Blank Letter Of Instruction PDF Template

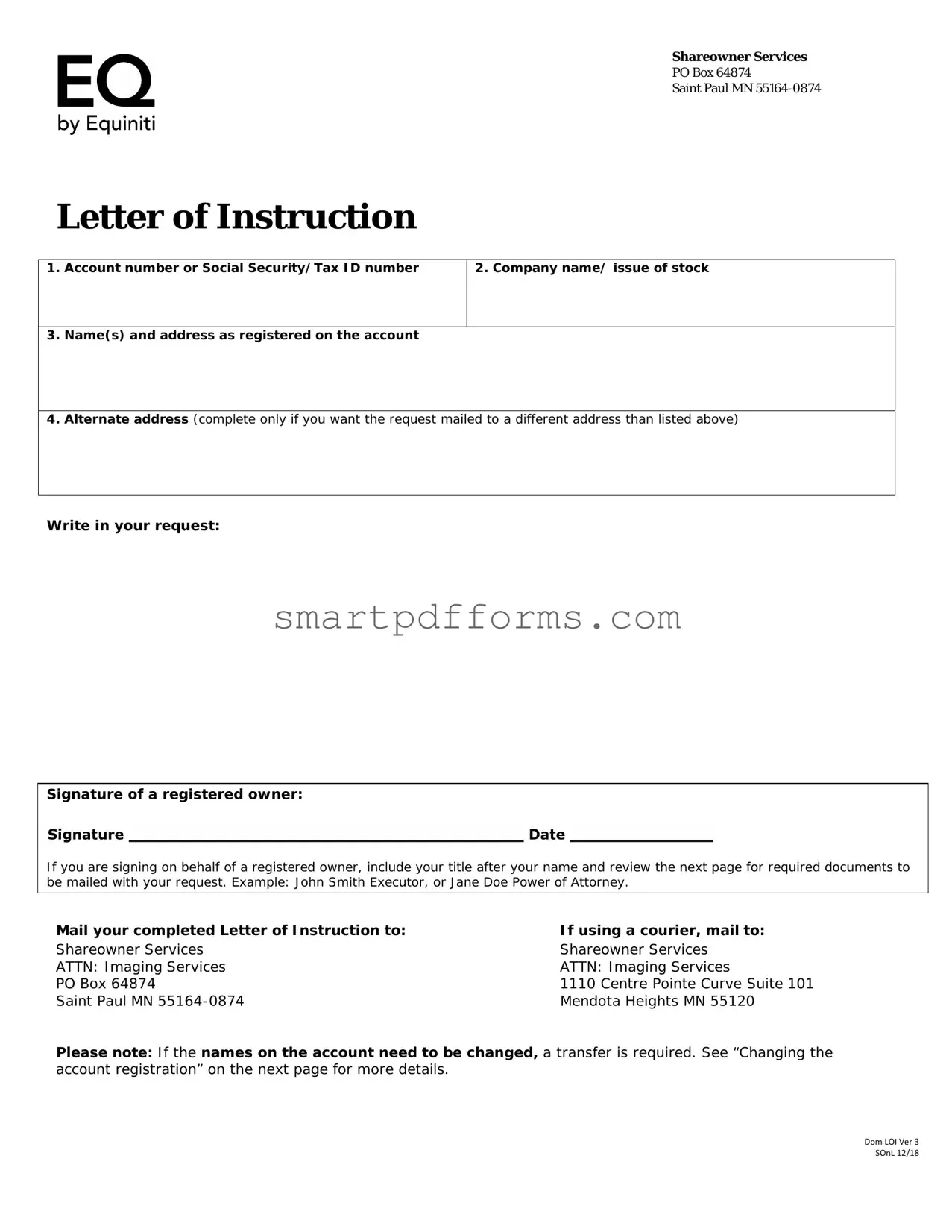

Navigating the intricacies of shareowner services and stock transactions requires a clear understanding of the necessary documentation, particularly when dealing with a Letter of Instruction form. This document is crucial for a wide range of requests related to shareowner accounts and serves as a direct line of communication with shareowner services. Located at PO Box 64874 in Saint Paul, MN, the Letter of Instruction form requires specific information to be provided by the account holder, including the account number or Social Security/Tax ID number, the name of the company or issue of stock, and the name(s) and address as registered on the account. An alternate address can also be specified for mailing, if different from the registered address. Signatures play a key role in this process, with the form necessitating the signature of a registered owner or an individual signing on behalf of the owner with an appropriate title such as Executor or Power of Attorney, accompanied by necessary documents based on the signer's authority. The need for additional documents, such as court-certified documents or a Certificate of Fiduciary Authority, varies based on the relationship to the account and the reason for the request, highlighting the form's flexibility and comprehensive nature. Whether it's for changing account registration, transferring stock, or updating account details due to life changes, the Letter of Instruction form is an essential tool for ensuring these processes are completed efficiently and accurately.

Preview - Letter Of Instruction Form

Shareowner Services

PO Box 64874

Saint Paul MN

Letter of Instruction

1. Account number or Social Security/Tax ID number |

2. Company name/ issue of stock |

|

|

3.Name(s) and address as registered on the account

4.Alternate address (complete only if you want the request mailed to a different address than listed above)

Write in your request:

Signature of a registered owner:

If you are signing on behalf of a registered owner, include your title after your name and review the next page for required documents to be mailed with your request. Example: John Smith Executor, or Jane Doe Power of Attorney.

Mail your completed Letter of Instruction to: |

If using a courier, mail to: |

Shareowner Services |

Shareowner Services |

ATTN: Imaging Services |

ATTN: Imaging Services |

PO Box 64874 |

1110 Centre Pointe Curve Suite 101 |

Saint Paul MN |

Mendota Heights MN 55120 |

Please note: If the names on the account need to be changed, a transfer is required. See “Changing the account registration” on the next page for more details.

Dom LOI Ver 3 SOnL 12/18

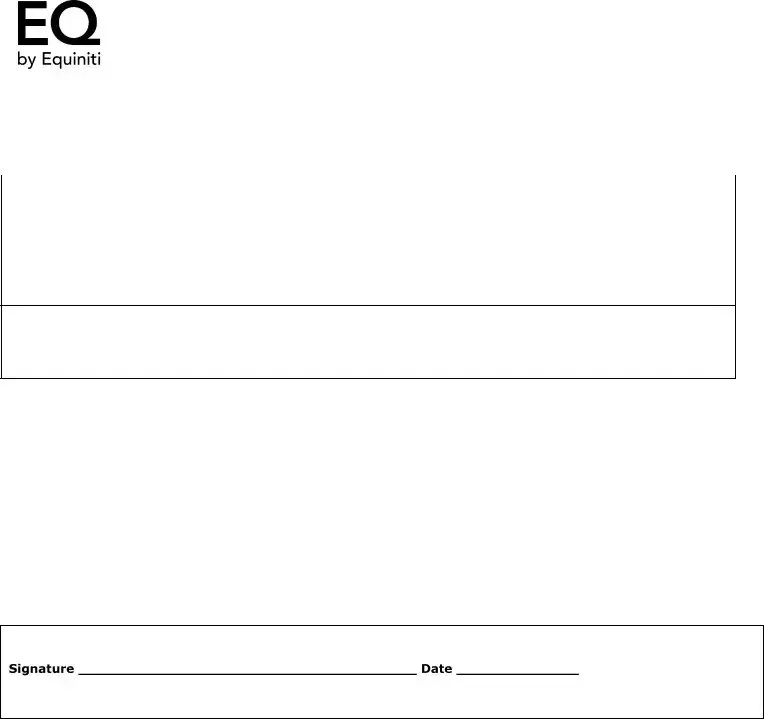

Instructions for individuals signing on behalf of a shareowner

If you are the: |

You need to include: |

|

|

|

|

|

A copy of the court certified document dated within 60 days (within six months if |

|

|

issued in New York or within one year if issued in Connecticut). |

|

Executor or administrator |

|

|

|

If the estate is not being probated, include a small estate affidavit and a photocopy of |

|

|

the death certificate. |

|

|

|

|

|

If your name has changed, please sign the letter as your name appears on the |

|

Your name has changed |

account, and then sign again using your new name. For example: Jane Doe now |

|

|

known as Jane Smith. |

|

|

|

|

Minor who is now over |

Sign the letter and include one of the following: a photocopy of your birth certificate, |

|

the age of majority on a |

||

driver's license, passport, or military ID. |

||

Custodial account |

||

|

||

|

|

|

|

A copy of POA document with the following statement written on the document: "The |

|

Power of attorney (POA) |

Power of Attorney is in full force and effect, is a true and correct copy of the original, |

|

and the maker is still alive." The POA document must state the attorney in fact can act |

||

|

||

|

on behalf of share or security transactions. |

|

|

|

|

|

A photocopy of the court certified Letters of Guardianship/Conservatorship, dated |

|

Guardian or conservator |

within the past 60 days (within six months if issued in New York or within one year if |

|

issued in Connecticut). The Letters must authorize the Guardian/Conservator to act on |

||

|

||

|

behalf of the individual’s assets. |

|

|

|

|

|

Include a Certificate of Fiduciary Authority. You may download this form at |

|

Successor trustee |

shareowneronline.com. Under Download Forms, select “Certificate of Fiduciary |

|

|

Authority.” |

|

|

|

|

|

Chief executive partners, general partners, or managing general partners may sign |

|

Partnership |

the letter listing their title, with no further documents needed. If the partnership has a |

|

|

governing resolution, please follow the requirements for a corporation. |

|

|

|

|

Sole proprietor |

Sole Proprietors may sign the letter listing their title as Sole Proprietor or Sole Owner, |

|

with no further documents needed. |

||

|

||

|

|

|

Corporation |

|

|

|

|

|

Investment club |

|

|

School |

Authorized individuals may sign with their title listed after their name. You will also |

|

|

need to include a copy of the corporate resolution, or governing document listing the |

|

Government agency |

||

authorized individuals who may sign on behalf of the Company or Organization. The |

||

|

||

Religious organization |

resolution/document must be dated within the past 6 months. It must also contain a |

|

|

corporate seal, or have a written statement on it advising there is no seal. The person |

|

|

signing the resolution or document may not be the same person signing this letter. |

|

Financial institution |

||

|

||

acting as custodian or |

|

|

trustee |

|

|

|

|

Changing the account registration

Your name or the names on the account have changed

To change the names on the account, a transfer must be completed. You can download instructions and forms at shareowneronline.com. Under Download Forms, select “Stock Power and Transfer Instructions.”

Form Data

| Fact Number | Description |

|---|---|

| 1 | The Letter of Instruction should be mailed to Shareowner Services at PO Box 64874, Saint Paul, MN 55164-0874. |

| 2 | For courier services, the destination is Shareowner Services, ATTN: Imaging Services, 1110 Centre Pointe Curve Suite 101, Mendota Heights, MN 55120. |

| 3 | Required information includes Account number or Social Security/Tax ID number, Company name/issue of stock, and registered Name(s) and address. |

| 4 | An alternate address can be provided for mailing if it differs from the registered address. |

| 5 | If requesting on behalf of a registered owner, the submitter must include their title after their name and might need to provide additional documents. |

| 6 | Changes to account registration or names require a transfer process, accessible at shareowneronline.com under "Stock Power and Transfer Instructions." |

| 7 | Executors or administrators must provide a court-certified document and possibly a small estate affidavit and death certificate. |

| 8 | Individuals with changed names must sign with both their previous and new names. |

| 9 | Guardians or conservators need to include a court-certified Letters of Guardianship/Conservatorship. |

| 10 | Corporations, government agencies, or NGOs must include a corporate resolution or governing document dated within the past 6 months, specifying the authorized signatories. |

Instructions on Utilizing Letter Of Instruction

Once you've gathered all the necessary information and documents, filling out a Letter of Instruction form is straightforward. This document helps ensure your requests regarding your shareowner account are clearly understood and processed accurately. Whether you're making changes to your account, transferring ownership, or providing instructions as an executor or power of attorney, this form is essential. Follow these steps carefully to fill it out correctly.

- Start by writing the account number or your Social Security/Tax ID number at the top of the form. This ensures your account is easily identifiable.

- Enter the company name or the issue of stock you're referencing. This information helps direct your instructions to the right place.

- Provide the name(s) and address as registered on the account. Accuracy here is crucial for verifying ownership or authority.

- If you wish correspondence to be sent to a different address than the one on record, fill in the alternate address section.

- Write your request clearly in the space provided. Whether you're changing account details, transferring shares, or providing other instructions, clarity is key.

- Sign the form. If you're the registered owner, simply sign your name. If you're signing on behalf of the registered owner, add your title (e.g., Executor or Power of Attorney) after your signature.

- Review the form for any additional documents required, especially if signing on behalf of a registered owner. Attach these documents with your Letter of Instruction.

- Mail your completed form and any necessary documents to the address listed. Use the specific address for courier services if applicable.

After your Letter of Instruction has been mailed, the shareowner services team will process your request based on the information and instructions provided. If any changes to the account registration are needed, such as a name change due to marriage or a transfer of ownership, remember that a separate process is required. Additional forms for these processes can be downloaded from the shareowner services website. Ensuring your form is accurately filled out and all necessary documents are included will help expedite your request.

Obtain Answers on Letter Of Instruction

- What is a Letter of Instruction, and when do I need to use it?

- Who can sign the Letter of Instruction?

- What supporting documents might I need to include with the Letter of Instruction?

- Executors or administrators might need to include court-certified documents or small estate affidavits and death certificates.

- Those with changed names should provide a signature under both the old and new names.

- Individuals who have reached the age of majority, guardians, conservators, successor trustees, and those acting under a Power of Attorney may need to include specific legal and identity-confirming documentation to prove their eligibility and authority.

- Entities such as corporations, partnerships, investment clubs, schools, government agencies, religious organizations, and non-profits should provide resolutions or governing documents clarifying the individuals authorized to act on their behalf.

- How do I change the names on the account or update my account information?

- Where do I send my completed Letter of Instruction and accompanying documents?

- For standard mail: PO Box 64874, Saint Paul MN 55164-0874

- For courier services: 1110 Centre Pointe Curve Suite 101, Mendota Heights MN 55120

A Letter of Instruction is a document that facilitates specific requests or instructions to Shareowner Services. It is used when an individual needs to convey their wishes regarding their account or stock holdings, such as changing an address, transferring shares, or updating account information. This form must be accompanied by a signature from the registered owner or an authorized signatory with appropriate documentation, if acting on behalf of the owner. Instances requiring a Letter of Instruction include but are not limited to, reporting a name change, requesting documents be sent to an alternate address, or executing stock-related transactions under the direction of a legally authorized individual.

The registered owner of the account or stock must sign the Letter of Instruction. If someone other than the registered owner is signing, they must indicate their title or relationship to the owner (e.g., Executor, Power of Attorney) directly after their name and include the necessary legal documents as evidence of their authority to act on the owner’s behalf. These documents may include court-certified documents, powers of attorney, and other verification forms as detailed in the instructions.

Depending on your specific situation, various supporting documents could be required:

Each situation might require a unique set of documents, so it's important to review the instructions thoroughly.

To change the names on an account or make updates to account information, a transfer must be completed with a different form. You can find the “Stock Power and Transfer Instructions” form and other relevant documentation for account changes at shareowneronline.com under the Download Forms section. This is essential for ensuring that the account reflects the current and accurate information for its owner or owners.

Your completed Letter of Instruction, along with any required supporting documents, should be mailed to Shareowner Services at the addressed listed on the form, depending on whether you are using standard postal service or a courier. The addresses are:

Common mistakes

Filling out a Letter of Instruction form may seem straightforward, but common errors can lead to delays or incorrect processing. Here are nine mistakes to avoid:

- Not including the account number or Social Security/Tax ID number. This is crucial for identifying your account.

- Omitting the company name or issue of stock. This information is necessary to accurately process your request.

- Incorrectly listing the names and address as registered on the account. Double-check to ensure this matches your account records to avoid any confusion.

- Skipping the alternate address section, if applicable. If you want correspondence sent elsewhere, be sure to fill this out.

- Forgetting to sign the form. A signature from the registered owner is mandatory for the form to be processed.

- Not specifying the title when signing on behalf of a registered owner. If you're an executor or have Power of Attorney, you must indicate your title next to your signature.

- Failing to include required documents. Depending on your role (executor, guardian, etc.), specific documents need to accompany your form.

- Signing in a new name without correctly indicating a name change. If your name has changed, sign both in the name registered on the account and your new name.

- Overlooking the instructions for changing the account registration. If you need to update the names on the account, follow the specific instructions provided, including completing additional forms.

Avoiding these mistakes will help ensure that your Letter of Instruction is processed smoothly and efficiently.

Documents used along the form

When dealing with the management or transfer of assets, particularly in relation to shareowner services, the Letter of Instruction plays a crucial role. However, to ensure thorough and effective handling of such matters, additional forms and documents are often utilized in conjunction. This helps in clarifying the intent of the shareowner or their legal representative and provides legal and procedural support to the actions initiated by the Letter of Instruction. Below is a list of some of these essential documents, each serving its unique purpose in the broader context of asset management and transfer.

- Will: Outlines how a person wants their assets distributed after their death. It can provide clarity and direction for the execution of the Letter of Instruction.

- Trust Documents: Establish the terms under which assets are held and managed by a trustee for the benefit of another party. Trust documents can specify details that might not be covered in a Letter of Instruction.

- Power of Attorney (POA): Authorizes someone else to act on behalf of the person in financial or health matters. The POA is crucial if the Letter of Instruction is executed by someone under a POA.

- Death Certificate: Required to prove the death of an account holder or asset owner. It is often necessary when the Letter of Instruction pertains to the assets of a deceased individual.

- Small Estate Affidavit: Used when the total value of the deceased's estate does not surpass a certain amount, allowing for a simpler transfer process of assets.

- Birth Certificate/Proof of Age: Needed to establish the age of majority for individuals claiming ownership or control over assets previously under guardianship or custodial care.

- Certificate of Fiduciary Authority: Verifies that an individual has the legal right to act on behalf of another person or estate in financial matters.

- Corporate Resolution: A formal declaration by the board of directors of a corporation, authorizing specific actions or decisions. Necessary when a corporation is involved in the transaction or action initiated by the Letter of Instruction.

- Stock Power and Transfer Instructions: A document that facilitates the actual transfer of stock ownership. Often required alongside the Letter of Instruction when changing the names on the account or transferring stock.

While the Letter of Instruction initiates the process, these accompanying documents ensure the legal and logistical requirements are met for the seamless execution of asset transfers or management. Each document plays an integral role in reinforcing the instructions, addressing regulatory compliance, and safeguarding the interests of all parties involved.

Similar forms

Will: Like a Letter of Instruction, a Will is crucial for outlining your wishes concerning the distribution of your assets after your death. However, while a Will goes through probate and becomes a public document, a Letter of Instruction remains private and can provide more informal guidance alongside the formal directives of a Will.

Power of Attorney (POA): This document authorizes someone to act on your behalf in legal or financial matters, similar to specific aspects of the Letter of Instruction. The POA can give broad or limited powers, much like how a Letter of Instruction may detail various levels of instructions for handling financial transactions or account changes.

Advance Healthcare Directive: Often known as a living will, this document specifies your wishes regarding medical treatment if you become unable to communicate them yourself. It parallels the Letter of Instruction's role in communicating wishes not necessarily related to asset distribution but rather to personal preferences and instructions.

Trust Document: Trusts are established to manage assets on behalf of beneficiaries, a purpose similar to what a Letter of Instruction might serve in guiding the trustees on the specifics not covered by the trust agreement. Both can outline detailed wishes for asset distribution and management.

Beneficiary Designations: Forms that specify who will receive assets from retirement accounts, life insurance policies, and other accounts upon death. While these designations are legally binding, a Letter of Instruction can supplement these forms with additional details or explanations about the choices made.

Bank Safe Deposit Box Inventory: An inventory list for a safe deposit box can act similarly to a Letter of Instruction by detailing the contents and their intended disposition. Both provide a roadmap for handling specific assets.

Corporate Resolution: Used in business settings, a corporate resolution documents the decisions made by the board of directors or shareholders. Like a Letter of Instruction, which may outline how to manage shares or business-related decisions after one's death, a corporate resolution provides documented guidance for business operations.

Dos and Don'ts

When dealing with a Letter of Instruction form, particularly for Shareowner Services, it's essential to handle the process correctly to ensure your requests are processed efficiently and without delay. Here are some dos and don'ts to guide you through this procedure:

Things You Should Do

- Review all instructions carefully: Before filling out the form, make sure to read through all the provided instructions to understand the documentation and information required.

- Gather necessary documents: Depending on your status (executor, guardian, power of attorney, etc.), ensure you have all the correct documents on hand, such as court-certified documents, photocopies of identification, or specific resolutions.

- Provide accurate information: Confirm that all information, including account numbers, social security/tax ID numbers, and registered names and addresses, is current and correct.

- Sign as registered or authorized: If you're signing on behalf of a registered owner, make sure to include your title after your name as indicated on the form and ensure all signatures are present and match the ones on record.

- Verify mailing details: Double-check the address where you'll be sending the completed form, especially if opting to use a courier service, to ensure it reaches the correct destination without issues.

Things You Shouldn't Do

- Leave sections blank: Neglecting to fill in necessary parts of the form can lead to processing delays. If a section does not apply, consider noting it as 'N/A' (not applicable) rather than leaving it empty.

- Use outdated information: Submitting the form with old or incorrect information can lead to confusion and potential errors in processing your request. This is particularly critical with names and addresses.

- Forget to sign: Failing to provide the necessary signature(s) can invalidate your entire request. Pay close attention to the form's signature requirements.

- Overlook document requirements: Each status, be it executor, guardian, or possessing a power of attorney, has specific document requirements. Ignoring these can lead to your application being denied or delayed.

- Send to the wrong address: Using an incorrect mailing address can significantly delay the processing of your request. Ensure you're sending it to the appropriate address for your method (standard mail vs. courier).

Following these guidelines will help streamline the process, ensuring that your Letter of Instruction is processed efficiently and accurately by Shareowner Services.

Misconceptions

There are several misconceptions about the Letter of Instruction form that can cause confusion or errors if not understood properly. Here we're going to dispel some of the common myths:

It’s a Legal Document: Many people mistakenly believe a Letter of Instruction is a legally binding document. While critical for providing guidance and instructions, it doesn’t hold legal weight like a will and cannot override the terms stated in one.

Only for the Wealthy: There’s a misconception that Letters of Instruction are only necessary for those with substantial assets. In reality, anyone can benefit from preparing one, as it helps articulate wishes that aren’t suited for the formal structure of a will.

It Can Replace a Will: Some individuals think that a Letter of Instruction can serve as a substitute for a will. This is not the case. While it complements a will by providing additional details, it cannot distribute assets upon death.

Complicated to Create: Another misunderstanding is the belief that crafting a Letter of Instruction is a complex process requiring legal expertise. Contrary to this, it can be quite simple and written personally, outlining clear instructions and information.

It’s Only About Financial Information: While financial details are significant, a Letter of Instruction should also encompass personal sentiments, funeral arrangements, and even online account information, making it a more comprehensive document than many realize.

Needs to Be Notarized: Unlike other formal documents, a Letter of Instruction does not need to be notarized. Its purpose is to serve as a guide and as such, formal validation through notarization isn't required.

Only Addresses Asset Distribution: There’s a narrow view that it should only cover the distribution of assets. However, it’s also an excellent place to include your final wishes, care instructions for pets, or personal messages to loved ones.

No Need to Update: Some may think once written, there’s no need for updates. However, life changes such as births, deaths, marriage, or divorce necessitate updates to ensure the Letter of Instruction remains relevant and reflective of current wishes.

Understanding these misconceptions is crucial to properly utilizing a Letter of Instruction and ensuring your wishes are known and considered in addition to the legal estate planning documents you have in place.

Key takeaways

Filling out and using the Letter of Instruction form requires attention to detail and adherence to specific guidelines to ensure the effective management of shareowner services. Here are key takeaways to guide you through the process:

- Accuracy is crucial: Make sure that the account number or Social Security/Tax ID number, company name/issue of stock, and the name(s) and addresses as registered are accurately provided. This ensures that your request is associated with the correct account, preventing delays or errors in processing.

- Understanding the role of alternate addresses: The form allows for an alternate address to be specified for mailing purposes, different from the registered address on the account. This option can be particularly helpful if you need documents sent to an address that is more convenient for you.

- Signatory details matter: If you are signing the Letter of Instruction on behalf of a registered owner, it is essential to include your title after your name (e.g., Executor, Power of Attorney). This clarifies your authority to act on behalf of the shareholder, ensuring the legitimacy of your request.

- Required documents for representatives: Depending on your role (e.g., Executor, Power of Attorney, Guardian), additional documentation may be necessary to accompany your Letter of Instruction. These documents could include court-certified documents proving your appointment and authority or other specific documents like a small estate affidavit or a birth certificate, depending on the context.

- Addressing changes in account registration: If the names on the account need to be updated due to reasons such as marriage, divorce, or legal name changes, a separate transfer process is required. The instructions and necessary forms for this process are available for download at shareowneronline.com, helping you make the required updates efficiently.

By keeping these key points in mind and following the specified guidelines, you can navigate the Letter of Instruction form with confidence. Whether you're managing your own shareowner services or acting on behalf of someone else, the process can be completed smoothly with proper preparation and attention to detail.

Popular PDF Forms

Lifestyle Management - A beneficial tool for pinpointing lifestyle areas that need attention, aiming for balanced nutrition, and managing stress.

Da Form 7274 - Assesses new unit or activity’s role in easing the PCS move, promoting a welcoming environment.