Blank Itemized Disposition PDF Template

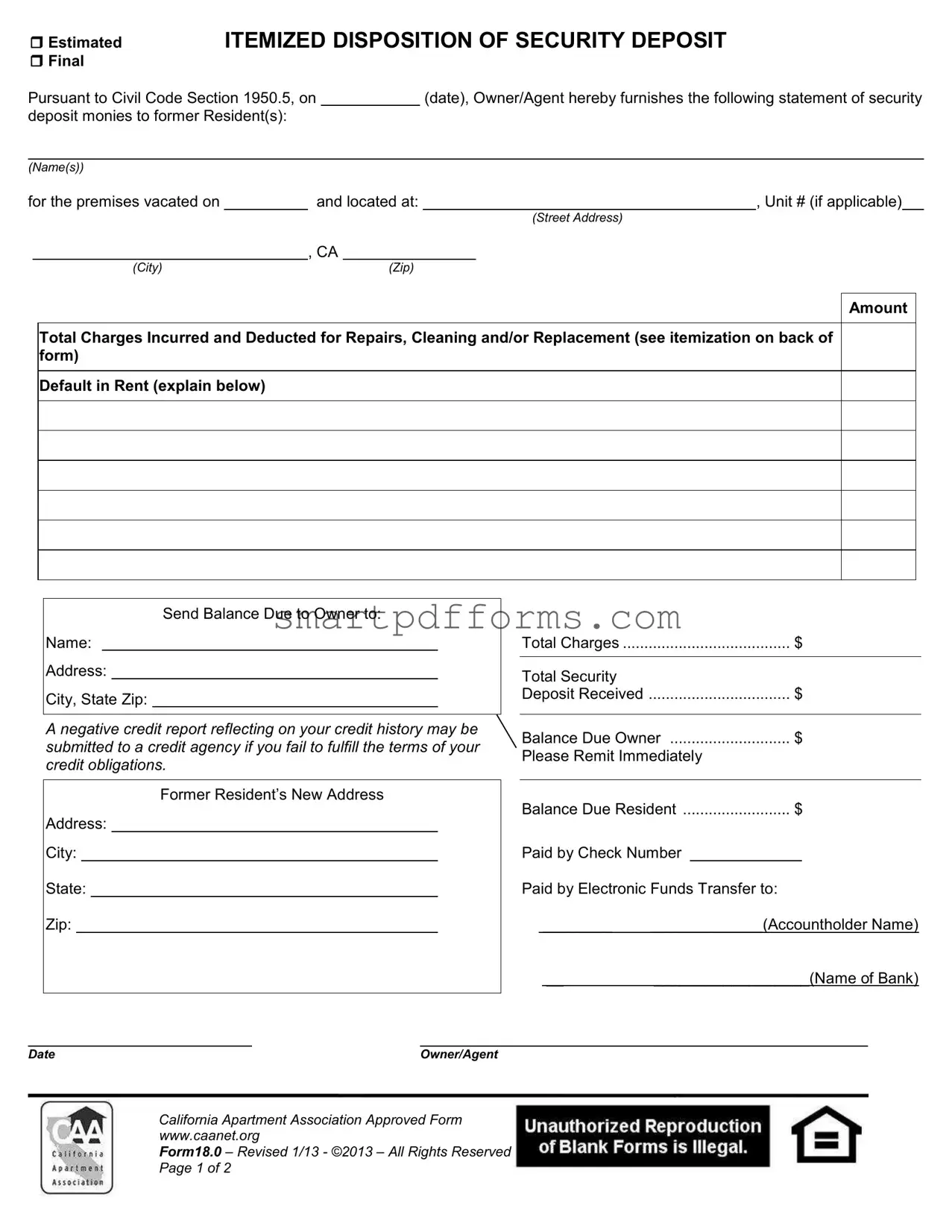

Navigating the complexities of housing rights and responsibilities can be challenging for both landlords and tenants, especially when it comes to the end of a lease term and the return of a security deposit. The Itemized Disposition of Security Deposit form plays a crucial role in this process, ensuring clarity and compliance with California Civil Code Section 1950.5. This form, which must be provided by the owner or agent to the former residents, details the allocation of the security deposit, including amounts retained for repairs, cleaning, and/or replacements, as well as any outstanding rent defaults. It serves as a transparent record that itemizes total charges incurred, how much of the security deposit was received, and the balance due to either the owner or the resident. By meticulously breaking down expenses, including the description of work done, the hourly rates, and materials used, the form is designed to prevent disputes and misunderstandings. The legal requirement for providing such a detailed statement underscores the importance of documentation in protecting the rights and obligations of both parties involved. It is a safeguard that ensures tenants are only charged for beyond normal wear and tear, while landlords can rightfully deduct costs for maintaining their property's condition.

Preview - Itemized Disposition Form

Estimated

Final

ITEMIZED DISPOSITION OF SECURITY DEPOSIT

Pursuant to Civil Code Section 1950.5, on |

|

|

|

|

(date), Owner/Agent hereby furnishes the following statement of security |

||||||

deposit monies to former Resident(s): |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

(Name(s)) |

|

|

|

|

|

|

|

|

|||

for the premises vacated on |

|

|

and located at: |

|

|

|

, Unit # (if applicable) |

|

|||

|

|

|

|

|

|

|

|

|

(Street Address) |

||

|

|

, CA |

|

|

|

|

|

||||

|

(City) |

|

|

|

(Zip) |

|

|

|

|

|

|

Amount

Total Charges Incurred and Deducted for Repairs, Cleaning and/or Replacement (see itemization on back of form)

Default in Rent (explain below)

Send Balance Due to Owner to:

Name:

Address:

City, State Zip:

A negative credit report reflecting on your credit history may be submitted to a credit agency if you fail to fulfill the terms of your credit obligations.

Former Resident’s New Address

Address:

City:

State:

Zip:

Total Charges |

|

$ |

|

|||

|

|

|

|

|

|

|

Total Security |

|

|

|

|

|

|

Deposit Received |

|

$ |

|

|||

|

|

|

|

|

|

|

Balance Due Owner |

$ |

|

||||

Please Remit Immediately |

|

|

|

|||

|

|

|

|

|

|

|

Balance Due Resident |

$ |

|

||||

Paid by Check Number |

|

|

|

|

||

Paid by Electronic Funds Transfer to: |

|

|

|

|||

|

________ |

_____________(Accountholder Name) |

|

|||

__ |

__________________(Name of Bank) |

Date |

Owner/Agent |

California Apartment Association Approved Form

www.caanet.org

Form18.0 – Revised 1/13 - ©2013 – All Rights Reserved

Page 1 of 2

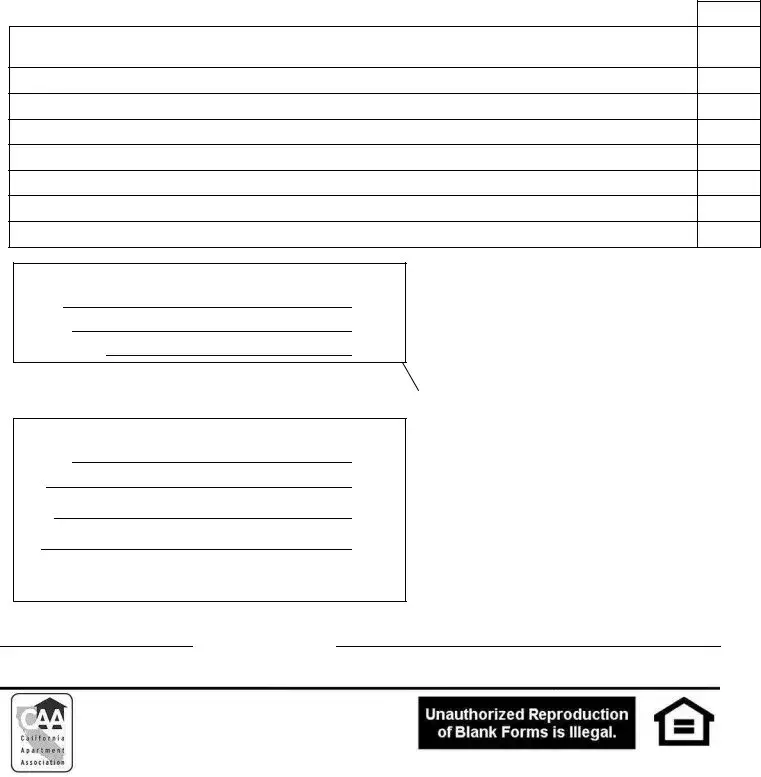

Summary of Estimated or Actual Charges Incurred and Deducted For Repairs, Cleaning and/or Replacement*

1. |

Description of work performed by Owner/Agent or Employee of Owner/Agent: |

|

Hourly Rate x Time = Amount |

|

||||||

|

|

|

|

|

x |

|

hr(s) = $ |

|

|

|

|

|

|

|

|

x |

|

hr(s) = $ |

|

||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Description of work performed by other person or entity. Name, address, and |

|

|

|

|

|

|

|

|

|

|

telephone number of the person or entity is provided below if not on bill, invoice, |

|

|

|

Receipt(s) Attached** |

|

||||

|

or receipt: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3. |

Description of deductions for materials and supplies: |

|

Bill, Invoice, Receipt, Vendor Price List |

|

||||||

|

|

|

|

or Other Vendor Document Attached** |

|

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4. |

Description of repairs to be done by Owner/Agent or Employee of Owner/Agent |

|

Estimate of charges |

|

||||||

|

that are not completed within 21 calendar days. Final documentation/receipts |

|

(i.e., labor/materials/supplies) |

|

||||||

|

will be mailed within 14 days of completion:** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. |

Description of services, materials, and supplies from other person or entity from |

|

Estimate of charges |

|

||||||

|

whom documentation has not yet been received. Name, address, and telephone |

|

(i.e., labor/materials/supplies) |

|

||||||

|

number of the person or entity is provided below. Final documentation/receipts |

|

|

|

|

|

|

|

|

|

|

will be mailed within 14 days of receipt by Owner/Agent:** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (enter this total in the column to the right and also on page one)

$

*Civil Code Section 1950.5(b) allows deductions from the security deposit for: (1) the compensation of a landlord for a tenant's default in the payment of rent. (2) The repair of damages to the premises, exclusive of ordinary wear and tear, caused by the tenant or by a guest or licensee of the tenant. (3) The cleaning of the premises upon termination of the tenancy necessary to return the unit to the same level of cleanliness it was in at the inception of the tenancy. (4) To remedy future defaults by the tenant in any obligation under the rental agreement to restore, replace, or return personal property or appurtenances, exclusive of ordinary wear and tear, if the security deposit is authorized to be applied thereto by the rental agreement.

**The Owner/Agent is not required to provide receipts or other documentation if (1) the total deductions for repairs, cleaning, and replacement do not exceed $125, or (2) the Resident has effectively waived the right to documentation.

Total Deductions for Repairs, Cleaning and Replacement Do Not Exceed $125.

Resident has Waived the Right to Documentation.

California Apartment Association Approved Form

www.caanet.org

Form18.0 – Revised 1/13 - ©2013 – All Rights Reserved

Page 2 of 2

Form Data

| Fact | Detail |

|---|---|

| Governing Law | The Itemized Disposition of Security Deposit is governed by Civil Code Section 1950.5 in California. |

| Documentation Requirement | Owners/Agents are required to provide an itemized statement of deductions from the security deposit for repairs, cleaning, replacements, and rent defaults, along with documentation unless deductions do not exceed $125 or the resident waives the right to documentation. |

| Timeframe for Providing Final Documentation | If repairs, cleaning, or replacements are not completed within 21 calendar days, the owner/agent must mail final documentation or receipts within 14 days of completion. |

| Purpose of Deductions | Deductions from the security deposit can be made for unpaid rent, repair of damages beyond ordinary wear and tear, cleaning to return the unit to its initial level of cleanliness, and to cover future defaults by the tenant as specified in the rental agreement. |

Instructions on Utilizing Itemized Disposition

Filling out the Itemized Disposition of Security Deposit form is a straightforward process that requires attention to detail. This form is used to explain how the security deposit is being handled after a resident moves out. It includes deductions for repairs, cleaning, and other fees against the initial security deposit amount. Carefully itemizing these charges ensures transparency between the owner/agent and the former resident. Follow these steps to correctly fill out the form:

- Check the appropriate box at the top of the form to indicate whether the document is an Estimated or Final account of the security deposit.

- Fill in the date on which the statement is being provided in the space provided.

- Enter the name(s) of the former Resident(s) and the date the premises were vacated.

- Provide the address of the vacated premises, including unit number if applicable, city, and zip code.

- List the total amount of charges incurred and deducted for repairs, cleaning, and/or replacement on the back of the form. Be detailed in the itemization to ensure clarity and transparency.

- If applicable, describe any default in rent and the balance due to the owner. Provide an explanation in the space provided.

- Enter the owner's name and mailing address where the balance due should be sent.

- Note that a negative credit report may be submitted if terms of the credit obligations are not met. This is a standard warning to ensure former residents understand the consequences of not settling their accounts.

- Fill in the former Resident’s new address, including city, state, and zip code, to ensure any correspondence or refunds can be correctly directed.

- Enter the total initial security deposit received, total charges, and the balance due either to the owner or the resident. If there is a balance due to the resident, specify how it will be paid (by Check Number or Electronic Funds Transfer), including the accountholder name and bank name.

- Under the summary of estimated or actual charges section, provide a detailed itemization of charges for repairs, cleaning, and replacement as required. Include descriptions of work performed, the hourly rate and time, cost of materials and supplies, and any estimates for charges not yet completed. Attach available documentation or receipts as necessary unless the total deductions do not exceed $125 or the resident has waived the right to documentation.

- Calculate and enter the total amount of deductions and ensure this figure is consistent on both pages of the form.

Once completed, review the form for accuracy and completeness. Ensure that any required documentation is attached or noted as waived by the resident. The clear itemization and detailed information provided in this form are crucial for maintaining a fair and transparent relationship with the former resident. It also serves as an official record that can be referred to if any disputes arise regarding the security deposit disposition.

Obtain Answers on Itemized Disposition

-

What is an Itemized Disposition of Security Deposit form?

An Itemized Disposition of Security Deposit form is a detailed statement provided by the owner or agent to the former resident. It outlines the security deposit amount received, total charges incurred for repairs, cleaning, and replacement, any rent default, and the balance due to either the owner or the resident. This document is furnished in accordance with Civil Code Section 1950.5 and is intended to make transactions related to security deposits transparent and fair for both parties involved.

-

When should I expect to receive the Itemized Disposition form?

Under Civil Code Section 1950.5, the owner or agent is required to provide this itemization of the security deposit deductions (and any remaining balance) to the former resident within 21 calendar days after the premises have been vacated. If there are charges for repairs, cleaning, or replacement that cannot be completed within this timeframe, an estimate will be provided first, with final documentation to follow within 14 days of completion.

-

Are receipts or documentation always required to be attached to the form?

No, receipts or other documentation for the deductions made from the security deposit are not required if either of two conditions is met: first, if the total deductions for repairs, cleaning, and replacement do not exceed $125; or second, if the resident has effectively waived the right to documentation. However, in all other cases, documentation such as bills, invoices, or receipts must be provided to substantiate the deductions made from the security deposit.

-

What can I do if I disagree with the deductions made on the Itemized Disposition form?

If you disagree with the deductions, it is recommended to first communicate directly with the owner or agent to discuss and potentially resolve the dispute. If an agreement cannot be reached, you may consider mediation or small claims court as possible avenues to contest the deductions. Remember, it's essential to keep a copy of the Itemized Disposition form and any related communication as evidence to support your case.

Common mistakes

When it comes to handling the Itemized Disposition of Security Deposit form, some common mistakes can result in misunderstandings, delays, or even financial loss. Being vigilant and attentive to detail can save much trouble for both the owner/agent and the former residents. Here are seven frequent mistakes:

Not specifying whether the charges are estimated or final. This clarity is crucial for understanding the current status of the account.

Failing to provide a complete and clear itemization of repairs, cleaning, and/or replacement on the back of the form. Detail is key to transparency and fairness.

Omitting the dates, such as when the premises were vacated and when itemized charges are estimated to be finalized. Dates ensure that all parties are aligned on timelines.

Incorrectly calculating the total charges incurred and deducted. This could lead to disputes or discrepancies in the security deposit disposition.

Forgetting to include the former resident's new address, which is essential for any communication or refunds due.

Not attaching necessary documentation such as bills, receipts, invoices, or vendor price lists, when the deductions exceed $125 or when the resident has not waived the right to documentation.

Leaving out details of how the balance due to the owner or the resident will be paid, by check or electronic funds transfer, including necessary account information.

Avoiding these mistakes can lead to a smoother transition for both parties involved. Compliance with the guidelines laid out in the Civil Code and ensuring all relevant information and documentation are thoroughly provided and checked can help prevent misunderstandings and ensure a fair and transparent process.

Documents used along the form

When handling rental agreements and the conclusion of tenancies, several documents work in tandem with the Itemized Disposition form to ensure clarity, compliance with legal requirements, and protection for both parties involved. These forms document the financial transactions and conditions related to the rental property's maintenance, damage repairs, and other pertinent aspects that affect the security deposit's disposition. Let's explore eight documents often used alongside the Itemized Disposition form:

- Rental Agreement: This foundational document outlines the terms and conditions agreed upon by the landlord and tenant, including rent, duration of the lease, and responsibilities of each party. It serves as a reference for any disputes regarding the rental arrangement.

- Move-In/Move-Out Inspection Checklist: This form records the property's condition at the time the tenant moves in and again when they leave. It's crucial for identifying any damages that occurred during the tenancy, which might be deducted from the security deposit.

- Receipts for Repairs and Cleaning: These are detailed receipts from contractors, cleaning services, or materials purchased for repairs and cleaning of the rental unit. They provide proof of the costs incurred by the landlord for deductions from the security deposit.

- Rent Ledger: This is a record of rent payments made by the tenant. It can be used to verify that rent is paid in full and on time, or to identify any outstanding amounts that could be deducted from the security deposit.

- Notice of Lease Violation: If the tenant breaches the lease terms, this document is issued to them. It serves as a formal warning and can support deductions from the security deposit if the issues are not remedied.

- Property Management Agreement: For rental properties managed by a third party, this agreement outlines the responsibilities of the property manager with respect to the property, including handling of security deposits and related documentation.

- Utility Bills: If the tenant is responsible for paying utilities and fails to do so, outstanding utility bills may be relevant. These would support deductions from the security deposit for utilities left unpaid at move-out.

- Eviction Notice: In unfortunate circumstances where eviction is necessary, this legal document initiates the process. While not directly related to the Itemized Disposition of the security deposit, it might contextualize deductions related to lease violations and damages.

In the intricate dance of tenancies, diligent documentation ensures all parties fulfill their obligations and protect their rights. From the lease agreement's inception to its conclusion, each form plays a pivotal role. They collectively provide a comprehensive view of the tenancy lifecycle, ensuring transparency and fairness in the final disposition of the security deposit. Handling these documents with care and precision is essential for maintaining positive landlord-tenant relationships and upholding legal standards.

Similar forms

Lease Agreement: Much like the Itemized Disposition form, a lease agreement outlines specific financial obligations of the tenant, including security deposit amounts, payment schedules, and conditions under which deductions may be made. Both documents are governed by legal statutes that protect both the tenant and landlord's interests.

Rental Inspection Checklist: This document is used at the beginning and end of a tenancy to record the condition of the property. Similar to the Itemized Disposition form, it can directly impact the security deposit deductions for repairs or cleaning needed due to damage beyond normal wear and tear.

Move-Out Reminder Notice: This notice often includes a checklist or guidance for tenants on how to leave the property to minimize or avoid deductions from their security deposit, akin to the purposes served by the Itemized Disposition form in detailing charges incurred and deducted.

Security Deposit Refund Letter: This corresponds closely with the Itemized Disposition form, as it itemizes deductions made from the security deposit and details any amounts being returned to the tenant, along with an explanation for each deduction.

Rent Receipts: While primarily serving as proof of payment, rent receipts share a commonality with the Itemized Disposition form in maintaining a financial record between the landlord and tenant, which can be helpful in disputes over payments or deductions.

Damage Report: Similar to the itemization on the back of the Itemized Disposition form, a damage report lists specific damages to the property, who is responsible, and the estimated or actual costs for repairs, which could be deducted from the security deposit.

Eviction Notice: While serving a different primary function, an eviction notice may include language similar to the Itemized Disposition form regarding the balance due to the owner or amounts to be deducted from the security deposit in cases of payment default.

Property Management Agreement: This document outlines the responsibilities of a property manager, including handling of security deposits and itemization of deductions, paralleling the financial transactional details provided in the Itemized Disposition form.

Final Account Statement: Similar to an Itemized Disposition form, this statement provides an end-of-tenancy summary of all charges, payments, and refunds between the landlord and tenant, including any deductions from the security deposit.

Tenant's Notice to Vacate: A tenant's notice to vacate might indirectly relate to the Itemized Disposition form by setting in motion the process of vacating the unit, inspection for damages, and the subsequent itemization of deductions from the security deposit.

Dos and Don'ts

When filling out the Itemized Disposition of Security Deposit form, there are several best practices to follow, as well as some common pitfalls to avoid. This guidance is crucial for both landlords and tenants to ensure the process is conducted fairly and within the legal framework established by the Civil Code Section 1950.5.

Things You Should Do

Provide complete and accurate information: Fill out every section of the form with accurate data, including the full names of the resident(s), the address of the premises, and the accurate dates relevant to the tenancy and vacating of the property. Accuracy is essential for legal and record-keeping purposes.

Itemize deductions clearly: Ensure that each deduction from the security deposit is listed clearly with a thorough description of the reason for the deduction. This includes detailed accounts of repairs, cleaning, and/or replacements, along with the respective costs.

Attach supporting documentation: For all charges that exceed $125 or when the resident has not waived their right to documentation, attach all pertinent receipts, bills, invoices, or estimates. This supports the deductions made and can serve as evidence should any dispute arise.

Communicate final amounts promptly: Once the deductions have been accounted for, promptly communicate the balance due to either the owner or the resident, as appropriate. If a refund is due to the resident, include the check number or EFT details to confirm payment.

Things You Shouldn't Do

Omit details about deductions: Avoid leaving out details or not specifying the nature of the charges deducted from the security deposit. Vague descriptions such as “for repairs” without further elaboration don’t provide the required clarity and could lead to misunderstandings or disputes.

Fail to provide documentation when required: Skipping the attachment of bills, invoices, or receipts when the deductions surpass $125 or when documentation is not waived by the resident can lead to questions regarding the legitimacy of the charges.

Include charges for ordinary wear and tear: It is inappropriate to deduct amounts for normal wear and tear from the security deposit. Charges should only be for damages beyond normal usage, unpaid rent, or additional cleaning necessary to return the unit to its initial condition.

Delay in sending the completed form: Failing to mail or distribute the completed form within the timeframe stipulated by the law (usually 21 days after the tenant moves out) can lead to legal penalties. Prompt completion and delivery are essential to comply with the statutory requirements.

Misconceptions

Many people have misconceptions about the Itemized Disposition of Security Deposit form, which can lead to confusion and misunderstanding. Here are seven common misconceptions clarified to help you understand how this form functions:

It's only for damages. While repairs and damage costs are a part of the form, it also includes charges for cleaning, unpaid rent, and replacement of items beyond ordinary wear and tear. It's a comprehensive breakdown of any deductions from your security deposit, not just those for damages.

Landlords can wait as long as they want to send it. In reality, there are strict timelines that landlords must follow. They need to send out an itemized statement within 21 calendar days after the tenant moves out, ensuring transparency and timeliness in returning the security deposit or explaining deductions.

Receipts are always required. While the form often includes receipts, invoices, or other documentation for charges deducted from the security deposit, landlords aren't required to provide these if the total deductions do not exceed $125 or if the tenant has waived their right to this documentation.

Landlords can deduct for any repairs. Deductions are allowed for repairs beyond ordinary wear and tear. This means that if something was damaged or excessively dirty beyond what would be considered normal use, landlords could deduct the cost of repairs or cleaning from the security deposit, not for basic maintenance or pre-existing conditions.

All disputes must be settled in court. While disputes over security deposit deductions can end up in court, many issues can be resolved through direct communication, mediation, or a local tenant-landlord dispute resolution service. Going to court is a last resort, not a first step.

Only physical damage can be deducted. Aside from physical damage, deductions can be made for unpaid rent, necessary cleaning to return the unit to its original level of cleanliness, and the replacement of items other than due to ordinary wear and tear. It's about ensuring the property is returned in the condition it was initially rented out, accounting for normal use.

If you receive the form, you can't dispute the charges. Receiving an itemized list doesn't mean the deductions are final and unquestionable. Tenants have the right to dispute any charges they believe are unfair or incorrect. The form serves as a starting point for discussions or disputes over the security deposit deductions.

Understanding these aspects of the Itemized Disposition of Security Deposit form can make the moving-out process smoother and more transparent for both landlords and tenants. It's all about knowing your rights, the implications of the form, and the best ways to address any concerns that arise.

Key takeaways

Filling out and using the Itemized Disposition of Security Deposit form properly is an essential process for both landlords and tenants to understand. This ensures transparency and compliance with legal obligations related to the return of security deposits. Here are key takeaways to consider:

- Understanding Legal Requirements: The form is grounded in Civil Code Section 1950.5, meaning it's designed to align with California law regarding the handling of security deposits. This highlights the importance of not only filling out the form accurately but also being aware of the legal framework guiding these transactions.

- Clear Itemization: The form requires a detailed breakdown of all charges incurred and deducted from the security deposit. This includes repairs, cleaning, replacement costs, and any rent defaults. Providing an itemized list promotes clarity and helps prevent disputes between landlords and tenants.

- Documentation Is Key: Whenever charges exceed $125 or if the tenant has not waived their right to documentation, the form stipulates that receipts, bills, or other relevant documentation must be attached. This ensures that all deductions from the security deposit are verifiable and justified.

- Timeliness Matters: There are specific time frames within which the landlord must complete certain actions, such as sending the itemized form and any applicable refunds to the tenant. Security deposit deductions for repairs and cleaning, for instance, need to be estimated within 21 calendar days if not completed, with final documentation following within 14 days of completion.

- Critical Information Included: The form captures vital information, including the amount of the security deposit received, total charges deducted, and the balance due to either party. It also requires information about how any balance due to the tenant will be paid, highlighting the importance of accuracy in these financial transactions.

Utilizing the Itemized Disposition form correctly is a critical step in ensuring a transparent and fair process when handling security deposits. Both parties must pay careful attention to the details and requirements outlined in the form to protect their interests and uphold their legal obligations.

Popular PDF Forms

How to Get W 2 From Old Employer - Assists companies in managing their tax reporting obligations by offering a corrective service for common W-2 issues.

Mv47 - Completing the MV-47 is a step in the process for certain DMV transactions, ensuring responsible driving history documentation.