Blank Ls 59 PDF Template

Understanding the nuances of workplace documents is crucial for both employers and employees. Among these essential documents, the LS 59 form, also known as the Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law, plays a pivotal role. This form is comprehensive, designed to ensure employees are fully aware of their compensation details, encompassing various types of pay rates such as hourly, salary, and commission-based structures. It's particularly noteworthy that the form mandates transparency about overtime pay rates, delineating when employees are entitled to receive 1.5 times their regular rate of pay for overtime work. Moreover, the form serves as a record of the employee's understanding and acceptance of their pay rate, payday, and, if applicable, overtime rate, which must be acknowledged through their signature. The requirement for employers to retain the original document for six years underscores the significance of this form in maintaining fair labor practices. Employers must furnish this form to employees at two critical junctures: upon hiring and before any changes in pay rate, allowances, or payday are implemented. This ensures that employees are not only aware of their initial compensation terms but are also promptly informed of any adjustments. The LS 59 form is a testament to the strides made towards fostering transparency and understanding between employers and employees, reinforcing the foundation of trust and compliance in the professional environment.

Preview - Ls 59 Form

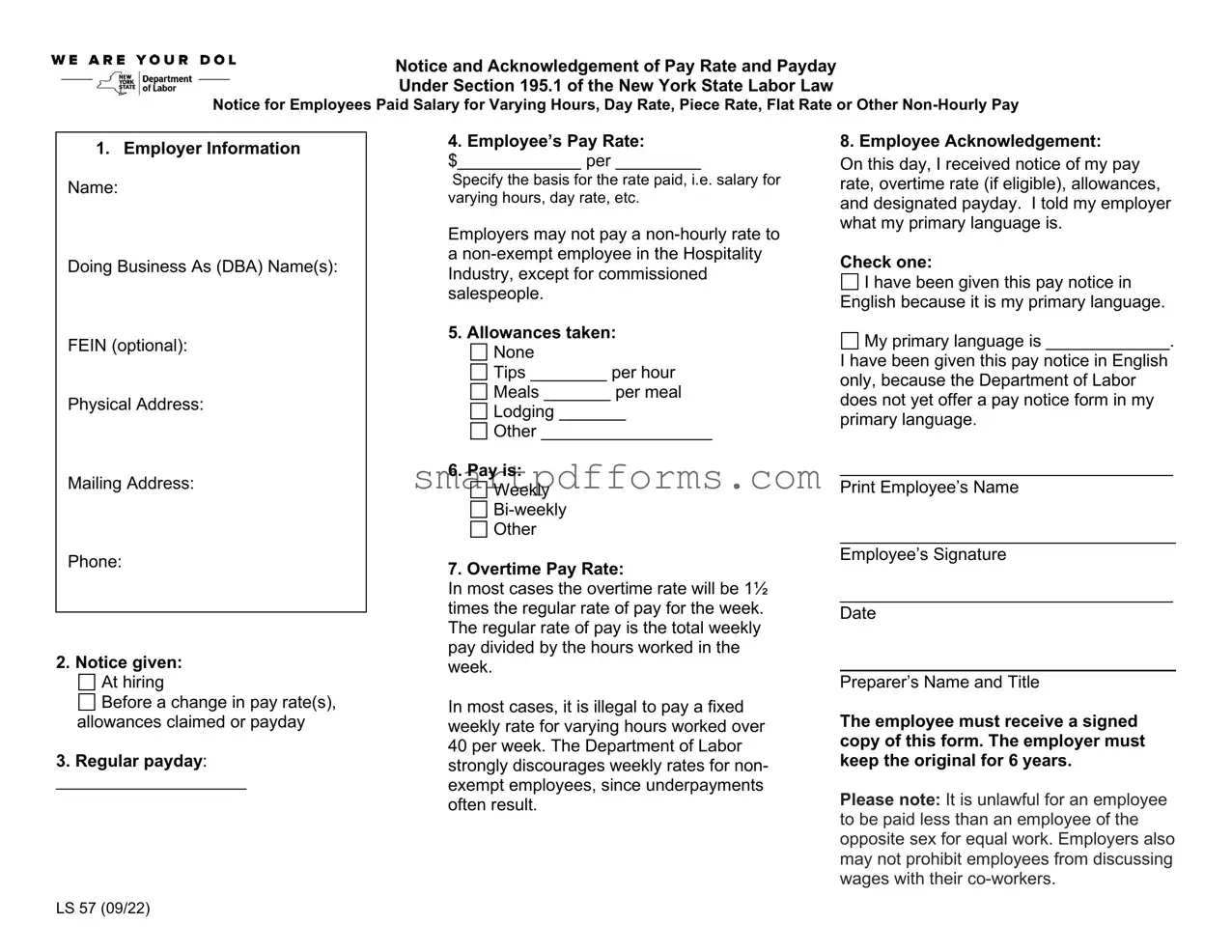

Notice and Acknowledgement of Pay Rate and Payday

Under Section 195.1 of the New York State Labor Law

Notice for Employees Paid Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other

1. Employer Information

Name:

Doing Business As (DBA) Name(s):

FEIN (optional):

Physical Address:

Mailing Address:

Phone:

2.Notice given:

At hiring

At hiring

Before a change in pay rate(s), allowances claimed or payday

Before a change in pay rate(s), allowances claimed or payday

3.Regular payday:

____________________

4. Employee’s Pay Rate:

$_____________ per _________

Specify the basis for the rate paid, i.e. salary for varying hours, day rate, etc.

Employers may not pay a

a

5.Allowances taken:

None

None

Tips ________ per hour

Tips ________ per hour

Meals _______ per meal

Meals _______ per meal

Lodging _______

Lodging _______

Other __________________

Other __________________

6.Pay is:

Weekly

Weekly

Other

Other

7. Overtime Pay Rate:

In most cases the overtime rate will be 1½ times the regular rate of pay for the week. The regular rate of pay is the total weekly pay divided by the hours worked in the week.

In most cases, it is illegal to pay a fixed weekly rate for varying hours worked over 40 per week. The Department of Labor strongly discourages weekly rates for non- exempt employees, since underpayments often result.

8. Employee Acknowledgement:

On this day, I received notice of my pay rate, overtime rate (if eligible), allowances, and designated payday. I told my employer what my primary language is.

Check one:

I have been given this pay notice in English because it is my primary language.

I have been given this pay notice in English because it is my primary language.

My primary language is _____________.

My primary language is _____________.

I have been given this pay notice in English only, because the Department of Labor does not yet offer a pay notice form in my primary language.

___________________________________

Print Employee’s Name

Employee’s Signature

___________________________________

Date

Preparer’s Name and Title

The employee must receive a signed copy of this form. The employer must keep the original for 6 years.

Please note: It is unlawful for an employee to be paid less than an employee of the opposite sex for equal work. Employers also may not prohibit employees from discussing wages with their

LS 57 (09/22)

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The LS 59 form is used for the Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law. |

| Governing Law | It is governed by Section 195.1 of the New York State Labor Law. |

| Employer Information | Employers must provide their name, any DBA (Doing Business As) names, FEIN (optional), and their physical and mailing addresses, along with a phone number. |

| Notice Requirements | Employers must give notice at hiring, before a change in pay rates, allowances, or payday. |

| Employee Pay Rate(s) | Details how employee pay is calculated - hourly, salary, day rate, piece rate, or other; special conditions apply to non-hourly rates in the Hospitality Industry. |

| Allowances | Specifies any allowances included in the pay, such as for tips, meals, lodging, or other expenses. |

| Overtime Pay Rate | Defines that most workers in NY must receive at least 1½ times their regular rate for hours worked over 40 in a week, with specified exceptions. |

| Employee Acknowledgement | Employees must acknowledge receipt of this notice, indicating their primary language, and both employee and preparer must sign the form. Employers are required to keep the original for 6 years. |

Instructions on Utilizing Ls 59

After completing the LS 59 form, it's crucial to understand the next steps to ensure compliance with New York State Labor Law requirements. This form is a critical part of employee onboarding and payroll management, detailing pay rate, payday, allowances, and other essential payroll information. It serves as an acknowledgment between employer and employee, confirming that the employee has been informed of their pay conditions. Accurate completion and proper handling of the document are essential to maintain clear communication and avoid legal complications.

- Start by filling in the Employer Information section. Provide the employer's name, any Doing Business As (DBA) names, the Federal Employer Identification Number (FEIN) if available, both the physical and mailing addresses, and the employer's phone number.

- Under Notice given, check the appropriate box to indicate whether the notice is given at hiring or before a change in pay rates, allowances, or payday.

- In the Employee’s pay rate(s) field, specify how the employee's pay is calculated: hourly, salary, day rate, piece rate, or other. Remember, hospitality industry employees must generally be paid an hourly rate, with specific exceptions such as for commissioned salespeople.

- For Allowances taken, check all that apply among none, tips per hour, meals per meal, lodging, or other, and provide the corresponding amounts.

- Specify the Regular payday, clearly indicating when employees will receive their pay.

- Indicate how often the employee is paid: weekly, bi-weekly, or specify another pay period under Pay is.

- Fill in the Overtime Pay Rate, ensuring it complies with New York State requirements, typically at least 1½ times the regular rate for over 40 hours of work in a workweek. Note any applicable exemptions.

- In the Employee Acknowledgement section, the employee should confirm receipt of the notice, their pay rate, and payday. The employee must indicate their primary language and acknowledge the notice has been given to them in English or note if a translated version was not available. The employee must then print their name, sign and date the form. Also, the preparer must include their name and title.

After completion and signing, ensure the employee receives a copy of the form for their records. The original should be kept by the employer for six years, as per the New York State Labor Law requirements. Proper filing and retention of this document are as crucial as its accurate completion, serving as proof of compliance and safeguarding against potential disputes or inquiries.

Obtain Answers on Ls 59

What is the LS 59 form?

The LS 59 form, "Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law," is a document employers in New York State use to inform their employees about their rates of pay, including overtime pay, allowances such as tips, meals, lodging, other permissible deductions, and the regular payday. This form is a requirement at the time of hiring, before any changes to pay rates or paydays, and ensures compliance with state labor laws.

When must the LS 59 form be given to employees?

Employers are required to provide the LS 59 form to employees at two specific times: upon hiring before the employee starts their work, and before any change in pay rates, allowances, or payday. This ensures that employees are fully informed of their payment terms in compliance with New York State Labor Law.

What information does the LS 59 form require from employers?

The LS 59 form requires employers to fill in comprehensive information including:

- Employer Information (Name, DBA Name(s), FEIN - optional, Physical and Mailing Address, Phone)

- Notice given at hiring or before a change in pay rate(s), allowances, or payday

- Employee’s pay rate(s) and the basis for this pay (hourly, salary, piece rate, etc.)

- Allowances taken (tips, meals, lodging, etc.)

- Regular payday schedule

- Pay frequency (weekly, bi-weekly, etc.)

- Overtime Pay Rate details

- Employee Acknowledgement section where the employee acknowledges the information received.

This detailed information is crucial for maintaining transparency between employers and employees regarding compensation.

Are all employees required to receive the LS 59 form?

Yes, all employees in New York State must receive the LS 59 form with some specific exceptions. This requirement helps ensure that employees are aware of their pay rate, overtime eligibility, and other wage-related details upfront. However, certain exempt positions might have different requirements regarding overtime pay acknowledgment.

What happens if an employee does not receive the LS 59 form?

Failure to provide the LS 59 form to an employee can lead to potential legal and financial penalties for an employer. It's a breach of the New York State Labor Law section 195.1, which could result in investigations by the Department of Labor, fines, and potential orders to pay back wages or damages to the affected employees. Employers are advised to keep accurate records and ensure compliance to avoid such issues.

How long should employers retain the LS 59 forms?

Employers must keep the original LS 59 forms for a duration of six years. This retention period allows for potential audits by the New York State Department of Labor, ensuring that employers are in compliance with labor laws and have adequately informed their employees about their pay and conditions of employment.

Can the LS 59 form be provided in languages other than English?

Yes, the LS 59 form should be provided in the primary language of the employee whenever possible. If an employee's primary language is not English and the New York State Department of Labor provides a translated version in that language, the employer is obligated to provide the form in the employee's primary language. If a translation is not available, the form must be given in English, and the form includes a section for acknowledging that the notice was provided in English because a translated version is unavailable.

Common mistakes

Not providing complete "Employer Information", including the DBA (Doing Business As) name and FEIN (Federal Employer Identification Number). Some employers overlook the importance of detailing every piece of information in this section, especially the DBA name and FEIN, if applicable. This mistake can lead to confusion about the legal entity employing the worker, and potential issues with tax documentation and employee identification.

Incorrectly indicating the "Notice given" section. Employers sometimes tick the wrong box or forget to mark at all whether the notice was given at hiring or before a change in pay rate, allowances, or payday. This can lead to misunderstandings and disputes about whether employees were properly informed of their pay conditions.

Failure to accurately specify the employee’s pay rate(s) and basis, especially in the case of non-exempt employees in the Hospitality Industry. Some employers might choose an inappropriate pay basis for non-exempt employees, such as a non-hourly rate when it is not permissible, leading to non-compliance with labor laws.

Overlooking or improperly listing allowances such as tips, meals, lodging, or others. This section is critical for accurate paycheck calculations, and not itemizing these allowances or incorrectly calculating their value can result in payroll errors and legal issues.

Not correctly stating the "Regular payday". A common error is providing vague information about when employees will be paid, which can cause confusion and even violate state labor laws requiring clear communication of payday schedules.

Errors in the "Overtime Pay Rate" section, especially not clarifying that most workers must receive at least 1½ times their regular rate of pay for overtime. Some employers fail to note this or incorrectly exempt employees from overtime, which can lead to significant legal troubles and underpaid employees.

When these mistakes are made on the LS 59 form, it can lead to both administrative headaches for the employer and potential legal and financial consequences. It's crucial to approach this document with attention to detail, ensuring that all sections are filled out accurately and completely to comply with New York State Labor Law.

Documents used along the form

When managing employment forms and processes, the LS 59 form, which is critical for ensuring compliance with New York State Labor Law Section 195.1, is often accompanied by several other key documents. Completing and maintaining these documents properly ensures both employers and employees are protected and informed. Below is a list of other essential forms and documents often used alongside the LS 59 form, each with a brief description.

- W-4 Form - This IRS form is used by employers to withhold the correct federal income tax from employees' pay. It's important for determining tax obligations.

- I-9 Employment Eligibility Verification Form - Required by the U.S. Citizenship and Immigration Services, this form verifies an employee's identity and authorization to work in the United States.

- State Withholding Tax Forms - Similar to the W-4 but for state taxes, these forms vary by state and are used to determine the amount of state income tax to withhold from employees' paychecks.

- Direct Deposit Authorization Form - This document is used by employees to authorize direct deposit of their paychecks into their bank accounts, specifying account details.

- Employee Handbook Acknowledgement Form - Employers use this form to acknowledge that an employee has received and understands the company’s employee handbook.

- Emergency Contact Information Form - This form gathers contact information for use in the case of an emergency, including names and phone numbers of friends or family.

- Job Description Document - A detailed description of the job’s duties, responsibilities, and requirements. This document helps clarify expectations for both employer and employee.

- Performance Evaluation Form - Used for assessing an employee’s job performance, providing feedback, and identifying areas for improvement and growth.

Together with the LS 59 form, these documents play a vital role in the effective management of employee records and employer compliance. They ensure that both parties are aware of their rights and responsibilities, thereby fostering a transparent and productive working environment. Keeping these documents updated and readily available is in the best interest of both the employer and the employees.

Similar forms

W-4 Form: This document is used by employers to determine the right amount of federal income tax to withhold from employees' paychecks. Similar to the LS 59 form, the W-4 requires personal information from the employee and necessitates employee acknowledgement, ensuring the employer acts in accordance with the employee's tax situation.

I-9 Form: The I-9 form is required for verifying the identity and employment authorization of individuals hired for employment in the United States. Like the LS 59 form, it gathers personal information and requires both employee and employer sections to be completed for regulatory compliance.

State-Specific New Hire Reporting Forms: These forms are used to report new or rehired employees to a state directory shortly after their date of hire, much like the LS 59 form is specific to New York State for informing about pay rates and paydays.

Direct Deposit Authorization Forms: These allow employees to authorize direct deposit payments into their bank accounts from their employers. Although focused on payment delivery rather than payment rates, they similarly require employee information and consent for financial processes.

Employee Handbook Acknowledgement Receipt: This form is an acknowledgement from employees that they have received, read, and understood the company's employee handbook. Similar to the LS 59's employee acknowledgement section, it documents the employee's receipt and understanding of important information.

Job Offer Letters: While not a form by strict definition, a job offer letter outlines the initial terms and conditions of employment, including salary, job position, and start date. Similar to the LS 59 form, it provides crucial employment details but in a less standardized format.

Overtime Authorization Forms: These documents are used by employers to manage and authorize overtime work by employees. They share the concept of regulating pay practices with the LS 59 form, especially concerning the overtime pay rate section.

Benefits Enrollment Forms: These forms allow employees to enroll in or make changes to their benefits plans. Although focused on benefits rather than pay, like the LS 59, they are critical for employees to understand and acknowledge their employment package comprehensively.

Dos and Don'ts

Filling out the LS 59 form, also known as the Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Exempt Employees, is a crucial process for both employers and employees. To ensure accuracy and compliance, here are some dos and don'ts to consider:

- Do provide complete and accurate employer information, including the name, doing business as (DBA) name(s), and physical and mailing addresses.

- Do clearly indicate the employee's pay rate, including whether it's an hourly, salary, day rate, piece rate, or other basis.

- Do select the appropriate option regarding notice given, whether at hiring or before a change in pay rate(s), allowances claimed, or payday.

- Do accurately list any allowances taken out of the employee's pay, such as tips, meals, lodging, or others.

- Don't leave the employee's regular payday section blank. Specify whether the pay is weekly, bi-weekly, or other.

- Don't forget to detail the overtime pay rate, especially noting that most workers in New York State must receive at least 1½ times their regular rate of pay for hours worked over 40 in a workweek.

- Don't have the employee sign the acknowledgment without ensuring they fully understand their pay rate, overtime eligibility, allowances, and payday. This is also the time to clarify their primary language for receiving this notice.

- Don't disregard the requirement to keep the original signed form for 6 years as part of your records, ensuring you comply with New York State Labor Law requirements.

By following these guidelines, employers can foster transparency and compliance in their workplace, while employees can have a clear understanding of their compensation arrangements. Paying attention to the details on forms like the LS 59 can prevent future misunderstandings and build a stronger employer-employee relationship.

Misconceptions

Understanding the LS 59 form, officially titled "Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Exempt Employees," is crucial for both employers and employees in New York State. However, several misconceptions surround its purpose and use. Let's clarify the most common misunderstandings.

- Misconception 1: The LS 59 form is optional for employers.

This is incorrect. New York State law requires employers to provide this form to all employees at the time of hiring, before any change in pay rates, allowances, or payday. It's not optional but a mandatory compliance requirement.

- Misconception 2: The form only needs to be completed for non-exempt employees.

In fact, the LS 59 form is specifically designed for exempt employees. It's a common misconception that exempt employees, such as those in managerial or professional roles who are not eligible for overtime, do not need this form. However, they also require notification of their pay rate and payday, as per Section 195.1 of the New York State Labor Law.

- Misconception 3: Employers only need to issue the form in English.

The law requires employers to provide the LS 59 form in the primary language of the employee. If the Department of Labor does not offer a form in the employee's primary language, then and only then can it be provided in English only. This ensures better understanding and compliance.

- Misconception 4: Digital acknowledgment of the form is not valid.

While the tradition has been to acknowledge the form in writing, digital acknowledgment, as long as properly documented and securely stored, is also acceptable. This reflects the evolving nature of workplace documentation in the digital age.

- Misconception 5: The form is a one-time requirement.

Not true. Employers must issue a new LS 59 form anytime there is a change in the employee's pay rate, allowances, or payday to maintain compliance with New York State Labor Law. It is not solely a hiring requirement but an ongoing obligation.

- Misconception 6: The form covers all types of employee compensation.

The LS 59 form specifically addresses pay rate, overtime (if applicable), allowances, and payday. It does not cover other types of compensation such as bonuses or health benefits, which are often documented separately.

- Misconception 7: An employer's failure to provide the LS 59 form has no real consequences.

This misunderstanding can be costly. Failure to provide the LS 59 form as required can result in penalties, fines, and other legal repercussions for employers. It's essential for maintaining fair labor practices and for the protection of both parties.

Clearing up these misconceptions is vital for ensuring that both employers and employees understand their rights and responsibilities under New York State labor laws. Compliance not only avoids legal pitfalls but fosters a transparent and respectful working relationship.

Key takeaways

Filling out the LS 59 form, a Notice and Acknowledgement of Pay Rate and Payday under Section 195.1 of the New York State Labor Law, is crucial for maintaining compliance with state regulations on employee wages. Here are key takeaways to ensure employers and employees navigate this process accurately and effectively.

- Complete Employer Information Thoroughly: The form requires detailed employer information, including the legal name, any DBA (Doing Business As) names, Federal Employer Identification Number (FEIN), physical and mailing addresses, and contact phone number.

- Timely Notice: The LS 59 form must be provided to employees at two critical times: at the time of hiring and before any change in their pay rate, allowances, or payday. This ensures transparency and acknowledgment from the employee about their compensation conditions.

- Clear Pay Rate Specification: Employers must specify the employee's pay rate clearly, ensuring it is identified as hourly, salary, day rate, piece rate, or other specific basis. It's important to note the restriction on non-hourly rates for non-exempt employees in the Hospitality Industry, except for commissioned salespeople.

- Allowances Details: If applicable, the form needs to include any allowances such as for tips, meals, lodging, or others that are part of the compensation package.

- Establishing Regular Payday: Employers must state the regular payday, providing clarity on when employees can expect to be paid, whether it's weekly, bi-weekly, or another agreed-upon schedule.

- Overtime Pay Rate: The form requires information on the employee's eligibility for overtime pay. In New York State, most workers are entitled to at least 1½ times their regular rate for hours worked over 40 in a workweek, with specific exceptions outlined.

- Employee Acknowledgement: A critical component of the LS 59 form is the employee's acknowledgment section, where they confirm receipt of the notice regarding pay rate and payday. The acknowledgment must include the employee's primary language for pay notice communication.

- Maintenance and Retention: After the employee signs the form, the original must be retained by the employer for six years. This requirement helps ensure that records are available for reference or audit by regulatory bodies.

- Language Accommodations: While the form is primarily in English, it includes provisions for employees to indicate their primary language. This is critical for ensuring comprehension and compliance, even if the New York Department of Labor does not yet offer a form in that primary language.

Understanding and adhering to the stipulations of the LS 59 form is essential for both employers and employees to ensure a transparent, compliant, and fair work environment. It safeguards against misunderstandings and disputes regarding wage agreements, and underscores the importance of clear communication and documentation in employment practices.

Popular PDF Forms

Tennessee Divorce Waiting Period - Contains a section for court costs and lawyer’s fees, making financial obligations transparent.

Lic Online - Facilities must attach key documents like Articles of Incorporation and By-Laws, signaling any amendments to their organizational structure.

How to Fill Out California Tax Form De 4 - The declaration section emphasizes the legal accountability for the accuracy of provided information.