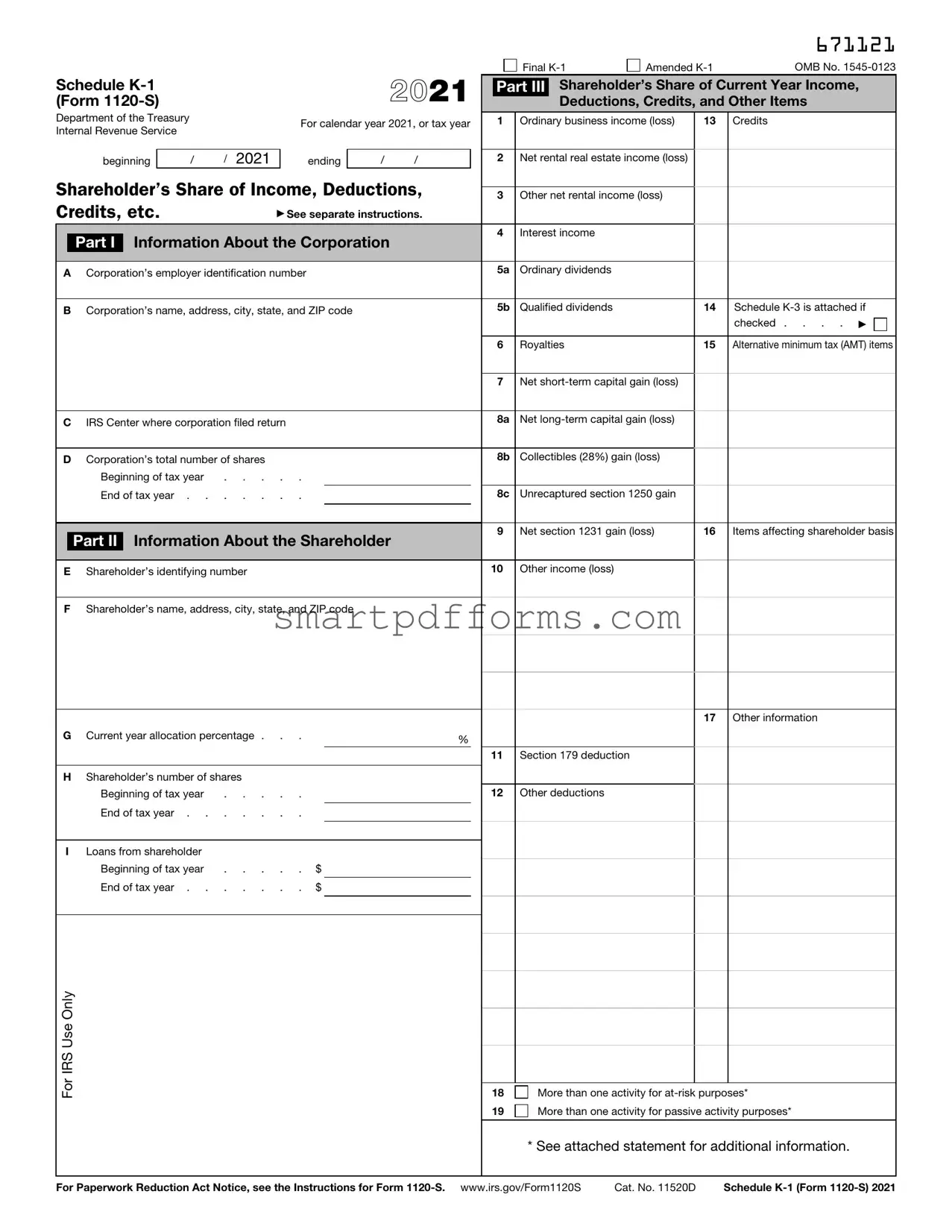

Blank IRS Schedule K-1 1120-S PDF Template

Navigating the intricacies of tax forms is essential for shareholders of S corporations, and the IRS Schedule K-1 (Form 1120-S) plays a pivotal role in this journey. This form serves as a conduit, providing shareholders with detailed reports on their share of the corporation’s income, deductions, credits, and other pertinent financial information for the tax year. Its significance cannot be overstated, as it directly influences the personal income tax returns of the shareholders, ensuring that their tax obligations are accurately reflected. Beyond merely reporting figures, the Schedule K-1 embodies the connection between the corporation's financial activities and the individual taxpayer's responsibilities. Understanding the nuances of this form is crucial, not just for compliance, but also for making informed decisions that can impact one's financial health. Through this comprehensive breakdown, shareholders can gain insights into how to properly interpret and utilize the information provided, setting the stage for a clearer understanding of their fiscal duties and opportunities for potential tax benefits.

Preview - IRS Schedule K-1 1120-S Form

Schedule |

|

|

|

|

2021 |

|

(Form |

|

|

|

|

||

Department of the Treasury |

|

|

For calendar year 2021, or tax year |

|||

Internal Revenue Service |

|

|

||||

|

|

|

|

|

||

|

|

|

|

|

|

|

beginning |

|

/ |

/ 2021 |

ending |

/ |

/ |

Shareholder’s Share of Income, Deductions, Credits, etc.

Part I Information About the Corporation

ACorporation’s employer identification number

BCorporation’s name, address, city, state, and ZIP code

CIRS Center where corporation filed return

DCorporation’s total number of shares

Beginning of tax year . . . . .

End of tax year . . . . . . .

Part II Information About the Shareholder

EShareholder’s identifying number

FShareholder’s name, address, city, state, and ZIP code

G Current year allocation percentage . . . |

% |

|

HShareholder’s number of shares

Beginning of tax year |

. . . . . |

|

|

|

End of tax year |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

I Loans from shareholder |

|

|

|

|

Beginning of tax year |

. . . . . |

$ |

|

|

End of tax year . . |

. . . . . |

$ |

|

|

|

|

|||

|

|

|

|

|

For IRS Use Only

|

|

671121 |

Final |

Amended |

OMB No. |

Part III Shareholder’s Share of Current Year Income,

Deductions, Credits, and Other Items

1 Ordinary business income (loss) |

13 Credits |

2Net rental real estate income (loss)

3Other net rental income (loss)

4Interest income

5a |

Ordinary dividends |

|

|

5b |

Qualified dividends |

14 |

Schedule |

|

|

|

checked . . . . ▶ |

6 |

Royalties |

15 |

Alternative minimum tax (AMT) items |

7Net

8a |

Net |

|

8b |

Collectibles (28%) gain (loss) |

|

|

||

8c |

Unrecaptured section 1250 gain |

|

|

||

9 |

Net section 1231 gain (loss) |

16 Items affecting shareholder basis |

10Other income (loss)

17 Other information

11Section 179 deduction

12Other deductions

18 More than one activity for

19 More than one activity for passive activity purposes*

* See attached statement for additional information.

For Paperwork Reduction Act Notice, see the Instructions for Form |

Cat. No. 11520D |

Schedule |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The Schedule K-1 (Form 1120-S) is used by shareholders of S corporations to report their share of the corporation's income, deductions, credits, etc. |

| Filing Requirement | Each shareholder of an S corporation must receive a Schedule K-1 (1120-S) to include their share of the corporation’s income or loss on their personal income tax return. |

| Tax Treatment | Income reported on the Schedule K-1 is passed through to the shareholders and taxed at their individual tax rates, avoiding the double taxation typical with C corporations. |

| Distribution of Form | The S corporation is responsible for completing and distributing Schedule K-1 to each shareholder by the IRS deadline. |

| Deadline for Filing | The form must be sent to shareholders by March 15th, allowing them to include the information in their personal tax filings. |

| State-Specific Regulations | While the Schedule K-1 (1120-S) is a federal form, some states require a similar form for state income tax purposes, governed by the state's tax laws. |

Instructions on Utilizing IRS Schedule K-1 1120-S

Filling out the IRS Schedule K-1 1120-S form is a necessary step for shareholders in an S corporation to report their share of the corporation's income, deductions, credits, etc. This form is essential for accurately reporting individual income and understanding tax obligations. Let's walk through the steps needed to properly fill out the form, ensuring all information is complete and accurate.

- Begin by gathering all necessary information about the S corporation's financial activities over the tax year. This should include income, losses, deductions, and credits.

- Enter the name, address, and Employer Identification Number (EIN) of the S corporation in the designated spaces at the top of the form.

- Fill in the shareholder's name and address in the appropriate section.

- Provide the shareholder’s social security number or taxpayer identification number in the space provided.

- Enter the shareholder's percentage of stock ownership at the start and end of the tax year. This accounts for any changes in ownership percentage.

- Report the shareholder's share of ordinary business income (or loss). This information comes from the S corporation's financial records.

- Detail the shareholder’s share of any deductions, such as section 179 deductions, and non-deductible expenses.

- List any credits that the shareholder is eligible for, including foreign tax credits and credits for alcohol and fuel.

- Fill in the information on distributions made to the shareholder throughout the year. This includes cash and property distributions.

- For any loans between the shareholder and the corporation, report changes in the shareholder's loan balances.

- Review the form for accuracy, ensuring that all financial information matches the corporation's records and the shareholder's personal records.

- Sign and date the form. The S corporation officer authorized to do so must also sign.

- File the completed Schedule K-1 (Form 1120-S) with the IRS by the filing deadline, typically March 15. Copies must also be provided to all shareholders for their records and use in filing individual tax returns.

After completing the Schedule K-1 1120-S form, it is crucial to keep a copy for the corporation’s records. The next step involves each shareholder using the information provided to comply with individual tax reporting requirements. This typically means reporting their share of the S corporation's income or losses on their personal tax returns. It's important for shareholders to accurately report this information to avoid any discrepancies with the IRS. Filling out the Schedule K-1 accurately and on time is a critical part of the tax process for both the corporation and its shareholders.

Obtain Answers on IRS Schedule K-1 1120-S

What is the IRS Schedule K-1 1120-S form?

The IRS Schedule K-1 1120-S form is a document used by S corporations to report each shareholder's share of the corporation's income, deductions, credits, and other items. This form is essential for shareholders to accurately report their share of the business's income on their personal tax returns.

Who needs to file the Schedule K-1 1120-S form?

Every shareholder in an S corporation must receive a Schedule K-1 1120-S form from the corporation. The corporation must prepare and provide this form to share the financial activity of the entity over the tax year with each shareholder. It's the shareholder's responsibility to include the information from the Schedule K-1 on their personal tax return.

What information is included on the Schedule K-1 1120-S form?

This form includes various pieces of financial information, such as the shareholder’s pro-rata share of income, losses, dividend distributions, and credits. It also covers deductions like the Section 179 deduction, non-deductible expenses, and other items relevant to the shareholder's tax obligations.

When is the Schedule K-1 1120-S form due?

S corporations must send out the Schedule K-1 forms to their shareholders by the 15th day of the 3rd month after the end of the corporation's tax year. For most, this deadline falls on March 15th. This ensures shareholders have the necessary information to complete their personal tax returns by April 15th.

How do shareholders use the information on the Schedule K-1 1120-S form?

Shareholders use the information on the form to fill out their personal tax returns. They need to report their share of the corporation's income, deductions, and credits on their 1040 form, under the appropriate sections. This ensures that they are taxed correctly on their income from the corporation.

What happens if you do not file or incorrectly report your Schedule K-1 1120-S information?

Failure to file or incorrect reporting of the Schedule K-1 1120-S information can result in penalties and interest charges. The IRS may also conduct audits or reassessments of your tax filings, which can lead to additional taxes owed. It's crucial to accurately report this information and keep detailed records to support your tax filings.

Can the Schedule K-1 1120-S form be filed electronically?

Yes, the Schedule K-1 1120-S form can be filed electronically, and many tax preparation software options support the electronic filing of this form. Filing electronically is convenient and ensures faster processing times, allowing shareholders to receive their forms in a timely manner.

Common mistakes

Filing taxes can be a complex process, especially when it involves forms like the IRS Schedule K-1 (1120-S) for S corporation shareholders. People often find this form challenging and can easily make mistakes. Understanding these common errors may help individuals avoid them and ensure their tax filings are correct and submitted on time.

-

Not reporting all income - Shareholders sometimes overlook or mistakenly omit certain items of income or deductions reported on the Schedule K-1. It's crucial to report all financial activities accurately to avoid potential audits or penalties.

-

Misunderstanding distribution amounts - There's often confusion between what constitutes a salary or a distribution. Shareholders must ensure they correctly classify the money they receive from the corporation, as this impacts how it's reported and taxed.

-

Incorrectly reporting state and local taxes - Shareholders may misreport state and local tax information due to the complexities of state tax law interactions. This can lead to discrepancies and potentially result in incorrect tax liabilities being assessed.

-

Failing to properly adjust the basis of stock - Shareholders need to adjust the basis of their S corporation stock for any income, losses, distributions, and other allocations. Incorrect basis calculations can affect tax liabilities and the gain or loss on stock disposition.

-

Omitting or inaccurately reporting foreign transactions - If an S corporation engages in foreign transactions, or has foreign taxes paid, these must be reported accurately. Failure to do so can lead to significant penalties, especially if the IRS requires disclosures related to foreign accounts or income.

It's advisable for shareholders to work closely with a tax professional when filling out the IRS Schedule K-1 (1120-S) to ensure accuracy and compliance with all tax laws and regulations. By avoiding these common mistakes, shareholders can contribute to a smoother tax process and potentially reduce their overall tax liability.

Documents used along the form

Filing taxes requires meticulous attention to detail and an array of documents, especially for entities such as S corporations. The IRS Schedule K-1 (1120-S) form is just one piece of the puzzle when it comes to tax preparation for these entities. This form helps shareholders of S corporations report their share of the corporation's income, deductions, credits, etc. However, to accurately and completely fill out a Schedule K-1 (1120-S), several other documents are often needed. Below is a list of forms and documents typically used alongside the Schedule K-1 (1120-S), each with a brief description of its purpose and importance.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation form. It is essential because it provides the overall income, deductions, and credits of the corporation before breaking down the shares for each shareholder on the Schedule K-1.

- Form 4562: Used for reporting depreciation and amortization. The information from this form helps in determining the values to be reported on Form 1120S and Schedule K-1 for property and equipment write-offs.

- Form 4797: This form reports the sale of business property. If an S corporation sells or exchanges property during the year, the results are reported here and affect the figures on the Schedule K-1.

- Form 8825: This form is akin to Schedule E (Form 1040) for rental real estate income and expenses but is used by S corporations. It details the income and expenses from rental properties owned by the corporation, affecting the income reported on the Schedule K-1.

- Form 8865: Required for reporting the S corporation's interest in foreign partnerships. It is vital for shareholders who need to report foreign activities included on the Schedule K-1.

- Form 8949: Used by individuals, businesses, and estates and trusts to report the sale and exchange of capital assets. S corporations must use this form to detail such transactions before passing the information onto the shareholders through Schedule K-1.

- Employment Tax Forms: These include Form 940 for Federal Unemployment (FUTA) Tax, and Form 941 for Employer’s Quarterly Federal Tax Return. These forms are essential for reporting employment taxes by the S corporation.

- State-specific Forms: Depending on the state where the S corporation operates, various state-specific tax forms may also be necessary. These forms are crucial for complying with state tax laws and will impact the information reported on Schedule K-1.

- Ledgers and Financial Statements: Keeping accurate books is critical. Ledgers and financial statements such as the balance sheet, income statement, and cash flow statement provide the raw data for filling out the tax returns and Schedule K-1.

- Shareholder Agreements: Though not a tax form, shareholder agreements are crucial documents that can affect how distributions and other tax-related items are reported on the Schedule K-1.

Collectively, these documents play a critical role in ensuring the accurate and efficient completion of the IRS Schedule K-1 (1120-S) form and other related tax documentation for S corporations. Proper preparation and organization of these forms can streamline the tax filing process, prevent errors, and help maintain compliance with tax laws.

Similar forms

Form 1065, Schedule K-1 - This document serves partnerships, mirroring the 1120-S for S corporations by reporting each partner's share of the business's income, deductions, and credits. Both ensure the income is taxed on individual returns, aligning with the pass-through taxation principle.

Form 1041, Schedule K-1 - Used by estates and trusts, this form parallels the 1120-S as it delineates the distribution of income and deductions to beneficiaries, ensuring income is taxed at the individual rather than the entity level.

Form 1120 - Although primarily for C corporations and not involving pass-through taxation, it resembles the 1120-S in its purpose to report a corporation's income, gains, losses, deductions, and credits to the IRS.

Form 1099-DIV - This form is used to report dividends and distributions to shareholders, similar to how the 1120-S reports income and losses to S corporation shareholders. Both are crucial for accurate individual tax return filing.

Form 1099-INT - Related to interest income reporting, it shares its goal with the 1120-S of ensuring income from investments is properly documented and taxed at the individual level.

Form 1099-MISC - It reports miscellaneous income to individuals, much like the 1120-S provides a breakdown of income and deductions to shareholders, emphasizing the need for accurate reporting of diverse income sources.

Form 8832 - The Entity Classification Election form, which allows entities to choose how they are taxed (C corporation, S corporation, partnership) directly impacts the necessity and relevance of filing an 1120-S, demonstrating the intertwined nature of tax election and reporting.

Form 2553 - Election by a Small Business Corporation form, crucial for electing S corporation status before using the 1120-S. The connection here is direct, as without Form 2553, there's no requirement for the 1120-S, making them intrinsically linked in the S corporation formation and reporting process.

Form 1040, Schedule E - It's pertinent to individuals receiving income through partnerships, S corporations, estates, and trusts. Schedule E and 1120-S are linked through the process of reporting pass-through income to individuals, ensuring accurate income tracking for tax purposes.

Dos and Don'ts

Filling out the IRS Schedule K-1 (1120-S) form meticulously is crucial for S corporation shareholders, ensuring that income and losses are reported accurately to the IRS. Below are essential dos and don'ts to keep in mind:

Do:

Review the shareholder's percentage of stock ownership accurately at the beginning and end of the tax year. This is essential for correctly allocating the income, deductions, and credits of the corporation.

Ensure that the S corporation's EIN (Employer Identification Number) is correctly entered. This number is critical for the IRS's recognition of the entity and for matching information provided by the shareholder on their individual tax return.

Report all items of income, deductions, and credits in the detail required by the form. Accurate and detailed reporting helps prevent discrepancies and potential audits.

Keep thorough records and supporting documentation for all amounts reported on the Schedule K-1 (1120-S), in case the IRS requires further clarification or proof of these amounts.

Don't:

Omit any information or provide estimates instead of exact figures. Estimates can lead to incorrect tax calculations and potentially trigger an audit by the IRS.

Forget to update the shareholder's contact information. Up-to-date contact information is vital for receiving important communications from the S corporation and the IRS.

Ignore the IRS instructions for filing the Schedule K-1 (1120-S). These instructions are designed to help shareholders report their income correctly and minimize errors.

Delay in filing the form to the IRS and providing a copy to the shareholder. Timely filing is crucial to avoid penalties and interest for both the shareholder and the corporation.

Misconceptions

The IRS Schedule K-1 Form 1120-S is a document that S corporations use to report each shareholder's income, deductions, and credits to the IRS. Several misconceptions surround this form, often leading to confusion for shareholders and businesses alike. Here are ten common misunderstandings explained to help clarify these points.

Only profits are reported: A common misconception is that the Schedule K-1 (1120-S) only reports the profits distributed to shareholders. In reality, it reports each shareholder's share of income, losses, deductions, and credits, whether or not these amounts were actually distributed.

It's filed with the shareholder's personal tax returns: Many people mistakenly believe that the Schedule K-1 needs to be filed with their personal tax returns. Though the information on the K-1 is used to complete personal returns, the form itself is filed with the S corporation's tax return and a copy is provided to each shareholder.

All shareholders receive the same amounts: The assumption that all shareholders are entitled to equal shares of income or loss is incorrect. The distribution depends on the ownership percentage or agreement among shareholders, as reported on the K-1.

Deadline for issue is the same as personal tax returns: It's believed that the Schedule K-1 must be issued by April 15, the same as personal tax returns. However, S corporations have until the 15th day of the third month after the end of their fiscal year to issue the K-1 forms.

Only needed if the corporation makes a profit: Another misconception is that K-1s are only necessary if the corporation makes a profit. Actually, they must be filed every year regardless of profit or loss, as they report more than just income.

Personal expenses can be deducted: Sometimes shareholders believe they can deduct personal expenses through the corporation on their K-1. However, only expenses directly related to generating the corporation's income can be deducted.

Audit risk increases with a Schedule K-1: There's a common fear that receiving a Schedule K-1 increases the likelihood of an IRS audit. The reality is that the integrity of the information reported affects audit risk more than the mere presence of the form.

It determines payroll taxes: Some shareholders incorrectly assume that the income reported on Schedule K-1 is subject to payroll taxes. In fact, this income is not considered wages and thus is not subject to payroll taxes but may still be subject to self-employment taxes under certain conditions.

Losses can always be deducted: There’s a notion that losses reported on the K-1 can always be fully deducted by the shareholder. However, the ability to deduct these losses may be limited based on the shareholder's basis in the corporation and at-risk limitations.

Only U.S. citizens need a K-1 to report S corporation income: Lastly, some believe that only U.S. citizens require a K-1 form to report income from an S corporation. Actually, all shareholders, including non-resident aliens, need to report their share of the corporation's income, deductions, and credits through a K-1.

Understanding these points can demystify aspects of the IRS Schedule K-1 (1120-S) and reduce errors in reporting shareholder income and corporation taxes. Properly handling this form is crucial for both compliance and the accurate representation of financial affairs.

Key takeaways

The IRS Schedule K-1 (1120-S) form is a document used by S corporations to report each shareholder’s income, deductions, and credits from the corporation. When it comes to understanding and using this form properly, there are several key takeaways to keep in mind to ensure accurate and compliant tax filings.

- Understand Its Purpose: The Schedule K-1 (1120-S) form serves a vital role in the tax reporting process for an S corporation and its shareholders. It ensures that the corporation's income, deductions, and credits are reported on each shareholder's individual tax return, aligning with the pass-through taxation structure of S corporations.

- Know the Deadlines: Filing the Schedule K-1 (1120-S) in a timely manner is crucial. Typically, the form is due to the IRS and the shareholders by March 15th of the year following the tax year in question. Late filings can result in penalties for both the corporation and its shareholders.

- Accurate Shareholder Information is Critical: The form requires detailed information about each shareholder, including the percentage of ownership and share of the corporation's income or loss. Ensuring this information is accurate is paramount to prevent discrepancies and issues with individual tax returns.

- Report All Necessary Information: Beyond just income, the Schedule K-1 (1120-S) also covers deductions, credits, and other relevant tax items. Shareholders use this information to complete their own tax returns. Therefore, providing a comprehensive and accurate account of these figures is essential.

- Consult with a Professional: Given the complexities associated with filling out and filing the Schedule K-1 (1120-S), consulting with a tax professional or legal consultant familiar with S corporations can be beneficial. They can offer guidance, ensure compliance with tax laws, and help avoid costly errors.

In conclusion, the Schedule K-1 (1120-S) is a critical document for both S corporations and their shareholders. By adhering to these key takeaways, individuals can navigate the tax reporting process more smoothly and ensure compliance with IRS requirements.

Popular PDF Forms

Mo Tax Forms - Ensure you have all necessary tax documents for legal or personal reasons by requesting your Missouri tax return copies.

1042-s Vs W2 - Aids in the reconciliation of payments of U.S. Source Fixed or Determinable, Annual or Periodical (FDAP) Income.

How Do I Know If My Medical Is Active - Family income must be listed, including sources and amounts, to assess financial eligibility for Medi-Cal.