Blank IRS 944 PDF Template

Navigating the complexities of tax documentation is a vital task for any business, especially when it involves understanding the purpose and proper use of the IRS 944 form. This unique form serves as an annual tax report, specifically designed for smaller employers to report their employees' federal income tax withholdings along with Social Security and Medicare taxes. The IRS determines who must file the 944 form, generally directing those with an annual liability of $1,000 or less in payroll taxes towards this simplified reporting method. It stands as an alternative to the more frequent filings required by the 941 form, aiming to reduce paperwork and administrative burdens for eligible small businesses. An accurate completion and timely submission of the IRS 944 form is crucial not only to remain in compliance with federal tax obligations but also to ensure the proper funding of employees' benefits under the Social Security and Medicare programs. Understanding when and how to file this form is imperative for eligible employers to maintain their standing with the IRS and avoid unnecessary penalties.

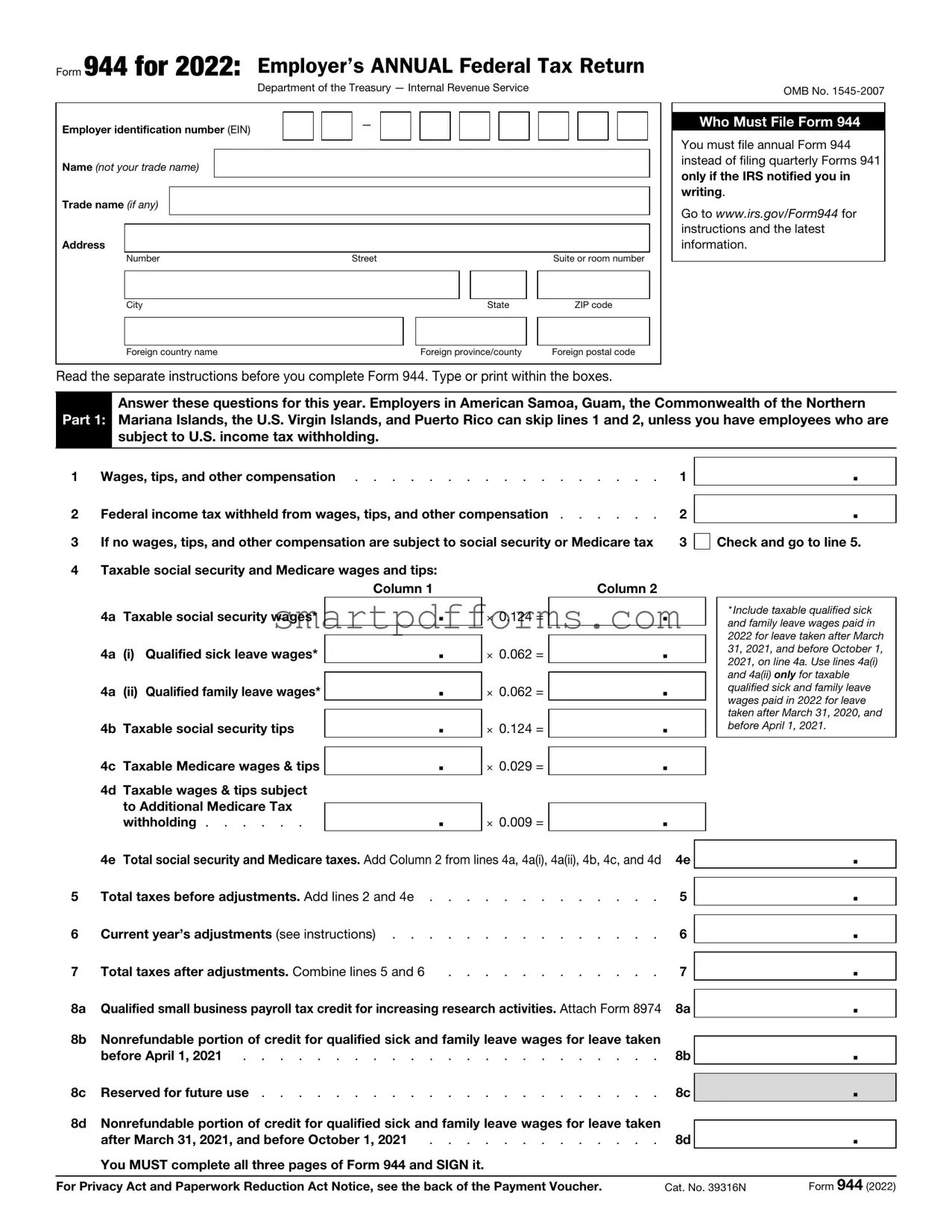

Preview - IRS 944 Form

Form 944 for 2022: Employer’s ANNUAL Federal Tax Return

Department of the Treasury — Internal Revenue Service

Employer identification number (EIN) |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Number |

Street |

|

Suite or room number |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/county |

|

Foreign postal code |

||

OMB No.

Who Must File Form 944

You must file annual Form 944 instead of filing quarterly Forms 941 only if the IRS notified you in writing.

Go to www.irs.gov/Form944 for instructions and the latest information.

Read the separate instructions before you complete Form 944. Type or print within the boxes.

Answer these questions for this year. Employers in American Samoa, Guam, the Commonwealth of the Northern

Part 1: Mariana Islands, the U.S. Virgin Islands, and Puerto Rico can skip lines 1 and 2, unless you have employees who are subject to U.S. income tax withholding.

1 |

Wages, tips, and other compensation |

1 |

|

2 |

Federal income tax withheld from wages, tips, and other compensation |

2 |

|

3 |

If no wages, tips, and other compensation are subject to social security or Medicare tax |

3 |

|

4 |

Taxable social security and Medicare wages and tips: |

|

|

|

Column 1 |

Column 2 |

|

.

.

Check and go to line 5.

4a Taxable social security wages*

4a (i) Qualified sick leave wages*

4a (ii) Qualified family leave wages*

4b Taxable social security tips

4c Taxable Medicare wages & tips

4d Taxable wages & tips subject to Additional Medicare Tax withholding . . . . . .

.

.

.

.

.

.

×0.124 =

×0.062 =

×0.062 =

×0.124 =

×0.029 =

×0.009 =

.

.

.

.

.

.

*Include taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021, on line 4a. Use lines 4a(i) and 4a(ii) only for taxable qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

|

4e Total social security and Medicare taxes. Add Column 2 from lines 4a, 4a(i), 4a(ii), 4b, 4c, and 4d |

|

5 |

Total taxes before adjustments. Add lines 2 and 4e |

|

6 |

Current year’s adjustments (see instructions) |

|

7 |

Total taxes after adjustments. Combine lines 5 and 6 |

. . . . . . . . . . . . |

8a |

Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 |

|

8b |

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken |

|

|

before April 1, 2021 |

|

8c |

Reserved for future use |

|

8d |

Nonrefundable portion of credit for qualified sick and family leave wages for leave taken |

|

|

after March 31, 2021, and before October 1, 2021 |

|

You MUST complete all three pages of Form 944 and SIGN it.

4e

5

6

7

8a

8b

8c

8d

.

.

.

.

.

.

.

.

.

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. |

Cat. No. 39316N |

Form 944 (2022) |

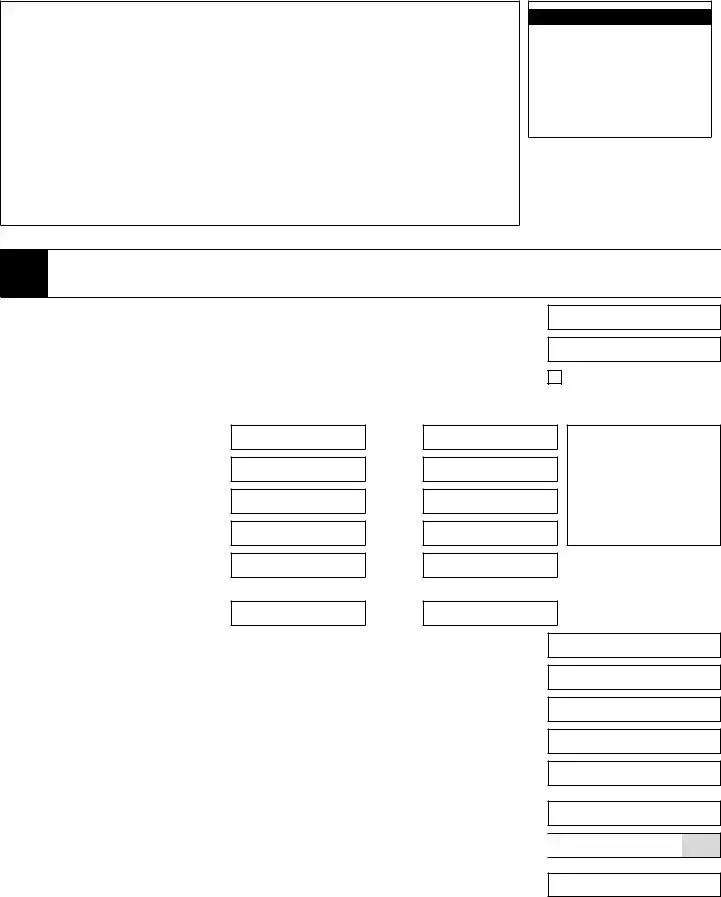

Name (not your trade name)

Employer identification number (EIN)

–

Part 1: Answer these questions for this year. (continued)

8e Nonrefundable portion of COBRA premium assistance credit . . . . . . . . . 8e

8f Number of individuals provided COBRA premium assistance

.

8g |

Total nonrefundable credits. Add lines 8a, 8b, 8d, and 8e |

. . |

8g |

9 |

Total taxes after adjustments and nonrefundable credits. Subtract line 8g from line 7 |

. . |

9 |

10a |

Total deposits for this year, including overpayment applied from a prior year |

and |

|

|

overpayments applied from Form |

. . |

10a |

.

.

.

10b |

Reserved for future use |

. . . . . . . . . . . |

. |

. |

. |

10b |

10c |

Reserved for future use |

. . . . . . . . . . . |

. |

. |

. |

10c |

10d Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021 . . . . . . . . . . . . . . . . . . . . . . . . 10d

.

.

.

.

.

10e |

Reserved for future use |

10e |

10f |

Refundable portion of credit for qualified sick and family leave wages for leave taken |

|

|

after March 31, 2021, and before October 1, 2021 |

10f |

10g |

Refundable portion of COBRA premium assistance credit |

10g |

10h |

Total deposits and refundable credits. Add lines 10a, 10d, 10f, and 10g |

10h |

10i |

Reserved for future use |

10i |

10j |

Reserved for future use |

10j |

11 |

Balance due. If line 9 is more than line 10h, enter the difference and see instructions . . . |

11 |

.

.

.

.

.

.

.

.

.

.

12Overpayment. If line 10h is more than line 9, enter the difference

.

Check one:

Apply to next return.

Send a refund.

Part 2: Tell us about your deposit schedule and tax liability for this year.

13 Check one:

Line 9 is less than $2,500. Go to Part 3.

Line 9 is $2,500 or more. Enter your tax liability for each month. If you’re a semiweekly schedule depositor or you became one because you accumulated $100,000 or more of liability on any day during a deposit period, you must complete Form

|

Jan. |

|

Apr. |

|

|

July |

13a |

. |

13d |

. |

13g |

|

. |

|

Feb. |

|

May |

|

|

Aug. |

13b |

. |

13e |

. |

13h |

|

. |

|

Mar. |

|

June |

|

|

Sept. |

13c |

. |

13f |

. |

13i |

|

. |

Total liability for year. Add lines 13a through 13l. Total must equal line 9. |

13m |

|||||

You MUST complete all three pages of Form 944 and SIGN it.

|

Oct. |

13j |

. |

|

Nov. |

13k |

. |

|

Dec. |

13l |

. |

.

Page 2 |

Form 944 (2022) |

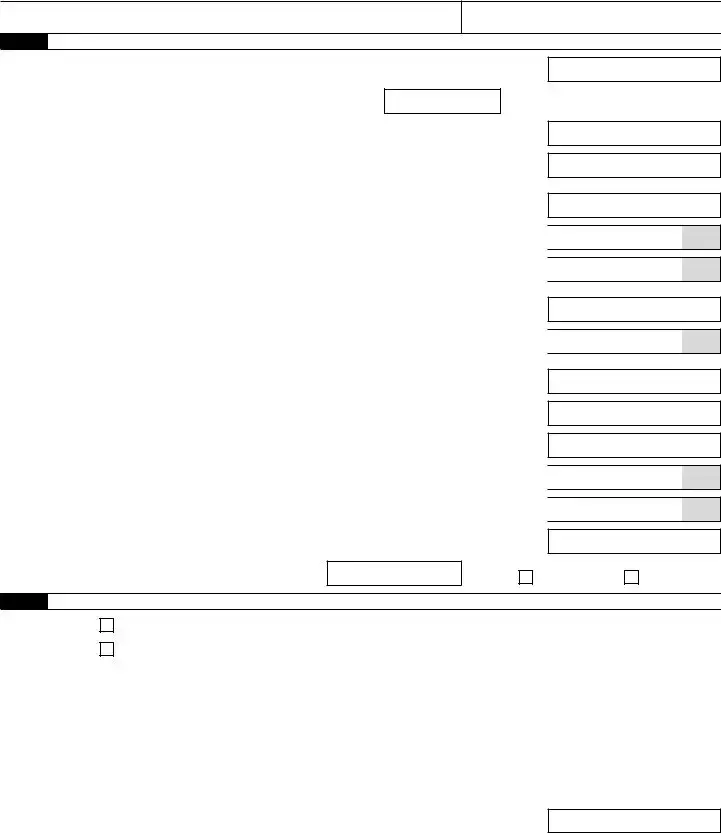

Name (not your trade name)

Employer identification number (EIN)

–

Part 3: Tell us about your business. If any question does NOT apply to your business, leave it blank.

14 If your business has closed or you stopped paying wages |

. . . . . . . . . . . . . . |

Check here, and

enter the final date you paid wages

/ /

; also attach a statement to your return. See instructions.

15Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

16Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

17 |

Reserved for future use |

18 |

Reserved for future use |

19Qualified sick leave wages for leave taken after March 31, 2021, and before October 1, 2021

20Qualified health plan expenses allocable to qualified sick leave wages reported on line 19

21Amounts under certain collectively bargained agreements allocable to qualified sick

leave wages reported on line 19 . . . . . . . . . . . . . . . . . . .

22Qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021

23Qualified health plan expenses allocable to qualified family leave wages reported on line 22

24Amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 22 . . . . . . . . . . . . . . . . . . .

15

16

17

18

19

20

21

22

23

24

.

.

.

.

.

.

.

.

.

.

.

.

25 |

Reserved for future use |

25 |

26 |

Reserved for future use |

26 |

.

.

.

.

Part 4: May we speak with your

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Select a

No.

Part 5: Sign here. You MUST complete all three pages of Form 944 and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your name here

Date

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

State

Check if you’re

PTIN

Date

EIN

Phone

ZIP code

Page 3 |

Form 944 (2022) |

This page intentionally left blank

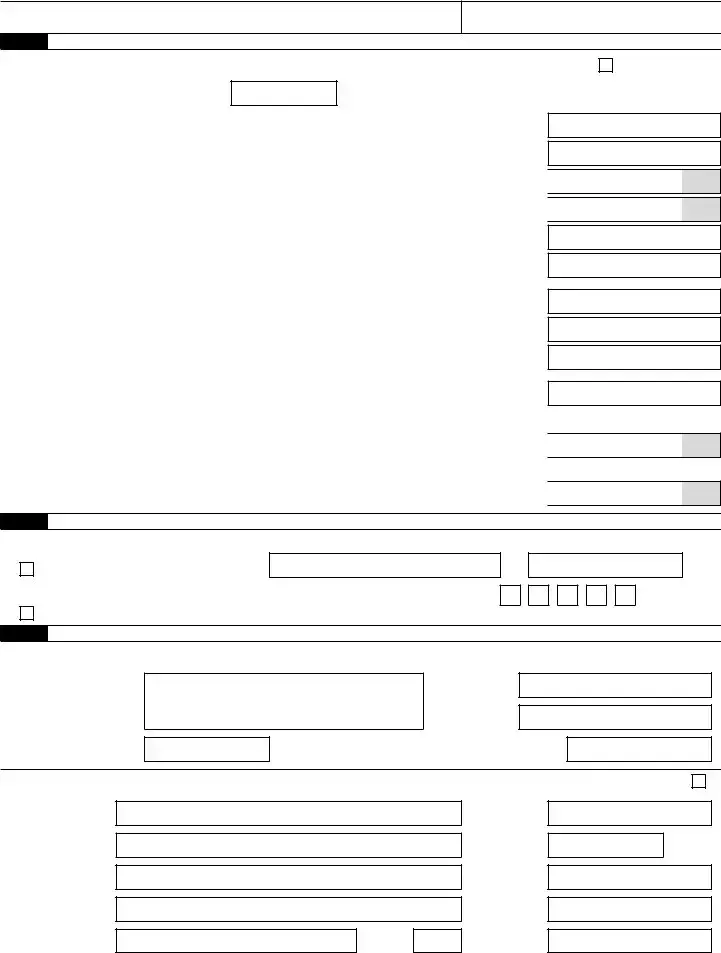

Form

Purpose of Form

Complete Form

Making Payments With Form 944

To avoid a penalty, make your payment with your 2022 Form 944 only if one of the following applies.

•Your net taxes for the year (Form 944, line 9) are less than $2,500 and you’re paying in full with a timely filed return.

•Your net taxes for the year (Form 944, line 9) are $2,500 or more and you already deposited the taxes you owed for the first, second, and third quarters of 2022; your net taxes for the fourth quarter are less than $2,500; and you’re paying, in full, the tax you owe for the fourth quarter of 2022 with a timely filed return.

•You’re a monthly schedule depositor making a payment in accordance with the Accuracy of Deposits Rule. See section 11 of Pub. 15, section 8 of Pub. 80, or section 11 of Pub. 179 for details. In this case, the amount of your payment may be $2,500 or more.

Otherwise, you must make deposits by electronic funds transfer. See section 11 of Pub. 15, section 8 of Pub. 80, or section 11 of Pub. 179 for deposit instructions. Don’t use Form

Use Form

may be subject to a penalty. See section 11 of Pub. 15, section 8 of Pub. 80, or section 11 of Pub. 179 for details.

Specific Instructions

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 944,” and “2022” on your check or money order. Don’t send cash. Don’t staple Form

•Detach Form

Note: You must also complete the entity information above Part 1 on Form 944.

Detach Here and Mail With Your Payment and Form 944.

Form

Department of the Treasury

Internal Revenue Service

1Enter your employer identification number (EIN).

–

|

Payment Voucher |

|

OMB No. |

|

|||

|

|

|

|

|

|

|

|

Don’t staple this voucher or your payment to Form 944. |

|

2022 |

|

|

|

||

|

|

|

|

2 |

Dollars |

Cents |

Enter the amount of your payment.

Make your check or money order payable to “United States Treasury.”

3 Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code; or your city, foreign country name, foreign province/county, and foreign postal code.

Form 944 (2022)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Subtitle C, Employment Taxes, of the Internal Revenue Code imposes employment taxes on wages and provides for income tax withholding. This form is used to determine the amount of the taxes that you owe. Section 6011 requires you to provide the requested information if the tax is applicable to you. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner, or provide false or fraudulent information, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose your tax information to the Department of Justice for civil

and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file Form 944 will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . . . . . . . 18 hr., 39 min.

Learning about the law or the form . . |

. 1 hr., 2 min. |

Preparing, copying, assembling, and |

|

sending the form to the IRS |

3 hr., 46 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 944 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Form Data

| Fact Number | Fact Name | Fact Detail |

|---|---|---|

| 1 | Form Purpose | The IRS Form 944 is designed for small employers to file their annual federal tax returns. |

| 2 | Eligibility | Employers are eligible to file Form 944 if their annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less. |

| 3 | Filing Frequency | Form 944 is filed annually, offering a simpler reporting method than quarterly filings for eligible small employers. |

| 4 | Due Date | The form is typically due by January 31st of the year following the reported tax year. |

| 5 | IRS Notification | Employers must be notified by the IRS that they are eligible to file Form 944 before using this form instead of the quarterly Form 941. |

| 6 | Electronic Filing | Eligible employers have the option to file Form 944 electronically through the IRS e-file system. |

| 7 | Penalties | Failure to file, late filing, or incorrect filing of Form 944 can result in penalties assessed by the IRS. |

| 8 | Payment with Filing | If taxes are owed, employers can make a payment when they file Form 944. |

| 9 | State-Specific Forms | While Form 944 is a federal form, some states may have their own forms for state-level tax reporting. There are no specific governing laws for Form 944 on a state level as it is a federal form. |

Instructions on Utilizing IRS 944

Filling out the IRS 944 form is a task that ensures your business stays compliant with its annual federal tax obligations. This form is designed for smaller employers to report their yearly tax liability. For many, the process might seem daunting at first, but by following step-by-step instructions, you can complete the form accurately and efficiently. Once you've submitted this form, you can focus more energetically on your business, knowing your tax responsibilities are in order for the year.

- Gather all necessary information and documents, including your Employer Identification Number (EIN), the total amount of wages you've paid, and federal income tax withheld from your employees.

- Enter your EIN, name, and address at the top of the form in the designated boxes.

- Proceed to line 1, where you will report the total wages, tips, and other compensation you have paid during the year.

- On line 2, input the federal income tax you have withheld from your employees' wages.

- For lines 3 and 4, calculate and report the total social security and Medicare taxes. These are based on a predetermined percentage of the wages paid. Ensure to multiply correctly and report both the employer’s and employees’ portions.

- If applicable, complete line 5 by tallying any adjustments for tips and group-term life insurance premiums for employees.

- Line 6 requires the total of lines 1, 2, 3, and 5 — this gives you the total taxes before adjustments.

- In lines 7 through 9, you'll apply any adjustments allowed, such as sick pay or tips. It's essential to review the specific instructions for these lines to see if they apply to your situation.

- Summarize your total taxes after adjustments on line 10.

- Line 11 is for claiming the small business payroll tax credit if eligible. Subtract this credit from the total taxes to find your total taxes after adjustments and credits on line 12.

- Finally, on lines 13 and 14, report the total deposits you've made for the year and any balance due or overpayment. If you owe taxes, ensure to send your payment with the form or make arrangements for electronic payment.

- Sign and date the form at the bottom, certifying that all the information provided is accurate.

Once you've completed these steps, review the form one last time to ensure everything is correct and there are no errors. Submitting accurate and precise information will save you from potential issues or delays with the IRS. After the form is filled out and sent off, you've taken a significant step in fulfilling your business's annual tax duties. The next steps include keeping a copy of the form for your records and staying informed about any updates or changes in tax reporting requirements for the upcoming year.

Obtain Answers on IRS 944

-

What is the IRS 944 form?

The IRS 944 form serves as an annual tax return for small employers, allowing them to report their federal income tax withholdings and both employer's and employee's share of Social Security and Medicare taxes for the year. This form is designed for businesses with a smaller tax liability, offering a simplified and less frequent filing than the quarterly 941 form.

-

Who needs to file the IRS 944 form?

This form is specifically intended for small employers whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less. However, it's not automatically assigned. The IRS will notify employers who qualify to file Form 944. If an employer believes they qualify but hasn't received notification, they should contact the IRS for clarification.

-

How do I know if I should file Form 944 or Form 941?

Form 944 is for small employers who have been notified by the IRS to file this form. In contrast, Form 941 is filed quarterly by employers regardless of size, unless they have received a notification to file the annual Form 944 or are exempt from filing. Employers should follow IRS instructions or consult with a professional to determine their filing obligations.

-

When is the IRS 944 form due?

Form 944 must be filed once a year by January 31, covering the previous tax year. If employers have made deposits in full and on time, they have until February 10 to file. Be cautious of deadlines to avoid penalties.

-

Can I file Form 944 electronically?

Yes, employers have the option to file Form 944 electronically through an IRS-authorized e-file provider. Electronic filing is encouraged as it is faster, more secure, and offers instant confirmation that the IRS has received your form.

-

What happens if I file the IRS 944 form late?

Filing Form 944 after the due date can result in penalties and interest charges on taxes owed. The amount of the penalty depends on how late the form is filed and the amount of tax due. It's crucial to file as soon as possible if the deadline has been missed to minimize penalties.

-

Can I switch between filing Form 944 and Form 941?

Switching between filing Form 944 and Form 941 is not a choice employers can make freely. The IRS assigns the filing of Form 944 based on the employer's tax liability. If an employer's business grows and their tax liability increases or if they prefer quarterly filing, they must contact the IRS to request a change in their filing requirements.

-

What should I do if I made a mistake on my filed IRS 944 form?

If an error has been made on a filed Form 944, it should be corrected as soon as possible to avoid potential penalties. Employers should use Form 944-X, Adjusted Employer’s ANNUAL Federal Tax Return or Claim for Refund, to correct errors on previously filed Form 944s. This form allows the correction of wages, taxes, and amounts previously reported to the IRS.

Common mistakes

Filing taxes can be a challenging process, especially when navigating the complexities of IRS Form 944, designated for small employers to report annual tax returns. A significant number of errors are commonly made by filers, impacting the accuracy of their tax obligations and potentially leading to penalties. We outline eight of these mistakes to help ensure more accurate filings.

Incorrectly determining if they are required to file Form 944 instead of Form 941. Employers sometimes misunderstand the eligibility criteria, filing the wrong form and complicating their tax situation.

Failing to report all taxable wages, including tips and other compensation. This omission can lead to underreported taxes and potential penalties.

Omitting to calculate and include all allowances and deductions accurately. Such oversights can result in incorrect tax liabilities being reported.

Not including the correct amount of taxes withheld from employees' wages. Employers must ensure that withholdings are accurately calculated and reported.

Miscalculating the employer's portion of Social Security and Medicare taxes. It is critical to accurately compute these figures to avoid under or overpaying taxes.

Forgetting to sign and date the form. An unsigned form is considered incomplete and will not be processed by the IRS, potentially resulting in delays and penalties.

Entering incorrect employer identification numbers (EINs). An incorrect EIN can lead to filing errors and complications in reconciling tax accounts.

Failing to file electronically when required. Some employers are mandated to file electronically based on certain criteria, and failure to do so can result in penalties.

In summary, when preparing IRS Form 944, accuracy, thoroughness, and adherence to IRS guidelines are key to avoiding common mistakes. Employers should carefully review their form before submission, considering consulting with a tax professional to ensure compliance and accuracy.

Documents used along the form

The IRS Form 944 is designed for small employers to file and report their employees' annual federal tax returns. While this form is crucial, it's often not the only document needed to fully comply with federal tax obligations. Understanding which documents and forms commonly accompany or are related to Form 944 can help ensure employers meet all their legal and administrative requirements.

- W-2 Forms: These are wage and tax statements that employers must provide to each of their employees and to the Social Security Administration annually. The W-2 forms report the total annual wages paid and taxes withheld from employees' paychecks.

- W-3 Form: This is the transmittal form that accompanies the W-2 forms when they are sent to the Social Security Administration. It summarizes the information of all W-2s for an employer's workforce.

- Form 940: Employers use this form to report and pay the federal unemployment tax (FUTA). The FUTA tax finances the federal government's oversight of state unemployment insurance programs.

- Form 941: This form is utilized by employers to report federal income tax withholdings from employees, as well as Social Security and Medicare taxes withheld, on a quarterly basis. Employers not directed to file Form 944 use Form 941 instead.

- Form W-4: Employees complete this form to indicate their withholding allowances to their employer. The information on the W-4 helps employers determine how much federal income tax to withhold from an employee's wages.

- Form W-9: Used by employers to request taxpayer identification numbers (TINs) from contractors, freelancers, and other non-employees. This information is needed for the employer to issue a 1099 form if required.

- Form 1099-NEC: Employers use this form to report non-employee compensation of $600 or more per year to the Internal Revenue Service (IRS). It applies primarily to independent contractors and freelancers.

Together with Form 944, these documents form a comprehensive framework for reporting and managing the taxes associated with employment. While the responsibility may seem daunting, understanding each form’s role and ensuring their accurate and timely filing can significantly simplify the process. Employers should always stay updated on the requirements and deadlines for each form to maintain compliance and promote a healthy financial practice within their business.

Similar forms

The IRS 944 form is a document used by employers to report annual federal tax returns. This document, while unique in its purpose, shares similarities with several other tax forms and documents used for financial reporting within the United States. Each of these documents plays a crucial role in ensuring compliance and accuracy in financial reporting and tax obligations. Below is a description of 9 other documents that are similar to the IRS 944 form and an explanation of how exactly they are similar:

- IRS Form 941: This is Employers' Quarterly Federal Tax Return, similar to the 944 as both are used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. The key difference is the reporting period; Form 941 is filed quarterly, while Form 944 is filed annually.

- IRS Form 940: This form is used for reporting Federal Unemployment Tax Act (FUTA) tax. Similar to the 944 form, Form 940 deals with employer tax responsibilities, but it is specifically focused on unemployment contributions.

- IRS Form W-2: This Wage and Tax Statement reports an employee's annual wages and the amount of taxes withheld from their paycheck. Like the 944, it provides a summary of wages paid and taxes withheld but from the employee's perspective.

- IRS Form W-3: The Transmittal of Wage and Tax Statements summarizes the information from multiple Forms W-2. It accompanies Form W-2 when filed with the IRS, similar to how Form 944 aggregates tax information for the year from an employer.

- IRS Form W-4: This form is filled out by employees to indicate their tax situation to their employer, so the correct amount of federal income tax is withheld from their pay. It's connected to the 944 in that the information provided impacts the calculations and reporting on the 944.

- IRS Form 1099: These forms are used to report various types of income other than wages, salaries, and tips. Like Form 944, 1099s deal with reporting to the IRS but focus on payments made to independent contractors and other non-employees.

- IRS Form 1040: The U.S. Individual Income Tax Return form is used by individuals to file their annual income taxes. Though focused on individual filers rather than employers, it similarly compiles annual income and tax data.

- IRS Form 1065: This is a Return of Partnership Income form, which partnerships use to report their profits, losses, deductions, and credits to the IRS annually. Like Form 944, it is an annual filing, but for partnerships instead of employers.

- IRS Form 1120: The U.S. Corporation Income Tax Return is used by corporations to report their annual income, gains, losses, deductions, and credits. Similar to Form 944, it is an annual report that contributes to the IRS's understanding of an entity's financial activities throughout the fiscal year.

Each of these forms and documents is integral to the United States' tax reporting and compliance framework. They serve various roles that, while specific to certain taxpayer categories or income types, collectively ensure the accurate and fair collection of taxes. The IRS 944 form is a part of this system, enabling small employers to report annually instead of quarterly, simplifying the process for those who qualify.

Dos and Don'ts

Filing out the IRS 944 form, an annual tax return utilized by smaller employers to report on federal income taxes, and FICA taxes (Social Security and Medicare) withheld from employees' wages, as well as the employer's portion of FICA taxes, requires due diligence and accuracy. Here are five practices to adopt and avoid for a smoother, error-free submission:

What You Should Do:

- Ensure eligibility by confirming that your business's annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less, which qualifies you to file using this form.

- Double-check your Employer Identification Number (EIN), business name, and contact information for accuracy to match IRS records and avoid processing delays.

- Report accurate figures by thoroughly reviewing wage reports and tax statements to ensure all taxable wages are correctly calculated and reported.

- Utilize the IRS's electronic filing options whenever possible for a secure and faster processing of your Form 944, reducing the risk of errors and delays associated with paper filing.

- Seek advice from a tax professional when in doubt about how to thoroughly and accurately complete your Form 944, especially if facing complex tax situations or recent changes in tax laws.

What You Shouldn't Do:

- Do not estimate wages and taxes; always use actual payroll records to report exact amounts. Estimations can result in inaccuracies leading to potential penalties.

- Avoid waiting until the last minute to gather essential documents or seek necessary clarifications, as this can lead to rushed decisions and mistakes.

- Do not disregard IRS notices or instructions related to form updates or changes in filing requirements, as these may affect how you complete Form 944.

- Avoid the mistake of not signing the form, as an unsigned form is considered incomplete and will not be processed, potentially leading to penalties for late filing.

- Do not overlook the need to keep a copy of the filed Form 944 and all relevant payroll records for at least four years after filing, as required by the IRS for potential future references or audits.

Misconceptions

Understanding the implications and uses of IRS form 944 requires a clear grasp of its purpose and how it relates to different business entities. Misconceptions can lead to confusion or errors in filing. Here are nine common misconceptions clarified for a better understanding:

All businesses must file IRS form 944 annually. This statement is not accurate. Only small employers whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less may be required to file Form 944. The IRS determines and notifies employers eligible to file this form.

Filing Form 944 means you don't have to file Form 941. Generally, this is true for eligible small employers. However, if the IRS notifies an employer to file Form 944, they should not file quarterly Forms 941 unless specifically instructed to revert back to Form 941 filing.

Employers can choose whether to file Form 944 or Form 941. The choice is not up to the employer. The IRS dictates the form an employer should use based on their tax liability. Employers must wait for an IRS notification regarding their filing requirement.

IRS form 944 is filed for state tax purposes. This misconception is false. Form 944 is a federal tax form used to report annual federal taxes withheld from employees' pay, along with the employer's portion of Social Security and Medicare taxes. State tax filings are separate obligations.

There are no penalties for late filing of Form 944. Employers can face penalties for failing to file Form 944 on time. The amount of the penalty depends on how late the form is filed and the amount of taxes due.

Once an employer files Form 944, they cannot change their filing frequency. If an employer's tax liability changes and they no longer meet the criteria for filing Form 944, or if they wish to change their filing frequency, they must contact the IRS to request a change. Employers may be required to start filing quarterly with Form 941 instead.

Electronic filing of Form 944 is optional. While employers may file paper returns, the IRS encourages electronic filing due to its efficiency and accuracy. In certain cases, especially for larger employers, electronic filing may be mandatory.

Form 944 covers other taxes beyond those withheld from employees and the employer's share of Social Security and Medicare. Form 944 is specifically designed to report federal income tax withheld from employees and the employer's share of Social Security and Medicare taxes. It does not cover other types of taxes, such as federal unemployment tax, which is reported separately on Form 940.

Employers must pay the reported taxes with Form 944. While Form 944 is used to report the taxes owed, the actual tax payments are generally required to be made throughout the year based on the employer’s specific tax liability and deposit schedule. The form reconciles the taxes due against what has been paid.

Key takeaways

Filling out the IRS 944 form is a critical task for small business owners who are navigating their yearly tax obligations. It's designed specifically for the smallest employers to report their annual federal tax responsibilities. Let's walk through some key takeaways that can help these employers manage this task more effectively and with confidence.

- Understand Who Should File: The IRS 944 form is specifically intended for businesses with annual employee tax liabilities of $1,000 or less. This means if you're a small employer, this form could simplify your tax reporting process significantly.

- Kick-Off with Accurate Information: Make sure to have all your employment tax records up to date. Accurate employee information, including social security numbers and total wages, is crucial for filling out the 944 form correctly.

- Determine Your Tax Liability: Before you start filling out the form, calculate your total tax liability for the year. This includes withheld federal income tax, social security, and Medicare taxes from your employees, as well as your share of social security and Medicare taxes.

- Filling out the Form: The 944 form requires you to report your total annual wages paid, taxable social security and Medicare wages, and federal income tax withheld from employees. For each section, ensure that the figures you enter are accurate and match your payroll records.

- Reporting Adjustments: If there are any adjustments to be made, such as sick pay or tips, the form provides specific lines where these amounts can be declared. This helps ensure that all taxable wages are accounted for accurately.

- Claiming Credits: The form also allows employers to claim credits for certain amounts, like small business payroll tax credits for increasing research activities. Understanding what credits you're eligible for can help reduce your overall tax liability.

- Sign and Date: Don't forget to sign and date the form before submission. An unsigned form is like not filing at all, and it could result in penalties or delays.

- Submission Methods: Depending on your preference or requirements, you can submit the form electronically through the IRS e-file system or mail it in. Ensure you're aware of the due date to avoid any late submission penalties.

Filling out the IRS 944 form doesn't have to be daunting if you're prepared and understand the requirements. By breaking down the process into manageable steps and knowing what information you need ahead of time, you can tackle this annual task with ease and accuracy.

Popular PDF Forms

Resale Certificate in California - The necessity for a detailed description of the property intended for resale ensures precise tax compliance and accountability.

Imm5713 Download - Warns against the submission of false information, reminding users of the legal consequences tied to the form’s usage.

Temporary Custody Order California - Encourages legal rectification for inmates seeking to resolve vehicle code violations during imprisonment.