Blank IRS Schedule SE 1040 PDF Template

Filing taxes can be a daunting process, especially for those navigating self-employment and the array of forms that come with it. Among these, the IRS Schedule SE 1040 form stands out as a critical piece of paperwork. This form is essential not just for calculating the amount of self-employment tax owed by individuals who work for themselves but also for understanding the intricacies of tax liabilities and credits available. It lays the foundation for paying into Social Security and Medicare, two pillars of retirement and healthcare for most Americans. With its importance spanning financial planning, social security benefits, and tax compliance, the Schedule SE form becomes an indispensable tool for self-employed individuals, freelancers, and independent contractors aiming to ensure their tax filings are accurate and beneficial in the long run.

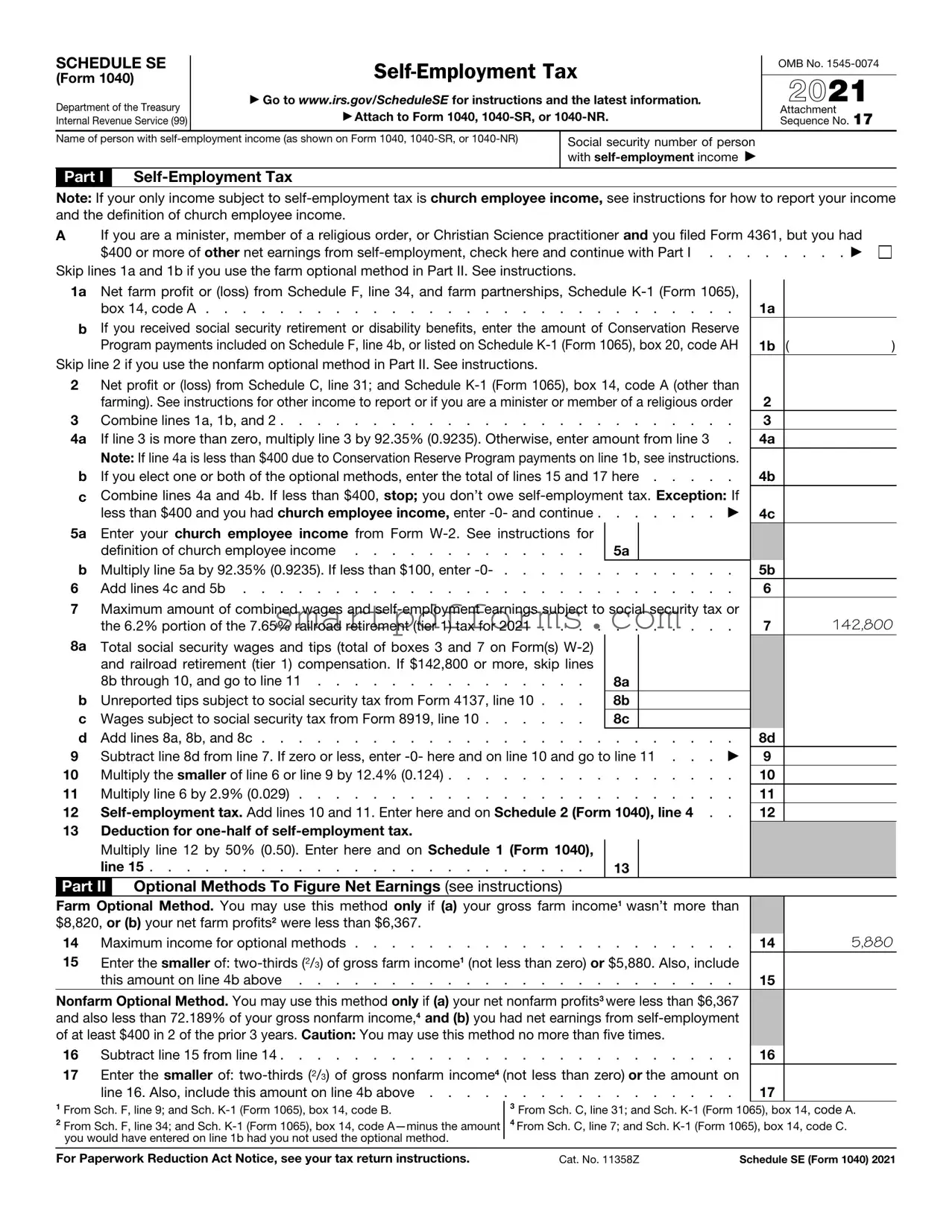

Preview - IRS Schedule SE 1040 Form

SCHEDULE SE

(Form 1040)

Department of the Treasury Internal Revenue Service (99)

▶Go to www.irs.gov/ScheduleSE for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 17

Name of person with

Part I

Social security number of person with

Note: If your only income subject to

AIf you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had

$400 or more of other net earnings from

1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule

bIf you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule

Skip line 2 if you use the nonfarm optional method in Part II. See instructions.

2Net profit or (loss) from Schedule C, line 31; and Schedule

3 |

Combine lines 1a, 1b, and 2 |

4a |

If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 . |

|

Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. |

b |

If you elect one or both of the optional methods, enter the total of lines 15 and 17 here |

cCombine lines 4a and 4b. If less than $400, stop; you don’t owe

5a |

Enter your church employee income from Form |

See instructions for |

|

|

|

definition of church employee income |

. . . . . . . |

5a |

|

b |

Multiply line 5a by 92.35% (0.9235). If less than $100, enter |

|||

6 |

Add lines 4c and 5b |

|||

7Maximum amount of combined wages and

the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 . . . . . . . . . . .

8a |

Total social security wages and tips (total of boxes 3 and 7 on Form(s) |

|

|

|

and railroad retirement (tier 1) compensation. If $142,800 or more, skip lines |

|

|

|

8b through 10, and go to line 11 |

8a |

|

b |

Unreported tips subject to social security tax from Form 4137, line 10 . . . |

8b |

|

c |

Wages subject to social security tax from Form 8919, line 10 |

8c |

|

d |

Add lines 8a, 8b, and 8c |

||

9 |

Subtract line 8d from line 7. If zero or less, enter |

||

10 |

Multiply the smaller of line 6 or line 9 by 12.4% (0.124) |

||

11 |

Multiply line 6 by 2.9% (0.029) |

||

12 |

|||

13 |

Deduction for |

|

|

|

Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), |

|

|

|

line 15 |

13 |

|

Part II Optional Methods To Figure Net Earnings (see instructions)

1a

1b ( |

) |

2

3

4a

4b

4c

5b

6

7142,800

8d

9

10

11

12

Farm Optional Method. You may use this method only if (a) your gross farm income1 wasn’t more than |

|

|

$8,820, or (b) your net farm profits2 were less than $6,367. |

|

|

14 Maximum income for optional methods |

14 |

5,880 |

15Enter the smaller of:

this amount on line 4b above |

15 |

|

Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits3 were less than $6,367 |

|

|

and also less than 72.189% of your gross nonfarm income,4 and (b) you had net earnings from |

|

|

of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. |

|

|

16 Subtract line 15 from line 14 |

16 |

|

17Enter the smaller of:

line 16. Also, include this amount on line 4b above |

17 |

1From Sch. F, line 9; and Sch.

2From Sch. F, line 34; and Sch.

3From Sch. C, line 31; and Sch.

4From Sch. C, line 7; and Sch.

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11358Z |

Schedule SE (Form 1040) 2021 |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Schedule SE | Used to calculate the self-employment tax owed by individuals who have earned income other than salaries and wages. |

| Who Must File | Required for individuals who have net earnings from self-employment of $400 or more. |

| Components of Self-Employment Tax | Comprises Social Security and Medicare taxes for individuals working for themselves. |

| Effect on Social Security Benefits | Self-employment tax contributes to an individual's Social Security benefits entitlement. |

| Deduction for Adjusted Gross Income | Allows individuals to deduct the employer-equivalent portion of their self-employment tax. |

| Short Schedule SE and Long Schedule SE | Short Schedule SE is for those whose net earnings are less than $132,900, and Long Schedule SE is for others. |

| Due Date | Typically due on April 15, along with Form 1040 or Form 1040-SR. |

| Required Attachments | Must be filed with Form 1040 or Form 1040-SR. |

| Governing Law | Federal law governs Schedule SE; no state-specific versions exist. |

Instructions on Utilizing IRS Schedule SE 1040

Filling out the IRS Schedule SE 1040 form is crucial for certain taxpayers, especially those who are self-employed. This form is used to determine the amount of self-employment tax owed to the federal government. The self-employment tax consists of Social Security and Medicare taxes, primarily for individuals who work for themselves. Properly completing this form ensures that you're not only complying with tax law but also contributing to your future Social Security and Medicare benefits. Below are the steps to guide you through filling out the Schedule SE 1040 form.

- Start by gathering all necessary documentation, including your 1040 form, profit and loss statements, and any other records of income and expenses.

- Locate the Schedule SE form on the IRS website and download it for the current tax year.

- Enter your name and Social Security Number (SSN) at the top of the form to match the information on your Form 1040.

- Calculate your net profit or loss from your business using the figures from your profit and loss statement. This amount should also be reported on your Form 1040 and needs to be carried over to Schedule SE.

- If you have earnings from services performed as a church employee or have used optional methods to calculate your earnings, make sure these amounts are also included in the total.

- Refer to the instructions provided with Schedule SE to determine if you should use Section A (for those with income below a certain threshold) or Section B (for those above that threshold).

- Calculate your self-employment tax using the provided rate in the instructions, applying it to the sum from either Section A or B, as applicable. This involves multiplying your self-employment earnings by the current self-employment tax rate.

- Once your self-employment tax has been calculated, subtract any allowable deductions (such as the deductible portion of your self-employment tax) to determine your total self-employment tax owed.

- Transcribe this amount onto your Form 1040 as instructed. This ensures that your total tax liability reflects your self-employment tax.

- Review the entire form for accuracy, ensuring all calculations are correct and all necessary information has been included.

- Sign and date the form. If you're filing jointly, make sure your spouse also signs.

- Attach Schedule SE to your Form 1040 and submit it to the IRS according to the provided filing instructions, whether it's via mail or electronically.

Following these steps carefully will help ensure that your Schedule SE 1040 form is correctly filled out and submitted. Accurate completion of this form plays a crucial role in your tax return, impacting not only your tax liability for the year but also your future Social Security and Medicare benefits. Always check the IRS website for the most current forms and instructions to guarantee compliance with the latest tax laws and regulations.

Obtain Answers on IRS Schedule SE 1040

-

What is the IRS Schedule SE 1040 form?

The IRS Schedule SE 1040 form is used to calculate the self-employment tax owed by individuals who have earned income other than a salary or wages from an employer. This includes income generated from business operations as a sole proprietor, an independent contractor, or a part of a partnership that carries out a trade or business. The form helps determine the amount owed for Social Security and Medicare taxes, as self-employed individuals are responsible for paying both the employer and employee portions of these taxes.

-

Who needs to file Schedule SE with their 1040 form?

Typically, individuals must file Schedule SE with their 1040 form if they had net earnings from self-employment of $400 or more. This applies to the self-employed, including those who are in business for themselves (even part-time), contractors, freelancers, and partners in a partnership. However, church employee income of $108.28 or more and earnings for services performed as a notary public must also be reported on Schedule SE.

-

How do you calculate the self-employment tax?

To calculate the self-employment tax on Schedule SE, one must first ascertain their net earnings from self-employment. This typically involves subtracting business expenses from gross income. The resulting net income is then multiplied by 92.35% to find the amount subject to self-employment taxes. The Schedule SE form applies two rates to this figure: 12.4% for Social Security up to the annual limit and 2.9% for Medicare. No cap exists on the Medicare portion. If your income exceeds a certain threshold, you may also be subject to an additional 0.9% Medicare tax.

-

Can deductions be claimed to offset self-employment tax?

Yes, individuals can claim deductions to offset their self-employment tax. The IRS allows self-employed individuals to deduct the employer-equivalent portion of their self-employment tax when calculating their adjusted gross income. This effectively halves the burden of Social Security and Medicare taxes by allowing you to deduct 50% of the self-employment tax from your net income. This deduction only affects income tax, not the total self-employment tax owed.

-

What are the due dates for filing Schedule SE?

Schedule SE is filed as part of the individual's federal income tax return (Form 1040), and therefore follows the same due dates. Typically, the deadline for filing is April 15th of the year following the tax year. If April 15th falls on a weekend or a legal holiday, the deadline is extended to the next business day. For those who request an extension to file their Form 1040, the extension also applies to Schedule SE. However, it's important to note that an extension to file does not grant more time to pay any taxes owed; interest and penalties may accrue on unpaid taxes.

Common mistakes

-

Not realizing you need to file it

Many people don't realize they're required to file Schedule SE if they have net earnings of $400 or more from self-employment. This includes freelancers, independent contractors, and small business owners. Overlooking this requirement can lead to underreporting income and result in penalties.

-

Incorrectly calculating net earnings

Calculating net earnings is more than just subtracting business expenses from your income. It involves understanding what the IRS considers as deductible expenses and taxable income. Misinterpreting these can lead to either underpaying or overpaying your taxes.

-

Misunderstanding the deduction for self-employment tax

You're allowed to deduct half of your self-employment tax when calculating your adjusted gross income on your Form 1040. However, the deduction only affects your income tax, not your self-employment tax on Schedule SE. This distinction is crucial and often misunderstood.

-

Not including all sources of self-employment income

If you have multiple sources of self-employment income, you need to report all of them on Schedule SE. Failing to include all sources can lead to an inaccurate calculation of self-employment tax owed.

-

Failing to pay quarterly estimated taxes

Self-employed individuals usually need to make estimated tax payments quarterly if they expect to owe $1,000 or more in taxes. Not doing so can result in penalties, even if you pay the full amount owed when filing your return.

-

Not checking the eligibility for special rules

Certain businesses, like farming or fishing, and certain individuals, such as church employees, may qualify for special rules when calculating self-employment tax. Overlooking these rules can lead to incorrect tax calculations.

-

Using incorrect tax years’ forms

It's essential to use the Schedule SE form that corresponds to the tax year you're filing for. Tax rates and rules can change from year to year, and using the wrong form can result in incorrect calculations and potential issues with your return.

-

Attempting to calculate self-employment tax without guidance

While it's entirely possible to calculate your self-employment tax on your own, it can be complex. Consulting with a tax professional or using reliable tax software can help ensure your calculations are correct and reduce the risk of errors.

By avoiding these common mistakes, you can ensure a smoother process when dealing with Schedule SE and potentially save yourself time, money, and stress come tax time.

Documents used along the form

The IRS Schedule SE 1040 form is essential for self-employed individuals, including sole proprietors, partners, and other independent contractors, as it is used to calculate the self-employment tax owed based on their net earnings. However, completing this form often requires additional documentation and forms to report and calculate income accurately. Here’s a list of six commonly used forms and documents that accompany the IRS Schedule SE 1040 form.

- Form 1040 or 1040-SR (U.S. Individual Income Tax Return): This is the primary form used by individuals to file their annual income tax returns. It provides the comprehensive income details required to calculate the amount of self-employment tax due.

- Schedule C (Profit or Loss From Business): Sole proprietors and single-member LLCs use this form to report their business’s profit or loss. The net income from Schedule C is transferred to the Schedule SE to determine the self-employment tax.

- Schedule F (Profit or Loss From Farming): This form is for individuals who operate a farm. Similar to Schedule C, the net farming income is used to calculate the self-employment tax on Schedule SE.

- Form 1099-NEC (Nonemployee Compensation): Independent contractors and freelancers receive this form from clients who have paid them $600 or more during the tax year. It reports income that typically isn’t subject to withholding, making it crucial for calculating net earnings for self-employment tax purposes.

- Form 4562 (Depreciation and Amortization): This form is used to claim deductions for the depreciation or amortization of property used in a business, affecting the net income reported on Schedule C or F, which in turn impacts the net earnings for Schedule SE.

- Form 8829 (Expenses for Business Use of Your Home): For those who use part of their home for business, this form allows them to calculate and deduct expenses for its business use. These deductions reduce the net income on Schedule C, affecting the self-employment tax calculation on Schedule SE.

Understanding and gathering the right documents is crucial for accurately reporting income and calculating taxes owed. These forms and documents directly influence the self-employment tax reported on the IRS Schedule SE 1040 form. Preparing them carefully ensures compliance with tax laws and can help minimize the amount owed or maximize any rightful deductions.

Similar forms

Schedule C (Form 1040): Both Schedule SE (Form 1040) and Schedule C are used by individuals who are self-employed. Schedule C is utilized to report the income or loss from a business you operated or a profession you practiced as a sole proprietor. The net profit or loss calculated on Schedule C is then used to determine the amount of self-employment tax owed, which is calculated on Schedule SE.

Schedule F (Form 1040): Similar to Schedule C, Schedule F is used by individuals to report income and expenses from farming activities. The net farm profit or loss reported on Schedule F is crucial for completing Schedule SE, as it impacts the calculation of self-employment tax for individuals involved in farming.

Form 1040-ES: This form is used by taxpayers, including those who are self-employed, to estimate and pay their quarterly taxes. Like Schedule SE, Form 1040-ES deals with earnings not subject to withholding, necessitating individuals to calculate and pay taxes on such income throughout the year. The estimated earning calculation can be dependent on the results from Schedule SE.

Form 1040: The Form 1040 U.S. Individual Income Tax Return is the foundational document where the results from Schedule SE are reported. The self-employment tax calculated on Schedule SE is added to the total tax liability on Form 1040, demonstrating a direct connection between these forms. Essentially, the completion of Schedule SE affects the amounts entered on Form 1040.

Schedule 1 (Form 1040): This schedule accompanies Form 1040 and is used for reporting additional income not included on the main form, such as the taxable portion of Social Security benefits, unemployment compensation, and, relevantly, additional taxes. The self-employment tax calculated on Schedule SE is reported on Schedule 1, which then affects the calculations on the 1040 form.

Form W-2: While Form W-2 is primarily for employees and reports wages, tips, and other compensation from an employer, it serves as a contrast to Schedule SE by highlighting the differences in tax responsibilities between employees and self-employed individuals. Where employees have Social Security and Medicare taxes withheld automatically, self-employed individuals use Schedule SE to calculate and remit these taxes themselves.

Form 1099-NEC: This form is used to report nonemployee compensation, often relevant for freelancers and independent contractors who are self-employed. Just like Schedule SE, Form 1099-NEC addresses the income of those who are not traditional employees and therefore must handle their taxes differently, specifically in regard to self-employment tax.

Dos and Don'ts

Navigating the IRS Schedule SE (Form 1040) can seem daunting, but it plays a crucial role for anyone who earns income not subject to traditional payroll taxes. This form is used to calculate the self-employment tax owed on income from self-employment ventures including freelance, small business ownership, or other independent contracts. Let's simplify the process with a list of dos and don’ts to ensure accuracy and compliance.

Do:- Double-check your eligibility: Verify that you need to file Schedule SE. Generally, if your net earnings from self-employment are $400 or more, you must file.

- Gather necessary documents: Have all records of your income and expenses ready. This includes 1099 forms, receipts, and records of any related expenses.

- Report all your self-employment income: This includes income that may not necessarily have been reported to you on a 1099 form.

- Calculate your net earnings accurately: Deduct your business expenses from your gross income to find your net earnings.

- Use the correct tax year’s form: Tax laws and forms update annually. Ensure you’re using the form corresponding to the tax year for which you are filing.

- Understand the terms: Familiarize yourself with terms such as "net earnings from self-employment," which affects your taxable amount and benefits.

- Check if you qualify for exceptions: Some types of income and situations are exempt from self-employment tax. See if any apply to you.

- Claim eligible deductions: Self-employed individuals may qualify for several deductions, such as the home office deduction, that can reduce your taxable income.

- Consider making quarterly estimated tax payments: If you expect to owe tax of $1,000 or more when your return is filed, the IRS typically requires you to make estimated tax payments throughout the year.

- Seek professional advice if needed: If you’re unsure about any aspect of filing Schedule SE, consulting with a tax professional can provide clarification and prevent mistakes.

- Procrastinate: Waiting until the last minute can lead to errors or missed deductions. Start your tax preparation early.

- Overlook small amounts of income: Every dollar of self-employment income counts and must be reported, even if it's less than $600 and doesn't come with a 1099.

- Mix personal and business expenses: Keep these separate to accurately report your business income and deductions.

- Ignore IRS notices: If you receive correspondence from the IRS, respond promptly to avoid additional issues.

- Forget to sign and date the form: An unsigned form is like an unsigned check – it’s not valid.

- Guesstimate your income and expenses: Always use actual figures backed up by documentation.

- Omit any of your deductions: Ensure you claim all deductions you’re entitled to, thereby lowering your taxable income.

- File paper forms if electronic is an option: Electronic filing is faster, more secure, and offers a confirmation upon receipt by the IRS.

- Dismiss the importance of recordkeeping: Maintaining organized records can save you a lot of time and hassle if the IRS has questions or if you're audited.

- Underestimate the complexity of your tax situation: If you have multiple sources of income, investments, or qualify for numerous deductions, the process can get complicated quickly. When in doubt, seek help.

Meticulous attention to detail and proactive planning are key when dealing with self-employment taxes. By adhering to these guidelines, you can navigate Schedule SE confidently and ensure you’re meeting your tax obligations accurately and efficiently.

Misconceptions

There are several misconceptions surrounding the IRS Schedule SE (Form 1040), which is used to calculate the self-employment tax owed by individuals who run their own businesses. Below are nine common misunderstandings about this form:

Only full-time business owners need to file. Many people believe that the Schedule SE is required solely for those who run their businesses full-time. However, this form must be filed by anyone who has net earnings from self-employment of $400 or more, regardless of their employment status elsewhere.

Employees cannot file Schedule SE. There's a misconception that only self-employed individuals need to worry about this form. However, employees who earn income through tips, or who have a side business that generates over $400 in profit, must also file Schedule SE.

Schedule SE taxes are double regular income taxes. Some people mistakenly believe that self-employment tax is twice the amount of income tax. In reality, the self-employment tax rate is 15.3%, covering Social Security and Medicare taxes. This is because self-employed individuals pay both the employee and employer portions, but it's not double the income tax rate.

Filing a Schedule C is the same as filing a Schedule SE. While both forms are relevant for self-employed individuals, they serve different purposes. Schedule C is used to report the profit or loss from a business, whereas Schedule SE calculates the self-employment tax based on the net earnings reported on Schedule C.

You can skip filing Schedule SE if your business didn’t profit. If your net earnings are $400 or more, you need to file Schedule SE, even if your overall business operation resulted in a loss once all deductions are accounted for. The requirement is based on net earnings, not the overall financial state of the business.

Self-employment tax is optional for smaller businesses. Some believe that if your business is small enough, paying self-employment tax isn’t required. The truth is, if you meet the $400 threshold in net earnings, filing Schedule SE and paying self-employment tax is mandatory, regardless of your business size.

Partners in a partnership don’t need to file Schedule SE. Each partner in a partnership who has net earnings of $400 or more from the partnership must file Schedule SE. This is a common oversight, as partners might think the partnership itself covers their individual tax obligations for Social Security and Medicare.

You can deduct all self-employment taxes on your income tax return. While self-employed individuals can deduct the employer-equivalent portion of their self-employment tax in determining their adjusted gross income, they cannot deduct the entire amount of self-employment tax from their income taxes.

Nonresidents cannot file Schedule SE. Nonresident aliens who are engaged in a trade or business in the United States may need to file Schedule SE if they meet the income thresholds. Citizenship status does not exempt individuals from self-employment tax if they earn income from U.S. sources.

Key takeaways

The IRS Schedule SE (Form 1040) is a crucial form for many taxpayers, particularly those who are self-employed. It's used to calculate the amount of self-employment tax owed, covering Social Security and Medicare contributions. When tackling this form, understanding its components and implications can make the process smoother and ensure you're paying the right amount of tax. Here are five key takeaways to remember when filling out and using Schedule SE:

- Determine if you need to file: You're required to file Schedule SE if your net earnings from self-employment were $400 or more. This includes individuals who freelance, own a business, or work as independent contractors.

- Understand the two parts: Schedule SE consists of two parts. Part I calculates the net earnings from self-employment, and Part II calculates the self-employment tax owed. It's essential to accurately report income and expenses in Part I to ensure the correct tax calculation in Part II.

- Know the tax rates: The self-employment tax rate is composed of two parts: 12.4% for Social Security on income up to a certain limit (which is adjusted annually) and 2.9% for Medicare with no upper limit. These percentages are applied to your net earnings to determine your tax owed.

- Take advantage of deductions: One silver lining with Schedule SE is the ability to deduct half of your self-employment tax when calculating your adjusted gross income on Form 1040. This deduction can reduce your overall taxable income, potentially lowering your tax bill.

- Consider voluntary contributions: If your net earnings are below a certain threshold, you may not be obligated to pay self-employment tax. However, making voluntary contributions can be beneficial for securing Social Security and Medicare benefits in the future, especially if you're in the early stages of your business.

Properly completing and understanding the Schedule SE can significantly impact your financial health, ensuring you're adequately covered for Social Security and Medicare benefits. It's always a good practice to consult with a tax professional if you're unsure about any aspects of your self-employment tax obligations.

Popular PDF Forms

Ford Credit Application Pdf - Prior business dealings with Ford Motor Credit Company and other creditors are inquired to gauge previous credit management.

21-0781a - Victims of military personal assault use VA Form 21-0781a to provide a thorough account of incidents contributing to PTSD for VA consideration.

How Much Does It Cost to Transfer a Car Title in Pa - Applicants must provide detailed vehicle descriptions, including body type and weight, to accurately process the registration.