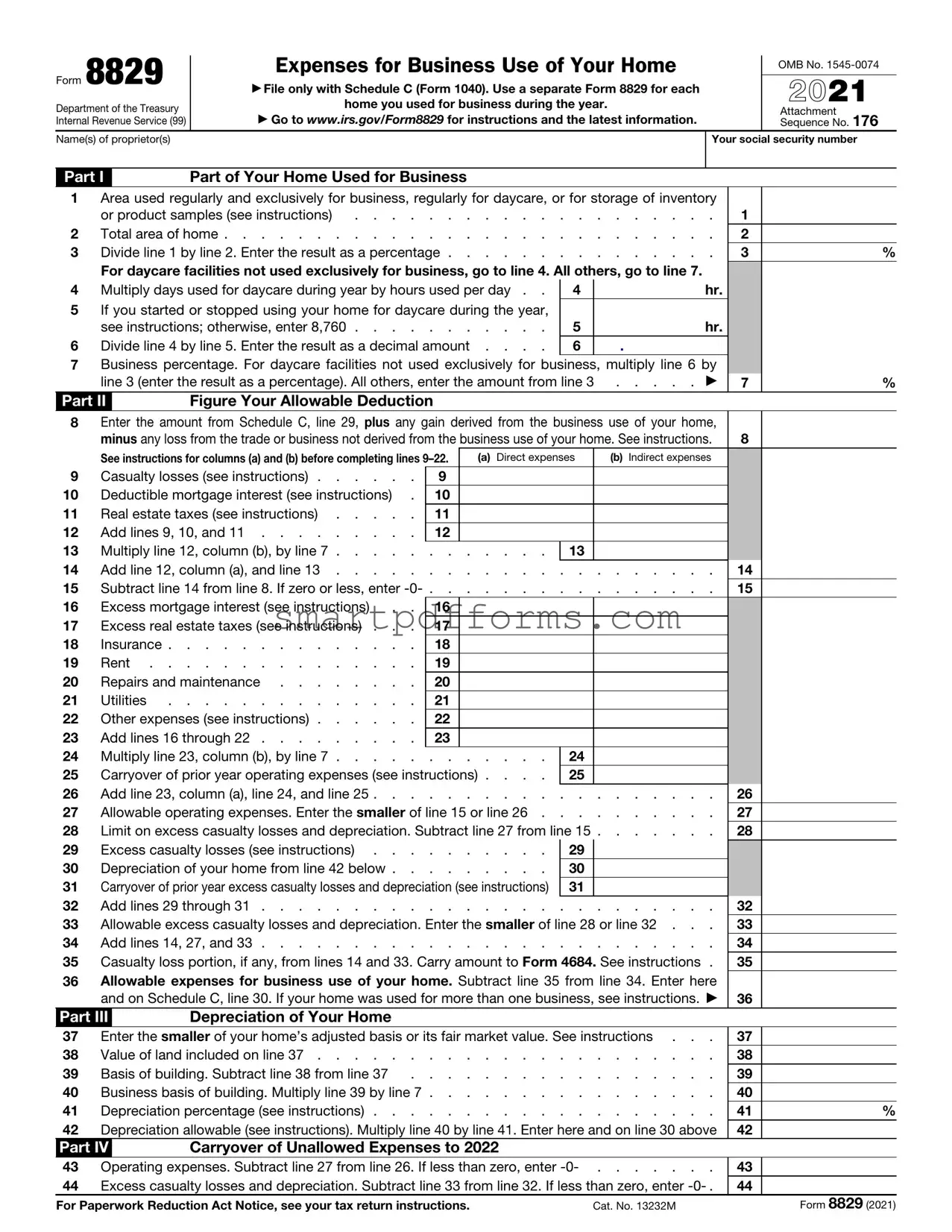

Blank IRS 8829 PDF Template

Many individuals who operate their businesses from their homes often overlook potential tax deductions that can help reduce their taxable income. This is where the IRS Form 8829 plays a crucial role. Designed for those who use part of their home for business, this form allows individuals to calculate and claim deductions for business use of their home. Covering a range of expenses from mortgage interest, insurance, utilities, repairs, and depreciation, Form 8829 intricately details how to determine the percentage of these expenses that can be attributed to business use. It’s important for filers to understand the specific requirements and limitations, such as the stipulation that the home must be the principal place of business or a place where clients are met. By accurately completing Form 8829, taxpayers can ensure they are leveraging available tax benefits, potentially lowering their overall tax liability. Accuracy and attention to detail are paramount when filling out this form to avoid any potential issues with the IRS.

Preview - IRS 8829 Form

|

Form 8829 |

|

Expenses for Business Use of Your Home |

|

|

OMB No. |

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||

|

▶ File only with Schedule C (Form 1040). Use a separate Form 8829 for each |

|

|

2021 |

||||||||

|

Department of the Treasury |

|

home you used for business during the year. |

|

|

|

||||||

|

|

▶ Go to www.irs.gov/Form8829 for instructions and the latest information. |

|

|

Attachment |

176 |

||||||

|

Internal Revenue Service (99) |

|

|

|

Sequence No. |

|||||||

|

Name(s) of proprietor(s) |

|

|

|

|

|

Your social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

Part I |

|

Part of Your Home Used for Business |

|

|

|

|

|

|

|

||

1 |

Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory |

|

|

|

||||||||

|

|

or product samples (see instructions) |

. |

1 |

|

|

||||||

2 |

Total area of home |

. |

2 |

|

|

|||||||

3 |

Divide line 1 by line 2. Enter the result as a percentage |

. |

3 |

|

% |

|||||||

|

|

For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7. |

|

|

|

|

||||||

4 |

Multiply days used for daycare during year by hours used per day . . |

4 |

|

|

hr. |

|

|

|

||||

5 |

If you started or stopped using your home for daycare during the year, |

|

|

|

|

|

|

|

||||

|

|

see instructions; otherwise, enter 8,760 |

5 |

|

|

hr. |

|

|

|

|||

6 |

Divide line 4 by line 5. Enter the result as a decimal amount . . . . |

6 |

|

. |

|

|

|

|

||||

7 |

Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by |

|

|

|

||||||||

|

|

line 3 (enter the result as a percentage). All others, enter the amount from line 3 |

▶ |

7 |

|

% |

||||||

|

Part II |

|

Figure Your Allowable Deduction |

|

|

|

|

|

|

|

||

8Enter the amount from Schedule C, line 29, plus any gain derived from the business use of your home,

|

minus any loss from the trade or business not derived from the business use of your home. See instructions. |

8 |

|||

|

See instructions for columns (a) and (b) before completing lines |

(a) Direct expenses |

(b) Indirect expenses |

|

|

9 |

Casualty losses (see instructions) |

9 |

|

|

|

10 |

Deductible mortgage interest (see instructions) . |

10 |

|

|

|

11 |

Real estate taxes (see instructions) |

11 |

|

|

|

12Add lines 9, 10, and 11 . . . . . . . . . 12

|

|

|

|

|

|

13 |

Multiply line 12, column (b), by line 7 |

. . . . . . |

13 |

|

|

14 |

Add line 12, column (a), and line 13 |

. . . . . . |

. . . . . . . . . |

14 |

|

15 |

Subtract line 14 from line 8. If zero or less, enter |

. . . . . . |

. . . . . . . . . |

15 |

|

16 |

Excess mortgage interest (see instructions) . . |

|

16 |

|

|

17Excess real estate taxes (see instructions) . . . 17

18Insurance . . . . . . . . . . . . . . 18

19 |

Rent |

19 |

20 |

Repairs and maintenance |

20 |

21 |

Utilities |

21 |

22Other expenses (see instructions) . . . . . . 22

23 |

Add lines 16 through 22 . . . . . . . . . 23 |

|

|

|

|

|

|

|

|

24 |

Multiply line 23, column (b), by line 7 |

24 |

|

|

25 |

Carryover of prior year operating expenses (see instructions) . . . . |

25 |

|

|

26 |

Add line 23, column (a), line 24, and line 25 |

. . . . . . . . . |

26 |

|

27 |

Allowable operating expenses. Enter the smaller of line 15 or line 26 . |

. . . . . . . . . |

27 |

|

28 |

Limit on excess casualty losses and depreciation. Subtract line 27 from line 15 |

28 |

||

29 |

Excess casualty losses (see instructions) |

29 |

|

|

30Depreciation of your home from line 42 below . . . . . . . . . 30

31 |

Carryover of prior year excess casualty losses and depreciation (see instructions) 31 |

|

|

32 |

|

|

32 |

Add lines 29 through 31 |

|||

33 |

Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32 . . . |

33 |

|

34 |

Add lines 14, 27, and 33 |

34 |

|

35 |

Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684. See instructions . |

35 |

|

36Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here

and on Schedule C, line 30. If your home was used for more than one business, see instructions. ▶ 36

Part III |

Depreciation of Your Home |

37 |

Enter the smaller of your home’s adjusted basis or its fair market value. See instructions . . . |

38 |

Value of land included on line 37 |

39 |

Basis of building. Subtract line 38 from line 37 |

40 |

Business basis of building. Multiply line 39 by line 7 |

41 |

Depreciation percentage (see instructions) |

42Depreciation allowable (see instructions). Multiply line 40 by line 41. Enter here and on line 30 above

Part IV |

Carryover of Unallowed Expenses to 2022 |

37

38

39

40

41

42

%

43 |

Operating expenses. Subtract line 27 from line 26. If less than zero, enter |

43 |

|

|

44 |

Excess casualty losses and depreciation. Subtract line 33 from line 32. If less than zero, enter |

44 |

|

|

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 13232M |

|

Form 8829 (2021) |

|

Form Data

| Fact | Description |

|---|---|

| Form Name | IRS Form 8829 |

| Purpose | Used to calculate the allowable expenses for business use of your home, which can then be deducted on your tax return. |

| Eligibility | Available to individuals who have a home office or specific area in their home used regularly and exclusively for business. |

| Deduction Categories | Includes expenses such as mortgage interest, insurance, utilities, repairs, and depreciation. |

| Limitations | The amount of the deduction is limited to the gross income derived from the business use of the home minus business expenses. |

| State-Specific Versions | Generally, IRS Form 8829 is federal and thus not subject to state-specific versions; however, taxpayers must check state tax requirements separately. |

| Filing Requirements | Should be filed with your annual tax return if claiming a deduction for the business use of your home. |

Instructions on Utilizing IRS 8829

Filling out IRS Form 8829 is necessary for individuals who operate a business from their home and aim to claim deductions for its use. The form can seem complicated at first glance, but breaking it down into steps makes the process more manageable. Understanding how to accurately complete Form 8829 ensures that you take full advantage of the home office deductions available, potentially saving money on your taxes. Here's a straightforward guide on how to fill it out.

- Start by gathering information about your home expenses, including rent or mortgage interest, insurance, utilities, repairs, and maintenance. You'll need these details to accurately fill out the form.

- Calculate the square footage of your home office space and the total square footage of your home. This information is essential for figuring out the percentage of your home used for business, which impacts how much you can deduct.

- Enter your name and social security number at the top of the form to ensure it's matched to your tax return correctly.

- In Part I, under "Part of Your Home Used for Business," provide the requested square footage measurements. Enter the square footage of your home used exclusively for business and the total square footage of your home.

- In Part II, "Figure Your Allowable Deduction," list your direct and indirect expenses. Direct expenses are those only for the business part of your home, like painting or repairs in your home office. Indirect expenses are for keeping up and running your entire home, such as rent, insurance, and utilities. Calculate the total of these expenses.

- Using the percentage calculated from your square footage in Part I, apply this to your indirect expenses to determine the portion that can be deducted. Add this to your direct expenses to calculate your total allowable deduction.

- If your business income is less than your total business expenses, Part III, "Limit on Write-off," will help you determine how much of your home office expenses you can deduct this year. The form guides you through subtracting certain expenses from your gross income to arrive at the limit for your deduction.

- Finally, in Part IV, "Carryover of Unallowed Expenses to 2023," if you aren't allowed to deduct all your home office expenses this year because of the limitation, you can carry over some expenses into the next year.

- Double-check all the entries to ensure accuracy. Small mistakes can cause delays or audits.

- Once completed, attach Form 8829 to your tax return. Remember, this form is used in conjunction with Schedule C, which is for reporting income and expenses from your business.

Correctly completing IRS Form 8829 plays a critical role in maximizing your home office deductions while staying compliant with tax laws. Take your time to accurately measure your space, gather necessary expense reports, and thoroughly review each part of the form before submission. This detailed approach helps streamline the process, ensuring you don't miss out on valuable deductions.

Obtain Answers on IRS 8829

-

What is IRS Form 8829?

IRS Form 8829 is used by individuals who operate a business from their home and want to claim a deduction for the business use of their home on their federal tax return. This form helps calculate the allowable expenses that can be deducted based on the percentage of the home used for business purposes.

-

Who is eligible to use Form 8829?

Individuals who use a portion of their home exclusively and regularly for business activities may use Form 8829. This includes homeowners and renters, and the home can be a house, apartment, or another type of dwelling. There are specific requirements regarding the business use of the home that must be met to be eligible.

-

What expenses can be deducted using Form 8829?

- Mortgage interest or rent

- Real estate taxes

- Utilities (e.g., electricity, gas, water)

- Repairs and maintenance directly related to the business area of your home

- Depreciation of the portion of the home used for business

These are among the primary expenses that can be deducted. However, the expenses must be allocated between personal and business use based on the square footage or another reasonable method.

-

How is the deductible amount for home office expenses calculated?

The deductible amount is calculated based on the percentage of the home's total square footage used for business. Expenses are then apportioned between personal and business use based on this percentage. The form provides a step-by-step calculation to help determine this amount.

-

Can I claim a deduction if I work from home for an employer?

Yes, but only if the use of the home is for the employer's convenience and you do not rent any part of your home to your employer. The exclusive and regular use criteria must also be met.

-

What records should I keep to support my deductions?

It's important to keep detailed records to support the expenses claimed on Form 8829. This includes bills, receipts, and records that specifically document the business use of your home. Additionally, keeping a diagram or photo of your workspace can help validate the exclusive use of the portion claimed for business.

-

How does the simplified option compare to the regular method?

The simplified option allows a standard deduction of $5 per square foot of the home used for business, up to 300 square feet, without the need to calculate individual expenses. The regular method requires detailed records and calculations of actual expenses. The simplified option may offer less paperwork, but possibly a smaller deduction.

-

Can I switch between the simplified method and the regular method each year?

Yes, taxpayers can choose between the simplified and regular methods on a yearly basis. This choice allows individuals to select the method that provides the higher deduction in any given year, based on their circumstances.

-

Where do I file IRS Form 8829?

IRS Form 8829 is filed as part of your Schedule C (Form 1040) or the tax return form applicable to your business type. It's not filed independently but is attached to and submitted with your income tax return.

Common mistakes

Filling out the IRS 8829 form, which is essential for individuals looking to claim the home office deduction on their tax returns, can be a tricky process. This form helps calculate the deduction for business use of your home, allowing taxpayers to account for expenses related to their home office. However, taxpayers often encounter pitfalls that can lead to mistakes, potentially impacting the deduction amount. Identifying these common errors can help ensure that you complete the form correctly and maximize your deductions.

Not meeting the exclusive use test. The space claimed must be used regularly and exclusively for business. Using the space for both business and personal purposes disqualifies the deduction.

Calculating the square footage incorrectly. It's vital to accurately measure the area used for business to determine the correct deduction.

Overlooking eligible expenses. Many individuals fail to include all allowable expenses, such as mortgage interest, insurance, utilities, repairs, and depreciation.

Improper allocation of expenses. The expenses must be divided between personal and business use based on the square footage or another reasonable method.

Mixing up direct and indirect expenses. Direct expenses benefit only the business part of your home and are fully deductible. Indirect expenses, benefiting the entire house, must be apportioned.

Incorrectly reporting carryover amounts. If the gross income from the business use of your home is less than your total home business expenses, you may carry over the excess to the next year. This amount is often reported inaccurately.

Failing to properly adjust the home basis for depreciation. Claiming depreciation reduces your home's basis, which is important to consider when selling your home.

Ignoring state-specific rules. Some states have their own qualifications and deductions that may differ from federal rules.

Avoiding these common mistakes can help taxpayers accurately claim the home office deduction. It's also advised to consult with a tax professional to navigate the complexities of the IRS 8829 form and to ensure that all eligible expenses are captured and properly reported.

Documents used along the form

When filing taxes, particularly for those who are self-employed or run a business from home, Form IRS 8829 is commonly utilized to calculate and report the expenses for business use of your home. However, this is often just one piece within a larger puzzle of documentation needed to navigate tax season successfully. There are several other forms and documents typically accompanied by or used in conjunction with Form IRS 8829 to ensure a thorough and accurate tax filing. Understanding these forms can help prevent missteps and maximize potential deductions.

- Form 1040: This is the standard federal income tax form used by individuals in the U.S. It's where you'll summarize your income, deductions, and credits, including any business income or loss that's calculated on other forms.

- Schedule C (Form 1040): Essential for self-employed individuals or small business owners, this form details the profits and losses of the business. Information from this form helps in filling out Form 8829.

- Schedule SE (Form 1040): Utilized to calculate self-employment tax owed by individuals who earned income as freelancers, contractors, or business owners.

- Form 1099-MISC: This document is important for reporting any income received as an independent contractor or freelancer. It’s often a key document for those who need to file Schedule C and Form 8829.

- Form 4562: For reporting depreciation and amortization, including any part of your home used for business purposes, which may also relate to deductions claimed on Form 8829.

- Receipts and Records: Keeping detailed records and receipts of all business expenses, including those related to the use of your home, is crucial for accurately filling out Form 8829 and other related tax forms.

- Bank Statements and Financial Documents: These documents can help substantiate income and expense claims made on your tax forms.

- Utility Bills: If you're claiming a portion of your home expenses for business use, copies of your utility bills will be necessary to calculate the portion you can deduct.

Filing your taxes can be a daunting process, especially with the numerous forms and stipulations involved. By understanding the above documents and their purposes, you can ensure a smoother filing process and avoid overlooking any deductions you're entitled to. Always keep in mind that tax laws change, and staying updated on the latest IRS guidelines is crucial for accurate filing. When in doubt, consulting with a tax professional can help clarify any uncertainties and provide peace of mind.

Similar forms

The Schedule C (Form 1040) is similar to IRS Form 8829 as it also deals with the reporting of income and expenses related to a business operated by a sole proprietor. Both forms are essential for those looking to deduct business expenses to lower their taxable income.

Schedule E (Form 1040) shares similarities with Form 8829 in its function of reporting income from rental real estate, royalties, partnerships, S corporations, trusts, and estates. Similar to Form 8829, which allows for the deduction of home office expenses, Schedule E enables taxpayers to deduct expenses related to rental property.

The Form 4562: Depreciation and Amortization parallels Form 8829 in its purpose of allowing taxpayers to claim deductions. While Form 8829 focuses on expenses related to the business use of a home, Form 4562 is used to deduct the cost of property over time, including items that might be used in a home office.

Form 2106: Employee Business Expenses is akin to Form 8829 in that it is designed for individuals to deduct work-related expenses. However, while Form 8829 is tailored for self-employed individuals deducting home office expenses, Form 2106 is intended for employees to deduct unreimbursed business expenses.

Lastly, the Schedule A (Form 1040) Itemized Deductions document is comparable to Form 8829 because both involve deducting expenses to reduce taxable income. While Schedule A covers a broad range of deductions such as medical and dental expenses, taxes paid, and interest, Form 8829 specifically focuses on expenses associated with the use of one's home for business purposes.

Dos and Don'ts

Filing out the IRS Form 8829, crucial for taxpayers seeking to deduct expenses for the business use of their home, requires careful attention. Below are the dos and don'ts that can help ensure the process is completed correctly and effectively:

Do's:

- Double-check your eligibility: Before you start, make sure you meet the criteria for claiming a home office deduction. This includes using part of your home exclusively for business on a regular basis.

- Gather all necessary documents: Collect all receipts, bills, and records of expenses related to your home office. This includes mortgage interest, insurance, utilities, repairs, and depreciation.

- Calculate the percentage of your home used for business: You will need to provide the size of your home office and the total size of your home to determine the percentage of business use. Accurate measurements are crucial here.

- Understand which expenses are deductible: Know the difference between direct and indirect expenses. Only certain costs are deductible, and how you claim them depends on whether they're solely for your home office or for your entire home.

- Seek professional help if needed: If you find the form confusing or your situation is complicated, don’t hesitate to seek advice from a tax professional. They can provide valuable guidance and prevent costly mistakes.

Don'ts:

- Mistake personal expenses for business expenses: Only claim costs that are directly related to your business operations. Personal living expenses are not deductible.

- Forget to keep a detailed record: It's important to maintain a log of all the expenses you’re claiming. This will be invaluable if the IRS has questions or if you're audited.

- Overlook depreciating your home: You may be able to claim depreciation on the portion of your home used for business. Failing to do this can result in a missed opportunity for larger deductions.

- Rush through filling out the form: Take your time with Form 8829 to avoid errors. Missteps can lead to delays or audits, so carefully review each section before submitting.

- Assume last year’s information applies: Even if you’ve filed this form in previous years, don’t assume all information stays the same. Re-evaluate your eligibility and the extent of your deductible expenses annually.

Misconceptions

The IRS Form 8829 is a document utilized by individuals who operate their businesses from home, enabling them to calculate and claim deductions for business use of their home on their tax returns. However, misconceptions surrounding the IRS Form 8829 can lead to errors or missed opportunities for deductions. Here are four common misconceptions:

- Only full-time business owners can use Form 8829. This is not accurate. Whether you're engaged in your business full-time or part-time, as long as part of your home is used regularly and exclusively for business, you may qualify to file Form 8829. This includes employees who work from home for the convenience of their employer and meet certain conditions.

- You can claim the entire home expenses on Form 8829. This statement is misleading. The expenses deductible on Form 8829 are based on the percentage of your home used for business. This means only a portion of the total expenses, proportional to the area used for business purposes, can be claimed, not the entire home expenses.

- Form 8829 is too complicated for the average taxpayer to complete without professional help. While it's true that Form 8829 involves detailed calculations, the IRS provides comprehensive instructions to assist taxpayers. Many find they can successfully fill out the form by carefully following these guidelines. Additionally, tax software often simplifies the process, making professional help not always necessary.

- The simplified option for home office deductions negates the need for Form 8829. The simplified option does offer a straightforward way to claim a home office deduction, allowing taxpayers to multiply a prescribed rate by the square footage of their home office, up to a certain limit. However, this doesn't always result in the highest deduction. Taxpayers should calculate their deduction both ways (using the simplified option and the regular method with Form 8829) to determine which provides the most significant benefit. Form 8829 may yield higher deductions for those with substantial home office expenses.

Key takeaways

When tackling the IRS 8829 form, which is essential for those looking to deduct expenses for the business use of their home, it's important to understand its requirements, benefits, and the common pitfalls to avoid. Here’s a breakdown of key takeaways to keep in mind.

- Eligibility is Key: Before diving into the form, ensure you actually qualify for the home office deduction. The space must be used regularly and exclusively for business.

- Understand Deductible Expenses: Know which expenses are deductible, including direct expenses (e.g., painting or repairs in the office area) and indirect expenses (e.g., utilities, insurance, depreciation).

- Proportional Deduction: The amount you can deduct is proportional to the size of your home office compared to your entire home. Accurate measurement is crucial.

- Simplify with the Simplified Option: For a simpler calculation, you can opt for the Simplified Option, which allows a standard deduction per square foot of your home used for business, up to 300 square feet.

- Maintain Records: Keep meticulous records of all expenses. This not only supports your deductions but also prepares you for any potential IRS inquiries.

- Differentiate Between Home and Business: Clearly delineate personal living expenses from business expenses to avoid muddling the calculation and risking IRS rejection.

- Consider Depreciation: If you're using the regular method for deductions, remember to compute depreciation for the portion of your home used for business.

- Be Aware of Deduction Limits: Your deduction might be limited if your business's gross income is less than your total business expenses. Carryover the unallowed portion to the next year if this applies.

- Professional Guidance Can Help: Due to the complexity and potential impacts on taxes, consulting with a tax professional can be beneficial to navigate the specifics of Form 8829 effectively.

Correctly filling out and understanding the IRS 8829 form can significantly affect your tax responsibilities and benefits. It’s worth taking the time to ensure it’s done right to maximize your home office deduction while staying compliant with IRS regulations.

Popular PDF Forms

Ohio Safe - Contains designated areas for the seller and buyer to provide their full addresses, facilitating contact if needed.

Hud1 - Shows the distribution of closing costs between buyer and seller in a real property transaction.

Transmittal Form Meaning - Provides a formal record of document transmittal, adding a layer of accountability and traceability.