and discuss the taxpayer’s information with the IRS. It does not allow them to represent the taxpayer before the IRS or sign any documents.

- Form 2848: Power of Attorney and Declaration of Representative allows a taxpayer to authorize an individual to represent them before the IRS. This representative can perform acts such as signing agreements or consents and discussing tax matters on behalf of the taxpayer.

Each document plays a substantial role in the broader tax management and compliance process, ensuring both individuals and businesses meet their legal obligations while taking advantage of available deductions and credits. Utilizing these forms in conjunction with Form 8822 can help maintain accuracy in taxpayer information and facilitate timely and efficient communication with the IRS.

Similar forms

The IRS 1040 form is similar to the IRS 8822 form in that it is also submitted to the Internal Revenue Service (IRS) by individuals. While the 8822 form is used to report a change of address, the 1040 form is used for the annual income tax return filing. Both forms are crucial for ensuring that the taxpayer's information is current and correctly recorded in the IRS system.

The IRS W-9 form shares similarities with the IRS 8822 form because both forms involve the submission of taxpayer information to the IRS. The W-9 is typically used to provide taxpayer identification number and certification to entities that pay income to the person completing the form. Like the 8822 form, the W-9 ensures accurate taxpayer information is available for IRS records.

Similar to the IRS 8822, the IRS W-4 form is used by individuals to provide necessary information to the IRS. The W-4 form, however, is specifically designed for employees to indicate their tax withholding preferences to their employers. Both the W-4 and 8822 forms play significant roles in managing individuals' tax responsibilities and personal information within the IRS database.

The Change of Address for Businesses, Form 8822-B, is closely related to the IRS 8822 form but is specifically tailored for business entities. Form 8822-B is used when a business needs to notify the IRS of a change in address or business location. This is analogous to how individual taxpayers use Form 8822 to report their personal address changes, ensuring the IRS has accurate and up-to-date information for sending correspondence and notices.

Dos and Don'ts

Changing your address with the Internal Revenue Service (IRS) is an important step in ensuring that you receive crucial tax documents and correspondence on time. The IRS Form 8822 is specifically designed for this purpose. To complete this task efficiently and accurately, it’s essential to be mindful of the dos and don'ts associated with this form.

Five Things You Should Do When Filling Out IRS Form 8822:

- Ensure your information is current: Double check that all personal information, including your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), is up to date and matches the information on file with the IRS.

- Be precise with your new address: Accuracy is key. Make sure the new address listed on the form is complete and includes any apartment or suite numbers if applicable.

- Use the correct form version: The IRS occasionally updates its forms. Verify that you are using the most current version of Form 8822 to avoid processing delays.

- Report changes promptly: Submit Form 8822 as soon as possible after moving to ensure the IRS has ample time to update your records before sending out important tax documents.

- Keep a copy for your records: After submitting Form 8822 to the IRS, retain a copy for your personal records. This can be helpful if there are any questions or issues that arise regarding your address change.

Five Things You Shouldn't Do When Filling Out IRS Form 8822:

- Don’t forget to sign and date the form: An unsigned or undated form will not be processed, potentially leading to delays in the acknowledgment of your address change.

- Don’t use pencil: Fill out the form using blue or black ink to ensure that the information is legible and maintains its integrity over time.

- Don’t neglect to inform your local post office: In addition to informing the IRS, it is also necessary to update your address with the United States Postal Service to ensure all mail is forwarded correctly.

- Don’t submit incomplete information: Leaving sections of Form 8822 blank can lead to processing delays or incorrect updates to your records.

- Don’t ignore joint accounts: If you file taxes jointly, both individuals must update their address with the IRS, either on the same form or separately, to ensure that both parties receive pertinent tax communications.

Filling out the IRS Form 8822 with attention and care not only ensures your tax records are accurate but also helps protect you from potential issues arising from missed communications. By following these simple guidelines, you can navigate this process more smoothly and with confidence.

Misconceptions

The IRS Form 8822 is used by taxpayers to notify the Internal Revenue Service (IRS) of a change in address. However, there are several misconceptions about this form and its usage. Understanding these can help ensure that individuals use the form correctly and avoid potential complications with their tax obligations.

Misconception 1: The IRS Form 8822 is required for all address changes. While it's important to keep your address current with the IRS to ensure you receive all tax-related correspondence, using Form 8822 is not the only way to report an address change. For example, you can also notify the IRS of your new address by indicating it on your annual tax return.

Misconception 2: Filing Form 8822 will update your address immediately. Even though filing this form notifies the IRS of your address change, the update process may take 4-6 weeks. It's important to make any critical updates or communications with the IRS taking this timeframe into account.

Misconception 3: The IRS automatically informs other federal agencies of your new address. The IRS does not share your updated address with other agencies. If you have obligations or accounts with other federal agencies, you'll need to notify them separately of any changes to your address.

Misconception 4: Form 8822 is also for updating a business address. There is a common misunderstanding that Form 8822 can be used for both personal and business address changes. However, businesses need to use Form 8822-B to report changes in address or the responsible party for the business.

Misconception 5: There is a fee to file Form 8822. There is no charge to file Form 8822 with the IRS. Taxpayers can download the form from the IRS website, complete it, and mail it to the IRS without incurring any costs.

Misconception 6: Electronic filing for Form 8822 is available. As of the last update, the IRS requires Form 8822 to be mailed in paper form. Unlike many other forms, you cannot submit Form 8822 electronically through the IRS website or any tax filing software.

Misconception 7: The IRS uses Form 8822 to track taxpayers for audits. There is a misconception that submitting a Form 8822 can flag an individual for audits. However, the purpose of this form is solely to ensure the IRS has your current address to send correspondence, refunds, and other notices efficiently. It does not influence audit determinations.

Key takeaways

Filing the IRS 8822 form is important for taxpayers who need to report a change of address. To ensure the process is smooth and effective, consider these key takeaways:

- Identify the correct form: There are two versions of Form 8822. Form 8822 is used for changes of address for individual tax returns, while Form 8822-B is used by businesses.

- Timeliness matters: Submit Form 8822 promptly after moving. This ensures that the IRS sends correspondence and refunds to the right address.

- Separate filings for joint filers: If you filed your last return with a spouse or ex-spouse, submit separate forms if you both have new addresses.

- Remember state tax departments: Changing your address with the IRS does not update your address with your state tax department. Contact them directly for an address change.

- Mail or fax only: The IRS currently accepts Form 8822 submissions only via mail or fax. Electronic submissions are not available.

- Details required: Fill out the form with your full name, old address, new address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Signature is mandatory: The form requires your signature to validate the change request. For joint filers, both parties must sign if the change affects both individuals.

- No fee involved: There is no fee to submit Form 8822. Beware of any services that charge a fee for filing this form on your behalf.

Accurately reporting your address change using the IRS 8822 form helps maintain the flow of critical tax-related information between you and the IRS. Taking swift action when you move can prevent missed notices and delayed refunds.

Popular PDF Forms

Connecticut 7B - Explore the straightforward method the Connecticut 7B form offers for demonstrating compliance with workers’ compensation insurance requirements.

Da 3355 - By consolidating promotion criteria into one document, the DA 3355 reduces administrative burdens and errors.

Motion for Contempt Colorado - Structured to help individuals navigate the Colorado judicial process for contempt of court cases with precision.