Blank IRS 911 PDF Template

When taxpayers find themselves in a maze of IRS processes that seem too complex to navigate alone, there's a beacon of hope that often goes unnoticed: the IRS Form 911, the request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order). This form is a critical tool for those seeking a helping hand in resolving tax issues that haven't been fixed through normal channels, or when these issues are causing significant hardship. The Taxpayer Advocate Service (TAS) is designed to be your ally within the IRS, offering a direct line to assist with problems that seem insurmountable. Whether it's a delayed refund, a complex dispute, or an urgent issue threatening financial stability, the IRS 911 form is the starting point for getting personalized, expedient help. By filling out this form, taxpayers can detail their concerns, outline the efforts they've made to resolve them, and officially request the assistance of an advocate who will work with them every step of the way. It's a crucial resource, offering a glimmer of hope and support for those feeling overwhelmed by their tax situations.

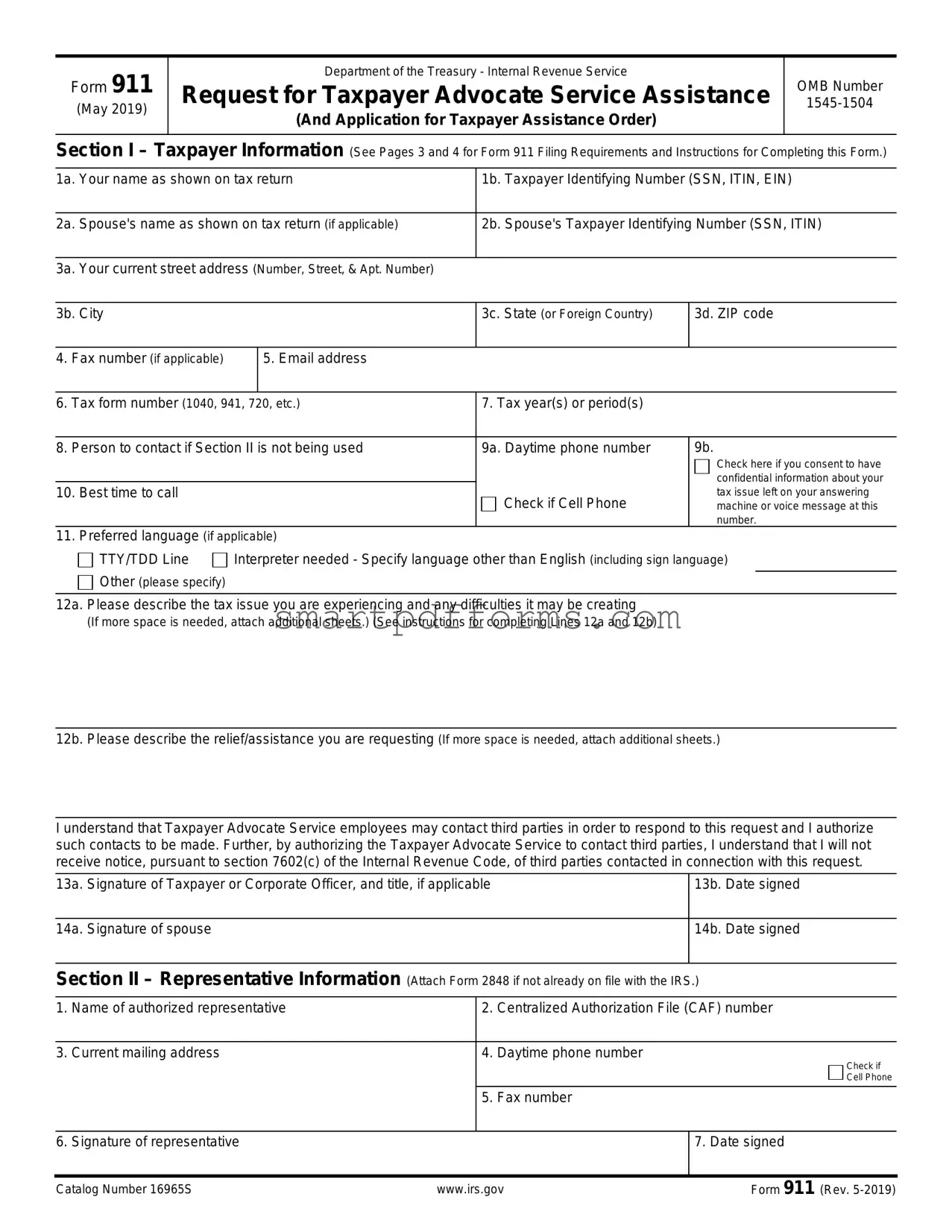

Preview - IRS 911 Form

Form 911

(May 2019)

Department of the Treasury - Internal Revenue Service

Request for Taxpayer Advocate Service Assistance

(And Application for Taxpayer Assistance Order)

OMB Number

Section I – Taxpayer Information (See Pages 3 and 4 for Form 911 Filing Requirements and Instructions for Completing this Form.)

1a. |

Your name as shown on tax return |

1b. Taxpayer Identifying Number (SSN, ITIN, EIN) |

||||

|

|

|

|

|

|

|

2a. |

Spouse's name as shown on tax return (if applicable) |

2b. Spouse's Taxpayer Identifying Number (SSN, ITIN) |

||||

|

|

|

|

|

|

|

3a. |

Your current street address (Number, Street, & Apt. Number) |

|

|

|

||

|

|

|

|

|

|

|

3b. |

City |

|

|

3c. State (or Foreign Country) |

3d. ZIP code |

|

|

|

|

|

|

|

|

4. Fax number (if applicable) |

|

5. Email address |

|

|

|

|

|

|

|

|

|

||

6. Tax form number (1040, 941, 720, etc.) |

7. Tax year(s) or period(s) |

|

|

|||

|

|

|

|

|||

8. Person to contact if Section II is not being used |

9a. Daytime phone number |

9b. |

||||

|

|

|

|

|

Check here if you consent to have |

|

|

|

|

|

|

confidential information about your |

|

10. |

Best time to call |

|

|

Check if Cell Phone |

tax issue left on your answering |

|

|

|

|

|

machine or voice message at this |

||

|

|

|

|

|

number. |

|

11. |

Preferred language (if applicable) |

|

|

|

||

|

TTY/TDD Line |

Interpreter needed - Specify language other than English (including sign language) |

||||

|

Other (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

12a. Please describe the tax issue you are experiencing and any difficulties it may be creating

(If more space is needed, attach additional sheets.) (See instructions for completing Lines 12a and 12b)

12b. Please describe the relief/assistance you are requesting (If more space is needed, attach additional sheets.)

I understand that Taxpayer Advocate Service employees may contact third parties in order to respond to this request and I authorize such contacts to be made. Further, by authorizing the Taxpayer Advocate Service to contact third parties, I understand that I will not receive notice, pursuant to section 7602(c) of the Internal Revenue Code, of third parties contacted in connection with this request.

13a. Signature of Taxpayer or Corporate Officer, and title, if applicable

13b. Date signed

14a. Signature of spouse

14b. Date signed

Section II – Representative Information (Attach Form 2848 if not already on file with the IRS.)

1. |

Name of authorized representative |

|

2. |

Centralized Authorization File (CAF) number |

|

|

|

|

|

|

|

3. |

Current mailing address |

|

4. |

Daytime phone number |

Check if |

|

|

|

|

|

|

|

|

|

|

|

Cell Phone |

|

|

|

|

|

|

|

|

|

5. |

Fax number |

|

|

|

|

|

|

|

6. |

Signature of representative |

|

|

|

7. Date signed |

|

|

|

|

||

Catalog Number 16965S |

www.irs.gov |

Form 911 (Rev. |

|||

|

|

|

|

|

|

Page 2 |

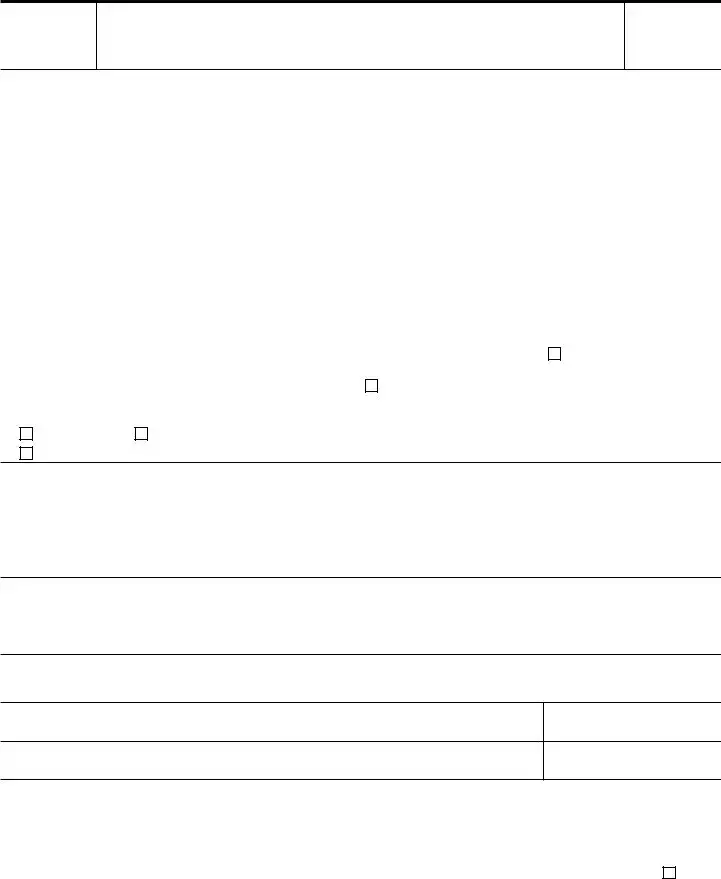

Section III – Initiating Employee Information (Section III is to be completed by the IRS only) |

|

|

||||

|

|

|

|

|||

Taxpayer name |

|

|

Taxpayer Identifying Number (TIN) |

|||

|

|

|

|

|

|

|

1. |

Name of employee |

2. Phone number |

3a. Function |

3b. Operating division |

4. |

Organization code no. |

|

|

|

|

|

|

|

5. |

How identified and received (Check the appropriate box) |

|

6. |

IRS received date |

||

IRS Function identified issue as meeting Taxpayer Advocate Service (TAS) criteria

(r) Functional referral (Function identified taxpayer issue as meeting TAS criteria)

(r) Functional referral (Function identified taxpayer issue as meeting TAS criteria)

(x) Congressional correspondence/inquiry not addressed to TAS but referred for TAS handling

(x) Congressional correspondence/inquiry not addressed to TAS but referred for TAS handling

Name of Senator/Representative

Taxpayer or Representative requested TAS assistance

(n) Taxpayer or representative called into a National Taxpayer Advocate (NTA)

(n) Taxpayer or representative called into a National Taxpayer Advocate (NTA)

(s) Functional referral (taxpayer or representative specifically requested TAS assistance)

(s) Functional referral (taxpayer or representative specifically requested TAS assistance)

7.TAS criteria (Check the appropriate box. NOTE: Checkbox 9 is for TAS Use Only)

(1) The taxpayer is experiencing economic harm or is about to suffer economic harm.

(1) The taxpayer is experiencing economic harm or is about to suffer economic harm.

(2) The taxpayer is facing an immediate threat of adverse action.

(2) The taxpayer is facing an immediate threat of adverse action.

(3) The taxpayer will incur significant costs if relief is not granted (including fees for professional representation).

(3) The taxpayer will incur significant costs if relief is not granted (including fees for professional representation).

(4) The taxpayer will suffer irreparable injury or

(4) The taxpayer will suffer irreparable injury or

(if any items

(5) The taxpayer has experienced a delay of more than 30 days to resolve a tax account problem.

(5) The taxpayer has experienced a delay of more than 30 days to resolve a tax account problem.

(6) The taxpayer did not receive a response or resolution to their problem or inquiry by the date promised.

(6) The taxpayer did not receive a response or resolution to their problem or inquiry by the date promised.

(7)A system or procedure has either failed to operate as intended, or failed to resolve the taxpayer's problem or dispute within the IRS.

(8)The manner in which the tax laws are being administered raise considerations of equity, or have impaired or will impair the taxpayer's rights.

(9) The NTA determines compelling public policy warrants assistance to an individual or group of taxpayers (TAS Use Only)

(9) The NTA determines compelling public policy warrants assistance to an individual or group of taxpayers (TAS Use Only)

8.What action(s) did you take to help resolve the issue? (This block MUST be completed by the initiating employee)

If you were unable to resolve the issue, state the reason why (if applicable)

9.Provide a description of the Taxpayer's situation, and where appropriate, explain the circumstances that are creating the economic burden and how the Taxpayer could be adversely affected if the requested assistance is not provided

(This block MUST be completed by the initiating employee)

10. How did the taxpayer learn about the Taxpayer Advocate Service |

|

|

||

IRS Forms or Publications |

Media |

IRS Employee |

Other (please specify) |

|

|

|

|

|

|

|

|

|

|

|

Catalog Number 16965S |

|

www.irs.gov |

|

Form 911 (Rev. |

Page 3

Instructions for completing Form 911

Form 911 Filing Requirements

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. We can help you resolve problems you can’t resolve with the IRS. And our service is free. TAS can help you if:

•Your problem is causing financial difficulty for you, your family, or your business.

•You face (or your business is facing) an immediate threat of adverse action.

•You’ve tried repeatedly to contact the IRS but no one has responded, or the IRS hasn’t responded by the date promised.

TAS will generally ask the IRS to stop certain activities while your request for assistance is pending (for example, lien filings, levies, and

seizures).

Where to Send this Form:

•The quickest method is Fax. TAS has at least one office in every state, the District of Columbia, and Puerto Rico. Submit this request to the TAS office in your state or city. You can find the fax number in the government listings in your local telephone directory, on our website at www.taxpayeradvocate.irs.gov, or in Publication 1546, Taxpayer Advocate Service - Your Voice at the IRS.

•You also can mail this form. You can find the mailing address and phone number (voice) of your local Taxpayer Advocate office in your phone book, on our website, and in Pub. 1546, or get this information by calling our

•Are you sending the form from overseas? Fax it to

•Please be sure to fill out the form completely and submit it to the TAS office nearest you so we can work your issue as soon as possible.

What Happens Next?

If you don't hear from us within one week of submitting Form 911, please call the TAS office where you sent your request. You can find

the number at www.taxpayeradvocate.irs.gov.

Important Notes: Please be aware that by submitting this form, you are authorizing TAS to contact third parties as necessary to respond to your request, and you may not receive further notice about these contacts. For more information see IRC 7602(c).

Caution: TAS will not consider frivolous arguments raised on this form. You can find examples of frivolous arguments in Publication 2105, Why do I have to Pay Taxes? If you use this form to raise frivolous arguments, you may be subject to a penalty of $5,000.

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. Your response is voluntary. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. Although the time needed to complete this form may vary depending on individual circumstances, the estimated average time is 30 minutes.

Should you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, please write to: Internal Revenue Service, Tax Products Coordinating Committee, Room 6406, 1111 Constitution Ave. NW, Washington, DC 20224.

Instructions for Section I

1a. Enter your name as shown on the tax return that relates to this request for assistance.

1b. Enter your Taxpayer Identifying Number. If you're an individual this will be either a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you're a business entity this will be your Employer Identification Number (EIN) (e.g. a

partnership, corporation, trust or

2a. Enter your spouse's name (if applicable) if this request relates to a jointly filed return.

2b. Enter your spouse's Taxpayer Identifying Number (SSN or ITIN) if this request relates to a jointly filed return.

4.Enter your fax number, including the area code.

5.Enter your email address. We'll only contact you by email if we can't reach you by phone and your issue appears to be time- sensitive. We will not, however, use your email address to discuss the specifics of your case.

6.Enter the number of the Federal tax return or form that relates to this request. For example, an individual taxpayer with an income tax issue would enter Form 1040.

7.Enter the quarterly, annual, or other tax year or period that relates to this request. For example, if this request involves an income tax issue, enter the calendar or fiscal year, if an employment tax issue, enter the calendar quarter.

Instructions for Section I ► continue on the next page

Catalog Number 16965S |

www.irs.gov |

Form 911 (Rev. |

Page 4

Instructions for Section I - (Continued from Page 3)

8.Enter the name of the individual we should contact if Section II is not being used. For partnerships, corporations, trusts, etc., enter the name of the individual authorized to act on the entity's behalf. If the contact person is not the taxpayer or other authorized individual, please see the Instructions for Section II.

9a. Enter your daytime telephone number, including the area code. If this is a cell phone number, please check the box.

9b. If you have an answering machine or voice mail at this number and you consent to TAS leaving confidential information about your tax issue at this number, please check the box. You are not obligated to have information about your tax issue left at this number. If other individuals have access to the answering machine or the voice mail and you do not wish for them to receive any confidential information about your tax issue, please do not check the box.

10.Indicate the best time to call you. Please specify A.M. or P.M. hours.

11.Indicate any special communication needs (such as sign language). Specify any language other than English.

12a. Please describe the tax issue you are experiencing and any difficulties it may be creating. Specify the actions that the IRS has taken (or not taken) to resolve the issue. If the issue involves an IRS delay of more than 30 days in resolving your issue, indicate the date you first contacted the IRS for assistance. See Section III for a specific list of TAS criteria.

12b. Please describe the relief/assistance you are requesting. Specify the action you want taken and believe necessary to resolve the issue. Furnish any documentation you believe would assist us in resolving the issue.

Note: The signing of this request allows the IRS by law to suspend any applicable statutory periods of limitation relating to the assessment or collection of taxes. However, it does not suspend any applicable periods for you to perform acts related to assessment or collection, such as petitioning the Tax Court for redetermination of a deficiency or requesting a Collection Due Process hearing.

Instructions for Section II

Taxpayers: If you wish to have a representative act on your behalf, you must give him/her power of attorney or tax information authorization for the tax return(s) and period(s) involved. For additional information see Form 2848, Power of Attorney and Declaration of Representative, or Form 8821, Tax Information Authorization, and the accompanying instructions.

Representatives: If you are an authorized representative submitting this request on behalf of the taxpayer identified in Section I, complete Blocks 1 through 7 of Section II. Attach a copy of Form 2848, Form 8821, or other power of attorney. Enter your Centralized Authorization File (CAF) number in Block 2 of Section II. The CAF number is the unique number that the IRS assigns to a representative after Form 2848 or Form 8821 is filed with an IRS office.

Note: Form 8821 does not authorize your appointee to advocate your position with respect to the Federal tax laws; to execute waivers, consents, or closing agreements; or to otherwise represent you before the IRS. Form 8821 does authorize anyone you designate to inspect and/or receive your confidential tax information in any office of the IRS, for the type of tax and tax periods you list on

Form 8821.

Instructions for Section III (For IRS Use Only) Please complete this section in its entirety.

Enter the taxpayer's name and taxpayer identification number from the first page of this form.

1.Enter your name.

2.Enter your phone number.

3a. Enter your Function (e.g., ACS, Collection, Examination, Customer Service, etc.).

3b. Enter your Operating Division (W&I, SB/SE, LB&I, or TE/GE).

4.Enter the Organization code number for your office (e.g., 18 for AUSC, 95 for Los Angeles).

5.Check the appropriate box that best reflects how the need for TAS assistance was identified. For example, did taxpayer or representative call or write to an IRS function or TAS.

6.Enter the date the taxpayer or representative called or visited an IRS office to request TAS assistance. Or enter the date when the IRS received the Congressional correspondence/inquiry or a written request for TAS assistance from the taxpayer or representative. If the IRS identified the taxpayer's issue as meeting TAS criteria, enter the date this determination was made.

7.Check the box that best describes the reason TAS assistance is requested. Box 9 is for TAS Use Only.

8.State the action(s) you took to help resolve the taxpayer's issue. State the reason(s) that prevented you from resolving the taxpayer's issue. For example, levy proceeds cannot be returned because they were already applied to a valid liability; an overpayment cannot be refunded because the statutory period for issuing a refund expired; or current law precludes a specific interest abatement.

9.Provide a description of the taxpayer's situation, and where appropriate, explain the circumstances that are creating the economic burden and how the taxpayer could be adversely affected if the requested assistance is not provided.

10.Ask the taxpayer how he or she learned about the TAS and indicate the response here.

Catalog Number 16965S |

www.irs.gov |

Form 911 (Rev. |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS 911 form is used to request assistance from the Taxpayer Advocate Service for taxpayers experiencing economic harm or who believe an IRS system or procedure is not working as it should. |

| Eligibility Criteria | To be eligible for assistance using form 911, taxpayers must be experiencing economic harm or need help resolving tax problems that they have not been able to resolve through regular IRS channels. |

| Confidentiality | Information provided on the IRS 911 form is kept confidential in accordance with IRS policies and regulations, ensuring taxpayer privacy and security. |

| Availability | The form is available for download on the IRS website and can be filed electronically or on paper, depending on the taxpayer's preference and accessibility. |

| Governing Law | The use and processing of the IRS 911 form are governed by federal tax law, specifically under the authority of the Internal Revenue Code (IRC) and regulated by the Internal Revenue Service (IRS). |

| No State-specific Versions | Since the IRS 911 form relates to federal tax issues, it does not have state-specific versions. The same form is used across all states under the governance of federal laws and regulations. |

Instructions on Utilizing IRS 911

Once the IRS 911 form is submitted, it sets a process in motion to address specific taxpayer issues that haven't been resolved through normal channels, or when the taxpayer believes an IRS system or procedure is not working as it should. This step is crucial for taxpayers seeking expedited resolution or facing hardships. Understanding the correct way to fill out this form is the first step in initiating this process, ensuring that your request receives the attention it deserves. Below are the steps you should follow to properly complete the IRS 911 form.

- Gather all necessary documents: Before you start filling out the form, ensure you have all relevant tax documents, correspondence, and notices from the IRS at hand. This information will help you provide accurate details in the form.

- Personal Information: At the top of the form, fill in your full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and your date of birth. If applicable, also provide the same information for your spouse.

- Contact Information: Enter your current mailing address, including any apartment or suite number, city, state, and ZIP code. Include your primary phone number and an alternative number where you can be reached during the day.

- Representation Information: If you have an authorized representative, fill in their name, phone number, and address. You'll also need to attach a signed copy of Form 2848, Power of Attorney and Declaration of Representative, unless already on file.

- Explain Your Tax Issue: In the section provided, clearly describe the tax issue you're facing. Include specific details such as dates, previous actions taken to resolve the issue, and why you believe the issue requires urgent attention or why the IRS's systems have failed to resolve it.

- State Your Desired Solution: Clearly articulate what you believe to be a fair resolution to your issue. This helps the Taxpayer Advocate Service understand your expectations and work towards a viable solution.

- Sign and Date the Form: The IRS 911 form requires your signature to validate your request. Make sure you sign and date the form. If you're filing jointly and both parties are seeking assistance, both must sign and date.

Completing the IRS 911 form is only the beginning of your journey to resolution. Once submitted, the Taxpayer Advocate Service, an independent organization within the IRS, will review your case. They may contact you for further information or clarification, so it’s important to be prepared to provide additional documentation or details about your situation. Patience and cooperation are crucial during this phase, as these professionals work diligently to offer solutions and guidance tailored to your unique case.

Obtain Answers on IRS 911

-

What is the IRS Form 911 and who uses it?

The IRS Form 911, formally known as the Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order), serves as a request mechanism for individuals seeking help resolving tax issues that haven't been resolved through normal IRS channels. It's particularly used by taxpayers who are experiencing financial difficulty or immediate threat of adverse action, and need the intervention of the Taxpayer Advocate Service (TAS) to help solve their tax problems.

-

How does one qualify for assistance through Form 911?

Qualification for assistance through Form 911 hinges on facing significant hardship, a looming threat of enforcement action, experiencing an IRS system or procedure delay, or if an individual believes that the IRS's system has not operated in a fair or equitable manner in their case. Essentially, if your issue with the IRS severely affects your financial condition, you might qualify for assistance.

-

What information is required when filling out Form 911?

When completing Form 911, taxpayers need to provide personal information, including their name, address, Social Security Number (or Employer Identification Number for businesses), and telephone number. Additionally, the form requires details about the tax issue at hand, including the tax periods or years involved, a thorough explanation of the issue, and what efforts have been made to resolve the issue with the IRS prior to seeking TAS assistance.

-

Where and how can one submit Form 911 to the IRS?

Form 911 can be submitted to the IRS in a number of ways, offering flexibility to the taxpayer. It can be sent via fax, mail, or delivered in person at a local Taxpayer Assistance Center. The specifics, such as fax numbers and mailing addresses, can be found on the IRS website or by contacting the Taxpayer Advocate Service directly. In some cases, calling the TAS directly can initiate the process over the phone, with a TAS employee helping to complete the form.

-

Is there a cost associated with filing Form 911 or receiving assistance from the Taxpayer Advocate Service?

No, there is no cost for filing Form 911 or for any assistance received from the Taxpayer Advocate Service. The TAS is an independent organization within the IRS, designed to ensure that every taxpayer is treated fairly and understands their rights under the Taxpayer Bill of Rights. Their services are provided free of charge to eligible taxpayers.

-

What happens after Form 911 is submitted?

After submitting Form 911, the case is reviewed by the Taxpayer Advocate Service. If the case is accepted, a case advocate is assigned to personally handle the taxpayer's issue. This advocate acts as an intermediary between the taxpayer and the IRS, working to resolve the problem. The advocate will keep the taxpayer informed throughout the process, working towards a resolution that relieves the taxpayer's hardship. The timeline for resolution can vary based on the complexity of the issue.

-

Can a taxpayer appeal a decision made by the Taxpayer Advocate Service?

While the Taxpayer Advocate Service works to achieve a resolution in favor of the taxpayer, their decision is not always subject to a formal appeal process. However, if a taxpayer is unsatisfied with the outcome or the handling of their case by the TAS, they can raise their concerns to a higher level within the TAS organization. Also, taxpayers maintain the right to appeal IRS decisions through the usual channels, independently of the TAS’s assistance.

Common mistakes

Filling out the IRS Form 911, which is used to request taxpayer advocate service assistance, can sometimes be overwhelming. Individuals might make errors due to the form's detailed nature. Understanding common mistakes can help in avoiding them, ensuring the process goes smoothly. Here are six frequently made errors:

Not providing complete contact information. It's crucial to fill in every field related to contact information. Missing details can delay or prevent the IRS from reaching out for further clarification or assistance.

Leaving the tax issue description vague. It's important to be as detailed and specific as possible when describing the tax issue being faced. A vague description may lead to misunderstandings about the nature of the problem.

Failing to specify the tax years or periods involved. Always list all the relevant tax years or periods your issue relates to. This helps the IRS to locate your records and understand the timeframe of your concern.

Forgetting to sign and date the form. A signature and date are required to process Form 911. This oversight can result in the form being returned or processing delays.

Omitting relevant documentation. Sometimes, additional documentation is necessary to support the request. Not attaching these documents can hinder the IRS's ability to fully understand or resolve the issue.

Ignoring the authorization section if a representative is being used. If someone else is representing your interests to the IRS, ensure the authorization section is filled out completely. Without this, the IRS cannot legally discuss your case with the representative.

Being mindful of these mistakes and taking the time to review the form before submission can lead to a smoother and quicker resolution of tax issues.

Documents used along the form

When facing tax issues, it’s essential to have a clear understanding of the resources at your disposal. The IRS Form 911 is a valuable tool for taxpayers seeking assistance from the Taxpayer Advocate Service. But navigating tax challenges often requires more than a single form. A range of other documents can be integral to resolving tax matters efficiently and effectively. Here’s a look at some of the key forms and documents that are commonly used in conjunction with the IRS Form 911.

- Form 1040 - This is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It collects information about the taxpayer's income, deductions, and credits to determine their tax liability.

- Form 2848 - Power of Attorney and Declaration of Representative. This form allows taxpayers to authorize an individual, such as an attorney, certified public accountant, or enrolled agent, to represent them before the IRS.

- Form 433-A - Collection Information Statement for Wage Earners and Self-Employed Individuals. It provides the IRS with detailed information about the taxpayer's financial situation. This form is often required when setting up a payment plan or negotiating an offer in compromise.

- Form 433-B - Collection Information Statement for Businesses. Similar to Form 433-A, but designed for businesses. It gathers detailed financial information needed to assess the business's ability to pay outstanding tax liabilities.

- Form 8857 - Request for Innocent Spouse Relief. This form is used by taxpayers seeking relief from joint tax liabilities due to actions or omissions by their spouse or former spouse.

- Form 9465 - Installment Agreement Request. Taxpayers use this form to propose a monthly payment plan to the IRS when they cannot pay their tax debt in full immediately.

- Form 4506 - Request for Copy of Tax Return. This form allows taxpayers to request copies of previously filed tax returns and attachments. These can be crucial for accurate record-keeping and future tax-related processes.

- Form 4506-T - Request for Transcript of Tax Return. It is used to request a transcript of a tax return, which is often sufficient for most legal, financial, and tax-related matters.

- Form 8821 - Tax Information Authorization. This authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential tax information for the type of tax and the years you list on the form.

- Form 656 - Offer in Compromise. This form allows taxpayers to settle their tax debt for less than the full amount owed if they can prove that paying the full amount would cause financial hardship.

In conclusion, while the IRS Form 911 is a critical starting point for dealing with tax issues, understanding and utilizing additional forms and documents can significantly enhance one’s ability to navigate through tax matters. Each of these documents serves a specific purpose and can be a key part of achieving resolution with the IRS. Being informed and prepared with the right forms at the right time can make all the difference in managing tax responsibilities effectively.

Similar forms

IRS Form 1040: This form, utilized for individual income tax returns, shares similarities with the IRS 911 in terms of requiring detailed personal information to assess financial status and obligations.

IRS Form 2848: Power of Attorney and Declaration of Representative form, like the IRS 911, allows taxpayers to designate someone to act on their behalf, underscoring the significance of representation in dealing with tax matters.

IRS Form 8821: Tax Information Authorization provides another parallel, as it authorizes individuals to request and inspect confidential tax documents, which is a function closely associated with the actions facilitated by the IRS 911 form in resolving tax issues.

IRS Form 4506-T: Request for Transcript of Tax Return, which enables individuals to request prior-year tax returns, shares a commonality with the 911 form in facilitating access to tax records essential for resolving discrepancies or issues.

IRS Form 843: Claim for Refund and Request for Abatement, much like the 911, is used by taxpayers seeking relief or corrections to their tax obligations, highlighting the forms' roles in addressing and rectifying tax-related concerns.

IRS Form 656: Offer in Compromise allows taxpayers to negotiate their tax liabilities, reflecting the IRS 911 form's purpose in offering a pathway to resolving tax issues through various resolutions, including reductions in tax obligations.

IRS Form 433-A: Collection Information Statement for Wage Earners and Self-Employed Individuals, gathers comprehensive financial information for assessing payment plans, similar to the in-depth analysis necessitated by the IRS 911 for issue resolution.

IRS Form 9465: Installment Agreement Request, which like the IRS 911, serves as a means for individuals facing financial difficulties to arrange a manageable plan to fulfill their tax obligations over time.

IRS Form 12153: Request for a Collection Due Process or Equivalent Hearing, parallels the IRS 911 form by offering taxpayers a formal avenue to dispute tax claims and seek a fair hearing regarding their liabilities.

IRS Form 8379: Injured Spouse Allocation, although specific in its application, it shares the underlying principle of the IRS 911 in helping individuals navigate tax issues, particularly in cases where joint filer relief is sought.

Dos and Don'ts

Filling out the IRS 911 form, which is a request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order), should be done carefully. The following guidelines help ensure the process goes smoothly and can potentially speed up the resolution of your tax issue.

Things you should do:

- Provide detailed information about your tax issue, including the tax years and types of tax involved. This helps the Taxpayer Advocate Service understand your problem and how to assist you.

- Explain what actions you have already taken to resolve your issue. For example, if you've contacted the IRS before, note the dates and the outcomes of those interactions.

- Clearly state the financial hardship you are experiencing or the systemic burden, if any, to highlight the urgency of your case.

- Ensure all your contact information is current and accurate. This includes your phone number, address, and email, if available. Quick and easy communication can significantly expedite the resolution process.

- Sign and date the form. An unsigned form may lead to delays as it can't be processed until it's properly signed.

- Keep a copy of the completed form and any supporting documents for your records. This can be helpful for any future follow-ups or inquiries.

Things you shouldn't do:

- Avoid leaving sections incomplete. If a section does not apply to your situation, write 'N/A' or 'Not Applicable' instead of leaving it blank. This shows that you didn't overlook the section.

- Do not provide vague descriptions of your problem. Be as specific as possible to prevent any misunderstandings and to help the Taxpayer Advocate Service advocate on your behalf efficiently.

- Refrain from sending original documents. Always send copies unless specifically requested to send the original ones.

- Do not wait until the last minute to seek help from the Taxpayer Advocate Service. The sooner you submit Form 911, the more time they have to work on your case.

- Avoid submitting the form without reviewing it for errors or missing information. Mistakes can delay the review process.

- Don't try to handle everything on your own if you're not sure about the process. Consider seeking help from a tax professional or advocate who can offer guidance and support.

Misconceptions

The IRS Form 911, Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order), is often misunderstood, leading to misconceptions that can prevent taxpayers from getting the help they need. Here are the most common misconceptions and the truth behind them:

Only for emergencies: Many believe the IRS Form 911 is only for emergencies, thinking it's akin to dialing 911 in a crisis. However, this form is actually used to request assistance from the Taxpayer Advocate Service for issues that haven't been resolved through normal IRS channels.

It’s a last resort: Some taxpayers think the form should only be used as a last resort. While it's true that you should attempt to resolve issues with the IRS first, you don't need to wait for a crisis to use this form.

Guarantees immediate action: Filing Form 911 doesn't guarantee immediate action or a quick resolution. The Taxpayer Advocate Service assists with issues in a timely manner, but complex cases may require more time to resolve.

Only for disputes: While disputes are a common reason for filing Form 911, it's also used for issues like processing delays, problems with refunds, or needing assistance due to economic harm.

For businesses only: Another misconception is that Form 911 is exclusively for businesses. In reality, both individuals and businesses experiencing tax problems can request assistance through this form.

Requires a lawyer: There's a misconception that you need a lawyer to file Form 911. Although having legal or tax representation can be helpful, it's not a requirement. Taxpayers can file this form on their own.

It's a complicated form: Some taxpayers avoid Form 911, fearing it's too complicated. While the form does require detailed information about your tax issue, the IRS provides instructions to guide you through the process.

Service is not free: Lastly, there’s a misconception that services rendered as a result of filing Form 911 come with a fee. The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers at no charge.

Key takeaways

When dealing with tax issues, sometimes they can become overwhelming. Here's where Form 911, the Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order), comes into play. It's a powerful tool designed to offer help when you're facing significant tax problems. Below are key takeaways about filling out and using the IRS 911 form:

- Understanding the Purpose: The IRS 911 form is specifically designed for taxpayers who are experiencing economic harm or systemic issues within the IRS that have not been resolved through regular channels. It's your line to a more personalized handling of your tax issue.

- Eligibility Criteria: Before filling out the form, ensure you’ve attempted to resolve your tax issue through the usual IRS channels. The Taxpayer Advocate Service (TAS) is meant to be a last resort, stepping in when typical resolution methods have failed or when immediate action is necessary to prevent significant hardship.

- Filling Out the Form: Provide detailed and accurate information about your tax issue, including previous attempts to resolve it and why you believe TAS assistance is needed. The more information you give, the easier it is for the advocate to understand and assist with your case.

- Submitting the Form: You can submit Form 911 by fax, mail, or in person at a local IRS office. In situations where fax or mail isn’t feasible, or you need immediate intervention, visiting a local office can be the fastest route.

- After Submission: Once the form is submitted, expect to be contacted by a TAS representative. They'll work with you closely, aiming to understand and resolve your tax issue efficiently. The timeframe for resolution can vary based on the complexity of your case.

- Other Services Offered by TAS: Beyond individual cases, the TAS also works to identify systemic issues within the IRS and propose changes. This means that by submitting Form 911, you're not only seeking assistance for your problem but potentially helping improve the system for others.

Everyone's tax situation is unique, and sometimes, direct intervention is needed to make things right. By understanding and utilizing the IRS 911 form correctly, you’re taking a strong step towards resolving your tax issues with a dedicated advocate by your side.

Popular PDF Forms

Dhcs 6002 - Information about Drug Medi-Cal Certification is included for relevant providers to understand additional certification requirements.

Imm 5562 Form - The IMM 5406E form serves as a declaration of complete and factual family details, certified by the applicant’s signature.

Sworn Statement Sample - A financial declaration of subcontractor and supplier balances for improvements on Michigan properties.