Blank It 2 PDF Template

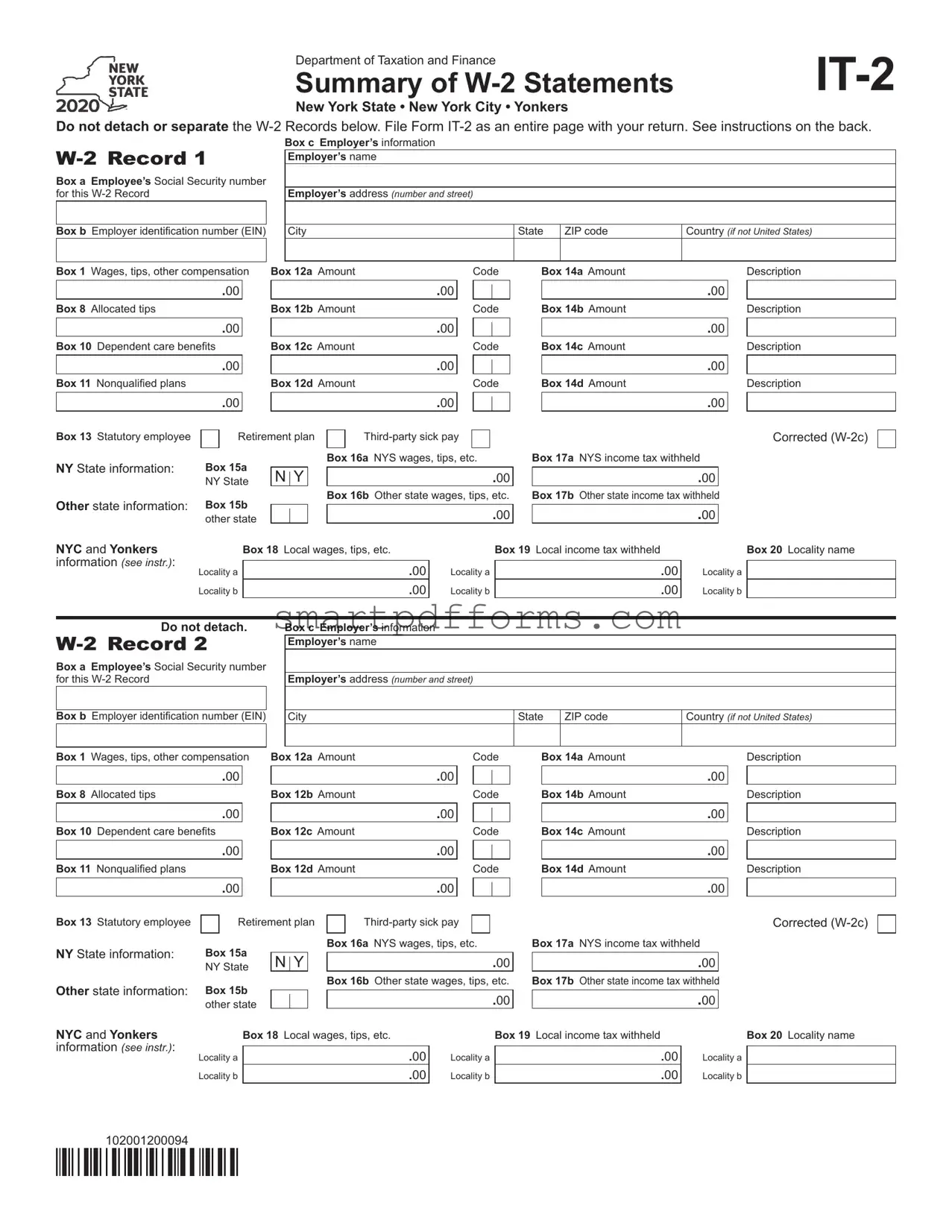

The IT-2 form, designated for filers in New York State, including New York City and Yonkers, serves as a critical document for accurately reporting wages, tips, and other compensation received, as delineated on an individual's W-2 statements when filing state income tax returns. This comprehensive form requires taxpayers to transfer key financial data from their federal W-2 forms into respective fields on the IT-2, specifically highlighting earnings and withholdings pertinent to New York State, New York City, or Yonkers, as well as detailing any other state's wage information if applicable. Further significance is found in its requirement for individuals who received foreign earned income, albeit without a W-2 form, to also utilize the IT-2 for proper reporting. With precise instructions on completing each box to mirror the corresponding information on the W-2, and specific guidelines for entering adjustments or multiple records as necessary, this form ensures that all relevant income and tax details are meticulously accounted for. Its role extends beyond mere documentation, as it intricately links to several New York State tax forms, facilitating the accurate calculation and withholding of state, city, or local taxes, and thereby enhancing the efficiency of the state's tax return processing. The imperative to submit the IT-2 form intact with the state income tax return, excluding the federal W-2 forms, underscores its importance in the fiscal framework of New York State, ensuring compliance and aiding taxpayers in their obligatory submissions.

Preview - It 2 Form

Department of Taxation and Finance

Summary of

New York State • New York City • Yonkers

Do not detach or separate the

Box a Employee’s Social Security number for this

Box c Employer’s information Employer’s name

Employer’s address (number and street)

Box b Employer identification number (EIN)

City

State

ZIP code

Country (if not United States)

Box 1 Wages, tips, other compensation |

Box 12a Amount |

Code |

Box 14a Amount |

Description |

.00

Box 8 Allocated tips

|

.00 |

|

|

|

Box 12b Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14b Amount |

|

|

Description |

.00

Box 10 Dependent care benefits

.00

Box 11 Nonqualified plans

|

.00 |

|

|

|

Box 12c Amount |

|

|

Code |

|

|

.00 |

|

|

|

Box 12d Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14c Amount |

|

|

Description |

|

.00 |

|

|

Box 14d Amount |

|

|

Description |

|

.00 |

|

|

|

|

.00 |

|

|

|

|

||

Box 13 Statutory employee |

|

Retirement plan |

|

|

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NY State information: |

Box 15a |

|

|

|

Box 16a NYS wages, tips, etc. |

|||||||

|

NY State |

N |

Y |

|

.00 |

|||||||

Other state information: |

Box 15b |

|

|

|

Box 16b Other state wages, tips, etc. |

|||||||

|

other state |

|

|

|

.00 |

|||||||

.00

Corrected

Box 17a NYS income tax withheld

.00

Box 17b Other state income tax withheld

.00

NYC and Yonkers information (see instr.):

Locality a

Locality b

Box 18 Local wages, tips, etc.

.00

.00

Locality a

Locality b

Box 19 Local income tax withheld

.00

.00

Box 20 Locality name

Locality a

Locality b

Do not detach.

Box a Employee’s Social Security number for this

Box c Employer’s information Employer’s name

Employer’s address (number and street)

Box b Employer identification number (EIN)

City

State

ZIP code

Country (if not United States)

Box 1 Wages, tips, other compensation |

Box 12a Amount |

Code |

Box 14a Amount |

Description |

.00

Box 8 Allocated tips

.00

Box 10 Dependent care benefits

|

.00 |

|

|

|

Box 12b Amount |

|

|

Code |

|

|

.00 |

|

|

|

Box 12c Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14b Amount |

|

|

Description |

|

.00 |

|

|

Box 14c Amount |

|

|

Description |

.00

Box 11 Nonqualified plans

|

.00 |

|

|

|

Box 12d Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14d Amount |

|

|

Description |

|

.00 |

|

|

|

|

.00 |

|

|

|

|

||

Box 13 Statutory employee |

|

Retirement plan |

|

|

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NY State information: |

Box 15a |

|

|

|

Box 16a NYS wages, tips, etc. |

|||||||

|

NY State |

N |

Y |

|

.00 |

|||||||

Other state information: |

Box 15b |

|

|

|

Box 16b Other state wages, tips, etc. |

|||||||

|

other state |

|

|

|

.00 |

|||||||

.00

Corrected

Box 17a NYS income tax withheld

.00

Box 17b Other state income tax withheld

.00

NYC and Yonkers information (see instr.):

Locality a

Locality b

Box 18 Local wages, tips, etc.

.00

.00

Locality a

Locality b

Box 19 Local income tax withheld

.00

.00

Box 20 Locality name

Locality a

Locality b

102001200094

Instructions

General instructions

Who must file this form – You must complete Form

tax return and you received federal Form(s)

If you received foreign earned income but did not receive a federal Form

Specific instructions

How to complete each

Multiple

Entering whole dollar amounts – When entering amounts, enter whole dollar amounts only (zeros have been preprinted). Use the following rounding rules when entering your amounts; drop amounts below 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

Enter in box a your entire

Box 1 – Enter federal wages, tips, and other compensation shown in Box 1 of federal Form

Boxes 8, 10, and 11 – If applicable, enter the amounts from federal Form

Boxes 12a through 12d – Enter the amount(s) and code(s), if any, shown in the corresponding boxes on federal Form

Box 13 – If your federal Form

Corrected

Boxes 14a through 14d – Enter the amount(s) and description(s), if any, shown in box 14 of federal Form

Boxes 15a through 17a (NYS only) – Complete only for New York State wage and withholding information (the corresponding box 15a has been prefilled with NY). Enter in box 16a the New York State wages exactly as reported on federal Form

Boxes 15b through 17b (Other state information) – If the federal Form

Boxes 18 through 20 (NYC or Yonkers only) – Complete the locality boxes 18 through 20 only for NYC or Yonkers (or both) wages and withholding, if reported on federal Form

Transfer the tax withheld amounts to your income tax return. Include the total NYS tax withheld amounts, the total NYC tax withheld amounts, and the total Yonkers tax withheld amounts from all your Form(s)

•NYS tax withheld – Include on Form

•NYC tax withheld – Include on Form

•Yonkers tax withheld – Include on Form

Submit Form(s)

102002200094

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form IT-2 | Used for summarizing W-2 statements for New York State, New York City, and Yonkers tax returns. |

| Filing Requirement | Required if filing a New York State income tax return and received one or more federal Form W-2. |

| Inclusion of Foreign Earned Income | Form IT-2 must be completed if foreign earned income was received without a federal Form W-2. |

| Wages and Withholding Information | Enter details from federal Form W-2, including wages, tips, other compensation, and tax withheld for NYS, NYC, or Yonkers. |

| Special Instructions for Multiple Items | If federal Form W-2 shows more than four items in box 12 or box 14, complete an additional W-2 Record section. |

| Governing Laws | New York State Department of Taxation and Finance governs the filing and processing of Form IT-2. |

| Submission With Tax Return | Form IT-2, as a whole page, must be submitted with your NYS income tax return; however, federal Form W-2s are not to be submitted but kept for records. |

Instructions on Utilizing It 2

When it comes time to file your New York State income tax return, if you’ve received W-2 forms, you’ll need to also complete Form IT-2. This form is essentially a summary of your W-2 statements, helping to streamline your tax filing. It captures important details from your employment over the past year, such as wages earned and taxes withheld by the state of New York, New York City, or Yonkers. Properly completing this form is crucial to ensuring your tax return is accurate and compliant with state tax laws. Here are the steps to fill out the IT-2 form correctly.

- Begin by entering your Social Security Number (SSN) in Box a. If you are filing jointly, include your spouse's SSN for their W-2 records.

- In Box b, fill in your employer's Identification Number (EIN) exactly as it appears on your W-2 form. If your employer is based outside of the United States and the EIN does not fit, you may leave this blank.

- For Box c, input your employer's name and address, including the city, state, ZIP code, and country if it's not the United States. This should also match the information on your W-2.

- In Box 1, report your wages, tips, and other compensation as shown in Box 1 of your W-2 form.

- If applicable, input amounts for allocated tips, dependent care benefits, and nonqualified plans in Boxes 8, 10, and 11, respectively, using the information from your W-2.

- For Boxes 12a through 12d, enter any relevant amount(s) and code(s) from your W-2. If you have more items to report than boxes available, complete a separate W-2 Record section.

- Check the appropriate box in Box 13 if your W-2 includes designations for statutory employee, retirement plan, or third-party sick pay.

- If filling out the form for a Corrected W-2 (W-2c), mark an "X" in the Corrected box and ensure to include the corrected information as needed.

- Fill in any descriptions and amounts in Boxes 14a through 14d that correspond with Box 14 on your W-2. If you have additional items, again, use a separate W-2 Record.

- Complete Boxes 15a through 17a with New York State wage and tax information specific to NYS withholding, as labeled on your W-2.

- For wages and taxes withheld by states other than New York, fill in Boxes 15b through 17b accordingly.

- Lastly, fill in Boxes 18 through 20 for local wages, taxes, and locality names relevant to New York City or Yonkers. Include local income and name for each, differentiating with "Locality a" and "Locality b" as necessary.

After completing the IT-2 form, ensure to review all information for accuracy before attaching it to your state income tax return. Remember, this form is a summary of your W-2 statements, and accuracy is key to a smooth tax return process. Store it properly with your records after filing, as it serves as an important document in your financial history.

Obtain Answers on It 2

Who needs to file Form IT-2, Summary of W-2 Statements?

Individuals who file a New York State (NYS) income tax return and received federal Form(s) W-2, Wage and Tax Statement, must complete Form IT-2. This includes individuals who received wages from sources outside of the United States but did not receive a federal Form W-2. This form should be filed for each federal Form W-2 received, regardless of whether the W-2 shows any NYS, New York City (NYC), or Yonkers wages or tax withheld.

How should I complete each W-2 Record on Form IT-2?

Complete each W-2 Record on Form IT-2 by entering information that corresponds to the similarly named or numbered box on the federal Form W-2. Enter amounts, codes, or descriptions as they appear on your federal Form W-2 into the corresponding boxes on the IT-2 form. If the information exceeds four items in boxes 12 or 14 on the federal Form W-2, you will need to complete additional W-2 Records on another IT-2 form. Ensure to round your amounts to whole dollars, following the guideline provided: amounts below 50 cents should be dropped, and amounts from 50 to 99 cents should be rounded to the next dollar.

What if my federal Form W-2 shows more than four items in box 12 or 14?

If your federal Form W-2 includes more than four items in box 12 or 14, you will need to complete an additional W-2 Record on a separate IT-2 form for the additional items. Make sure you copy the employee’s social security number, employer identification number (EIN), and employer’s information from the first W-2 Record onto the additional IT-2 form.

Are there specific instructions for filers with foreign earned income?

Individuals with foreign earned income who did not receive a federal Form W-2 must also complete Form IT-2. Foreign earned income includes salaries, wages, commissions, bonuses, and certain noncash income. If the employer’s identification number (EIN) does not fit in the space provided on the form, leave box b (EIN) blank.

How do I enter information for boxes 1, 8, 10, and 11 on Form IT-2?

For box 1 (federal wages, tips, and other compensation), enter the amount shown in Box 1 of your federal Form W-2. For boxes 8 (allocated tips), 10 (dependent care benefits), and 11 (nonqualified plans), enter the applicable amounts from your federal Form W-2 if any.

What to do if the W-2 Record is for a Corrected Wage and Tax Statement (W-2c)?

If the W-2 Record is for a federal Form W-2c, Corrected Wage and Tax Statement, mark an X in the corrected (W-2c) box. Then enter the corrected information from the W-2c in addition to all other requested information from your original federal Form W-2.

How do I report New York State, NYC, or Yonkers wages and tax withheld?

- If reporting NYS wages and tax withheld, complete boxes 15a through 17a. Use box 16a for NYS wages as reported on federal Form W-2, and box 17a for NYS tax withheld.

- For wages and tax withheld for a state other than New York, complete boxes 15b through 17b with the corresponding W-2 box information for the other state.

- To report NYC or Yonkers wages and tax withheld, complete boxes 18 through 20. Enter local wages, income tax withheld, and locality name as reported on Form W-2.

After completing Form IT-2, how do I submit it?

Submit Form IT-2 as an entire page with your New York State income tax return. Do not separate the W-2 Records or detach instructions from the back page. Importantly, you should not submit your federal Form(s) W-2 with your tax return; instead, keep them for your records. Ensure to include the total NYS, NYC, and Yonkers tax withheld amounts from all your Form(s) IT-2 on your income tax return as directed in the instructions for Forms IT-201, IT-203, or IT-205.

Is rounding necessary when entering amounts on Form IT-2?

Yes, when entering amounts on Form IT-2, you should round to whole dollar amounts. Use the rounding rules provided: drop amounts below 50 cents and increase amounts from 50 to 99 cents to the next dollar. Ensure to enter these amounts in whole dollars only.

What should I do if I have no New York State wages or withholding to report?

If you have no New York State wages or withholding to report, leave the corresponding sections, specifically boxes 16a and 17a for NYS wages and withholding, blank on Form IT-2.

Common mistakes

When filling out the IT-2 form, a summary of W-2 statements for New York State, New York City, and Yonkers, individuals often make mistakes that can lead to processing delays or errors in their tax returns. It’s crucial to complete this form accurately and avoid the following common errors:

Not including the form with their tax return. The IT-2 form must be filed as an entire page and should not be detached or separated from the tax return.

Failing to complete a separate W-2 Record section for each W-2 form received, even if the W-2 does not show any NYS, NYC, or Yonkers wages or tax withheld. This omission can lead to incomplete reporting of income and withheld taxes.

Incorrectly reporting foreign earned income or not reporting it at all when a federal W-2 form is not received. This is particularly important for filers with foreign earned income to ensure all income is accurately reported.

Entering incorrect information in boxes a, b, and c, such as the employee’s social security number, employer identification number (EIN), and employer’s information. This can cause mismatches with federal W-2 forms and potentially result in processing errors.

Omitting or inaccurately entering amounts in boxes related to wages, tips, and other compensation (Boxes 1, 8, 10, and 11), which could lead to incorrect tax calculations.

Not completing additional W-2 Records when more than four items exist in box 12 or box 14. This oversight can result in missing or incomplete data regarding specific earnings or deductions.

Failure to round amounts to whole dollar figures as instructed, which is necessary for consistency in tax reporting and calculation. Incorrect rounding or not rounding at all can affect the total tax liability.

Incorrectly marking or failing to mark the Corrected (W-2c) box when appropriate. If using the form for a Corrected Wage and Tax Statement, it is crucial to denote this to alert the tax authorities of the correction.

Avoiding these mistakes when completing the IT-2 form ensures the accurate and timely processing of one's tax return. Attention to detail and a thorough review of all entries against the federal Form W-2s can prevent common errors and the resulting complications with New York State tax filings.

Documents used along the form

Filing a New York State income tax return involves more than just submitting Form IT-2 alongside your federal Form W-2. To ensure a thorough and accurate tax filing process, several additional forms and documents are often needed. Below is a brief overview of other essential forms and documents that taxpayers should be familiar with when completing their tax returns.

- Form IT-201: This is the full-year resident income tax return form. It's meant for individuals who have lived in New York State for the entire tax year. It compiles all income, deductions, and credits to calculate state tax liability.

- Form IT-203: Non-residents or part-year residents of New York State use this form. It helps in reporting income earned in New York State and calculating the appropriate amount of New York State tax.

- Form IT-205: This form is used for filing estate or trust income tax returns in New York State. It gathers information on income, deductions, and taxes payable by estates or trusts.

- Form W-2c: The Corrected Wage and Tax Statement is used to correct errors on the original Form W-2. It may accompany the IT-2 form if errors in the initial W-2 require corrections for New York State tax purposes.

- Form 1099: These forms report various types of income other than wages, such as freelance income (1099-MISC), interest and dividends (1099-INT and 1099-DIV), and withdrawals from retirement accounts (1099-R). They are essential for accurately reporting income.

- Schedule C: For individuals who operate a business or are self-employed, Schedule C is used to report profits or losses from that business. It provides details that affect taxable income and liabilities.

- Schedule E: This form is used to report income and losses from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It’s pertinent for taxpayers with these types of income sources.

- Form IT-215: This form claims the Earned Income Credit on a New York State tax return, providing tax relief for low to moderate-income working individuals and families.

Together, these forms and documents play various roles in the tax filing process, from reporting different income sources to claiming credits and deductions tailored to individual financial situations. Taxpayers must complete the appropriate forms accurately and submit them within filing deadlines to comply with New York State's tax laws and, hopefully, maximize their returns or minimize their tax liabilities. Understanding each document's purpose ensures a smoother tax preparation process and avoids common errors that could lead to audits or penalties.

Similar forms

The Form W-2, Wage and Tax Statement, is quite similar to the IT-2 form because it details employees' wages and taxes withheld by the employer. The IT-2 form acts as a summary of the W-2 statements specifically for reporting to New York State, hence why each box on the IT-2 corresponds directly with boxes on the W-2 form.

The Form 1099-MISC, Miscellaneous Income, shares purposes with the IT-2 form in that it reports specific types of income to recipients other than wages, such as freelance or contract work. While IT-2 compiles W-2 information for state tax purposes, 1099-MISC gathers non-employee compensation for taxpayer and IRS records.

Form 1040, U.S. Individual Income Tax Return, although more comprehensive, is related to the IT-2 form as it is the primary form used by individuals to file their federal income taxes. IT-2 assists filers in New York in summarizing W-2 information, which is crucial for completing the income section of Form 1040.

The Form W-3, Transmittal of Wage and Tax Statements, serves a role akin to IT-2 but on the federal level, acting as a summary of all W-2 forms sent by an employer to the Social Security Administration. Similarly, the IT-2 form summarizes all W-2 information for New York State tax filing purposes.

Form IT-201, Resident Income Tax Return (New York State), is directly connected to the IT-2 since the information summarized on the IT-2 form is required when filling out the IT-201 form. It reflects New York State wages, tips, and income tax withheld - all crucial data for accurately reporting state income tax.

Dos and Don'ts

When preparing to fill out the IT-2 form, a Summary of W-2 Statements for New York State, New York City, and Yonkers taxes, it is crucial to understand the dos and don'ts to ensure accurate and complete submission. Below is a curated list of practices to adopt and avoid during this process.

Things You Should Do:

Verify that each W-2 Record is completed for each federal Form W-2 you received, ensuring that New York State, New York City, or Yonkers wages or tax withheld are accurately reflected.

Transfer all applicable amounts, codes, or descriptions from your federal Form W-2 into the corresponding boxes on the IT-2 form, paying close attention to only include the information requested.

Enter whole dollar amounts only, rounding according to the provided rules: amounts below 50 cents should be dropped and amounts from 50 to 99 cents rounded up to the next dollar.

For those with multiple items in box 12 or 14 of their federal Form W-2, be sure to fill out an additional W-2 Record section as needed, without duplicating records for the same wages from different states.

Mark the correct boxes for statutory employees, retirement plans, or third-party sick pay if indicated on your federal Form W-2 to accurately transpose your situation to the IT-2 form.

Include only New York State, New York City, or Yonkers wages and withholding information, and ensure these are correctly partitioned in the designated boxes for each locality.

Things You Shouldn't Do:

Do not detach or separate the W-2 records from the IT-2 form when submitting; the form should be submitted as an entire page.

Avoid entering penny amounts or using decimals. Only whole dollars are acceptable, based on the rounding rules provided.

Do not include information not specifically requested on the IT-2 form, such as income that does not pertain to New York State, New York City, or Yonkers.

Refrain from submitting multiple W-2 Records for withholding from more than one other state for the same wages. Only one record is needed per state.

Do not fill in the Corrected (W-2c) box unless you are submitting a corrected W-2 Record. Only check this box if the submission includes corrected information.

Avoid forgetting to include your Social Security Number and the employer identification number exactly as they appear on your federal Form W-2.

Misconceptions

Understanding tax forms can sometimes be complex and lead to misconceptions, especially regarding the Form IT-2, Summary of W-2 Statements. This form is critical for New York State taxpayers. To ensure clarity, here are five common misconceptions about the IT-2 form and the truths behind them:

- Form IT-2 replaces the W-2 for state taxes.

This is incorrect. Form IT-2 does not replace the W-2 form but rather summarizes the information from your federal Form W-2 for New York State income tax returns. Taxpayers must file it along with their state return, but it's supplementary to the original W-2 forms, not a replacement.

- All New York State taxpayers must file Form IT-2.

This statement can be misleading. Only taxpayers who file a New York State income tax return and have received federal Form(s) W-2 must complete the IT-2 form. If your W-2 does not show any New York State, New York City, or Yonkers wages or taxes withheld, or if you did not receive a W-2 at all (for example, due to foreign earned income), different rules may apply.

- Form IT-2 needs every detail from the W-2.

Actually, Form IT-2 requires only specific information from your W-2 form relevant to New York State returns. Not every detail from your W-2 form needs to be transferred over. This includes your wages, tips, and other compensation, as well as New York State and local taxes withheld, as reported on the W-2.

- Filers with foreign income should not submit Form IT-2.

This is not entirely true. If you received foreign earned income and did not receive a W-2 because of this, you might still need to complete Form IT-2 by including this foreign income. It’s about reporting the income accurately, even if it doesn't fit perfectly into the categories detailed on a standard W-2.

- The IT-2 form is only about wage and tax information.

While it is primarily about wages and taxes, the IT-2 form also includes other significant information, such as dependent care benefits, nonqualified plans, and other specific codes and descriptions that reflect certain types of compensation or deductions. It's a holistic summary of your income as it pertains to your state tax return, not just a simple wage report.

In summary, Form IT-2 is an essential document for accurately reporting W-2 information on your New York State income tax return. By addressing these misconceptions, taxpayers can better understand how to complete their tax documents correctly, ensuring they meet their obligations without misunderstanding their tax forms.

Key takeaways

When filing a New York State (NYS) income tax return, using Form IT-2, Summary of W-2 Statements, is mandatory for individuals who have received federal Form(s) W-2, Wage and Tax Statement. This requirement also extends to those who have foreign earned income but did not receive a federal Form W-2.

Form IT-2 is designed to summarize the information provided on federal Form W-2. Each box on the IT-2 corresponds to a similarly named or numbered box on the federal W-2. It's crucial to transfer the information accurately from the federal W-2 to the corresponding sections on the IT-2.

If a federal Form W-2 includes more than four items in either box 12 or box 14, additional W-2 Records sections on the IT-2 form need to be completed. Ensure that boxes a, b, and c are filled with identical information as provided on the first W-2 Record for the same federal Form W-2 before listing the additional items.

- Only whole dollar amounts should be entered on Form IT-2. This means rounding amounts below 50 cents down and increasing amounts from 50 to 99 cents to the next highest dollar.

- For individuals with foreign earned income and no employer identification number fits the designated space, box b should be left blank.

- Corrected W-2 forms, indicated by a federal Form W-2c, must be marked with an 'X' in the corrected box. This signals that the information being provided reflects corrections from the original federal Form W-2.

- For New York State wage and withholding information, boxes 15a through 17a must be completed with precise details as reported on the federal Form W-2. If there are no New York State wages or withholding, these sections should be left blank.

- Similarly, if wages and withholding are reported for states other than New York, boxes 15b, 16b, and 17b should be completed with the specific other state information.

- For NYC or Yonkers localities, boxes 18 through 20 should be filled only if these wages and withholdings are reported on the federal Form W-2. It's important not to include locality information from any states other than New York.

Finally, when submitting Form IT-2, it must be included as a full page with the New York State income tax return. Do not detach or separate any W-2 Records, and keep federal Form W-2(s) for personal records. The total NYS, NYC, and Yonkers tax withheld amounts from all Form(s) IT-2 should be transferred to specified lines on the state income tax return.

Popular PDF Forms

Individual Vehicle Distance Record - Valuable for projecting future travel costs based on historical data.

Empire Today Coupons - Important note: Referrals for services like non-participating providers and inpatient admissions require direct approval through Empire Medical Management.