Blank IRS 941-X PDF Template

For businesses across the United States, staying compliant with tax regulations is a critical component of successful operations. Among the plethora of forms and filings, the IRS 941-X form plays a vital role, particularly when corrections are needed. This form is essentially a bridge for employers to rectify any inaccuracies that may have occurred in the reporting of payroll taxes. Whether it's an oversight in the amount of taxes withheld from employees' wages or a discrepancy in the reported number of employees, the 941-X form offers a pathway to amend those errors. The process of navigating through corrections highlights the importance of precision in payroll tax reporting, underscoring the necessity for businesses to maintain meticulous records. As employers endeavor to align their filings with the realities of their payroll expenditures, understanding the nuances of how and when to use this form becomes paramount. The intention is not just to adhere to the law but also to ensure the financial health of the business by avoiding potential penalties associated with incorrect filings.

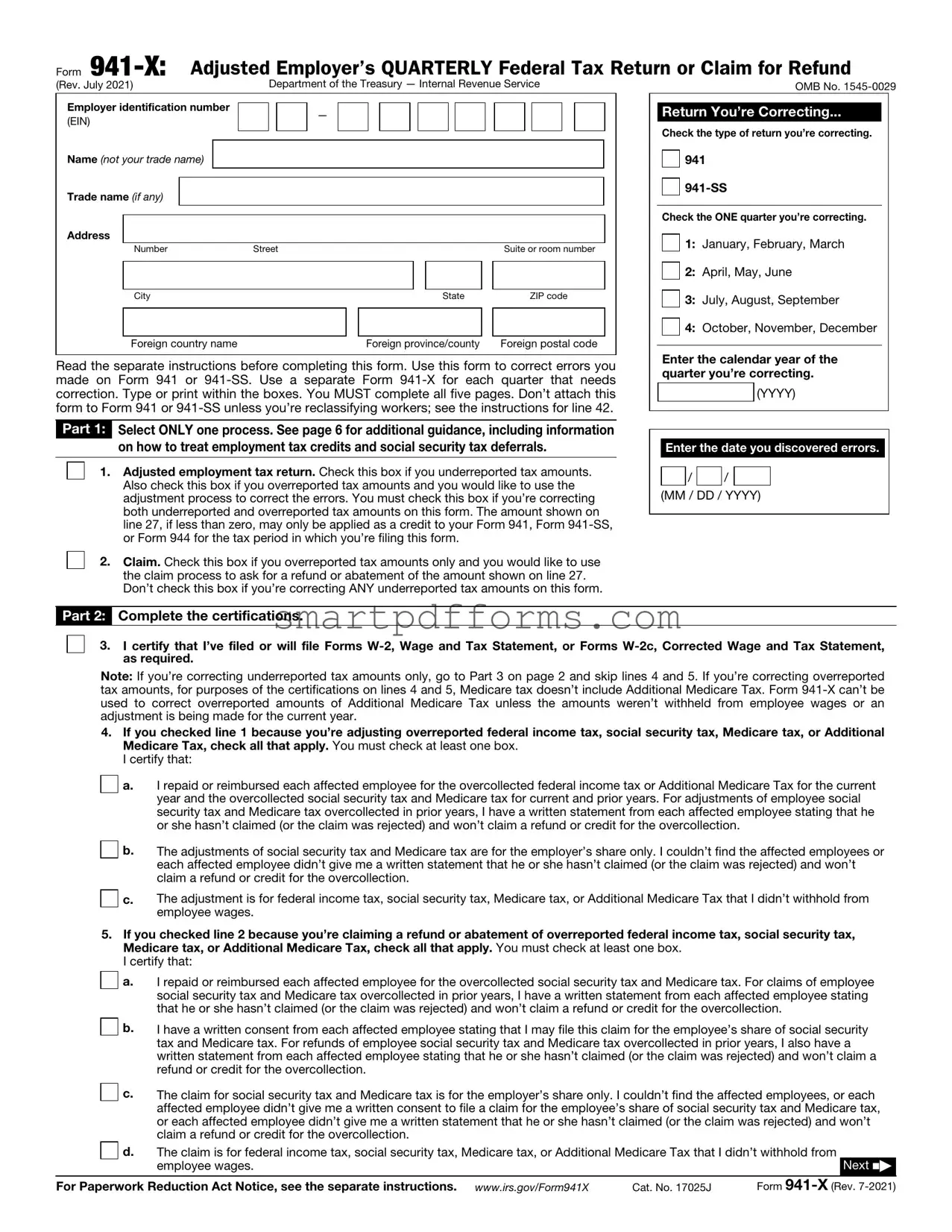

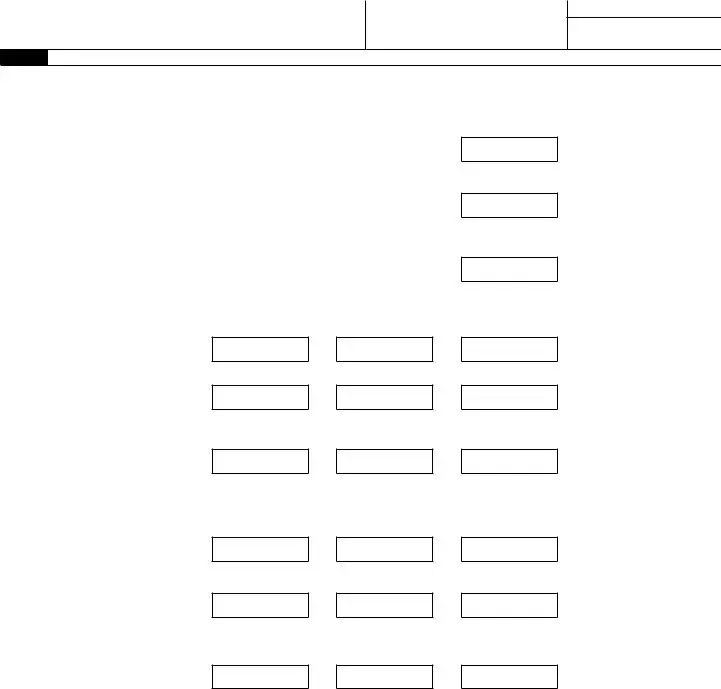

Preview - IRS 941-X Form

Form

(Rev. July 2021) |

Department of the Treasury — Internal Revenue Service |

OMB No. |

Employer identification number |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Number |

Street |

|

|

|

Suite or room number |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/county |

Foreign postal code |

Read the separate instructions before completing this form. Use this form to correct errors you made on Form 941 or

Return You’re Correcting...

Check the type of return you’re correcting.

941

Check the ONE quarter you’re correcting.

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Enter the calendar year of the quarter you’re correcting.

(YYYY)

Part 1: Select ONLY one process. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals.

1.Adjusted employment tax return. Check this box if you underreported tax amounts. Also check this box if you overreported tax amounts and you would like to use the adjustment process to correct the errors. You must check this box if you’re correcting both underreported and overreported tax amounts on this form. The amount shown on line 27, if less than zero, may only be applied as a credit to your Form 941, Form

2. Claim. Check this box if you overreported tax amounts only and you would like to use the claim process to ask for a refund or abatement of the amount shown on line 27. Don’t check this box if you’re correcting ANY underreported tax amounts on this form.

Enter the date you discovered errors.

/ |

|

/ |

(MM / DD / YYYY)

Part 2: Complete the certifications.

3.I certify that I’ve filed or will file Forms

Note: If you’re correcting underreported tax amounts only, go to Part 3 on page 2 and skip lines 4 and 5. If you’re correcting overreported tax amounts, for purposes of the certifications on lines 4 and 5, Medicare tax doesn’t include Additional Medicare Tax. Form

4.If you checked line 1 because you’re adjusting overreported federal income tax, social security tax, Medicare tax, or Additional Medicare Tax, check all that apply. You must check at least one box.

I certify that:

a.I repaid or reimbursed each affected employee for the overcollected federal income tax or Additional Medicare Tax for the current year and the overcollected social security tax and Medicare tax for current and prior years. For adjustments of employee social security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

b. The adjustments of social security tax and Medicare tax are for the employer’s share only. I couldn’t find the affected employees or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

b. The adjustments of social security tax and Medicare tax are for the employer’s share only. I couldn’t find the affected employees or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

c.The adjustment is for federal income tax, social security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from employee wages.

5.If you checked line 2 because you’re claiming a refund or abatement of overreported federal income tax, social security tax, Medicare tax, or Additional Medicare Tax, check all that apply. You must check at least one box.

I certify that:

|

|

a. |

I repaid or reimbursed each affected employee for the overcollected social security tax and Medicare tax. For claims of employee |

|||

|

|

|

social security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating |

|||

|

|

|

that he or she hasn’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection. |

|||

|

|

b. |

I have a written consent from each affected employee stating that I may file this claim for the employee’s share of social security |

|||

|

|

|

tax and Medicare tax. For refunds of employee social security tax and Medicare tax overcollected in prior years, I also have a |

|||

|

|

|

written statement from each affected employee stating that he or she hasn’t claimed (or the claim was rejected) and won’t claim a |

|||

|

|

|

refund or credit for the overcollection. |

|

|

|

|

|

c. |

The claim for social security tax and Medicare tax is for the employer’s share only. I couldn’t find the affected employees, or each |

|||

|

|

|||||

|

|

|

affected employee didn’t give me a written consent to file a claim for the employee’s share of social security tax and Medicare tax, |

|||

|

|

|

or each affected employee didn’t give me a written statement that he or she hasn’t claimed (or the claim was rejected) and won’t |

|||

|

|

|

claim a refund or credit for the overcollection. |

|

|

|

|

|

d. |

The claim is for federal income tax, social security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from |

|||

|

|

|

employee wages. |

|

|

Next ■▶ |

|

|

|

|

|||

For Paperwork Reduction Act Notice, see the separate instructions. www.irs.gov/Form941X |

Cat. No. 17025J |

Form |

||||

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

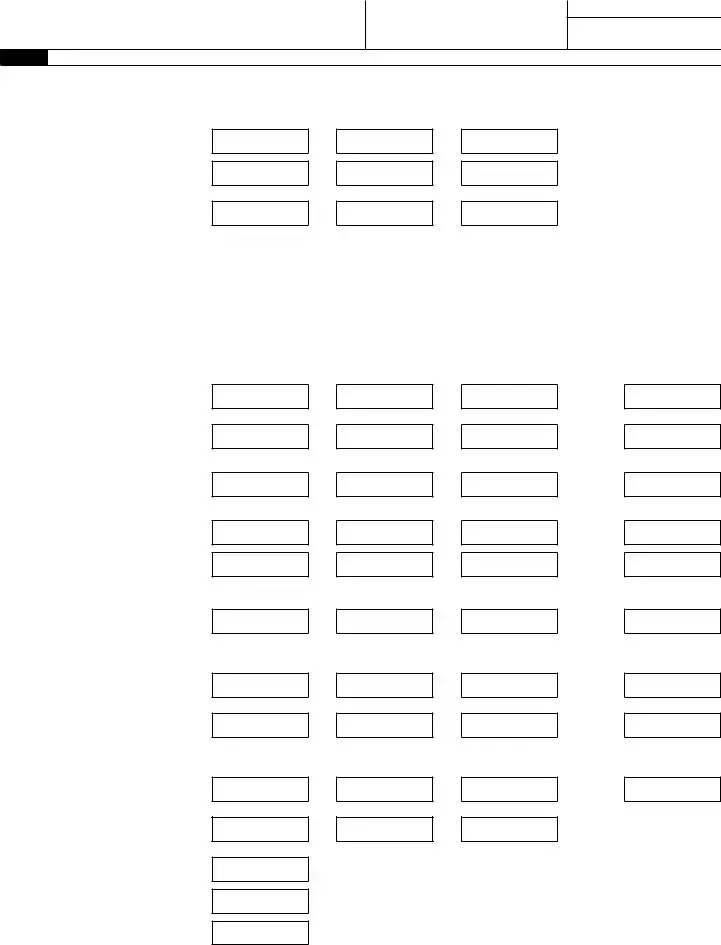

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank.

Column 1 |

Column 2 |

Column 3 |

Column 4 |

6. |

Wages, tips, and other |

|

compensation (Form 941, line 2) |

7. |

Federal income tax withheld |

|

from wages, tips, and other |

|

compensation (Form 941, line 3) |

8. |

Taxable social security wages |

|

(Form 941 or |

|

Column 1) |

Total corrected amount (for ALL employees)

.

.

.

Amount originally reported or as

—previously corrected (for ALL employees)

—.

—.

—.

=

=

=

=

Difference

(If this amount is a negative number, use a minus sign.)

.

.

.

Tax correction

Use the amount in Column 1 when you prepare your Forms

Copy Column |

. |

3 here ▶ |

|

|

|

|

|

× 0.124* = |

. |

9. |

Qualified sick leave wages* |

|

(Form 941 or |

|

Column 1) |

|

|

|

|

* If you’re correcting your employer share only, use 0.062. See instructions. |

|||

|

— |

|

= |

|

|

|

|

. |

. |

|

. |

× 0.062 = |

. |

||

* Use line 9 only for qualified sick leave wages paid after March 31, 2020, for leave taken before April 1, 2021.

10.Qualified family leave wages* (Form 941 or

11.Taxable social security tips (Form 941 or

. |

— |

. |

= |

. |

× 0.062 = |

. |

* Use line 10 only for qualified family leave wages paid after March 31, 2020, for leave taken before April 1, 2021.

. |

— |

. |

= |

. |

× 0.124* = |

. |

|

|

* If you’re correcting your employer share only, use 0.062. See instructions.

12.Taxable Medicare wages & tips (Form 941 or

.

—

.

= |

. |

× 0.029* = |

. |

|

* If you’re correcting your employer share only, use 0.0145. See instructions.

13. |

Taxable wages & tips subject to |

|

Additional Medicare Tax |

|

withholding (Form 941 or |

|

.

—

. |

= |

. |

× 0.009* = |

. |

|

* Certain wages and tips reported in Column 3 shouldn’t be multiplied by 0.009. See instructions.

14. |

Section 3121(q) Notice and |

|

|

|

unreported tips (Form 941 or |

|

|

15. |

Tax adjustments (Form 941 or |

|

|

16. |

Qualified small business payroll tax |

|

credit for increasing research |

|

activities (Form 941 or |

|

11a; you must attach Form 8974) |

17. |

Nonrefundable portion of credit |

|

for qualified sick and family |

|

leave wages for leave taken |

|

before April 1, 2021 (Form 941 |

|

or |

18a. Nonrefundable portion of employee retention credit

(Form 941 or

18b. Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021 (Form 941

or

18c. Nonrefundable portion of COBRA premium assistance credit

(Form 941 or

18d. Number of individuals provided COBRA premium assistance

(Form 941 or

.

.

.

.

.

.

.

—

—

—

—

—

—

—

—

.

.

.

.

.

.

.

=

=

=

=

=

=

=

=

.

.

.

.

.

.

.

Copy Column 3 here ▶

Copy Column 3 here ▶

See instructions

See instructions

See instructions

See instructions

See instructions

.

.

.

.

.

.

.

19.Special addition to wages for federal income tax

20.Special addition to wages for social security taxes

21.Special addition to wages for Medicare taxes

.

.

.

—

—

—

. |

= |

. |

See |

. |

|

|

instructions |

||||

|

= |

|

See |

|

|

. |

. |

. |

|||

|

instructions |

||||

|

= |

|

See |

|

|

. |

. |

. |

|||

|

instructions |

Next ■▶

Page 2 |

Form |

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

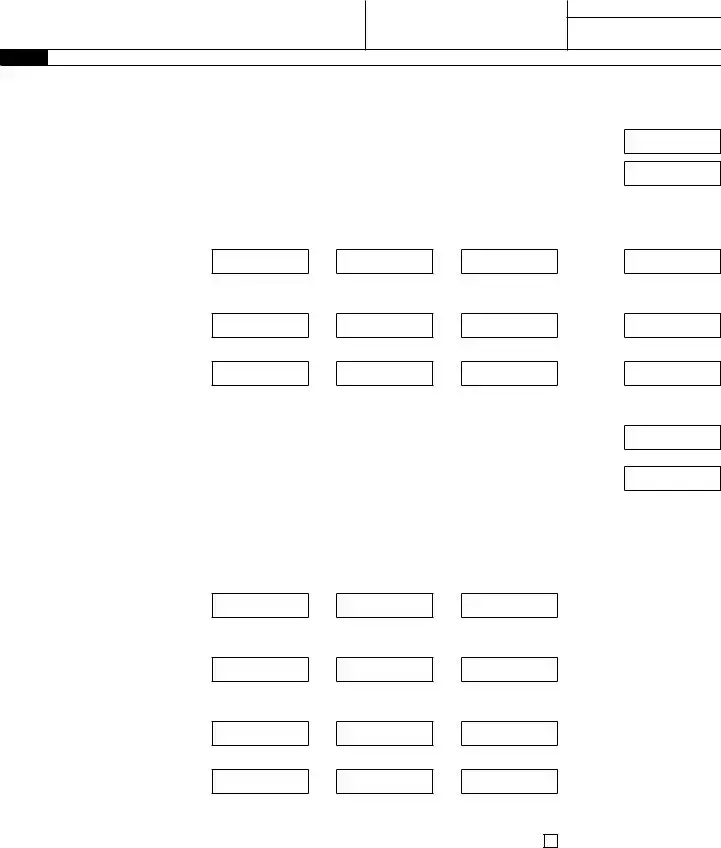

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank. (continued)

|

|

Column 1 |

|

|

Column 2 |

|

Column 3 |

|

|

|

Total corrected |

|

|

Amount originally |

|

Difference |

|

|

|

amount (for ALL |

|

reported or as |

= |

(If this amount is a |

|

|

|

|

employees) |

|

— |

previously corrected |

negative number, |

|

|

|

|

|

|

|

(for ALL employees) |

|

use a minus sign.) |

|

22. |

Special addition to wages for |

|

. |

— |

. |

= |

. |

See |

|

Additional Medicare Tax |

|

||||||

|

|

|

|

instructions |

||||

23. |

Combine the amounts on lines 7 through 22 of Column 4 |

|||||||

Column 4

Tax correction

.

.

24.Deferred amount of social security tax* (Form 941 or

. |

— |

. |

= |

. |

See |

. |

|

|

instructions |

* Use this line to correct the employer deferral for the second quarter of 2020 and the employer and employee deferral for the third and fourth quarters of 2020.

25.Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021 (Form 941 or 941- SS, line 13c)

.

—

.

=

.

See instructions

.

26a. Refundable portion of employee

retention credit (Form 941 or

26b. Refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021 (Form 941 or

.

.

—

—

.

.

=

=

.

.

See instructions

See instructions

.

.

26c. |

Refundable portion of COBRA |

. |

— |

. |

= |

. |

See |

|

premium assistance credit |

||||||

|

|

|

instructions |

||||

|

(Form 941 or |

|

|

|

|

|

|

27. |

Total. Combine the amounts on lines 23 through 26c of Column 4 |

||||||

|

If line 27 is less than zero: |

|

|

|

|

|

|

.

.

•If you checked line 1, this is the amount you want applied as a credit to your Form 941 or

•If you checked line 2, this is the amount you want refunded or abated.

If line 27 is more than zero, this is the amount you owe. Pay this amount by the time you file this return. For information on how to pay, see Amount you owe in the instructions.

28.Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021 (Form 941 or 941- SS, line 19)

29.Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021 (Form 941 or

30.Qualified wages for the employee retention credit (Form 941 or

.

.

.

—

—

—

.

.

.

=

=

=

.

.

.

31a. Qualified health plan expenses for the employee retention credit

(Form 941 or

.

—

.

=

.

31b. Check here if you’re eligible for the employee retention credit in the third or fourth quarter of 2021 solely because your business is a recovery startup business . . . . . . . . . . . .

32.Credit from Form

. |

— |

. |

= |

. |

|

|

|||

|

|

|

|

|

* Use line 32 to correct only the second, third, and fourth quarters of 2020, and the first quarter of 2021.

Next ■▶

Page 3 |

Form |

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

Part 3: Enter the corrections for this quarter. If any line doesn’t apply, leave it blank. (continued)

Column 1 |

Column 2 |

Column 3 |

33a. Qualified wages paid March 13 through March 31, 2020, for the employee retention credit*

(Form 941 or

33b. Deferred amount of the employee share of social security tax included on Form 941 or

(Form 941 or

Total corrected |

|

Amount originally |

|

|

amount (for ALL |

|

reported or as |

= |

|

employees) |

— |

previously corrected |

||

|

|

(for ALL employees) |

|

|

|

— |

|

= |

|

. |

. |

|||

|

|

|||

|

|

|

|

* Use line 33a to correct only the second quarter of 2020.

. |

— |

. |

= |

|

|

||

|

|

|

|

* Use line 33b to correct only the third and fourth quarters of 2020.

Difference

(If this amount is a negative number, use a minus sign.)

.

.

34. |

Qualified health plan expenses |

. |

— |

. |

|

allocable to wages reported on |

|||

|

|

|||

|

Form 941 or |

|

|

|

|

* Use line 34 to correct only the second quarter of 2020. |

|||

|

(Form 941 or |

|

|

|

Caution: Lines

=

.

35.Qualified sick leave wages for leave taken after March 31, 2021 (Form 941 or

36.Qualified health plan expenses allocable to qualified sick leave wages for leave taken after March 31, 2021 (Form 941 or

37.Amounts under certain collectively bargained agreements allocable to qualified sick leave wages for leave taken after March 31, 2021 (Form 941 or

.

.

.

—

—

—

.

.

.

=

=

=

.

.

.

38.Qualified family leave wages for leave taken after March 31, 2021 (Form 941 or

39.Qualified health plan expenses allocable to qualified family leave wages for leave taken after March 31, 2021 (Form 941 or

.

.

—

—

.

.

=

=

.

.

40.Amounts under certain collectively bargained agreements allocable to qualified family leave wages for leave taken after March 31, 2021 (Form 941 or

.

—

.

=

.

Next ■▶

Page 4 |

Form |

Name (not your trade name) |

Employer identification number (EIN) |

Correcting quarter |

(1, 2, 3, 4) |

Correcting calendar year (YYYY)

Part 4: Explain your corrections for this quarter.

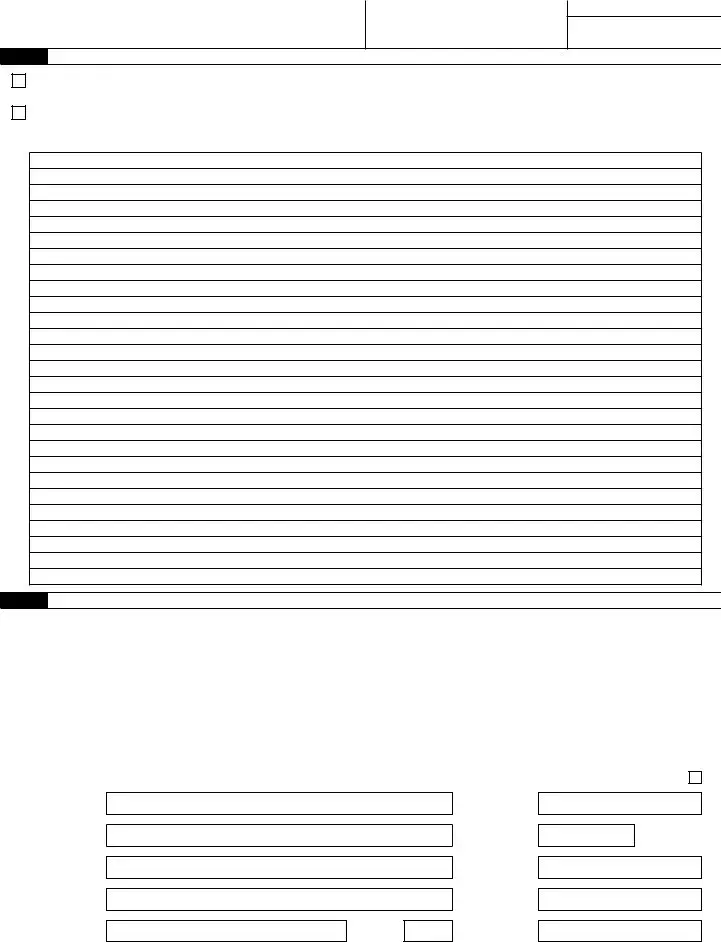

41. Check here if any corrections you entered on a line include both underreported and overreported amounts. Explain both your underreported and overreported amounts on line 43.

42. Check here if any corrections involve reclassified workers. Explain on line 43.

43.You must give us a detailed explanation of how you determined your corrections. See the instructions.

Part 5: Sign here. You must complete all five pages of this form and sign it.

Under penalties of perjury, I declare that I have filed an original Form 941 or Form

✗ |

|

|

|

|

|

Print your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign your |

|

|

|

|

name here |

|

|

|

|

|

|

|

|

Print your |

|

|

|

|

|

name here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

title here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

/ |

/ |

|

Best daytime phone |

|

|

|

|

|

|

|

|

|

||||

Paid Preparer Use Only |

|

|

|

Check if you’re |

|

||||

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

State

PTIN

Date

EIN

Phone

ZIP code

/ /

Page 5 |

Form |

Form

|

Unless otherwise specified in the separate instructions, an underreported employment tax credit or social |

|

|

security tax deferral should be treated like an overreported tax amount. An overreported employment tax credit |

|

Type of errors |

or social security tax deferral should be treated like an underreported tax amount. For more information, |

|

including which process to select on lines 1 and 2, see Correcting an employment tax credit or social security tax |

||

you’re correcting |

||

deferral in the separate instructions. |

||

|

||

|

|

|

Underreported |

Use the adjustment process to correct underreported tax amounts. |

|

• Check the box on line 1. |

||

tax amounts |

||

ONLY |

• Pay the amount you owe from line 27 by the time you file Form |

Overreported tax amounts

ONLY

The process you use depends on when you file Form

If you’re filing Form |

Choose either the adjustment process or the claim |

|

MORE THAN 90 days before |

process to correct the overreported tax amounts. |

|

the period of limitations on |

Choose the adjustment process if you want the |

|

credit or refund for Form 941 |

||

amount shown on line 27 credited to your Form 941, |

||

or Form |

||

Form |

||

|

||

|

file Form |

|

|

OR |

|

|

Choose the claim process if you want the amount |

|

|

shown on line 27 refunded to you or abated. Check |

|

|

the box on line 2. |

|

|

|

|

If you’re filing Form |

You must use the claim process to correct the |

|

WITHIN 90 days of the |

overreported tax amounts. Check the box on line 2. |

|

expiration of the period of |

|

|

limitations on credit or refund |

|

|

for Form 941 or Form |

|

BOTH underreported and overreported tax amounts

The process you use depends on when you file Form

If you’re filing Form |

Choose either the adjustment process or both the |

|

MORE THAN 90 days before |

adjustment process and the claim process when you |

|

the period of limitations on |

correct both underreported and overreported tax |

|

credit or refund for Form 941 |

amounts. |

|

or Form |

Choose the adjustment process if combining your |

|

|

underreported tax amounts and overreported tax |

|

|

amounts results in a balance due or creates a credit |

|

|

that you want applied to Form 941, Form |

|

|

Form 944. |

|

|

• File one Form |

|

|

• Check the box on line 1 and follow the instructions |

|

|

on line 27. |

|

|

OR |

|

|

Choose both the adjustment process and the |

|

|

claim process if you want the overreported tax |

|

|

amount refunded to you or abated. |

|

|

File two separate forms. |

|

|

1. For the adjustment process, file one Form |

|

|

to correct the underreported tax amounts. Check |

|

|

the box on line 1. Pay the amount you owe from |

|

|

line 27 by the time you file Form |

|

|

2. For the claim process, file a second Form |

|

|

to correct the overreported tax amounts. Check |

|

|

the box on line 2. |

|

|

|

|

If you’re filing Form |

You must use both the adjustment process and |

|

WITHIN 90 days of the |

the claim process. |

|

expiration of the period of |

File two separate forms. |

|

limitations on credit or |

1. For the adjustment process, file one Form |

|

refund for Form 941 or |

||

to correct the underreported tax amounts. Check |

||

Form |

||

the box on line 1. Pay the amount you owe from |

||

|

||

|

line 27 by the time you file Form |

|

|

2. For the claim process, file a second Form |

|

|

to correct the overreported tax amounts. Check |

|

|

the box on line 2. |

Page 6 |

Form |

Form Data

| Fact | Description |

|---|---|

| Purpose | The IRS Form 941-X is used to make corrections to previously filed Form 941, Employer's Quarterly Federal Tax Return. Businesses use it to correct errors in wages, tips, and other compensation. |

| Timing | Form 941-X can be filed after the original Form 941 has been submitted and if the employer has discovered errors that need correction. There's no deadline for filing, but to receive credit or refund, it must be filed within 3 years from the date the original form was filed or 2 years from the date the tax was paid, whichever is later. |

| Types of Corrections | This form allows correction of various types of errors, including overreporting and underreporting of taxes, wages, and tips. It's crucial for maintaining accurate tax records. |

| Method of Filing | Currently, the IRS requires Form 941-X to be filed on paper, as electronic filing is not available for this correction form. |

| State-Specific Forms | While the IRS Form 941-X is a federal form, many states have their own forms for correcting state payroll taxes. These forms and the requirements for filing them vary by state, and they are governed by the state's specific payroll tax laws. |

Instructions on Utilizing IRS 941-X

Filling out the IRS 941-X form requires careful attention to detail and a clear understanding of the adjustments or corrections being made to previously filed IRS 941 forms. The IRS 941-X form is used by employers to correct errors on a previously filed 941 form, which is the quarterly federal tax return. The process involves identifying the types of errors, calculating the correct amounts, and providing a detailed explanation for each correction. Following the steps outlined below will guide you through the process of completing the 941-X form accurately.

- Identify the Quarter Being Corrected: At the top of the form, check the box corresponding to the quarter for which you are making corrections. This step is critical as it ensures the IRS applies the corrections to the appropriate filing period.

- Fill in Employer Information: Enter the employer's name, address, and Employer Identification Number (EIN) as they appeared on the original IRS 941 form that is being corrected.

- Choose the Process Type: Decide whether you're applying for an adjustment (to correct errors without seeking a refund or abatement of penalties) or making a claim (to request a refund for overpaid taxes). Select the appropriate box at the top of the form.

- Explain Corrections: On line 15, provide a detailed explanation for each correction. This explanation should include what was reported incorrectly on the original 941 form, the correct amount, and why the initial error occurred. This clarity is essential for the IRS to understand and process your corrections.

- Correct the Tax Liability: If your corrections involve changes to your tax liability, accurately report the corrected tax liability for each month of the quarter in Part 2 of the form. This part clarifies the corrected amount owed for each month, ensuring accurate processing and application of payments.

- Sign and Date the Form: The process concludes with the employer (or authorized representative) signing and dating the form. This signature certifies that all information provided is accurate to the best of the signer's knowledge. An incomplete or missing signature can result in the rejection of the form, so this step should not be overlooked.

Once the IRS 941-X form is filled out correctly, it should be mailed to the address specified in the form's instructions. Mailing addresses can vary based on the employer's location and whether a payment is included with the form, so it's essential to refer to the latest IRS instructions for the correct address. After submission, the correction process involves the IRS reviewing the form, which may take some time. Employers should monitor for any communications from the IRS in case additional information is requested.

Obtain Answers on IRS 941-X

What is the IRS 941-X form used for?

The IRS 941-X form, officially known as the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, is utilized by employers to correct errors on previously filed Form 941s, Employer's Quarterly Federal Tax Return. This includes mistakes related to wages, tips, and other compensation; income tax withheld from wages, tips, and other compensation; and taxable social security and Medicare wages.

When should an employer file the IRS 941-X form?

An employer should file the IRS 941-X form as soon as they discover an error on a previously filed Form 941. It's important to correct these errors promptly to avoid potential penalties. However, there's a limit to how far back corrections can be made, typically within three years from the date the original 941 form was filed, or two years from the date the tax was paid, whichever is later.

Can the IRS 941-X form be filed electronically?

As of the latest guidance, the IRS does not accept electronic filing for the 941-X form. Employers must complete the form manually and mail it to the appropriate IRS address, which varies depending on the state in which the business is located. It's recommended to use certified or registered mail to have a record of the submission.

What are the consequences of not correcting a 941 form?

Failure to correct a 941 form can result in penalties and interest charges on any underpaid taxes. The IRS may also conduct an audit if discrepancies are found during their review process. It is in the best interest of employers to correct errors as soon as they are discovered to minimize potential penalties.

How does an employer determine what corrections to make on the 941-X form?

To determine necessary corrections on the 941-X form, employers should first review the original 941 form closely to identify any inaccuracies. This includes calculating the correct amounts for wages, withheld taxes, and contributions to social security and Medicare. Employers must also reference the instructions for Form 941-X, which provide detailed guidance on how to report these corrections.

Is it possible to claim a refund using the IRS 941-X form?

Yes, if an employer discovers they have overpaid taxes due to an error on a previously filed Form 941, they can use the 941-X form to adjust their tax liability and claim a refund. The form allows employers to specify whether they want the overpayment applied to upcoming tax liabilities or refunded directly.

Can multiple quarters be corrected on a single IRS 941-X form?

No, each 941-X form is designated for correcting errors on a single Form 941 for one specific quarter. If errors occurred in multiple quarters, separate 941-X forms must be filed for each quarter's corrections. This ensures the accuracy and clarity of corrections and simplifies processing by the IRS.

What are the key sections of the IRS 941-X form?

The key sections of the IRS 941-X form include identification of the taxpayer (including name, address, and EIN), the quarter and year being corrected, detailed explanation of the corrections, computation of the corrected amounts, and the declaration section where the employer certifies the accuracy of the information provided. Each section must be filled out carefully to ensure the corrections are processed correctly.

How long does it take for a 941-X form to be processed?

The processing time for a 941-X form can vary depending on the IRS's workload and staffing levels, but employers should typically expect a processing time of at least several weeks. During times of high volume, such as tax season, processing times may be longer. Employers can contact the IRS directly to inquire about the status of their submission if a significant amount of time has passed.

Common mistakes

Correcting payroll taxes can feel like navigating through a maze in the dark. The IRS Form 941-X is designed for employers to make corrections to previously filed Form 941s, which report quarterly federal tax returns. However, the process can be fraught with pitfalls. Here are eight common mistakes people make when they fill out their 941-X forms:

Not filing the 941-X form for each quarter needing corrections. Many don't realize that a separate 941-X form is required for each quarter in which mistakes were made. This oversight can lead to incomplete corrections and further IRS complications.

Failing to choose the correct process option on the form. The 941-X allows for two correction methods: the “Adjusted Employer” and “Claim” processes. Selecting the wrong option can delay corrections or affect refunds.

Incorrectly reporting overreported and underreported amounts. It's crucial to accurately detail where you overreported or underreported taxes. Mixing these up can cause the IRS to adjust your figures incorrectly.

Omitting supporting documentation. Every adjustment needs to be backed by documentation. Not providing supporting evidence for the corrections can result in rejections of the submitted changes.

Forgetting to sign the form. It sounds simple, but you’d be surprised how many forget this final step. An unsigned form is like an unread letter — it won’t get you any response from the IRS.

Miscalculating the interest on underpayments. If you owe more than you initially paid, interest accrues on the underpayment. Incorrectly calculating this amount can lead to further debts and complications.

Using the wrong version of the form. The IRS updates tax forms periodically. Using an outdated version can lead to an automatic rejection of your correction attempt.

Not checking the IRS guidelines for line-by-line instructions. Each line on the 941-X form has specific instructions. Misunderstandings or assumptions about what to include can lead to errors in your submission.

Avoiding these mistakes requires meticulous attention to detail and a thorough understanding of the correction process. Here are a few tips to navigate this complex process more smoothly:

Review the instructions: Before you fill out the form, thoroughly review the IRS’s line-by-line instructions.

Double-check your work: Go over your calculations and the completed form multiple times to ensure accuracy.

Seek professional help: If you’re unsure about any part of the process, consider consulting with a tax professional. They can provide valuable guidance and help avoid costly mistakes.

Stay organized: Keep all related documentation well-organized and readily accessible. This can save you a significant amount of time if the IRS requests additional information.

Navigating the correction of payroll taxes through the 941-X form doesn't have to be a bewildering experience. By understanding where others have stumbled and taking steps to avoid those same pitfalls, you can correct your tax records with confidence and precision.

Documents used along the form

When correcting payroll taxes, businesses often use the IRS 941-X form, but it is not the only document required for comprehensive tax corrections and adjustments. The process involves several other forms and documents to ensure accuracy and compliance with the Internal Revenue Service (IRS) regulations. Below is a brief overview of other essential forms and documents that are frequently used alongside the IRS 941-X.

- IRS Form 941: This is the original Employer’s Quarterly Federal Tax Return form. It is used to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks and is essential for comparing the corrected amounts on Form 941-X.

- IRS Form 940: This form is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It’s important for reconciling any discrepancies in unemployment taxes that may also require adjustments.

- IRS Form W-2: The Wage and Tax Statement form is crucial for verifying employee wage and tax information. Corrections made with 941-X may necessitate amendments to previously submitted W-2 forms.

- IRS Form W-3: The Transmittal of Wage and Tax Statements summarizes the total earnings, social security wages, Medicare wages, and withholding for all employees for a given year. It must align with any changes made on Form 941-X.

- IRS Form W-4: Employee’s Withholding Certificate informs employers of the amount to withhold from an employee's paycheck for federal taxes, affecting reported totals on Form 941.

- IRS Form 945: Used to report withheld federal income tax from nonpayroll payments, including gambling winnings, it may need to be reviewed if adjustments on 941-X impact reported withholdings.

- IRS Form 1040: Individual Income Tax Return may need to be considered for personal implications of corrections made to payroll records, especially for sole proprietors and business owners.

- Schedule B (Form 941): This schedule lists tax liability for each month of the quarter and must match the corrected tax liabilities reflected by adjustments on Form 941-X.

- State and Local Tax Forms: Depending on the location of the business, state and local tax forms related to employment may also require updates to reflect any corrections made on federal forms.

Together, these forms and documents play a critical role in ensuring that businesses’ payroll practices remain in full compliance with tax laws and regulations. By carefully reviewing and adjusting these documents as needed when filing a Form 941-X, businesses can correct past mistakes and minimize potential legal and financial penalties.

Similar forms

IRS Form 940: This document, much like the IRS 941-X, is used by employers to report their annual Federal Unemployment (FUTA) tax. Both forms are part of the employer's federal tax responsibilities and require detailed payroll information. However, Form 940 focuses on unemployment taxes specifically, while Form 941-X is used to correct mistakes on previously filed Form 941s, which cover Medicare, Social Security, and income tax withholdings.

IRS Form 943: Employers who pay wages to farm workers use IRS Form 943 to report and pay agriculture employee taxes. Similar to the 941-X, this form deals with reporting employer tax responsibilities. The key difference is that Form 943 is for agricultural employers, and Form 941-X serves as a correction document for Form 941 filers.

IRS Form 944: Designed for small employers whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less. The similarity between the 941-X and Form 944 lies in their focus on employer tax obligations concerning employee payrolls. However, Form 941-X is specifically used for corrections, while Form 944 is an annual reporting form.

IRS Form 945: This form is used for reporting federal income tax withheld from non-payroll items, such as gambling winnings, backup withholding, and military retirement. Similar to the 941-X, Form 945 deals with withholding taxes, albeit for non-payroll items. Both forms are integral for accurate tax reporting and compliance.

IRS Form W-2: Employers use this form to report wages paid and taxes withheld for their employees annually. While Form W-2 is directly related to employee wage reporting, the 941-X serves to correct errors in quarterly wage reports initially filed via Form 941. Both forms are critical in the reconciliation of employee earnings and tax withholdings.

IRS Form W-3: This is a transmittal form that accompanies Form W-2 when submitted to the Social Security Administration. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the year. Like the 941-X, it deals with the correction and verification of reported employee wage and tax information, albeit in a different context and annual consolidation.

Dos and Don'ts

Facing the task of correcting a previously filed IRS 941 form can seem daunting. Yet, understanding both the actions to embrace and avoid simplifies this process, ensuring accuracy and compliance. Below are guidelines designed to assist in the diligent completion of the IRS 941-X form.

- Do review the instructions for Form 941-X provided by the IRS. These instructions are comprehensive and can answer many questions you might have.

- Do gather all necessary documents before beginning. This includes your original Form 941, any relevant payroll records, and the calculations for the corrections you need to make. Accurate records are the foundation of a correct Form 941-X submission.

- Do use the correct version of Form 941-X. The IRS updates its forms periodically, so ensure you're using the version that corresponds to the year you're correcting.

- Do be clear about the reason for the corrections. Form 941-X asks for a detailed explanation of why you are making an adjustment. Being specific and concise helps the IRS understand your corrections and process your form more efficiently.

- Do double-check your math. Errors in calculations can lead to further discrepancies and may trigger questions or audits from the IRS.

- Don't assume corrections only result in additional payments. Sometimes, corrections lead to overpayments, which you can apply to future taxes or request a refund for.

- Don't overlook interest and penalties. If you owe additional taxes due to the correction, interest and penalties may apply. Consider consulting a tax professional to understand any potential financial impacts fully.

- Don't use Form 941-X for changes in your business information, such as a new address or business structure change. Use the appropriate form or method to report these changes separately.

- Don't delay filing Form 941-X. Once you've discovered an error, it's important to address it promptly. Waiting can result in increased penalties and interest.

Misconceptions

When it comes to amending employer tax returns, the IRS Form 941-X plays a crucial role. However, there are several misconceptions about this form that need to be addressed:

You can only file a 941-X to correct errors that result in a tax refund. This is not true. Employers should use Form 941-X to correct errors in their previously filed Form 941 regardless of whether the correction results in an additional tax owed, a refund, or no tax change at all. The form is designed to report both underreported and overreported amounts.

Once you've submitted Form 941, it's too late to make changes. This belief is incorrect. If you discover mistakes in a previously filed Form 941, the IRS encourages you to correct those mistakes using Form 941-X. There is a timeframe for making these corrections, however, which usually extends up to three years from the original filing date.

Filing a 941-X for a refund guarantees you'll get one. Filing Form 941-X to correct an overpayment does not automatically ensure that the IRS will issue a refund. The IRS will review the correction, and if they agree with your adjustments, they may issue a refund. However, there are instances where the IRS may apply the overpayment to any outstanding tax liabilities you may have first.

The only way to file Form 941-X is through paper mail. While it's true that many businesses file Form 941-X through paper mail, the IRS has been working on providing electronic filing options for a range of forms. It's always a good idea to check the latest filing options on the IRS website or consult with a tax professional to see if electronic filing is available for Form 941-X.

Key takeaways

Businesses occasionally need to correct or amend their quarterly federal tax returns. This necessity arises for various reasons, from reporting additional taxes owed to claiming a refund or credit for overpayment. The IRS Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund, serves this very purpose. It's important to navigate this form with precision to ensure accurate reporting. Here are some key takeaways when it comes to filling out and using the IRS 941-X form:

- Timing matters: Generally, you have three years from the date you filed your original Form 941, or two years from the date you paid the tax reported on that form, whichever is later, to file Form 941-X. Filing within these timeframes is crucial for your amendment to be considered.

- Choose the correct reason for filing: The IRS 941-X form requires you to indicate the precise reason for the amendment. This can range from reporting additional taxes due to correcting over-reported amounts that could either reduce your tax liability or increase your refund or credits. It’s vital to carefully assess the reason to ensure the accuracy and validity of your amendment.

- Detail your corrections: Completing Form 941-X involves more than just entering the corrected figures. You must also explain each correction in Part III of the form, detailing the nature of the error and the reason behind the amendment. This explanation helps the IRS quickly understand the adjustments, thereby facilitating smoother processing.

- Accuracy is key: It may seem obvious, but ensuring the accuracy of your corrected figures cannot be overstated. Double-check your calculations and the information you provide. Discrepancies or errors in your amendment can lead to delays or additional queries from the IRS, potentially complicating the process.

Lastly, remember to keep a copy of your 941-X submission and any correspondence with the IRS. This record-keeping will be invaluable in case of queries or when verifying the status of your amendment. Navigating the world of tax amendments need not be daunting, especially with a clear understanding of the required steps and careful attention to detail.

Popular PDF Forms

Marriott Friends and Family Form - Secure special hotel rates with Marriott's Friends and Family authorization form.

Court Affidavit - Filling out the CJA-23 accurately can significantly impact the outcome of your request for legal aid.

Hsmv 82101 - Avoid legal complications by promptly applying for a duplicate title using the HSMV 82101 form if your Florida vehicle title is compromised.