Blank Letter Of Lien PDF Template

When individuals or businesses provide work, materials, or equipment for a residential project but don't receive the agreed-upon compensation, they have the option to pursue a legal claim to ensure payment. This is where the Letter of Lien Form comes into play, serving as a critical initial step in the lien process. Designed to formally notify the responsible party, this document details the work or materials provided, the outstanding amount, and the contractual basis for the claim. It presents a clear ultimatum: if the amount due is not settled within 15 days from the date of the notice, the issuer plans to record a claim of lien against the property in question. This form not only lays out essential information like the original contract amount, any modifications or additions to the contract, and payments received but also highlights the total amount still owed. Through this letter, the rights of workers and suppliers are protected, encouraging swift resolution of payment disputes and ensuring that those who have contributed to improving a property are fairly compensated for their efforts.

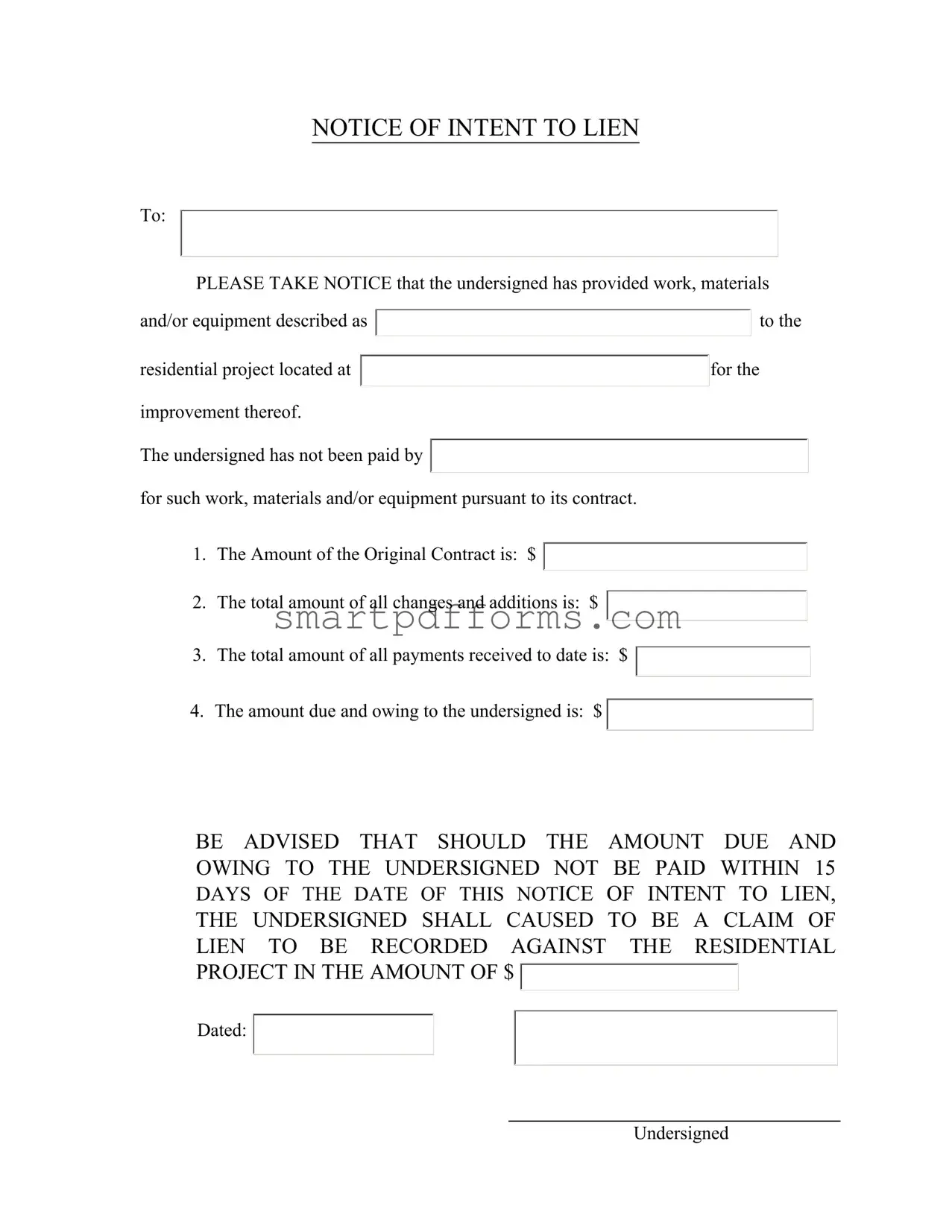

Preview - Letter Of Lien Form

NOTICE OF INTENT TO LIEN

To:

PLEASE TAKE NOTICE that the undersigned has provided work, materials

and/or equipment described as |

|

|

|

|

|

|

to the |

|

||

|

|

|

|

|

|

|

|

|

|

|

residential project located at |

|

|

|

|

|

|

for the |

|

||

|

|

|

|

|

|

|

|

|

||

improvement thereof. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

The undersigned has not been paid by |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

for such work, materials and/or equipment pursuant to its contract. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

1. |

The Amount of the Original Contract is: $ |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

2. |

The total amount of all changes and additions is: $ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

3. |

The total amount of all payments received to date is: $ |

|

|

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

|||||||

4. The amount due and owing to the undersigned is: $ |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

BE ADVISED THAT SHOULD THE AMOUNT DUE AND OWING TO THE UNDERSIGNED NOT BE PAID WITHIN 15 DAYS OF THE DATE OF THIS NOTICE OF INTENT TO LIEN, THE UNDERSIGNED SHALL CAUSED TO BE A CLAIM OF LIEN TO BE RECORDED AGAINST THE RESIDENTIAL PROJECT IN THE AMOUNT OF $

Dated:

Undersigned

Form Data

| Fact Name | Description |

|---|---|

| Purpose | This document serves as a formal notification that the issuer intends to file a lien due to unpaid work, materials, or equipment provided for a residential project. |

| Contract Documentation | It outlines key financial details related to the contract, including the original contract amount, adjustments, payments received, and the outstanding balance. |

| Notice Period | Specifies that if the outstanding balance is not paid within 15 days, the issuer will proceed with recording a claim of lien against the project. |

| Intent to Lien | A clear declaration that the issuer plans to secure a lien on the property as a means to recover owed amounts. |

| Target of Notice | Directed towards the party responsible for the payment, highlighting the legal expectation for remuneration. |

| Legal Foundation | Reflects the legal framework allowing contractors and suppliers to claim a lien on property as security for payment for services rendered or materials supplied. |

| Governing Law(s) | Laws vary by state, but generally, this notice is governed by state-specific mechanics' lien or construction lien statutes that dictate the process and timelines for filing such notices and liens. |

Instructions on Utilizing Letter Of Lien

When dealing with unpaid work, materials, or equipment for a residential project, issuing a Letter of Lien can be a crucial step towards ensuring you are paid for your contributions. This document serves as a formal notice to the party responsible for making payments, indicating your intent to place a lien on the property if the payment is not made within a specified timeframe. Below are detailed instructions on how to fill out this form to assert your rights and navigate this situation effectively.

- Start by addressing the letter to the party responsible for the payment. This includes their full name or the name of the company and their address. Place this information at the top of the form, following the "To:" prompt.

- Clearly describe the work, materials, and/or equipment you have provided. Include specific details that will help identify the services or goods in question. This description should go into the section provided after the introduction paragraph.

- Identify the residential project's location by providing the complete address. This includes the street address, city, state, and zip code. This detail is crucial as it specifies where the lien will be placed if necessary.

- Fill in the name of the party who has not made the payment to you. This ensures clarity on who is being notified of the unpaid debt and the potential lien.

- Enter the original contract amount in the space provided. This is the initial sum agreed upon for the work, materials, and/or equipment.

- Add the total amount of all changes and additions to the project. This figure should cover any modifications or extra work requested beyond the original agreement.

- Document the total amount of all payments you have received to date. This will show how much has been paid and how much is still owed.

- Calculate the amount due and owing, and enter this figure. This is the difference between the total contract amount (including changes and additions) and the payments received.

- Signal your intention to place a lien on the property if the due amount is not paid within 15 days from the date of notice. Make sure to enter the due amount again in this section for emphasis.

- Include the date when you are filling out the form. This establishes a timeline for the payment window before further legal action is considered.

- Finally, sign the document at the "Undersigned" line to validate the notice. Your signature represents your intention to pursue the claimed amount should the payment not be settled.

Filling out the Letter of Lien form correctly is a decisive step in securing your right to compensation for provided work, materials, or equipment. By following these steps, you can ensure that your notice is clear, detailed, and adheres to legal standards. Remember, this document is not only a notification but also a preliminary step before taking further legal action, making its accuracy and completeness vital.

Obtain Answers on Letter Of Lien

- What is a Letter Of Lien?

A Letter Of Lien, also known as a Notice of Intent to Lien, is a formal document sent to a property owner indicating that the sender, usually a contractor, subcontractor, or supplier, intends to file a lien on the property. This is due to unpaid work, materials, or equipment provided for the improvement of the property. It serves as a preliminary step before officially recording a lien against the property if payment is not received within the specified timeframe.

- Why is it necessary to send a Letter Of Lien?

Sending a Letter Of Lien is a crucial step for securing the right to claim a lien on a property. It acts as a warning to the property owner that the sender has not received payment for services or materials provided. This letter legally informs the property owner about the unpaid debt and grants them a window to settle the payment before a lien is recorded against their property, which could severely affect their ability to sell or refinance the property.

- What should be included in a Letter Of Lien?

A comprehensive Letter Of Lien should include the following details:

- The name and contact information of the sender.

- A description of the work, materials, or equipment provided.

- The address of the property in question.

- The total amount of the original contract.

- The total amount of all changes and additions to the contract.

- The total amount of all payments received to date.

- The total amount due and owing.

- A statement warning of the intent to file a lien if the amount is not paid within 15 days.

- The date of the notice and the signature of the sender.

- Who should receive the Letter Of Lien?

The Letter Of Lien should be directed and sent to the property owner of the residential project in question. It is essential to ensure that the letter is delivered to the correct party to potential mitigate issues related to non-payment and to legally enforce the sender's rights to claim a lien.

- How is a Letter Of Lien delivered?

The method of delivering a Letter Of Lien varies by jurisdiction but typically requires a method that provides proof of delivery, such as certified mail with a return receipt, personal delivery with a signed acknowledgment, or via a process server. This ensures that there is a record of the property owner receiving the notice, an important step should the matter proceed to legal action.

- What happens after a Letter Of Lien is sent?

Upon sending a Letter Of Lien, the property owner has 15 days to settle the outstanding payment. If the payment is not made within this timeframe, the sender has the legal right to proceed with recording a claim of lien against the residential project. This recorded lien can significantly impact the property's title, making it difficult for the owner to sell or refinance until the debt is settled.

- Can a Letter Of Lien be contested?

Yes, property owners have the right to contest a Letter Of Lien. If they believe the claim is unjustified, whether due to disagreement about the work quality, the amount claimed, or other reasons, they can seek legal advice to dispute the claim. Contesting a lien typically involves legal proceedings, and the property owner may need to provide evidence supporting their position.

- What is the legal impact of failing to respond to a Letter Of Lien?

Failing to respond to a Letter Of Lien by not settling the outstanding amount can lead to the recording of a lien against the property. This can damage the property owner’s credit score, affect the property’s title, and potentially lead to legal action aimed at recovering the unpaid debt. It is advisable for property owners to address a Letter Of Lien promptly to avoid these legal and financial complications.

- When is it appropriate to seek legal advice regarding a Letter Of Lien?

It is advisable to seek legal advice regarding a Letter Of Lien under several circumstances, including if you are a property owner contesting the claim, if you are unsure about the process of filing or contesting a lien, or if you require assistance in drafting a legally compliant notice. Legal expertise can provide guidance, ensure that all actions are appropriately taken, and help protect your rights and interests in the matter.

Common mistakes

Not providing detailed descriptions of the work, materials, and/or equipment supplied. When filling out a Letter of Lien, it's essential to clearly and comprehensively list what was provided for the residential project. Failing to do so may lead to misunderstandings or disputes about what is included in the lien.

Incorrectly stating the amounts involved. It's critical to accurately fill in the amount of the original contract, any changes and additions, payments received, and the amount still due and owing. Mistakes in these numbers can complicate or delay lien proceedings.

Forgetting to include the date. The Letter of Lien must have the date it was issued clearly stated. This date starts the countdown for the 15-day payment window and is crucial for determining the timeline of the lien process.

Omitting the project's address or misidentifying the property. The notice needs to accurately specify the location of the residential project to ensure the lien is attached to the correct property.

Failing to properly identify the parties involved. Both the entity issuing the lien (the undersigned) and the party responsible for payment must be clearly identified. Confusion over the parties' identities can lead to legal challenges against the lien.

Not complying with the 15-day notice period before moving forward with the lien claim. The Letter of Lien serves as a formal warning, and proper procedure must be followed, including waiting the specified period after notice delivery before recording a claim of lien.

When these common mistakes are avoided, the process of filing a lien can proceed more smoothly, potentially leading to a quicker resolution. It's important for individuals to be meticulous in completing the form to protect their rights to payment for work, materials, and equipment provided.

Documents used along the form

When dealing with a Letter of Lien, several other forms and documents often play crucial roles in the process. These documents are integral for providing clarity, ensuring accuracy, and fulfilling legal requirements associated with the lien process. Below is a list of documents typically used alongside a Letter of Lien.

- Contract Agreement: This is the original agreement between the parties involved, detailing the scope of work, materials to be provided, payment schedules, and any other conditions that were agreed upon.

- Change Order Forms: These forms document any changes or additions to the original contract, including adjustments in cost, materials, or timelines. These are necessary to justify any alterations that impact the lien amount.

- Proof of Notice: Documentation that proves notice of intent to file a lien was served to the property owner or responsible party. This could include certified mail receipts or other delivery confirmation.

- Waiver and Release Forms: These documents are typically used during payments and indicate that a partial or full waiver of lien rights is provided in exchange for payment. Waivers may be conditional or unconditional and are crucial for the payment process.

- Payment Application: A detailed request for payment that outlines the work completed, materials supplied, and the amount being billed. This document is often submitted periodically throughout the project duration.

- Lien Release: This form is filed upon the full payment of the amount claimed in the lien. It formally removes the lien from the property title, clearing any encumbrances related to the lien.

- Claim of Lien: This legal document is filed with the county recorder’s office to officially secure the claimant’s interest in the property until the debt is paid. It provides public notice of the lien on the property.

- Construction Project Accounting Record: Detailed records of all financial transactions related to the project, including invoices, receipts, and proof of payments. These records support the amounts claimed in liens and other legal actions.

Together, these documents create a comprehensive legal framework that supports the execution and enforcement of a lien. From establishing the basis for the lien through the contract to the final release of the lien upon payment, each document plays a vital role. The clearer and more thorough the documentation, the smoother the lien process tends to go, providing security for all parties involved in the project.

Similar forms

Mechanic’s Lien: Like the Letter of Lien, a Mechanic's Lien is used in the construction industry to secure payments. It is a legal claim against a property by a contractor or subcontractor who has not been paid for work done on that property. Both documents serve to notify the property owner of unpaid debts and threaten legal action to recover the owed amount.

Promissory Note: A Promissory Note is a financial document in which one party promises to pay another party a specific sum of money at a certain time or on demand. Similar to the Letter of Lien, it outlines a financial obligation. However, the Promissory Note itself doesn't secure an interest in property as collateral for the debt unless accompanied by a security instrument like a mortgage or lien.

Mortgage Agreement: This document secures a loan on real property. Like a Letter of Lien, it places a lien on a property, but in this case, it’s voluntary and created when buying the property or refinancing. The lien exists to guarantee the loan’s repayment. The property can be seized and sold if the borrower fails to comply with the terms of the mortgage agreement.

Deed of Trust: Functioning similarly to a mortgage, a Deed of Trust involves a third party, the trustee, holding the legal title to a property until a borrower pays off their debt. Like the Letter of Lien, it creates a lien on the property as security for a debt, but it typically involves the sale of the property by the trustee to repay the debt if the borrower defaults.

UCC Financing Statement: This is a public notice, usually filed with a state's Secretary of State, indicating a secured interest in personal property (as opposed to real estate). Although it deals with personal property instead of real property, like a Letter of Lien, its purpose is to publicize a security interest and secure repayment of a debt.

Stop Notice: This legal document is sent to a property owner to notify them of unpaid labor or materials, requesting the owner to withhold funds from the contractor until the claimant is paid. Just like the Letter of Lien, it serves as a notification of unpaid bills, although it does not create a lien against the property.

Payment Bond Claim: Often used in public projects where Mechanic's Liens are not permitted, a Payment Bond Claim is made against a surety bond to recover payment for work performed. Similar to a Letter of Lien, both are legal tools to ensure contractors and suppliers receive payment for their work, although the Payment Bond Claim targets a bond rather than the property itself.

Conditional Waiver and Release on Progress Payment: This form is used in the construction industry whereby a contractor or supplier can waive future lien rights to a date with a promise of payment. Like the Letter of Lien, it handles the topic of securing payments, but from the angle of releasing lien rights conditionally, rather than asserting them.

Notice of Completion: Upon the completion of a construction project, this notice is filed with the local county recorder's office. It starts the clock on the time period within which contractors must file their lien claims. While serving a different function, it is related to the Letter of Lien in timing and subject matter, focusing on the closure of financial obligations at the end of a project.

Demand Letter for Payment: A more general form of demand, this letter requests payment for any owed amount and may threaten legal action but does not specifically threaten a lien. Like the Letter of Lien, it's used to prompt payment from a debtor, but it lacks the specific leverage of threatening a property lien.

Dos and Don'ts

When preparing to fill out the Letter of Lien form, it is crucial to understand the steps to ensure accuracy and legal compliance. This guidance will highlight essential dos and don'ts to navigate this process efficiently.

Things You Should Do

- Verify all details: Double-check the description of the work, materials, or equipment provided, and ensure the residential project's location is accurately specified.

- Include exact amounts: Clearly state the original contract amount, total of all changes and additions, payments received, and the outstanding balance due.

- Review the contractual agreement: Confirm the terms as per your contract to ensure the amounts and conditions meet the agreed-upon terms.

- Meet all deadlines: Note the 15-day window for payment after issuing this notice. Ensure the Letter of Lien is prepared and sent in a timely manner to meet legal timelines.

- Keep accurate records: Maintain documented evidence of all communications and transactions related to the project and this notice for future reference.

- Consult with a professional: Seek advice from a legal expert specializing in liens and construction law to ensure all procedures are correctly followed and your rights are protected.

Things You Shouldn't Do

- Avoid assumptions: Don’t presume that verbal agreements not documented in the contract will be recognized. Ensure all claims are supported by the contractual agreement.

- Omit details: Missing information about the work provided or inaccuracies in the amounts claimed can lead to disputes and potentially void the lien.

- Delay the process: Postponing the preparation or submission of the Letter of Lien can jeopardize your ability to secure a lien within the legally prescribed timeframe.

- Ignore state laws: Each state has unique regulations governing liens. Failing to comply with your state's specific requirements can invalidate your claim.

- Overlook the notice requirement: Neglecting to send this Notice of Intent before proceeding with a lien claim can lead to legal challenges against the lien’s enforceability.

- Attempt to inflate amounts: Claiming more than what is genuinely owed or including costs not directly related to the contract can be considered fraudulent and may lead to legal penalties.

Misconceptions

When dealing with the Notice of Intent to Lien, several misconceptions can lead to misunderstandings about its purpose and effects. Here, we'll clarify some of these common misunderstandings to provide a clearer picture of what a Notice of Intent to Lien truly involves.

- Misconception #1: A Notice of Intent to Lien is the final step in the lien process.

Many believe that once a Notice of Intent to Lien is issued, the process is nearly complete. However, this notice serves as a preliminary step, offering the property owner a final opportunity to settle unpaid debts before an actual lien is placed on the property. The notice is a prerequisite action that must occur before filing a formal lien.

- Misconception #2: Issuing a Notice of Intent to Lien immediately tarnishes the property owner's credit score.

This statement is not accurate. The Notice of Intent to Lien itself does not affect a person's credit score as it is simply a formal warning. It is the recording of an actual lien that may have negative consequences on the property owner’s creditworthiness.

- Misconception #3: Only contractors can file a Notice of Intent to Lien.

It's a common belief that these notices are exclusive to contractors. In reality, subcontractors, laborers, and material suppliers who have not been paid for work or materials provided can also issue a Notice of Intent to Lien. This inclusivity ensures that all parties involved in the improvement of a property have a mechanism to seek payment.

- Misconception #4: A Notice of Intent to Lien affects all owners of the property equally.

This misunderstanding overlooks the nuances of property ownership and the specific details outlined in the lien law. The impact of a Notice of Intent to Lien, and any subsequent lien, can vary based on the property's ownership structure, how the property is titled, and state laws. It's essential to understand the specific circumstances surrounding each case.

Understanding these misconceptions about the Notice of Intent to Lien can help individuals navigate the complexities of lien laws with greater clarity and confidence. It emphasizes the importance of knowing one's rights and responsibilities within the framework of construction and property law.

Key takeaways

When dealing with the preparation and use of the Letter of Lien form, it is essential to understand its function and how it is properly executed. Here are key takeaways to ensure that individuals and businesses handle this legal tool with due diligence:

- Understand the purpose: The Letter of Lien form is a preliminary notice that informs a property owner about unpaid work and intends to secure payment for services or materials provided. It's a critical step before filing a formal lien.

- Accurate description of services: Clearly and accurately describe the work, materials, and equipment provided. Vague descriptions can weaken your position if a dispute arises.

- Project location is crucial: Ensure the address of the project is correct. Mistakes here can lead to filing the lien on the wrong property, making it invalid.

- Detailed contract information: Include specific details about the original contract, such as the agreed amount, any changes or additions, payments received, and the amount still owed.

- Timeliness matters: The notice gives the property owner a 15-day window to settle the unpaid amount. Be prompt in sending the letter once you realize payment will not be made.

- Intend to record a claim: The letter explicitly states that a lien will be recorded against the property if the due amount is not settled within the specified period. This statement serves as a legal warning.

- Documentation: Keep all relevant documentation, including contracts, communication records, the Letter of Lien, and receipts, as they may be required if the matter escalates to court.

- Be precise with amounts: When calculating the amounts for the original contract, changes or additions, payments received, and outstanding balances, accuracy is paramount. Inaccuracies can jeopardize your claim.

- Date and signature: Do not forget to date the notice and sign it. The date is necessary to track the 15-day response period, and your signature validates the notice.

- Seek legal advice: Before proceeding with a Letter of Lien, it may be beneficial to consult with a legal professional. They can provide guidance tailored to your situation, ensuring that the lien process is handled correctly and effectively.

By adhering to these guidelines, individuals and companies can navigate the complexities of the lien process with confidence, safeguarding their rights and ensuring that they are compensated for their work, materials, and equipment supplied to projects.

Popular PDF Forms

Medicaid Card Online - The form allows for the application of multiple children under the same household, streamlining the process for families with more than one eligible child.

Certificate of Membership Template - Details the terms of ownership and member contributions in the LLC, serving as an official record of the same.