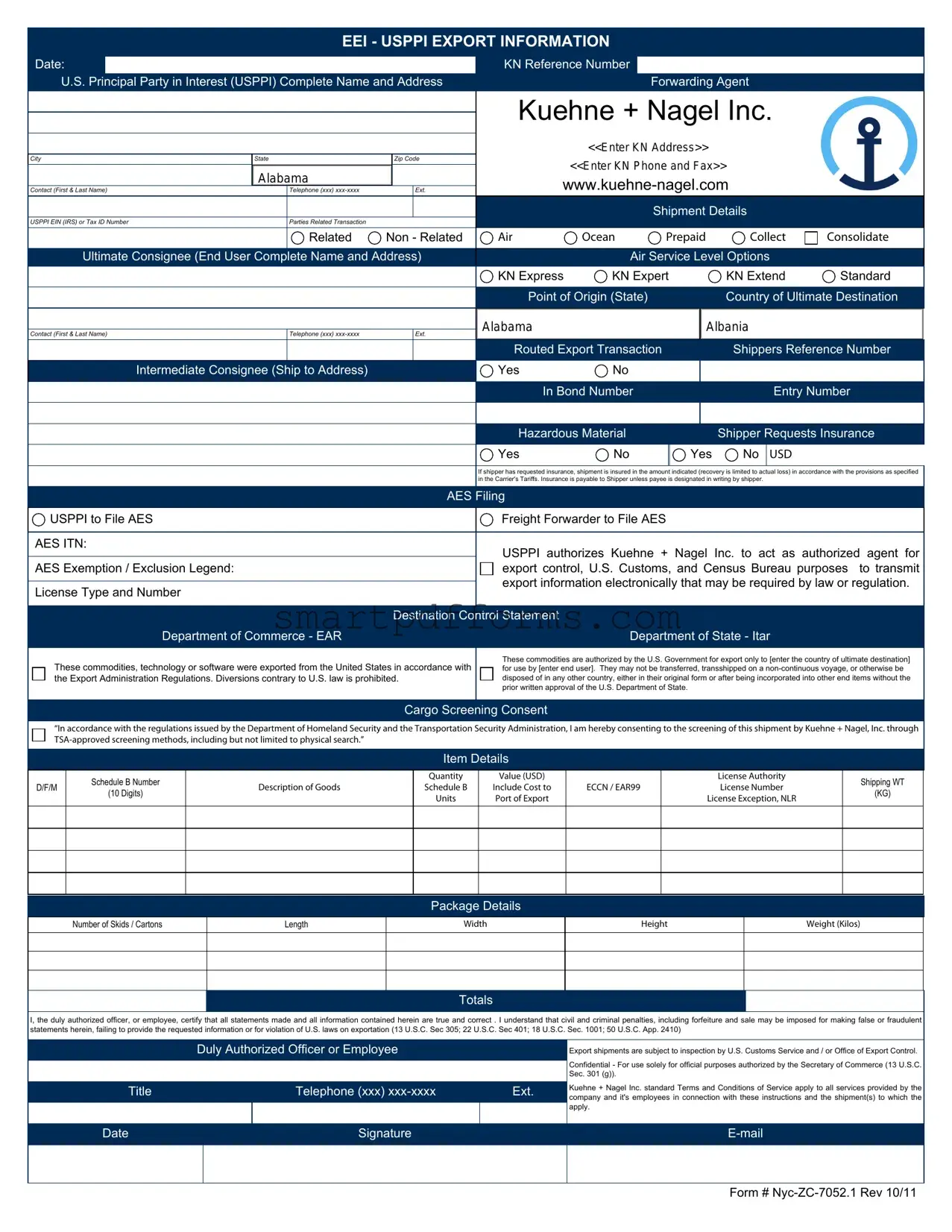

Blank Kuehne Nagel Eei PDF Template

Navigating the complexities of international shipping and U.S. export regulations can be a daunting task for businesses. The Kuehne + Nagel EEI (Electronic Export Information) form serves as a critical tool in this process, providing a structured way to report key details about shipments leaving the United States. This form is part of a comprehensive effort to comply with export control laws and regulations, helping to ensure that goods move across borders smoothly and legally. It captures a wide range of information, from the U.S. Principal Party in Interest (USPPI) and their tax identification number to detailed shipment and item specifics such as Schedule B numbers, descriptions of commodities, quantities, and values. The EEI form also addresses whether the shipment involves related parties, the mode of transport, licensure details under the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR), and the ultimate consignee, among other critical data points. This form is not only a requirement for regulatory compliance but also eases the process of international logistics by providing all the necessary information in one place. Whether you're a seasoned exporter or new to international trade, understanding the components and purpose of the Kuehne + Nagel EEI form is essential for the efficient and lawful execution of global shipping operations.

Preview - Kuehne Nagel Eei Form

EEI - USPPI EXPORT INFORMATION

|

Date: |

|

|

|

|

|

|

|

KN Reference Number |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

U.S. Principal Party in Interest (USPPI) Complete Name and Address |

|

|

|

|

Forwarding Agent |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

Kuehne + Nagel Inc. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

<<Enter KN Address>> |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City |

State |

|

Zip Code |

|

|

<<Enter KN Phone and Fax>> |

|

|

|||||||||||

|

|

|

|

Alabama |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

Contact (First & Last Name) |

|

Telephone (xxx) |

|

|

Ext. |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shipment Details |

|

|

||||

USPPI EIN (IRS) or Tax ID Number |

|

Parties Related Transaction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Related |

Non - Related |

|

Air |

Ocean |

Prepaid |

Collect |

|

Consolidate |

||||||

|

|

Ultimate Consignee (End User Complete Name and Address) |

|

|

Air Service Level Options |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

KN Express |

KN Expert |

KN Extend |

|

Standard |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Point of Origin (State) |

|

|

|

Country of Ultimate Destination |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alabama |

|

|

|

|

Albania |

|

|

|||

Contact (First & Last Name) |

|

Telephone (xxx) |

|

|

Ext. |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Routed Export Transaction |

|

Shippers Reference Number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Intermediate Consignee (Ship to Address) |

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

In Bond Number |

|

|

|

|

Entry Number |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Hazardous Material |

|

|

|

Shipper Requests Insurance |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Yes |

No |

USD |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

If shipper has requested insurance, shipment is insured in the amount indicated (recovery is limited to actual loss) in accordance with the provisions as specified |

||||||||||

|

|

|

|

|

|

|

|

|

in the Carrier's Tariffs. Insurance is payable to Shipper unless payee is designated in writing by shipper. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AES Filing |

|

|

|

|

|

|

|

|

|

||

|

|

USPPI to File AES |

|

|

|

|

|

|

Freight Forwarder to File AES |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AES ITN: |

|

|

|

|

|

|

USPPI authorizes Kuehne + Nagel Inc. to act as authorized agent for |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

AES Exemption / Exclusion Legend: |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

export control, U.S. Customs, and Census Bureau purposes to transmit |

||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

export information electronically that may be required by law or regulation. |

|||||||||

|

License Type and Number |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Destination Control Statement |

|

|

|

|

|

|

|

|

|

|||

|

|

|

Department of Commerce - EAR |

|

|

|

|

|

Department of State - Itar |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

These commodities are authorized by the U.S. Government for export only to [enter the country of ultimate destination] |

|||||||||

|

|

These commodities, technology or software were exported from the United States in accordance with |

|

for use by [enter end user]. They may not be transferred, transshipped on a |

|||||||||||||||

|

|

|

|||||||||||||||||

|

|

the Export Administration Regulations. Diversions contrary to U.S. law is prohibited. |

|

disposed of in any other country, either in their original form or after being incorporated into other end items without the |

|||||||||||||||

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

prior written approval of the U.S. Department of State. |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cargo Screening Consent

“In accordance with the regulations issued by the Department of Homeland Security and the Transportation Security Administration, I am hereby consenting to the screening of this shipment by Kuehne + Nagel, Inc. through

Item Details

D/F/M

Schedule B Number

(10 Digits)

Description of Goods

Quantity

Schedule B

Units

Value (USD)

Include Cost to Port of Export

ECCN / EAR99

License Authority

License Number

License Exception, NLR

Shipping WT

(KG)

Package Details

Number of Skids / Cartons |

Length |

Width |

Height |

Weight (Kilos) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals

I, the duly authorized officer, or employee, certify that all statements made and all information contained herein are true and correct . I understand that civil and criminal penalties, including forfeiture and sale may be imposed for making false or fraudulent statements herein, failing to provide the requested information or for violation of U.S. laws on exportation (13 U.S.C. Sec 305; 22 U.S.C. Sec 401; 18 U.S.C. Sec. 1001; 50 U.S.C. App. 2410)

|

Duly Authorized Officer or Employee |

|

Export shipments are subject to inspection by U.S. Customs Service and / or Office of Export Control. |

||

|

|

|

|

|

Confidential - For use solely for official purposes authorized by the Secretary of Commerce (13 U.S.C. |

|

|

|

|

|

|

|

|

|

|

|

Sec. 301 (g)). |

|

|

|

|

|

Kuehne + Nagel Inc. standard Terms and Conditions of Service apply to all services provided by the |

Title |

|

|

Telephone (xxx) |

Ext. |

|

|

|

company and it's employees in connection with these instructions and the shipment(s) to which the |

|||

|

|

|

|

|

|

|

|

|

|

|

apply. |

|

|

|

|

|

|

Date |

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form #

USPPI EXPORT INFORMATION

All members of the exporting community share an interest and responsibility in complying with U.S. Export Control laws and regulations. To ensure accurate and complete reporting to the U.S. Government (AES), we ask you to complete the EEI- USPPI Export Information Form. Below you will find a list of the “Required Information”, their definitions and links to government web sites which may help you in completing these fields. Please contact your local Kuehne + Nagel representative with questions or concerns. We appreciate your cooperation and value your commitment to export compliance.

The

Meets the TSA requirement for Cargo Screening Consent Method to communicate shipping instructions

Convenient form, listing all the information required to properly file the EEI (Electronic Export Information) via AES (Automated Export System), including commodity and export control information May function as an authorization to file the AES record on behalf of the USPPI (authorization is valid for a single shipment)

Required Information

USPPI NAME

ADDRESS OF USPPI- Report the address or location (no post office box number) from which the goods actually begin the journey to the port of export. For shipments with multiple origins, report the address from which the commodity with the greatest value begins its export journey. If such information is not known, report the address in state in which the commodities are consolidated for export.

USPPI EIN (IRS) NO. or ID NO. - Enter the USPPI's Internal Revenue Service Employer Identification Number (EIN). An EIN can be obtained by calling the IRS at

PARTIES TO TRANSACTION - Indicate if this is a RELATED or

ULTIMATE CONSIGNEE - Enter the name and address of the foreign person, party, or designee that is located abroad and that will actually receive the merchandise for the designated

INTERMEDIATE CONSIGNEE (If applicable): Enter the name and address of the party in a foreign country who acts an agent for the principal party in interest with the purpose of effecting delivery of items to the ultimate consignee or the party so named on the export license.

SHIPMENT DETAILS

AIR SHIPMENT LEVEL OPTIONS (if applicable)

POINT OF ORIGIN and if applicable FTZ NO. - If from a FTZ enter the FTZ number for items leaving the FTZ, otherwise enter the:

COUNTRY OF ULTIMATE DESTINATION - Enter the country in which the merchandise is to be consumed, further processed, or manufactured; the final country of destination as known to the USPPI at the time of export; or the country of ultimate destination as shown on the export license.

ROUTED EXPORT TRANSACTION - Check the appropriate “Yes” or “No” indicator depending upon whether goods are controlled by the Foreign Principal ( FPPI). If the FPPI is controlling the export from the U.S. select “Yes”. {Routed export transaction is a transaction in which the FPPI authorizes a U.S. agent to facilitate the export of items from the U.S. on its behalf and may authorize the U.S. agent or the USPPI to file the EEI).

SHIPPERS REFERENCE - Enter your reference number

IN BOND NUMBER (If applicable) - If in bond enter the code type:

IMPORT ENTRY NUMBER (If applicable)- Enter the Import Entry Number when the export transaction is used as proof of export for import transactions, such as

HAZARDOUS MATERIALS - Check the appropriate “Yes” or “No” indicator

SHIPPER REQUEST INSURANCE (If applicable)

AES FILING

USPPI

DESTINATION CONTROL STATEMENT (If applicable)

CARGO SCREENING CONSENT - Select to meet requirements of Department of Homeland Security and Transportation Security Administration)

D/F OR M - DOMESTIC EXPORTS (D): Commodities that are grown, produced, or manufactured in the United States (including commodities incorporating foreign components) and articles of foreign origin that have been enhanced in value or changed from the form in which imported by further manufacture or processing in the U.S.). FOREIGN EXPORTS (F): merchandise that has entered the U.S. (including U.S. FTZs) and at time of export have undergone no change in form or condition or enhancement in value by further manufacture. FOREIGN MILITARY SALES (M): exports of merchandise that are sold under the foreign military sales program.

SCHEDULE B NUMBER - Enter the 10 digit schedule B number or HTS for each item. Visit the following link

DESCRIPTION OF COMMODITIES - Enter the commercial description for each item. Enter a sufficient description of the commodity as to permit verification of the Schedule B Commodity Number or the commodity description as shown on the validated export license. Include marks, numbers, or other identification shown on the packages and the numbers and kinds of packages (boxes, barrels, baskets, etc.). When exporting a used

QUANTITY (SCHEDULE B UNITS) - Report whole unit(s) as specified in the Schedule B/HTS commodity classification code.

VALUE (U.S. Dollars) - Enter the selling price or, if not sold, enter the cost of the goods, including freight, insurance, and other charges to U.S. port of export, but excluding unconditional discounts and commissions (nearest whole dollar, omit cents). Report the export value in U.S. Dollars for each Schedule B number entered.

EXPORT CONTROL CLASSIFICATION NUMBER (ECCN) or EAR99 - You must enter the correct Export Control Classification Number (ECCN) on record for all exports authorized under a license or License Exception, and also for items being exported under the “No License Required” (NLR) provisions of the EAR that are listed on the CCL and have a reason for control other than

ExportControls:http://www.bis.doc.gov/Licensing/BIS_Exports.pdf;

CCL overview: http://www.access.gpo.gov/bis/ear/pdf/738.pdf,

CCL: http://www.access.gpo.gov/bis/ear/ear_data.html#ccl,

Country Chart: http://www.access.gpo.gov/bis/ear/pdf/738spir.pdf

LICENSE NO. /LICENCE EXCEPTION SYMBOL/AUTHORIZATION - Enter the license number when you are exporting under the authority of a Department of Commerce, a Bureau of Industry and Security license; a Department of State, Directorate of Defense Trade Controls (DDTC) ITAR license; a Department of the Treasury, Office of Foreign Assets Control (OFAC) license (enter either the general or specific OFAC license number), a Department of Justice, Drug Enforcement Agency (DEA) permit, or any other export license number issued by a Federal government agency.

Enter the correct License Exception symbol (e.g. LVS, GBS, CIV) when you are exporting under the authority of a License Exception. You may refer to the Export Administration Regulations (EAR).

Enter the “No License Required” (NLR) designator when you are exporting items under the NLR provisions of the EAR. When the items being exported are subject to the EAR but not listed on the Commerce Control List (CCL) (i.e. items that are classified as EAR99); and when the items being exported are listed on the CCL but do not require a license enter (NLR) designator.

SHIPPING WEIGHT (kilograms) - Enter the gross shipping weight in kilograms of each Schedule B number, including the weight of packaging. To determine kilograms use pounds (lbs) Multiplied by 0.4536 = kilograms (report whole units).

PACKAGING DETAILS- Indicate total pieces, weight, and dims of shipment

DULY AUTHORIZED OFFICER OR EMPLOYEE, TITLE, TELEPHONE AND EMAIL AND SIGNATURE of person completing the form

TERMS AND CONDITIONS OF SERVICE

These terms and conditions of service constitute a legally binding contract between Kuehne + Nagel Inc. (the "Company") and the "Customer". In the event the Company renders services and issues a document containing Terms and Conditions governing such services, the Terms and Conditions set forth in such other document(s) shall govern those services to the extent they are inconsistent with these terms and conditions. When affiliates of the Company provide services to Customer, their standard trading terms and conditions will govern such services.

1. Definitions.

(a)"Company" shall mean Kuehne + Nagel Inc., its subsidiaries, agents and/or representatives;

(b)"Customer" shall mean the person for which the Company is rendering service, as well as its agents and/or representatives. It is the responsibility of the Customer to provide notice and copy(s) of these terms and conditions of service to its agents or representatives;

(c)"Documentation" shall mean all information received directly or indirectly from Customer, whether in paper or electronic form;

(d)"Ocean Transportation Intermediaries" ("OTI") shall include an "ocean freight forwarder" and a

(e)"Third parties" shall include, but not be limited to, the following: "carriers, truckmen, cartmen, lightermen, forwarders, OTIs, customs brokers, agents, warehousemen and others to which the goods are entrusted for transportation, cartage, handling and/or delivery and/or storage or otherwise".

2.Company as agent. The Company acts as the "agent" of the Customer for the purpose of performing duties in connection with the entry and release of goods, post entry services, the securing of export licenses, the filing of export documentation on behalf of the Customer and other dealings with Government Agencies: as to all other services, Company acts as an independent contractor.

3.Limitation of Actions.

(a)All claims against Company for a potential or actual loss must be made in writing and received by Company within ninety (90) days of the event giving rise to claim; the failure to give Company timely notice shall be a complete defense to any suit or action commenced by Customer.

(b)All suits against Company must be filed and properly served on Company as follows:

(i)For claims arising out of ocean transportation, within one (1) year from the date of the loss;

(ii)For claims arising out of air transportation, within two (2) years from the date of the loss;

(iii)For claims arising out of the preparation and/or submission of an import entry(s), within seventy five (75) days from the date of liquidation of the entry(s);

(iv)For any and all other claims of any other type, within two (2) years from the date of the loss or damage.

4.No Liability For The Selection or Services of Third Parties and/or Routes.

Unless services are performed by persons or firms engaged pursuant to express written instructions from the Customer, Company shall use reasonable care in its selection of third parties used for the handling, transportation, clearance and delivery of the shipment. Unless the Company carries, stores or otherwise physically handles the shipment, and the loss, damage, expense or delay occurs during such activity, the Company assumes no liability as a carrier, and is not to be held responsible for any loss, damage, expense or delay to the shipment. Advice by the Company that a particular person or firm has been selected to render services with respect to the goods, shall not be construed to mean that the Company warrants or represents that such person or firm will render such services nor does Company assume responsibility or liability for any action(s) and/or inaction(s) of such third parties and/or its agents, and shall not be liable for any delay or loss of any kind, which occurs while a shipment is in the custody or control of a third party or the agent of a third party; all claims in connection with the act of a third party shall be brought solely against such party and/or agents; in connection with any such claim, the Company shall reasonably cooperate with the Customer, which shall be liable for any charges or costs incurred by the Company.

5. Quotations Not Binding.

Quotations as to fees, rates of duty, freight charges, insurance premiums or other charges given by the Company to the Customer are for informational purposes only and are subject to change without notice; no quotation shall be binding upon the Company unless the Company in writing agrees to undertake the handling or transportation of the shipment at a specific rate or amount set forth in the quotation and payment arrangements are agreed to between the Company and the Customer.

6. Reliance On Information Furnished.

(a)Customer acknowledges that it is required to review all documents and declarations prepared and/or filed with the Customs Service, other Government Agency and/or third parties, and will immediately advise the Company of any errors, discrepancies, incorrect statements, or omissions on any declaration filed on Customers behalf;

(b)In preparing and submitting customs entries, export declarations, applications, documentation and/or export data to the United States and/or a third party, the Company relies on the correctness of all documentation, whether in written or electronic format, and all information furnished by Customer; Customer shall use reasonable care to insure the correctness of all such information and shall indemnify and hold the Company harmless from any and all claims asserted and/or liability or losses suffered by reason of the Customer's failure to disclose information or any incorrect or false statement by the Customer upon which the Company reasonably relied. The Customer agrees that the Customer has an affirmative

7. Declaring Higher Value to Third Parties.

Third parties to whom the goods are entrusted may limit liability for loss or damage; the Company will request excess valuation coverage only upon specific written instructions from the Customer, which must agree to pay any charges therefor; in the absence of written instructions or the refusal of the third party to agree to a higher declared value, at Company's discretion, the goods may be tendered to the third party, subject to the terms of the third party's limitations of liability and/or terms and conditions of service.

8. Insurance.

Unless requested to do so in writing and confirmed to Customer in writing, Company is under no obligation to procure insurance on Customer's behalf; in all cases, Customer shall pay all premiums and costs in connection with procuring requested insurance.

9. Disclaimers; Limitation of Liability.

(a)Except as specifically set forth herein, Company makes no express or implied warranties in connection with its services;

(b)Subject to (c) below, Customer agrees that in connection with any and all services performed by the Company, the Company shall only be liable for its negligent acts, which are the direct and proximate cause of any injury to Customer, including loss, delay or damage to Customer's goods, and the Company shall in no event be liable for the acts of third parties;

(c)In connection with all services performed by the Company, Customer may obtain additional liability coverage, up to the actual or declared value of the shipment or transaction, by requesting such coverage and agreeing to make payment therefor, which request must be confirmed in writing by the Company prior to rendering services for the covered transaction(s).

(d)In the absence of additional coverage under (b) above, the Company's liability shall be limited to the following;

(i)where the claim arises from activities other than those relating to customs brokerage, $50.00 per shipment or transaction, or

(ii)where the claim arises from activities relating to "Customs business," $50.00 per violation or the amount of brokerage fees paid to Company for the entry, whichever is less;

(e)In no event shall Company be liable or responsible for consequential, indirect, incidental, statutory or punitive damages, even if it has been put on notice of the possibility of such damages.

10. Advancing Money.

All charges must be paid by Customer in advance unless the Company agrees in writing to extend credit to customer; the granting of credit to a Customer in connection with a particular transaction shall not be considered a waiver of this provision by the Company.

11. Indemnification/Hold Harmless.

The Customer agrees to indemnify, defend, and hold the Company harmless from any claims and/or liability arising from the importation or exportation of customers merchandise and/or any conduct of the Customer, which violates any Federal, State and/ or other laws, and further agrees to indemnify and hold the Company harmless against any and all liability, loss, damages,

costs, claims and/or expenses, including but not limited to reasonable attorney's fees, which the Company may hereafter incur, suffer or be required to pay by reason of such claims; in the event that any claim, suit or proceeding is brought against the Company, it shall give notice in writing to the Customer by mail at its address on file with the Company.

12. C.O.D. or Cash Collect Shipments.

Company shall use reasonable care regarding written instructions relating to "Cash/Collect" on "Deliver (C.O.D.)" shipments, bank drafts, cashier's and/or certified checks, letter(s) of credit and other similar payment documents and/or instructions regarding collection of monies but shall have no liability if the bank or consignee refuses to pay for the shipment.

13. Costs of Collection.

In any dispute involving monies owed to Company, the Company shall be entitled to all costs of collection, including reasonable attorney's fees and interest at 15% per annum or the highest rate allowed by law, whichever is less, unless a lower amount is agreed to by Company.

14. General Lien and Right To Sell Customer's Property.

(a)General Lien. Company shall have a general and continuing lien on any and all property (and documents relating thereto) of Customer in its possession, custody, control, or en route / in transit, or coming into Company's actual or constructive possession or control, for monies owed to Company with regard to the shipment on which the lien is claimed, a prior shipment(s) and/or both, including for all claims for charges, expenses, or advances incurred by the Company in connection with any shipments of the Customer.

(b)Notice. Company shall provide written notice to Customer of its intent to exercise such lien, the exact amount of monies due and owing, as well as any

(c)Right to Sell. Unless, within thirty days of receiving notice of lien, Customer posts cash or letter of credit at sight, or an acceptable bond equal to 110% of the value of the total amount due, in favor of Company, guaranteeing payment of the monies owed, plus all storage charges accrued or to be accrued, Company shall have the right to sell such shipment(s), including goods, wares, or merchandise as may be necessary to satisfy such lien, at public auction or private sale and any net proceeds remaining thereafter, after payment of amounts due Company, shall be refunded to Customer, provided that Customer shall remain liable for any deficiency arising from the sale.

(d)Warehouseman's Lien. In connection with warehouse services provided by Company, Company shall have a general warehouse lien for all lawful charges for storage and preservation of goods; also for all lawful claims for money advanced, interest, insurance, transportation, labor, weighing coopering, and other charges and expenses in relation to such goods, and for the balance on any other accounts that may be due. Company further claims a general warehouse lien for all such charges, advances and expenses with respect to any other goods stored by Customer in any other facility owned or operated by Company. In order to protect its lien, Company reserves the right to require advance payment of all charges prior to shipment of goods.

(e)Limitation of Damages for Goods Stored. Company shall not be liable for any loss or damage to goods tendered, stored or handled, however caused unless such loss or damage resulted from the failure by Company to exercise such care in regard to them as a reasonably careful person would exercise under like circumstances and Company is not liable for damages which could not have been avoided by the exercise of such care. Customer declares that damages for loss, damage or delay are limited to $.50 per pound provided, however, that such liability may be increased upon Customer requesting in writing such excess valuation coverage and agreeing to make payment therefor, which request must be confirmed in writing by the Company.

(f)Liability. Any liability of Company for whatever reason shall in any event be limited to a maximum of $10,000 per event or series of events with one and the same cause of damage. In further consideration of the rates herein, and in keeping with the definitions of company's legal liability as a warehouseman contained herein and in Article

15. No Duty To Maintain Records For Customer.

Customer acknowledges that pursuant to Sections 508 and 509 of the Tariff Act, as amended, (19 USC § 1508 and 1509) it has the duty and is solely liable for maintaining all records required under the Customs and/or other Laws and Regulations of the United States; unless otherwise agreed to in writing, the Company shall only keep such records that it is required to maintain by Statute(s) and/or Regulation(s), but not act as "recordkeeper" or "recordkeeping agent" for Customer.

16. Obtaining Binding Rulings, Filing Protests, etc.

Unless requested by Customer in writing and agreed to by Company in writing, Company shall be under no obligation to undertake any pre- or post Customs release action, including, but not limited to, obtaining binding rulings, advising of liquidations, filing of petition(s) and/or protests, etc.

17. Preparation and Issuance of Bills of Lading.

Where Company prepares and/or issues a bill of lading, Company shall be under no obligation to specify thereon the number of pieces, packages and/or cartons, etc.; unless specifically requested to do so in writing by Customer or its agent and Customer agrees to pay for same, Company shall rely upon and use the cargo weight supplied by Customer. Relative to the liability limits set forth elsewhere in this Agreement, Customer and Company hereby waive all rights and remedies under the Carmack Amendment and the ICC Termination Act of 1995 (the "Act"), pursuant to Section 14101(b) of the Act. As required by regulation, Customer and Company do not waive the provisions governing registration, insurance, or safety fitness. Unless Company physically handles and carries the shipment, and the loss, damage, expense or delay occurs during such carriage activity, the Company assumes no liability as a carrier.

18. No Modification or Amendment Unless Written.

These terms and conditions of service may only be modified, altered or amended in writing signed by both Customer and Company; any attempt to unilaterally modify, alter or amend same shall be null and void.

19. Compensation of Company.

The compensation of the Company for all its services shall be included with and is in addition to the rates and charges of all carriers and all other agencies selected by the Company to transport and deal with the goods and such compensation shall be exclusive of any brokerage, commissions, dividends, or other revenue received by the Company from carriers, insurers and others in connection with the shipment. On ocean exports, upon request, the Company shall provide a detailed breakout of the components of all charges assessed and a true copy of each pertinent document relating to these charges. In any referral for collection or action against the Customer for monies due the Company, upon recovery by the Company, the Customer shall pay the expenses of collection and/or litigation, including a reasonable attorney fee.

20. Severability.

In the event any Paragraph(s) and/or portions(s) hereof is found to be invalid and/or unenforceable, then in such event the remainder hereof shall remain in full force and effect.

21. Governing Law; Consent to Jurisdiction and Venue.

These terms and conditions of service and the relationship of the parties shall be construed according to the laws of the State of NEW YORK without giving consideration to the principles of conflict of law.

Customer and Company

(a)irrevocably consent to the jurisdiction of the United States District Court and the State courts of NEW YORK;

(b)agree that any action relating to the services performed by Company, shall only be brought in said courts;

(c)consent to the exercise of in personam jurisdiction by said courts over it, and

(d)further agree that any action to enforce a judgement may be instituted in any jurisdiction.

Copyrighted by the National Customs Brokers & Forwarders Association of America, Inc. (Revised 04/00)

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | The EEI-USPPI Export Information Form is designed to comply with U.S. Export Control laws, facilitate cargo screening consent, communicate shipping instructions, and properly file the Electronic Export Information (EEI) via the Automated Export System (AES). |

| USPPI Definition | The U.S. Principal Party in Interest (USPPI) is defined as the person in the United States that receives the primary benefit, monetary or otherwise, from the export transaction. This is typically the U.S. seller, manufacturer, or order party. |

| EIN Requirement | USPPI must enter their Internal Revenue Service Employer Identification Number (EIN), necessary for reporting EEI to the federal government. |

| Transaction Party Type | Identifies whether the transaction is between related or non-related parties, with a related party transaction being one where there is at least a 10% ownership shared by the same U.S. or foreign person or business enterprise. |

| Ultimate Consignee | The name and address of the foreign entity that will actually receive the merchandise for the designated end-use or as designated end-user on the export license. |

| Routing and Shipment Details | Specifies if the shipment is by air or ocean, whether it is prepaid or collect, and includes options for air service level like KN Express, KN Expert, KN Extend, and Standard. |

| AES Filing Responsibility | Indicates whether the USPPI or Kuehne + Nagel Inc. will file the AES, including the AES ITN if Kuehne + Nagel Inc. is authorized to file. |

| Destination Control Statement | Required for compliance with the Export Administration Regulations (EAR) or the International Traffic in Arms Regulations (ITAR), specifying that the commodities can only be exported to the indicated country. |

| Cargo Screening Consent | This section is in accordance with Department of Homeland Security and Transportation Security Administration regulations, where the shipper consents to the screening of the shipment by Kuehne + Nagel, Inc. |

| Governing Laws | Terms and conditions indicate that the relationship of the parties and the terms of service are construed according to the laws of the State of New York, specifying consent to jurisdiction and venue in New York courts for any actions relating to the services performed. |

Instructions on Utilizing Kuehne Nagel Eei

Completing the EEI-USPPI Export Information Form is a critical step for exporters to ensure compliance with U.S. Export Control laws and regulations. This document not only provides the necessary authorization to file Electronic Export Information (EEI) through the Automated Export System (AES) but also facilitates cargo screening consent and details specific shipment instructions. When filled out correctly, it plays a pivotal role in smooth export operations and compliance adherence. To navigate this process efficiently, follow these steps:

- Start by entering the Date of the export shipment at the top of the form.

- Fill in the KN Reference Number provided by Kuehne + Nagel Inc. for tracking and reference purposes.

- Under U.S. Principal Party in Interest (USPPI), provide the complete name and address, including city, state, and zip code.

- Enter the contact details of the USPPI, including Contact First & Last Name and Telephone number with an extension, if applicable.

- For the Forwarding Agent section, the information for Kuehne + Nagel Inc. should already be pre-filled. Confirm the details are correct.

- Input the USPPI EIN (IRS) or Tax ID Number. This number is crucial for identification and tracking purposes.

- Indicate the nature of the transaction under Parties Related Transaction by selecting either Related or Non-Related.

- Choose the mode of shipment under Shipment Details by marking Air or Ocean, and indicate Prepaid or Collect, and if the shipment is Consolidated.

- Provide information about the Ultimate Consignee including full name and address.

- Select the Air Service Level Options if shipping by air, by choosing among KN Express, KN Expert, or KN Extend.

- For Point of Origin and Country of Ultimate Destination, enter the respective state and country details.

- In the Routed Export Transaction section, specify whether the shipment is controlled by the Foreign Principal Party in Interest by selecting Yes or No.

- Under Shipper's Reference Number, input your reference number for this shipment.

- Fill in details regarding Intermediate Consignee, In Bond Number, Entry Number, and if applicable, mark the Hazardous Material and Shipper Requests Insurance sections appropriately.

- If the shipment requires insurance, specify the amount in USD under the insurance section.

- Select who will file the AES, the USPPI or the Forwarding Agent, and provide the AES ITN if already obtained.

- For shipments subject to export control, complete the License Type and Number, and Destination Control Statement sections as required.

- Gain consent for Cargo Screening by selecting the appropriate checkbox, in compliance with Department of Homeland Security and Transportation Security Administration regulations.

- Detail the Item Details including Schedule B Number, Description of Goods, Quantity, Value (USD), and ECCN/EAR99.

- Under Package Details, list the Number of Skids/Cartons, dimensions, and total weight in Kilos.

- Sign the form by providing the title, telephone, and email of the Duly Authorized Officer or Employee, and don’t forget to date the signature.

Remember, this form is not just a procedural requirement; it's your declaration to comply with export regulations and laws. Ensuring that each section is accurately filled out mitigates the risk of delays or legal complications in your shipping process.

Obtain Answers on Kuehne Nagel Eei

-

What is the purpose of the Kuehne Nagel EEI form?

The Kuehne Nagel EEI form serves multiple crucial roles in the export process. It complies with TSA requirements for cargo screening consent, provides a method to communicate shipping instructions, and is a convenient form for listing all information required to properly file Electronic Export Information (EEI) via the Automated Export System (AES). It can also function as an authorization for Kuehne + Nagel to file the AES record on behalf of the U.S. Principal Party in Interest (USPPI).

-

Who needs to complete the EEI-USPPI Export Information Form?

Any entity in the United States that plans to export goods to a foreign country should complete the EEI-USPPI Export Information Form. This includes U.S. sellers, manufacturers, or order parties who receive the primary benefit, monetary or otherwise, from the export transaction.

-

How can one obtain a USPPI EIN (IRS) or Tax ID Number required on the form?

The Internal Revenue Service (IRS) Employer Identification Number (EIN) can be obtained by calling the IRS at 800-829-4933 or applying online at http://www.irs.gov. This number is essential for any person or entity residing in the United States that ships goods to a foreign country, regardless of the type of items being shipped or the shipping frequency.

-

What information is required about the ultimate consignee?

The form requires the complete name and address of the foreign person, party, or designee abroad who will actually receive the merchandise for the designated end-use or the party designated as the end-user on the export license. For overland shipments to Mexico, the address must also include the Mexican state.

-

Is it mandatory to have cargo insurance for the shipment?

It is not mandatory to have cargo insurance for all shipments. However, if the shipper requests insurance, the form provides an option to indicate this, along with the insurance amount. The insurance covers recovery limited to actual loss in accordance with the provisions as specified in the carrier's tariffs and is payable to the shipper unless otherwise designated in writing by the shipper.

-

How can I determine whether my shipment requires an AES filing and who should file it?

The need for an AES filing depends on the nature of your shipment and its destination. The form allows for the USPPI to file or for Kuehne + Nagel to file on behalf of the USPPI. It's essential to determine whether your exported goods fall under specific regulations that require AES filing. Consultation with a Kuehne + Nagel representative can help determine your requirements based on the details of your shipment.

Common mistakes

Filling out the Kuehne Nagel EEI form requires attention to detail and a comprehensive understanding of the export process. Mistakes can lead to delays, fines, or other compliance issues. Below are four common mistakes often made when completing this form:

-

Incorrect or Incomplete USPPI Information: The U.S. Principal Party in Interest (USPPI) is the person in the United States that receives the primary benefit, monetary or otherwise, from the export transaction. Failing to provide the complete name and address of the USPPI, or providing inaccurate details, can cause significant delays. This section is crucial for defining responsibility in the export transaction.

-

Incorrect Classification of Commodities: The Schedule B Number and the Export Control Classification Number (ECCN) must be accurately reported to comply with U.S. export laws and regulations. Misclassification can lead to the shipment being held at customs, and can also result in fines or penalties for non-compliance. It's important to verify the correct classification through the U.S. Census Bureau or the Bureau of Industry and Security websites.

-

Neglecting Destination Control Statements and License Information: For items subject to the Export Administration Regulations (EAR) or the International Traffic in Arms Regulations (ITAR), it is necessary to include the appropriate Destination Control Statement. Additionally, if a license is required for the export, failing to include the license type and number can result in the shipment being blocked or fined. Ensuring that all licensing requirements are clearly and accurately stated is essential for legal compliance.

-

Overlooking Cargo Screening Consent: Given the stringent requirements set by the Department of Homeland Security and the Transportation Security Administration, consent for cargo screening must be explicitly provided. Overlooking or failing to select the cargo screening consent option can delay the shipment. It’s imperative to provide consent for TSA-approved screening methods, including physical searches when necessary.

Understanding and avoiding these common mistakes can help ensure that your export process is smooth and compliant with all relevant regulations, avoiding unnecessary complications.

Documents used along the form

When exporting goods internationally, it is crucial to understand the various documents involved in the process to ensure compliance and streamline operations. The Kuehne + Nagel EEI (Electronic Export Information) form is an essential document, but it often works in tandem with several other forms and documents that facilitate international trade. Here, we explore some additional forms and documents commonly used alongside the EEI form.

- Commercial Invoice: This document provides detailed information about the transaction between the seller and the buyer. It typically includes the names and addresses of the seller and buyer, a description of the goods, the terms of sale, and the value of the items being shipped. It acts as a proof of sale and is used for customs clearance.

- Bill of Lading (BOL): A contract between the owner of the goods and the carrier. There are two types: a straight bill of lading, which is non-negotiable, and a negotiable or shipper's order bill of lading. It serves as a receipt for the shipped goods, a contract of carriage, and a document of title.

- Packing List: This document details the specific contents of each package within the shipment. It includes information such as the number of packages, the contents of each package, the weight, and dimensions of each package. Customs officials use packing lists to verify the cargo.

- Certificate of Origin: A document that certifies the country in which the goods were manufactured. The certificate of origin may be required by the governing authorities of the importing country. Trade agreements between countries can often reduce customs duties based on the country of origin.

- Export License: Depending on the nature of the goods being shipped and their destination, an export license may be required. This government document authorizes the export of goods in specific quantities to a particular destination.

- Shipper's Export Declaration (SED): For shipments over a certain value threshold or those requiring an export license, the SED is a form used to control exports and supply export statistics. The EEI submitted through the AES (Automated Export System) has largely replaced the need for a paper SED, but the term is still frequently used.

Documents like the EEI form are designed to ensure compliance with export regulations and facilitate the efficient handling of shipments from origin to destination. Understanding and accurately completing these documents is imperative for a successful international trade operation. Each document serves a unique purpose and collectively, they provide customs authorities and other interested parties with the necessary information to process and clear the shipment, assess duties and taxes, and enforce trade laws.

Similar forms

Commercial Invoice: Similar to the Kuehne Nagel EEI form, a commercial invoice contains detailed information on the transaction between the seller and the buyer, including the name and address of both parties, a description of the goods, the value of the shipment, and the terms of sale. Both documents are crucial for international trade, providing essential details needed for customs clearance.

Bill of Lading: This document is issued by a carrier to acknowledge receipt of cargo for shipment. Like the Kuehne Nagel EEI form, a Bill of Lading includes details on the shipping route, point of origin, destination, and the party responsible for the cargo. Both are used to ensure that the logistics of transporting goods are clearly communicated and understood.

Shipper’s Letter of Instruction (SLI): The SLI provides detailed information to the freight forwarder or shipping agent about how an export shipment should be handled, akin to how the EEI form specifies shipment details, including the ultimate consignee and export control information. Both forms are key in guiding the parties involved in the handling and transportation of goods.

Certificate of Origin: This certifies the country where the goods were manufactured. The EEI form and a Certificate of Origin both contain details that are critical to customs compliance and tariff classification. Information such as the country of ultimate destination found in the EEI can complement the data in the Certificate of Origin, facilitating trade agreements and duty determinations.

Packing List: Provides details about the packing of the shipped goods, including weight and dimensions of packages, similar to the Item Details and Packaging Details sections of the Kuehne Nagel EEI form. Both documents offer essential information for logistics and customs purposes, ensuring that the cargo is adequately described and documented for transportation.

Air Waybill (AWB): For air cargo shipments, the AWB is the counterpart to the EEI form for ocean freight. It entails the contract of carriage and includes details on the shipper, consignee, and the goods being transported. Both the EEI form and AWB are necessary for customs and regulatory compliance in their respective modes of transport.

Export License: Some exports require a license due to the nature of the goods or the destination country. The EEI form includes a section for License Type and Number, similar to how an Export License itself specifies authorization for export. Both documents ensure compliance with export controls and regulations.

Power of Attorney (POA): Freight forwarders require a POA from shippers to act on their behalf in preparing and submitting the EEI. While the POA is an authorization document and the EEI form is a declaration, both are integral in the export process, enabling the forwarder to legally execute necessary actions regarding the shipment.

Customs Bond: Required for shipments exceeding certain values or for those subject to other customs requirements, a customs bond assures compliance with all laws and regulations. The bond, while a financial guarantee, and the EEI form share the goal of ensuring adherence to customs protocols, facilitating the smooth processing of international shipments.

Electronic Export Information (EEI) Confirmation: After the EEI is filed through the Automated Export System (AES), a confirmation including an AES ITN (Internal Transaction Number) is provided. The Kuehne Nagel EEI form itself may become a record of this transaction once completed, making the confirmation and the original EEI form complementary documents in proving that export information was duly submitted and accepted.

Dos and Don'ts

When completing the Kuehne Nagel EEI form, attention to detail and accuracy is paramount. Below are guidelines designed to assist in ensuring the process is conducted effectively and efficiently.

Do:

Verify all details: Double-check the USPPI (U.S. Principal Party in Interest) information, Tax ID numbers, and descriptions of goods to ensure accuracy before submission.

Use the correct Schedule B number: Each item exported has a specific Schedule B number. Using the correct number helps avoid delays.

Include complete contact information: Provide complete names, addresses, and telephone numbers for both the USPPI and the ultimate consignee.

Declare the correct value: Ensure that the value of the goods, in USD, reflects the selling price or cost to U.S. port of export, excluding discounts and commissions.

Check for hazardous materials: If shipping hazardous materials, make sure to indicate this accordingly and include any necessary documentation.

Don't:

Omit the AES ITN: If the Automated Export System (AES) filing is required, ensure the AES Internal Transaction Number (ITN) is included on the form.

Leave blanks: If a section does not apply, use N/A or a similar indication instead of leaving it blank to confirm that no information was overlooked.

Use P.O. Boxes for addresses: Provide physical addresses instead of P.O. Boxes for both the USPPI and consignee’s addresses.

Ignore the Destination Control Statement: If your items are subject to Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR), include the appropriate destination control statement.

Forget to sign and date: The form requires a signature and date to validate its accuracy and the authority of the person completing it.

Misconceptions

When discussing the Kuehne + Nagel EEI (Electronic Export Information) form, it's paramount to clarify several misconceptions that frequently emerge. Insights into these areas will not only assist in understanding the requirements but also ensure the accurate and lawful completion of the document. The following are four common misconceptions:

- The EEI is only necessary for large businesses: It is often thought that only large corporations must comply with EEI filing requirements. However, this is inaccurate. Regardless of size, any entity or individual in the United States exporting goods to a foreign country must file EEI if the shipment exceeds the monetary threshold set by the U.S. Census Bureau or if it requires an export license. The need for an EEI form spans across businesses of all sizes and even includes personal shipments if they meet specific criteria.

- Only the U.S. Principal Party in Interest (USPPI) can file the EEI: Another common misconception is that only the USPPI is responsible for filing the EEI. While the USPPI can file, they may also authorize a forwarding agent, like Kuehne + Nagel Inc., to file on their behalf. Authorization for the freight forwarder to act as the filing agent must be confirmed in writing, ensuring that all necessary export information is transmitted correctly for compliance with export controls, U.S. Customs, and the Census Bureau's regulations.

- Filling out the EEI form is enough for export compliance: Completing and submitting the EEI form is undeniably crucial for compliance. However, this task alone doesn't fulfill all export compliance requirements. Exporters must also ensure that their shipments comply with the U.S. Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and other applicable export control laws. This includes correctly classifying their merchandise, obtaining the necessary export licenses, and adhering to any destination control statements on the EEI form.

- The EEI form is merely a bureaucratic formality: Some may see the EEI form submission as just another bureaucratic hurdle in the export process. On the contrary, the submission of the EEI is a critical component of national security, assisting in the prevention of exports to unauthorized locations or entities. It serves as a tool for the U.S. government to compile official U.S. export statistics, helping to monitor and control the export of sensitive technology and commodities, thereby playing a significant role in the country's economic and security interests.

Understanding these misconceptions about the Kuehne + Nagel EEI form ensures that businesses and individuals comply with the export laws and regulations while contributing to the safety and security of international trade initiatives.

Key takeaways

Understanding the Kuehne Nagel EEI form is essential for smooth export transactions. Here are five key takeaways to ensure accuracy and compliance:

- The U.S. Principal Party in Interest (USPPI) section must be filled out with the complete name and address of the person or company in the United States that is the primary beneficiary of the transaction. This information is crucial as it identifies who is responsible for the export. Remember, an EIN or Tax ID number is required here.

- Transaction details such as whether it's related or non-related, and the selection between air or ocean shipping, prepaid or collect, and if the shipment consolidates, are all critical choices that affect the logistics planning and the regulatory reporting of the shipment.

- Ultimate Consignee and Intermediate Consignee information need accurate detailing since they specify the final recipient and, if applicable, the agent or party receiving the goods to facilitate delivery to the end user. These details are important for compliance with export regulations.

- The Authorization for the Automated Export System (AES) filing is a mandatory part of the process. The form can designate who is responsible for filing the EEI (Electronic Export Information) – whether it's the USPPI or the freight forwarder, Kuehne Nagel. This authorization is critical for meeting U.S. export requirements.

- Cargo Screening Consent and Destination Control Statement sections are essential for compliance with security and export control laws. These sections confirm the shipper’s consent for cargo screening as per Department of Homeland Security regulations and include necessary export control statements for goods subject to EAR (Export Administration Regulations) or ITAR (International Traffic in Arms Regulations).

Each section of the Kuehne Nagel EEI form serves a specific purpose, ensuring that all parties involved in the export process are informed and that the shipment adheres to U.S. export compliance laws. Accurate and thorough completion of this form is not only necessary for compliance but also facilitates a smoother shipping process by providing clear instructions and information to all parties involved.

Popular PDF Forms

What Items Qualify for Va Clothing Allowance - A vital form for veterans who experience wear and tear or staining on clothing from prescribed medical items.

Editable Frayer Model - A valuable component of a classroom strategy toolkit, designed to systematically expand adolescent literacy with clear, editable sections.

Delaware Prevailing Wage - Requirements for listing and calculating the total hours worked and the applicable pay rate for each employee in Delaware.