Blank It38 PDF Template

When navigating the complexities of gift and inheritance tax, understanding the IT38 form is crucial for individuals who have received gifts or inheritances on or after 5th December 2001. The form serves as a self-assessment return for gift/inheritance tax, excluding gifts of foreign property appointed from discretionary trusts created before 1/12/1999. With sections dedicated to the disponer (the giver) and the beneficiary (the receiver), the form seeks detailed information including personal identifiers, residency status, and the relationship between the two parties. Additionally, it inquires about specific reliefs, such as favorite nephew/niece and foster child relief, allowing for precise tax calculation. The IT38 form also delves into the nature of the benefit, whether it's a gift or inheritance, and the relevant dates and values associated with it, ensuring a comprehensive understanding of the assets being transferred. For further assistance, the guide provided in Booklet IT 39 is recommended, aimed at simplifying the completion process. Ultimately, this document plays a pivotal role in the accurate assessment and payment of taxes due on gifts and inheritances, aligning with the guidelines established by the Capital Acquisitions Tax Consolidation Act, 2003, and ensuring compliance with tax obligations.

Preview - It38 Form

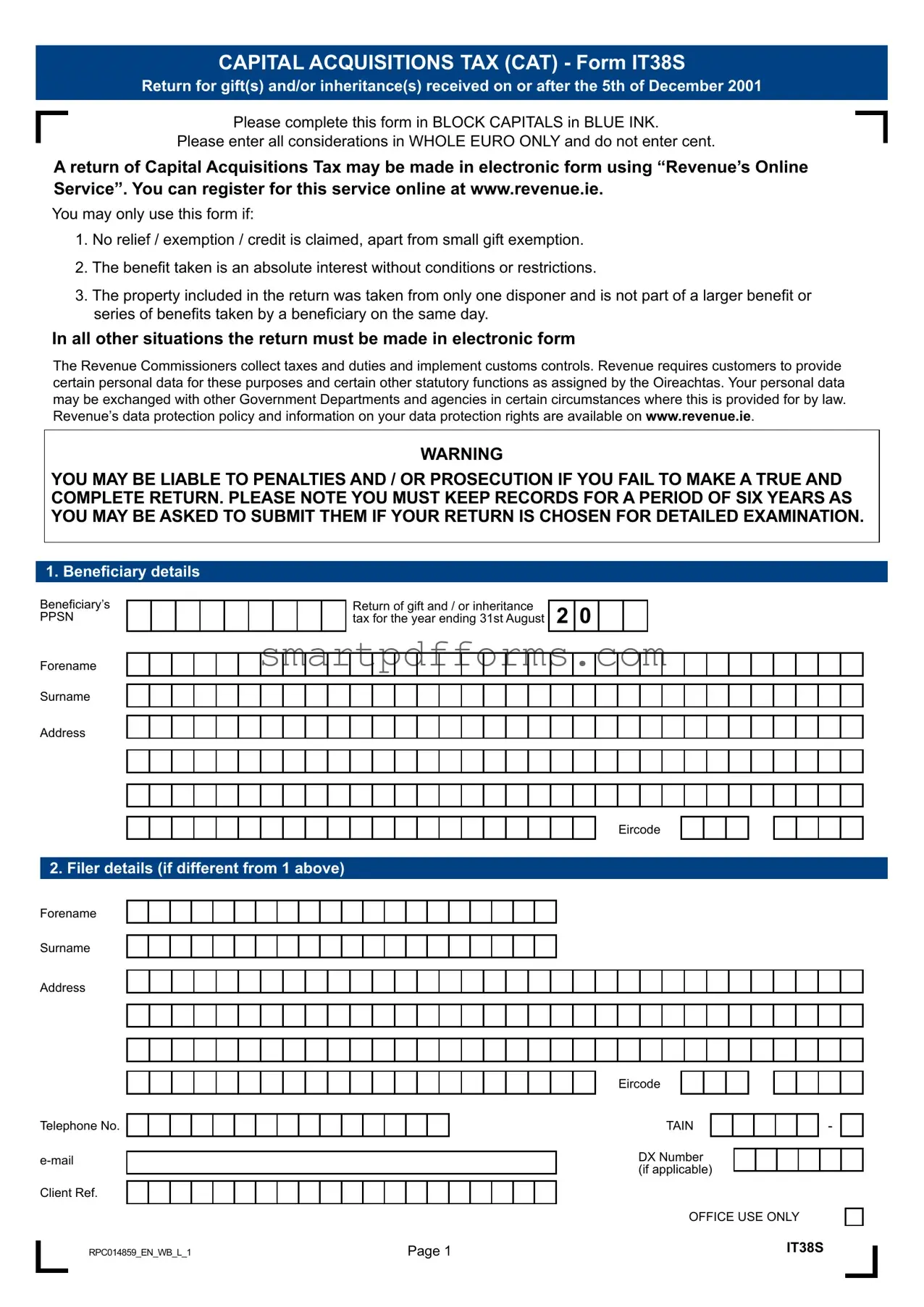

CAPITAL ACQUISITIONS TAX (CAT) - Form IT38S

Return for gift(s) and/or inheritance(s) received on or after the 5th of December 2001

Please complete this form in BLOCK CAPITALS in BLUE INK.

Please enter all considerations in WHOLE EURO ONLY and do not enter cent.

A return of Capital Acquisitions Tax may be made in electronic form using “Revenue’s Online Service”. You can register for this service online at www.revenue.ie.

You may only use this form if:

1.No relief / exemption / credit is claimed, apart from small gift exemption.

2.The benefit taken is an absolute interest without conditions or restrictions.

3.The property included in the return was taken from only one disponer and is not part of a larger benefit or series of benefits taken by a beneficiary on the same day.

In all other situations the return must be made in electronic form

The Revenue Commissioners collect taxes and duties and implement customs controls. Revenue requires customers to provide certain personal data for these purposes and certain other statutory functions as assigned by the Oireachtas. Your personal data may be exchanged with other Government Departments and agencies in certain circumstances where this is provided for by law. Revenue’s data protection policy and information on your data protection rights are available on www.revenue.ie.

WARNING

YOU MAY BE LIABLE TO PENALTIES AND / OR PROSECUTION IF YOU FAIL TO MAKE A TRUE AND COMPLETE RETURN. PLEASE NOTE YOU MUST KEEP RECORDS FOR A PERIOD OF SIX YEARS AS YOU MAY BE ASKED TO SUBMIT THEM IF YOUR RETURN IS CHOSEN FOR DETAILED EXAMINATION.

1. Beneficiary details

Beneficiary’s

PPSN

Forename

Surname

Address

Return of gift and / or inheritance tax for the year ending 31st August

2 0

Eircode

2. Filer details (if different from 1 above)

Forename

Surname

Address

Telephone No.

Client Ref.

Eircode

TAIN |

|

|

|

|

|

- |

DX Number (if applicable)

OFFICE USE ONLY

RPC014859_EN_WB_L_1 |

Page 1 |

IT38S |

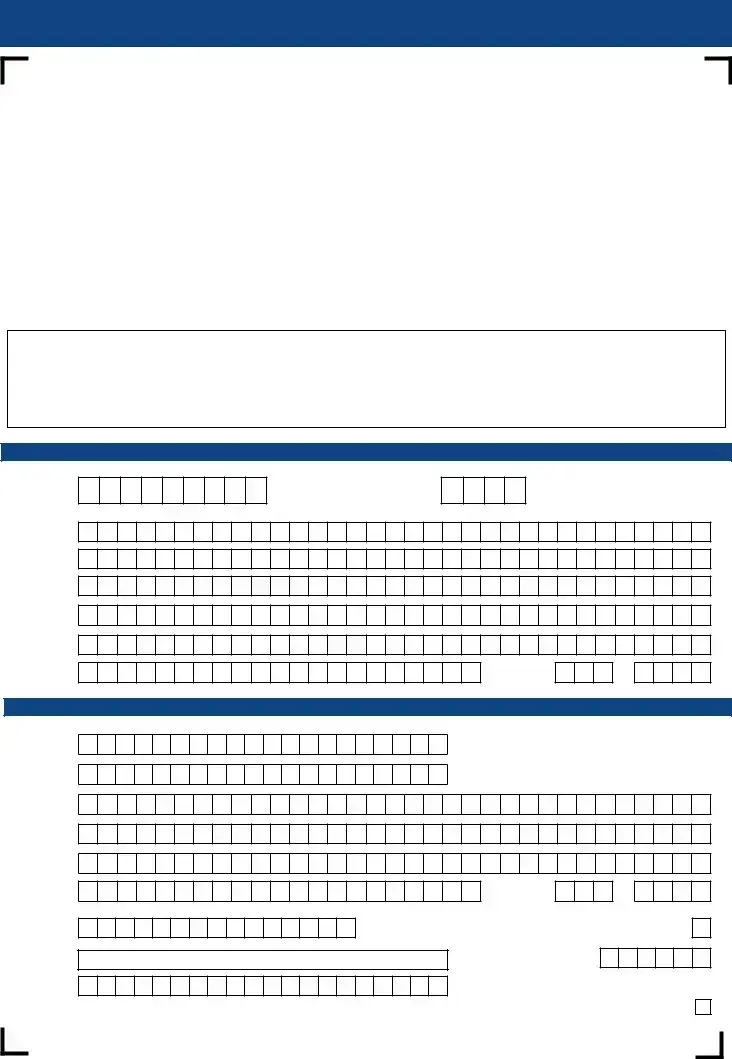

CAPITAL ACQUISITIONS TAX (CAT) - Form IT38S

Return for gift(s) and/or inheritance(s) received on or after the 5th of December 2001

Beneficiary’s

PPSN

Disponer details

Year

2  0

0

Disponer’s

PPSN Forename

Surname

Address

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eircode |

|

|

|

Place in the appropriate box to indicate the nature of the benefit |

|

Gift |

|||||||||||||||||

|

|

|

Place in the appropriate box to indicate whether the property is |

Real Property |

||||||||||||||||||

Inheritance

and/or Other Property

Date of gift/inheritance State the valuation date In the case of an inheritance, state the date of the disponer’s death

Place in the appropriate box to indicate the applicable Group Threshold

D D M M

/

/

/

A

Y Y Y Y

/

/

/

B |

|

C |

|

|

|

Information on current group thresholds is available on www.revenue.ie/en/tax/cat/thresholds.html Assessment of Capital Acquisitions Tax

A. Taxable Value of this gift/inheritance

B. Small Gift Exemption (where relevant)

C. Net Taxable Value of the benefit (A - B)

D. Relevant Threshold

E. Less Taxable Value of Prior Aggregable

Benefits within this Group Threshold

Millions Thousands Hundreds

, |

|

|

|

, |

, |

|

|||

|

|

|

, |

|

F. Available Threshold for this Benefit (D - E)

G. Taxable Excess (C - F)

Tax on Current Benefit (Rate______%)

Millions Thousands Hundreds

, |

|

|

|

, |

, |

|

|||

|

|

|

, |

|

, |

|

|||

|

|

|

, |

|

, |

|

|

|

, |

, |

|

|||

|

|

|

, |

|

, |

|

|||

|

|

|

, |

|

DECLARATION

I/We declare that the information given is true and complete and that the return is in accordance with the provisions of the Capital Acquisitions Tax Consolidation Act, 2003.

Signed

Capacity |

|

Date |

|

(Agent/beneficiary/trustee, etc.)

D D M M Y Y Y Y

/

/

/

OFFICE USE ONLY

RPC014859_EN_WB_L_1 |

Page 2 |

IT38S |

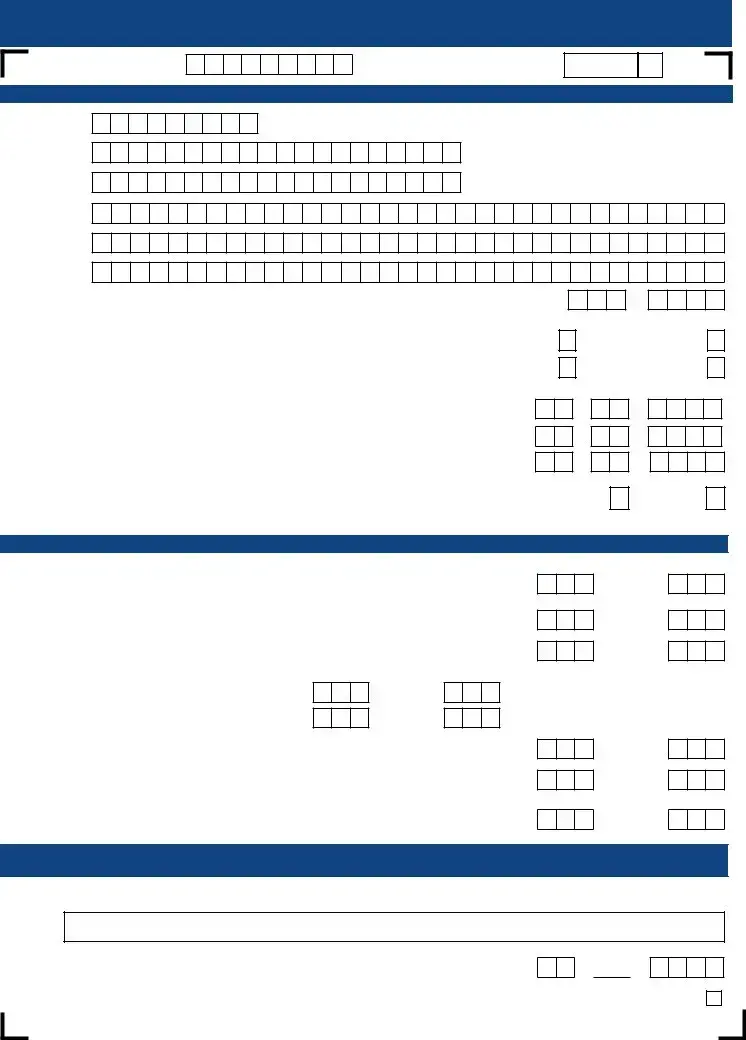

NAMEPPSN

PAY AND FILE 31 OCTOBER

2  0

0

In accordance with section 46 of the Capital Acquisitions Tax Consolidation Act 2003, a person who receives a gift or an inheritance with a valuation date in a year ending 31 August is required to pay gift or inheritance tax and file a tax return by the following

31 October.

All returns may be made in electronic format. However, you may use the attached paper form only if you meet the 3 conditions outlined at the top of the form.

In completing the payslip below, the name and PPSN to be entered are those of the beneficiary.

How to complete the payslip

You can ensure that your Capital Acquisition Tax payments are promptly and properly processed by completing the payslip below and forwarding it to the

Please enter an amount in the relevant space on the Payslip for the following:

1. Inheritance Tax

This is the amount of Capital Acquisitions Tax payable on inheritances received with valuation dates arising in the year ending

31August.

2.GIFT TAX

This is the amount of Capital Acquisitions Tax payable on gifts received with valuation dates arising in the year ending 31 August.

3. TOTAL NET AMOUNT

The Total Net Amount figure is the total Capital Acquisitions Tax payable comprising Inheritance Tax and Gift Tax.

PPSN:

|

|

|

|

|

|

|

|

€ Payslip |

Return of gift and/or inheritance tax |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

2 |

0 |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

for the year ending 31st August |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

Inheritance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

Tax |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

Name:

Signature:

Date:

Gift Tax

TOTAL NET

AMOUNT

, |

, |

, |

, |

.00

CAT

.00

PAY AND FILE - 31 OCTOBER

Please read the important information on this page before completing the payslip overleaf

IMPORTANT |

Methods of Payment |

|

|

You can make a payment against a tax liability using one of the following:

1. Revenue

For details on how to submit returns and make payments using the Revenue

2. Cheque

All cheques should be made payable to the

Do not enclose cash.

Importance of Prompt Payments

■Make sure that you allow sufficient time - at least three working days - for your payment to reach the Collector- General by the due date.

■Late payment of tax carries an interest charge.

■Failure to pay a tax liability, or failure to pay on time, can result in enforced collection through the Sheriff, Court proceedings or Attachment.

Enforcement carries costs, additional to any interest charged.

ENQUIRIES

Any enquiry regarding liability should be addressed to your local Revenue Office.

Any enquiry regarding payment should be addressed to the

Please return the payslip with a payment to:

Form Data

| Fact | Detail |

|---|---|

| Form Use | For gift and inheritance tax self-assessment for gifts and inheritances taken on or after 5th December 2001 |

| Exclusions | Not for use with gifts of foreign property appointed out of discretionary trusts created before 1/12/1999 |

| Completion Guidance | Refer to Booklet IT 39 for help with the return |

| Beneficiary and Disponer Residency | Includes questions on the residency status of both the beneficiary and the disponer at the time of the disposition |

| Nature of Benefit | Requires specification of the benefit as either a gift or inheritance, including relevant dates and origins |

| Limited Interest | Queries if the benefit is a limited interest and details on the person for whose life the interest is taken |

| Payment of Tax | Sections on whether tax is being paid from the proceeds of a policy or by the disponer, along with subsequent details |

| Benefit Details | Detailed breakdown required of the property comprising the gift/inheritance at valuation date |

| Tax Calculation | Section for self-assessment of Capital Acquisitions Tax including application of thresholds and reliefs |

| Supporting Documents | Attachments for agricultural and business relief calculation, and guidance on liabilities and consideration |

| Governing Law | Capital Acquisitions Tax Consolidation Act, 2003 governs the form |

Instructions on Utilizing It38

Filling out the IT38 form is a necessary step for those who have received a gift or inheritance and need to report it to the tax authorities. This form helps calculate the tax, if any, that needs to be paid on these received assets. It's important to gather all relevant information regarding the gift or inheritance before beginning the form to ensure accuracy and compliance with tax laws. Follow the steps outlined below with careful attention to each detail, and consider consulting the IT39 booklet if any questions arise during the process.

- Read through the entire form to familiarize yourself with all the sections and information required.

- Start with PART 1 THE DISPONER, filling out the details of the person who provided you with the gift or inheritance. This includes their PPS No., name, address, and residency status at the time of the disposition.

- In PART 2 THE BENEFICIARY, input your personal information, including your PPS No., name, address, and residency status as of the date of the gift or inheritance. Also, answer questions regarding your relationship to the disponer and any relevant reliefs claimed.

- Move on to PART 3 NATURE OF BENEFIT/RELEVANT DATES. Determine if the benefit is a gift or an inheritance and provide the relevant dates and nature of how the benefit was received.

- In PART 4 OTHER RELEVANT INFORMATION, disclose any additional pertinent information that may affect the tax assessment, like previous gifts received or if the tax is being paid through specific methods like proceeds from a policy.

- For PART 5 DETAILS OF BENEFIT, list all property comprising the gift/inheritance, categorizing each item under agricultural, business, or other property and providing market values for each.

- In PART 6 LIABILITIES, COSTS, CONSIDERATION, ETC., deduct any liabilities, costs, and considerations paid that are properly payable out of the benefit.

- Complete PART 7 TAXABLE VALUE OF BENEFIT by calculating the market value of property listed in PART 5, applying any relevant reliefs or exemptions, and deducting liabilities and costs to arrive at the taxable value of the benefit.

- PART 8 SELF-ASSESSMENT OF CAPITAL ACQUISITIONS TAX (INCLUDING INTEREST) PAYABLE involves calculating the tax payable on the benefit. Follow the instructions to determine the group threshold, taxable value, and calculate any applicable tax rate.

- Lastly, in PART 9 DECLARATION, sign and date the form, declaring that the information provided is accurate and complete. Ensure the capability for which you are signing (e.g., beneficiary) is clearly indicated.

Upon completing the form, review all parts to ensure accuracy and completeness. The next step involves filing the form with your local tax office, which can often be done electronically via the Revenue Online Service. Don't forget to include payment for any tax due, unless planning to pay in installments or if another payment arrangement has been made.

Obtain Answers on It38

-

What is Form IT38 used for?

Form IT38 is used for the self-assessment of gift and inheritance taxes in situations where the gifts and inheritances were taken on or after 5th December 2001. It should not be used for gifts of foreign property appointed out of discretionary trusts established before 1/12/1999.

-

Can Form IT38 be filled out electronically?

Yes, Form IT38 can be filed and the corresponding tax paid electronically using the Revenue Online Service (ROS) at www.revenue.ie.

-

Which parts of Form IT38 are compulsory to complete?

All relevant sections of Form IT38 should be completed, including information about the disponer (the person giving the gift or leaving the inheritance), the beneficiary (the person receiving the gift or inheritance), the nature and valuation date of the benefit, other relevant information, details of the benefit, liabilities, the calculation of taxable value, self-assessment of tax payable, and declaration. Appendices for specific reliefs should also be completed if applicable.

-

What should be done if there is uncertainty about any item on the return?

If there is uncertainty regarding the tax treatment of any item in the return, the "Expression of Doubt" box should be ticked, and a detailed covering letter should be attached to the return, setting out the issue clearly.

-

How is the taxable value of a benefit calculated?

The taxable value of a benefit is determined by taking the market value of the property making up the gift/inheritance at the valuation date, then accounting for any liabilities, costs, or expenses that are properly payable out of the benefit. Deductions for reliefs and exemptions may also apply before arriving at the net taxable value.

-

Are there specific reliefs that can be claimed on the IT38 form?

Yes, there are specific reliefs available, such as agricultural relief and business property relief. These reliefs can significantly reduce the taxable value of the property if the required conditions are met. Details for claiming these reliefs are outlined in the appendices of the IT38 form.

-

What if the beneficiary has received other gifts or inheritances?

If the beneficiary has received other gifts or inheritances, these may need to be aggregated depending on their group threshold and the date received to accurately assess the tax liability. The form contains sections to provide details about such prior benefits.

-

Can tax be paid in installments?

Yes, tax can be paid in statutory installments under certain conditions. Specific areas of the IT38 form address the calculation and declaration for those opting to pay by installments.

-

What happens after submitting Form IT38?

After submitting Form IT38 and the tax payment, the return may be selected for audit by the revenue authorities. Accurate and complete filling of the form is crucial as penalties may be imposed for incorrect returns.

-

Where should the completed IT38 form be sent?

The completed IT38 form and payment, if not submitted electronically, should be sent to the Disponer’s Regional Office. The contact details for the office can be found at www.revenue.ie, or assistance can be obtained via the provided telephone number.

Common mistakes

Filling out the IT38 form for Gift/Inheritance Tax Self-Assessment Return can sometimes be tricky. People often stumble over several common pitfalls during the process. Awareness and attention to detail can prevent these errors, helping to submit the form accurately and efficiently.

Failing to use block capitals or type, which is recommended for clarity.

Incorrectly stating the disponer and beneficiary's residency status leading to potential misclassification for tax purposes.

Omitting or inaccurately entering the PPS numbers, which are crucial for identification.

Not specifying the nature of the benefit correctly as a gift or an inheritance, which can impact the tax calculation.

Overlooking the various relief claims such as favourite nephew/niece relief or foster child relief that could significantly reduce the tax liability.

Misunderstanding the valuation date's importance, leading to incorrect tax amounts being calculated.

Neglecting to attach necessary documentation or evidence for areas of doubt, slowing down the assessment process.

Errors in calculating the taxable value of the benefit, often due to incorrect deductions or valuation of property.

Misreporting previous gifts, which affects the cumulative threshold and potentially the tax owed.

Forgetting to sign the declaration part, an essential step for the form’s validity.

These errors, though common, can have significant implications on the tax assessment and compliance. It’s always best to review the IT38 form carefully before submission, and when in doubt, seek guidance by consulting the Guide to completing the Gift/Inheritance Tax Self-Assessment Return (Booklet IT 39) or by contacting the appropriate tax information service.

Documents used along the form

When navigating the process of managing taxes for gifts and inheritances, understanding the right forms and documents can make a significant difference. The IT38 form is essential for reporting gift and inheritance taxes, but there are other documents you might need to complete the process effectively and comply with all legal requirements.

- Booklet IT39: This guide provides detailed instructions on how to complete the IT38 form. It clarifies various sections of the form and helps you understand the tax implications of your gift or inheritance.

- Form IT40: Required if inheritance tax is being paid by the tender of Government Stock, offering an alternative payment method for the obligations owed.

- Form IT43: Helps calculate the Double Taxation Credit, ensuring that you do not pay more tax than necessary if the same event is taxed in another country as well as in Ireland.

- Appendix A: Included in the IT38 form, this appendix is essential for calculating agricultural relief, which can substantially reduce the taxable value of agricultural property included in the gift or inheritance.

- Appendix B: Also part of the IT38 form, which focuses on calculating relief for business property. This can affect the taxable value of business assets included in your gift or inheritance.

- Revenue Online Service (ROS): While not a form, ROS is an essential platform for electronically filing the IT38 form and other tax documents. It simplifies the process of submitting your documents and making payments.

With these documents and resources, individuals can ensure they are correctly reporting and paying taxes on gifts and inheritances. It is important to seek out the correct forms and understand the specific circumstances of your gift or inheritance to make sure you are in compliance with tax laws. Managing taxes for gifts and inheritances can be complex, but the right information and resources can guide you through the process.

Similar forms

Form 1040 (U.S. Individual Income Tax Return): Similar to the IT38 form, the 1040 form is used for self-assessment and reporting of tax liabilities, in this case, income tax. Both forms require detailed personal and financial information to calculate the tax due accurately.

Form 709 (United States Gift (and Generation-Skipping Transfer) Tax Return): Form 709 is similar to the IT38 form because it deals with the reporting of gifts, similar to how the IT38 form is used for reporting gifts and inheritances for tax purposes. Both forms assess tax liabilities arising from transfers of wealth.

Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return): This form, like the IT38, is used to report taxes related to inheritances. The 706 form is specifically for estate taxes upon death, capturing similar data to what's required on the IT38 concerning the decedent and beneficiaries.

Schedule K-1 (Form 1041) for Estates and Trusts: Schedule K-1 shares a purpose with the IT38 form in that it reports individual beneficiaries' share of an estate or trust's income, deductions, and credits. Like the IT38, it requires detailed information on both the giver (the estate/trust) and the receiver (the beneficiary).

Form 8283 (Noncash Charitable Contributions): While used for slightly different purposes, Form 8283 is similar to the IT38 in that it involves valuation of non-cash items for tax-related purposes. Both require detailed descriptions of property and its value to ensure accurate tax reporting and liability assessment.

Dos and Don'ts

When filling out the IT38 form for Gift/Inheritance Tax Self-Assessment Returns, it's important to approach the task with care and attention to detail. Here are five key dos and don'ts to help guide you through the process:

Do:- Read the instructions carefully. Before you begin, consult the Guide to completing the Gift/Inheritance Tax Self-Assessment Return (Booklet IT 39) to understand each section's requirements.

- Type or use block capitals. This enhances the clarity of your information, reducing the potential for errors during processing.

- Provide complete information for both the disponer and the beneficiary. Details such as PPS numbers, names, addresses, and residency status are crucial for accurately assessing tax obligations.

- Check the valuation date and ensure accurate property valuation. The market value of the property as of the valuation date is essential for determining the taxable value of the benefit.

- Apply for relevant reliefs and exemptions correctly. If you're eligible for reliefs such as dwelling-house exemption or agricultural relief, make sure to apply them properly to reduce the taxable value.

- Leave sections incomplete. Failing to provide required information can lead to processing delays or incorrect assessments.

- Misunderstand residency and domicile information. Ensure the correct residency and domicile status of both the disponer and beneficiary are accurately recorded, as this can affect tax liability.

- Incorrectly assess the nature of the benefit. Clearly differentiate whether the benefit is a gift or an inheritance, and understand how it arose (i.e., via will, intestacy, deed, etc.).

- Forget to claim eligible exemptions and reliefs. Neglecting to claim exemptions you're entitled to can result in paying more tax than necessary.

- Overlook the declaration and signature at the end of the form. The declaration confirms that all information provided is true and complete. An unsigned form can render the submission invalid.

Filling out the IT38 form with diligence and accuracy is crucial for ensuring that the Gift/Inheritance Tax Self-Assessment is correctly processed, thereby avoiding potential penalties for incorrect returns.

Misconceptions

Understanding the complexities of tax forms is essential, but misconceptions can lead to potential errors. The IT38 form, specifically designed for reporting gifts and inheritances in self-assessment tax returns, is no exception. Here, we dispel some common misunderstandings related to its use and requirements.

Misconception 1: The IT38 form is applicable for all types of gifts. Contrary to this belief, the IT38 form should not be used for gifts of foreign property appointed out of discretionary trusts if the trust was established before December 1, 1999. It's important for taxpayers to use the correct form to avoid processing delays or other issues.

Misconception 2: Only the beneficiary needs to provide information. Actually, both the disponer (the person giving the gift or inheritance) and the beneficiary (the person receiving the gift or inheritance) must supply information. This includes residency status, domicile, and relationship to the other party, which are critical for accurately assessing tax liability.

Misconception 3: The form does not accommodate multiple gifts or inheritances. This misunderstanding can lead to incomplete reporting. The IT38 form is designed to cover both singular and multiple gifts or inheritances, provided they meet the specified criteria. If dealing with multiple instances, careful attention to detail is necessary to ensure all are correctly documented.

Misconception 4: Any questions or doubts can't be addressed in the form. If a taxpayer is unsure about the tax treatment of any item, they actually can express this doubt directly on the form. By ticking the appropriate box and attaching a letter outlining the issue, they can seek clarification or assistance from tax authorities.

Misconception 5: The IT38 form determines the tax payable. While it's true that the form asks for a self-assessment of Capital Acquisitions Tax (CAT), including any reliefs or exemptions claimed, it doesn’t automatically calculate the tax due. Taxpayers should use the information provided in the form along with guidance from the Revenue Commissioners or a tax professional to accurately determine their tax liability.

Misconception 6: Once submitted, the IT38 form cannot be audited. In fact, like many tax forms, submissions may be reviewed or audited by tax authorities to ensure accuracy and compliance with tax laws. Incorrect returns can lead to penalties, emphasizing the importance of careful completion and adherence to guidelines.

Dispelling these misconceptions encourages accurate and efficient tax reporting. For further assistance, taxpayers should refer to the official guide or consult with a tax professional.

Key takeaways

Filling out the IT38 form accurately is crucial for individuals dealing with Gift/Inheritance Tax Self-Assessment Returns for gifts and inheritances taken on or after December 5, 2001. Here are key takeaways to guide you through the process:

- Ensure the use of the IT38 form is appropriate for your situation; it is designed specifically for self-assessing gift and inheritance taxes but is not applicable for gifts of foreign property appointed out of discretionary trusts created before December 1, 1999.

- Completing the form in block capitals and typing, if possible, facilitates clearer communication and minimizes processing errors.

- The guidance provided in the Guide to Completing the Gift/Inheritance Tax Self-Assessment Return (Booklet IT 39) is an invaluable resource that should be consulted to avoid common pitfalls and understand the nuances of the form.

- Accurately identifying the relationship between the disponer and the beneficiary, along with their residency statuses at the time of the gift or inheritance, is fundamental for determining tax liabilities.

- Clarity about the nature of the benefit (gift or inheritance) and the relevant dates (such as the date of gift/inheritance, date of disponer’s death, and the valuation date) is essential for correct tax calculation.

- Disclosing previous gifts within specified timeframes and any potential tax payments from section 72/73 policies can significantly impact the tax calculation.

- Detailed information about the property comprising the gift/inheritance and associated liabilities, costs, and considerations is required to accurately determine the taxable value.

- Specific reliefs and exemptions, such as dwelling-house exemption or agricultural relief, must be carefully assessed and claimed where applicable.

- The self-assessment part of the form requires careful calculation to establish the taxable value, incorporate any applicable thresholds, and calculate the tax due, including any potential interest on unpaid tax.

- Ensuring that the declaration section is signed and dated correctly is crucial, as inaccuracies or omissions can lead to audits and penalties.

Compliance with these key aspects when completing and using the IT38 form can help individuals navigate the complexities of Gift/Inheritance Tax Self-Assessment, thus avoiding common mistakes and ensuring that their tax obligations are met accurately and efficiently.

Popular PDF Forms

Vehicle Documents - Special plates and decals issuance, including reissues for lost or damaged plates, are facilitated through the VSA 14 form's plate information section.

433 a Oic - The details provided in Form 433-A help the IRS determine the taxpayer's reasonable collection potential, important in offer evaluations.