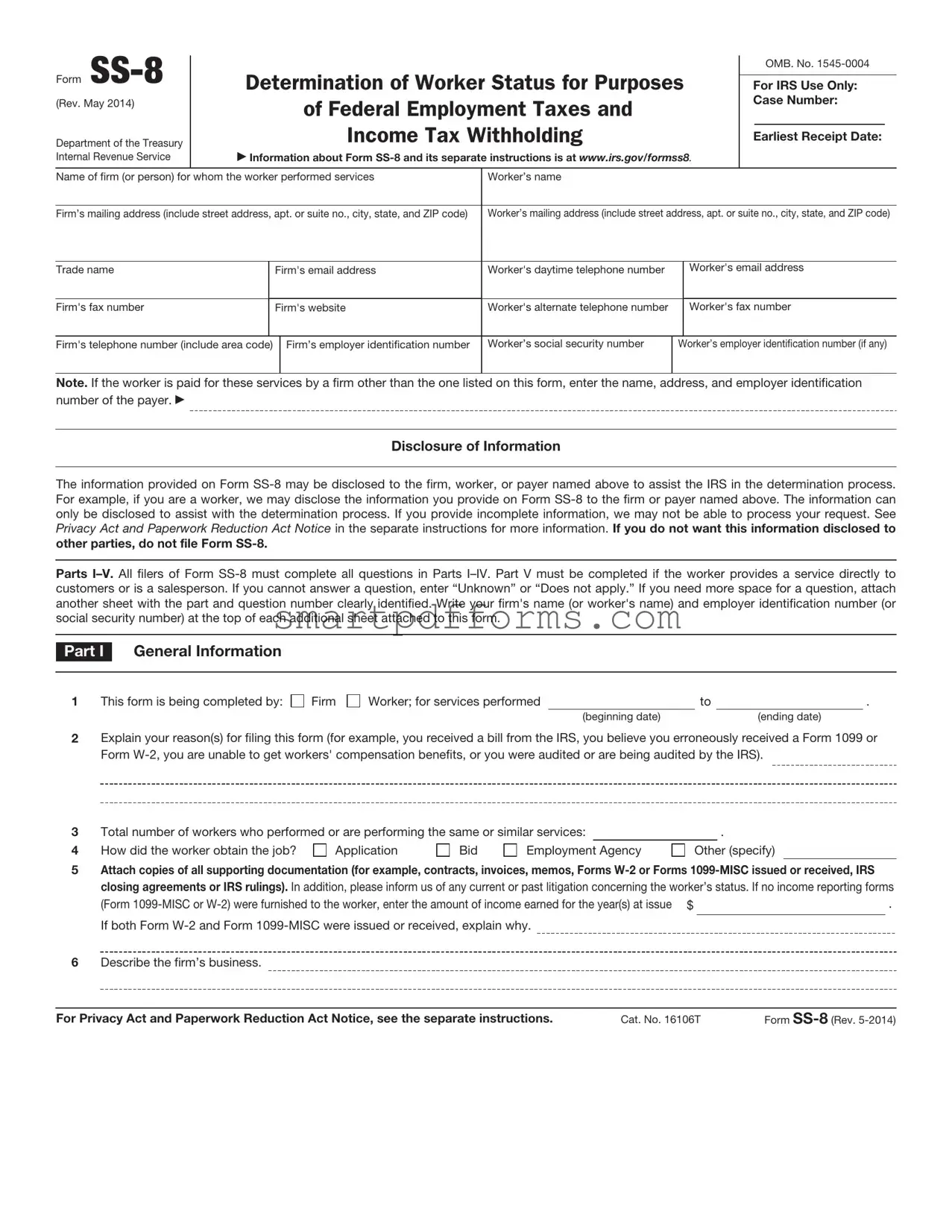

Blank IRS SS-8 PDF Template

Navigating the landscape of employment can often lead to questions about one's status as either an employee or an independent contractor. This distinction is not just a matter of titles; it bears significant implications for tax obligations, eligibility for benefits, and responsibility for withholding taxes. The Internal Revenue Service (IRS) offers a solution to this confusion through the SS-8 form, a tool designed to clarify this crucial employment status. When a worker or a company is uncertain about the correct classification, they can submit this form to the IRS for a determination. This process not only helps ensure that individuals and businesses comply with tax laws but also protects rights and clarifies duties. By providing detailed information about the nature of the work, how it is performed, and the degree of control exercised by the company over the worker, the SS-8 form plays a pivotal role in helping the IRS make informed decisions, thereby allowing workers and businesses to make appropriate arrangements for taxes and benefits.

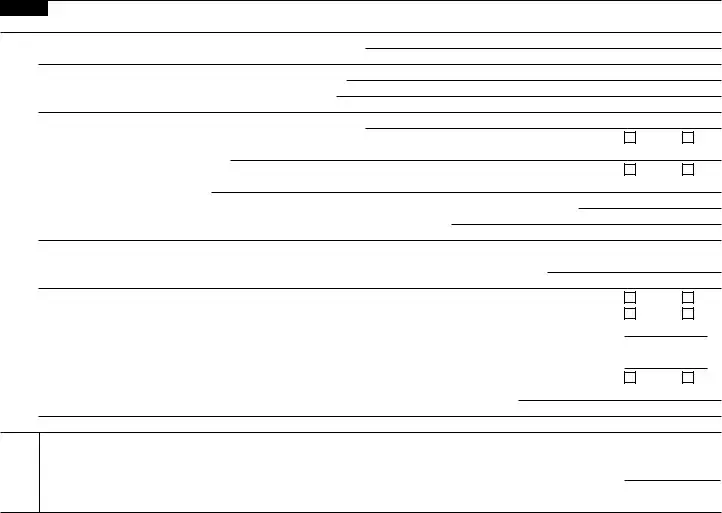

Preview - IRS SS-8 Form

Form |

Determination of Worker Status for Purposes |

|

OMB. No. |

|

|

|

|

||||

For IRS Use Only: |

|

||||

(Rev. May 2014) |

of Federal Employment Taxes and |

Case Number: |

|

||

|

|

|

|

||

|

Income Tax Withholding |

|

|

|

|

Department of the Treasury |

Earliest Receipt Date: |

|

|||

Internal Revenue Service |

Information about Form |

|

|

|

|

|

|

|

|

|

|

Name of firm (or person) for whom the worker performed services |

Worker’s name |

|

|

|

|

Firm’s mailing address (include street address, apt. or suite no., city, state, and ZIP code)

Worker’s mailing address (include street address, apt. or suite no., city, state, and ZIP code)

Trade name

Firm's email address

Worker's daytime telephone number

Worker's email address

Firm's fax number

Firm's website

Worker's alternate telephone number

Worker's fax number

Firm's telephone number (include area code)

Firm’s employer identification number

Worker’s social security number

Worker’s employer identification number (if any)

Note. If the worker is paid for these services by a firm other than the one listed on this form, enter the name, address, and employer identification number of the payer.

Disclosure of Information

The information provided on Form

Parts

Part I General Information

1This form is being completed by:

Firm

Worker; for services performed |

|

to |

|

. |

|

(beginning date) |

|

(ending date) |

|

2Explain your reason(s) for filing this form (for example, you received a bill from the IRS, you believe you erroneously received a Form 1099 or Form

3 |

Total number of workers who performed or are performing the same or similar services: |

|

|

. |

|||

4 |

How did the worker obtain the job? |

Application |

Bid |

Employment Agency |

Other (specify) |

||

5Attach copies of all supporting documentation (for example, contracts, invoices, memos, Forms

|

(Form |

. |

|

|

If both Form |

|

|

6 |

Describe the firm’s business. |

|

|

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 16106T |

Form |

Form |

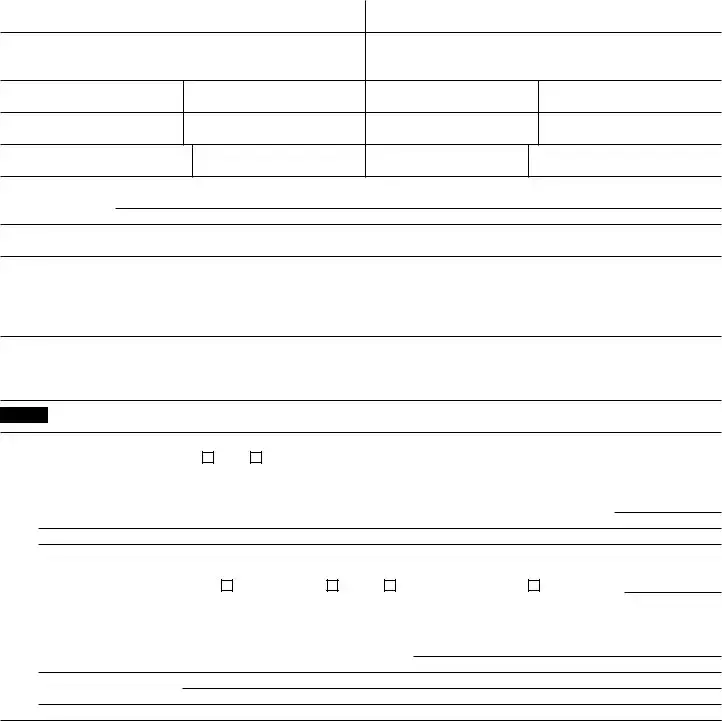

Page 2 |

Part I General Information (continued)

7If the worker received pay from more than one entity because of an event such as the sale, merger, acquisition, or reorganization of the firm for whom the services are performed, provide the following: Name of the firm's previous owner:

Previous owner's taxpayer identification number: |

Change was a: |

Sale |

Merger |

Acquisition |

Reorganization |

Other (specify) |

|

|

|

|

|

Description of above change: |

|

|

|

|

|

Date of change (MM/DD/YY):

8Describe the work done by the worker and provide the worker’s job title.

9Explain why you believe the worker is an employee or an independent contractor.

10Did the worker perform services for the firm in any capacity before providing the services that are the subject of this determination request?

Yes

No

N/A

If “Yes,” what were the dates of the prior service?

If “Yes,” explain the differences, if any, between the current and prior service.

11If the work is done under a written agreement between the firm and the worker, attach a copy (preferably signed by both parties). Describe the terms and conditions of the work arrangement.

Part II Behavioral Control (Provide names and titles of specific individuals, if applicable.)

1What specific training and/or instruction is the worker given by the firm?

2How does the worker receive work assignments?

3Who determines the methods by which the assignments are performed?

4Who is the worker required to contact if problems or complaints arise and who is responsible for their resolution?

5What types of reports are required from the worker? Attach examples.

6Describe the worker’s daily routine such as his or her schedule or hours.

7At what location(s) does the worker perform services (for example, firm’s premises, own shop or office, home, customer’s location)? Indicate the appropriate percentage of time the worker spends in each location, if more than one.

8Describe any meetings the worker is required to attend and any penalties for not attending (for example, sales meetings, monthly meetings, staff meetings).

9 |

Is the worker required to provide the services personally? |

Yes |

No |

10If substitutes or helpers are needed, who hires them?

11 |

If the worker hires the substitutes or helpers, is approval required? |

Yes |

No |

|

If “Yes,” by whom? |

|

|

12Who pays the substitutes or helpers?

13 |

Is the worker reimbursed if the worker pays the substitutes or helpers? |

Yes |

No |

|

If “Yes,” by whom? |

|

|

Form

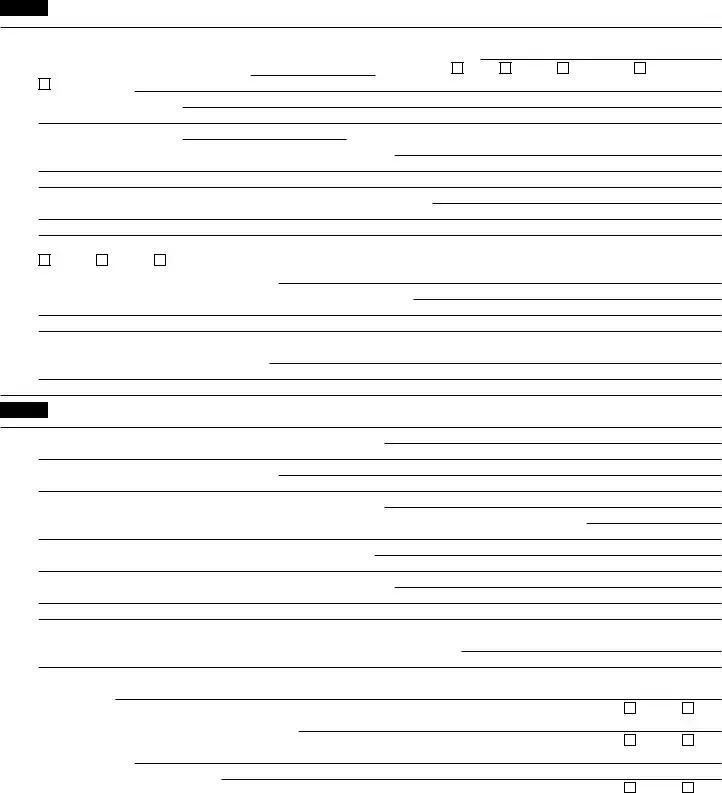

Form |

Page 3 |

Part III Financial Control (Provide names and titles of specific individuals, if applicable.)

1List the supplies, equipment, materials, and property provided by each party: The firm:

The worker:

Other party:

2 Does the worker lease equipment, space, or a facility? . . . . . . . . . . . . . . . . . . . .

If “Yes,” what are the terms of the lease? (Attach a copy or explanatory statement.)

Yes

No

3What expenses are incurred by the worker in the performance of services for the firm?

4Specify which, if any, expenses are reimbursed by: The firm:

|

Other party: |

|

|

|

|

|

|

|

5 |

Type of pay the worker receives: |

Salary |

Commission |

Hourly Wage |

Piece Work |

|

||

|

Lump Sum |

Other (specify) |

|

|

|

|

|

|

|

If type of pay is commission, and the firm guarantees a minimum amount of pay, specify amount. $ |

|

|

|

||||

6 |

Is the worker allowed a drawing account for advances? |

Yes |

No |

|||||

|

If “Yes,” how often? |

|

|

|

|

|

|

|

|

Specify any restrictions. |

|

|

|

|

|

|

|

7 |

Whom does the customer pay? |

. . . . . . |

Firm |

|

|

If worker, does the worker pay the total amount to the firm? |

Yes |

No If |

“No,” explain. |

Worker

8 |

Does the firm carry workers' compensation insurance on the worker? |

Yes |

No |

9What economic loss or financial risk, if any, can the worker incur beyond the normal loss of salary (for example, loss or damage of equipment, material)?

10 |

Does the worker establish the level of payment for the services provided or the products sold? |

|

If “No,” who does? |

Yes

No

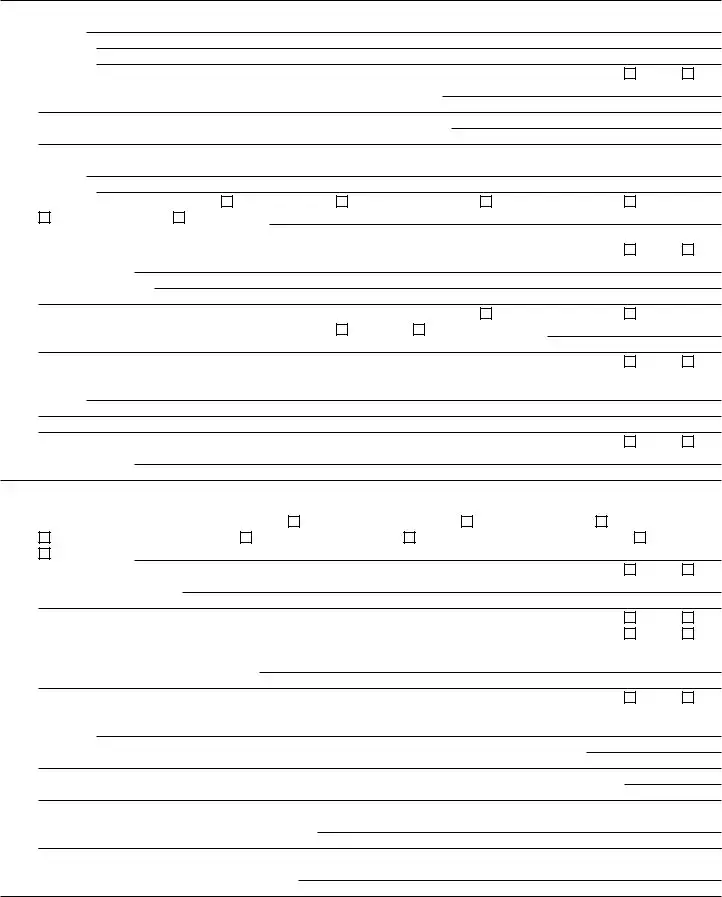

Part IV |

Relationship of the Worker and Firm |

|

|

|

|

||

|

|

|

|

|

|

|

|

1 |

Please check the benefits available to the worker: |

Paid vacations |

Sick pay |

Paid holidays |

|

||

|

|

Personal days |

Pensions |

|

Insurance benefits |

Bonuses |

|

|

|

Other (specify) |

|

|

|

|

|

2 |

Can the relationship be terminated by either party without incurring liability or penalty? |

Yes |

No |

||||

|

If “No,” explain your answer. |

|

|

|

|

|

|

3 |

Did the worker perform similar services for others during the time period entered in Part I, line 1? |

Yes |

No |

||||

|

If “Yes,” is the worker required to get approval from the firm? |

Yes |

No |

||||

4Describe any agreements prohibiting competition between the worker and the firm while the worker is performing services or during any later period. Attach any available documentation.

5 Is the worker a member of a union? |

Yes |

6What type of advertising, if any, does the worker do (for example, a business listing in a directory or business cards)? Provide copies, if applicable.

7If the worker assembles or processes a product at home, who provides the materials and instructions or pattern?

No

8What does the worker do with the finished product (for example, return it to the firm, provide it to another party, or sell it)?

9How does the firm represent the worker to its customers (for example, employee, partner, representative, or contractor), and under whose business name does the worker perform these services?

10If the worker no longer performs services for the firm, how did the relationship end (for example, worker quit or was fired, job completed, contract ended, firm or worker went out of business)?

Form

Form |

Page 4 |

Part V For Service Providers or Salespersons. Complete this part if the worker provided a service directly to customers or is a salesperson.

1What are the worker’s responsibilities in soliciting new customers?

2Who provides the worker with leads to prospective customers?

3Describe any reporting requirements pertaining to the leads.

4What terms and conditions of sale, if any, are required by the firm?

5 Are orders submitted to and subject to approval by the firm? . . . . . . . . . . . . . . . . . .

6Who determines the worker’s territory?

7 |

Did the worker pay for the privilege of serving customers on the route or in the territory? |

|

If “Yes,” whom did the worker pay? |

|

If “Yes,” how much did the worker pay? . . . . . . . . . . . . . . . . . . . . . $ |

8Where does the worker sell the product (for example, in a home, retail establishment)?

Yes

Yes

No

No

9List the product and/or services distributed by the worker (for example, meat, vegetables, fruit, bakery products, beverages, or laundry or dry cleaning services). If more than one type of product and/or service is distributed, specify the principal one.

10 |

Does the worker sell life insurance full time? |

11 |

Does the worker sell other types of insurance for the firm? |

|

If “Yes,” enter the percentage of the worker’s total working time spent in selling other types of insurance |

12If the worker solicits orders from wholesalers, retailers, contractors, or operators of hotels, restaurants, or other similar

establishments, enter the percentage of the worker’s time spent in the solicitation . . . . . . . . . . . .

13Is the merchandise purchased by the customers for resale or use in their business operations? . . . . . . . .

Describe the merchandise and state whether it is equipment installed on the customers’ premises.

Yes Yes

Yes

No No

%

%

No

Sign Here

Under penalties of perjury, I declare that I have examined this request, including accompanying documents, and to the best of my knowledge and belief, the facts presented are true, correct, and complete.

F |

|

Title |

|

Date |

|

|

|

||

|

|

|

|

|

|

Type or print name below signature. |

|

|

|

Form

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form SS-8 | This form is used to determine the status of a worker for federal tax purposes, whether they are an independent contractor or an employee. |

| Who Can File | Either the worker or the firm can file Form SS-8 to request a determination of the worker’s status. |

| Impact of Determination | The IRS's determination will affect how the worker is taxed and whether they are entitled to employee benefits. |

| Governing Law | Form SS-8 determinations are governed by federal tax law, specifically the Internal Revenue Code and regulations. |

Instructions on Utilizing IRS SS-8

When dealing with the uncertainty of worker status for tax purposes, individuals or firms can turn to the IRS Form SS-8. This form is used to request a formal determination of a worker’s status, deciphering whether they should be classified as an employee or an independent contractor. After submission, the IRS reviews the provided information to make this determination. It is paramount to provide comprehensive and accurate information to facilitate a well-informed decision by the IRS.

- Start by downloading the most current version of Form SS-8 from the IRS website to ensure all recent updates are included.

- Read through the form carefully to understand the type of information required. Use the instructions provided by the IRS to assist in filling out the form accurately.

- Section 1 focuses on information about the firm. Fill in the legal name of the firm, address, type of business, and the form of business entity (LLC, partnership, corporation, etc.).

- In Section 2, provide information regarding the worker whose status is in question. This includes the worker's name, address, and the nature of the work performed.

- Section 3 requires details about the relationship between the firm and the worker. Answer questions pertaining to behavioral control, financial control, and the type of relationship that exists, including questions about contracts, benefits, and the permanency of the relationship.

- Throughout the form, there are sections for additional information where you can explain or provide further details about the worker’s duties, the contractual agreement, or other relevant circumstances. Utilize these sections fully to give a comprehensive picture of the worker’s role and relationship with the firm.

- Review the information provided for accuracy and completeness. Double-check the form to ensure that no applicable section has been missed.

- Sign and date the form. If you are filling this out on behalf of a firm, ensure that an authorized person signs the form.

- Mail the completed form to the IRS. The specific mailing address can be found in the instructions for the Form SS-8.

- After submission, wait for the IRS to process the request. This may take several months, during which the IRS might contact either the firm or the worker for additional information.

The completion and submission of Form SS-8 set into motion a detailed review by the IRS to establish a worker’s status. While this process takes time, it provides clarity and guidance for tax reporting obligations. After the IRS reaches a decision, both the firm and the worker will be notified, thereby providing an official stance on the worker’s employment status.

Obtain Answers on IRS SS-8

-

What is the IRS SS-8 Form?

The IRS SS-8 form, officially titled "Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding," is used to request a determination from the Internal Revenue Service (IRS) about whether a worker should be classified as an employee or an independent contractor. This classification affects how workers are taxed and whether they are entitled to certain benefits and protections under the law.

-

Why would someone file an SS-8 Form?

There are several reasons to file an SS-8 form. Workers might file it if they believe their employer has incorrectly classified them as independent contractors instead of employees, potentially missing out on benefits like health insurance, retirement plans, and overtime pay. Employers might also file it to ensure they are complying with tax laws when determining worker classification.

-

How does the IRS determine worker status?

The IRS uses a variety of factors to determine worker status, focusing on the degree of control and independence in the relationship. These factors are grouped into three categories: behavioral control (instructions, training); financial control (investment, expenses, opportunity for profit or loss); and the type of relationship (contracts, benefits, permanency of the relationship). No single factor stands alone, and the entire situation is taken into account.

-

What happens after submitting an SS-8 Form?

After submitting an SS-8 form, the IRS reviews the information provided and may contact the worker, the firm, or both for additional information. Once the IRS makes a determination, it will send a letter to both the worker and the firm stating the worker's status. This process can take at least six months, and during this time, it's important for the worker and the firm to continue meeting all tax obligations.

-

Can the determination made by the IRS be appealed?

Yes, the determination made by the IRS can be appealed. If either the worker or the firm disagrees with the IRS's determination, they can request a reconsideration. This involves submitting a written request stating why they believe the determination is incorrect, along with any additional documentation to support their position. The specifics of the appeals process are outlined in the determination letter.

-

How long does it take to get a determination after filing an SS-8?

The time it takes to get a determination after filing an SS-8 Form varies and can be lengthy. Typically, it can take at least six months, but it could be longer depending on the complexity of the case and the current IRS workload. It's crucial for both parties to be prepared for this waiting period and continue to comply with tax laws in the meantime.

-

Is filing an SS-8 Form confidential?

While the IRS takes confidentiality seriously, filing an SS-8 Form is not entirely without risk of disclosure. When a worker files an SS-8 form, the IRS might contact the employer for more information, thereby revealing the worker's name as part of the inquiry. However, the IRS does not disclose the worker's reason for filing the form or the fact that it was the worker who initiated the case.

Common mistakes

Filling out the IRS SS-8 form, which determines whether a worker should be classified as an employee or an independent contractor, is a critical process that requires meticulous attention to detail. However, individuals commonly encounter pitfalls during this process. Recognizing and avoiding these mistakes can significantly streamline your dealings with the IRS.

Not providing detailed information about the working relationship. It is essential to describe the nature of the work and the relationship between the worker and the company in depth, as this greatly influences the IRS's determination.

Overlooking the importance of the behavioral control questions. The IRS uses these questions to assess how much control the business has over how the worker does the job. Ambiguous or incomplete answers can lead to a misclassification.

Failing to accurately describe the financial control. This relates to how the business pays the worker and any reimbursement of expenses. Clear and precise information helps the IRS understand the financial ties between the parties.

Ignoring the relationship of the parties section. This aspect of the form clarifies how the worker and business perceive their relationship, which is crucial for the final determination.

Misunderstanding the purpose of the form. Some individuals mistakenly fill out the form for situations that it is not designed for, such as disputing wages or seeking tax advice.

Apart from the aforementioned errors, there are other frequent oversights:

Not checking the latest version of the form. The IRS occasionally updates its forms, and using an outdated version can delay the determination process.

Leaving sections blank. Every question on the SS-8 form is designed to elicit information that is crucial for an accurate determination. Skipping questions can result in a need for further clarification, thereby lengthening the process.

Failing to provide additional documentation when necessary. In some cases, the IRS may require further documentation to understand the working relationship fully. Not supplying this when requested can also lead to delays.

Submitting handwritten forms that are hard to read. While handwritten forms are accepted, they must be legible. Poor handwriting can lead to misunderstandings or request for resubmission.

Incorrectly assuming the determination is immediate. The process can take several months, and expecting a quick turnaround can lead to frustration and improper planning.

By being vigilant and avoiding these common mistakes, individuals can navigate the IRS SS-8 form process more efficiently and with greater confidence in the outcome.

Documents used along the form

The IRS SS-8 form plays a pivotal role in determining the status of workers as either employees or independent contractors. This determination is crucial as it influences tax responsibilities, benefits, and protections under labor laws. Accompanying the SS-8, there are several other forms and documents that are commonly utilized. These materials support various aspects of employment, tax, and legal documentation, ensuring comprehensive compliance and clarity for both parties involved.

- Form W-9, Request for Taxpayer Identification Number and Certification: This form is often used by businesses to request the taxpayer identification number (TIN) of a U.S. person, including resident aliens, and to request certain certifications and claims for exemption. It's pivotal for independent contractors, as it aids employers in reporting income paid to the IRS.

- Form 1099-MISC, Miscellaneous Income: Employers use this document to report payments made to independent contractors if they pay them $600 or more in a year. It's essential for reporting income other than wages, salaries, and tips.

- Form 1099-NEC, Nonemployee Compensation: Recently separated from form 1099-MISC, this form is specifically used to report any compensation of $600 or more paid to non-employees, such as independent contractors, to the IRS.

- Form W-2, Wage and Tax Statement: This form is used by employers to report wage, salary, and other compensation paid to employees. The data on the form is vital for employees when preparing their tax returns.

- Form W-4, Employee's Withholding Certificate: Employees use this form to indicate their tax situation to their employer. The employer then uses the information to withhold the correct federal income tax from their pay.

- Form I-9, Employment Eligibility Verification: Both employees and employers use this form to verify the identity and employment authorization of individuals hired for employment in the United States. This document is critical for compliance with the Immigration Reform and Control Act.

- State-Specific New Hire Reporting Forms: Employers are also required to report new or rehired employees to a designated state directory, often within 20 days of their hire or rehire date. These forms vary by state but are essential for maintaining compliance with state employment laws.

Together, these forms and documents form a comprehensive suite that addresses multiple facets of the employment relationship and tax compliance. They work in conjunction with the IRS SS-8 form to ensure that worker classifications align with federal and state regulations, protecting the rights and responsibilities of both workers and employers. Familiarity with these documents is a critical component of maintaining compliance and fostering transparent, fair employment practices.

Similar forms

W-9 Form: This form, like the IRS SS-8, is used to provide taxpayer identification information. However, the W-9 is provided to independent contractors or freelancers by businesses to report income to the IRS, instead of being used to determine employee status.

W-4 Form: The IRS W-4 form is similar because it is also involved in the employment process, specifically for new hires. It's used by employees to determine the amount of federal income tax to withhold from their pay, contrasting with the SS-8's purpose of clarifying worker status for tax liability reasons.

1099-NEC Form: This document is used for reporting non-employee compensation, closely aligning with one potential outcome of the SS-8 determination—identifying workers as independent contractors. Both forms help the IRS track how individuals should be taxed based on their working relationship with an entity.

I-9 Form: The I-9 form is utilized to verify the identity and employment authorization of individuals hired for employment in the United States, much like the SS-8 plays a role in the employment classification process. While the I-9 focuses on eligibility to work, the SS-8 focuses on whether someone is an employee or an independent contractor for tax purposes.

8832 Form: This form is used by businesses to choose their tax classification. Similar to the SS-8, it involves determining the appropriate tax status which affects how taxes are reported and paid. The key difference is that Form 8832 is used by entities to select their classification, whereas the SS-8 addresses individuals' employment status.

Dos and Don'ts

Filling out the IRS SS-8 form involves distinguishing between an employee and an independent contractor for tax purposes. This distinction is crucial, as it affects tax responsibilities and benefits eligibility. To complete this form effectively, here are some do's and don'ts:

- Do gather all necessary information about your work relationship with the company or individual you're providing services to. This includes contracts, payment receipts, and descriptions of the work performed.

- Do review the IRS criteria for what constitutes an independent contractor versus an employee. Understanding these guidelines will help you answer the questions on the form more accurately.

- Do answer every question to the best of your knowledge. If a question does not apply to your situation, mark it as "Not Applicable" or "N/A" instead of leaving it blank.

- Do provide detailed explanations when asked. Brief, unclear answers may delay processing or lead to misunderstandings about your work relationship.

- Do review your completed form for accuracy before submitting. Double-check for any spelling errors, incorrect dates, or omitted information.

- Don't guess on answers. If you're unsure about how to answer a question, it's better to seek clarification from the IRS or a tax professional than to risk providing incorrect information.

- Don't use technical jargon or industry-specific terms without explanation. Keep your descriptions clear and understandable to someone not familiar with your line of work.

- Don't forget to sign and date the form before submitting. An unsigned form is considered incomplete and will not be processed.

- Don't neglect to keep a copy of the completed form and any correspondence with the IRS for your records. This documentation can be crucial if there are any questions or disputes in the future.

Misconceptions

The IRS Form SS-8, titled "Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding," often triggers a series of misconceptions among both employers and workers. Understanding and clarifying these misconceptions is crucial in ensuring compliance with IRS regulations and avoiding potential penalties. Below are eight common misconceptions about the IRS SS-8 form:

Only employees can request a determination. In reality, both employers and workers can file Form SS-8 to request a determination of a worker’s status. This request can help clarify if a worker should be classified as an employee or an independent contractor.

Filing an SS-8 for a worker automatically triggers an IRS audit. This is not necessarily true. While filing SS-8 may lead to a closer look at the relationship between the worker and the employer, it does not automatically trigger an IRS audit. The primary purpose of the form is to determine the worker's status.

Submitting an SS-8 will result in an immediate response from the IRS. Many expect a swift reply once they submit the form. However, due to the complexity of employment tax issues and the volume of requests the IRS receives, it can take several months to receive a determination.

The determination made by the IRS is only advisory and not binding. This is incorrect. The determination by the IRS on a worker's status is binding on the taxpayer unless successfully appealed. This holds significant implications for taxes and compliance.

An SS-8 determination applies to all workers in similar roles within the company. Each SS-8 determination is specific to the individual worker and the facts of their case. Employers should not assume that a determination applies broadly to all workers in similar positions.

There are no repercussions for disregarding the determination. Ignoring or failing to comply with an SS-8 determination can lead to penalties, interest, and the accrual of back taxes. It’s essential to adhere to the determination or seek a proper appeal if there are grounds to do so.

The SS-8 form is only for the use of for-profit entities. Both for-profit and non-profit entities, as well as workers, can use the SS-8 form when there is uncertainty about the correct classification of a worker.

If a worker is deemed an employee, the employer must pay all back taxes owed with no penalties. While it’s true that classification as an employee may result in the employer being responsible for back taxes, the IRS may also assess penalties and interest. However, there are relief programs available under certain conditions that can reduce or eliminate these penalties.

Correct understanding and application of the rules concerning the IRS SS-8 form are key to ensuring compliance and avoiding unnecessary financial or legal consequences. Employers and workers alike should consider seeking advice from tax professionals when navigating these complex areas.

Key takeaways

The Internal Revenue Service (IRS) Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, plays a crucial role in defining the relationship between workers and those who hire them. Here are several key takeaways concerning the filling out and using of the IRS SS-8 form:

- Determining Worker Status: The primary function of the IRS SS-8 form is to determine whether a worker should be classified as an employee or an independent contractor. This classification affects how workers are taxed and how they pay their taxes.

- Impact on Taxes and Benefits: The delineation between an employee and an independent contractor has significant tax implications for both the worker and the employer, including who is responsible for withholding income taxes and paying Social Security and Medicare taxes. It also affects eligibility for benefits and protections such as unemployment insurance and workers’ compensation.

- Voluntary Submission: Either a worker or an employer can submit Form SS-8 to the IRS for clarification of a worker’s status. Submission is voluntary but recommended in cases where the status is unclear or disputed.

- Comprehensive Questionnaire: The SS-8 form contains a detailed set of questions regarding the nature of the work, the relationship between the worker and the company, and how the worker is paid. The answers provided play a crucial role in the IRS’s determination process.

- Response Time: Patience is required as the IRS’s decision on the form can take at least six months. During this period, compliance with existing tax laws, based on the filer's understanding of the worker's status, is essential.

- Confidentiality: The inquiry process is confidential, and the IRS does not disclose who submitted the form. However, the information provided may lead to further investigation by the IRS.

- Legal and Financial Consequences: The determination made by the IRS through Form SS-8 can have legal and financial consequences. It’s important to consult with a tax professional or a lawyer to fully understand the implications of the classification and to ensure compliance with tax laws and employment regulations.

Utilizing the IRS SS-8 form correctly is a measure that promotes fair treatment of workers and adherence to federal tax obligations. Given the complexities of employment law and the IRS’s procedures, seeking expert advice when in doubt is highly advisable.

Popular PDF Forms

Sexual Consent Contract - A Sexual Contract isn't just about rules; it's about fostering a deeper, more satisfying connection.

What Happened to Forethought Life Insurance Company? - District of Columbia residents are warned that providing false information is a crime with potential imprisonment and fines.

1099 Write Off List - Helps to ensure that self-employed professionals meet their tax obligations and are eligible for Social Security benefits upon retirement.