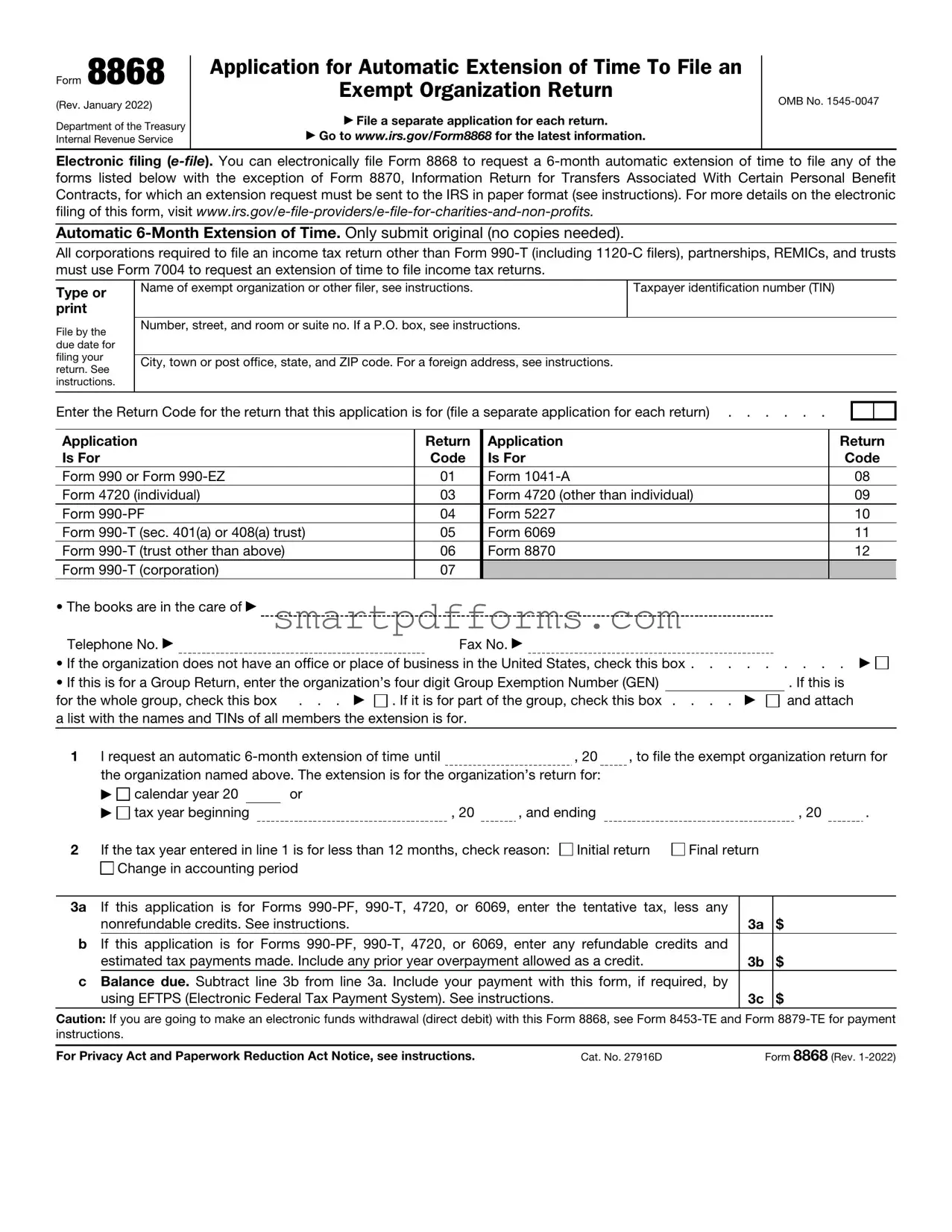

Blank IRS 8868 PDF Template

For individuals and organizations finding themselves in need of additional time to file their tax returns, the IRS provides a necessary solution through Form 8868. This form stands as a critical tool in the tax preparation process, offering a straightforward way to request an extension for filing tax-exempt or certain other returns. It's important to understand the key aspects of Form 8868, including eligibility criteria, the specific types of returns it covers, and the deadlines by which the form must be submitted to avoid penalties. The process of applying for an extension using Form 8868 is designed to alleviate the stress and pressure that often come with tax season, ensuring that filers have the extra time needed to gather the necessary documentation and accurately complete their returns. While the form itself might seem simple, the implications of properly or improperly using it can significantly affect an organization’s compliance with IRS regulations, highlighting the importance of being well-informed about the form's purposes and uses.

Preview - IRS 8868 Form

Form 8868

(Rev. January 2022)

Department of the Treasury Internal Revenue Service

Application for Automatic Extension of Time To File an

Exempt Organization Return

▶File a separate application for each return.

▶Go to www.irs.gov/Form8868 for the latest information.

OMB No.

Electronic filing

Automatic

All corporations required to file an income tax return other than Form

Type or |

|

Name of exempt organization or other filer, see instructions. |

|

Taxpayer identification number (TIN) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File by the |

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

due date for |

|

|

|

|

|

|

|

|

|

filing your |

|

|

|

|

|

|

|

|

|

|

City, town or post office, state, and ZIP code. For a foreign address, see instructions. |

|

|

|

|||||

return. See |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Enter the Return Code for the return that this application is for (file a separate application for each return) |

|

|

|

||||||

|

|

|

|||||||

|

|

|

|

|

|

|

|

||

Application |

|

Return |

Application |

|

Return |

||||

Is For |

|

Code |

Is For |

|

Code |

||||

Form 990 or Form |

01 |

Form |

|

08 |

|

||||

Form 4720 (individual) |

03 |

Form 4720 (other than individual) |

|

09 |

|

||||

Form |

04 |

Form 5227 |

|

10 |

|

||||

Form |

05 |

Form 6069 |

|

11 |

|

||||

Form |

06 |

Form 8870 |

|

12 |

|

||||

Form |

07 |

|

|

|

|

|

|

||

• The books are in the care of ▶

Telephone No. ▶ |

Fax No. ▶ |

•If the organization does not have an office or place of business in the United States, check this box . . . . .

•If this is for a Group Return, enter the organization’s four digit Group Exemption Number (GEN)

for the whole group, check this box . . . ▶ |

. If it is for part of the group, check this box . . . . ▶ |

a list with the names and TINs of all members the extension is for.

. . . . ▶

. If this is and attach

1 |

I request an automatic |

|

|

, 20 |

, to file the exempt organization return for |

|||||

|

the organization named above. The extension is for the organization’s return for: |

|

|

|

||||||

|

▶ |

calendar year 20 |

|

or |

|

|

|

|

|

|

|

▶ |

tax year beginning |

|

, 20 |

, and ending |

|

, 20 |

. |

||

2 |

If the tax year entered in line 1 is for less than 12 months, check reason: |

Initial return |

Final return |

|

||||||

|

|

Change in accounting period |

|

|

|

|

|

|

||

|

|

|

||||||||

3a |

If this application is for Forms |

|

||||||||

|

nonrefundable credits. See instructions. |

|

|

|

|

3a $ |

|

|||

bIf this application is for Forms

estimated tax payments made. Include any prior year overpayment allowed as a credit. |

3b $ |

cBalance due. Subtract line 3b from line 3a. Include your payment with this form, if required, by

using EFTPS (Electronic Federal Tax Payment System). See instructions. |

3c $ |

Caution: If you are going to make an electronic funds withdrawal (direct debit) with this Form 8868, see Form

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 27916D |

Form 8868 (Rev. |

Form 8868 (Rev. |

Page 2 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8868 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form8868.

What’s New

Trusts required to file Form

Reminders

Automatic revocation. If an organization has not filed the required Form 990 series for 3 consecutive years, and if the due date (or extended due date) of the third year’s filing has passed, the

Taxpayer identification number. All users must enter their taxpayer identification number (TIN).

Return Code. A Return Code is assigned to each return type. Enter the Return Code of the form this application pertains to in the Return Code Box.

Electronic filing

|

If you are going to make an |

▲ |

|

! |

electronic funds withdrawal |

(direct debit) with this Form |

|

CAUTION |

8868, see Form |

|

Form

Purpose of Form

Form 8868 is used by an exempt organization to request an automatic

Also, the trustee of a trust required to file Form

Use this form to apply for an automatic

The automatic

|

You cannot use Form 8868 to |

▲ |

|

! |

extend the due date of Form |

CAUTION |

|

An organization will only be allowed an extension of 6 months for a return for a tax year.

When To File

File Form 8868 by the due date of the return for which you are requesting an extension.

Where To File

If you do not file electronically, send the application to:

Department of the Treasury Internal Revenue Service Center Ogden, UT

An application for extension of time to file Form 8870 must be sent in paper format to the address above.

Do not file for an extension of time by attaching Form 8868 to the exempt organization’s return when it is filed.

Filing Information

No blanket requests. File a separate Form 8868 for each return for which you are requesting an automatic extension of time to file. This extension will apply only to the specific return checked. It does not extend the time for filing any related returns. For example, an extension of time for filing a private foundation return will not apply to the return of certain excise taxes on charities (Form 4720).

Each Form 8868 filer who owes taxes for the year should file its own Form 8868, and pay only its share of the total tax liability due.

Exempt Organization Group Returns. A central organization may apply for an extension of time to file a group return. Enter the applicable Return Code and enter the Group Exemption Number (GEN) on the line provided. Check the applicable box to indicate whether the application applies to the whole group or part of the group. If the extension is not for all the organizations that are part of the group, you must

attach a schedule to Form 8868 showing the name, address, and taxpayer identification number of each organization that is included in this request for an extension.

Interest. Interest will be charged on any tax not paid by the regular due date of the return from the regular due date until the tax is paid. It will be charged even if the organization has been granted an extension or has shown reasonable cause for not paying on time.

Late payment penalty. Generally, a penalty of ½ of 1% of any tax not paid by the due date is charged for each month or part of a month that the tax remains unpaid. The penalty cannot exceed 25% of the amount due. The penalty will not be charged if you can show reasonable cause for not paying on time.

If you receive an extension of time to file, you will not be charged a late payment penalty if (a) the tax shown on line 3a (or the amount of tax paid by the regular due date of the return) is at least 90% of the tax shown on the return, and

(b)you pay the balance due shown on the return by the extended due date.

Late filing penalty. A penalty is charged if the return is filed after the due date (including extensions) unless you can show reasonable cause for not filing on time.

Different late filing penalties apply to information returns. See the specific form instructions for details.

Reasonable cause determinations. If you receive a notice about penalties after you file your return, send an explanation and we will determine if you meet reasonable cause criteria. Do not attach an explanation when you file your return. Explanations attached to the return at the time of filing will not be considered.

Tax Payments

General rule. Each

EFTPS is a free service provided by the Department of the Treasury. If you choose to use a tax professional, financial institution, payroll service, or other third party to make federal tax deposits on your behalf, you may be charged a fee for this service.

Form 8868 (Rev. |

Page 3 |

Visit www.eftps.gov, or call

Specific Instructions

Extending the time to file does TIP not extend the time to pay tax.

Name of exempt organization or other filer. The filer may be an exempt organization, a nonexempt organization (for example, a disqualified person or a foundation manager trustee), or an individual. The typical filer will be an exempt organization. Certain filers may not be an exempt organization. For example, Form 4720 filers may be one of the other entities listed above.

Address. Include the suite, room, or other unit number after the street address. If the Post Office does not deliver mail to the street address and the exempt organization has a P.O. box, show the box number instead of the street address.

If the organization receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line “C/O” followed by the third party’s name and street address or P.O. box.

If the address is outside the United States or its possessions or territories, in the space for “city or town, state, and ZIP code,” enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

If the organization’s mailing address has changed since it filed its last return, use Form 8822, Change of Address, to notify the IRS of the change. A new address shown on Form 8868 will not update the organization’s record.

Enter the Return Code for the type of return to be filed. Enter the appropriate Return Code in the box to indicate the type of return for which you are requesting an extension. Enter only one Return Code. You must file a separate Form 8868 for each return.

Exempt organizations such as corporations, private foundations, and trusts must enter their taxpayer identification number. Individuals must also enter their taxpayer identification number.

Line 1. The date that is entered on line 1 cannot be later than 6 months from the original due date of the return.

Line 2. If you checked the box for change in accounting period, you must have applied for approval to change the organization’s tax year unless certain conditions have been met. See Form 1128, Application To Adopt, Change, or Retain a Tax Year, and Pub. 538, Accounting Periods and Methods, for details.

Note: All filers must complete lines 3a, b, and c, even if you are exempt from tax or do not expect to have any tax liability.

Line 3a. See the organization’s tax return and its instructions to estimate the amount of tentative tax reduced by any nonrefundable credits. If you expect this amount to be zero, enter

Line 3c. Balance due. Form 8868 does not extend the time to pay tax. To avoid interest and penalties, send the full balance due by the original due date of the return.

For information on EFTPS, see Tax Payments, above.

Note: Be sure to see any deposit rules that are in the instructions for the particular form you are getting an extension for to determine how payment must be made.

No signature is required for this form.

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. However, certain returns and return information of tax exempt organizations and trusts are subject to public disclosure and inspection, as provided by section 6104. The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for tax exempt organizations filing this form is approved under OMB control number

We may disclose this information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can send us comments through www.irs.gov/FormComments. Or you can write to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 8868 | This form is used by tax-exempt organizations to request an automatic 6-month extension of time to file their annual return or notice. |

| Eligible Filers | Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations can use Form 8868 if they need additional time to file their returns. |

| Form Type | Form 8868 is an Application for Extension of Time To File an Exempt Organization Return. |

| Due Date | The form must be filed by the due date of the return for which the extension is requested. |

| No Extension for Payment | While Form 8868 extends the filing time, it does not extend the time for payment of any taxes owed. |

Instructions on Utilizing IRS 8868

Filling out the IRS 8868 form is a task that might seem daunting at first, but it's quite straightforward once you understand the steps involved. This form is used to apply for an extension of time to file an exempt organization tax return. An extension gives your organization additional time to gather necessary information and ensure your filing is accurate. Remember, this form does not extend the time to pay taxes due. If your organization owes taxes, you're expected to estimate and pay the due amount by the original deadline. Let's walk through the steps needed to fill out the form correctly.

- Start by downloading the latest version of Form 8868 from the IRS website to ensure you have the most current form and instructions.

- Provide the organization's identifying information, including the name, Employer Identification Number (EIN), and address. It's crucial to double-check these details for accuracy to avoid processing delays.

- Check the box on line 1 if you're applying for an automatic 6-month extension. Note, this is the most common choice for organizations seeking more time.

- If your organization is using the group return option, mark the appropriate box on line 2. This is specific to organizations filing a group return rather than an individual one.

- Enter the tax form number your organization is requesting an extension for in the designated space. This informs the IRS which tax return's deadline needs to be extended.

- Calculate and enter any tentative tax due amounts in the space provided. While the form extends the filing deadline, it does not extend the deadline to pay estimated taxes due.

- Include any payments you're making with the extension. It’s important to estimate and pay as accurately as possible to avoid penalties and interest.

- Sign and date the form. An authorized person from the organization, such as an officer or the treasurer, should sign the form confirming the accuracy of the information provided.

- Mail the completed form to the IRS, or file electronically through an IRS-approved e-file provider. The mailing address can vary, so refer to the instructions for the correct address. Filing electronically is faster and reduces the risk of errors.

Once the form is submitted, the IRS will process your extension request. If you've filed electronically, you may receive immediate confirmation of your extension. When approved, your organization will have an additional six months to file its return without incurring late-filing penalties. During this time, ensure all necessary documentation is accurate and complete to avoid issues when you do file the tax return. Keep a copy of the extension and confirmation for your records. Remember, this extension doesn't grant more time to pay taxes owed, so it’s important to have estimated and paid any tax liability by the original due date to avoid extra charges.

Obtain Answers on IRS 8868

Understanding the IRS 8868 form is crucial for organizations seeking an extension on their tax returns. Below are answers to some frequently asked questions regarding the form and its use.

What is the purpose of the IRS 8868 form?

The IRS 8868 form is specifically designed for tax-exempt organizations, non-exempt charitable trusts, and section 527 political organizations seeking an automatic 6-month extension of time to file their return. It applies to forms such as the 990, 990-EZ, 990-PF, and others. This extension allows these organizations extra time to gather necessary information and prepare their returns accurately.

How can an organization file Form 8868?

An organization can file Form 8868 electronically through an IRS-approved e-file provider or mail a paper form to the IRS if e-filing is not an option. The IRS encourages electronic filing for its speed and accuracy, ensuring that the request for an extension is processed more efficiently.

When is the deadline to submit Form 8868?

The deadline for submitting Form 8868 is the due date of the organization’s return. Generally, this is the 15th day of the 5th month after the organization’s tax year ends. For example, if an organization operates on a calendar year, the normal due date is May 15th, making that the deadline for requesting an extension through Form 8868.

Does filing Form 8868 extend the time to pay taxes owed?

It’s important to understand that filing Form 8868 only extends the time to file the return, not the time to pay any taxes that may be owed. Organizations should estimate and pay any owed taxes by their original due date to avoid potential penalties and interest. The form does provide space to estimate the amount of tax due, but this does not alter the payment deadline.

Are there any penalties for not filing Form 8868 by the deadline?

Failure to file Form 8868 by the original due date of the return can result in the inability to receive an extension, potentially leading to penalties for late filing. Organizations that anticipate a delay in filing or payment should ensure they submit Form 8868 on time to avoid such penalties and maintain their tax-exempt status.

Common mistakes

Not double-checking the Tax Identification Number (TIN). This is crucial, as the IRS uses the TIN to process your form and link it to the correct account. A typo can lead to processing delays or the form being rejected outright.

Overlooking the need to file separate forms for different returns. Organizations sometimes mistakenly believe one Form 8868 covers all their filings. However, if you need extensions for more than one return (like separate ones for Form 990 and Form 990-T), you must file a Form 8868 for each.

Failing to request the specific extension period. The IRS offers a 6-month extension, yet you must clearly specify this on your form. Skipping this step might leave you with less time than you need.

Miscalculating the tax due. If you owe tax with your return, it's critical to estimate and report this amount accurately on Form 8868. Incorrect calculations can lead to penalties for underpayment.

Omitting the required signature. An unsigned form is like an unsent email – it won’t get you anywhere. Ensuring that Form 8868 is signed is a simple but often overlooked step.

Ignoring the filing deadline. Just as with the tax returns themselves, extension requests have strict deadlines. Failing to submit Form 8868 on time negates the possibility of an extension and can lead to late filing penalties.

Forgetting to keep a copy for records. Once your form is sent off, keeping a copy is vital for your records. It serves as proof of your request and can be crucial if any questions arise later.

To navigate the complexities of Form 8868 effectively, attention to detail is key. Avoiding the mistakes listed above can streamline the process, ensuring your tax-exempt organization stays compliant and avoids unnecessary penalties. As always, when in doubt, seeking the guidance of a tax professional can provide valuable peace of mind.

Documents used along the form

When organizations or individuals find themselves needing additional time to file their exempt organization tax returns, the IRS Form 8868 becomes a crucial document for obtaining an extension. However, navigating tax obligations doesn't stop with this form. In fact, several other documents often accompany or follow the use of Form 8868 to ensure compliance and thoroughness in tax preparation. Below is a brief overview of documents typically used in conjunction with IRS Form 8868, each playing a vital role in the tax filing process for exempt organizations.

- IRS Form 990: This is the primary form used by tax-exempt organizations to provide the IRS with annual financial information. It details the organization's mission, programs, and finances. Filing this form is often the next step after receiving an extension with Form 8868.

- IRS Form 990-EZ: This form serves as a shorter version of Form 990. It is designed for eligible organizations with gross receipts of less than $200,000 and total assets of less than $500,000 at the end of the year. It simplifies the reporting process for smaller entities.

- IRS Form 990-PF: Specific to private foundations, regardless of financial status, this form reports earnings, expenditures, and assets. It is crucial for private foundations to file this to maintain compliance and transparency regarding their operations and financial activities.

- IRS Form 990-T: Organizations with unrelated business income exceeding $1,000 must file this form. It's used to report and pay taxes on income not related to the organization's exempt purpose. Following the extension granted by Form 8868, this might be necessary to file for some entities.

- Form 1120-POL: For political organizations and certain types of nonprofits engaging in political activities, this form reports their taxable income. While not all organizations using Form 8868 will need to file Form 1120-POL, it's pertinent for those involved in political campaigns or activities.

The journey through tax preparation involves meticulous attention to detail and adherence to deadlines. Organizations often leverage these documents collectively to navigate their tax responsibilities fully and accurately. While the IRS Form 8868 grants the needed extra time, the subsequent use of these forms ensures compliance and aligns with the commitment to financial transparency and accountability. Engaging with these documents thoughtfully helps organizations maintain their good standing and continue their critical work within their communities.

Similar forms

The IRS Form 7004 is similar to Form 8868 because it is used for requesting an automatic extension of time to file certain business income tax, information, and other returns. Both forms serve the purpose of allowing additional time for filing, albeit for different types of entities and tax returns.

The IRS Form 4868 also closely relates to Form 8868 as it provides individuals, rather than organizations, the ability to request a six-month extension to file their federal income tax return. The similarity lies in the mechanism of extending the filing deadline, though they cater to different taxpayer groups.

IRS Form 2350, used by U.S. citizens and resident aliens abroad who cannot meet the April 15th deadline to qualify for certain tax benefits, shares a common goal with Form 8868. Both forms allow taxpayers more time to file their taxes to ensure accuracy and completeness in their submissions.

The IRS Form 5558 is used for requesting an extension of time to file certain employee plan returns. Like Form 8868, it is designed to provide relief from filing deadlines, though Form 5558 specifically targets pension and profit plans rather than tax-exempt organizations or government entities.

Lastly, the IRS Form 8809 is for requesting an extension of time to file information returns, such as forms in the 1099 series. Similar to Form 8868, Form 8809 is a tool for requesting additional time to gather and report information accurately, though it serves a broader array of filers beyond just tax-exempt organizations.

Dos and Don'ts

The IRS Form 8868 is pivotal for organizations seeking an extension of time to file their tax returns. Accuracy and attentiveness are crucial when dealing with tax documentation to assure compliance and avoid unnecessary delays or penalties. Below, find essential dos and don'ts to guide you through the process of filling out the IRS Form 8868 effectively.

Do:- Verify the Tax Year: Ensure that the tax year stated on the form aligns with the year for which you are requesting an extension.

- Provide Accurate Information: Double-check the organization's name, address, and Employer Identification Number (EIN) for correctness.

- Specify the Return Type: Clearly indicate the specific tax form number for which the extension is being requested.

- Estimate Tax Liability Carefully: Provide a reasonable estimate of the tax liability for the year, if applicable.

- Sign the Form: An authorized individual must sign the form to validate the request for an extension.

- Ignore Deadlines: Be cognizant of the filing deadline to ensure the extension request is submitted on time.

- Overlook the Payment of Estimated Taxes: If taxes are owed, failing to pay the estimated amount can lead to penalties, even if an extension is granted.

- File Without Necessity: If an extension is not required, avoid filing Form 8868 to prevent confusion or unnecessary processing.

- Misunderstand the Extension Length: Understand that the form typically grants a 6-month extension, not beyond.

- Send Incomplete Forms: Ensure all required sections are completed to avoid delays in the processing of your extension request.

Adhering to these guidelines will contribute to a smooth and efficient filing process. Remember, the goal is to comply with IRS regulations while securing the necessary time to accurately prepare your tax returns. Should questions or concerns arise, consider reaching out to a tax professional for assistance.

Misconceptions

Filing taxes can often seem daunting, particularly when dealing with specific forms like the IRS 8868 form. This is a request for an extension of time to file an exempt organization's return. However, several misconceptions surround this form, leading to confusion and potential errors. Let's address and clarify some of these common misunderstandings.

- Misconception #1: Filing Form 8868 automatically extends the time to pay taxes.

This is a common misunderstanding. While Form 8868 does grant an organization more time to file their tax return, it does not provide an extension for any taxes that may be owed. Taxes owed are still due by the original deadline, and failure to pay on time may result in penalties and interest.

- Misconception #2: All tax-exempt organizations can use Form 8868.

Not all tax-exempt organizations are eligible to use Form 8868. There are certain restrictions and eligibility criteria that apply. For example, private foundations and certain types of trusts may have different forms or procedures for requesting an extension. Always check the specific requirements for your organization type.

- Misconception #3: Form 8868 grants a six-month extension.

The length of the extension granted upon filing Form 8868 can vary. Historically, it provided a six-month extension, but recent changes now allow certain types of filings a different period. It's vital to understand the specific extension period applicable to your organization's return type.

- Misconception #4: You must explain why you need an extension.

Unlike some other forms or situations where an explanation is necessary, Form 8868 does not require an organization to provide a reason for requesting an extension. The process is designed to be straightforward, focusing on the request rather than the justification.

- Misconception #5: The extension applies to all filings.

Form 8868 specifically applies to the extension of time for filing an exempt organization's return. This does not cover other possible filings or obligations an organization may have with the IRS. Each type of filing might have its own form or process for requesting extensions.

- Misconception #6: Electronic filing is not available for Form 8868.

Another common misconception is that Form 8868 needs to be filed in paper form. However, the IRS encourages electronic filing, and Form 8868 can indeed be filed electronically. This method is often faster and more efficient, allowing for prompt acknowledgment of the extension request.

Understanding these common misconceptions can help organizations navigate the process of requesting an extension more smoothly. Remember, when in doubt, it's always a good idea to consult the IRS guidelines directly or seek professional advice to ensure compliance and avoid potential penalties.

Key takeaways

The IRS 8868 form is an essential document for organizations seeking an extension on their tax return deadlines. Understanding its intricacies can ease the filing process and ensure compliance with tax regulations. Here are eight key takeaways about filling out and using the IRS 8868 form.

- IRS 8868 form serves as an application for organizations to request an automatic 6-month extension on their deadline to file an exempt organization tax return or submit notices.

- The form is divided into two parts: Part I is for an automatic 3-month extension (6 months for certain organizations), and Part II is for an additional (non-automatic) 3-month extension, if needed.

- Filing. The Form can be filed electronically or by mail. Electronic filing is quicker and offers a more immediate confirmation of submission.

- Ensure accuracy in the information provided, including the organization’s name, Employer Identification Number (EIN), and the tax form number for which the extension is requested.

- No explanation is required to be provided with the form for the automatic 3-month extension request. However, for the additional 3-month extension in Part II, a detailed explanation of why the additional time is needed must be included.

- Tax-exempt organizations should still note the importance of attempting to file by the original due date; filing an extension does not extend the time to pay any taxes that may be owed. Interest and penalties may accrue from the original due date of the payment.

- Keep a copy of the filed Form 8868 and any confirmation of the IRS’s receipt of the form for the organization's records. This documentation is crucial in case of disputes or questions about the extension request.

- Timing is crucial: to be effective, the form must be filed by midnight on the due date of the organization's return. Failing to file on time may invalidate the extension request, leading to late filing penalties.

Appropriately managing the Form 8868 filing can significantly impact an organization’s tax filing process, ensuring that they remain in good standing with tax authorities while securing the necessary time to accurately compile and submit their tax information.

Popular PDF Forms

Fbi Fingerprint Background Check - The I-783 form is essential for those needing proof of background checks for employment or licensing.

How to Fill Out California Tax Form De 4 - Contact information fields are designed to appoint a primary point of communication for EDD inquiries.

Ca Jury Duty - The form provides a mechanism for officially declaring the correctness of the information supplied, with a signature and date to affirm this.