Blank IRS SS-4 PDF Template

For new business owners, navigating the intricacies of tax obligations can often feel overwhelming. Among the pivotal first steps in this journey is becoming acquainted with the Internal Revenue Service (IRS) Form SS-4, the application for an Employer Identification Number (EIN). This crucial identifier not only facilitates the process of tax filing and compliance but also serves as a prerequisite for a variety of business activities, including opening a bank account, hiring employees, and managing payroll. Understanding the nuances of the SS-4 form is essential not just for compliance, but for laying the foundational structures of a business's financial operations. Completing the form requires detailed information about the business, including its name, address, type of organization, and the reason for applying for an EIN. The IRS allows for the form to be filed online, by fax, or by mail, offering flexibility to suit different preferences. With its significant role in the establishment and operation of a business within the United States, the SS-4 form is a key step in the administrative lifecycle of a business, ensuring that the entity is properly registered and recognized by the IRS.

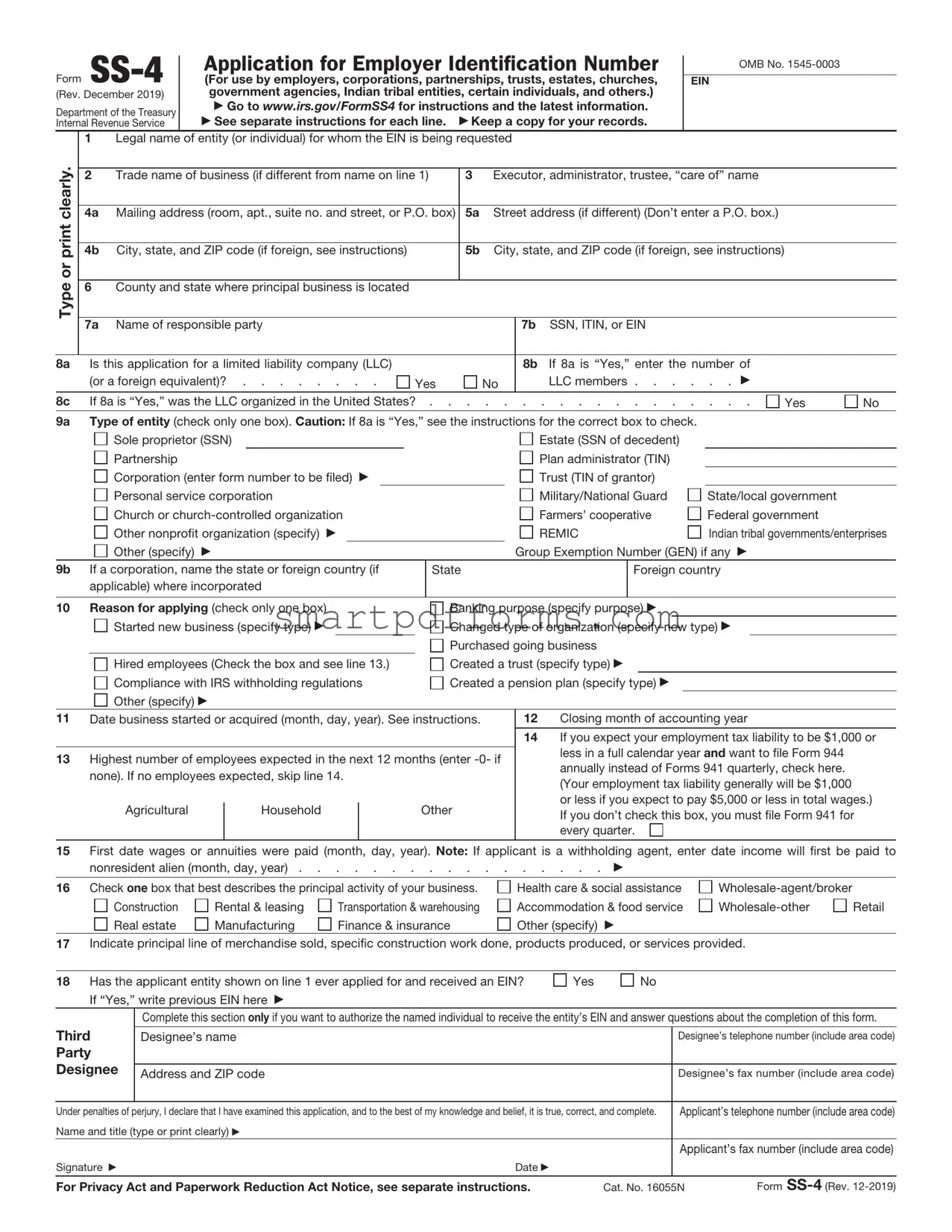

Preview - IRS SS-4 Form

Form

Department of the Treasury Internal Revenue Service

Application for Employer Identification Number

(For use by employers, corporations, partnerships, trusts, estates, churches, government agencies, Indian tribal entities, certain individuals, and others.)

Go to www.irs.gov/FormSS4 for instructions and the latest information.

See separate instructions for each line. |

Keep a copy for your records. |

OMB No.

EIN

Type or print clearly.

8a

8c

9a

1Legal name of entity (or individual) for whom the EIN is being requested

2 |

Trade name of business (if different from name on line 1) |

3 Executor, administrator, trustee, “care of” name |

|

|

|

4a Mailing address (room, apt., suite no. and street, or P.O. box) |

5a Street address (if different) (Don’t enter a P.O. box.) |

|

|

|

|

4b City, state, and ZIP code (if foreign, see instructions) |

5b City, state, and ZIP code (if foreign, see instructions) |

|

|

|

|

6County and state where principal business is located

7a Name of responsible party |

|

|

|

|

7b SSN, ITIN, or EIN |

|

|

|

|||

Is this application for a limited liability company (LLC) |

|

|

|

|

8b If 8a is “Yes,” enter the number of |

|

|

||||

(or a foreign equivalent)? |

Yes |

No |

|

|

LLC members |

|

|

||||

If 8a is “Yes,” was the LLC organized in the United States? . . . . |

. . . . . . . . . . . |

. . . |

Yes |

No |

|||||||

Type of entity (check only one box). Caution: If 8a is “Yes,” see the instructions for the correct box to check. |

|

|

|

||||||||

Sole proprietor (SSN) |

|

|

|

|

|

Estate (SSN of decedent) |

|

|

|

||

Partnership |

|

|

|

|

Plan administrator (TIN) |

|

|

|

|||

Corporation (enter form number to be filed) |

|

|

|

|

|

Trust (TIN of grantor) |

|

|

|

||

Personal service corporation |

|

|

|

|

Military/National Guard |

State/local government |

|

||||

Church or |

|

|

|

|

Farmers’ cooperative |

Federal government |

|

||||

Other nonprofit organization (specify) |

|

|

|

|

|

REMIC |

Indian tribal governments/enterprises |

||||

Other (specify) |

|

|

|

|

Group Exemption Number (GEN) if any |

|

|

||||

9b If a corporation, name the state or foreign country (if applicable) where incorporated

State

Foreign country

10 Reason for applying (check only one box)

Started new business (specify type)

Hired employees (Check the box and see line 13.) Compliance with IRS withholding regulations Other (specify)

Banking purpose (specify purpose)

Changed type of organization (specify new type) Purchased going business

Created a trust (specify type) Created a pension plan (specify type)

11Date business started or acquired (month, day, year). See instructions.

13Highest number of employees expected in the next 12 months (enter

Agricultural |

Household |

Other |

|

|

|

12Closing month of accounting year

14If you expect your employment tax liability to be $1,000 or less in a full calendar year and want to file Form 944 annually instead of Forms 941 quarterly, check here. (Your employment tax liability generally will be $1,000

or less if you expect to pay $5,000 or less in total wages.)

If you don’t check this box, you must file Form 941 for every quarter.

15First date wages or annuities were paid (month, day, year). Note: If applicant is a withholding agent, enter date income will first be paid to

nonresident alien (month, day, year) . . . . . . . . . . . . . . . . .

16 Check one box that best describes the principal activity of your business. |

Health care & social assistance |

|

|||

Construction |

Rental & leasing |

Transportation & warehousing |

Accommodation & food service |

Retail |

|

Real estate |

Manufacturing |

Finance & insurance |

Other (specify) |

|

|

17Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided.

18 Has the applicant entity shown on line 1 ever applied for and received an EIN? |

Yes |

No |

If “Yes,” write previous EIN here |

|

|

Complete this section only if you want to authorize the named individual to receive the entity’s EIN and answer questions about the completion of this form.

Third |

Designee’s name |

|

Designee’s telephone number (include area code) |

|

Party |

|

|

|

|

Designee |

|

|

|

|

Address and ZIP code |

|

Designee’s fax number (include area code) |

||

|

|

|||

|

|

|||

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete. |

Applicant’s telephone number (include area code) |

|||

Name and title (type or print clearly) |

|

|

|

|

|

|

|

Applicant’s fax number (include area code) |

|

Signature |

Date |

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 16055N |

Form |

||

Form

Do I Need an EIN?

File Form

IF the applicant... |

AND... |

THEN... |

|

|

|

started a new business |

doesn’t currently have (nor expect to have) |

complete lines 1, 2, |

|

employees |

9b (if applicable), and |

|

|

|

hired (or will hire) employees, |

doesn’t already have an EIN |

complete lines 1, 2, |

including household employees |

|

|

|

|

|

opened a bank account |

needs an EIN for banking purposes only |

complete lines |

|

|

(if applicable), 9a, 9b (if applicable), 10, and 18. |

|

|

|

changed type of organization |

either the legal character of the organization or its |

complete lines |

|

ownership changed (for example, you incorporate a |

|

|

sole proprietorship or form a partnership)2 |

|

|

|

|

purchased a going business3 |

doesn’t already have an EIN |

complete lines |

created a trust |

the trust is other than a grantor trust or an IRA |

complete lines |

|

trust4 |

|

created a pension plan as a |

needs an EIN for reporting purposes |

complete lines 1, 3, |

plan administrator5 |

|

|

is a foreign person needing an |

needs an EIN to complete a Form |

complete lines |

EIN to comply with IRS |

Form |

8a, |

withholding regulations |

or claim tax treaty benefits6 |

and 18. |

|

|

|

is administering an estate |

needs an EIN to report estate income on Form 1041 |

complete lines |

|

|

and 18. |

|

|

|

is a withholding agent for |

is an agent, broker, fiduciary, manager, tenant, or |

complete lines 1, 2, 3 (if applicable), |

taxes on nonwage income |

spouse who is required to file Form 1042, Annual |

|

paid to an alien (that is, |

Withholding Tax Return for U.S. Source Income of |

|

individual, corporation, or |

Foreign Persons |

|

partnership, etc.) |

|

|

|

|

|

is a state or local agency |

serves as a tax reporting agent for public assistance |

complete lines 1, 2, |

|

recipients under Rev. Proc. |

|

|

|

|

is a |

needs an EIN to file Form 8832, Entity Classification |

complete lines |

similar |

Election, for filing employment tax returns and excise |

|

|

tax returns, or for state reporting purposes8, or is a |

|

|

|

|

|

EIN to file Form 5472, Information Return of a 25% |

|

|

|

|

|

Corporation Engaged in a U.S. Trade or Business |

|

|

|

|

is an S corporation |

needs an EIN to file Form 2553, Election by a Small |

complete lines |

|

Business Corporation9 |

|

1For example, a sole proprietorship or

2However, don’t apply for a new EIN if the existing entity only (a) changed its business name, (b) elected on Form 8832 to change the way it is taxed (or is covered by the default rules), or (c) terminated its partnership status because at least 50% of the total interests in partnership capital and profits were sold or exchanged within a 12- month period. The EIN of the terminated partnership should continue to be used. See Regulations section

3Don’t use the EIN of the prior business unless you became the “owner” of a corporation by acquiring its stock.

4However, grantor trusts that don’t file using Optional Method 1 and IRA trusts that are required to file Form

5A plan administrator is the person or group of persons specified as the administrator by the instrument under which the plan is operated.

6Entities applying to be a Qualified Intermediary (QI) need a

7See also Household employer agent in the instructions. Note: State or local agencies may need an EIN for other reasons, for example, hired employees.

8See Disregarded entities in the instructions for details on completing Form

9An existing corporation that is electing or revoking S corporation status should use its

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS SS-4 form is used to apply for an Employer Identification Number (EIN), which is necessary for businesses to legally operate in the United States. |

| Applicant Types | It is applicable to various types of entities, including sole proprietorships, corporations, partnerships, trusts, estates, and non-profit organizations. |

| Filing Methods | Applicants can submit the form online, by fax, or mail, although online submission is encouraged for its quicker processing time. |

| Processing Time | When submitted online, the EIN is usually issued immediately. However, fax and mail submissions can take significantly longer, from several days to weeks. |

| No Fee Required | The IRS does not charge a fee for applying for an EIN using the SS-4 form. |

| Governing Law | The SS-4 form and the issuance of EINs are governed by federal law, as the Internal Revenue Service is a federal agency. |

Instructions on Utilizing IRS SS-4

After deciding to start a business or hire employees, obtaining an Employer Identification Number (EIN) through the IRS SS-4 form is essential. This process can be straightforward when approached step by step. Following the completion of this form, the business is assigned an EIN, which facilitates a variety of business activities, including opening a bank account, hiring employees, and filing tax returns. Here's how to correctly fill out the IRS SS-4 form.

- Go to the IRS website and download the latest version of the SS-4 form.

- Begin by entering the legal name of the entity or individual requesting the EIN in line 1.

- For line 2, if there's a trade name that differs from the legal name, enter it here.

- In line 3, provide the executor, administrator, trustee, “care of” name, or entity name if applicable.

- Line 4 asks for the mailing address; enter the address where all correspondence should be sent.

- On line 5, provide the physical location of the business if different from the mailing address.

- The county and state where the business is located are requested in line 6.

- Line 7 requires the name and Social Security Number (SSN), EIN, or Individual Taxpayer Identification Number (ITIN) of the responsible party.

- Check the appropriate box for the entity type in line 8. If "Other" is chosen, provide a brief explanation.

- For line 9a, select the reason for applying. Whether the EIN is needed to start a new business, for banking purposes, hiring employees, or another reason, indicate it here.

- In line 9b, indicate the state where the Articles of Incorporation were filed, if applicable.

- Line 10 asks for the date when the business started or acquired the entity. Provide the month and year.

- Specify the primary activity of the business in line 11, whether it's a service, manufacturing, construction, or another type of activity.

- Estimate the number of employees you expect to hire within the next 12 months in line 13, and check the appropriate boxes regarding federal tax withholdings.

- Finally, line 18 requires information about whether the business is involved in gambling, wagering, or operates as a nonprofit organization.

- Once all relevant sections are completed, review the form for accuracy. Then, sign and date the bottom of the form.

- Submit the form to the IRS by fax, mail, or online submission, following the instructions provided with the form.

After submitting the form, the waiting period for an EIN assignment can vary. During this time, it's crucial to keep a copy of the submitted form and any correspondence from the IRS. The assigned EIN will be a crucial identifier for your business, used in a variety of legal, tax, and business transactions. Moving forward, ensure this number is kept secure and utilized properly in all relevant business activities.

Obtain Answers on IRS SS-4

-

What is the IRS SS-4 form?

The IRS SS-4 form, also known as the Application for Employer Identification Number (EIN), is used by businesses to apply for a unique identification number that is necessary for tax purposes. This nine-digit number is used by the Internal Revenue Service (IRS) to identify businesses for reporting and tax purposes.

-

Who needs to file an SS-4 form?

Entities such as corporations, partnerships, LLCs, estates, trusts, and other business entities typically need to file an SS-4 form to obtain an EIN. Sole proprietors may also need to file if they hire employees, have a retirement plan, or operate their business as a corporation or partnership.

-

How can I submit an SS-4 form?

The SS-4 form can be submitted to the IRS in several ways:

- Online, through the IRS website, which is the fastest method

- By fax

- By mail

- By telephone (for international applicants)

-

Is there a fee to apply for an EIN using the SS-4 form?

No, the IRS does not charge a fee to apply for an EIN. You can submit the SS-4 form and obtain an EIN free of charge.

-

What information do I need to provide on the SS-4 form?

To complete the SS-4 form, you will need to provide detailed information about your business, including the name of the business entity, address, type of business, reason for applying, and the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the principal officer or owner.

-

How long does it take to receive an EIN after submitting the SS-4 form?

If you submit the SS-4 form online, you can receive your EIN immediately upon completion of the application. For fax submissions, the turnaround time is usually about four business days. For mail submissions, expect to wait up to four weeks. If you provide an incorrect fax number or mailing address, this can delay the process.

-

Can I use my EIN immediately after receiving it?

Yes, you can start using your EIN immediately for most business activities, such as opening a bank account, applying for business licenses, and filing a tax return by mail. However, it may take up to two weeks for your EIN to become fully integrated into the IRS's records for electronic filings.

-

What if I lose or forget my EIN?

If you lose or forget your EIN, you can call the IRS Business & Specialty Tax Line. After verifying your identity, they can provide you with your EIN over the phone. You can also find your EIN on previously filed tax returns or other tax documents.

-

Do I need a new EIN if my business changes its structure or ownership?

In most cases, a business will need to obtain a new EIN if it changes its structure (e.g., from a sole proprietorship to a corporation) or if there is a change in ownership. There are specific scenarios detailed by the IRS that require a new EIN, so it’s important to consult their guidelines or speak with a tax professional.

Common mistakes

Filling out the IRS SS-4 form, which is used to apply for an Employer Identification Number (EIN), often comes with its own set of challenges. Individuals can make several common mistakes during this process. Recognizing and avoiding these mistakes can streamline the application process, ensuring a smoother path to obtaining an EIN.

Not checking the form for updates: The IRS periodically updates the SS-4 form. Applicants who don't use the latest version may have their application rejected.

Incorrectly identifying the responsible party: The form requires the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the true principal officer, general partner, grantor, owner, or trustor. Errors here can lead to processing delays.

Misidentifying the legal structure of the business: Selecting the wrong entity type can have significant legal and tax implications.

Omitting the "reason for applying": Applicants must specify why they are applying for an EIN, whether it's starting a new business, hiring employees, banking purposes, etc. Failure to include this information can result in an incomplete application.

Filling out the form with inaccurate business address information: The IRS uses this address to send important documents; thus, inaccuracies can lead to missed communications.

Not specifying the primary nature of the business: The form asks for a brief description of the principal business activity. Vague or inaccurate descriptions can complicate the application process.

Missing signatures: The IRS requires a signature from the individual authorized to act on behalf of the entity. An unsigned form will not be processed.

Applying for a new EIN when not necessary: Some business changes, like a name change or address update, don't require a new EIN. Unnecessary applications can complicate a business's tax affairs.

By addressing these common mistakes before submitting an SS-4 form, individuals can enhance their chances of a hassle-free application process. Paying attention to detail and thoroughly reviewing the form for accuracy is crucial in this regard.

Documents used along the form

When starting a business or formalizing an existing enterprise, the path to compliance involves several important steps, including the acquisition of an Employer Identification Number (EIN) through the IRS SS-4 form. This form is crucial as it registers the business with the federal government for tax purposes. However, the IRS SS-4 form often represents just the beginning of a series of documents needed to fully establish a business's legal and operational structure. The following documents play a pivotal role in complementing the information provided on the IRS SS-4, ensuring that a business is well-prepared and compliant with various regulations.

- Articles of Incorporation/Organization: Depending on whether the business is set up as a corporation or a limited liability company (LLC), the articles of incorporation (for corporations) or organization (for LLCs) are filed with the state government. These documents officially form the legal entity of the business, outline its basic structure, and include essential details such as the business name, purpose, and the details of its founders.

- Operating Agreement: Especially relevant for LLCs, the operating agreement sets forth the management structure and operational guidelines of the business. It covers ownership percentages, profit distribution, roles and responsibilities of members, and procedures for adding or removing members. Although not all states require an operating agreement, it is highly recommended to have one to ensure clear communication and expectations among members.

- Business License and Permits: Depending on the type of business and its location, different licenses and permits may be required to legally operate. These can range from a general business license from the local municipality to specific permits related to health, safety, and environmental regulations. The process of obtaining these licenses often requires submitting detailed business information that aligns with what is provided on the IRS SS-4 form.

- Employer Registration Form: Specific to the state where the business operates, this form registers the business as an employer at the state level for tax withholding and unemployment insurance purposes. Similar to the IRS SS-4 form, the employer registration form is integral for compliance with state tax laws and necessitates detailed business information, including the EIN obtained through the IRS SS-4.

The process of establishing a business is multifaceted, involving careful attention to both federal and state requirements. While the IRS SS-4 form is a critical component in this process, ensuring compliance and legitimacy, the aforementioned documents are equally vital. They not only complement the information on the IRS SS-4 but also lay the groundwork for a business’s legal and operational framework. Together, these forms and documents facilitate a smooth launch and sustainable operation of a business, paving the way for its success.

Similar forms

Form W-9, Request for Taxpayer Identification Number and Certification: Similar to the IRS SS-4, the Form W-9 is used to request a taxpayer identification number (TIN), which is crucial for reporting income paid and ensuring compliance with tax laws. Both forms collect taxpayer information for identification purposes.

Form 2553, Election by a Small Business Corporation: This form, like the SS-4, involves the IRS and is used by small businesses to elect S corporation status. It requires detailed information about the corporation that is somewhat analogous to the information the SS-4 collects about entities needing an Employer Identification Number (EIN).

Form 8832, Entity Classification Election: Businesses use Form 8832 to choose their classification for federal tax purposes, similar to how the SS-4 is used by entities to obtain an EIN to be identified by the IRS. Both forms are critical for tax identification and status purposes.

Form 1065, U.S. Return of Partnership Income: While primarily a tax return form for partnerships, Form 1065 shares the requirement with the SS-4 for entities to provide identification information. It's similar in that it deals with the tax responsibilities of businesses.

Form 1120, U.S. Corporation Income Tax Return: Form 1120 is filed by corporations to report their income, gains, losses, deductions, and credits. The connection to the SS-4 is in the foundational requirement for corporations to have an EIN, which is obtained through the SS-4, to file their taxes.

Form W-7, Application for IRS Individual Taxpayer Identification Number: Similar to the SS-4, which is used to obtain an EIN, Form W-7 is used by individuals to obtain an Individual Taxpayer Identification Number (ITIN). Both forms are integral to the tax identification process, catering to different taxpayer categories.

Dos and Don'ts

When applying for an Employer Identification Number (EIN) using the IRS SS-4 form, it's crucial to approach this task with attention and care. Here's a curated directory of do's and don'ts designed to guide you through the process seamlessly.

Do's:

- Verify all information before submission: Ensure that all the information provided on the form is accurate and up to date to avoid any complications or delays with the IRS.

- Use the legal name of the entity: The name entered on the form should match the official legal name of the entity as recorded in its formation documents.

- Provide a valid physical address: The address you provide should be a physical location where the business is located, not a P.O. Box, to facilitate official correspondence.

- Identify the responsible party accurately: Enter the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the true principal officer, general partner, owner, or trustor who owns or controls the entity.

- Double-check the entity type: Make sure to select the correct entity type that matches your organization's legal structure to ensure proper classification and avoid tax issues.

- Sign and date the form: The SS-4 form must be signed and dated by an authorized individual to validate the application.

- Seek assistance if needed: If you encounter any uncertainties or complications, don't hesitate to seek help from a tax professional or the IRS directly.

Don'ts:

- Don't use nicknames or abbreviations: Always use the full legal name of the business without abbreviations to prevent confusion or misidentification.

- Don't leave fields blank: If a field is applicable to your entity, make sure to provide the necessary information. If a field is not applicable, consider entering "N/A" to indicate that it has been reviewed but does not apply.

- Don't provide inaccurate entity type designation: Misclassifying your organization can lead to incorrect tax obligations and potential penalties.

- Don't guess on dates or figures: All numerical information, including dates and financials, should be exact to ensure the accuracy of your application.

- Don't forget to review the IRS instructions: The IRS provides detailed instructions for the SS-4 form, which can clarify questions and guide you through each section.

- Don't submit without checking for updates: Tax laws and form requirements can change, so it's important to ensure you're using the most current version of the form and have the latest information.

- Don't neglect to keep a copy: After submission, retain a copy of the completed form and any correspondence for your records.

Misconceptions

Understanding the IRS SS-4 form, used to apply for an Employer Identification Number (EIN), is crucial for anyone starting a business or managing taxation. However, several misconceptions exist, leading to confusion and mistakes. Let's clarify some of these misconceptions to ensure clear comprehension and smooth handling of tax responsibilities.

- The SS-4 form is only for corporations. A common misunderstanding is that the SS-4, necessary for acquiring an EIN, is solely for corporations. In fact, a variety of entities, including sole proprietors, partnerships, non-profit organizations, trusts, estates, and even individuals hiring household employees, may need to complete this form.

- Only businesses with employees need an EIN. While hiring employees is a common reason to obtain an EIN, there are other situations where it's required. For instance, if your business is taxed as a corporation or partnership, or you wish to open a business bank account, usually an EIN is necessary, regardless of your employee count.

- You can only submit an SS-4 form online. The IRS provides multiple submission options for the SS-4 form. While online application is popular and convenient, applicants can also submit this form via fax or mail, and, under certain circumstances, even by phone.

- Getting an EIN is always a complicated process. Many assume that obtaining an EIN through the SS-4 form is a lengthy and complex process. However, the IRS has streamlined the application, providing straightforward instructions, and in many cases, EINs can be issued immediately online or within a few weeks when submitted by mail or fax.

- There's a fee to obtain an EIN. Another common myth is the existence of a processing fee to acquire an EIN. The IRS does not charge to assign an EIN. Be wary of third-party services that do; while they may offer convenience, directly applying through the IRS is free.

- If your business closes, your EIN remains with you for future use. This misconception leads some to believe they can retain an EIN for a new business after closing another. EINs are unique to the business they are initially assigned to and cannot be transferred or reused for other businesses. If you start a new venture, you'll need to apply for a new EIN.

- An SS-4 form must be filed annually. Unlike tax returns, an SS-4 form for obtaining an EIN is a one-time filing requirement. Once an EIN is assigned to your business, it does not need to be renewed or reapplied for annually. However, certain changes in business structure or ownership may necessitate a new application.

- An existing personal Taxpayer Identification Number (TIN) can replace an EIN. Even if you have a personal TIN, such as a Social Security Number (SSN), your business must obtain an EIN for tax purposes if it meets the IRS criteria for needing one. Mixing personal and business taxes can lead to complications and potential legal issues.

- International applicants need a Social Security Number to obtain an EIN. A prevalent misunderstanding is that international applicants must have an SSN to complete the SS-4 form and receive an EIN. In reality, international applicants without an SSN or Individual Taxpayer Identification Number (ITIN) can still apply for an EIN by providing a foreign details and following specific IRS guidelines for international applications.

Clearing up these misconceptions about the IRS SS-4 form and the process of obtaining an EIN ensures that business owners and other entities are well informed. This leads to smoother operations, compliance with tax obligations, and the foundation for a secure financial future for businesses and their stakeholders.

Key takeaways

The IRS SS-4 form is an essential document for entities needing to obtain an Employer Identification Number (EIN). Understanding its importance and knowing how to properly complete and use this form is crucial for compliance with IRS regulations. Here are key takeaways:

An EIN is necessary for businesses to hire employees, open business bank accounts, and comply with the IRS tax requirements.

The IRS SS-4 form serves as the application for obtaining an EIN.

Applications can be submitted online, by fax, or mail, but online applications often provide the fastest EIN assignment.

It’s free to apply for an EIN through the IRS. Be cautious of third-party services that charge a fee for obtaining an EIN on your behalf.

Accurate information is paramount. Providing incorrect details can delay the process or require submitting a correction form.

The form requires details about the entity, such as the legal name, address, type of entity (corporation, partnership, etc.), and reason for applying.

Knowing the responsible party’s information is essential. The responsible party is the individual or entity that controls, manages, or directs the entity and the disposition of its funds and assets.

If changes occur with the responsible party or the entity’s structure, the IRS must be notified by filing the necessary forms or information changes.

Keep a copy of the SS-4 form and the EIN confirmation letter for your records. These documents are often required for various business activities.

There are specific instances where a new EIN is needed, such as when the ownership or structure of the entity changes significantly.

Properly completing and understanding the use of the IRS SS-4 form is a foundational step in ensuring that your entity is set up correctly from a legal and tax standpoint. Always refer to the most current IRS guidelines or consult with a tax professional if you have specific questions or situations.

Popular PDF Forms

W2 Forms - This form serves as an official amendment to the tax record of an employee as reported by an employer.

State of Georgia Workers Compensation - Incorporates physician input to confirm the suitability of proposed employment for the injured employee's condition.

Jimmy Johns Jobs - Enhance your career prospects by filling out the Jimmy John's Application for Employment, which comprehensively evaluates your suitability for a role in their fast-paced setting.