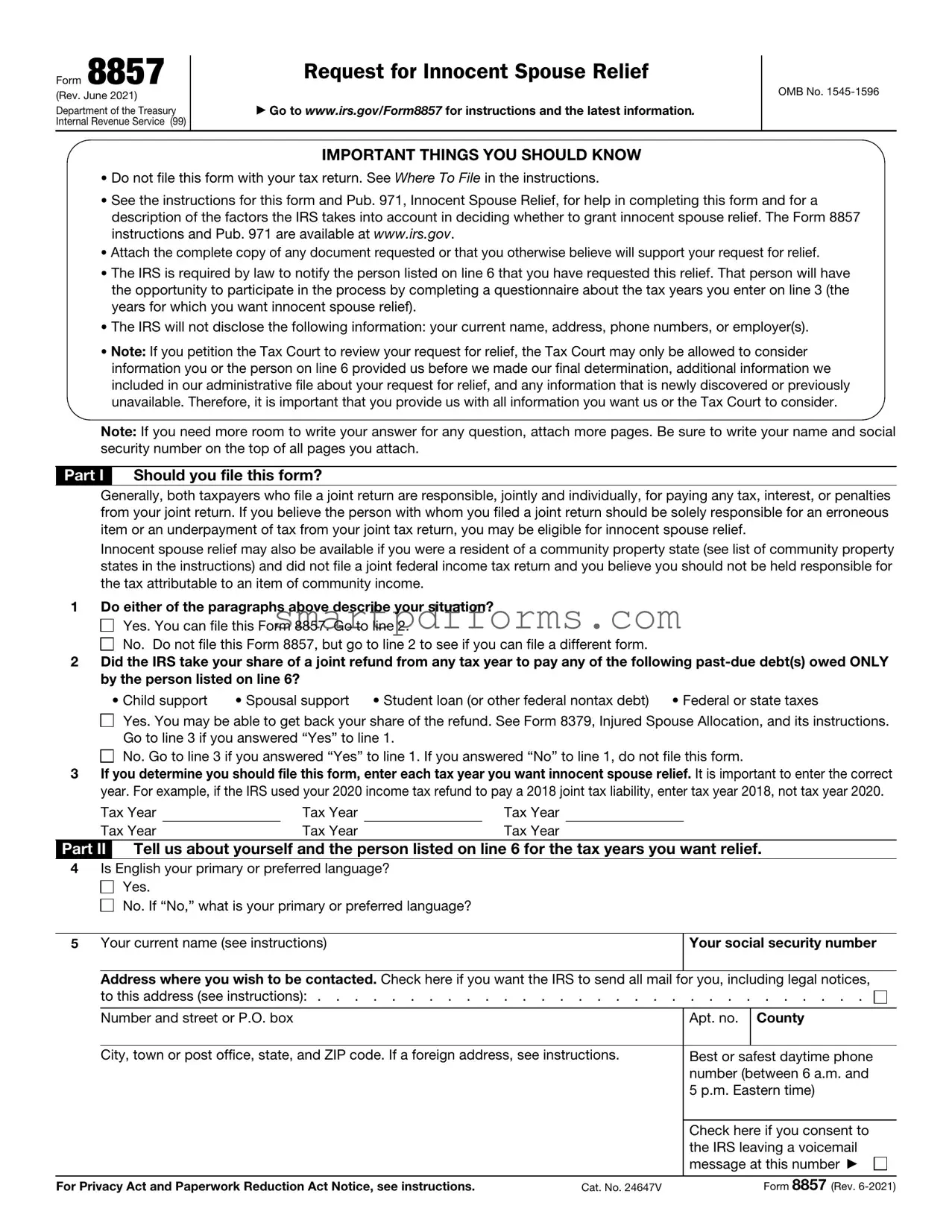

Blank IRS 8857 PDF Template

Filing taxes jointly as a married couple can offer several benefits, but it also comes with shared responsibilities for any debts that arise from mistakes or oversights on tax returns. When one partner feels unjustly burdened by these liabilities, especially due to actions they were not aware of or involved in, the IRS 8857 form serves as a crucial lifeline. It's designed to request relief under the categories of Innocent Spouse Relief, Separation of Liability Relief, and Equitable Relief. These segments are tailored to address different situations where individuals believe they should not be held accountable for a spouse's or ex-spouse's tax errors or fraud. The form's comprehensive nature allows affected parties to present their case, outline why they are requesting relief, and provide detailed information to support their claims. By doing so, it opens a pathway to potential financial freedom for those ensnared in tax dilemmas through no fault of their own, making it a critical document for navigating the intricate processes of tax liability and relief.

Preview - IRS 8857 Form

Form 8857

(Rev. June 2021)

Department of the Treasury

Internal Revenue Service (99)

Request for Innocent Spouse Relief

▶Go to www.irs.gov/Form8857 for instructions and the latest information.

OMB No.

IMPORTANT THINGS YOU SHOULD KNOW

•Do not file this form with your tax return. See Where To File in the instructions.

•See the instructions for this form and Pub. 971, Innocent Spouse Relief, for help in completing this form and for a description of the factors the IRS takes into account in deciding whether to grant innocent spouse relief. The Form 8857 instructions and Pub. 971 are available at www.irs.gov.

•Attach the complete copy of any document requested or that you otherwise believe will support your request for relief.

•The IRS is required by law to notify the person listed on line 6 that you have requested this relief. That person will have the opportunity to participate in the process by completing a questionnaire about the tax years you enter on line 3 (the years for which you want innocent spouse relief).

•The IRS will not disclose the following information: your current name, address, phone numbers, or employer(s).

•Note: If you petition the Tax Court to review your request for relief, the Tax Court may only be allowed to consider information you or the person on line 6 provided us before we made our final determination, additional information we included in our administrative file about your request for relief, and any information that is newly discovered or previously unavailable. Therefore, it is important that you provide us with all information you want us or the Tax Court to consider.

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

Part I Should you file this form?

Generally, both taxpayers who file a joint return are responsible, jointly and individually, for paying any tax, interest, or penalties from your joint return. If you believe the person with whom you filed a joint return should be solely responsible for an erroneous item or an underpayment of tax from your joint tax return, you may be eligible for innocent spouse relief.

Innocent spouse relief may also be available if you were a resident of a community property state (see list of community property states in the instructions) and did not file a joint federal income tax return and you believe you should not be held responsible for the tax attributable to an item of community income.

1 Do either of the paragraphs above describe your situation?

Yes. You can file this Form 8857. Go to line 2.

No. Do not file this Form 8857, but go to line 2 to see if you can file a different form.

2Did the IRS take your share of a joint refund from any tax year to pay any of the following

• Child support |

• Spousal support |

• Student loan (or other federal nontax debt) |

• Federal or state taxes |

Yes. You may be able to get back your share of the refund. See Form 8379, Injured Spouse Allocation, and its instructions. Go to line 3 if you answered “Yes” to line 1.

No. Go to line 3 if you answered “Yes” to line 1. If you answered “No” to line 1, do not file this form.

3If you determine you should file this form, enter each tax year you want innocent spouse relief. It is important to enter the correct year. For example, if the IRS used your 2020 income tax refund to pay a 2018 joint tax liability, enter tax year 2018, not tax year 2020.

Tax Year |

|

Tax Year |

|

Tax Year |

Tax Year |

|

Tax Year |

|

Tax Year |

Part II Tell us about yourself and the person listed on line 6 for the tax years you want relief.

4Is English your primary or preferred language?

Yes.

Yes.

No. If “No,” what is your primary or preferred language?

No. If “No,” what is your primary or preferred language?

5 Your current name (see instructions) |

Your social security number |

Address where you wish to be contacted. Check here if you want the IRS to send all mail for you, including legal notices, to this address (see instructions): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

Number and street or P.O. box |

|

Apt. no. |

County |

|

|

|

|

|

|

|

|

City, town or post office, state, and ZIP code. If a foreign address, see instructions. |

Best or safest daytime phone |

|||

|

|

|

number (between 6 a.m. and |

||

|

|

|

5 p.m. Eastern time) |

||

|

|

|

|

|

|

|

|

|

Check here if you consent to |

||

|

|

|

the IRS leaving a voicemail |

||

|

|

|

message at this number ▶ |

||

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 24647V |

|

Form 8857 (Rev. 6- |

2021) |

|

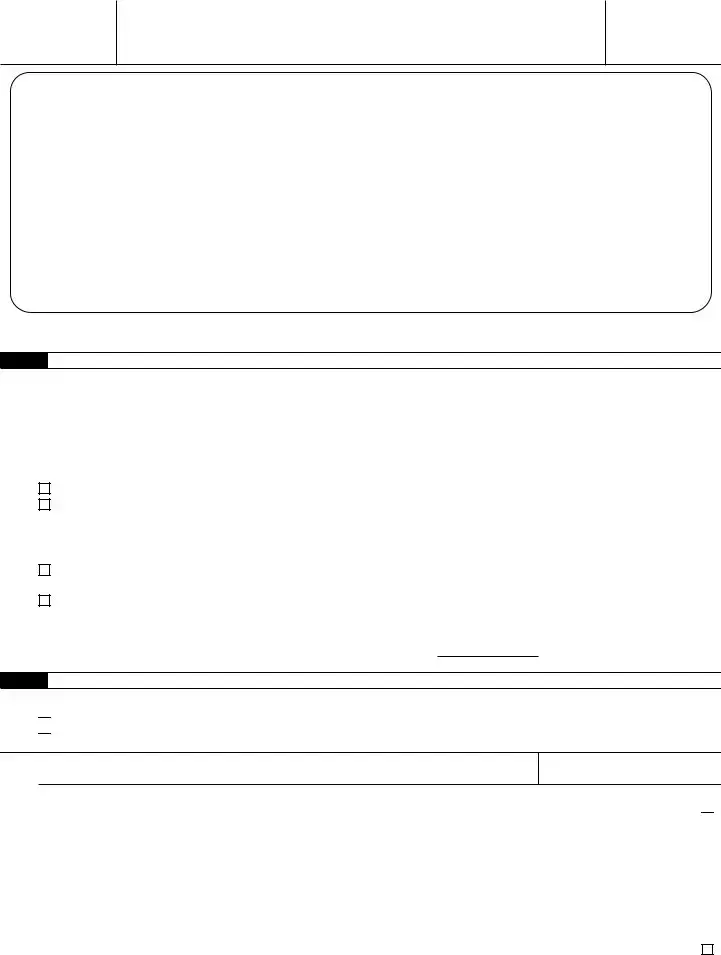

Form 8857 (Rev. |

Page 2 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

6Who was your spouse for the tax years you want relief? File a separate Form 8857 for tax years involving different spouses or former spouses.

That person’s current name

Social security number (if known)

Current home address (number and street) (if known). If a P.O. box, see instructions.

Apt. no.

City, town or post office, state, and ZIP code. If a foreign address, see instructions.

Daytime phone number (between 6 a.m. and 5 p.m. Eastern time)

7 What is the current marital status between you and the person on line 6?

Married and still living together

Married and living apart since

|

MM/DD/YYYY |

|

Widowed since |

|

Attach a photocopy of the death certificate and will (if one exists). |

|

MM/DD/YYYY |

|

Legally separated since |

|

Attach a photocopy of your entire separation agreement. |

|

MM/DD/YYYY |

|

Divorced since |

|

Attach a photocopy of your entire divorce decree. |

|

MM/DD/YYYY |

|

Note: A divorce decree stating that your former spouse must pay all taxes does not necessarily mean you qualify for relief.

8What was the highest level of education you had completed when the return or returns were filed? If the answers are not the same for all tax years, explain below.

Did not complete high school

Did not complete high school

High school diploma or equivalent

High school diploma or equivalent

Some college

Some college

College degree or higher. List any degrees you have ▶

College degree or higher. List any degrees you have ▶

List any

9When any of the returns listed on line 3 were filed, did you have a mental or physical health problem or do you have a mental or physical health problem now? If the answers are not the same for all tax years, explain below.

Yes. Attach a statement to explain the problem and when it started. Provide photocopies of any documentation, such as medical bills or a doctor’s report or letter.

Yes. Attach a statement to explain the problem and when it started. Provide photocopies of any documentation, such as medical bills or a doctor’s report or letter.

No. Explain ▶

No. Explain ▶

10 Is there any information you are afraid to provide on this form, but are willing to discuss?

Yes

No

Part III Tell us if and how you were involved with finances and preparing returns for the tax years you want relief.

11Did you intend to file a joint return for the tax year(s) listed on line 3? See instructions. Explain why or why not ▶

Yes

No

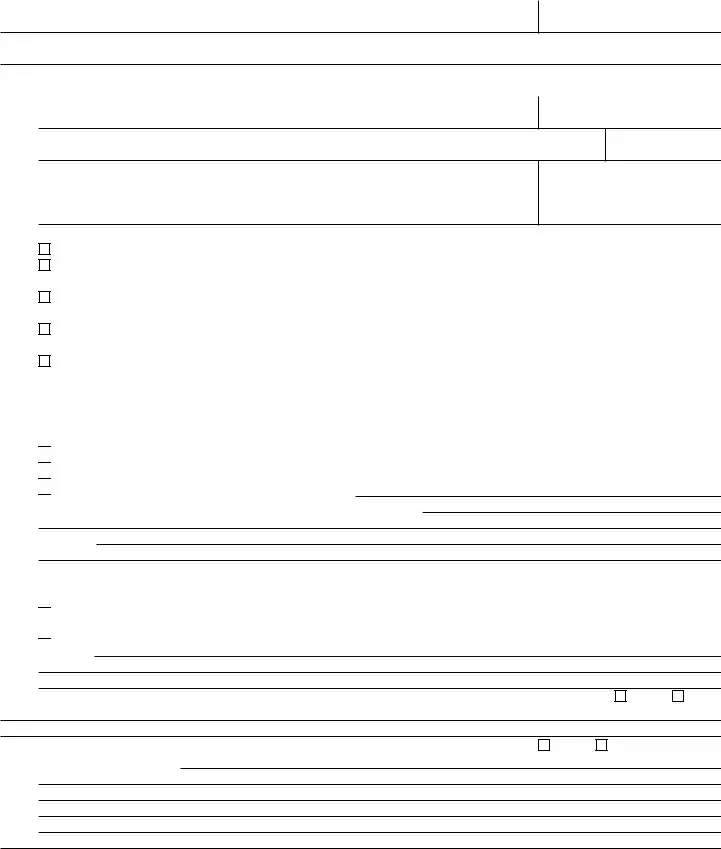

Form 8857 (Rev.

Form 8857 (Rev. |

Page 3 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

12Describe your involvement in preparing the returns. Include details such as whether you prepared or assisted in the preparation of joint returns (for example, by providing Forms

13Explain what you knew about the income of the person on line 6 when the returns were filed. For example, describe each type of income that person had (such as wages, social security, gambling winnings, or

14Explain what you knew about any missing information on the returns when they were filed, and whether you asked about anything on the returns that you knew was missing. Also, explain what you knew about any incorrect information on the returns, even if you did not know the information was incorrect when the returns were filed, and whether you asked about anything on the returns that was incorrect. For example, if there was a deduction or credit on the returns, were you aware of any facts that made the item not allowable as a deduction or credit? If the answer is not the same for all tax years, explain below.

15If the returns showed a balance due to the IRS, explain when and how you thought the balance due would be paid. If you didn’t know the returns showed a balance due, explain why not.

16Describe any financial problems you were having when the returns were filed, such as bankruptcy or bills you could not pay. If the financial problems were not the same for all tax years, explain below.

17Describe how you were involved in the household finances and your role in deciding how money was spent. For example, explain whether you and the person on line 6 had joint accounts and how you or the person on line 6 used them (such as by making deposits, paying bills from those accounts, or reviewing the monthly bank statements). Explain what you knew about any separate accounts the person on line 6 had. If your involvement was not the same for all tax years, explain below.

18 For the years you want relief, did you or the person on line 6 incur any large purchases and/or expenses?

Yes

No

If “Yes,” describe any large expenses you or the person on line 6 incurred (such as trips, home improvements, or private schooling), or any large purchases you or the person on line 6 made (such as automobiles, appliances, jewelry, etc.). Include the types and amounts of the expenses and purchases and the years they were incurred or made.

Form 8857 (Rev.

Form 8857 (Rev. |

Page 4 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

19 Did the person on line 6 transfer any assets to you? |

Yes |

No |

If “Yes,” list the assets (money or property, such as real estate, stocks, bonds, or other property) the person on line 6 transferred to you. Include the dates they were transferred and their fair market value on the dates of transfer. If the property was secured by any debt (such as a mortgage on real estate), explain who was responsible for making payments on the debt, how much was owed on the debt at the time of transfer, and whether the debt has been satisfied. Explain why the assets were transferred to you. If you no longer possess or own the assets, explain what happened to the assets.

Part IV Tell us about your current financial situation.

20Tell us about your assets. Your assets are your money and property. Property includes real estate, motor vehicles, stocks, bonds, and other property that you own. In the table below, list the amount of cash you have on hand and in your bank accounts. Also, list each item of property, the fair market value (as defined in the instructions) of each item, and the balance of any outstanding loans you used to acquire each item.

Description of Asset

Fair Market Value

Balance of Any Outstanding Loans You Used To Acquire the Asset

21 How many people are you currently supporting, including yourself?

22 Tell us your current average monthly income and expenses for your entire household.

|

Monthly |

Amount |

|

Gifts |

|

|

Wages (gross pay) |

|

|

Pensions |

|

|

Unemployment |

|

|

Social security |

|

|

Government assistance, such as housing, food stamps, grants, etc |

|

|

Alimony |

|

|

Child support |

|

|

|

|

|

Rental income |

|

|

Interest and dividends |

|

|

Other income, such as disability payments, gambling winnings, etc. List each type below: |

|

|

Type |

|

|

Type |

|

|

Type |

|

|

Total Monthly Income |

|

|

|

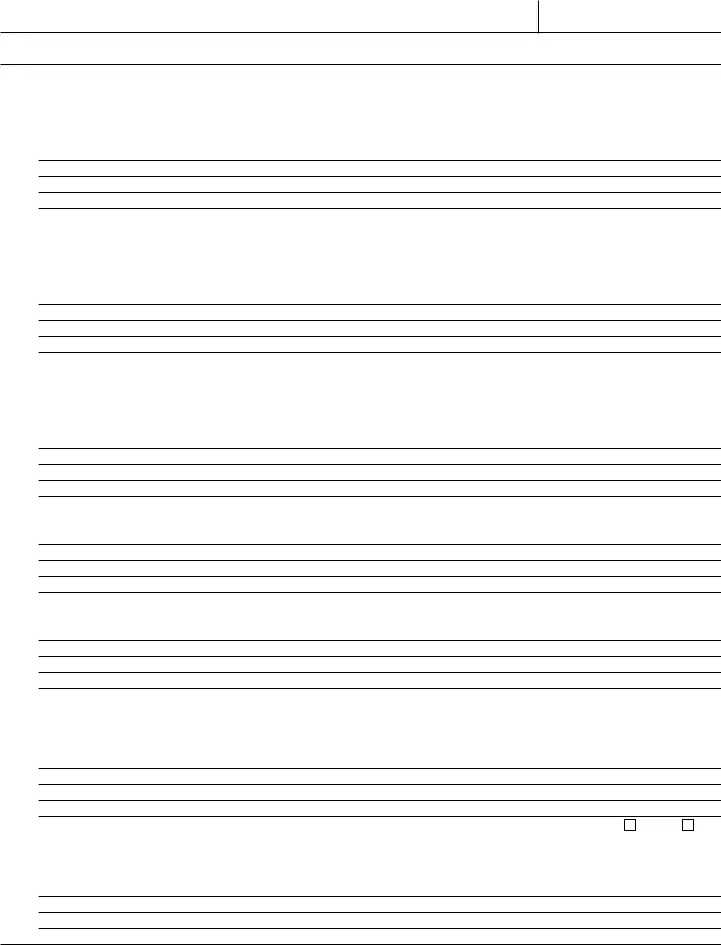

Form 8857 (Rev. |

Form 8857 (Rev. |

Page 5 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

|

Monthly |

Amount |

|

|

Food and Personal Care: |

|

|

|

Food |

|

|

|

Housekeeping supplies |

|

|

|

Clothing and clothing services |

|

|

|

Personal care products and services |

|

|

|

Transportation: |

|

|

|

Auto loan/lease payment, gas, insurance, licenses, parking, maintenance, etc |

|

|

|

Public transportation |

|

|

|

Housing and Utilities: |

|

|

|

Rent or mortgage |

|

|

|

Real estate taxes and insurance |

|

|

|

Electric, oil, gas, water, trash, etc |

|

|

|

Telephone and cell phone |

|

|

|

Cable and Internet |

|

|

|

Medical: |

|

|

|

Health insurance premiums |

|

|

|

|

|

|

|

Other: |

|

|

|

Child and dependent care |

|

|

|

Caregiver expenses |

|

|

|

Income tax withholding (federal, state, and local) |

|

|

|

Estimated tax payments |

|

|

|

Term life insurance premiums |

|

|

|

Retirement contributions (employer required) |

|

|

|

Retirement contributions (voluntary) |

|

|

|

Union dues |

|

|

|

Unpaid state and local taxes (minimum payment) |

|

|

|

Student loans (minimum payment) |

|

|

|

|

|

|

|

garnishments). List each type below: |

|

|

|

Type |

|

|

|

Type |

|

|

|

Type |

|

|

|

Miscellaneous |

|

|

|

Total Monthly Expenses |

|

|

Part V Complete this part if you were (or are now) a victim of domestic violence or abuse.

This information is not mandatory. See Pub. 971 for assistance. If you have concerns about your safety, please consider contacting the confidential

23a Were you or a member of your family a victim of abuse or domestic violence by the person on line 6? (Abuse includes physical, psychological, sexual, emotional, or financial abuse, and can include the abuser making you afraid to disagree with him or her or causing you to fear for your safety.)

Yes. Complete the questions below. We will put a code on your separate account. This will enable us to respond appropriately and be sensitive to your situation.

Note: We will remove the code from your account if you request it. If you do not want us to put the code on your account check here.

No. If “No,” go to Part VI.

Form 8857 (Rev.

Form 8857 (Rev. |

Page 6 |

Your current name |

Your social security number |

Note: If you need more room to write your answer for any question, attach more pages. Be sure to write your name and social security number on the top of all pages you attach.

bDescribe the abuse you experienced, including approximately when it began and how it may have affected you, your children, or other members of your family. Explain how this abuse affected your ability to question the reporting of items on your tax return or the payment of the tax due on your return. Please attach a written statement, if needed.

cAre you afraid of the person listed on line 6?

Yes

No

dDoes the person listed on line 6 pose a danger to you, your children, or other members of your family?

Yes

No

To properly evaluate your claim, please attach copies of documentation you may have, for example:

•Protection and/or restraining order;

•Police reports;

•Medical records, including those of therapists or counselors;

•Doctor’s report or letter;

•Injury photographs;

•A statement from someone who was a victim of or witnessed the abuse or the results of the abuse; and

•Any other documentation you may have.

Part VI |

Additional information |

24Please provide any other information you want us to consider from the years that this form is about or any other years during which you filed a joint return with the person you listed on line 6 in determining whether it would be unfair to hold you liable for the tax.

Part VII Tell us if you would like a refund.

25 By checking this box and signing this form, you are indicating that you would like a refund if you qualify for relief and if you already paid the tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . .

Reminder: Please attach the complete copy of any document requested or that you otherwise believe will support your request for innocent spouse relief.

Caution:

By signing this form, you understand that, by law, we must contact the person on line 6. See instructions for details.

Sign Here

Under penalties of perjury, I declare that I have examined this form and any accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy for your records.

Paid

Preparer

Use Only

▲ |

Your signature |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

||

Print/Type preparer’s name |

|

Preparer’s signature |

|

Date |

|

Check |

if |

|

PTIN |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

|

Firm’s EIN ▶ |

|

|

|

||

Firm’s address ▶ |

|

|

|

|

Phone no. |

|

|

|

||

Form 8857 (Rev.

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The IRS Form 8857 is used to request relief from tax liability under the Innocent Spouse Relief provisions. |

| 2 | This form can be filed by a spouse or former spouse who believes only their partner or ex-partner should be held responsible for all or part of the tax. |

| 3 | There are three types of relief available: Innocent Spouse Relief, Separation of Liability Relief, and Equitable Relief. |

| 4 | Applicants must file Form 8857 no later than 2 years after the date the IRS first attempted to collect the tax. |

| 5 | Submitting Form 8857 does not guarantee relief; the IRS evaluates each case based on its merits. |

| 6 | The IRS will notify the applicant's spouse or former spouse that the Form 8857 has been filed, which is a legal requirement. |

| 7 | Filing this form can suspend collection activities against the requesting spouse until the case is resolved. |

| 8 | If relief is granted, it can lead to a refund for the innocent spouse, but not if it relates to unpaid taxes. |

| 9 | The IRS takes into account abuse or financial control by the other spouse as significant factors when considering relief. |

| 10 | While the federal form 8857 is standardized, different states may have their own processes or requirements for claiming similar relief. |

Instructions on Utilizing IRS 8857

Filling out the IRS Form 8857 is a necessary step for individuals seeking relief from joint tax liabilities under certain conditions. This form is designed to request relief from tax, interest, and penalties related to a joint tax return. By completing this form, a person can request consideration for relief by the IRS. The process involves providing detailed personal and financial information to the IRS for evaluation. Once submitted, the IRS reviews the Form 8857 to determine if the requester qualifies for the relief sought. The following steps will guide you through the process of filling out the form accurately.

- Start by gathering all necessary documents, including prior year tax returns, notices received from the IRS, and any relevant financial documents.

- Download the latest version of IRS Form 8857 from the Internal Revenue Service website.

- Read the instructions provided with the form carefully to understand each section and what information is required.

- Fill in your personal information, including your name, Social Security Number (SSN), current address, and the tax years for which you are requesting relief.

- Answer all questions related to your filing status, the relief you are requesting, and any involvement you had in the preparation of the tax returns in question.

- Provide detailed information about your financial situation, including income, expenses, assets, and liabilities. This information is crucial for the IRS to evaluate your request properly.

- Explain the reasons for your request for relief in the section provided. Here, you should detail any circumstances that support your claim for relief, such as lack of knowledge about the underreported income or incorrect deductions on the joint return.

- Sign and date the form. If you are filing with your spouse or a former spouse, they must also sign the form if they are requesting relief or providing information relevant to your request.

- Review the form to ensure all information is accurate and complete.

- Mail the completed form to the IRS at the address provided in the instructions. Keep a copy of the form and any supporting documents for your records.

After submitting Form 8857, expect to hear back from the IRS. They may contact you for additional information or to notify you of their decision. The review process can take time, so patience is essential. If the IRS approves your request for relief, you will be notified of the specific relief granted and how it affects your tax liability. If denied, you have the right to appeal the decision. It's important to respond promptly to any requests from the IRS during this process to ensure the best possible outcome.

Obtain Answers on IRS 8857

-

What is the IRS Form 8857?

The IRS Form 8857 is used to request relief under the Innocent Spouse Relief law. This relief is designed for individuals who filed a joint tax return and believe they should not be held responsible for their spouse's or former spouse's tax debt, interest, or penalties due to circumstances beyond their control. It can provide a way out for those unfairly saddled with tax issues they did not cause.

-

When should I file Form 8857?

You should file Form 8857 as soon as you become aware of a tax liability for which you believe only your spouse or former spouse should be held responsible. Generally, the form must be filed within 2 years after the date on which the IRS first attempted to collect the tax from you. However, it's important to consult with a tax advisor to understand the specific deadlines that may apply to your situation.

-

How do I file IRS Form 8857?

IRS Form 8857 cannot be filed electronically. You'll need to fill out the form carefully, providing all required information about your situation, including details about your income, living expenses, and the circumstances that led to your request for relief. Once completed, mail it to the IRS at the address provided in the form instructions.

-

What happens after I submit Form 8857?

After you submit Form 8857, the IRS will begin a review process, which includes contacting your spouse or former spouse to notify them of your request. This process can take several months. The IRS may request more information from you during this time. You will eventually receive a determination letter from the IRS informing you whether your request for relief has been granted.

-

Can I file Form 8857 jointly with my spouse?

No, Form 8857 is specifically intended for individuals seeking innocent spouse relief independently of their spouse. If both spouses believe they qualify for relief, each person must file a separate Form 8857 to explain their circumstances and reason for seeking relief.

-

What types of relief can I request with Form 8857?

There are three types of relief you can request with Form 8857: Innocent Spouse Relief, Separation of Liability Relief, and Equitable Relief. Each type of relief has specific requirements and applies to different situations. Innocent Spouse Relief generally applies when you were unaware of a mistake on your joint tax return. Separation of Liability Relief may apply if you are divorced or separated and were unaware of an incorrect item on your joint return. Equitable Relief may apply if you don’t qualify for the other two types but still believe it's unfair to be held responsible for the tax debt.

-

What information do I need to include in Form 8857?

When filling out Form 8857, you'll need to provide detailed information about your tax situation, including the year(s) for which you are requesting relief, information about your finances, and a thorough explanation of why you believe you should not be held responsible for the tax liability. Supporting documentation, such as court documents or statements detailing financial abuse, can also be helpful to your case.

-

Is there a fee to file Form 8857?

No, there is no fee to file Form 8857 with the IRS. The request for innocent spouse relief is a right provided to qualifying taxpayers at no cost, except potentially incidental expenses related to gathering and sending the necessary documentation.

-

How long does it take for the IRS to process Form 8857?

The time it takes for the IRS to process Form 8857 can vary greatly depending on the complexity of your case and the IRS's backlog. It can take anywhere from a few months to over a year. The IRS will notify you once they have made a decision, and you will have the opportunity to appeal if your request is denied.

-

Can I receive relief for penalties and interest with Form 8857?

Yes, if your request for relief is granted, it may include relief from penalties and interest in addition to the tax owed. The specific details will depend on the type of relief granted and your individual circumstances.

Common mistakes

Filling out IRS Form 8857, a request for Innocent Spouse Relief, can be a complex process that often requires detailed financial information. When individuals attempt to navigate this process, several common mistakes may occur. Understanding these errors can lead to a more successful application process.

-

Not providing sufficient detail about the circumstances. For the IRS to grant relief, they need a comprehensive understanding of the situation. However, applicants often fail to provide enough context or explanation regarding their case. This lack of detail can lead to misunderstandings or the IRS not fully appreciating the applicant's position.

-

Incorrectly determining eligibility. Before filling out the form, it's crucial to determine whether you're eligible for Innocent Spouse Relief. Many individuals either assume they're eligible without understanding the criteria or are not aware of the different types of relief available (such as Separation of Liability Relief or Equitable Relief). This misunderstanding can lead to an incorrect application.

-

Forgetting to sign and date the form. Although it may seem basic, forgetting to sign and date the form is a common mistake. An unsigned or undated form is considered incomplete by the IRS and will not be processed. This oversight can delay the entire process.

-

Not including necessary documentation. Supporting documents are crucial for the IRS to make an informed decision. Applicants sometimes submit Form 8857 without the required backing documentation, such as proof of financial status, evidence of abuse (if applicable), or relevant tax documents. This omission can severely impact the review process and the outcome of the application.

By avoiding these mistakes, individuals can improve their chances of successfully obtaining relief through IRS Form 8857. It’s always recommended to seek advice from a tax professional or legal advisor to ensure the application is complete and accurately reflects the individual’s situation.

Documents used along the form

When dealing with the IRS 8857 form, which is used to request relief under the innocent spouse rules, it is common to need additional documentation. These documents are necessary to provide comprehensive information about one's financial situation, support claims, or meet specific tax-related requirements. Here is a list of documents often used in conjunction with Form 8857 to ensure that the request for relief is well-supported and accurately reflects the individual's circumstances.

- Tax Returns for Previous Years: These documents are essential for providing the IRS with context regarding your tax history and demonstrating any discrepancies or consistencies relevant to the relief being sought.

- Proof of Income: This can include W-2s, 1099 forms, pay stubs, or any other documentation that proves income. It helps in assessing the proper tax obligations and ensuring that the information on the 8857 form is accurate.

- Bank Statements: Bank statements may be used to verify income, expenses, and the financial situation disclosed on Form 8857. They can provide a clearer picture of the household's financial dealings.

- Marriage, Divorce, or Legal Separation Documents: These documents help the IRS understand the timeline and legal status of the relationship, which is crucial for cases that depend on marital status.

- Documentation of Alleged Abuse: If claiming relief due to abuse, any legal, medical, or police records can strengthen the case by providing evidence of the circumstances leading to the claim.

- Copies of Notices and Letters from the IRS: Providing copies of communication between you and the IRS regarding the tax years in question can help clarify the issue at hand and expedite the review process.

Accurately compiling and submitting these documents alongside IRS Form 8857 is crucial for an effective relief request. It's important to ensure that all provided information is accurate and up to date. Failure to provide necessary documentation can delay the process or result in denial of the request for relief. It is always advisable to keep copies of all submitted documents for your records.

Similar forms

-

Form 1040: The hallmark of annual income reporting, Form 1040, shares a common thread with IRS Form 8857 in its requirement for personal financial disclosure. Both forms necessitate a detailed account of an individual's fiscal data, albeit for different purposes—Form 1040 for the assessment of tax liability, and Form 8857 for requesting relief under the Innocent Spouse Relief provisions. This comparison highlights the shared focus on financial integrity and personal accountability inherent in both documents.

-

Form 9465, Installment Agreement Request: Similar to Form 8857, Form 9465 is used by taxpayers seeking a different form of leniency from the IRS, specifically to make arrangements for paying tax debt over time. Both documents represent a dialogue with the IRS where the taxpayer's current financial situation against past obligations is considered, aiming to structure a solution that acknowledges the taxpayer's ability to manage their fiscal responsibilities within their current means.

-

Form 843, Claim for Refund and Request for Abatement: Form 843 and Form 8857 resemble each other in the aspect of seeking relief, although their contexts differ. While Form 8857 is specifically for innocent spouse relief, Form 843 can be applied to a variety of situations, including penalties, interests, or additions to tax. Both require the taxpayer to present a case to the IRS detailing why relief should be granted, underlining the necessity for a narrative that explains the circumstances behind the request.

-

Form 656, Offer in Compromise: This form is used to settle tax liabilities for less than the amount owed, echoing the relief-seeking nature of Form 8857. Both forms open a pathway for negotiation with the IRS, allowing taxpayers to propose a resolution that acknowledges their financial limitations. While the specific conditions and outcomes differ, the underlying principle of negotiation in light of financial hardship is a shared cornerstones of both documents.

-

Form 433-A (OIC), Collection Information Statement for Wage Earners and Self-Employed Individuals: Supporting Form 656, this document provides the IRS with detailed personal financial information necessary to consider an Offer in Compromise. Its relevance to Form 8857 lies in its detailed financial disclosure requirement, which is foundational in assessing the taxpayer's financial situation to determine eligibility for relief. Both forms necessitate a deep dive into the taxpayer’s financial life, aiming to furnish a complete picture that supports their request for relief or negotiation.

Dos and Don'ts

Filling out the IRS 8857 form, related to requesting innocent spouse relief, requires careful attention to detail and accuracy. It's a process where knowing what to do and what not to do can significantly affect the outcome of your request. While this guide aims to make the process clearer, always consider seeking professional advice for your specific situation.

Do These:

Read all the instructions provided with the form carefully before you start filling it out. This ensures that you understand every requirement and reduces the chances of making errors.

Gather all necessary documentation and evidence before beginning. This includes items like your tax return for the relevant year, any correspondence from the IRS, and documents that support your case for relief.

Provide detailed explanations when necessary. If the form asks for an explanation of your situation, be as detailed and clear as possible. Offer context and specifics to give the IRS a full understanding of your circumstance.

Use additional sheets if needed. If you run out of space on the form, you can attach extra pages. Just make sure to indicate clearly on the form that you have attached additional sheets and reference each question accurately.

Sign and date the form. An unsigned form is considered incomplete and can delay processing.

Make a copy of the completed form and all attachments for your records before mailing it to the IRS. This is crucial should there be any disputes or you need to refer back to the information you provided.

Don't Do These:

Don't leave sections blank. If a section does not apply to your situation, write “N/A” (for Not Applicable) rather than leaving it blank. This shows the IRS that you did not simply overlook the question.

Don't rush through the form. Take your time to ensure all information is filled out accurately and completely. Mistakes or omissions can lead to delays in processing or a denial of your request.

Don't forget to include the tax year you are requesting relief for. The IRS needs to know which year’s taxes are in question to provide the appropriate relief.

Don't neglect to inform your spouse or former spouse about your intention to file this form if you're doing so without their initial involvement. They have a right to be informed and can participate in the process.

Don't send your form to the wrong office. The IRS instructions include specific addresses for where to send your form, depending on your circumstances and location.

Don't attempt to hide or omit information. Being transparent and honest in your form is crucial for a fair assessment and consideration of your request for relief.

By following these do's and don'ts, you can navigate the process of filling out the IRS 8857 form with greater confidence and accuracy, setting the stage for a more favorable evaluation of your request for innocent spouse relief.

Misconceptions

When it comes to the IRS Form 8857, many people have misunderstandings about its purpose and process. This form is critical for those seeking relief under the Innocent Spouse Relief provisions, but let's clear up some common misconceptions.

- Only women can apply: Anyone, regardless of gender, can file Form 8857 if they meet the criteria for innocent spouse relief.

- You can file anytime: There's a strict timeframe for filing Form 8857. You must do so within two years after the IRS has attempted to collect the tax in question.

- It clears all your tax debts: Filing Form 8857 doesn't automatically wipe away all tax responsibilities. It's designed to provide relief from joint tax liability under certain circumstances.

- It’s only for currently married individuals: Former spouses can also apply for innocent spouse relief if they believe they're unfairly held responsible for joint tax liabilities.

- You don’t need evidence: Providing detailed information and evidence to support your case is crucial. The more evidence you provide, the better your chances for approval.

- The process is quick: The review process can be lengthy, often taking six months or more, depending on the case's complexity.

- It stops all collection activities: Filing Form 8857 does not immediately stop collection activities related to the joint tax debt, although the IRS may hold off on certain actions until a decision is made.

- Approval is guaranteed: Not all applications are approved. The IRS examines each case individually, and decisions are based on numerous factors.

- You must have a lawyer: While having a tax professional can be beneficial, especially in complicated cases, it’s not a requirement for filing Form 8857.

- If denied, that's the end: If your request is denied, you have the right to appeal the decision. There are options to contest the determination and seek a favorable outcome.

Understanding these misconceptions about Form 8857 can help you navigate the process more effectively and set realistic expectations. When in doubt, consulting with a tax professional can provide clarity and assistance tailored to your situation.

Key takeaways

The IRS 8857 form, known as the Request for Innocent Spouse Relief, is an important document for individuals seeking relief from joint tax liabilities. Understanding this form's intricacies can significantly impact one’s financial and emotional well-being. Here are ten key takeaways about filling out and using the IRS 8857 form:

- Familiarizing oneself with the eligibility criteria for claiming innocent spouse relief before filling out Form 8857 is crucial. These criteria include not knowing, and having no reason to know, that there was an understatement of tax.

- Submitting Form 8857 as soon as you become aware of a tax liability for which you believe you should not be held responsible is important. There is a time frame to consider, generally within two years after the IRS starts collection activity against you.

- Completeness and accuracy in providing information on Form 8857 can significantly impact the outcome of your request. This includes detailing the circumstances that led to the tax understatement or underpayment.

- Supporting documentation can strengthen your case. When submitting Form 8857, include any evidence that supports your claim, such as emails, letters, financial documents, or affidavits from witnesses.

- Understanding the types of relief available under the innocent spouse provision can help you make informed decisions. The IRS provides three types of relief: innocent spouse relief, separation of liability relief, and equitable relief.

- The IRS’s determination of your eligibility for relief can be influenced by various factors, including your involvement in the household finances, any benefit received from the understated tax, and your current financial situation.

- If the IRS denies your request for innocent spouse relief, you have the right to appeal the decision. Knowing the appeals process and the relevant deadlines is critical.

- While Form 8857 is processing, which can take up to 6 months or longer, the IRS generally suspends collection activities related to the joint tax liability.

- Effectively communicating with the IRS during the review process can be beneficial. This includes promptly responding to any requests for additional information and being proactive in addressing potential issues.

- Seeking professional advice when dealing with complex cases or if you're unsure about the process can provide significant benefits. Tax professionals or attorneys specializing in tax law can offer guidance and increase the chances of a favorable outcome.

A thorough understanding of the IRS 8857 form and the process involved in seeking innocent spouse relief can not only help individuals navigate through challenging circumstances but also provide a clearer path towards resolving tax liabilities in a manner that is fair and just. Proper use of this form requires careful consideration of the nuances of tax law, as well as attention to one's specific situation.

Popular PDF Forms

Counseling Printable Mental Health Treatment Plan Template - A framework designed to foster mutual agreement between patient and therapist on targeted health outcomes and the methods to achieve them.

Fire Alarm Frequency - Detailed record keeping of fire alarm system specifics, ensuring compliance with fire safety standards.

Tuition Statement - Homeowners anticipating the mortgage interest deduction should look out for Form 1098 from their lender early in the tax season.