Blank Isf PDF Template

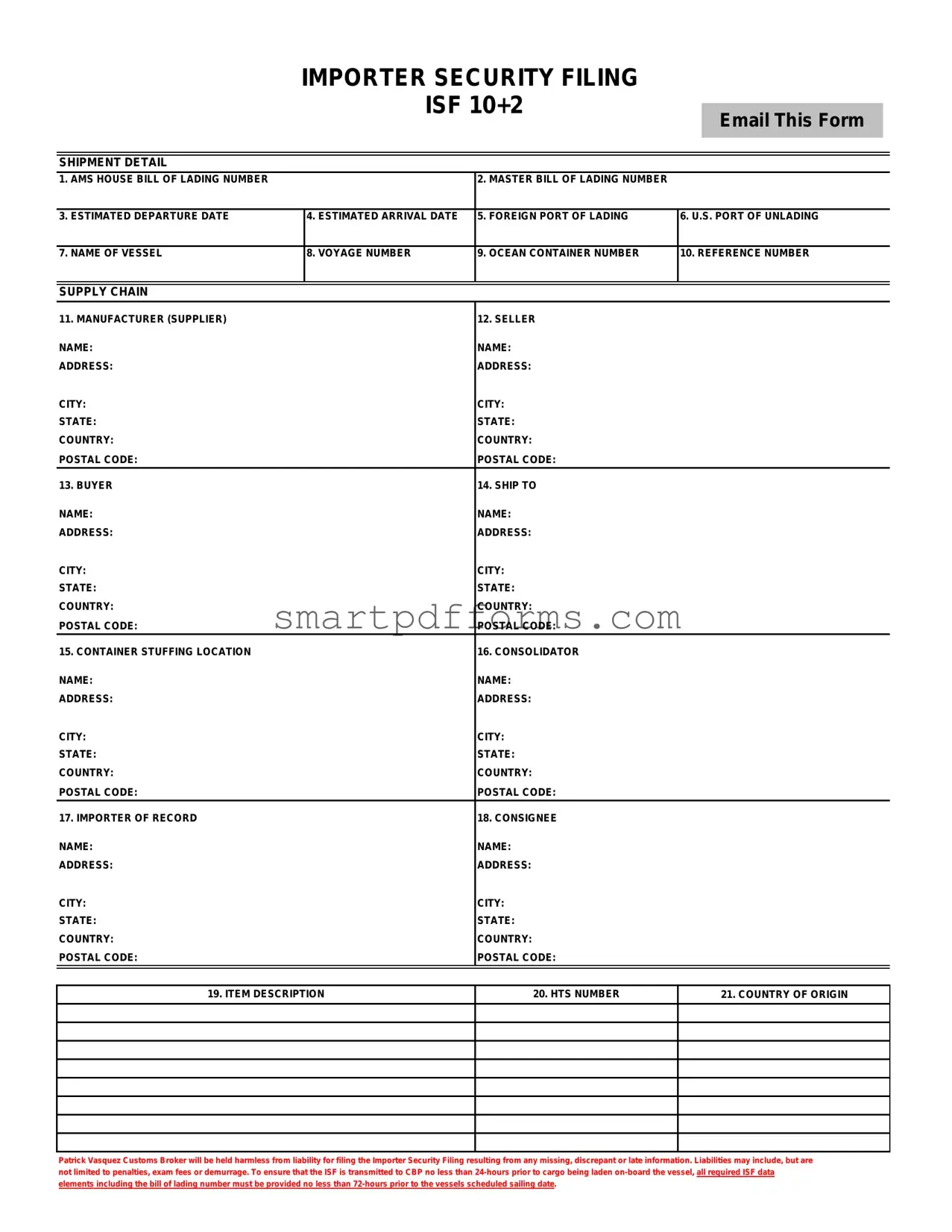

The Importer Security Filing (ISF), commonly referred to as the "10+2" initiative, is a critical requirement for enhancing maritime cargo security that U.S. Customs and Border Protection (CBP) has instituted. This comprehensive document covers various aspects necessary for shipment detail and supply chain information, which includes but is not limited to the Master and House Bill of Lading numbers, the estimated dates of departure and arrival, details on the vessel and voyage, as well as the ocean container number. Additionally, it delves into specifics about the supply chain, listing detailed information about the manufacturer, seller, buyer, and the consolidation and shipping locations. The form also necessitates the provision of the importer of record and consignee details, alongside descriptions of the items being shipped, the Harmonized Tariff Schedule (HTS) number, and the country of origin of the goods. The meticulous process requires that the Patrick Vasquez Customs Broker, or any acting customs broker, be absolved of any liability for ISF filing inaccuracies resulting from misinformation or delays, highlighting the importance of timely and accurate submissions. Given the significant consequences such as penalties, exam fees, or demurrage that can arise from non-compliance, it underscores the vital role of the ISF in maintaining the integrity of international trade and cargo security. Ensuring that the ISF is transmitted to CBP no less than 24-hours prior to the cargo being loaded onto the vessel with all required data elements supplied in a timely fashion is not just a regulatory requirement but a crucial step in safeguarding global supply chains.

Preview - Isf Form

IMPORTER SECURITY FILING

|

ISF 10+2 |

|

|

|

|

|

|

Email This Form |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHIPMENT DETAIL |

|

|

|

|

|

1. AMS HOUSE BILL OF LADING NUMBER |

|

2. MASTER BILL OF LADING NUMBER |

|

|

|

|

|

|

|

|

|

3. ESTIMATED DEPARTURE DATE |

4. ESTIMATED ARRIVAL DATE |

5. FOREIGN PORT OF LADING |

6. U.S. PORT OF UNLADING |

||

|

|

|

|

|

|

7. NAME OF VESSEL |

8. VOYAGE NUMBER |

9. OCEAN CONTAINER NUMBER |

10. REFERENCE NUMBER |

||

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLY CHAIN |

|

|

|

|

|

11. MANUFACTURER (SUPPLIER) |

|

12. SELLER |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

13. BUYER |

|

14. SHIP TO |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

15. CONTAINER STUFFING LOCATION |

|

16. CONSOLIDATOR |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

17. IMPORTER OF RECORD |

|

18. CONSIGNEE |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

|

|

|

|

|

|

19. ITEM DESCRIPTION

20. HTS NUMBER

21. COUNTRY OF ORIGIN

Patrick Vasquez Customs Broker will be held harmless from liability for filing the Importer Security Filing resulting from any missing, discrepant or late information. Liabilities may include, but are

not limited to penalties, exam fees or demurrage. To ensure that the ISF is transmitted to CBP no less than

Form Data

| Fact Name | Description |

|---|---|

| Purpose of ISF 10+2 | The Importer Security Filing (ISF), popularly known as "10+2", is a U.S. Customs and Border Protection (CBP) requirement for maritime cargo shipments to the United States. It mandates importers and vessel carriers to provide additional data elements for security purposes before the cargo is loaded onto a ship destined to the U.S. |

| Data Elements Required | The "10" in ISF 10+2 refers to 10 data elements required from the importer, which includes details such as the manufacturer, seller, buyer, consignee, and items like container stuffing location, consolidator, and importer of record. The "+2" refers to the carrier's requirement to submit the vessel stow plan and container status messages. |

| Timeliness of Filing | The ISF must be transmitted to CBP no less than 24 hours before cargo is loaded on the vessel bound for the United States. Failure to file on time, accurately, or completely can result in penalties, including fines and delayed shipments. |

| Governing Law(s) | This requirement is enforced under the Security and Accountability for Every (SAFE) Port Act of 2006 and is regulated by U.S. Customs and Border Protection. The CBP holds authority to issue penalties for non-compliance. |

Instructions on Utilizing Isf

Filling out the Importer Security Filing (ISF) 10+2 form is a crucial step for ensuring the smooth passage of your shipment into the United States. The process involves providing detailed information about your shipment's journey, including data on the suppliers, buyers, and the cargo itself. The objective is to comply with U.S. Customs and Border Protection (CBP) requirements, thereby minimizing the risk of delays or penalties. Here's a step-by-step guide to assist you in completing the ISF form accurately:

- Under SHIPMENT DETAIL, locate the AMS HOUSE BILL OF LADING NUMBER and enter the specific number associated with your shipment.

- Fill in the MASTER BILL OF LADING NUMBER field with the corresponding number, ensuring it's accurate for tracking and reference purposes.

- Provide the ESTIMATED DEPARTURE DATE that indicates when the shipment is expected to leave the foreign port.

- In the ESTIMATED ARRIVAL DATE field, enter the date the shipment is anticipated to arrive at the U.S. port.

- Specify the FOREIGN PORT OF LADING to indicate where your shipment originates from.

- For the U.S. PORT OF UNLADING, indicate the U.S. port where the shipment will be unloaded.

- Input the NAME OF VESSEL carrying your shipment.

- Enter the VOYAGE NUMBER associated with the vessel's journey.

- Provide the OCEAN CONTAINER NUMBER to identify your specific shipment container.

- Fill in a REFERENCE NUMBER for your own tracking and identification purposes.

- Under SUPPLY CHAIN, provide the MANUFACTURER (SUPPLIER) and SELLER details including name, address, city, state, country, and postal code.

- Enter BUYER and SHIP TO information with the same level of detail: name, address, city, state, country, and postal code.

- Detail the CONTAINER STUFFING LOCATION and CONSOLIDATOR information, which includes locations and parties responsible for packing the shipment.

- Provide the IMPORTER OF RECORD and CONSIGNEE details: name, address, city, state, country, postal code, to identify the parties authorized to handle the shipment in the U.S.

- For the items being imported, list each ITEM DESCRIPTION and the corresponding HTS NUMBER (Harmonized Tariff Schedule) to classify your shipment.

- Enter the COUNTRY OF ORIGIN for each item, ensuring accuracy as this can affect duty rates and eligibility for import.

After completing the form, review all entered information carefully for accuracy and completeness. Late, missing, or incorrect information can lead to penalties, examination fees, or demurrage charges as outlined by Patrick Vasquez Customs Broker's disclaimer. Remember, the ISF must be transmitted to CBP at least 24 hours before your cargo is loaded onto the vessel, and all required data should be provided no less than 72 hours before the vessel’s scheduled departure. By following these steps meticulously, you can facilitate a smoother entry process for your shipment and avoid unnecessary complications.

Obtain Answers on Isf

What is an Importer Security Filing (ISF), commonly referred to as "10+2"?

The Importer Security Filing (ISF), commonly known as "10+2", is a U.S. Customs and Border Protection (CBP) requirement for maritime cargo shipments entering the United States. It mandates that importers provide ten specific data elements to the CBP, while the carrier must submit an additional two data elements, no less than 24-hours before cargo is loaded onto a vessel destined for the U.S. This requirement aims to enhance maritime security and facilitate the lawful international trade by ensuring high-risk shipments are identified and addressed before arrival.

Who is responsible for filing the ISF?

The responsibility of filing the ISF primarily falls upon the importer or their authorized agent, such as a licensed customs broker. It is crucial for the importer to ensure all information submitted is accurate and timely to avoid potential delays, inspections, or penalties.

What are the key data elements required in the ISF 10+2 filing?

In the ISF 10+2 filing, the ten data elements required from the importer include details about the shipment and supply chain, such as:

- AMS House Bill of Lading Number

- Master Bill of Lading Number

- Estimated Departure Date

- Estimated Arrival Date

- Foreign Port of Lading

- U.S. Port of Unlading

- Name of Vessel

- Voyage Number

- Ocean Container Number

- Reference Number

- Container Stuffing Location

- Consolidator (Stuffer)

What happens if the ISF is not filed or is filed inaccurately?

Failing to file the ISF, or submitting inaccurate or incomplete data, can lead to severe consequences. These may include monetary penalties, increased inspections at the port of entry, and possible delays in cargo release. The CBP can impose fines up to $5,000 per violation, which underscores the importance of timely and accurate compliance.

When should the ISF be filed?

The ISF must be filed no later than 24 hours before cargo is loaded onto a vessel bound for the United States. To facilitate this timeline, all required ISF information should be provided to the filing party, typically a customs broker, at least 72 hours before the vessel's scheduled departure. This advance filing is crucial in allowing sufficient time for data processing and risk assessment by CBP officials.

Can the ISF be amended after it is filed?

Yes, the ISF can be amended after filing if new information becomes available or if errors are identified in the initially submitted details. It is crucial to make such amendments as soon as possible to ensure compliance and facilitate a smooth customs clearance process. However, it is essential to note that amendments might be subject to CBP review and could potentially trigger inspections or queries.

Is there a standard form for submitting the ISF?

While there is not a "standard" paper form, the ISF is typically submitted electronically to the U.S. Customs and Border Protection through systems such as the Automated Broker Interface. A customs broker or other authorized agent often handles this electronic submission on behalf of the importer, utilizing the detailed information provided in a format consistent with CBP requirements.

What are the liabilities for failing to comply with ISF requirements?

Liabilities for non-compliance with ISF requirements can be substantial. Beyond monetary penalties, importers may face demurrage charges due to delays in cargo release, increased examination fees, and possible seizure of the cargo. It is also crucial for importers to understand that customs brokers, while responsible for filing the ISF based on provided information, are held harmless from liability for any missing, discrepant, or late filing. Thus, the onus is on the importer to ensure accurate and timely data submission.

How can an importer verify that their ISF has been filed and accepted by CBP?

Importers can verify the status of their ISF filing through their customs broker, who can access the Automated Broker Interface (ABI) system for real-time status updates. Additionally, CBP may provide confirmation of filing acceptance, which can include a transaction receipt number indicating successful submission. It is advisable for importers to maintain open communication with their brokers to ensure that filings are completed as required and to verify acceptance by CBP.

Common mistakes

Filling out the Importer Security Filing (ISF) 10+2 form is a critical step for ensuring that shipments comply with U.S. Customs and Border Protection (CBP) requirements. Mistakes on this form can lead to significant delays, penalties, and additional costs. Understanding the common errors can help streamline the process and avoid unnecessary issues. Here are nine mistakes often made when filling out the ISF form:

Incorrect or incomplete Bill of Lading numbers. Both the AMS House Bill of Lading Number and the Master Bill of Lading Number must be accurately provided.

Estimation errors in the Estimated Departure and Arrival Dates. Accuracy in these dates ensures that the ISF aligns with the actual shipping schedule.

Mistakes in identifying the correct Foreign Port of Lading and U.S. Port of Unlading. These ports must correspond to those designated in the shipping documentation.

Incorrectly naming the Vessel and Voyage Number. The name of the vessel and its voyage number are essential for tracking the shipment.

Failing to provide or inaccurately listing the Ocean Container Number. This number is critical for identifying and tracking the specific container.

Incomplete or incorrect details in the Supply Chain section, including Manufacturer (Supplier), Seller, Buyer, Ship To, Container Stuffing Location, Consolidator, Importer of Record, and Consignee details. Each of these requires complete and accurate information.

Omitting or misstating the Item Description and HTS Number. The description and Harmonized Tariff Schedule number must precisely match the cargo.

Incorrect Country of Origin. This must accurately reflect where the goods were produced.

Not submitting the ISF form 24-hours prior to cargo being loaded onto the vessel, which is a requirement to avoid penalties.

Addressing these mistakes requires attention to detail and understanding of the import process. Filling out the ISF form correctly the first time helps ensure a smoother, more efficient importation process, potentially saving time and reducing costs associated with corrections or penalties.

Remember, the responsibility for accurate and timely filing rests with the importer, and relying on the expertise of a knowledgeable customs broker can be invaluable in navigating these requirements.

Documents used along the form

The completion and submission of the Importer Security Filing (ISF), commonly known as the "10+2" form, is a critical step for ensuring compliance with U.S. Customs and Border Protection (CBP) regulations for maritime cargo shipments. This form is a key component of the security measures taken to enhance border protection. However, it is rarely the only document required in the intricate process of importing goods into the United States. A suite of additional forms and documents typically accompanies the ISF to support the importation process, ensure compliance with regulations, and facilitate the smooth clearance of goods through customs. Understanding these complementary documents can greatly assist importers and their brokers in navigating the complexities of trade law and customs requirements.

- Bill of Lading (B/L): A contract between the owner of the goods and the carrier. There are two types: a master bill of lading (MBL) which is issued by the main carrier of the goods, and a house bill of lading (HBL) issued by a freight forwarder.

- Commercial Invoice: Provides information about the transaction between the seller and buyer. It details the products being shipped, their value, and other pertinent transaction information.

- Packing List: Accompanies the commercial invoice and provides detailed information about the contents of each package within the shipment, including the quantity, description, and weight of the goods.

- Certificate of Origin: A document used to certify the country where the goods were made. It is important for determining whether the goods are eligible for import, and if they are subject to duties.

- Arrival Notice: Sent by the carrier to notify the relevant parties that the cargo has arrived at the port of entry.

- Cargo Release Order: A document from the carrier that authorizes the release of cargo to the rightful consignee.

- Customs Bond: A binding agreement that ensures any duties, taxes, and fees owed to the government will be paid. This is particularly required for goods valued over $2,500 or for items subject to other federal agency requirements.

- Entry Summary (CBP Form 7501): Submitted to CBP to declare particulars about the shipment, including the importer of record, classification of goods, and the value of the cargo. This document is necessary for determining duty rates and compliance with import regulations.

Together with the ISF, these documents form the backbone of the documentation necessary for importing goods into the United States. Each document serves specific roles in the importation process, from providing detailed information about the shipment's contents and its journey to meeting regulatory requirements and facilitating the efficient clearance of goods. Importers should ensure that they prepare and submit these documents as accurately and timely as possible to prevent delays, penalties, or other complications arising from non-compliance. Navigating the complexities of these requirements often involves working closely with experienced customs brokers and freight forwarders who can provide invaluable assistance throughout the process.

Similar forms

The Bill of Lading shares similarities with the ISF form, as both documents require details such as the bill of lading number, vessel name, and voyage number. These elements are crucial for tracking and processing shipments.

The Commercial Invoice, like the ISF, includes information about the seller and buyer, including names and addresses, which are necessary for establishing the ownership and financial responsibility for the shipped goods.

The Packing List is similar to the ISF in that it provides details about the shipment's content, which is akin to the ISF's requirement for an item description and the container stuffing location, helping in identifying what is being shipped.

Shipper's Export Declaration (SED) parallels the ISF form by requesting details on the shipper and receiver, as well as a description of the goods being exported, to ensure compliance with export regulations.

The Entry Summary (7501), required by Customs and Border Protection (CBP), shares common elements with the ISF, such as the import details, importer of record, and consignee, which are vital for assessing duties and for entry documentation.

Certificate of Origin is akin to the ISF's requirement for stating the country of origin of the shipped items, essential for determining tariff rates and verifying the legitimacy of the goods.

The Arrival Notice issued by carriers, much like the ISF, contains details on the estimated arrival date and the U.S. port of unlading, information critical for the importer and customs officials for planning and processing entries.

Manifest documentation, required by the transportation carrier, mirrors the ISF form in detailing the ship vessel, voyage number, and container numbers, ensuring accurate tracking and identification of cargo shipments.

A Customs Bond, while not a direct document comparison, is indirectly related to the ISF form as it guarantees that all duties, taxes, and fees owed to the federal government will be paid. This requirement underscores the financial responsibilities tied to imported goods, hinted at in the ISF form through the naming of parties involved in the transaction.

Dos and Don'ts

When filling out the Importer Security Filing (ISF) 10+2 form, it is crucial to pay close attention to detail and ensure accuracy in the information you provide. Here are eight dos and don'ts to help guide you through the process:

- Do gather all necessary information before starting to fill out the form. This includes bill of lading numbers, manufacturer details, and HTS numbers.

- Do double-check the accuracy of all provided information, especially numbers and addresses, to prevent any delay in your shipment.

- Do make sure to submit the ISF form at least 24 hours before your cargo is loaded onto the vessel, adhering to the guidelines set by Customs and Border Protection (CBP).

- Do ensure that the form is completed comprehensively. Incomplete forms can lead to delays and possible penalties.

- Don't overlook the importance of the estimated departure and arrival dates. Accuracy in these fields is essential for timely processing.

- Don't hesitate to consult with a customs broker if you're unsure about any part of the ISF filing process. Their expertise can help prevent errors and potential legal issues.

- Don't forget to provide the correct HTS (Harmonized Tariff Schedule) number for each item in your shipment. This classification is crucial for duty and tax determination.

- Don't submit information that is outdated or likely to change without notifying your customs broker. Up-to-date information is key to a smooth customs clearance process.

Following these guidelines can help avoid common pitfalls and ensure that your ISF filing process is smooth and compliant with CBP requirements. Always remember that being meticulous and proactive are your best tools in navigating the complexities of international shipping regulations.

Misconceptions

When it comes to the Importer Security Filing (ISF), commonly referred to as the ISF 10+2, there are numerous misconceptions that can lead to confusion. Understanding these misconceptions is pivotal for importers to ensure compliance and avoid potential penalties.

- ISF is only about security.

While it's true that the ISF is designed to enhance cargo security, it's also a critical tool for U.S. Customs and Border Protection (CBP) to assess cargo risk and facilitate the movement of legitimate trade. It's not solely for security purposes but also for efficiency and compliance with trade regulations.

- Any missing information can be updated at any time without penalties.

This is incorrect. The ISF must be filed 24 hours before your cargo is laden aboard a vessel destined for the U.S. While certain edits can be made after the initial filing, failure to provide accurate information within the timeframe can result in penalties. It’s imperative to furnish all required data elements as early as possible.

- ISF filing is the responsibility of the customs broker only.

Although a customs broker can file an ISF on behalf of the importer, the ultimate responsibility for the filing's accuracy and timeliness falls on the importer of record. Importers should verify that their customs brokers have all the necessary information well in advance.

- The same information is required for every shipment.

Each shipment may have different requirements based on its content, origin, and destination. While the ISF 10+2 outlines specific data elements, the details provided for each element can vary significantly from one shipment to another.

- Failure to file an ISF does not affect cargo release.

This is a serious misunderstanding. If the ISF is not filed, or is filed incorrectly, CBP can hold your cargo at the port of arrival until compliance is achieved, which may include the submission of an accurate ISF. This can result in significant delays and additional costs, such as demurrage fees.

- An ISF filing is not needed for cargo transiting through the U.S.

Even if cargo is merely passing through the U.S. en route to another country, an ISF still needs to be filed. The requirement applies to all cargo arriving in the U.S. as a point of transit.

Understanding the nuances of the ISF filing process can significantly mitigate risks associated with importing goods into the U.S. It’s essential for importers to familiarize themselves with the requirements and ensure they remain compliant to avoid unnecessary penalties and delays.

Key takeaways

Filling out the Importer Security Filing (ISF) form is an essential step in complying with U.S. Customs and Border Protection (CBP) requirements for importing goods. Understanding the key takeaways from this form can help ensure that the process is smooth and free from penalties. Below are six important aspects to keep in mind.

- Timeliness is Critical: It's required to transmit the ISF to CBP at least 24 hours before the cargo is loaded onto the vessel. This helps in avoiding potential delays at the port.

- Complete and Accurate Information is Necessary: All the fields in the ISF form, including shipment details and supply chain information, must be filled out accurately. Inaccuracies or missing information can lead to penalties.

- Understanding the 10+2 Requirement: The ISF 10+2 form encompasses details about the shipment and the supply chain. This includes data on the manufacturer, seller, buyer, ship-to details, and container stuffing location, among others.

- Responsibility for Liabilities: The customs broker, Patrick Vasquez in this instance, will not be held liable for any issues arising from missing, discrepant, or late information on the form. Instead, the responsibility falls on the party providing the details.

- Potential Penalties: Failure to comply with ISF filing requirements can result in penalties, exam fees, or demurrage. This emphasizes the importance of providing complete and timely information.

- Double-check Before Submission: Given the importance of accuracy and completeness, it's advisable to review all entries carefully before submission. This could save time and money by avoiding penalties for errors or omissions.

By keeping these key points in mind, individuals and businesses can navigate the complexities of the ISF form more effectively, leading to a smoother importation process. Remember, staying informed and prepared is the best defense against potential issues that could arise during the importing process.

Popular PDF Forms

How to Transfer a Rifle in California - This form is used for documenting the private transfer of firearms between individuals who aren't licensed dealers in the same state.

Federal Odometer Statement Pdf - A key document for private vehicle sales where dealer forms are not applicable.

Federal Employee Retirement System - Options available on the form allow for customized survivor benefit planning, considering the needs of both the retiree and the spouse.