Blank Ma Resale Certificate PDF Template

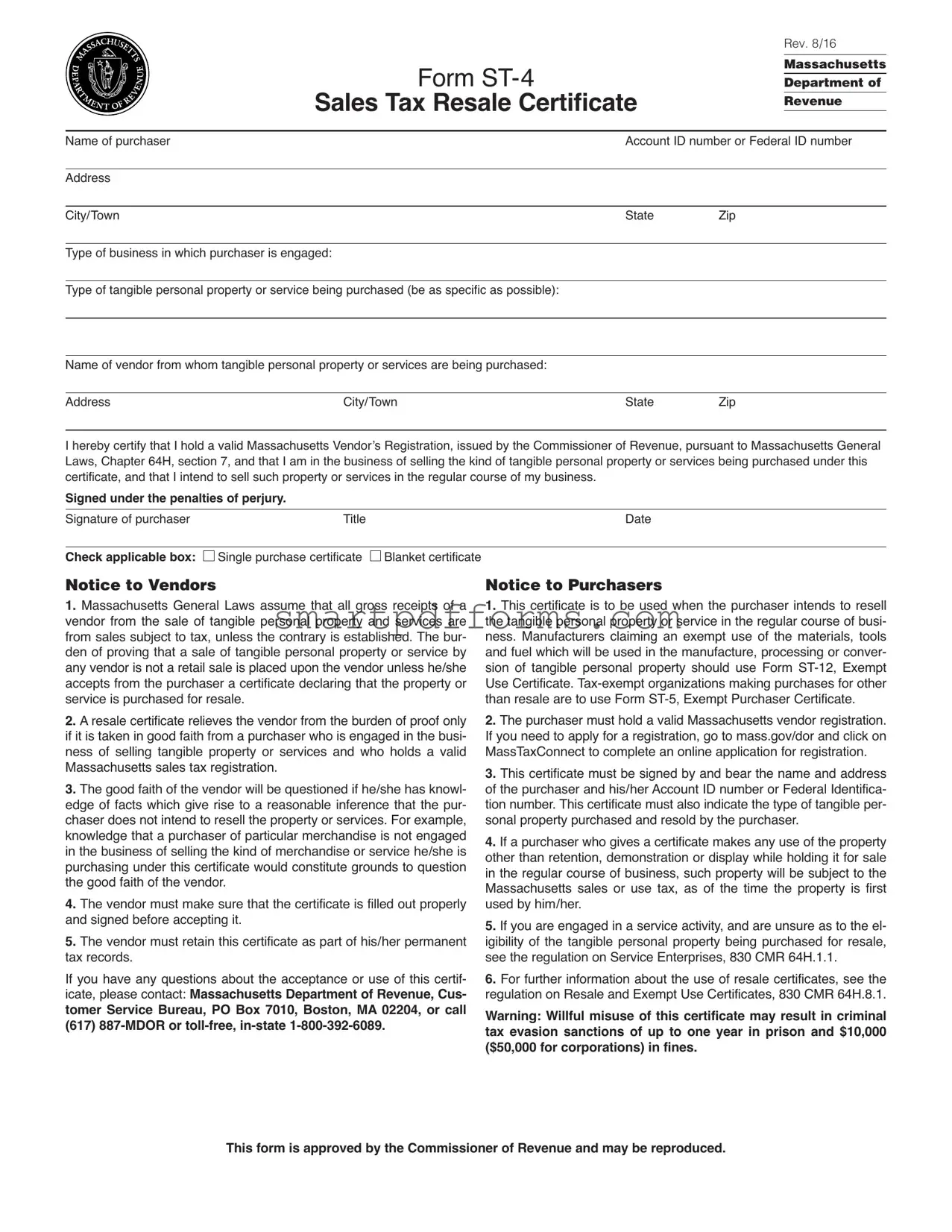

The Massachusetts Resale Certificate form, officially known as the Sales Tax Resale Certificate Rev. 8/16, plays a pivotal role in the commerce sector by allowing businesses to purchase goods without paying sales tax, provided those goods are intended for resale. Issued by the Massachusetts Department of Revenue, this document requires detailed information about the purchaser, including name, business type, and a valid sales tax registration number, ensuring that only qualified entities can partake in tax-free transactions. The form distinguishes between single and blanket certificates, the latter of which covers multiple purchases from the same vendor. Vendors, on the receiving end, are obligated to maintain these certificates for verification purposes, ensuring they are completely filled out and retained as part of their permanent records. Importantly, the integrity of this system relies on good faith; both the vendor's belief in the purchaser's intent to resell and the purchaser's compliance with regulations governing the resale of tangible personal property. Misuse of this certificate, as warned by the Massachusetts Department of Revenue, could lead to severe penalties, including criminal sanctions for tax evasion. This instrument thus not only facilitates a smoother flow of goods within the commercial ecosystem but also imposes a regulatory framework designed to prevent abuse, ensuring that the process of exempting sales tax on purchases for resale remains transparent and fair.

Preview - Ma Resale Certificate Form

orm

Sales Tax Resale Certificate

Rev. 8/16

Massachusetts

Department of

Revenue

me of purser |

|

unt numer or eerl numer |

||

|

|

|

|

|

ress |

|

|

|

|

|

|

|

|

|

itTown |

|

|

te |

ip |

|

|

|

||

Tpe of usiness in wi purser is ene |

|

|

||

|

|

|

||

Tpe of tnile personl propertor ser ein purse e |

s spefis possile) |

|

||

|

|

|

||

|

|

|

||

me of nor from wom tnile personl propertor sers re |

ein purse |

|

||

|

|

|

|

|

ress |

|

itTown |

te |

ip |

|

|

|

|

|

erertiftt |

ol li ssusetts enors e |

istrtion issue te ommissioner of enue pursunt to ss |

usetts enerl |

|

ws pter |

seion n tt m in te usine |

ss of sellin te kin of tnile personl propertor sers |

ein purse uner tis |

|

rtifite n tt inten to sell su propertor sers i |

n te reulr urse of musiness |

|

||

Signed under the penalties of perjury. |

|

|

||

|

|

|

|

|

nture of purser |

Title |

te |

|

|

|

|

|

|

|

Check applicable box: |

nle purse rtifite nket rtifite |

|

|

|

Notice to Vendors

1.ssusetts enerl ws ssume tt ll ross reipts of nor from te sle of tnile personl propertn sers re

from sles suje to t unless te ntrris estlise Te |

|

ur |

||

en of pron tt sle of tnile personl propertor |

|

ser |

||

nnor is not retil sle is pl upon te nor un |

|

|

less ese |

|

pts from te purser |

rtifite erin tt te prope |

|

|

rtor |

ser is purse for resle |

|

|

|

|

2. resle rtifite relies te nor from te uren of proof |

onl |

|||

if it is tken in oo fit from purser wo is |

|

ene in te usi |

||

ness of sellin tnile propertor sers n wo ols |

l |

i |

||

ssusetts sles treistrtion |

|

|

|

|

3. Te oo fit of te nor will e questione if e |

|

|

se s knowl |

|

ee of fs wi i rise to |

resonle inferen tt |

|

|

te pur |

ser oes not inten to resell te propertor sers or empl |

e |

|||

knowlee tt purser of prtilr mernise is not en |

|

e |

||

in te usiness of sellin te kin of mer |

nise or ser ese is |

|||

pursin uner tis rtifite woul nstitute rouns to q |

|

uestion |

||

te oo fit of te nor |

|

|

|

|

4. Te nor must mke sure tt te rtifite is fille out pro |

perl |

|||

n sine efore ptin it |

|

|

|

|

5. Te nor must retin tis rtifite s prt of iser permn |

ent |

|||

trers |

|

|

|

|

f u nquestions out te ptn or use of tis |

|

|

r tif |

|

ite plese nt |

Massachusetts Department of Revenue, Cus- |

|||

tomer Service Bureau, PO Box 7010, Boston, MA 02204, or call (617)

Notice to Purchasers

1. Tis rtifite is to e use wen te purser intens to |

resell |

|

te tnile personl propertor ser in te reulr urse of |

usi |

|

ness nufurers imin n empt use of te mterils tools |

|

|

n fuel wi will e use in te mnufure prossin |

or nr |

|

sion of tnile personl propertsoul use orm mpt |

|

|

se ertifite Tmpt orni |

tions mkin purses for oter |

|

tn resle re to use orm |

mpt rser |

ertifite |

2. Te purser must ol li ssusetts nor reis |

trtion |

|

f u nee to pplfor reistrtion o to mssoor n |

ion |

|

ssTonne to mplete n online pplition for reistrti |

on |

|

3. Tis rtifite must e sine n er te nme n |

ress |

|

of te purser n iser unt |

numer or eerl ent |

ifi |

tion numerTis rtifite must lso inite te te of |

tnile per |

|

sonl propertpurse n resol te purser |

|

|

4. f purser wo is rtifite mkes nuse of te propert |

|

|

oter tn retention emonstrtion or isplwile olin |

it for sle |

|

in te reulr urse of usiness su propertwill e suje t |

o te |

|

ssusetts sles or use t s of te time te propertis first |

|

|

use imer |

|

|

5. f u re ene in ser itn re unsure s to |

te el |

|

iiilitof te tnile personl propertein purse |

for resle |

|

see te reultion on r terprises |

|

|

6. or furter informtion out te use of resle rtifites se |

e te |

|

reultion on esle n mpt se ertifites |

|

|

Warning: Willful misuse of this certificate may result in criminal tax evasion sanctions of up to one year in prison and $10,000 ($50,000 for corporations) in fines.

This form is approved by the Commissioner of Revenue and may be reproduced.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | Allows purchasers to buy tangible personal property or services for resale without paying sales tax. |

| Eligibility | Applies to purchasers who are registered with the Massachusetts Department of Revenue and engaged in the business of selling tangible personal property or services. |

| Governing Law | Massachusetts General Laws, Chapter 64H, Section 8. |

| Penalty for Misuse | Misuse of this certificate may lead to criminal tax evasion charges, including up to one year in prison and fines up to $10,000 ($50,000 for corporations). |

Instructions on Utilizing Ma Resale Certificate

Before filling out the Massachusetts Resale Certificate form, it's essential to understand the steps to ensure accuracy and compliance. This form is a critical document for businesses that purchase tangible personal property or services intended for resale. It enables these businesses to buy items or services tax-free, under the condition that they will sell them in the regular course of business. Proper completion and understanding of the form not only facilitate smooth transactions between vendors and purchasers but also prevent potential legal and financial penalties associated with misuse. To fill out the form correctly, follow the steps outlined below.

- Enter the name of the purchaser at the top of the form. This is the legal name of the business making the purchase for resale.

- Provide the purchaser's business registration number or federal identification number. This is a unique identifier issued by the government.

- Fill in the business address, including city, state, and ZIP code, to verify the location of the business.

- Specify the type of business in which the purchaser is engaged. This helps in determining eligibility for tax exemption under specific categories.

- Indicate the type of tangible personal property or service being purchased. Be as specific as possible to avoid ambiguity.

- Enter the name of the vendor from whom the tangible personal property or services are being purchased. This ensures the form is linked to a specific transaction.

- Provide the vendor's address, including city, state, and ZIP code, to accurately identify the supplier in the transaction.

- Check the applicable box to indicate whether this is a single-purchase certificate or a blanket certificate. The former is used for a one-time purchase, while the latter covers multiple purchases from the same vendor.

- The purchaser must sign and date the form under the declaration that the information provided is accurate and that the purchased items or services are intended for resale in the regular course of business. This signature also acknowledges the legal responsibilities and potential penalties for misuse of the certificate.

- Finally, submit the completed form to the vendor before or at the time of purchase to ensure the transaction is processed without the addition of sales tax.

After the form has been accurately filled out and submitted to the vendor, it's important for both parties to retain a copy for their records. The vendor is required to keep the form as part of their permanent transaction records. It serves as proof of the exemption in case of an audit by the Massachusetts Department of Revenue. This step completes the process, ensuring that both the purchaser and the vendor adhere to Massachusetts General Laws and regulations regarding sales tax on resale transactions.

Obtain Answers on Ma Resale Certificate

What is a Massachusetts Resale Certificate, and why do I need one?

A Massachusetts Resale Certificate is a document that allows businesses to purchase goods without paying the sales tax if the goods are to be resold in the regular course of business. It is issued by the Massachusetts Department of Revenue and is necessary for vendors who are purchasing items for resale to avoid the upfront cost of sales tax. This certificate ensures that sales tax is collected from the final consumer, not at each step of the distribution chain.

How can I obtain a Massachusetts Resale Certificate?

To obtain a Massachusetts Resale Certificate, your business must be registered with the Massachusetts Department of Revenue for a sales tax permit. After registration, you can apply for the resale certificate through the MassTaxConnect online platform. The certificate will require you to provide detailed information about your business, including the type of tangible personal property or services being purchased for resale.

What are the responsibilities of the purchaser when using the Resale Certificate?

When using the Resale Certificate, the purchaser is responsible for ensuring that the goods or services bought are indeed for resale in the normal course of business. The certificate must be completed and signed, indicating the purchaser's intent. Misuse of this certificate, such as purchasing items for personal use while claiming them for resale, may result in criminal tax evasion penalties, including fines and possible imprisonment.

What obligations does a vendor have when accepting a Massachusetts Resale Certificate?

- The vendor must ensure the certificate is fully completed and signed by the purchaser before accepting it.

- It's the vendor's duty to operate in good faith, meaning if they have any reason to believe the purchaser is not intending to resell the items, they should not accept the certificate.

- Vendors are required to retain a copy of the certificate for their records to prove why sales tax was not collected on a transaction.

Can a Resale Certificate be used for purchases other than for resale purposes?

No, a Resale Certificate is specifically designed for purchases that will be resold in the regular course of business. If a purchaser uses the certificate for items that are not for resale, such as for personal use or for items used in the production process (which do not qualify), they are misusing the certificate. This misuse is considered tax evasion, with severe consequences including fines and imprisonment. For non-resale purposes, other forms, such as Exempt Use Certificates, may be applicable depending on the situation.

Common mistakes

Not providing complete information regarding the purchaser, such as leaving the "Name of Purchaser" or "Federal Identification Number" sections blank. This omission can invalidate the certificate as it fails to accurately identify the purchaser.

Incorrectly describing the type of tangible personal property or service being purchased for resale. It's crucial to specify as detailed as possible to ensure the certificate's legitimacy and to avoid confusion or misuse.

Failing to sign and date the certificate. A signature and date confirm that the purchaser acknowledges the conditions under the penalties of perjury, making this step vital for the document's enforceability.

Choosing the wrong certificate type, such as marking the "Blanket Certificate" box when only a single purchase certificate is appropriate, or vice versa. This mistake could lead to complications in tax liability and compliance.

Using the resale certificate for purchases that are not for resale. This misuse not only violates tax laws but also subjects the purchaser to potential criminal tax evasion sanctions including fines and imprisonment if done willfully.

Important Note: Always ensure that the resale certificate is filled out properly and retained as part of permanent records. If there are any questions regarding the completion or use of this certificate, contacting the Massachusetts Department of Revenue is advised for guidance and compliance purposes.

Documents used along the form

When businesses engage in transactions that require a Massachusetts Resale Certificate, several other forms and documents may also be commonly used in conjunction to ensure all tax and legal requirements are being met. The following list includes some of these essential documents, briefly described to provide a clearer understanding of their purpose.

- Business Registration Form: This form is necessary for officially registering a business with the Massachusetts Department of Revenue, enabling it to legally operate within the state.

- Sales Tax Registration Certificate: Similar to the Resale Certificate, this certificate allows a business to collect sales tax on taxable sales.

- Annual Tax Return Forms: Businesses are required to file these forms annually for tax reporting purposes, detailing income, expenses, and other relevant financial information.

- Use Tax Return: For items purchased for business use without paying Massachusetts sales tax, this return covers the use tax due on those items.

- Exempt Use Certificate: Utilized when a business buys goods that will be used in a manner qualifying them as tax-exempt, such as manufacturing or in producing taxable services.

- Vendor’s License: This document grants permission to sell goods and services within the state and is often required at municipal levels.

- Uniform Commercial Code (UCC) Filing: Important for businesses seeking to secure interests in certain collateral, UCC filings can protect transactions involving personal property.

- Certificate of Good Standing: This certificate verifies that a business is properly registered, up-to-date on state requirements, and authorized to conduct business in Massachusetts.

- Employee Identification Number (EIN) Confirmation Letter: Issued by the IRS, this confirms the unique ID number for businesses for tax purposes.

- Worker’s Compensation Insurance Proof: Proof of insurance that is required to protect employees in case of work-related injuries or illness.

Each document serves its unique role in the ecosystem of business paperwork, helping ensure that enterprises not only comply with regulatory demands but also establish the groundwork for smooth operational processes. Regardless of the industry, grasping the purpose and application of these documents is pivotal for any enterprise aiming to thrive within Massachusetts’ regulatory environment.

Similar forms

Uniform Sales & Use Tax Certificate - Multijurisdiction: Like the Massachusetts Resale Certificate, the Uniform Sales & Use Tax Certificate serves a similar purpose for businesses that operate in multiple states. Both forms are used by sellers to purchase items tax-free for resale, and they require information about the purchaser's business and the nature of the transaction. The main difference is the geographical scope; while the Massachusetts form is state-specific, the Uniform Certificate is recognized across participating states.

California Resale Certificate: This certificate closely resembles the Massachusetts form in function, allowing businesses to buy goods without paying state sales tax if the items are intended for resale. Both documents require the purchaser to provide details about their business and to certify that the purchased goods are for resale. The primary variance lies in state-specific rules and the administration by different state departments.

New York State Department of Taxation and Finance ST-120, Resale Certificate: The New York resale certificate is another document with a similar role, facilitating tax-free purchases of goods for resale. Like the Massachusetts document, it requires the buyer's identification, business type, and a declaration of intent to resell the purchased goods. Both certificates protect sellers from the liability of proving the tax-exempt status of sales if they are filled out in good faith.

Florida Annual Resale Certificate for Sales Tax: In Florida, businesses use this certificate to make tax-free purchases of goods that will be resold. Similar to the Massachusetts Resale Certificate, it features requirements for the purchaser's details and a declaration regarding the resale of goods. The main difference is the validity period; the Florida certificate must be renewed annually.

Texas Sales and Use Tax Resale Certificate: Like its Massachusetts counterpart, this certificate enables businesses in Texas to buy goods tax-free for the purpose of resale. Both forms require information about the purchaser and the type of goods being purchased and both enforce compliance with state tax laws. Each certificate reflects its state's specific requirements while serving the same essential function.

Illinois Certificate of Resale: This certificate is used by Illinois businesses to buy products without paying sales tax when those products are intended for resale. Similar to the Massachusetts Resale Certificate, it requires detailed information from the purchaser about the intended resale of the goods. Both documents are integral to the tax-exempt purchase process within their respective states.

Colorado Sales Tax Exemption Certificate - Multi-jurisdiction: While generally used for tax exemption on purchases that may include, but are not limited to, resale, this form functions in a similar way to the Massachusetts Resale Certificate by allowing businesses to make tax-exempt purchases. The multi-jurisdiction aspect means it is recognized more broadly, perhaps in various localities within Colorado, compared to the state-specific nature of the Massachusetts document.

Washington State Reseller Permit: The reseller permit issued by Washington State allows businesses to make purchases without paying sales tax, strictly for items that will be resold. It is similar to the Massachusetts Resale Certificate, with requirements for business information and the nature of the goods being purchased for resale. Both serve as critical tools for businesses in managing sales tax liabilities.

Dos and Don'ts

When filling out the Massachusetts Resale Certificate form, knowing what to do and what not to do can save you from unwanted trouble. Here are some essential dos and don'ts to help you complete the form accurately.

Do:- Ensure all information is complete and accurate before submitting the form. This includes your name, business address, and registration number.

- Sign the certificate to certify that the information provided is true and that you intend to resell the taxable property or services.

- Retain a copy of the completed certificate for your records as proof of compliance and for future reference.

- Include the type of tangible personal property or services being purchased for resale. Specificity helps clarify the intended use.

- Check the appropriate box indicating whether you are applying for a single purchase certificate or a blanket certificate.

- Provide your sales tax registration number or federal identification number, as this verifies your business’s legitimacy.

- Contact the Massachusetts Department of Revenue for any questions or clarifications you might need regarding the form.

- Leave any section of the form blank. Incomplete forms may lead to processing delays or rejections.

- Use this certificate for personal purchases. It's intended only for goods and services meant for resale.

- Forget to update your blanket certificate periodically. Keeping your information current is crucial.

- Ignore the notice to vendors and purchasers. Understanding these notices ensures you are informed about your responsibilities and liabilities.

- Attempt to misuse the certificate. Misuse can lead to criminal tax evasion charges, including fines and imprisonment.

- Sign the certificate if you're not sure about the information you've provided. Signing under the penalties of perjury means you're legally bound by your declarations.

- Assume that holding a resale certificate absolves you from all tax obligations. You are still responsible for collecting and remitting sales tax on retail sales if applicable.

By following these guidelines, you can ensure that your Massachusetts Resale Certificate form is correctly filled out and submitted, minimizing any potential issues and keeping your business compliant with state tax regulations.

Misconceptions

When navigating the complexities of the Massachusetts Resale Certificate form, misunderstandings can easily arise. Here are ten common misconceptions:

- It's only for retail businesses: In truth, the certificate is applicable to any business that purchases goods to resell them, irrespective of whether they operate in retail, wholesale, or even certain service-based sectors.

- Any business can use it: Contrary to this notion, only businesses with a valid Massachusetts sales tax registration are eligible to use this certificate. It's not a free-for-all for every business entity.

- It exempts you from all taxes: The certificate specifically provides an exemption from sales tax on purchases intended for resale. It does not exempt a business from other taxes it may be liable for.

- Once issued, it's good forever: The reality is, businesses should regularly verify their eligibility and reissue the certificate if necessary, ensuring compliance with current regulations.

- Paper form is mandatory: While a physical form can be used, electronic forms that are filled out, signed, and stored digitally are also acceptable, as long as they meet the state requirements.

- It covers personal use items: If a business owner or employee uses the purchased items for personal use, those items become subject to sales tax. The certificate only covers items for resale.

- All purchases are eligible: Not every purchase made by a reseller will be sales tax-exempt. The items purchased must be intended for resale or must directly relate to the business's scope of sales.

- It’s immediately effective: The seller must verify the validity of the certificate. Misuse or inaccurately applying the certificate can lead to penalties and back taxes.

- It provides blanket coverage for all transactions: Specific transactions might require additional documentation or may not qualify under the resale certificate. Each purchase needs individual consideration.

- No record-keeping is necessary: Both sellers and purchasers must keep thorough records of transactions using the resale certificate to validate their tax-exempt status in case of audits.

Understanding these misconceptions is crucial for any business striving to comply with Massachusetts tax laws. Misusing the certificate not only incurs legal ramifications, including fines and penalties but may also result in criminal tax evasion charges. Always ensure proper usage and compliance.

Key takeaways

When engaging with the Massachusetts Resale Certificate form, several key elements are crucial for businesses aiming to navigate the complexities of tax exemptions on purchases intended for resale. The importance of understanding these facets can't be overstated, ensuring compliance and avoiding potential penalties.

- Familiarity with the certificate's purpose is fundamental. This document serves as an assertion by the purchaser that the item purchased is for resale in the regular course of business. The certificate exempts the buyer from paying sales tax on these purchases, channeling the responsibility of collecting taxes to the point of final sale.

- Accuracy and completeness of the form are mandatory. Before accepting the certificate, the vendor must ensure that it is filled out correctly and signed by the purchaser. This step is critical, as an incomplete or inaccurately filled certificate may not offer protection against the obligation of proving a sale was for resale.

- The vendor's good faith acceptance is essential. Vendors are relieved from the responsibility of proving the tax-exempt status of a sale when they accept a resale certificate in good faith. However, if there's evident knowledge that the purchase is not for resale – for instance, if the purchaser of particular merchandise is known not to be in the resale business – the protection provided by the certificate might be invalidated.

- Record keeping is non-negotiable. Vendors must retain a copy of the resale certificate for their permanent records. This practice is crucial for substantiating the tax-exempt nature of past transactions, should questions arise from the Massachusetts Department of Revenue.

Understanding these critical points ensures that both buyers and sellers can confidently navigate the nuances of transactions involving the Massachusetts Resale Certificate. The goal is to foster an environment where business operations can thrive, unencumbered by unintended tax liabilities.

Popular PDF Forms

Paternity Affidavit - It is a cost-effective alternative to a court-ordered paternity establishment process.

Community Service Hours Log - Assists in fostering a lifelong commitment to community service by instilling the importance of documented societal contributions in students.