Blank IRS Schedule D 1040 or 1040-SR PDF Template

Handling investments and ensuring accurate tax reporting can be challenging, yet the IRS provides tools to simplify this process. Among these tools, the Schedule D form for the 1040 or 1040-SR tax returns plays a crucial role for individuals navigating the complexities of capital gains and losses. This form is specifically designed to report the sales and exchanges of capital assets, ranging from stocks and bonds to real estate properties, helping taxpayers calculate their capital gains tax or identify deductible losses. Its connection to the standard 1040 or the 1040-SR form, which is aimed at senior citizens, highlights its importance in the broader landscape of tax reporting. Through the careful reporting on Schedule D, taxpayers can ensure compliance with tax laws, potentially reducing their tax liability, and avoiding common mistakes that lead to audits. Covering both short-term transactions, typically held for a year or less, and long-term transactions, the form's design provides a clear framework for reporting that impacts an individual's financial obligations to the federal government.

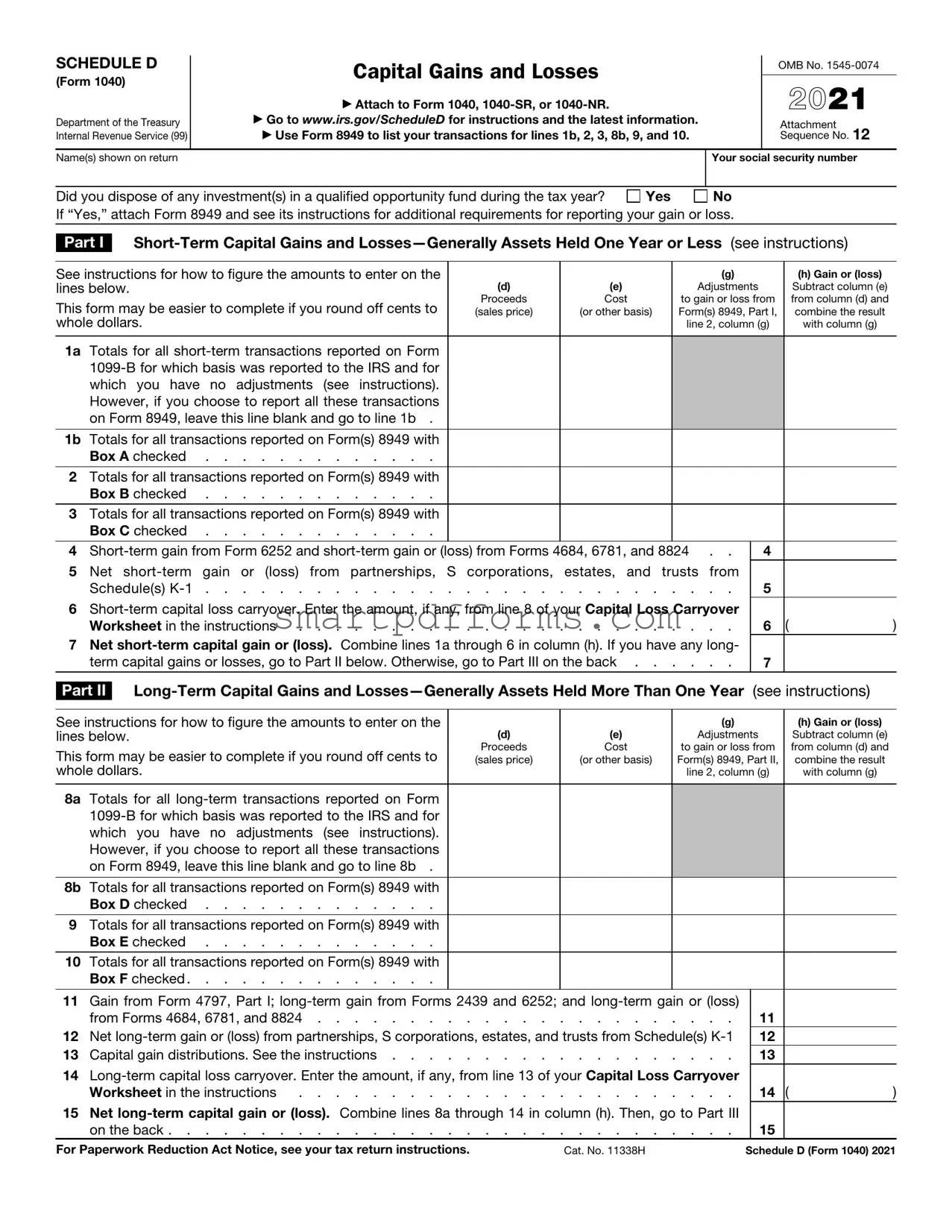

Preview - IRS Schedule D 1040 or 1040-SR Form

SCHEDULE D |

|

Capital Gains and Losses |

|

|

|

|

|

OMB No. |

|||||||

|

|

|

|

|

|

||||||||||

(Form 1040) |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

2021 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

▶ Attach to Form 1040, |

|

|

|

|

|

|

||||

Department of the Treasury |

|

▶ Go to www.irs.gov/ScheduleD for instructions and the latest information. |

|

|

Attachment |

12 |

|||||||||

|

▶ Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. |

|

|

||||||||||||

Internal Revenue Service (99) |

|

|

|

Sequence No. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name(s) shown on return |

|

|

|

|

|

|

Your social security number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? |

Yes |

|

No |

|

|

|

|

||||||||

If “Yes,” attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. |

|

|

|

|

|||||||||||

|

|

|

|

||||||||||||

Part I |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

See instructions for how to figure the amounts to enter on the |

|

|

|

|

(g) |

|

|

(h) Gain or (loss) |

|||||||

lines below. |

|

|

|

(d) |

(e) |

|

Adjustments |

|

|

Subtract column (e) |

|||||

This form may be easier to complete if you round off cents to |

Proceeds |

Cost |

|

to gain or loss from |

from column (d) and |

||||||||||

(sales price) |

(or other basis) |

Form(s) 8949, Part I, |

combine the result |

||||||||||||

whole dollars. |

|

|

|

|

|

line 2, column (g) |

with column (g) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

1a |

Totals for all |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

which you have no adjustments (see instructions). |

|

|

|

|

|

|

|

|

|

|

||||

|

However, if you choose to report all these transactions |

|

|

|

|

|

|

|

|

|

|

||||

|

on Form 8949, leave this line blank and go to line 1b . |

|

|

|

|

|

|

|

|

|

|

||||

1b |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box A checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

2 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box B checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

3 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box C checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||||

4 |

|

4 |

|

|

|||||||||||

5 |

Net |

|

|

|

|

|

|||||||||

|

Schedule(s) |

. . . |

|

5 |

|

|

|||||||||

6 |

|

|

|

( |

) |

||||||||||

|

Worksheet in the instructions |

. . . |

|

6 |

|||||||||||

7 |

Net |

|

|

|

|

|

|||||||||

|

term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back . . . |

. . . |

|

7 |

|

|

|||||||||

|

|

||||||||||||||

Part II |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||

See instructions for how to figure the amounts to enter on the |

|

|

|

|

(g) |

|

|

(h) Gain or (loss) |

|||||||

lines below. |

|

|

|

(d) |

(e) |

|

Adjustments |

|

|

Subtract column (e) |

|||||

This form may be easier to complete if you round off cents to |

Proceeds |

Cost |

|

to gain or loss from |

from column (d) and |

||||||||||

(sales price) |

(or other basis) |

Form(s) 8949, Part II, |

combine the result |

||||||||||||

whole dollars. |

|

|

|

|

|

line 2, column (g) |

with column (g) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

8a |

Totals for all |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

which you have no adjustments (see instructions). |

|

|

|

|

|

|

|

|

|

|

||||

|

However, if you choose to report all these transactions |

|

|

|

|

|

|

|

|

|

|

||||

|

on Form 8949, leave this line blank and go to line 8b . |

|

|

|

|

|

|

|

|

|

|

||||

8b |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box D checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

9 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box E checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

10 |

Totals for all transactions reported on Form(s) 8949 with |

|

|

|

|

|

|

|

|

|

|

||||

|

Box F checked |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||||

11 |

Gain from Form 4797, Part I; |

|

|

|

|

|

|||||||||

|

from Forms 4684, 6781, and 8824 |

. . . |

|

11 |

|

|

|||||||||

12 |

Net |

|

12 |

|

|

||||||||||

13 |

Capital gain distributions. See the instructions |

. . . |

|

13 |

|

|

|||||||||

14 |

|

|

|

( |

) |

||||||||||

|

Worksheet in the instructions |

. . . |

|

14 |

|||||||||||

15 |

Net |

|

|

|

|

|

|||||||||

|

on the back |

. . . |

|

15 |

|

|

|||||||||

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11338H |

Schedule D (Form 1040) 2021 |

Schedule D (Form 1040) 2021 |

Page 2 |

|

|

Summary |

|

Part III |

|

|

16 Combine lines 7 and 15 and enter the result . . . . . . . . . . . . . . . . . .

•If line 16 is a gain, enter the amount from line 16 on Form 1040,

•If line 16 is a loss, skip lines 17 through 20 below. Then, go to line 21. Also be sure to complete line 22.

•If line 16 is zero, skip lines 17 through 21 below and enter

17Are lines 15 and 16 both gains?

Yes. Go to line 18.

Yes. Go to line 18.

No. Skip lines 18 through 21, and go to line 22.

No. Skip lines 18 through 21, and go to line 22.

18If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the

amount, if any, from line 7 of that worksheet . . . . . . . . . . . . . . . . . ▶

19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet . . . . . . . . . ▶

20Are lines 18 and 19 both zero or blank and are you not filing Form 4952?

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

No. Complete the Schedule D Tax Worksheet in the instructions. Don’t complete lines 21 and 22 below.

No. Complete the Schedule D Tax Worksheet in the instructions. Don’t complete lines 21 and 22 below.

21If line 16 is a loss, enter here and on Form 1040,

• The loss on line 16; or |

} |

• ($3,000), or if married filing separately, ($1,500) |

Note: When figuring which amount is smaller, treat both amounts as positive numbers.

22Do you have qualified dividends on Form 1040,

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and

No. Complete the rest of Form 1040,

No. Complete the rest of Form 1040,

16

18

19

21 ( |

) |

Schedule D (Form 1040) 2021

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Schedule D | Used to report the sale or exchange of capital assets not reported on another form or schedule. It summarizes capital gains and losses for the tax year. |

| Applicability to Forms | Schedule D is a supplement to either Form 1040 or 1040-SR, which are used by individuals to file their annual income tax returns. |

| Tax Rate Determination | Capital gains reported on Schedule D may be taxed at different rates, depending on how long the asset was held before it was sold. |

| Governing Law | Federal income tax laws govern the requirements for Schedule D, as it is a form used for IRS federal tax filings, not state-specific filings. |

Instructions on Utilizing IRS Schedule D 1040 or 1040-SR

Filling out the IRS Schedule D (Form 1040 or 1040-SR) is necessary for reporting the sale or exchange of capital assets not reported on another form or schedule, including stocks, bonds, and real estate. It is an essential part of managing capital gains and losses, ensuring accurate tax reporting. The following steps are designed to guide you through the process of completing this form efficiently and accurately.

- Begin by gathering all necessary documentation, including sale and purchase records of stocks, bonds, real estate, and other capital assets.

- Access the latest version of Schedule D (Form 1040 or 1040-SR) from the Internal Revenue Service (IRS) website to ensure you are working with the most current form.

- Enter your name and Social Security number at the top of the form to identify your tax return.

- Calculate and report your short-term capital gains or losses in Part I. Transactions considered short-term have been held for one year or less. You'll need to list the sales price, cost, or other basis, and adjustments to gain or loss for each asset.

- Calculate and report your long-term capital gains or losses in Part II. These pertain to assets held for more than one year. Similar to Part I, you will need to provide sales price, cost or other basis, and adjustments for each transaction.

- If applicable, complete Form 8949 first if you have a lot of transactions or need to report certain types of transactions. Form 8949 helps summarize these transactions, and its totals are then carried over to Schedule D.

- Add the totals from both sections. If you have completed Form 8949, ensure to include these totals in the respective parts of Schedule D as instructed.

- If you have a net gain, it may be subject to taxation. Consult the Schedule D Tax Worksheet in the instructions for Schedule D to calculate the tax accurately.

- If a net loss is reported, you may be able to deduct it from other income. However, there are limits to how much can be deducted annually. Any loss exceeding the limit can be carried over to future years.

- Review the form for accuracy. Double-check your calculations and the information provided to ensure everything is correct.

- Attach Schedule D to your Form 1040 or 1040-SR when you file your tax return.

- Keep copies of Schedule D and all relevant documents for your records. The IRS may require these documents if your tax return is selected for review.

By following these steps, you'll have accurately completed Schedule D for your Form 1040 or 1040-SR, ensuring that your capital gains and losses are correctly reported to the IRS. Remember, accurate reporting helps in the smooth processing of your tax return and avoids potential issues with the IRS.

Obtain Answers on IRS Schedule D 1040 or 1040-SR

-

What is the IRS Schedule D 1040 or 1040-SR form?

The IRS Schedule D form is a supplement to the 1040 or 1040-SR tax forms and is used by individuals to report capital gains or losses from the sale or exchange of certain assets. This includes, but is not limited to, sales of stocks, bonds, real estate, and mutual funds. The purpose is to calculate the tax liability on capital gains, distinguishing between short-term and long-term transactions based on their holding period.

-

Who needs to file Schedule D with their 1040 or 1040-SR form?

Individuals who have sold or exchanged capital assets during the tax year, or have capital loss carryover from previous years, must file Schedule D along with their Form 1040 or 1040-SR. If you've received Forms 1099-B or 1099-S for such transactions, it's a strong indication that you'll need to file Schedule D.

-

What are short-term and long-term capital gains and losses?

Capital gains and losses are categorized based on the duration the asset was held before sale. If you held the asset for one year or less, any gain or loss is considered short-term. Conversely, if you held the asset for more than one year, the gain or loss is considered long-term. This period affects the tax rate applied to the gain or can impact the deductibility of the loss.

-

How do I calculate capital gains and losses?

To calculate capital gains or losses, subtract the asset's purchase price (basis) from the selling price. If the result is positive, it's a gain; if it's negative, it's a loss. Adjustments to the basis or selling price, for expenses such as commissions or improvements, should be considered. Schedule D and its instructions offer detailed guidance on these calculations.

-

Can I use tax software to prepare Schedule D?

Yes, most tax preparation software programs can handle Schedule D calculations as part of your overall tax return. These programs guide you through entering your sale transactions, calculating gains or losses, and integrating these figures with your Form 1040 or 1040-SR. Always ensure that your software is up-to-date and supports the latest IRS tax filing requirements.

-

What are capital loss carryovers, and how do I report them?

If your total capital losses exceed your total capital gains for the year, you can use this loss to offset up to $3,000 ($1,500 if married filing separately) of other income. If any unused losses remain, they can be carried forward to future years. This carryover is reported on Schedule D and requires careful tracking from year to year.

-

Where can I find more information or assistance?

For more detailed instructions and guidance, the IRS provides a Schedule D instructions booklet and the Publication 550, "Investment Income and Expenses." Additionally, qualified tax advisors or certified public accountants (CPAs) can offer personalized advice and assistance with your specific tax situation.

-

What documents do I need to complete Schedule D?

You'll need documentation of all capital asset transactions, including purchase and sale dates, prices, commissions, and any improvements or adjustments. Common forms include Forms 1099-B (Broker and Barter Exchange Transactions) and 1099-S (Proceeds from Real Estate Transactions). Collecting and organizing these documents before you start filling out Schedule D will simplify the process.

-

How does Schedule D affect my tax return?

Completing Schedule D can impact both the tax owed or the refund due on your tax return. Calculating your capital gains or losses accurately ensures that your tax liability is correctly assessed, potentially leading to a lower tax bill or higher refund. Incorrect or incomplete filing of Schedule D can result in penalties, interest, or even an audit.

-

Can I file Schedule D electronically with my tax return?

Yes, you can file Schedule D electronically as part of your electronic tax return. The IRS encourages electronic filing because it's faster, more secure, and ensures accurate processing of your tax return. Check with your tax preparation software or provider to ensure that they support e-filing of Schedule D.

Common mistakes

Filling out the IRS Schedule D (Form 1040 or 1040-SR), which relates to capital gains and losses, can be a daunting task, rife with potential pitfalls. This complex form requires meticulous attention to detail to accurately report the sale or exchange of capital assets. The consequences of incorrect filings range from minor corrections to audits, penalties, and interest charges. Below are some of the most common mistakes individuals make while completing this form:

Not reporting all transactions: Many people overlook or choose not to report smaller transactions, thinking they are inconsequential. However, every transaction, no matter the size, must be reported to the IRS.

Misclassifying the holding period: Capital assets are classified as short-term or long-term based on how long they were held. Mistakes in classification can lead to incorrect tax calculations.

Failing to account for reinvested dividends: It's a common oversight not to realize that reinvested dividends increase the cost basis of an investment, which needs to be reported.

Inaccurate calculation of the cost basis: The cost basis is what you paid for the asset plus adjustments. Incorrect calculations can either inflate or reduce your tax liability.

Overlooking capital loss carryovers: If your capital losses exceed your capital gains, the loss can be carried over to future years. Many fail to realize or accurately report this carryover.

Missing out on wash sale rules: The IRS prohibits claiming a loss on a sale or trade of stock or securities in a wash sale. Not observing this rule can lead to errors in reporting.

Mixing up types of gains: There are different rules for different types of gains (e.g., collectibles, real estate), and mixing these can lead to inaccurate tax obligations.

Incorrectly reporting options and futures: Special rules apply to the reporting of gains or losses from options and futures. Errors here can stem from misunderstandings of these rules.

Omitting state tax considerations: While Schedule D is a federal form, failing to consider the impact of capital gains on state taxes can lead to under or overestimation of overall tax liability.

Avoiding these mistakes requires a clear understanding of the tax implications of your investments and meticulous record-keeping throughout the year. For those who find themselves uncertain, seeking advice from a tax professional is a wise decision. Tax laws are complex and ever-evolving, making it easy to overlook key details that could impact your financial well-being.

Documents used along the form

When preparing tax returns, individuals commonly encounter a variety of forms and documents that are necessary to accurately report financial activities, especially when it comes to capital gains and losses. The IRS Schedule D (Form 1040 or 1040-SR) is integral for reporting these transactions. Along with Schedule D, several other documents are frequently required to provide a comprehensive view of an individual's financial landscape for the tax year. These documents assist in the preparation and substantiation of the entries made on Schedule D.

- Form 1099-B: This form is provided by brokers or mutual fund companies. It reports the sale of stocks, bonds, or mutual funds through the broker.

- Form 8949: Individuals use this form to list all capital gain and loss transactions, which then supports the totals entered on Schedule D.

- Form 1099-DIV: Distributed by corporations and mutual funds, this form reports dividends and capital gain distributions.

- Form 1099-INT: This form documents interest income received, such as from savings accounts or interest-bearing investment accounts.

- Form 1099-S: Relevant for real estate transactions, this form is issued to report proceeds from real estate sales or exchanges.

- Form 3921: Companies issue this form to employees who exercise an incentive stock option (ISO) to report the exercise of the option.

- Form 3922: This form is used to report the transfer of stock purchased through an employee stock purchase plan (ESPP).

- Form 2439: Issued by mutual funds or real estate investment trusts (REITs), this form reports undistributed long-term capital gains to shareholders.

Accurately reporting financial transactions related to investments and capital assets requires careful attention to detail and thorough documentation. The forms listed above are vital tools for individuals in compiling the necessary information to fulfill their tax obligations. They also serve as records that substantiate the reported figures should the IRS request more information or clarification. In the dynamic landscape of tax requirements, individuals are encouraged to leverage these documents effectively to ensure compliance and maximize their financial strategy.

Similar forms

Schedule C (Form 1040 or 1040-SR): This form is used by sole proprietors to report income or loss from a business they operated or a profession they practiced as a sole proprietor. Both Schedule C and Schedule D require taxpayers to calculate the gain or loss on their activities, although Schedule C focuses on business income while Schedule D is used for reporting capital gains and losses.

Schedule E (Form 1040): This form is used to report income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Similar to Schedule D, Schedule E involves reporting income that may not be subject to regular wage withholding, and both require the taxpayer to summarize yearly financial activity.

Schedule F (Form 1040): Utilized by farmers and ranchers, Schedule F reports income from farming activities. Like Schedule D, it deals with the results of operations over a financial year, calculating profit or loss that affects the taxpayer’s overall taxable income or loss figure.

Form 8949: Sales and Other Dispositions of Capital Assets: Form 8949 is used to list all capital gain and loss transactions, which directly feeds into Schedule D. This form is akin to the first step in gathering detailed information on each transaction before net gains and losses are summarized on Schedule D.

Schedule B (Form 1040): This schedule is used for reporting interest and ordinary dividends. Similar to Schedule D, it is used when certain types of income exceed threshold amounts, necessitating more detailed reporting to the IRS.

Schedule A (Form 1040): Schedule A is for itemized deductions, including but not limited to, medical and dental expenses, taxes paid, and interest paid. While serving different purposes, both Schedule A and Schedule D require taxpayers to detail specific financial transactions that will influence their total tax liability.

Form 4797: Sales of Business Property: This form is for reporting the sale or exchange of property used in a trade or business. Form 4797 and Schedule D are similar in that they both involve calculating gains or losses from the disposition of assets, though Form 4797 specifically focuses on business assets rather than personal or investment assets.

Form 6252: Installment Sale Income: This form is used when income from a sale is being received in installments. The requirement to report income over time as it is received parallels the need in Schedule D to account for gains or losses in the year they occur, offering a structured way to recognize financial changes over more than one tax year.

Dos and Don'ts

Filing the IRS Schedule D for 1040 or 1040-SR forms involves reporting capital gains and losses from your investments. It's essential to get it right to avoid unnecessary errors or audits. Here are four do's and don'ts to keep in mind:

Do:- Review your 1099 forms: Ensure all investment sales or exchanges reported by your broker are accurate before filling out Schedule D.

- Separate short-term and long-term transactions: These are taxed differently, so it’s crucial to list them in their respective sections.

- Use the correct form: Short-term transactions go on Part I of Schedule D, while long-term transactions belong in Part II.

- Double-check your math: Arithmetic errors can lead to discrepancies and might trigger an IRS inquiry.

- Forget to report all transactions: Even if a sale did not result in a gain, you must report it. Ignoring to report any transaction is a common mistake.

- Overlook carryover losses: If you had capital losses that exceeded your gains in previous years, you could carry over these losses. Make sure not to forget about them.

- Mix up short-term and long-term transactions: This can significantly affect your tax liabilities due to the different tax rates that apply.

- Ignore the instructions: The IRS provides detailed instructions for the Schedule D form. Failing to follow these can lead to mistakes in filing.

Misconceptions

The IRS Schedule D form, utilized with either the 1040 or 1040-SR tax returns, often sparks confusion among taxpayers due to its complexities related to reporting capital gains and losses. Let's dispel some common misconceptions:

All financial asset transactions need to be reported on Schedule D. Not all transactions require documentation on Schedule D. For instance, qualified retirement accounts like IRAs or 401(k)s are exempt since their transactions are tax-deferred until withdrawals are made.

If you don't owe taxes, you don't have to file Schedule D. This isn’t always true. The requirement to file Schedule D is triggered by the realization of capital gains or losses, regardless of the final tax liability. Failing to report these can lead to IRS inquiries or penalties.

Losses are only deductible up to $3,000 each year for everyone. While it's true that capital losses are generally capped at a $3,000 deduction against ordinary income per year for individuals, the specifics can vary depending on filing status, such as for married individuals filing separately, where the limit is $1,500.

Capital losses can offset any type of income. Capital losses first offset capital gains. If losses exceed gains, up to $3,000 ($1,500 if married filing separately) can then be used to offset other types of income such as wages or salaries.

You only need to report the sale of stocks or bonds on Schedule D. Beyond stocks and bonds, the sale or exchange of other capital assets (including real estate, collectibles, and more) must also be reported on Schedule D, underscoring the form’s broad applicability.

Filing Schedule D is straightforward and requires minimal information. Filing Schedule D can be complex. It requires careful documentation of acquisition dates, sale dates, costs, proceeds, and adjustments to gain or loss. Inaccuracies can trigger audits or reassessments by the IRS.

Capital gains are always taxed at the same rate. The tax rate on capital gains can vary widely, influenced by factors such as the asset's holding period and the taxpayer's taxable income. Long-term gains generally enjoy lower rates than short-term gains.

Every taxpayer can navigate Schedule D without professional help. Given its complexity and the potential for costly mistakes, many taxpayers benefit from professional guidance when completing Schedule D, ensuring accurate reporting and potentially optimizing tax outcomes.

Dispelling these misconceptions is crucial for taxpayers aiming to comply fully with tax laws while ensuring they don't pay more than what is due. Understanding the nuances of Schedule D can lead to better financial planning and tax strategy execution.

Key takeaways

The IRS Schedule D form, associated with the 1040 or 1040-SR, is a vital document for taxpayers who report capital gains or losses from investments. Understanding how to accurately fill out this form can ensure proper tax calculation and compliance. Here are five key takeaways:

- Determine the need to file: You must file Schedule D if you have sold assets like stocks, real estate, or mutual funds, received capital gain distributions, or have a capital loss carryover from the previous year. Identifying whether any of these situations apply to you is the first step.

- Organize your records: Before filling out Schedule D, gather all necessary documents, including sale proceeds, purchase costs, and dates of transactions. Accurate record-keeping simplifies the process and ensures correctness on the form.

- Understand short-term vs. long-term: Assets held for one year or less are considered short-term and are taxed differently than long-term assets, which are held for more than a year. This distinction affects how you report the asset on Schedule D.

- Calculate gains and losses: You will need to calculate both your capital gains and losses, which involves subtracting the cost basis (the purchase price plus any adjustments) from the sale price of your assets. These calculations determine the amount of tax you owe or the deduction you can claim.

- Use other forms if necessary: Schedule D may require information from Forms 8949 and 1099-B, or similar statements. Form 8949 is used to list all capital gain and loss transactions. Form 1099-B, provided by brokers, shows sales transactions. These forms help fill out Schedule D accurately.

Completing Schedule D with accuracy is crucial for reporting capital gains and losses. It impacts your tax liabilities or refunds. Always consult with a tax professional if you're unsure about your specific tax situation to avoid errors that could lead to audits or penalties.

Popular PDF Forms

What Happened to Forethought Life Insurance Company? - The form includes fraud warnings specific to residents of certain states, highlighting the legal consequences of providing false information.

What Is Debt to Income Ratio - Increases access to USDA loans for applicants with strong compensating factors despite high debt ratios.

Temporary Custody Order California - Streamlines the process for inmates to leverage Vehicle Code 41500 for dismissing charges.