Blank IRS 8936 PDF Template

Electric cars are cruising into the mainstream, pushing the boundaries of personal transport, and along the way, lighting up a path toward tax benefits. A key player for individuals and businesses looking to grasp these opportunities is the IRS 8936 form. Designed to incentivize the adoption of electric and plug-in hybrid vehicles, this form is the gateway to potentially significant federal tax credits. Eligible vehicles can secure their drivers a credit up to $7,500, an enticing prospect for those considering an eco-friendly shift. However, navigating the specifics of this form requires a keen understanding of its requirements, the types of vehicles that qualify, and how the credit interacts with one's tax obligations. Additionally, it's crucial to keep abreast of the evolving legislation, as these laws can influence eligibility and the credit's value. Thus, while the promise of a tax break is alluring, fulfilling the detailed conditions laid out by the IRS for this credit demands attention and diligence from taxpayers and their advisors.

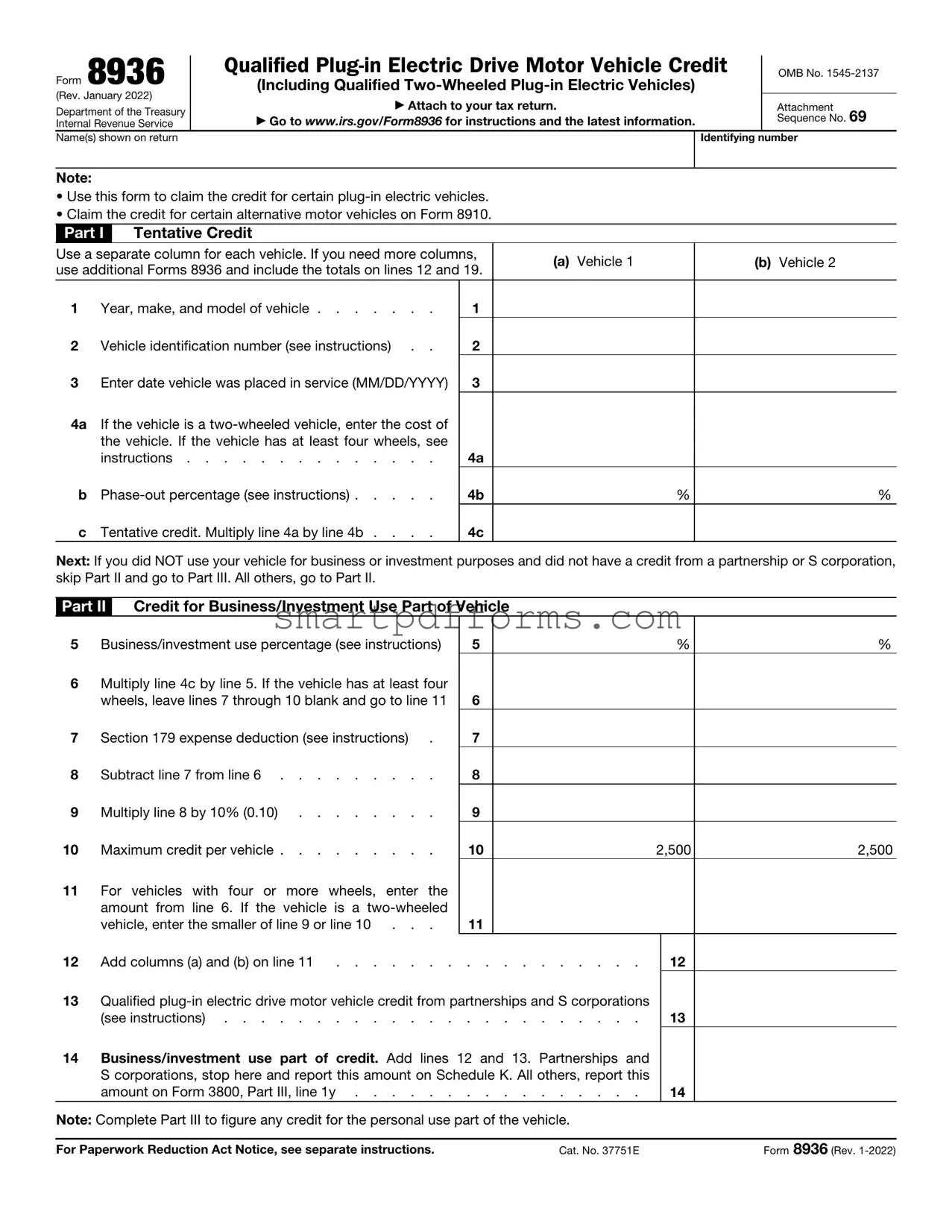

Preview - IRS 8936 Form

Form 8936 |

|

Qualified |

|

OMB No. |

|

|

|

||||

|

(Including Qualified |

|

|

||

(Rev. January 2022) |

|

▶ Attach to your tax return. |

|

Attachment |

|

Department of the Treasury |

|

|

|||

|

▶ Go to www.irs.gov/Form8936 for instructions and the latest information. |

|

Sequence No. 69 |

||

Internal Revenue Service |

|

|

|||

Name(s) shown on return |

|

|

Identifying number |

||

|

|

|

|

|

|

Note:

•Use this form to claim the credit for certain

•Claim the credit for certain alternative motor vehicles on Form 8910.

Part I |

Tentative Credit |

|

|

|

|

||

Use a separate column for each vehicle. If you need more columns, |

(a) |

Vehicle 1 |

(b) Vehicle 2 |

||||

use additional Forms 8936 and include the totals on lines 12 and 19. |

|||||||

|

|

|

|||||

|

|

|

|

|

|

||

1 |

Year, make, and model of vehicle |

1 |

|

|

|

||

2 |

Vehicle identification number (see instructions) . . |

2 |

|

|

|

||

3 |

Enter date vehicle was placed in service (MM/DD/YYYY) |

3 |

|

|

|

||

4a |

If the vehicle is a |

|

|

|

|

||

|

the vehicle. If the vehicle has at least four wheels, see |

|

|

|

|

||

|

instructions |

4a |

|

|

|

||

b |

4b |

|

% |

% |

|||

c |

Tentative credit. Multiply line 4a by line 4b . . . . |

4c |

|

|

|

||

Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or S corporation, skip Part II and go to Part III. All others, go to Part II.

Part II Credit for Business/Investment Use Part of Vehicle

5Business/investment use percentage (see instructions)

6Multiply line 4c by line 5. If the vehicle has at least four wheels, leave lines 7 through 10 blank and go to line 11

7 |

Section 179 expense deduction (see instructions) . |

8 |

Subtract line 7 from line 6 |

9 |

Multiply line 8 by 10% (0.10) |

10Maximum credit per vehicle . . . . . . . . .

11For vehicles with four or more wheels, enter the

amount from line 6. If the vehicle is a

5

6

7

8

9

10

11

%

2,500

%

2,500

12 Add columns (a) and (b) on line 11 |

12 |

13Qualified

(see instructions) |

13 |

14Business/investment use part of credit. Add lines 12 and 13. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, report this

amount on Form 3800, Part III, line 1y |

14 |

Note: Complete Part III to figure any credit for the personal use part of the vehicle.

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 37751E |

Form 8936 (Rev. |

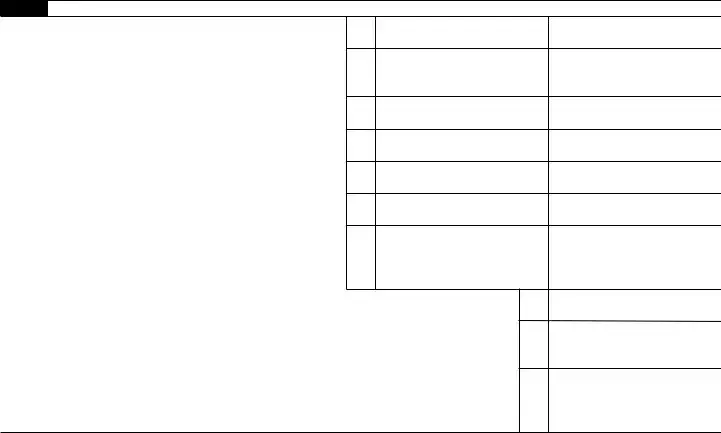

Form 8936 (Rev. |

|

Page 2 |

||

Part III |

Credit for Personal Use Part of Vehicle |

|

|

|

|

|

|

(a) Vehicle 1 |

(b) Vehicle 2 |

15 |

If you skipped Part II, enter the amount from line 4c. If |

|

|

|

|

|

|||

|

you completed Part II, subtract line 6 from line 4c. If the |

|

|

|

|

vehicle has at least four wheels, leave lines 16 and 17 |

|

|

|

|

blank and go to line 18 |

15 |

|

|

16 |

Multiply line 15 by 10% (0.10) |

16 |

|

|

17Maximum credit per vehicle. If you skipped Part II, enter $2,500. If you completed Part II, subtract line 11

from line 10 |

17 |

18For vehicles with four or more wheels, enter the amount from line 15. If the vehicle is a

|

vehicle, enter the smaller of line 16 or line 17 . . . |

18 |

|

19 |

Add columns (a) and (b) on line 18 |

19 |

|

20 |

Enter the amount from Form 1040, |

20 |

|

21 |

Personal credits from Form 1040, |

21 |

|

22Subtract line 21 from line 20. If zero or less, enter

the personal use part of the credit |

22 |

23Personal use part of credit. Enter the smaller of line 19 or line 22 here and on

Schedule 3 (Form 1040), line 6f. If line 22 is smaller than line 19, see instructions . . |

23 |

Form 8936 (Rev.

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 8936 is used for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit, a tax credit for purchasing a qualified electric vehicle. |

| Eligible Vehicles | This form applies to both new four-wheeled electric vehicles and two-wheeled electric vehicles that meet specific criteria set by the IRS and the Department of Energy. |

| Credit Amount | The credit amount can range up to $7,500, depending on the battery capacity and the vehicle's weight. |

| Phase-Out Period | The credit begins to phase out for a manufacturer’s vehicles when at least 200,000 qualifying vehicles have been sold in the United States. |

| Limitations | The credit is non-refundable, meaning it can only be used to the extent that it doesn’t reduce the taxpayer's liability to less than zero. |

| Documentation | Taxpayers must retain documentation proving that the vehicle is qualified for the credit and may be required to furnish more information if audited by the IRS. |

Instructions on Utilizing IRS 8936

Filing an IRS form can often feel daunting, especially when it's not quite clear what comes next after the paperwork is done. When dealing with IRS Form 8936, it's important to approach the task methodically, ensuring all the required information is accurately filled out. This form is a crucial step for individuals seeking to obtain the benefits available to them, and as such, precision and attention to detail cannot be overstressed. After completing the form, the next steps typically involve submitting it by the deadline (usually by April 15, unless an extension is filed), and then waiting for the IRS to process the information. Approval times can vary, so patience is often necessary. To navigate the process, here are the steps you'll need to follow.

- Begin by gathering all necessary documents related to the credit you are claiming. This may include sales receipts and manufacturer's certifications.

- Access the latest version of IRS Form 8936, making sure it's the version for the correct tax year. This can be found on the IRS website.

- Read the instructions carefully. The IRS provides detailed guidelines for every line on the form, ensuring you understand what is required for each section.

- Enter your name and social security number at the top of the form. This information should match what's on your tax return.

- Fill out Part I if you're claiming a credit for a qualified plug-in electric drive motor vehicle you placed in service during the tax year. This section asks for details about the vehicle, such as the date it was placed in service and its cost.

- In Part II, calculate the tentative credit for each vehicle. This involves several steps, such as determining the battery capacity and the base amount of the credit.

- If applicable, complete Part III to determine the phase-out amount. This section is relevant if the manufacturer has sold a certain number of vehicles and the credit is being phased out.

- Combine the amounts from Parts I and II, then enter this figure on your Form 1040, 1040-SR, or 1040-NR. Instructions on where to report the credit on your tax return can be found in the instructions for Form 8936.

- Review the form thoroughly. Make sure all the information is correct and that you haven't missed any required sections.

- Attach Form 8936 to your tax return. If you are filing electronically, follow the software's instructions for attaching forms.

- Submit your tax return by the filing deadline. If you're mailing it, use certified mail for proof of delivery.

Remember, accurate and timely completion of IRS Form 8936 is essential for ensuring you receive the credit you're entitled to. Carefully follow the steps listed above, and consider consulting with a tax professional if you encounter any uncertainties or complexities. This can provide peace of mind, knowing that the form is completed correctly, and maximize your potential benefits.

Obtain Answers on IRS 8936

-

What is the 8936 form used for?

The 8936 form is a document utilized by the Internal Revenue Service (IRS) in the United States. Its primary purpose is to allow individuals who purchase certain types of electric and plug-in hybrid vehicles to claim a tax credit. This incentive is part of the government’s effort to encourage the adoption of environmentally friendly vehicles, aiming to reduce greenhouse gas emissions. The amount of credit you can claim depends on the vehicle's battery capacity and its gross weight, among other factors.

-

Who is eligible to file Form 8936?

Eligibility to file Form 8936 is not universal. It is designated for individuals who have purchased a new qualifying electric vehicle (EV) or plug-in hybrid electric vehicle (PHEV) for use in the United States. This credit isn't only limited to personal vehicles; businesses purchasing qualifying vehicles for business use can also claim this credit. However, for a vehicle to be eligible, it must be primarily used within the United States and be newly acquired for use or lease, not for resale.

-

Can Form 8936 be filed for used vehicles?

No, used vehicles do not qualify for the credit. The tax credit associated with Form 8936 is exclusively available for new vehicles. This stipulation ensures that the vehicle's initial acquisition, whether through purchase or lease, is for use or lease by the taxpayer, and not for resale or re-lease. The aim is to promote the purchase of new, clean-energy vehicles to incrementally replace older, less efficient ones.

-

How is the tax credit calculated?

The calculation of the tax credit on Form 8936 is multi-faceted, taking into account the vehicle's battery capacity and its intended use. Essentially, the base credit starts with an amount set by the government, and additional credit is granted based on the kilowatt-hours (kWh) of the vehicle's battery capacity. The credit can increase if the vehicle is used for business purposes. However, there's also a phase-out period for the credit for each manufacturer after they sell a certain number of eligible vehicles, effectively reducing the credit amount until it's no longer available.

-

Is there a deadline for filing Form 8936?

Yes, there is a deadline for filing Form 8936, which coincides with the tax filing deadline for the year in which the eligible vehicle was purchased. Typically, this deadline is April 15 of the following year, unless an extension is filed. It's important to note that for businesses claiming the credit, the deadline may vary based on their tax filing dates. Late submission may result in delayed or denied credits.

-

How can I file Form 8936?

Form 8936 can be filed electronically with your tax return using most commercial tax return preparation software, or it can be filed on paper along with a paper tax return. The IRS encourages electronic filing because it speeds up the processing time and reduces errors. For those who choose to file on paper, detailed instructions for completing and attaching Form 8936 to your tax return are provided by the IRS.

-

Can the credit be carried forward or back?

Yes, if the credit amount on Form 8936 exceeds the individual’s tax liability for the year, the excess credit may not be refundable but can be carried forward to offset future tax liabilities. However, it cannot be carried back to previous tax years. This feature ensures that taxpayers can benefit from the full amount of the credit, even if their tax burden in the year of purchase is lower than the credit amount.

-

What happens if my vehicle is leased?

In the case of a leased vehicle, the tax credit is claimed by the entity that owns the leased vehicle, usually the leasing company, and not by the individual who has leased the vehicle. The leasing company may choose to pass the savings from the credit on to the lessee in the form of lower monthly payments, but this arrangement is dependent on the terms of the lease and the policies of the leasing company.

Common mistakes

Not verifying eligibility criteria: The first mistake often made is assuming all electric and plug-in hybrid vehicles qualify for the credit without checking the specific eligibility requirements set by the IRS. The list of qualifying vehicles is updated regularly, so it's crucial to verify that your vehicle is eligible for the credit in the year you're claiming it.

Incorrect vehicle identification number (VIN): People frequently enter the wrong VIN for their vehicle. This identification number is critical for the IRS to verify the eligibility of the car for the credit. An incorrect VIN can lead to automatic rejection of the tax credit claim.

Not being the original use purchaser: To be eligible for the credit, you must be the first owner of the vehicle. The credit does not apply to used or second-hand vehicles. Claiming the credit for a vehicle that isn't new to you is a common blunder.

Missing or incorrect tax year: Sometimes, filers forget to indicate the tax year for which they're claiming the credit. The IRS needs this information to process the credit correctly. Moreover, entering the wrong tax year can cause significant processing delays.

Claiming the credit for a leased vehicle: If you're leasing the vehicle rather than buying it, the credit actually goes to the leasing company, as they are the official owner of the vehicle. Leaseholders often mistakenly claim the credit, not realizing it is not available to them directly.

Forgetting to attach required documentation: The IRS may require additional documentation to support your claim for the electric vehicle credit. This could include the purchase contract or lease agreement. Failing to attach such documents can result in the denial of your claim.

Not understanding the phase-out: The electric vehicle tax credit undergoes a phase-out process once a manufacturer sells 200,000 eligible vehicles. Claimants often overlook this and assume the full credit amount is always available, leading to discrepancies in their tax return calculations.

When filling out the IRS 8936 form, paying attention to detail and ensuring accurate information can significantly smooth the process of claiming your electric vehicle tax credit. Avoiding these common mistakes will help ensure that you receive the full credit you're entitled to without unnecessary delays.

Documents used along the form

When filing the IRS 8936 form, which is utilized for claiming the electric vehicle tax credit, several other documents might also need to be submitted to comprehensively fulfill tax obligations and optimize benefits. These forms and documents ensure that taxpayers comply with all regulations while also allowing them to avail themselves of any applicable deductions or credits. Understanding these documents can simplify the process and guarantee that one maximizes their opportunities for tax savings.

- Form 1040 - The U.S. individual income tax return is central to all personal tax filings. It serves as the foundation where the results from other forms, including the credit from Form 8936, are compiled to calculate the taxpayer's total tax liability or refund.

- Schedule 3 (Form 1040) - This schedule allows taxpayers to input credits from Form 8936 into their overall tax picture. Essential for integrating specific credits with the broader context of one's tax return.

- Form 1098 - Mortgage Interest Statement, which is crucial for homeowners as it details the amount of mortgage interest paid. It can influence the taxpayer's deductions and, indirectly, the tax benefits of owning an electric vehicle, especially if the home includes a charging station.

- Form 2441 - Child and Dependent Care Expenses. While not directly related to electric vehicles, this form impacts the overall tax scenario by allowing deductions for child or dependent care, which can affect the total tax situation of an individual claiming the electric vehicle credit.

- Form 8863 - Education Credits (American Opportunity and Lifetime Learning Credits). Like Form 2441, it indirectly impacts the tax return of an individual claiming the electric vehicle tax credit by accounting for education-related credits.

- Form 5695 - Residential Energy Credits. This form is particularly relevant for electric vehicle owners who install solar panels or other renewable energy sources in their homes, as it can provide additional tax credits.

- State-specific forms - Depending on the taxpayer's state of residence, there may be additional forms to file to claim state-level electric vehicle incentives or credits, which can provide further benefits beyond federal tax credits.

Gathering and correctly filling out these forms can be quite a task but is often worth the effort. Each form serves as a building block towards a complete and compliant tax filing, potentially leading to significant savings for eligible taxpayers. Recognizing the role and relevance of these documents in connection with the IRS 8936 form can streamline the tax preparation process and help taxpayers navigate their obligations more efficiently.

Similar forms

The IRS 8936 form, designed for claiming the plug-in electric drive motor vehicle credit, shares similarities with various other tax documents. Each of these documents serves a specific purpose in the realm of tax filings, offering credits, deductions, or necessary reporting for taxpayers. The resemblance they bear to form 8936 stems from their design to incentivize behaviors, investments, or to provide a structured way for taxpayers to report certain financial activities.

- Form 1040: This is the U.S. individual income tax return form. It's the backbone of personal tax reporting, into which the results from form 8936 are integrated. Form 8936 contributes directly to adjustments in the taxpayer’s overall tax liability, which is detailed on the 1040.

- Form 8863: This document is used for claiming education credits, similar to how 8936 is used for electric vehicles. Both forms facilitate tax credits based on qualifying expenses (tuition and related expenses for 8863, and electric vehicle purchases for 8936).

- Form 5695: Used for residential energy credits, it parallels form 8936 in its purpose to offer tax incentives for personal investments in energy efficiency, such as solar panels or other renewable energy sources.

- Form 8910: This form is for alternative motor vehicle credit, including credits for vehicles that do not qualify under form 8936. It targets different technologies but pursues the same goal of incentivizing cleaner transportation options.

- Form 8801: Credit for prior year minimum tax - individuals, estates, and trusts. Analogous to form 8936, it allows taxpayers to carry forward unused credits, in this case, the Alternative Minimum Tax credits to future years.

- Form 8859: The District of Columbia first-time homebuyer credit form, similar to 8936, offers a tax credit for specific qualifying investments, highlighting the government’s role in encouraging certain economic activities.

- Form 4562: Depreciation and amortization form. Like form 8936, it involves claiming tax benefits related to the purchase of assets, albeit through depreciation rather than direct credits.

- Form 3800: General business credit form, which accumulates various business-related tax credits from different forms, similar to how form 8936 might be used by businesses acquiring electric vehicles for fleet use.

- Form 2441: Child and Dependent Care Expenses. It's akin to form 8936 in that it offers tax relief for personal expenses that meet certain criteria, benefiting taxpayers’ responsibilities towards dependents, similar to how 8936 benefits taxpayers’ environmental responsibilities.

- Form 8283: Noncash charitable contributions. While primarily used for donations of property, it shares the concept of providing tax benefits for specific actions deemed beneficial by the government, akin to the incentive for purchasing electric vehicles."

Dos and Don'ts

Filling out IRS Form 8936, which pertains to the Qualified Plug-in Electric Drive Motor Vehicle Credit, can seem daunting at first. However, approaching this task with the right mindset and preparation can make the process smoother and help ensure you don't overlook potential benefits. To assist, here are seven do’s and don'ts you should keep in mind:

Do’s:- Double-check your vehicle's eligibility. Before diving deep into paperwork, ensure your vehicle qualifies for the credit by verifying its make, model, and year against the IRS’s list of eligible vehicles.

- Gather your documentation. Have all necessary information, such as purchase details and the vehicle’s identification number (VIN), readily available before you start filling out the form.

- Read the instructions carefully. It might seem tedious, but the IRS provides detailed instructions for Form 8936 for a reason. Understanding every part of the form is crucial to filling it out correctly.

- Use the correct tax year’s form. Tax laws and form requirements can change from year to year. Ensure you’re using the most current version of Form 8936 for the tax year you’re filing.

- Calculate the credit correctly. Take your time to understand how to calculate your credit accurately. Mistakes here can lead to processing delays or an incorrect credit amount.

- Attach Form 8936 to your tax return. Once completed, attach Form 8936 to your federal income tax return. This step is essential for claiming your credit.

- Keep copies of all documents. After submitting your tax return and Form 8936, make sure to keep copies of these documents and any related receipts or certifications for your records.

- Don’t guess on vehicle specifications or credit amounts. Base your entries on factual, documented information to avoid errors or potential fraud allegations.

- Don’t overlook leased vehicles. If you’re leasing an eligible vehicle, you may still qualify for certain benefits, but the credit might be claimed differently.

- Don’t neglect tax software or professional assistance. If you’re unsure about anything, using tax software with built-in guidance for Form 8936 or consulting with a tax professional can be very helpful.

- Don’t file electronically without retaining a printed copy. Even if you file your tax return electronically, keep a printed copy of Form 8936 and related documents for your records.

- Don’t assume the credit will reduce your taxes owed dollar for dollar. Understand how the credit works; it may reduce the amount of tax you owe but not necessarily result in a refund.

- Don’t forget to review state or local incentives. In addition to the federal credit, your state or locality may offer additional incentives for electric vehicle ownership.

- Don’t wait until the last minute. Rushing through tax documents can lead to mistakes. Give yourself plenty of time to fill out Form 8936 accurately and thoroughly.

Misconceptions

The IRS 8936 form, associated with the tax credit for electric vehicles (EVs) and plug-in hybrids, often stirs confusion and misconceptions among taxpayers. To help clarify, let's correct some common misunderstandings:

It's only for electric cars. While it's known as a benefit for electric vehicle owners, the IRS 8936 form applies to both all-electric vehicles and plug-in hybrid electric vehicles. The key requirement is the ability to be recharged from an external source of electricity.

You get the same credit amount for any qualifying vehicle. The credit amount varies based on the battery capacity and the vehicle's make and model. It can range from $2,500 to $7,500, depending on these specifics.

The credit always reduces the amount of tax you owe, dollar for dollar. True, the credit is designed to lower your owed taxes. However, since it's a non-refundable tax credit, it can only bring your tax liability to zero and won't result in a refund if the credit exceeds your liability.

Leased vehicles don’t qualify for the credit. Actually, while you personally won't claim the credit on a leased vehicle, the credit can benefit you indirectly. The leasing company, which technically owns the vehicle, can claim the credit and often passes the savings down to you through lower lease payments.

If your vehicle is eligible, you automatically get the credit. To claim the credit, you must meet specific eligibility criteria, such as using the vehicle primarily in the United States and for personal use, not for resale. Moreover, you need to attach Form 8936 to your tax return to actually claim the credit.

Used vehicles qualify for the credit. The tax credit is exclusive to the original purchase of a new, qualifying vehicle. Used electric vehicles do not qualify for this specific credit, though some states offer incentives for used EV purchases.

Every electric vehicle on the market is eligible for the full $7,500 credit. Not all EVs qualify for the maximum credit. The full credit amount is determined by the vehicle’s battery size and other factors. Additionally, the full credit phases out for a manufacturer’s vehicles when they sell 200,000 qualifying vehicles, at which point the credit available to buyers gets reduced and eventually eliminated.

You can't claim the credit after the year you purchased the vehicle. This misconception leads people to believe they must claim the credit in the same tax year they purchased the vehicle. However, if you didn't owe taxes in the year of purchase but owe taxes in the following year, you can't carry the credit forward. It's a use-it-or-lose-it deal for the year of purchase only.

Understanding these misconceptions about IRS Form 8936 can significantly affect how one approaches the purchase and tax treatment of electric vehicles and plug-in hybrids. Carefully reviewing eligibility and credit details can ensure that taxpayers take full advantage of available benefits correctly.

Key takeaways

When it comes to understanding and utilizing the IRS Form 8936, it's essential for taxpayers seeking to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit. This credit is a financial incentive designed to encourage the purchase of electric vehicles. Here are five key takeaways to ensure accurate completion and usage of the form:

- Determine Eligibility: Before filling out the form, it's crucial to confirm that your vehicle qualifies. The credit applies only to new vehicles that are primarily used in the United States and have a battery with at least 4 kilowatt hours of capacity. Additionally, the vehicle must be placed in service during the tax year in which you're claiming the credit.

- Accurate Information is Key: Ensure all the information you provide on Form 8936 is accurate. This includes your vehicle's make, model, year, and vehicle identification number (VIN), along with your personal information. Errors can delay processing or result in denial of the credit.

- Understand the Credit Amount: The credit amount can vary from $2,500 to $7,500, based on the battery capacity and the gross vehicle weight rating. Be sure to calculate the credit correctly to maximize your benefit while ensuring compliance with IRS rules.

- Attach to Your Tax Return: Form 8936 should be completed and attached to your tax return. If you’re filing electronically, follow the software's instructions for attaching the form. Paper filers need to include it with their return, ensuring it's properly signed and dated.

- Keep Records: It's advisable to keep detailed records regarding your electric vehicle purchase, including the sales contract or lease agreement, proof of payment, and the original manufacturer’s certification stating that the vehicle qualifies for the credit. These documents should be kept with your tax records in case the IRS requires verification.

By paying close attention to these considerations, taxpayers can navigate the complexities of Form 8936 more effectively, ensuring that they accurately claim the credit they're entitled to. Remember, the goal of the credit is not just to provide financial benefits to electric vehicle owners but also to support environmental sustainability through the promotion of cleaner, electric transportation options.

Popular PDF Forms

Healthy Paws Claim - With Healthy Paws Pet Insurance, keeping track of your claim submission is made easy by providing a direct email, fax number, and mailing address for your convenience.

Religious Vaccine Exemption - It is an essential document for families whose religious convictions are at odds with the state's general vaccination mandates.

Form 3520 - By requiring detailed reporting, the form plays a critical role in the government's taxation and regulatory mechanisms.