Blank IRS Schedule 2 1040 or 1040-SR PDF Template

Navigating the complexities of the tax season can often feel overwhelming, with a variety of forms and schedules to consider. Among these, the IRS Schedule 2 for 1040 or 1040-SR forms stands out as a vital document for many taxpayers. This additional form plays a crucial role for those who have other taxes that aren’t covered in the main form, such as alternative minimum tax or household employment taxes. It is also where taxpayers need to report any excess advance premium tax credit repayment. Understanding the specifics of Schedule 2 is essential not only for accurately reporting your financial information but also for optimizing your tax return. As tax laws and guidelines evolve, staying informed about these forms ensures compliance and helps avoid potential penalties. Whether you're navigating the tax season on your own or with professional guidance, a clear grasp of the Schedule 2 form and its significance can make the process more manageable.

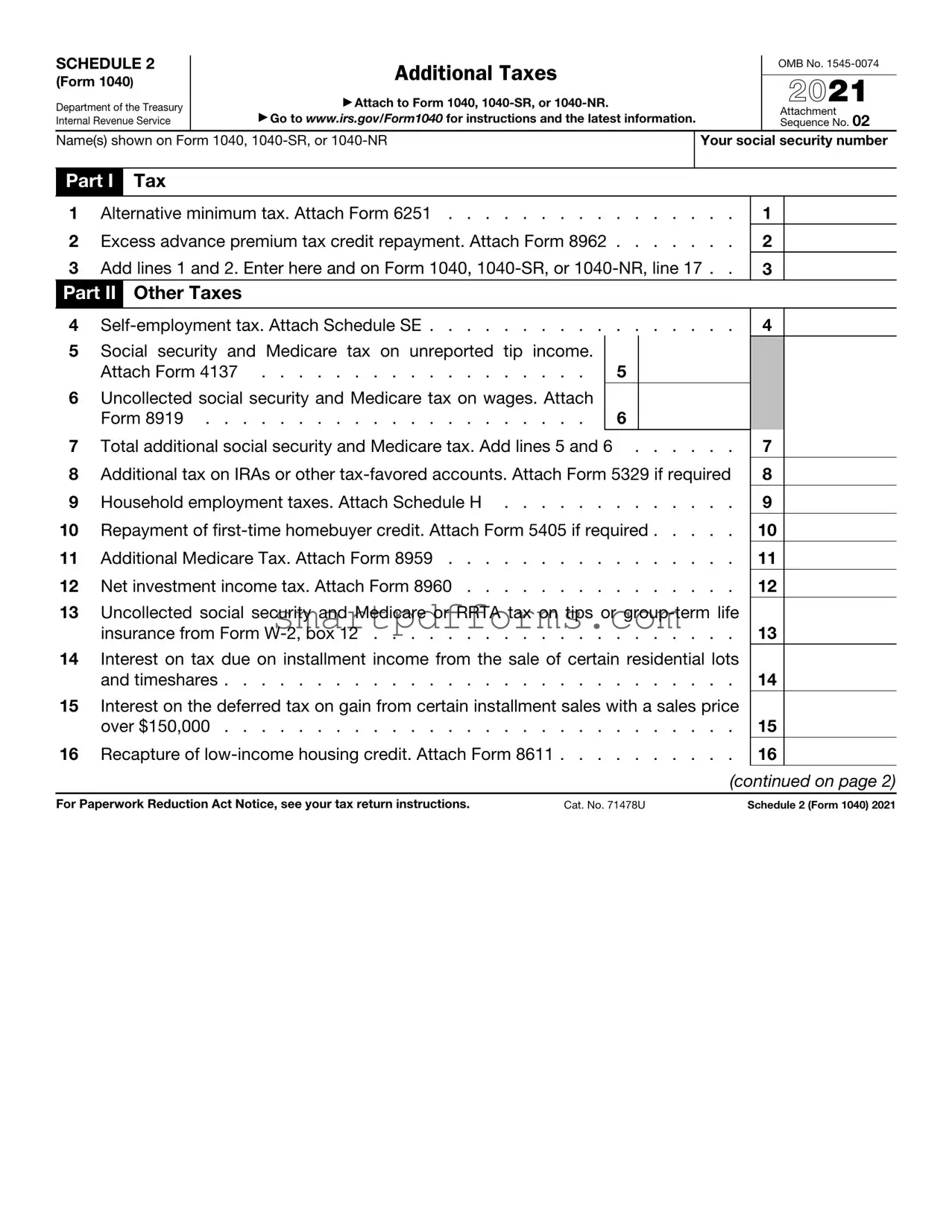

Preview - IRS Schedule 2 1040 or 1040-SR Form

SCHEDULE 2

(Form 1040)

Department of the Treasury Internal Revenue Service

Additional Taxes

▶Attach to Form 1040,

▶Go to www.irs.gov/Form1040 for instructions and the latest information.

OMB No.

2021

Attachment Sequence No. 02

Name(s) shown on Form 1040, |

Your social security number |

|

|

Part I |

Tax |

|

|

|

|

|

|

|

|

1 |

Alternative minimum tax. Attach Form 6251 |

1 |

|

|

2 |

Excess advance premium tax credit repayment. Attach Form 8962 |

2 |

|

|

3 |

Add lines 1 and 2. Enter here and on Form 1040, |

3 |

|

|

Part II |

Other Taxes |

|

|

|

|

|

|

|

|

4 |

4 |

|

||

5Social security and Medicare tax on unreported tip income.

Attach Form 4137 |

5 |

6Uncollected social security and Medicare tax on wages. Attach

|

Form 8919 |

6 |

|

|

7 |

Total additional social security and Medicare tax. Add lines 5 and 6 |

|

7 |

|

8 |

Additional tax on IRAs or other |

|

8 |

|

9 |

Household employment taxes. Attach Schedule H |

9 |

||

10Repayment of

11 |

Additional Medicare Tax. Attach Form 8959 |

11 |

12 |

Net investment income tax. Attach Form 8960 |

12 |

13Uncollected social security and Medicare or RRTA tax on tips or

insurance from Form

14Interest on tax due on installment income from the sale of certain residential lots

and timeshares . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15Interest on the deferred tax on gain from certain installment sales with a sales price

over $150,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16Recapture of

|

|

(continued on page 2) |

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 71478U |

Schedule 2 (Form 1040) 2021 |

Schedule 2 (Form 1040) 2021 |

Page 2 |

Part II Other Taxes (continued)

17Other additional taxes:

a |

Recapture of other credits. List type, form number, and |

|

|

|

|

|||

|

amount ▶ |

|

|

17a |

|

|||

b |

Recapture of federal mortgage subsidy. If you sold your home in |

|

|

|

|

|||

|

2021, see instructions |

17b |

|

|||||

c |

Additional tax on HSA distributions. Attach Form 8889 . . . . |

17c |

|

|||||

d |

Additional tax on an HSA because you didn’t remain an eligible |

|

|

|

|

|||

|

individual. Attach Form 8889 |

17d |

|

|||||

e |

Additional tax on Archer MSA distributions. Attach Form 8853 . |

17e |

|

|||||

f |

Additional tax on Medicare Advantage MSA distributions. Attach |

|

|

|

|

|||

|

Form 8853 |

17f |

|

|||||

g |

Recapture of a charitable contribution deduction related to a |

|

|

|

|

|||

|

fractional interest in tangible personal property |

17g |

|

|||||

h |

Income you received from a nonqualified deferred compensation |

|

|

|

|

|||

|

plan that fails to meet the requirements of section 409A . . . |

17h |

|

|||||

i |

Compensation you received from a nonqualified deferred |

|

|

|

|

|||

|

compensation plan described in section 457A |

17i |

|

|||||

j |

Section 72(m)(5) excess benefits tax |

17j |

|

|||||

k |

Golden parachute payments |

17k |

|

|||||

l |

Tax on accumulation distribution of trusts |

17l |

|

|||||

m Excise tax on insider stock compensation from an expatriated |

|

|

|

|

||||

|

corporation |

17m |

|

|||||

n |

|

|

|

|

||||

|

8697 or 8866 |

17n |

|

|||||

o |

Tax on |

|

|

|

|

|||

|

year you were a nonresident alien from Form |

17o |

|

|||||

p |

Any interest from Form 8621, line 16f, relating to distributions |

|

|

|

|

|||

|

from, and dispositions of, stock of a section 1291 fund . . . . |

17p |

|

|||||

q |

Any interest from Form 8621, line 24 |

17q |

|

|||||

z |

Any other taxes. List type and amount ▶ |

17z |

|

|||||

18 |

|

|

|

|

18 |

|||

Total additional taxes. Add lines 17a through 17z |

. . . . . . . |

|

||||||

19 |

Additional tax from Schedule 8812 |

. . . . . . . |

|

19 |

||||

20 |

Section 965 net tax liability installment from Form |

20 |

|

|

|

|||

21Add lines 4, 7 through 16, 18, and 19. These are your total other taxes. Enter here and on Form 1040 or

Schedule 2 (Form 1040) 2021

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | IRS Schedule 2 (Form 1040 or 1040-SR) is used to report additional taxes owed such as the Alternative Minimum Tax or taxes on things like unearned income from a child over certain thresholds. |

| Form Structure | The form is divided into two parts: Part I for Alternative Minimum Tax (AMT) calculations and Part II for other taxes. |

| Taxpayers Impacted | This form is relevant for taxpayers who need to add certain types of taxes to their base income tax. It includes those with certain types of investments, high incomes, or complex tax situations. |

| Filing Requirement | Taxpayers need to file Schedule 2 with their Form 1040 or 1040-SR if they owe additional taxes that are not reported on the standard form. |

| Impact on Tax Liability | Schedule 2 can increase a taxpayer's total tax liability for the year if additional taxes are due beyond the standard income tax. |

| Electronic Filing | Taxpayers can file Schedule 2 electronically with their Form 1040 or 1040-SR, which can speed up the processing and issuance of any tax refund they may be owed. |

Instructions on Utilizing IRS Schedule 2 1040 or 1040-SR

Filling out the IRS Schedule 2 for the 1040 or 1040-SR form is a necessary step for reporting additional taxes that individuals might owe. This form accounts for alternative minimum tax and other taxes such as self-employment tax. It's important to complete this form accurately to ensure compliance with tax obligations. Following a sequential process can simplify the task, ensuring all required information is correctly reported. Below is a step-by-step guide designed to help taxpayers complete the form without overlooking essential details.

- Obtain the most recent version of the IRS Schedule 2 (Form 1040 or 1040-SR) from the official IRS website.

- Have your Form 1040 or 1040-SR ready, as you will need information from it to fill out Schedule 2.

- Start by entering your full name and Social Security Number (SSN) at the top of Schedule 2, ensuring it matches the information on your Form 1040 or 1040-SR.

- Review Part I of Schedule 2 which is for the Alternative Minimum Tax. If this section applies to you, calculate the amount according to the instructions and enter the value in the designated field.

- In Part II of the form, examine each line to determine which additional taxes apply to your situation. This part includes taxes such as Additional Medicare Tax, Self-employment tax, and Household employment taxes.

- For each relevant line in Part II, calculate the tax amount based on the instructions provided for that line. The instructions will guide you on how to calculate each type of tax, referring you to other forms if necessary.

- Sum up the amounts from Part I and Part II, if applicable, and enter the total amount in the section provided at the end of the form.

- After completing Schedule 2, attach it to your Form 1040 or 1040-SR. Ensure that all the information aligns with the details provided in your main tax return.

- Review the entire form to check for accuracy. Errors or missing information can result in processing delays or audits.

- Finally, submit your Schedule 2 along with your Form 1040 or 1040-SR to the IRS by the filing deadline. If you're filing electronically, follow the e-filing instructions provided by the tax software you're using.

Completing Schedule 2 is a critical step for taxpayers who need to report additional taxes. By following the steps outlined above, individuals can navigate the form with greater confidence. It's always recommended to consult the instructions provided by the IRS or seek assistance from a tax professional if there are uncertainties at any stage of the process.

Obtain Answers on IRS Schedule 2 1040 or 1040-SR

-

What is IRS Schedule 2 for on the 1040 or 1040-SR form?

Schedule 2 is a form taxpayers use alongside their 1040 or 1040-SR to report amounts owed for the alternative minimum tax or to make any necessary adjustments to their income that aren't captured on the standard form. This includes additional taxes on items such as self-employment tax, household employment taxes, and taxes on unearned income of minors, among others.

-

Who needs to file Schedule 2?

Individuals who have additional taxes that can’t be entered directly on Form 1040 or 1040-SR need to file Schedule 2. If you’re subject to alternative minimum tax or need to report additional taxes related to self-employment, unearned income of minors, and other specific tax situations, filling out Schedule 2 is necessary.

-

How do I know if I owe alternative minimum tax?

The alternative minimum tax (AMT) is designed to ensure that individuals who benefit from certain tax advantages pay at least a minimum amount of tax. To determine if you owe AMT, you will need to complete IRS Form 6251. Factors like your income level, deductions claimed, and certain exclusions affect whether or not you'll owe AMT. If you find that you owe AMT, it must be reported on Schedule 2.

-

What are the sections in Schedule 2?

Schedule 2 is divided into two parts. Part I is used to report alternative minimum tax and includes the calculations to find out if you owe such tax. Part II lists additional taxes, such as self-employment tax, additional tax on IRAs and other retirement plans, and household employment taxes, among others. Each section guides the taxpayer on where to find the appropriate information and how to calculate the amount owed.

-

Can I e-file Schedule 2?

Yes, you can e-file Schedule 2 along with your 1040 or 1040-SR. Most tax software programs include the ability to prepare and transmit Schedule 2 electronically. Filing electronically is recommended for faster processing and quicker refunds.

-

What happens if I make a mistake on Schedule 2?

If you discover an error on your filed Schedule 2, you should correct it by filing an amended return using Form 1040-X. It's important to amend your return as soon as possible to avoid potential penalties and interest. Include a corrected Schedule 2 along with the Form 1040-X to ensure your tax liability is accurately reflected.

Common mistakes

Filing your taxes can feel like navigating through a maze, where the IRS Schedule 2 (form 1040 or 1040-SR) serves as one of the puzzle pieces. This additional form is crucial for reporting certain kinds of taxes, such as the alternative minimum tax or additional taxes on things like IRAs, other retirement plans, and health savings accounts (HSAs). While it might seem straightforward, errors can creep in easily. Let's explore seven common mistakes taxpayers make when filling out this form:

- Overlooking Additional Taxes: Many taxpayers simply forget to report or miscalculate additional taxes owed, such as the alternative minimum tax or the self-employment tax. This oversight can lead to an inaccurate tax return and potentially underpaying taxes.

- Incorrect Information: Entering incorrect information, such as an inaccurate Social Security number or misreported earnings from Form 1099, can cause significant delays in processing and potential penalties.

- Misunderstanding Tax Liability: Some individuals might not fully understand their tax liabilities, especially when it comes to specific deductions or credits that affect the amounts reported on Schedule 2. This lack of understanding can lead to incorrect entries.

- Missing Attachments: Failing to attach required documents or forms that support the entries made on Schedule 2 is a common error. This mistake can result in the IRS requesting additional information, delaying any refunds.

- Math Errors: Simple math mistakes remain a frequent issue. Since tax calculations can get complex, small errors in arithmetic can alter the outcome significantly, either in favor of the taxpayer or the IRS.

- Not Updating Personal Information: If personal circumstances change, such as marital status or number of dependents, and these changes are not reflected on the tax return, it can affect the accuracy of Schedule 2 filings.

- Using the Wrong Tax Year's Form: The IRS updates tax forms annually to reflect changes in tax law. Using an outdated form can lead to errors in compliance and calculations.

To avoid these pitfalls, careful review and understanding of the tax forms and instructions are indispensable. Additionally, consulting with a tax professional can help ensure that you're not only compliant but also taking advantage of all the deductions and credits available to you.

Documents used along the form

When navigating the intricacies of the U.S. tax code, individuals often encounter the IRS Schedule 2 (Form 1040 or 1040-SR), a crucial document for those who have additional taxes that aren’t entered on the standard form. This may encompass a wide array of financial situations, from alternative minimum tax to self-employment tax. However, Schedule 2 doesn’t stand alone; it's typically accompanied by other forms and documents that help taxpayers comprehensively report their financial activities to the Internal Revenue Service (IRS). Below are several forms that are frequently used alongside Schedule 2, each playing a pivotal role in ensuring accurate tax reporting and compliance.

- Schedule 1 (Form 1040 or 1040-SR) – This form is crucial for individuals reporting additional income or adjustments to income not listed on the standard 1040 form. It includes income from rentals, business earnings as a sole proprietor, farm income, and alimony received, alongside deductions such as educator expenses, student loan interest, or contributions to health savings accounts.

- Schedule 3 (Form 1040 or 1040-SR) – Schedule 3 is used to claim nonrefundable tax credits that aren’t listed directly on Form 1040 or 1040-SR. Examples include credits for foreign tax paid, education expenses, and residential energy credits.

- Schedule SE (Form 1040) – Essential for self-employed individuals, this form calculates the amount of self-employment tax owed, covering Social Security and Medicare taxes for those who work for themselves.

- Schedule C (Form 1040 or 1040-SR) – For individuals operating a business as a sole proprietorship, Schedule C outlines the profits or losses of the business, providing a detailed account of income and expenses related to the taxpayer’s business venture.

- Form 8962 – This form is critical for taxpayers who are claiming the premium tax credit, a subsidy offered to individuals and families with low to moderate income to assist them in covering the costs of health insurance purchased through the Health Insurance Marketplace.

- Form 8863 – For those paying for education, this form is required to claim education credits, namely the American Opportunity Credit and the Lifetime Learning Credit, which can offset the costs of higher education for the taxpayer, their spouse, or dependents.

- Form 6251 – This form determines whether an individual should pay the Alternative Minimum Tax (AMT), a separate tax mechanism designed to ensure that those with higher earnings pay at least a minimum amount of tax.

Accurately completing and submitting these forms can be a formidable task, requiring meticulous attention to detail. For many, the process underscores the importance of seeking professional guidance to navigate the maze that is the U.S. tax system. Each document serves as a piece of the larger financial puzzle, providing the IRS with a detailed picture of an individual's fiscal responsibilities and entitlements. As such, understanding the role and requirement of each form is essential for achieving compliance and optimizing one's tax position.

Similar forms

The IRS Schedule 1 (Form 1040 or 1040-SR) is used for reporting additional sources of income or adjustments to income that cannot be entered directly on the main form of the 1040 series. Similar to Schedule 2, Schedule 1 is a supplemental form filed alongside the main tax return document. It caters to different categories, focusing on additional income and some adjustments, whereas Schedule 2 focuses more on tax and credits adjustments.

IRS Schedule 3 (Form 1040 or 1040-SR) bears similarities by being another supplement to the main 1040 tax return form. It primarily deals with nonrefundable credits that taxpayers may qualify for. While Schedule 2 addresses tax payments and specific assessments over the standard income tax requirements, Schedule 3 helps in reducing the total tax bill through various credits, even if its function is distinct in the vast ecosystem of tax documentation.

IRS Schedule A (Form 1040) is used for itemizing deductions, offering taxpayers an alternative to the standard deduction. This form shares its nature of supplementing the main tax form with Schedule 2, as both provide vehicles for adjustments that could affect the individual's net tax liability. The key difference lies in their focus—Schedule A is all about deductions, while Schedule 2 is about additional taxes and specific credit adjustments.

The IRS Schedule SE (Form 1040) relates closely because it is utilized for calculating the self-employment tax owed by individuals who run their own business. Like Schedule 2, it serves as an appendage to the core filing process, ensuring accurate tax reporting for specific situations. Schedule SE focuses specifically on self-employment contributions to Social Security and Medicare, highlighting a specialized scenario just as Schedule 2 does for particular tax conditions.

IRS Schedule C (Form 1040) is relevant for individuals who operate a sole proprietorship. It's used to report income or loss from a business one directly operates. Although its purpose varies significantly, focusing on business-related financial activities, it shares the fundamental trait with Schedule 2 of being a supplementary form. Both are necessary for taxpayers under certain conditions to provide a full picture of their financial situation, thereby ensuring the accuracy of tax liability calculations.

Dos and Don'ts

When filling out the IRS Schedule 2 for Form 1040 or 1040-SR, it's important to follow specific guidelines to ensure accuracy and compliance with tax laws. Here are some important dos and don'ts to keep in mind:

Do:

- Review the instructions for Schedule 2 carefully to understand the types of taxes and payments that must be reported on this form.

- Ensure all amounts entered are accurate and match the documentation you have, such as records of alternative minimum tax or self-employment tax.

- Use the correct tax year's form to avoid any discrepancies or updates in tax laws that may affect the information required on Schedule 2.

- Double-check your calculations and the final numbers to prevent any errors that might delay processing or result in incorrect tax assessments.

Don't:

- Leave any required fields blank. If a section does not apply to you, ensure you enter "0" instead of leaving it empty.

- Forget to include your name and social security number at the top of Schedule 2 to ensure it's matched correctly with your Form 1040 or 1040-SR.

- Overlook additional taxes or contributions that need to be reported on Schedule 2, such as excess advance Premium Tax Credit repayment.

- Delay submitting your return because Schedule 2 is incomplete. Missing the deadline can lead to penalties and interest on any unpaid taxes.

Misconceptions

Understanding the IRS Schedule 2 form for the 1040 or 1040-SR can seem daunting at first glance. Many taxpayers are overwhelmed by its complexities, which leads to a number of misconceptions. Let's clarify some of these myths:

It's Only for the Wealthy: A common misconception is that Schedule 2 is exclusively for high-income earners. In reality, this form applies to various financial situations, such as owing alternative minimum tax or needing to make an excess advance premium tax credit repayment, regardless of income level.

All Taxpayers Must File It: Not everyone needs to file Schedule 2 with their 1040 or 1040-SR. This form is specifically for those who have certain types of taxes, such as additional taxes on IRAs or other qualified retirement plans, household employment taxes, or health care: individual responsibility (if applicable), to report. If these situations don't apply to you, you might not need to file it.

It’s Complicated to Fill Out: While tax forms can be intimidating, Schedule 2 is structured to be straightforward if you have the right information on hand. The form guides taxpayers through the process of reporting additional taxes not included on the standard 1040 or 1040-SR. With proper preparation, it can be more manageable than expected.

It’s Only About Healthcare Penalties: Though part of Schedule 2 involves reporting healthcare-related taxes, it encompasses much more. This form also covers additional taxes on IRAs, other retirement plans, and household employment taxes, among others. It’s a common mistake to reduce its purpose solely to healthcare penalties.

Filing it Means You Owe More Taxes: Filing Schedule 2 does not automatically mean you owe more taxes. It's possible that after calculating your total tax liability, you've already paid enough through withholdings or estimated tax payments. This form helps determine if additional payments are necessary or if you've fulfilled your tax obligations.

It’s the Same Each Year: Tax laws and forms are updated regularly. Assuming Schedule 2 remains the same year after year can lead to errors in your tax return. It's important to review the form each tax year for any changes or updates that may affect your tax situation.

By debunking these misconceptions, taxpayers can approach Schedule 2 of the 1040 or 1040-SR forms with more confidence and accuracy. Understanding the purpose and requirements of this form is crucial in ensuring a smooth tax filing process.

Key takeaways

Filing taxes can often seem like navigating a complex maze, especially when additional forms like the IRS Schedule 2 (1040 or 1040-SR) come into play. Understanding the key aspects of this form can make the process smoother and help ensure that filers meet their tax responsibilities accurately. Below are four essential takeaways to consider when dealing with Schedule 2:

- Understanding the Purpose: Schedule 2 is designed for those who need to report additional taxes that aren't directly entered on the Form 1040 or 1040-SR. This includes alternative minimum tax and taxes on other forms of income, such as self-employment tax or household employment taxes.

- Knowing When to Use It: It's critical to recognize whether your financial situation requires you to fill out Schedule 2. If you have certain types of additional taxes, like those mentioned above, you’ll need to include this schedule with your tax return.

- Accurate Reporting is Crucial: Ensuring that all information is accurately reported on Schedule 2 is paramount. Mistakes or omissions could result in audits or penalties. Taking your time to double-check the figures and descriptions can save you from potential problems with the IRS.

- Seeking Professional Help: If you find the process of determining whether you need to file Schedule 2, or if completing it, is overwhelming, it may be in your best interest to consult with a tax professional. They can provide guidance tailored to your specific situation, which can be particularly helpful for complex tax scenarios.

In summary, the IRS Schedule 2 form plays a critical role for taxpayers with additional taxes beyond what is covered in the standard Form 1040 or 1040-SR. Recognizing when and how to properly complete this form is essential in fulfilling your tax obligations accurately. Whether you’re confident in your ability to navigate the process independently, or you decide to seek professional advice, being informed is your best defense against potential tax issues down the line.

Popular PDF Forms

Aldi Application Online - Specify the type of business for each of your previous employers to give Aldi a context of your work experience.

Free Diabetic Log Book by Mail - Through consistent use, the logbook becomes a valuable historical record, offering insights into long-term blood sugar management and the effectiveness of various strategies.

Check on the Status of My Passport - Special notes for parents and guardians about minors' applications help ensure that legal requirements are met.