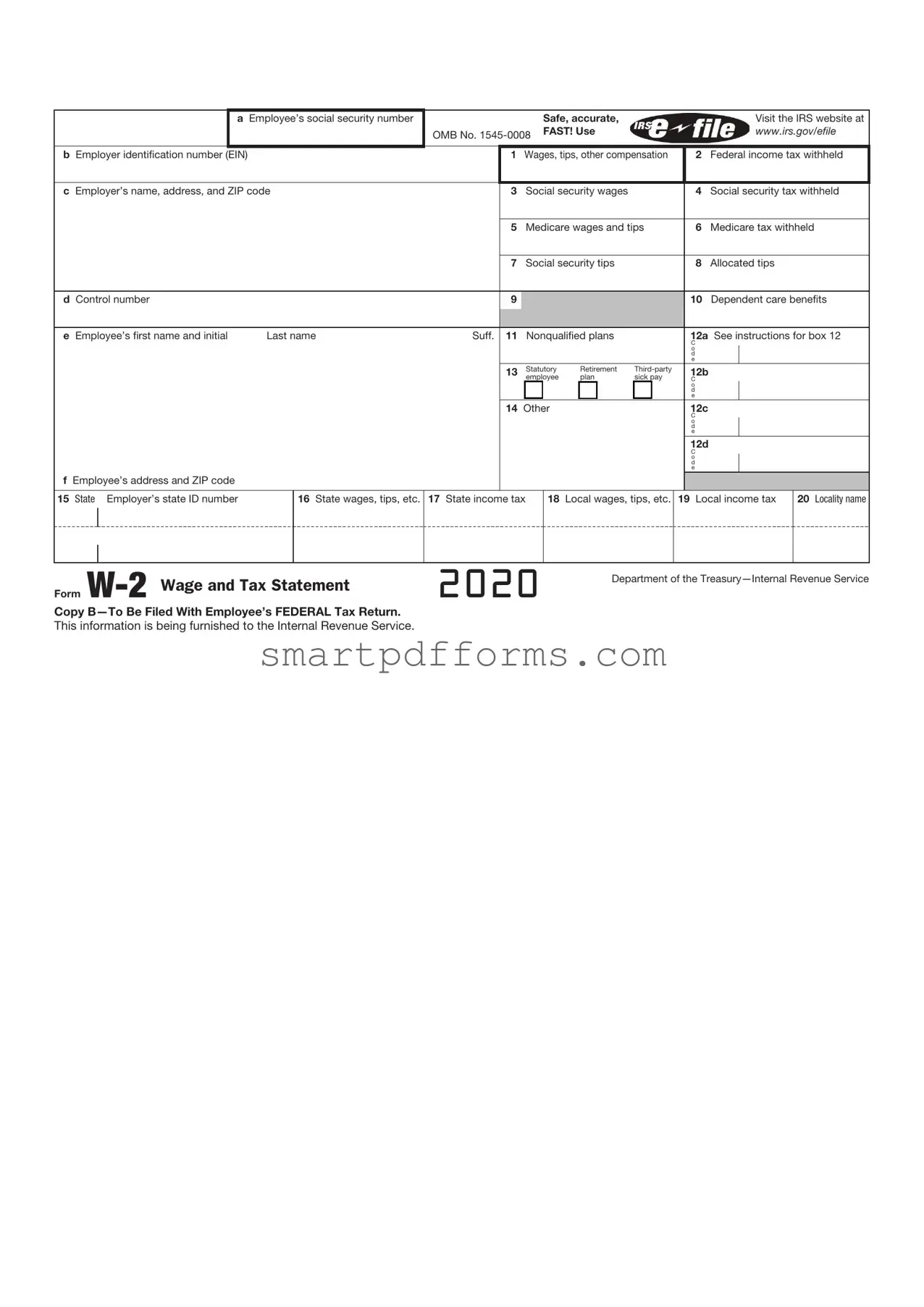

Blank IRS W-2 PDF Template

The landscape of taxpayer obligations in the United States features the IRS W-2 form as a cornerstone document, pivotal for both employees and employers in the meticulous journey of annual income reporting and tax preparation. At the very heart of annual tax filing, the W-2 form serves as a comprehensive record of an individual's earnings from employment, including wages, tips, and other compensations, alongside the taxes withheld by the employer over the course of the year. Not only does this form play a crucial role in validating an employee's income tax return, but it also aids in ensuring that Social Security and Medicare contributions are accurately reported. The obligations surrounding the W-2 form extend to employers who are tasked with the meticulous preparation and timely distribution of the form to both their employees and the Social Security Administration, thereby anchoring the form as an essential element in the broader framework of fiscal responsibility and regulatory compliance. This form's dual utility underscores its significance in the synchrony between individual taxpayer duties and the operational responsibilities of employers, underscoring the critical nature of the W-2 in the overall tapestry of the nation's tax system.

Preview - IRS W-2 Form

|

|

I |

Employee’s social security number |

|

|

|

Safe, accurate, |

Visit the IRS website at |

|

||||||||||||

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

OMB No. |

FAST! Use |

|

|

|

|

|

|

|

www.irs.gov/efile |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

|

4 Social security tax withheld |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

|

8 |

Allocated tips |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

[_J |

|

|

|

|

|

|

|

|

|

Dependent care benefits |

|||||||

|

|

|

9 |

|

|

|

|

|

|

|

|

10 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

|

12a See instructions for box 12 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

|

12b |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

|

sick pay |

|

C |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

□ |

|

□ |

|

|

□ |

|

|

e |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

|

12c |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2020 |

|

|

Department of the |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

This information is being furnished to the Internal Revenue Service.

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form W-2 | The Form W-2 is used by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. |

| Deadline for Distribution | Employers must send the Form W-2 to employees by January 31st of the year following the reporting year. |

| Electronic Submission | Employers can submit Form W-2 to the Social Security Administration electronically, and this is required for employers who issue 250 or more W-2 forms. |

| Correcting Errors | If there are errors on a W-2, employers must correct them using a Form W-2c, Corrected Wage and Tax Statement. |

| Impact on Tax Returns | Information from Form W-2 is used by employees to file their federal and state tax returns. |

| State-Specific Forms | Some states have their own version of the W-2 form or additional requirements; these are governed by individual state laws. |

| Penalties for Noncompliance | Employers who fail to provide accurate W-2 forms by the deadline can face penalties from the IRS. |

Instructions on Utilizing IRS W-2

Filling out the IRS W-2 form is a critical step for employers at the end of the fiscal year. It involves reporting wages paid to employees and taxes withheld from their paychecks. The process requires attention to detail to ensure accuracy and compliance with federal regulations. By following these steps carefully, employers can fulfill their obligations and help their employees complete their tax returns efficiently.

- Start by gathering all necessary employee information, including full names, addresses, Social Security numbers, and total wages paid.

- Obtain the Employer Identification Number (EIN) and the employer's name and address as registered with the IRS.

- Fill in the employee's Social Security number in the appropriate box on the form.

- Enter the employer's EIN, name, and address in the designated fields.

- Report the total wages, tips, and other compensation paid to the employee in the year in box 1.

- Calculate and enter the amount of federal income tax withheld from the employee's pay in box 2.

- Record the total amount of Social Security wages in box 3, along with any Social Security tax withheld in box 4.

- Input the total Medicare wages and tips in box 5, and the Medicare tax withheld in box 6.

- If applicable, fill in box 7 with social security tips.

- Include any allocated tips in box 8, following the guidelines for tip reporting.

- Utilize boxes 9 through 14 to report any additional income, deductions, or tax withholdings as specified by the IRS instructions.

- Ensure that state and local tax information is accurately reported in the designated sections.

- Double-check all entered information for accuracy before finalizing the form.

- Distribute W-2 copies to employees no later than January 31, allowing them to file their tax returns.

- Submit the employer copy of the W-2 form to the Social Security Administration by the end of January, along with Form W-3, which summarizes the W-2 information.

After completing the necessary steps to fill out and distribute the W-2 forms, employers should retain copies for their records. Maintaining accurate and accessible records is essential for future reference and in case of inquiries from the IRS or employees. Employers should also be prepared to correct any mistakes by issuing amended W-2 forms if errors are discovered after distribution.

Obtain Answers on IRS W-2

-

What is the purpose of the IRS W-2 form?

The IRS W-2 form serves as an official report detailing the income an individual has received from their employer over the tax year, alongside the taxes withheld from their paycheck. It is a necessity for employees to prepare their annual tax returns, as it provides essential information to accurately report earnings, tax withholdings, Social Security contributions, and Medicare contributions. It must be sent to each employee and the Internal Revenue Service (IRS) by employers, ensuring both the employer and the employee's compliance with federal tax obligations.

-

When should I receive my W-2 form?

Employers are under a mandate to furnish W-2 forms to their employees by January 31st of the year following the reported earnings year. This deadline allows for employees to have ample time to prepare their tax returns ahead of the April 15 tax filing deadline. If the date is on a weekend or holiday, the deadline is extended to the next business day. If you have not received your W-2 by the expected time, it is advised to first contact your employer to ensure it was sent. If this does not resolve the issue, you may contact the IRS for assistance.

-

What should I do if there are errors on my W-2 form?

If you spot inaccuracies on your W-2, it's essential to take immediate action to have these errors corrected. The first step is to reach out to your employer for a corrected form, known as a W-2c. This includes discrepancies in your name, Social Security number, reported wages, or withholdings. It's imperative for your tax records to reflect accurate information to prevent potential issues with your tax return, including delays in processing or unexpected tax liabilities.

-

Can I file my taxes without a W-2 form?

Filing your taxes without a W-2 is discouraged as it can lead to errors in your tax return. However, if you haven't received your W-2 in time for the filing deadline, you may use Form 4852, which serves as a substitute for the W-2. On Form 4852, you will need to estimate your wage and withholding information to the best of your ability, based on your final pay stub or other documentation. It's vital to notify the IRS about the missing W-2 and to try obtaining the actual figures to amend your return once you receive the missing W-2 form.

-

How do I file my W-2 form if I worked in multiple states?

Working in multiple states throughout the year can complicate the W-2 filing process since you’ll potentially owe state taxes in more than one jurisdiction. In such instances, you should receive a W-2 form from each employer for whom you worked during the year, and each should correctly reflect the income you earned in the respective state. It's important to file a separate state tax return for each state, according to their individual filing requirements, and to report the income earned within each. This may result in needing to allocate your income among the states based on where it was earned, which can get complex, and sometimes seeking help from a tax professional may be beneficial.

-

Is it possible to receive a W-2 form if I am self-employed?

As a self-employed individual, you will not receive a W-2 form. W-2 forms are specifically designed for individuals who are considered employees of a business. Instead, self-employed individuals commonly report their income and expenses on Schedule C (Form 1040) or Schedule C-EZ (for simpler tax situations), and pay self-employment taxes as per Schedule SE (Form 1040). If you've performed work as an independent contractor, you may receive Form 1099-NEC from businesses for which you've completed work of $600 or more during the tax year.

-

What measures should I take if my W-2 form is lost or stolen?

If your W-2 form is lost or stolen, it's crucial to act promptly to mitigate the risk of identity theft or delays in tax filing. Begin by contacting your employer to issue a replacement W-2 form. If you're unable to obtain a replacement in time for tax filing, you may file Form 4852 as a substitute. It’s also advisable to monitor your credit reports and IRS account for any unusual activity, as the personal information on a W-2 could be used for fraudulent purposes. Be proactive in safeguarding your personal information in the future to prevent similar incidents.

Common mistakes

When it comes to accurately filling out IRS W-2 forms, several common mistakes can lead to delays, incorrect tax calculations, or notices from the Internal Revenue Service (IRS). Avoiding these errors is crucial for both the employee and employer to ensure compliance with tax laws and regulations. Here are seven frequent missteps to watch out for:

-

Incorrect or Missing Social Security Numbers - Providing a Social Security Number (SSN) that is incorrect or omitting it altogether can result in processing delays and potentially incorrect tax calculations.

-

Mismatched Names and Social Security Numbers - Names on the W-2 form must match exactly with the information on the Social Security card. Any discrepancies can cause issues with the IRS and may affect social security benefits.

-

Incorrect Tax Year - Filling in the form with the wrong tax year can lead to confusion and complications when the IRS processes annual tax returns. It's important to verify the tax year before submission.

-

Errors in Wages, Tips, and Other Compensation - Reporting inaccurate figures for wages, tips, or other forms of compensation can lead to miscalculations in taxes owed or refunds.

-

Failing to Report All Income Sources - Omitting additional sources of income, such as bonuses or commissions, can result in incorrect tax filings and potential penalties.

-

Incorrect Taxable Income After Pre-Tax Contributions - Not accounting for pre-tax contributions to retirement accounts, health savings accounts (HSAs), or flexible spending accounts (FSAs) correctly may lead to reporting higher taxable income than necessary.

-

Incorrect State or Local Tax Information - Mistakes in state or local tax reporting can lead to discrepancies and require amendments. This includes incorrect state or municipality identifiers or incorrect amounts for state or local taxes withheld.

By carefully preparing and reviewing the IRS W-2 form to ensure accuracy in these areas, both employees and employers can avoid these common pitfalls. Attention to detail and double-checking entries can prevent unnecessary headaches during the tax season.

Documents used along the form

The IRS W-2 form, a crucial document for both employers and employees, serves as a summary of an individual's earnings and tax withholdings for a given year. It plays a vital role in preparing annual tax returns, providing verifiable data regarding one's income taxes, Social Security, and Medicare contributions. Its importance in the financial documentation ecosystem is further highlighted when used alongside other forms and documents that complement or require information from the W-2. Below is an overview of several key forms and documents often utilized in conjunction with the IRS W-2 form.

- Form 1040: The U.S. Individual Income Tax Return is where individuals report their yearly income, deductions, and credits to compute their tax liability or refund. The information on the W-2 is crucial for accurately filling out this form, particularly for reporting wages, salary, and taxes withheld.

- Form W-4: The Employee's Withholding Certificate determines the amount of taxes to be withheld from an employee's paycheck. While it does not directly accompany the W-2 during tax filing, the information provided on the W-4 affects the data reported on the W-2 at the end of the year.

- Schedule C (Form 1040): For individuals who are self-employed or own small businesses, this form is used to report income or loss from a business. The W-2 forms might be necessary for those who have both employment income and self-employment income to provide a complete picture of their earnings for the year.

- Form 1099-MISC: This document reports income from sources other than wages, salaries, and tips (like freelance or contract work). Those who receive both a W-2 and a 1099-MISC will need them together to report their total income accurately.

The interplay among these forms and the IRS W-2 is a testament to the intricate nature of income reporting and tax preparation. By understanding the purpose and requirements of each document, individuals can navigate the tax filing process more effectively, ensuring compliance and optimizing their financial outcomes. Each document serves as a puzzle piece in the broader financial picture, with the W-2 form playing a central role in bringing that picture into focus.

Similar forms

IRS Form 1099-MISC: Similar to the W-2 form, the 1099-MISC form is used to report income. However, instead of reporting wages, salaries, and tips to employees, it reports payments to independent contractors. Both forms are essential for accurately reporting an individual’s annual income to the Internal Revenue Service (IRS).

IRS Form 1099-NEC: This form, like the W-2, is aimed at reporting income. Introduced to specifically capture payments made to non-employees, the 1099-NEC form is used to report income to freelancers, independent contractors, and other non-employee workers. The main distinction is its focus on non-employee compensation, as opposed to employee wages, salaries, and tips reported on the W-2.

IRS Form W-4: The W-4 form is closely related to the W-2 in that it deals with employment. However, the W-4 is filled out by employees when they start a new job. Its purpose is to determine the correct amount of tax withholding from an employee’s paycheck. This information contributes to what is ultimately reported on the W-2 form, making them complementary to each other.

IRS Form 1040: The Form 1040 is the U.S. individual income tax return form and is deeply interconnected with the W-2 form. The information reported on a W-2, such as wages, tips, and other compensation, is directly used to fill out the Form 1040. This makes the W-2 a critical piece of documentation for individuals preparing their annual tax returns.

IRS Form 940: While primarily used by employers, the Form 940 shares a connection with the W-2 through its focus on employment. The Form 940 is used to report federal unemployment tax (FUTA) on employees. The total payments reported on W-2 forms help determine the amount of FUTA tax an employer owes, linking the use of both documents in the broader context of employment and taxation.

Dos and Don'ts

When it comes to filling out the IRS W-2 form, accuracy and attention to detail are crucial. This form plays a vital role in ensuring your employees' tax filings are accurate and comply with federal regulations. Whether you're a small business owner or managing payroll for a larger company, here are some important dos and don'ts to keep in mind:

Do's:

- Double-check the employee's information. This includes their Social Security Number (SSN), name, and address. Errors here can lead to processing delays and might require issuing a corrected W-2 form.

- Report all income, including wages, tips, and other compensation, in the appropriate boxes. Make sure you understand what constitutes taxable income and where it should be reported on the form.

- Use the electronic filing option if you are submitting W-2 forms for 250 or more employees. Electronic filing is not only more efficient but also reduces the risk of errors.

- Ensure timely filing. The W-2 form must be sent to employees by January 31st and to the Social Security Administration by the same date or the next business day if January 31st falls on a weekend or holiday.

Don'ts:

- Don't guess or estimate information. Whether it's the amount of wages paid or tax withheld, make sure your figures are accurate and based on your payroll records.

- Don't forget state requirements. In addition to federal filing, some states require a copy of the W-2 form. Make sure you're aware of and comply with any state-specific filing requirements.

- Don't overlook the importance of consent for electronic delivery. If you plan to provide W-2 forms to your employees electronically, you must first obtain their consent.

- Don't hesitate to seek assistance if you're unsure about the process or have questions. Mistakes on the W-2 form can lead to penalties for the employer, so it's better to get help from a professional if needed.

Misconceptions

When it comes to handling taxes, the IRS W-2 form is a critical document that often leads to confusion. Here are nine common misconceptions about the W-2 form, explained to help clear up any confusion.

Only full-time employees get a W-2. This is a misconception. Part-time and seasonal employees also receive a W-2 form as long as they are considered employees and have earned wages.

Independent contractors should receive a W-2. This isn't correct. Independent contractors should not expect a W-2 form. Instead, they usually receive a Form 1099-NEC reflecting their earned income.

If you didn't make much money, you won't receive a W-2. Even if you earned a small amount, your employer is obligated to send you a W-2 form. There is no minimum threshold for W-2 issuance.

You only need your W-2 form to file taxes. While the W-2 is important, you may need additional documents to file your taxes accurately, such as interest statements, other income statements, and records of eligible deductions.

W-2 forms are sent by the IRS. Actually, your employer generates and sends you the W-2 form, not the IRS. The IRS receives a copy from your employer.

Electronic W-2 forms are unofficial. This is false. Electronic W-2 forms are just as official as paper ones. The key is to ensure the form has all the necessary information and is received from a legitimate source.

Correcting a mistake on a W-2 form is the employee's responsibility. While employees should promptly report any discrepancies to their employer, it is ultimately the employer's duty to correct and reissue a W-2 if there are mistakes.

All boxes on the W-2 must be filled. Not every box will be applicable to every employee. Some boxes may rightfully remain blank, depending on individual circumstances and benefits.

A lost W-2 form means you can't file taxes. If you lose your W-2, or it never arrives, first contact your employer to request a reissued form. If that doesn't work, you can contact the IRS or file with a Form 4852, a substitute for the W-2.

Understanding the facts about the W-2 form will make tax time less stressful and help ensure that you're filing your taxes correctly and on time. If you have specific questions or concerns, it's always a good idea to consult with a tax professional or the IRS directly.

Key takeaways

Filling out and using the IRS W-2 form is an essential process for employers and employees in the United States. This document provides a summary of an employee's annual wages and the taxes withheld from their paychecks. Understanding how to properly complete and use this form can ensure accuracy in tax reporting and compliance with federal regulations. Here are five key takeaways to help guide individuals and businesses through this process:

- Accuracy is crucial: When completing the W-2 form, it's imperative that all information is accurate. This includes the employee's social security number, the employer identification number (EIN), and the details regarding wages and taxes withheld. Mistakes can lead to delays in tax processing and potential penalties.

- Timely distribution: Employers must provide employees with their W-2 form by January 31st of the year following the reported earnings. This deadline ensures employees have sufficient time to file their taxes.

- Digital or paper submission: Employers have the option to distribute W-2 forms to their employees either digitally or in paper form. Regardless of the method chosen, consent should be obtained from employees for digital distribution, and it must be ensured that they can access the document.

- Multiple W-2s: Employees who have worked for more than one employer during the tax year may receive multiple W-2 forms. Each one should be included when filing their tax returns to accurately reflect total income and taxes paid.

- Correcting errors: If mistakes are discovered on a W-2 form, the employer is responsible for correcting them and issuing a corrected form, known as a W-2c. This must be done as soon as the error is recognized to prevent issues for the employee with the IRS.

Understanding these key aspects of the W-2 form can significantly ease the annual tax reporting process, ensuring both employers and employees remain compliant with IRS requirements. For more detailed information, consulting the IRS guidelines or seeking professional advice is recommended.

Popular PDF Forms

How to Notify Medicaid of Income Change - Learn how to effectively utilize attached proof, such as pay stubs or expense receipts, to substantiate the information provided in your Medi-Cal redetermination form.

Wh3c - Incorporates sections for both state and county tax withholdings to streamline reconciliation processes.

Imm 1344 Form 2023 Pdf - Sponsors are asked about their financial ability to support the sponsored family member.