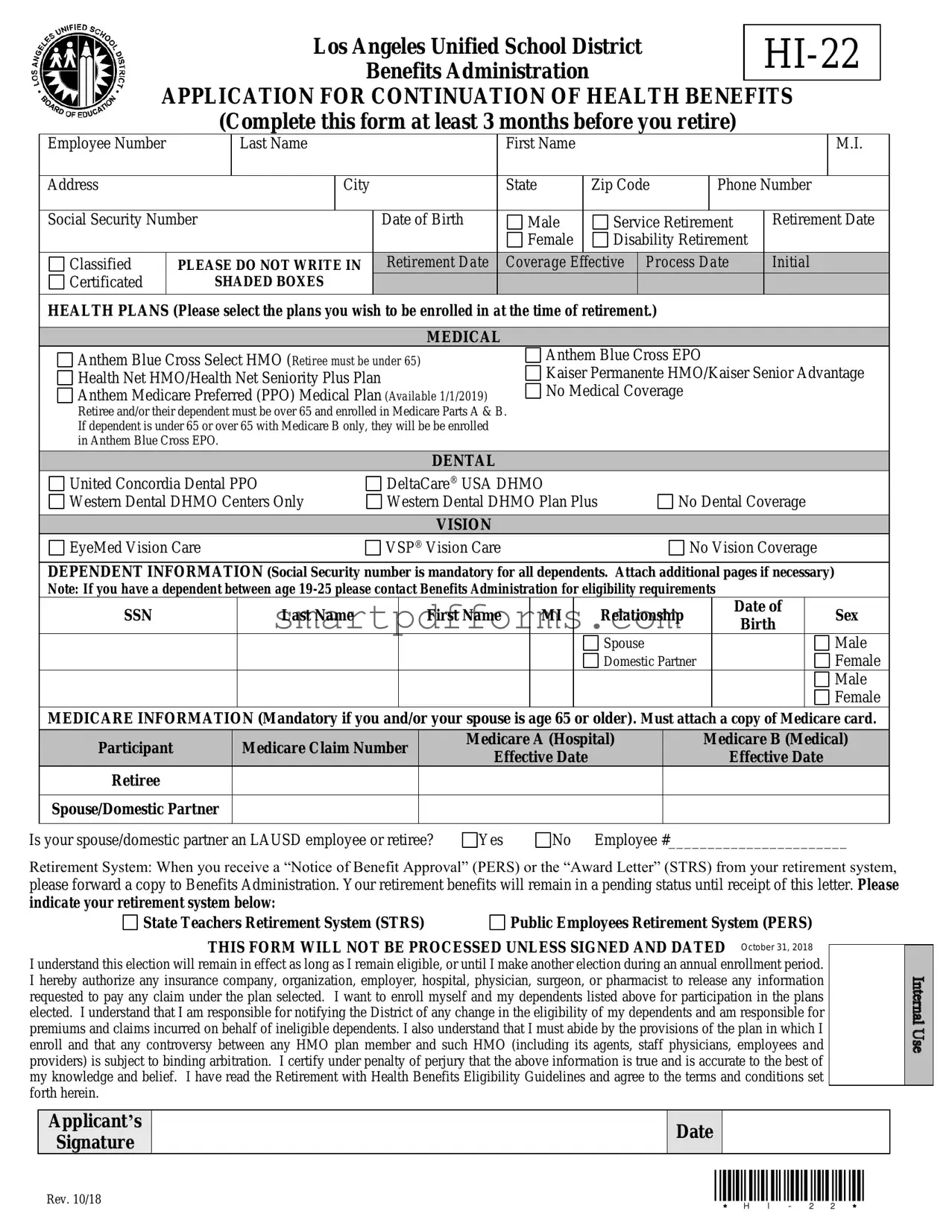

Blank Lausd Hi 22 PDF Template

The Los Angeles Unified School District (LAUSD) HI-22 Benefits Administration Application for Continuation of Health Benefits serves as a critical document for employees approaching retirement, striking a balance between procedural formality and crucial benefits management. It emphasizes the necessity for employees to apply at least three months before retirement to ensure the continuation of their medical, dental, and vision coverage. Selections include various plans catered to retirees under and over 65 years of age, acknowledging Medicare eligibility as a significant factor in determining applicable health plans. Additionally, this form addresses the inclusion of dependents, specifying the need for social security numbers and other identifying information, which underscores the district’s compliance with federal regulations and personal record accuracy. The form also outlines specific eligibility criteria for retirement with health benefits, which vary based on the employee's hire date and years of service, integrating Medicare requirements and options for life insurance conversion and flexible spending account (FSA) instructions post-retirement. The comprehensive nature of the LAUSD HI-22 form encapsulates a crucial transition phase for employees, ensuring they are informed and compliant with the necessary stipulations to secure their health benefits into retirement.

Preview - Lausd Hi 22 Form

Los Angeles Unified School District |

|

|

|

Benefits Administration |

|

APPLICATION FOR CONTINUATION OF HEALTH BENEFITS |

|

(Complete this form at least 3 months before you retire) |

|

Employee Number |

|

Last Name |

|

First Name |

|

|

|

|

M.I. |

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

City |

|

State |

Zip Code |

Phone Number |

|||

|

|

|

|

|

|

|

|

|

||

Social Security Number |

Date of Birth |

Male |

Service Retirement |

Retirement Date |

||||||

|

|

|

|

|

Female |

Disability Retirement |

|

|

||

|

|

|

|

|

|

|

||||

Classified |

PLEASE DO NOT WRITE IN |

Retirement Date |

Coverage Effective |

Process Date |

Initial |

|||||

Certificated |

SHADED BOXES |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

HEALTH PLANS (Please select the plans you wish to be enrolled in at the time of retirement.)

MEDICAL

Anthem Blue Cross Select HMO (Retiree must be under 65)

Anthem Blue Cross Select HMO (Retiree must be under 65)

Health Net HMO/Health Net Seniority Plus Plan

Health Net HMO/Health Net Seniority Plus Plan

Anthem Medicare Preferred (PPO) Medical Plan (Available 1/1/2019) Retiree and/or their dependent must be over 65 and enrolled in Medicare Parts A & B. If dependent is under 65 or over 65 with Medicare B only, they will be be enrolled in Anthem Blue Cross EPO.

Anthem Medicare Preferred (PPO) Medical Plan (Available 1/1/2019) Retiree and/or their dependent must be over 65 and enrolled in Medicare Parts A & B. If dependent is under 65 or over 65 with Medicare B only, they will be be enrolled in Anthem Blue Cross EPO.

Anthem Blue Cross EPO

Anthem Blue Cross EPO

Kaiser Permanente HMO/Kaiser Senior Advantage

Kaiser Permanente HMO/Kaiser Senior Advantage

No Medical Coverage

No Medical Coverage

DENTAL

United Concordia Dental PPO |

DeltaCare® USA DHMO |

|

Western Dental DHMO Centers Only |

Western Dental DHMO Plan Plus |

No Dental Coverage |

|

|

|

|

VISION |

|

EyeMed Vision Care |

VSP® Vision Care |

No Vision Coverage |

DEPENDENT INFORMATION (Social Security number is mandatory for all dependents. Attach additional pages if necessary) Note: If you have a dependent between age

SSN |

Last Name |

First Name |

MI |

Relationship |

Date of |

Sex |

|

Birth |

|||||||

|

|

|

|

|

|

||

|

|

|

|

Spouse |

|

Male |

|

|

|

|

|

Domestic Partner |

|

Female |

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

Female |

MEDICARE INFORMATION (Mandatory if you and/or your spouse is age 65 or older). Must attach a copy of Medicare card.

|

|

Participant |

|

|

Medicare Claim Number |

|

|

Medicare A (Hospital) |

|

|

Medicare B (Medical) |

|

|

|

|

|

|

|

|

Effective Date |

|

|

Effective Date |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Retiree |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse/Domestic Partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Is your spouse/domestic partner an LAUSD employee or retiree? |

Yes |

No Employee #_______________________ |

|||||||||||

Retirement System: When you receive a “Notice of Benefit Approval” (PERS) or the “Award Letter” (STRS) from your retirement system, please forward a copy to Benefits Administration. Your retirement benefits will remain in a pending status until receipt of this letter. Please

indicate your retirement system below: |

|

State Teachers Retirement System (STRS) |

Public Employees Retirement System (PERS) |

THIS FORM WILL NOT BE PROCESSED UNLESS SIGNED AND DATED October 31, 2018

I understand this election will remain in effect as long as I remain eligible, or until I make another election during an annual enrollment period. I hereby authorize any insurance company, organization, employer, hospital, physician, surgeon, or pharmacist to release any information requested to pay any claim under the plan selected. I want to enroll myself and my dependents listed above for participation in the plans elected. I understand that I am responsible for notifying the District of any change in the eligibility of my dependents and am responsible for premiums and claims incurred on behalf of ineligible dependents. I also understand that I must abide by the provisions of the plan in which I enroll and that any controversy between any HMO plan member and such HMO (including its agents, staff physicians, employees and providers) is subject to binding arbitration. I certify under penalty of perjury that the above information is true and is accurate to the best of my knowledge and belief. I have read the Retirement with Health Benefits Eligibility Guidelines and agree to the terms and conditions set forth herein.

Applicant’s

Signature

Date

Rev. 10/18 |

If you change your address, you must notify Benefits Administration or you may fail to receive important benefits information. Failure to receive information could result in the loss of your benefits.

Retirement with Health Benefits Eligibility Guidelines

TO RECEIVE COVERAGE AS A RETIRED EMPLOYEE, YOU MUST MEET THE FOLLOWING REQUIREMENTS:

1.Select any available plan you wish to be enrolled in at the time of retirement. If your selection is different than the plan you are currently enrolled in, the effective date will be the first of the following month after your retirement date.

If you are not enrolled in a medical, dental, or vision care plan, you must contact Benefits Administration regarding enrollment procedures before your retirement date.

2.You must resign to retire from District service and be eligible to receive an allowance from your retirement system (CalSTRS or CalPERS) for either age or disability retirement the day after your District resignation.

You are not eligible for retirement health benefits if you separated, resigned without retiring, or were dismissed from District Service.

Your District resignation date and CalSTRS/CalPERS retirement date must be consecutive dates (may include weekend days).

If there is a gap between your District resignation date and your CalSTRS/CalPERS retirement date, you will not be eligible for retirement health benefits.

3.You must receive a monthly retirement payment from your retirement system. If you take deferred retirement (that is, leaving funds on deposit with the retirement system for withdrawal at a later date) or a lump sum distribution, you are not eligible for these retirement benefits.

4.You must meet the following requirements:

a.For employees hired prior to March 11, 1984, five (5) consecutive years of qualifying service immediately prior to retirement shall be required in order to qualify for retiree health benefits for the life of the retiree.

b.For employees hired on or after March 11, 1984, but prior to July 1, 1987, ten (10) consecutive years of qualifying service immediately prior to retirement shall be required in order to qualify for retiree health benefits for the life of the retiree.

c.For employees hired on or after July 1, 1987, but prior to June 1, 1992, fifteen (15) consecutive years of qualifying service immediately prior to retirement shall be required, or ten (10) consecutive years immediately prior to retirement plus an additional ten (10) years which are not consecutive.

d.For employees hired on or after June 1, 1992, years of qualifying service and age must total at least eighty (80) in order to qualify for retiree health benefits. For employees who have a break in service, this must include at least ten (10) consecutive years immediately prior to retirement.

e.For employees hired on or after March 1, 2007 shall be required to have a minimum of fifteen (15) consecutive years of service with the District immediately prior to retirement, in concert with the “Rule of 80” eligibility requirement (section 4.0 (d) above) to receive employee and dependents’ health and welfare benefits (medical dental and vision) upon retirement as provided for in this agreement.

f.For employees hired on or after April 1, 2009, years of qualifying service and age must total at least

g.For School Police (sworn personnel), if you were hired on or after April 1, 2009, the employee’s age plus the number of consecutive qualifying years of service, when added together, must equal 80 and you must have twenty (20) consecutive years of qualifying service immediately prior to retirement.

5.Medicare requirement (Effective January 1, 2010):

If you and/or your dependent reach/are age 65 or older you must enroll and remain enrolled in Medicare Part B. If you do not enroll in

Medicare Part B, you will lose your health benefits until proof of enrollment is submitted.

If you and/or your dependent are eligible for Medicare Part A

If you are not eligible for Medicare Part A

If you are a member of Kaiser, you must enroll in Senior Advantage (Kaiser’s Medicare Advantage Plan) in order to maintain your coverage. If you are a member of Health Net HMO, you must enroll in Seniority Plus (Health Nets Medicare Advantage Plan) in order to maintain your coverage. All retirees in Anthem Medicare Preferred (PPO) Medical plan or Health Net Seniority Plus plan must have Medicare parts A and B.

6.Life Insurance: Conversion plans are available for both the Basic

7.Flexible Spending Account (FSA): Employees who retire before the end of the plan year have 90 days following the termination date of their account to submit claims for reimbursement. All expenses must be incurred during employment. For more details, contact ConnectYourCare at

If you meet the above requirements, you may be eligible for health benefits for yourself and your eligible dependents. Complete and return this form along

with copies of the required documents to:

Los Angeles Unified School District - Benefits Administration

P.O. Box 513307

Los Angeles, CA

Telephone:

eMail: benefits@lausd.net Website: benefits.lausd.net

Form Data

| Fact Number | Description |

|---|---|

| 1 | The LAUSD HI-22 form is used by employees of the Los Angeles Unified School District for applying for continuation of their health benefits upon retirement. |

| 2 | It must be completed at least 3 months before an employee's retirement date to ensure continuous health coverage. |

| 3 | The form includes selections for medical, dental, and vision plans for both the employee and their dependents. |

| 4 | Eligibility for retiree health benefits has criteria based on the date of hire, years of service, and must align with retirement from service and eligibility for retirement allowance from CalSTRS or CalPERS. |

| 5 | Medicare requirements stipulated in the form mandate enrollment in Medicare Part B (and Part A, if eligible) for the retiree and/or dependents age 65 or older to maintain health benefits. |

| 6 | Information regarding Life Insurance options upon retirement, including conversion plans and a continuation decreasing term insurance plan, is provided in the form. |

| 7 | For those enrolled in a Flexible Spending Account (FSA), claims for reimbursement must be submitted within 90 days post-termination of employment, for expenses incurred during employment. |

Instructions on Utilizing Lausd Hi 22

Filling out the LAUSD HI-22 form is a necessary step for employees who are nearing retirement and wish to continue receiving health benefits. This form must be completed at least three months before retiring to ensure there is no interruption in your coverage. The process involves selecting the medical, dental, and vision plans you wish to be enrolled in upon your retirement, as well as providing detailed information about any dependents. To ensure everything is filled out correctly, follow these detailed steps:

- Write your employee number at the top of the form.

- Fill in your last name, first name, and middle initial (M.I.).

- Enter your address, city, state, and zip code.

- Provide your phone number and social security number.

- Indicate your date of birth, check the appropriate box for male or female, and select your retirement type (Service Retirement or Disability Retirement) along with the retirement date.

- Under the HEALTH PLANS section, select the medical plan you wish to enroll in at the time of your retirement by marking the box next to the appropriate plan.

- If enrolling dependents, provide their social security number, last name, first name, MI, relationship to you, their date of birth, and sex.

- For Medicare information, if applicable, include the Medicare claim number and effective dates for both Medicare A (Hospital) and Medicare B (Medical).

- If you have a spouse or domestic partner who is an LAUSD employee or retiree, answer Yes or No and provide their employee number if applicable.

- Select your retirement system: State Teachers Retirement System (STRS) or Public Employees Retirement System (PERS).

- Sign and date the form to certify your understanding and agreement with the elections you've made. Your signature verifies that the information provided is true and correct to the best of your knowledge.

After completing the HI-22 form, you will need to gather any required documents, such as a copy of your Medicare card if you are enrolling in a plan that requires this documentation. Once everything is gathered, send the form and documents to the Los Angeles Unified School District - Benefits Administration. You can mail it, fax it, or email it using the contact information provided. This step is crucial for ensuring that your health benefits continue seamlessly into your retirement.

Obtain Answers on Lausd Hi 22

When it comes to managing your benefits with the Los Angeles Unified School District (LAUSD), the HI-22 form is a crucial document for employees approaching retirement. Understanding this form can help ensure a smooth transition to retirement, especially regarding your health benefits. Below are answers to some frequently asked questions about the HI-22 form.

What is the HI-22 form?

The HI-22 form is an application for the continuation of health benefits provided by the Los Angeles Unified School District (LAUSD). It's specifically designed for employees who are nearing retirement and wish to continue their health, dental, and vision coverages into their retirement years. This form should be completed at least three months before the retirement date to avoid any interruptions in coverage.

Who needs to fill out the HI-22 form?

Any LAUSD employee who is planning to retire and wants to continue receiving health benefits through the district must fill out the HI-22 form. This includes both certificated and classified employees who meet the district’s retirement eligibility criteria.

When should I submit the HI-22 form?

You should submit the HI-22 form at least three months before your planned retirement date. This lead time is crucial for processing your application and ensuring that your health benefits continue without interruption once you retire.

What information do I need to provide on the HI-22 form?

You'll need to provide personal details such as your employee number, name, date of birth, and Social Security number. Additionally, you must choose your health plans for medical, dental, and vision care. If you're eligible for Medicare, you must include Medicare information for yourself and any dependents. Be sure to sign and date the form to attest to the accuracy of the information provided.

How do I choose the right health plans on the HI-22 form?

Before you retire, consider your and your dependents' healthcare needs carefully. LAUSD offers various plans, including options for those under 65 and over 65 (with different Medicare requirements). If you need guidance, LAUSD's Benefits Administration can provide more detailed information about each plan, including coverage details and whether it's the right fit for your post-retirement healthcare needs.

What happens if I don’t submit the HI-22 form?

If you fail to submit the HI-22 form before retiring, your health benefits may be interrupted or terminated. It's essential to complete and return this form to ensure continuous coverage during your retirement years. Keep a close eye on the submission deadline and consider reaching out to the Benefits Administration if you have questions or concerns.

Where do I submit the HI-22 form?

Completed HI-22 forms should be submitted to the Los Angeles Unified School District - Benefits Administration. You can send it via postal mail, fax, or email as listed on the form. Ensure that all required documents and information are included to avoid delays in processing your application.

Moving into retirement is a significant life change, and managing your health benefits is a critical part of this transition. Taking the time to understand and correctly fill out the HI-22 form can help you maintain your and your dependents' health coverage seamlessly as you enter this new chapter of your life.

Common mistakes

Filling out forms can often be a straightforward process, but mistakes are common, especially on important forms like the Los Angeles Unified School District (LAUSD) HI-22 Benefits Administration Application for Continuation of Health Benefits. Let's explore seven common mistakes people make when filling out this form, so you can avoid them.

-

People often forget to fill in the form at least three months before retirement. This can delay the processing and activation of benefits.

-

Another frequent oversight is not signing and dating the form. Without the applicant’s signature and the date, the form is considered incomplete and will not be processed.

-

Incorrect or incomplete Social Security numbers especially for dependents, is a common error. Every dependent's Social Security number is mandatory and must be accurately filled in.

-

Applicants sometimes fail to attach a copy of their Medicare card when they and/or their spouse are 65 or older, which is a necessary step for processing the application.

-

A misstep often made is not selecting a healthcare plan appropriate to the age and Medicare enrollment status of the retiree or their dependents. This can result in incorrect or insufficient coverage.

-

Not notifying the Benefits Administration of any address changes is another mistake that can lead to missed important information regarding benefits, potentially resulting in the loss of benefits.

-

Forgetting to forward the "Notice of Benefit Approval" from the retirement system to the Benefits Administration, which leaves retirement benefits in pending status until the document is received.

Avoiding these mistakes can lead to a smoother transition into retirement with the proper health benefits in place. Double-checking the application for accuracy and completeness before submission can make all the difference.

Documents used along the form

When navigating the complexities of health benefits administration, especially within the Los Angeles Unified School District (LAUSD), understanding the forms and documents that complement the HI-22 form is crucial. This guide aims to demystify the paperwork involved in ensuring a seamless transition into retirement for employees, shedding light on the additional documents often encountered alongside the HI-22 form.

- Notice of Benefit Approval: Issued by retirement systems such as PERS or STRS, this document officially confirms your retirement benefits.

- Award Letter: Another critical piece from retirement systems (such as PERS or STRS), detailing the benefits the retiree is entitled to receive.

- Medicare Card: Essential for those 65 or older, or for certain younger people with disabilities; must be submitted alongside the HI-22 to confirm Medicare Parts A & B enrollment.

- Dependency Documentation: Required for adding dependents to your plan, including marriage certificates for spouses or birth certificates for children.

- Life Insurance Conversion Forms: For those looking to continue or convert their life insurance policies post-retirement, provided by insurance carriers like MetLife.

- Flexible Spending Account (FSA) Claim Forms: Necessary for retirees wishing to get reimbursed for eligible expenses incurred before retirement.

- Proof of Previous Health Coverage: If opting for different health plans post-retirement, proof may be required to ensure continuity of care without penalties.

- Direct Debit Authorization Form: For retirees opting to have their health plan premiums directly deducted from their retirement checks.

- Change of Address Form: Critical for ensuring the retiree receives all necessary correspondence regarding their benefits.

- Request for Employment Verification: Required for spouses or dependents who may need to confirm eligibility for certain benefits based on the retiree's employment history.

In the pursuit of a well-deserved retirement, the paperwork can sometimes seem daunting. However, with the right information and understanding of these essential documents, navigating this process can be made smoother. The LAUSD HI-22 form is just the beginning. Each accompanying document plays a pivotal role in securing your benefits and ensuring that your retirement is as rewarding as it should be. Remember, proper preparation and timely submission of these forms can make all the difference in enjoying a seamless transition to retirement.

Similar forms

The COBRA Election Notice is similar to the LAUSD HI-22 form in that it also provides options for individuals to continue health benefits after a change in employment status, albeit under the Consolidated Omnibus Budget Reconciliation Act for private sector employees.

The Employee Retirement Income Security Act (ERISA) Benefits Claim Form shares similarities in providing details necessary for retired employees to claim their entitlements and benefits, mirroring the procedural aspect of applying for continuation of health benefits.

Medicare Part B Enrollment Form is akin to aspects of the LAUSD HI-22 form, particularly where the enrollment into Medicare Parts A & B is required for certain health plan selections for individuals over 65.

The State Retirement System Pension Application Forms (such as CalPERS or STRS for California employees) resemble the LAUSD HI-22 form in terms of applying for retirement benefits, including health coverage, from a state employees' retirement system.

Health Insurance Marketplace Enrollment Application parallels the LAUSD HI-22 form in allowing individuals to select and enroll in health insurance plans, though through the Affordable Care Act's Marketplace rather than employer-provided plans.

The Group Health Plan Enrollment Form used by many employers for active employees enrolling in health insurance closely matches the LAUSD HI-22 form's purpose of enrolling retirees in health plans.

Flexible Spending Account (FSA) Enrollment Form is similar in the administrative process aspect, where employees decide on their benefits package, though focusing on spending accounts rather than health insurance.

A Life Insurance Conversion Form shares the continuity of benefits theme with the LAUSD HI-22 form, in this case, allowing retirees to convert their group life insurance to individual policies upon retirement.

The Disability Retirement Application forms for public employees also have parallels, as they include the provision of health benefits alongside retirement benefits for those retiring due to disability.

The Medicare Advantage Plan Enrollment Form is similar to sections of the LAUSD HI-22 which discuss enrollment into plans like the Anthem Medicare Preferred or Kaiser Senior Advantage, meant for those who are eligible for Medicare.

Dos and Don'ts

When completing the Los Angeles Unified School District HI-22 Benefits Administration Application for Continuation of Health Benefits, it is essential to follow the proper steps and avoid common mistakes. By adhering to the guidelines, individuals can ensure their application process is smooth and successful.

Do:Start Early: Begin the application process at least three months before your retirement date. This allowance provides ample time to gather necessary documents and information, ensuring a timely and accurate application.

Review Eligibility Requirements: Carefully read and understand the retirement health benefits eligibility guidelines before starting your application. This includes knowing your retirement date and ensuring you have the correct years of service.

Accurately Complete All Sections: Fill in every section of the form with accurate and up-to-date information. Pay special attention to personal details such as your social security number, date of birth, and the plans you wish to be enrolled in at the time of retirement.

Attach Required Documents: Attach all necessary documentation, including a copy of your Medicare card if you and/or your dependents are 65 years or older. This step is crucial for verifying eligibility and ensuring proper enrollment in health plans.

Ignore Shaded Boxes: Do not fill in the shaded boxes on the form. These are reserved for administrative use and should be left blank by the applicant.

Leave Sections Blank: Avoid skipping sections or leaving them incomplete. Every part of the application provides vital information that affects your benefits eligibility and enrollment.

Forget to Sign and Date: Failing to sign and date the application will render it unprocessed. Your signature certifies that the information provided is accurate and that you understand the terms and conditions.

Delay Submission: Do not wait until the last minute to submit your application. Late applications may result in a delay or loss of benefits. Ensure your application and all supporting documents are submitted well before your retirement date.

Misconceptions

There are many misconceptions surrounding the Los Angeles Unified School District (LAUSD) HI-22 Benefits Administration Application for Continuation of Health Benefits form. Let's clarify the most common misunderstandings:

- The necessity to complete the form is only for employees over 65. In fact, this form must be completed by all employees seeking to continue their health benefits into retirement, regardless of age.

- All retirees will automatically be enrolled in Medicare plans through the LAUSD. While the form does cater to those over 65 with options relevant to Medicare, enrollment in Medicare Parts A & B is the responsibility of the individual and must be proven for certain coverages.

- One can enroll in any medical plan after retirement regardless of age. Some plans, such as the Anthem Blue Cross Select HMO, are specifically limited to those under 65, while others are designed for those over 65 and enrolled in Medicare.

- Filling out this form guarantees continuous health coverage automatically. The form initiates the process, but eligibility requirements must be met, and all necessary documentation must be provided for coverage to continue.

- The form’s process is done entirely online. Despite digital advances, retirees are required to submit this form along with necessary documentation by mail or in person to the Benefits Administration office.

- Employees who resign without retiring are eligible for retirement health benefits. You must retire and meet specific eligibility requirements linked to your retirement system (CalSTRS or CalPERS) to qualify for retirement health benefits.

- Dependent information is optional. Social Security numbers and other pertinent details for all dependents are mandatory for anyone who wants them covered under their plan.

- It’s unnecessary to inform the District of changes in dependent status post-retirement. The retiree is responsible for notifying the District of any changes in the eligibility of their dependents to avoid issues with coverage or premiums.

- Signing the HI-22 form is all that’s needed for immediate effect. Coverage selections become effective at the start of the month following your retirement date, not immediately upon signing the form.

- There’s no penalty for not selecting a health plan before retirement. Failing to make selections before retirement can lead to a gap in coverage, requiring contact with Benefits Administration to arrange coverage potentially.

Understanding these misconceptions and having a clear picture of the requirements and processes involved with the LAUSD HI-22 form is crucial for a smooth transition into retirement with continued health benefits. Always refer to the most current documents and consult the LAUSD Benefits Administration for the most accurate information.

Key takeaways

Filling out the LAUSD HI-22 form is crucial for employees who are nearing retirement and wish to continue receiving health benefits. Here are eight key takeaways to ensure the process is completed smoothly:

- Submit Early: It’s recommended to complete the HI-22 form at least three months before retirement. This gives enough time for processing and ensures coverage starts without delay.

- Selection of Health Plans: You have the option to select from various medical, dental, and vision plans for your retirement. Make sure to choose the plan that best suits your needs post-retirement. Pay special attention to eligibility criteria, especially for medical coverage, which may vary based on age and Medicare enrollment.

- Medicare Information is Critical: If you or your dependents are 65 or older, enrolling in Medicare Parts A & B is mandatory to maintain your health benefits. Failure to enroll can result in the loss of benefits.

- Dependent Information: You must provide Social Security numbers for all dependents. If you have dependents between the ages of 19-25, contact the Benefits Administration for specific eligibility requirements.

- Retirement System Documentation: Your retirement benefits will remain pending until the Benefits Administration receives a copy of your “Notice of Benefit Approval” from your retirement system (PERS or STRS).

- Address Changes: Notify the Benefits Administration of any address changes immediately. Failure to do so might mean missing out on crucial benefits information, potentially jeopardizing your coverage.

- Qualifying for Coverage: Eligibility guidelines for retiree health benefits are based on your hiring date and years of service. Make sure you meet these requirements to qualify for benefits upon retirement.

- Life Insurance and Flexible Spending Account (FSA): Information on converting your life insurance plans upon retirement is available, and retirees have a 90-day window to submit FSA claims after employment ends. It is important to contact the respective companies for detailed guidance.

Thoroughly reviewing and accurately completing the HI-22 form is essential for a smooth transition into retirement with your health benefits intact. Always double-check your entries and consult the Benefits Administration for any clarifications.

Popular PDF Forms

Mpp Extended Warranty - Template for revoking a car's Mechanical Protection Plan agreement.

Form 1000 Ontario - Requiring details like the WSIB No. and WSIB Rate No. underscores the importance of workers' compensation coverage and compliance.