Blank IRS Schedule 1 1040 or 1040-SR PDF Template

Navigating the complexities of tax forms is crucial for accurately reporting income and understanding tax liabilities. Among these, the IRS Schedule 1 for the 1040 or 1040-SR form plays a pivotal role. This form is used by individuals to report additional income not entered on the main tax form, such as earnings from a hobby, rental income, or prize winnings. Additionally, it is where adjustments to income, including contributions to an IRA, student loan interest deduction, and educator expenses, are reported. Proper completion of Schedule 1 is essential for taxpayers seeking to ensure they are not only meeting legal obligations but also taking advantage of permissible deductions to reduce their taxable income. By providing a platform for reporting extra sources of income and adjustments, this schedule ensures a more detailed and precise overview of an individual's financial status, forming a critical component of the tax filing process.

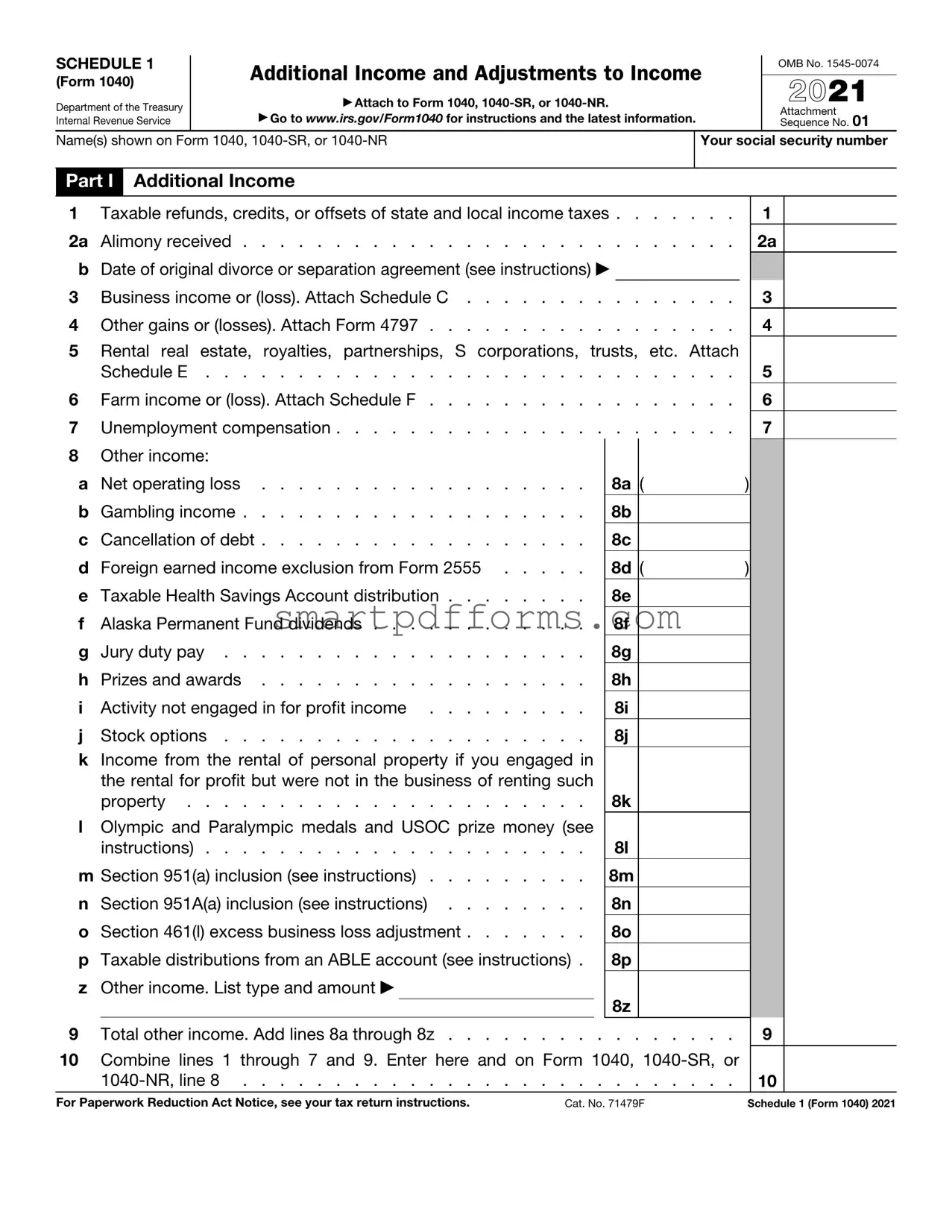

Preview - IRS Schedule 1 1040 or 1040-SR Form

SCHEDULE 1

(Form 1040)

Department of the Treasury Internal Revenue Service

Additional Income and Adjustments to Income

▶Attach to Form 1040,

▶Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No.

2021

Attachment Sequence No. 01

Name(s) shown on Form 1040,

Your social security number

Part I Additional Income

1 |

Taxable refunds, credits, or offsets of state and local income taxes |

1 |

|

||

2a |

Alimony received |

2a |

|||

b Date of original divorce or separation agreement (see instructions) ▶ |

|

|

|

|

|

3 |

Business income or (loss). Attach Schedule C |

3 |

|

||

4 |

Other gains or (losses). Attach Form 4797 |

4 |

|

||

5Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach

|

Schedule E |

5 |

6 |

Farm income or (loss). Attach Schedule F |

6 |

7 |

Unemployment compensation |

7 |

8Other income:

a |

Net operating loss |

8a |

( |

|

) |

|

||

b |

Gambling income |

8b |

|

|

|

|

||

c |

Cancellation of debt |

8c |

|

|

|

|

||

d |

Foreign earned income exclusion from Form 2555 |

8d |

( |

|

) |

|

||

e |

Taxable Health Savings Account distribution |

8e |

|

|

|

|

||

f |

Alaska Permanent Fund dividends |

8f |

|

|

|

|

||

g |

Jury duty pay |

8g |

|

|

|

|

||

h |

Prizes and awards |

8h |

|

|

|

|

||

i |

Activity not engaged in for profit income |

8i |

|

|

|

|

||

j |

Stock options |

8j |

|

|

|

|

||

k |

Income from the rental of personal property if you engaged in |

|

|

|

|

|

||

|

the rental for profit but were not in the business of renting such |

|

|

|

|

|

||

|

property |

8k |

|

|

|

|

||

l |

Olympic and Paralympic medals and USOC prize money (see |

|

|

|

|

|

||

|

instructions) |

8l |

|

|

|

|

||

m Section 951(a) inclusion (see instructions) |

8m |

|

|

|

|

|||

n |

Section 951A(a) inclusion (see instructions) |

8n |

|

|

|

|

||

o |

Section 461(l) excess business loss adjustment |

8o |

|

|

|

|

||

p |

Taxable distributions from an ABLE account (see instructions) . |

8p |

|

|

|

|

||

z |

Other income. List type and amount ▶ |

8z |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

9 |

Total other income. Add lines 8a through 8z |

. . . . . . |

. |

9 |

||||

10Combine lines 1 through 7 and 9. Enter here and on Form 1040,

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 71479F |

Schedule 1 (Form 1040) 2021 |

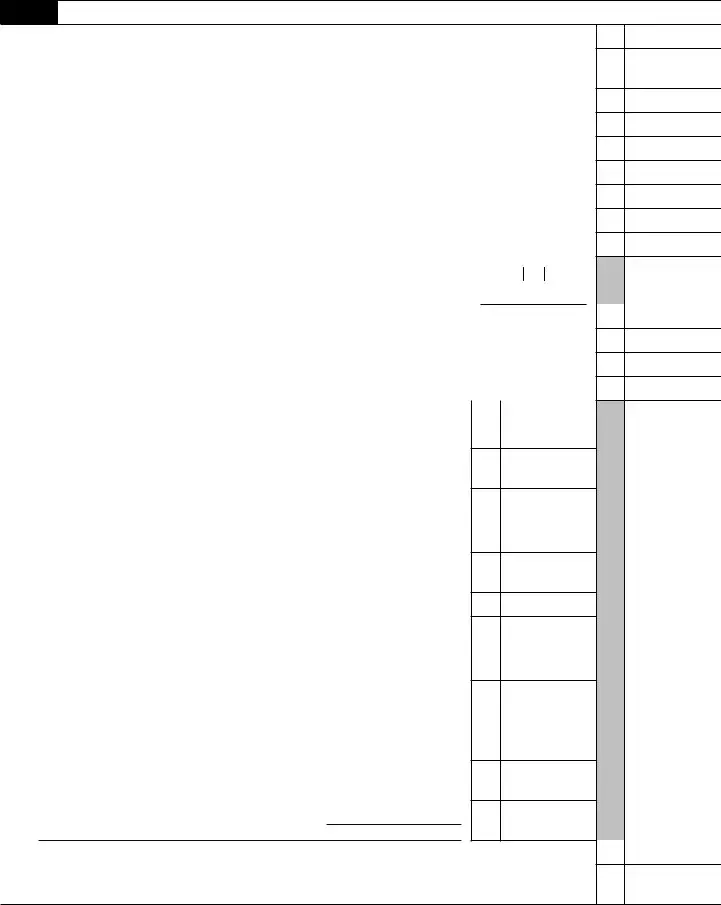

Schedule 1 (Form 1040) 2021 |

Page 2 |

Part II Adjustments to Income

11 Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . .

12Certain business expenses of reservists, performing artists, and

officials. Attach Form 2106 . . . . . . . . . . . . . . . . . . . . . . .

13 Health savings account deduction. Attach Form 8889 . . . . . . . . . . . .

14Moving expenses for members of the Armed Forces. Attach Form 3903 . . . . .

15 Deductible part of

16

17

18 |

Penalty on early withdrawal of savings |

|

19a |

Alimony paid |

|

b |

Recipient’s SSN . . . . . . . . . . . . . . . . . . . . ▶ |

|

cDate of original divorce or separation agreement (see instructions) ▶

20 |

IRA deduction |

21 |

Student loan interest deduction |

22 |

Reserved for future use |

23 |

Archer MSA deduction |

24Other adjustments:

a Jury duty pay (see instructions) . . . . . . . . . . . . . 24a

bDeductible expenses related to income reported on line 8k from

the rental of personal property engaged in for profit . . . . . 24b

cNontaxable amount of the value of Olympic and Paralympic

medals and USOC prize money reported on line 8l |

24c |

d Reforestation amortization and expenses |

24d |

eRepayment of supplemental unemployment benefits under the

Trade Act of 1974 . . . . . . . . . . . . . . . . . . . 24e

fContributions to section 501(c)(18)(D) pension plans . . . . . 24f

g |

Contributions by certain chaplains to section 403(b) plans . . |

24g |

h |

Attorney fees and court costs for actions involving certain |

|

|

unlawful discrimination claims (see instructions) |

24h |

iAttorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the

IRS detect tax law violations |

24i |

j Housing deduction from Form 2555 |

24j |

kExcess deductions of section 67(e) expenses from Schedule

(Form 1041) . . . . . . . . . . . . . . . . . . . . . 24k

zOther adjustments. List type and amount ▶

24z

25Total other adjustments. Add lines 24a through 24z . . . . . . . . . . . . .

26Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or

11

12

13

14

15

16

17

18

19a

20

21

22

23

25

26

Schedule 1 (Form 1040) 2021

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | IRS Schedule 1 for Forms 1040 or 1040-SR is used to report certain types of income that aren't entered directly on the standard tax return forms. It's also where taxpayers deduct certain adjustments to income. |

| Types of Income Reported | This includes income such as business earnings for self-employed individuals, alimony received, rental real estate, royalties, partnership and S corporation income, and unemployment compensation among others. |

| Adjustments to Income | Adjustments can include educator expenses, student loan interest deduction, certain retirement contributions, health savings account deductions, and more, thus reducing the total taxable income. |

| Federal Form with State Variations | While the IRS Schedule 1 form is a federal document, certain states may require additional forms or schedules based on the adjustments and additional income reported on Schedule 1. These state-specific requirements vary and are governed by individual state tax laws. |

Instructions on Utilizing IRS Schedule 1 1040 or 1040-SR

Filing your taxes involves a meticulously detailed process, ensuring that every piece of information is accurate for a smooth Internal Revenue Service (IRS) transaction. The IRS Schedule 1 for the 1040 or 1040-SR form is a critical component of this process for many taxpayers. It's designed to report certain types of income that aren't entered directly on the Form 1040 or 1040-SR, such as capital gains, unemployment compensation, prize money, and gambling winnings. It's also where deductions like student loan interest, educator expenses, and self-employment tax are reported. Steering through this form systematically can make this task less daunting.

To begin filling out the IRS Schedule 1 for 1040 or 1040-SR, gather all necessary documentation related to your additional income and adjustments to income. This preparation ensures the accuracy and completeness of the form. Here are the detailed steps to follow:

- Identify if you need to file Schedule 1 by reviewing the types of income and adjustments to income reported on this form. If you have income or adjustments that are not reported directly on Form 1040 or 1040-SR, you'll need to complete Schedule 1.

- Start with the Additional Income section. Enter the total amounts for each type of income you have that's not included on Form 1040 or 1040-SR. This includes taxable refunds, alimony received (for agreements executed before 2019), business income, capital gains, rental real estate, royalties, partnerships, S corporations, trusts, unemployment compensation, and other income.

- Proceed to the Adjustments to Income section. List the total amounts for any eligible adjustments, such as educator expenses, business expenses for reservists, performing artists, and fee-basis government officials, health savings account deduction, moving expenses for members of the Armed Forces, deductible part of self-employment tax, self-employed SEP, SIMPLE, and qualified plans, self-employed health insurance deduction, penalty on early withdrawal of savings, alimony paid (for agreements executed before 2019), IRA deduction, student loan interest deduction, and other adjustments.

- Add up the total additional income amounts and adjustments to income, then enter these totals in the designated spots at the end of their respective sections.

- Transfer the total additional income amount to your Form 1040 or 1040-SR, line 7a.

- Carry the total of adjustments to income over to Form 1040 or 1040-SR, line 8a. This amount will be subtracted from your income to determine your adjusted gross income (AGI).

- Review the information for accuracy and completeness. Rectify any errors or omissions.

- Attach Schedule 1 to your Form 1040 or 1040-SR when you file your tax return. Ensure you've also completed any other necessary schedules and forms based on your financial situation.

Correctly filling out the IRS Schedule 1 for Forms 1040 or 1040-SR is crucial for accurately reporting your income and adjustments. This step-by-step guide aims to simplify the process, making your tax filing experience as smooth as possible. Remember, the key to a successful tax filing is preparation and thoroughness, ensuring every dollar is accounted for and placed in the right category. Once completed, you're one step closer to finalizing your tax obligations for the year.

Obtain Answers on IRS Schedule 1 1040 or 1040-SR

-

What is IRS Schedule 1 for Form 1040 or 1040-SR?

Schedule 1 for Form 1040 or 1040-SR is used by taxpayers to report additional income not listed on the standard 1040 form, such as capital gains, unemployment compensation, prize or award money, and gambling winnings. It is also used to claim adjustments to income, including educator expenses, student loan interest deduction, and contributions to a health savings account (HSA).

-

Who needs to file Schedule 1 with their 1040 or 1040-SR form?

If you have additional sources of income not reported on a standard Form 1040 or 1040-SR or need to make adjustments to your income, you need to complete and attach Schedule 1. Examples include earnings from self-employment, alimony received, business income, and deductible part of self-employment tax.

-

How do I know if I have to report any additional income on Schedule 1?

Review all sources of income received during the year. If you have income from sources like rental property, farm income, or you received dividends on insurance policies exceeding the total premiums paid, you likely need to report this income on Schedule 1.

-

Can I claim deductions for adjustments to income on Schedule 1?

Yes, Schedule 1 allows you to claim various adjustments to your income, which can lower your taxable income. Some of these adjustments include educator expenses, health savings account contributions, moving expenses for members of the Armed Forces, deductible part of self-employment tax, and the student loan interest deduction.

-

What are the educator expenses I can deduct on Schedule 1?

Educator expenses are deductible up to $250 ($500 if married filing jointly and both spouses are eligible educators, but not more than $250 each). These are out-of-pocket expenses for classroom supplies, materials, books, computer equipment, and other supplies used in the classroom.

-

How do I report unemployment compensation on Schedule 1?

Unemployment compensation received during the tax year should be reported on Schedule 1, line 7. The total amount of unemployment compensation received is usually reported to you on Form 1099-G.

-

What is the student loan interest deduction on Schedule 1?

This is an adjustment to income for the interest paid during the year on qualified student loans. The maximum deduction is $2,500 per return, and this amount may be reduced depending on your modified adjusted gross income.

-

Where do I include my health savings account (HSA) contributions on Schedule 1?

Contributions to your HSA made with after-tax dollars can be reported as an adjustment to income on Schedule 1. This can lower your taxable income. Be sure to report only contributions made with after-tax dollars.

-

Can I file Schedule 1 electronically along with my Form 1040 or 1040-SR?

Yes, you can file Schedule 1 and your Form 1040 or 1040-SR electronically through IRS e-file. Using an authorized IRS e-file provider, you can submit your forms quickly and securely.

-

What should I do if I realize I need to file a Schedule 1 after submitting my Form 1040 or 1040-SR?

If you discover that you need to file Schedule 1 after having already submitted your Form 1040 or 1040-SR, you should file an amended return using Form 1040-X. Attach the completed Schedule 1 to the amended return before submission.

Common mistakes

-

Not reporting all sources of income. People often overlook or forget to include various income streams such as freelance work, interest from savings accounts, or earnings from gig economy jobs. It is crucial to report every income source to avoid potential penalties.

-

Miscalculating adjustable gross income (AGI). This can stem from arithmetic errors, not understanding which deductions are allowed, or incorrectly claiming deductions. The AGI affects tax liabilities and eligibility for certain tax credits and deductions, so accuracy is key.

-

Forgetting to include additional income statements. Taxpayers sometimes fail to attach necessary documentation for other income, like alimony received or business income. This omission can lead to processing delays or a mismatch in reported and IRS-calculated income.

-

Failing to claim all eligible deductions or tax credits. Taxpayers often miss out on deductions or credits either because they're unaware of them or misunderstand the eligibility requirements. This mistake can result in paying more tax than necessary.

-

Mixing up tax credits and deductions. Understanding the difference is crucial: Tax credits provide a dollar-for-dollar reduction of your income tax liability, while deductions lower your taxable income. Confusing the two can lead to inaccuracies in tax calculations.

-

Incorrectly reporting retirement contributions. Contributions to retirement accounts like IRAs can be deductible, but the taxpayer needs to report these correctly. Overlooking or misreporting can affect one's taxable income and subsequent tax liability.

-

Not seeking professional help when needed. The tax code can be complex, and misunderstandings can lead to errors on a return. For those with multiple income streams, significant investments, or unusual deductions, consulting with a tax professional can be invaluable in avoiding mistakes.

Documents used along the form

When it comes to tax time, understanding the forms and documents you need can make the process smoother. The IRS Schedule 1 form for either 1040 or 1040-SR filers is often just the starting point. This form is designed to report certain types of income that aren't entered directly on the front page of the 1040 or 1040-SR, like capital gains, unemployment compensation, prize money, and deductible expenses. Along with Schedule 1, there are several other forms and documents you might need to gather to report accurately and take advantage of potential deductions or credits. Here's a brief overview of six other forms commonly used in conjunction with Schedule 1.

- Form W-2: This is the wage and tax statement most employees receive from their employer. It reports annual wages and the amount of taxes withheld from your paycheck.

- Form 1099-MISC: Independent contractors or freelancers often receive this form from their clients. It reports income you’ve earned outside of traditional employment.

- Form 1099-INT: This form is for interest income. If you've earned more than $10 in interest from bank accounts or other investments, you’ll likely receive this document.

- Form 1099-DIV: Similar to the 1099-INT, this form is for dividends you've earned from investments. It’s important for reporting income from stocks or mutual funds.

- Schedule A (Form 1040): If you itemize deductions instead of taking the standard deduction, you’ll use Schedule A. This form covers a variety of deductions including medical expenses, state and local taxes, and charitable contributions.

- Schedule D (Form 1040): For reporting capital gains or losses from the sale of assets, you’ll need Schedule D. This could include sales from stocks, property, or other investments.

Beyond just filing your taxes, understanding these forms can help you better manage your finances throughout the year. By knowing what documents and information you'll need, you can keep better track of your income, expenses, and potential deductions, which in turn can help ensure a smoother tax filing process. Don’t forget, if your circumstances are complex, reaching out to a tax professional can be a wise move. They can provide personalized advice and help you navigate through the maze of tax forms and regulations.

Similar forms

IRS Schedule C (Form 1040 or 1040-SR): Similar to Schedule 1, Schedule C is used by individuals to report income or loss from a business they operated or a profession they practiced as a sole proprietor. Both forms contribute to the total income calculation on the 1040 form, although Schedule C focuses on business-related income and expenses, whereas Schedule 1 combines additional income sources and adjustments to income.

IRS Schedule D (Form 1040): This form parallels Schedule 1 in its role of reporting specific types of income — in the case of Schedule D, capital gains or losses from the sale of assets. Both schedules feed into the main 1040 form to adjust gross income, with Schedule D focusing on investment-related transactions.

IRS Schedule E (Form 1040): Schedule E is used to report income from rental real estate, royalties, partnerships, S corporations, trusts, and estates, making it akin to Schedule 1. Each document captures different income sources that are not covered by standard employment, assisting individuals in reporting a comprehensive income picture on their 1040 or 1040-SR form.

IRS Schedule F (Form 1040): This form is intended for reporting income from farming activities. Like Schedule 1, Schedule F adds another layer to the individual income reporting process, allowing for the detailed declaration of income not derived from wages, salaries, or tips, which impacts the adjusted gross income calculations on the 1040 or 1040-SR forms.

IRS Form 4797: Form 4797 is used for the sale of business property and is similar to Schedule 1 in the way that it deals with specific income-generating activities that need to be reported separately from standard wage or salary income. Both forms feed into the overarching 1040 or 1040-SR document to ensure a complete record of an individual's income sources.

IRS Schedule SE (Form 1040): Schedule SE is utilized for calculating self-employment tax, related closely to Schedule 1's function of adding to one's income-story by accounting for additional income types or adjustments. While Schedule SE specifically addresses self-employment taxes, Schedule 1 serves as a broader document for reporting additional income and adjustments.

IRS Form 8960: Form 8960 is used to calculate the Net Investment Income Tax applicable to individuals, estates, and trusts with income above certain threshold amounts. It relates to Schedule 1 as both deal with the more complex aspects of tax calculations stemming from various income sources, impacting the total tax liability reported on the 1040 or 1040-SR form.

Dos and Don'ts

When filling out the IRS Schedule 1 for form 1040 or 1040-SR, individuals should ensure accuracy and completeness to avoid potential issues with the IRS. Below are some recommended actions to take and avoid.

Do:

- Double-check all information for accuracy before submission, including income and adjustments.

- Provide complete information for all required fields to prevent unnecessary delays or inquiries from the IRS.

- Use the instructions provided by the IRS for Schedule 1 to guide the completion of the form accurately and to understand the requirements for additional income and adjustments to income.

- Seek assistance from a tax professional if there is any uncertainty in how to properly fill out the form or report income and adjustments.

Don't:

- Omit additional income that needs to be reported, such as business income, alimony, rental income, or other types of income not listed on Form 1040 or 1040-SR.

- Forget to report adjustments to income that can lower taxable income, such as educator expenses, student loan interest, or contributions to certain retirement accounts.

- Dismiss the importance of keeping records that support the information reported on Schedule 1, as these may be needed for future reference or in case of an IRS audit.

- Falsify information on Schedule 1, as this can lead to penalties, interest, or more severe consequences from the IRS.

Misconceptions

When it comes to filing taxes, the IRS Schedule 1 for Form 1040 or 1040-SR often comes with its share of misconceptions. Understanding these can make the tax-filing process smoother and less daunting. Here are six common misconceptions:

- It's only for the self-employed. Many people think Schedule 1 is exclusively for self-employed individuals to report their income and expenses. However, this form is also required for reporting income such as alimony, rental income, or prize money, among others, regardless of one's employment status.

- You must itemize deductions to use it. This misunderstanding can lead to missing out on reporting additional income or adjustments. Schedule 1 is used to report certain types of income and to make adjustments to income whether you itemize deductions or not.

- It makes tax filing more complicated. While introducing another form into your tax return might seem daunting, Schedule 1 is straightforward when you have the necessary documents on hand. It's designed to make sure you're taxed accurately based on your total income.

- Filing Schedule 1 means you owe more taxes. Not necessarily. Schedule 1 is used to report additional income sources and adjustments. Some adjustments can actually decrease your taxable income, potentially leading to a lower tax bill or a higher refund.

- It's only about reporting additional income. Besides reporting additional types of income, Schedule 1 is also important for making adjustments to income, such as student loan interest deductions, educator expenses, or IRA contributions that can lower your taxable income.

- Everything reported on Schedule 1 is taxed the same. Different types of income reported on Schedule 1 can be subject to different tax rates or rules. For example, capital gains may be taxed at a different rate than other types of income, and some adjustments to income can directly reduce your taxable income.

Recognizing these misconceptions about IRS Schedule 1 can help filers approach their tax preparation with more confidence and accuracy. A clear understanding ensures you report your income correctly and take advantage of any adjustments to income that you're eligible for.

Key takeaways

The IRS Schedule 1 Form 1040 or 1040-SR plays a crucial role in the tax filing process, providing a means for taxpayers to report additional income and make various adjustments to their income. Here are nine key takeaways regarding the filling out and use of this form:

- To report types of income not listed on the standard Form 1040 or 1040-SR, such as business income, alimony received, rental income, or farm income, Schedule 1 is necessary.

- Adjustments to income can also be made through Schedule 1, which may include educator expenses, student loan interest deduction, or contributions to a retirement account.

- Filling out Schedule 1 accurately is essential to ensure the correct tax liability is calculated. Taxpayers should carefully review all sections related to their income and deductions.

- If additional taxes owed are identified, such as self-employment tax or additional taxes on IRAs or other qualified plans, they are also reported on Schedule 1.

- The total additional income and adjustments to income from Schedule 1 are transferred to lines 7a and 8a, respectively, on Form 1040 or 1040-SR.

- Understanding every source of income and potential deduction available helps taxpayers not only comply with tax laws but also maximize their potential tax benefits.

- The IRS provides instructions for Schedule 1 that include detailed guidance on how to report specific types of income and how to calculate certain adjustments to income.

- Using tax preparation software can simplify filling out Schedule 1, as it guides taxpayers through questions and automatically fills in the appropriate fields based on their answers.

- Taxpayers should keep thorough records of all their income and any related expenses that could affect their taxes to support the figures entered on Schedule 1.

Popular PDF Forms

Form 7004 - Businesses facing transitions, mergers, or acquisitions find Form 7004 invaluable for securing the time needed to sort out tax matters.

How to Get Msds Sheets - Information on the acute and chronic health effects resulting from exposure, addressing the product’s potential to cause irritation, sensitization, or more severe health impacts.