Blank Massachusetts Short Financial Statement PDF Template

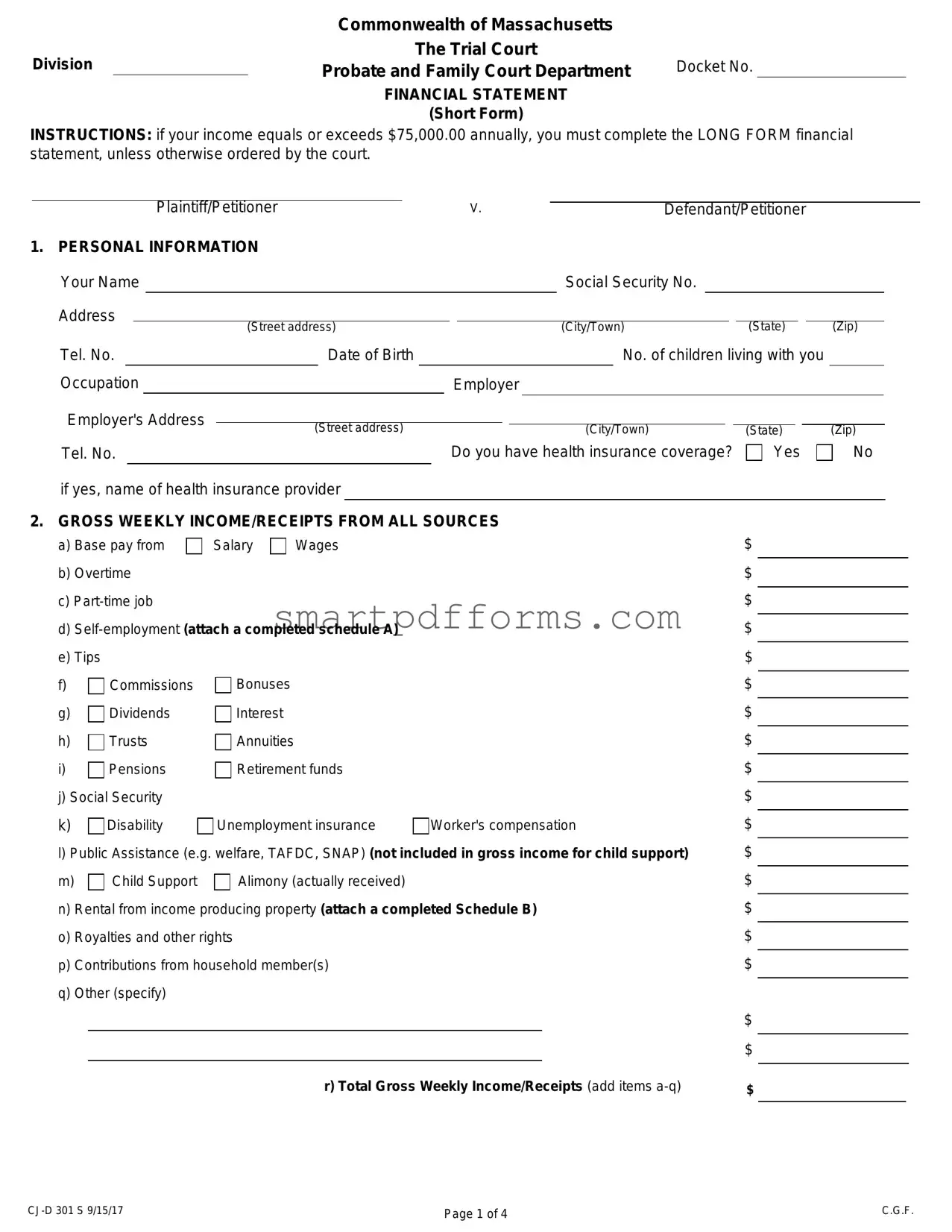

Navigating the legal obligations during court proceedings in Massachusetts can often feel overwhelming, especially when dealing with financial matters. Among the paramount tools used in this process is the Massachusetts Short Financial Statement form, a critical document for individuals undergoing legal disputes in the Probate and Family Court Department. This concise yet comprehensive form is mandatory for individuals whose annual income is under $75,000, detailing personal information, gross weekly income from various sources, necessary deductions, net weekly income, and yearly expenses. It serves as a vital record, providing a snapshot of one's financial condition, which is crucial in cases where financial information plays a key role, such as alimony, child support, or division of assets. The form also requires information about one's assets, liabilities, and anticipated legal expenses, making it a central piece of documentation in legal proceedings. Ensuring accuracy and full disclosure in completing this form is not only a requirement but a significant responsibility, as it is certified under the penalties of perjury. This process underscores the importance of honesty and thoroughness in representing one's financial standing to the court, making it a cornerstone document that can greatly influence the outcome of legal actions.

Preview - Massachusetts Short Financial Statement Form

|

|

Commonwealth of Massachusetts |

|

Division |

|

The Trial Court |

Docket No. |

|

Probate and Family Court Department |

||

|

FINANCIAL STATEMENT

(Short Form)

INSTRUCTIONS: if your income equals or exceeds $75,000.00 annually, you must complete the LONG FORM financial statement, unless otherwise ordered by the court.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

Plaintiff/Petitioner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Defendant/Petitioner |

|

|

|

|

|

|

|||||||||||||||||||

1. PERSONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Your Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

(Street address) |

|

|

|

|

|

|

|

|

|

|

|

(City/Town) |

|

|

(State) |

|

|

(Zip) |

|

|

|

||||||||||

|

Tel. No. |

|

|

|

|

Date of Birth |

|

|

|

|

No. of children living with you |

|

|

|

|

||||||||||||||||||||||||||

|

Occupation |

|

|

|

|

|

|

|

|

|

|

|

Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Employer's Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Street address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(City/Town) |

(State) |

|

(Zip) |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Tel. No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have health insurance coverage? |

□ Yes |

□ No |

|

|

|||||||||||||||||||||

|

if yes, name of health insurance provider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

2. GROSS WEEKLY INCOME/RECEIPTS FROM ALL SOURCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

a) Base pay from □ Salary □ Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

b) Overtime |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

e) Tips |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

f) |

□ Commissions |

|

□ Bonuses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

g) |

□ Dividends |

|

□ Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

h) |

□ Trusts |

|

□ Annuities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

i) |

□Pensions |

|

□ Retirement funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

j) Social Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

k) |

□Disability |

□Unemployment insurance |

□Worker's compensation |

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

l) Public Assistance (e.g. welfare, TAFDC, SNAP) (not included in gross income for child support) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

m) |

□ Child Support |

|

□ Alimony (actually received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

n) Rental from income producing property (attach a completed Schedule B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

o) Royalties and other rights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

p) Contributions from household member(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

q) Other (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

r) Total Gross Weekly Income/Receipts (add items |

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 4 |

C.G.F. |

|

|

|

|

Commonwealth of Massachusetts |

|

|

|

|

|

|

|

|||||

|

Division |

|

The Trial Court |

Docket No. |

|

|||||||||||

|

|

|

Probate and Family Court Department |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

FINANCIAL STATEMENT |

|

|

|

|

|

|

|

||||

|

|

|

|

|

(Short Form) |

|

|

|

|

|

|

|

||||

3. |

ITEMIZED DEDUCTIONS FROM GROSS INCOME |

|

|

|

|

|

|

|

||||||||

|

a) Federal income tax deductions (claiming |

|

|

exemptions) |

$ |

|

|

|

|

|

||||||

|

b) State income tax deductions (claiming |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

|

|

exemptions) |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||||||

|

c) F.I.C.A. and Medicare |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

d) Medical Insurance |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

e) Union Dues |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

f) Total Deductions (a through e) |

$ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||||

4. |

ADJUSTED NET WEEKLY INCOME |

|

2(r) minus 3(f) |

$ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||||||

5. |

OTHER DEDUCTIONS FROM SALARY/WAGES |

|

|

|

|

|

|

|

||||||||

|

a) Credit Union □ Loan repayment |

□ Savings |

$ |

|

|

|

|

|

||||||||

|

$ |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|||||||||||

|

b) Savings |

|

|

|

|

|

|

|

|

|

|

|

||||

|

c) Retirement |

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

d) |

|

|

$ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||||||

|

|

|

e) Total Deductions (a through d) |

$ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||||

6. |

NET WEEKLY INCOME |

|

4 minus 5(e) |

$ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||||||

7. |

GROSS YEARLY INCOME FROM PRIOR YEAR |

$ |

|

|

|

|

|

|||||||||

|

|

|

|

|

||||||||||||

|

(attach copy of all |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||||||

|

Number of Years you have paid into Social Security |

|

|

|

|

|

|

|

||||||||

8. |

WEEKLY EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

a) Rent or Mortage (PIT) |

$ |

b) Homeowners/Tenant Insurance |

$ |

c) Maintenance and Repair |

$ |

d) Heat |

$ |

e) Electricity and/or Gas |

$ |

f) Telephone |

$ |

g) Water/Sewer |

$ |

h) Food |

$ |

i) House Supplies |

$ |

j) Laundry and Cleaning |

$ |

k) Clothing |

$ |

l) Life Insurance |

$ |

|

m) Medical Insurance |

$ |

|

n) Uninsured Medicals |

$ |

|

o) Incidentals and Toiletries |

$ |

|

p) Motor Vehicle Expenses |

$ |

|

q) Motor Vehicle Payment |

$ |

|

r) Child Care |

$ |

|

s) Other (explain) |

|

|

|

|

$ |

|

|

$ |

|

|

|

t) Total Weekly Expenses (a through s) |

|

$ |

|

|

||

9. COUNSEL FEES |

|

|

|

|

|

|

a) Retainer amount(s) paid to your attorney(s) |

|

$ |

|

|

|

|

b) Legal fees incurred, to date, against retainer(s) |

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

c) Anticipated range of total legal expense to litigate this action |

$ |

|

to $ |

|

|

|

Page 2 of 4 |

C.G.F. |

Division |

|

Commonwealth of Massachusetts |

Docket No. |

|

The Trial Court |

||

|

|

Probate and Family Court Department |

|

|

|

|

|

|

|

FINANCIAL STATEMENT |

|

|

|

(Short Form) |

|

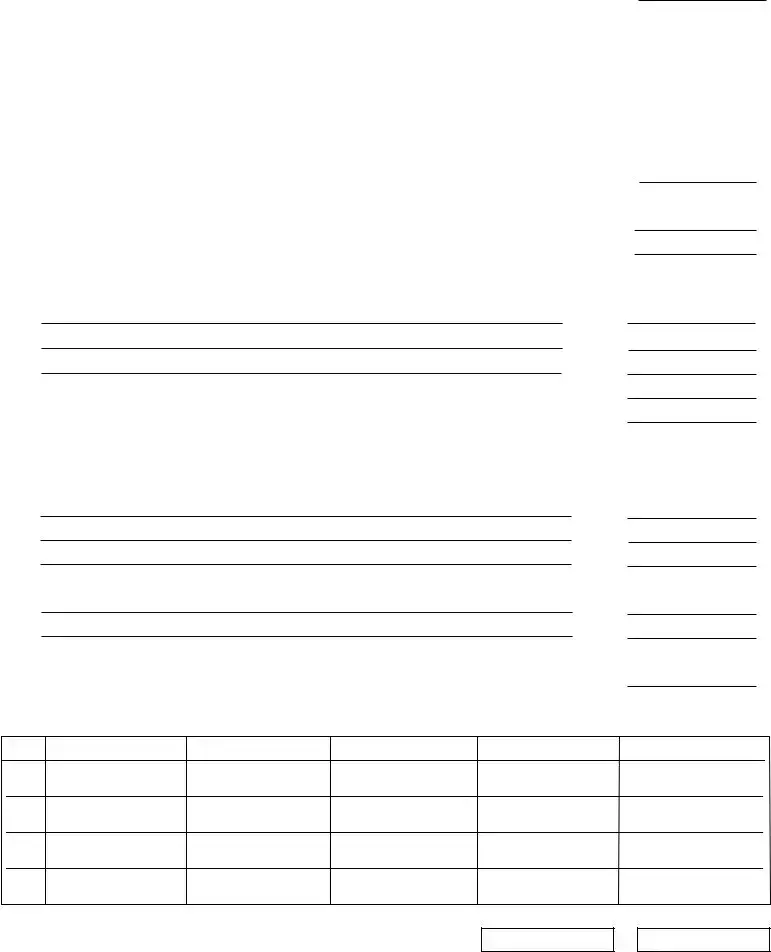

10.ASSETS (attach additional sheet if necessary)

a) Real Estate |

|

|

|

|

|

|

|

||||

Location |

|

|

|

|

|

|

|

|

|||

Title held in the name of |

|

|

|

|

|

|

|

|

|||

Fair Market Value $ |

|

|

- Mortgage $ |

|

|

|

|

= Equity $ |

|||

b) Motor Vehicles |

|

|

|

|

|

|

|

||||

Fair Market Value $ |

|

|

- Motor Vehicle Loan $ |

|

|

|

= Equity $ |

||||

Fair Market Value $ |

|

|

- Motor Vehicle Loan $ |

|

|

|

= Equity $ |

||||

c)IRA, Keogh, Pension, Profit Sharing, Other Retirement Plans: Financial Institution or Plan Name and Account Number

$

$

$

d) Tax Deferred Annuity Plan(s) |

$ |

e) Life Insurance: Present Cash Value |

$ |

f)Savings & Checking Accounts, Money Market Accounts, Certificates of

Financial Institution or Plan Name and Account Number

$

$

$

g) Other (e.g. stocks, bonds, collections)

$

$

h) Total Assets (a through g) |

$ |

11.LIABILITIES (Do not list expenses shown in item 8 above.)

a)

b)

c)

d)

Creditor |

Nature of Debt |

Date Incurred |

Amount Due |

Weekly Payment |

$$

$$

$$

$$

e) Total Liabilities

$

$

Page 3 of 4 |

C.G.F. |

|

|

Commonwealth of Massachusetts |

|

Division |

|

The Trial Court |

Docket No. |

|

Probate and Family Court Department |

||

|

|

|

|

|

|

FINANCIAL STATEMENT |

|

|

|

(Short Form) |

|

CERTIFICATION

I certify under the penalties of perjury that the information stated on this Financial Statement and the attached schedules, if any, is complete, true, and accurate.

Date |

|

Signature |

INSTRUCTIONS: In any case where an attorney is appearing for a party, said attorney

MUST complete the Statement by Attorney.

STATEMENT BY ATTORNEY

I the undersigned attorney, am admitted to practice law in the Commonwealth of

Date

(Signature of attorney)

(Print name)

(Street address)

(City/Town) |

(State) |

(Zip) |

Tel. No.

B.B.O. #

Page 4 of 4 |

C.G.F. |

Form Data

| Fact | Detail |

|---|---|

| 1. Purpose | The Massachusetts Short Financial Statement form is designed to provide financial information in cases heard by the Probate and Family Court Department. |

| 2. Income Threshold for Form Type | If an individual's income equals or exceeds $75,000.00 annually, they must complete the Long Form financial statement unless directed otherwise by the court. |

| 3. Content Sections | The form includes sections for personal information, gross weekly income, deductions from gross income, net weekly income, yearly income from the prior year, weekly expenses, counsel fees, assets, and liabilities. |

| 4. Supporting Documents | Applicants must attach copies of all W-2 and 1099 forms for the prior year, along with any required schedules for detailing self-employment income or income from rental properties. |

| 5. Certification Requirement | Filers must certify under the penalties of perjury that the information provided is complete, true, and accurate. |

| 6. Governing Law | This form is mandated by the laws of the Commonwealth of Massachusetts and is used within the framework of family law proceedings in the Probate and Family Court Department. |

Instructions on Utilizing Massachusetts Short Financial Statement

The Massachusetts Short Financial Statement form is a crucial document for individuals dealing with financial considerations in the Probate and Family Court Department, especially in contexts like divorce, child support, or alimony. In cases where your annual income is less than $75,000.00, you'll use this short form. Accurately completing this form requires attention to detail and thoroughness to ensure the court has a clear understanding of your financial situation. Follow these step-by-step instructions to fill out the form correctly.

- General Information: Start by inputting your personal information, including your name, social security number, address, telephone number, date of birth, number of children living with you, occupation, employer’s name, and employer's address. Also, indicate whether you have health insurance.

- Income: Detail your gross weekly income from all sources, including salary, wages, overtime, part-time jobs, self-employment, tips, commissions, bonuses, dividends, interest, trusts, annuities, pensions, retirement funds, social security, disability, unemployment insurance, worker's compensation, public assistance, child support, alimony, rental income, royalties, contributions from household members, and any other sources of income. Sum these to calculate your total gross weekly income.

- Deductions from Gross Income: List your deductions, such as federal and state income taxes, FICA, Medicare, medical insurance, and union dues. Subtract these from your gross income to find your adjusted net weekly income.

- Other Deductions from Salary/Wages: Include deductions like credit union loan repayments or savings, retirement contributions, and any other specified deductions from your salary or wages to find your net weekly income.

- Gross Yearly Income: Provide your gross yearly income from the previous year, attaching copies of all W-2 and 1099 forms. Also, state the number of years you've paid into Social Security.

- Weekly Expenses: Itemize your weekly expenses such as rent or mortgage, insurance, maintenance, utilities, groceries, household supplies, child care, motor vehicle expenses, and any other relevant expenses. Calculate your total weekly expenses.

- Counsel Fees: Document any retainer amounts paid, legal fees incurred against retainers, and the anticipated range of total legal expenses to litigate this action.

- Assets: List your assets including real estate, motor vehicles, retirement plans, life insurance, financial accounts, and any other significant assets you own. Calculate the total value of these assets.

- Liabilities: Outline your debts excluding the expenses already mentioned in your weekly expenses. Include creditor information, nature of debt, date incurred, amount due, and weekly payment details. Sum up your total liabilities.

- Certification and Attorney Statement: Certify that the information provided is complete, true, and accurate under the penalties of perjury. If an attorney is representing you, they must also complete the Statement by Attorney section.

After completing all sections, review the form thoroughly to ensure accuracy and completeness before signing and dating the document. Submit the completed form to the Probate and Family Court Department as required for your case.

Obtain Answers on Massachusetts Short Financial Statement

Frequently Asked Questions about the Massachusetts Short Financial Statement Form

Who is required to complete the Massachusetts Short Financial Statement Form?

Individuals involved in Probate and Family Court matters in Massachusetts must complete this form if their annual income is less than $75,000. Those earning $75,000.00 or more annually are required to complete the Long Form Financial Statement, unless the court orders otherwise.

What information do I need to provide on the Short Form Financial Statement?

The Short Form Financial Statement requires detailed information about your personal finances, including but not limited to: personal information, gross weekly income from all sources, itemized deductions from gross income, other salary/wage deductions, gross yearly income from the previous year, weekly expenses, counsel fees, assets, and liabilities. It is essential to provide accurate and complete information to the best of your ability.

Are there any attachments I need to include with my Financial Statement?

Yes, certain sections of the form require you to attach additional documentation. For instance, if you have income from self-employment, you must attach a completed Schedule A. Similarly, for rental income from property, attach a completed Schedule B. Furthermore, you should also attach copies of all W-2 and 1099 forms from the previous year to verify your gross yearly income.

What happens if I fail to provide accurate information on the form?

Submitting the Financial Statement involves certifying under penalty of perjury that the information provided is complete, true, and accurate. Therefore, intentionally providing false information can lead to significant legal consequences, including criminal charges. Additionally, inaccuracies may negatively impact the outcome of your legal matter. Always ensure the information you provide is current and correct to the best of your knowledge.

Common mistakes

Filling out the Massachusetts Short Financial Statement form is crucial for those navigating the complexities of Probate and Family Court matters. However, it's common for people to slip up in this detailed process. Here are nine mistakes often made, which can potentially undermine the accuracy and integrity of this vital document.

- Overlooking the Income Threshold: It’s important to note that if your annual income is $75,000 or more, you should be completing the Long Form instead. Missing this instruction can lead to filling out the wrong form from the start.

- Underreporting Income: All income sources, including base pay, overtime, part-time jobs, self-employment, and any other forms of income listed, must be accurately reported. Failing to include all income sources can lead to incorrect calculations and potential legal consequences.

- Incorrect Expense Reporting: Just as with income, all weekly expenses must be accurately reported. Misreporting or omitting certain expenses can affect your financial standing in the eyes of the court.

- Misunderstanding Deductions: Deductions from gross income are specific and must be accurately calculated. Incorrect deductions can lead to an inaccurate portrayal of net income.

- Asset and Liability Confusion: Failing to correctly list all assets and liabilities or misunderstanding what qualifies as an asset or liability may significantly impact the financial statement's accuracy.

- Leaving Sections Blank: Every section of the form is important. Skipping sections or leaving them blank because they seem irrelevant or because of uncertainty can result in an incomplete submission.

- Not Attaching Required Schedules: The form mandates the attachment of certain schedules (like Schedule A for self-employment and Schedule B for rental income). Not attaching these schedules can result in an incomplete application.

- Miscalculating Totals: Whether it's the total gross income or total weekly expenses, inaccuracies in these totals can significantly affect your financial representation.

- Lack of Documentation: Forgetting to attach copies of all W-2 and 1099 forms for the prior year under gross yearly income from the previous year is a common oversight that can delay proceedings.

Understanding and avoiding these mistakes can make the process of filling out the Massachusetts Short Financial Statement smoother and ensure that the information presented is accurate and complete. Always review your form carefully and consult with a legal professional if you’re unsure about any aspect of your financial statement.

Documents used along the form

When navigating the complexities of financial disclosure in the Commonwealth of Massachusetts, particularly within the Probate and Family Court Department, individuals are often required to submit not just the Short Form Financial Statement but also associated documents to provide a comprehensive view of their financial situation. These documents collectively offer a detailed picture to the court, facilitating decisions regarding alimony, child support, and the division of marital assets, among other matters. Let's delve into some of the other forms and documents that are often used alongside the Massachusetts Short Financial Statement form to ensure thorough financial disclosure.

- Long Form Financial Statement: This form is a more detailed version of the financial statement, required for individuals with an annual income of $75,000 or more. It gathers exhaustive information about the person's income, expenses, assets, and liabilities, providing a complete financial overview to the court.

- Schedule A - Self-Employment: For those who run their own business or are independently employed, Schedule A is a necessary attachment. It details the income from self-employment, including revenue and operating expenses, offering a clear view of the net income generated from such endeavors.

- Schedule B - Rental Income: Individuals who earn income from property rentals must complete Schedule B. This document breaks down the income and expenses related to income-producing property, enabling the court to understand this source of revenue accurately.

- Child Support Guidelines Worksheet: This worksheet is essential for cases involving child support. It calculates the amount of support in accordance with state guidelines, taking into account the parents' incomes, the number of children, and other relevant financial obligations and resources.

Together with the Massachusetts Short Financial Statement form, these documents paint a full picture of an individual's financial standing. Accurate and comprehensive financial disclosure is crucial for the equitable resolution of family law matters. Ensuring all relevant forms and documents are thoroughly and precisely completed can significantly impact the outcomes of court proceedings, affecting not just the individual completing them but also their dependents and former partners. Navigating these requirements with diligence and care is essential for all parties involved in such legal matters.

Similar forms

Long Form Financial Statement (Massachusetts): This is a more detailed version of the Short Form Financial Statement required for individuals with an annual income of $75,000.00 or more. Like the Short Form, it gathers comprehensive financial information but delves deeper into financial details, assets, liabilities, and expenses to provide a fuller picture of an individual's financial situation in family and probate court matters.

Uniform Financial Statement: Often used in various legal and financial proceedings, this form closely resembles the structure of the Massachusetts Short Financial Statement, capturing income sources, deductions, and net income. It is designed to standardize the financial disclosure process across different scenarios, making it easier for courts and other bodies to review and understand an individual's financial standing.

Child Support Financial Statement: This specialized financial statement focuses on the financial details relevant to determining child support obligations. Similar to the Massachusetts Short Financial Statement, it includes income, expenses, and the financial needs of children, but it is tailored specifically to calculate child support in accordance with state guidelines.

Loan Application Form: Borrowers must provide detailed financial information when applying for a loan, much like the requirements of the Short Financial Statement. Though the purpose differs, both documents require disclosure of income, expenses, assets, and liabilities to assess the applicant's financial health and ability to meet financial obligations.

Bankruptcy Means Test Form: Used in bankruptcy filings to determine eligibility for Chapter 7 or to establish payment plans under Chapter 13, this form requires detailed financial disclosures similar to those in the Massachusetts Short Financial Statement. It assesses income, expenses, and the debtor's ability to pay off debts, playing a crucial role in the bankruptcy process.

Dos and Don'ts

Filling out the Massachusetts Short Financial Statement form is a crucial step in various legal and financial proceedings within the state. Ensuring accuracy and completeness is of the utmost importance. Here are several do's and don'ts to guide individuals in the process:

- Do verify if your annual income is below $75,000. This determines whether you are eligible to use the Short Form or if you must complete the Long Form Financial Statement instead.

- Do gather all necessary documents related to your income, expenses, assets, and liabilities before starting the form. This includes recent pay stubs, bank statements, and billing statements, among others, ensuring you provide the most accurate information possible.

- Do accurately report all sources of income, including salaries, wages, tips, and any other earnings, in the section designated "GROSS WEEKLY INCOME/RECEIPTS FROM ALL SOURCES". Underestimating or omitting income can lead to issues with the court or opposing parties.

- Do list all itemized deductions accurately, such as federal and state taxes, F.I.C.A., Medicare, and any other deductions from your gross income. This helps in determining your net income accurately.

- Do include all weekly expenses and liabilities to provide a clear picture of your financial situation. This includes fixed expenses such as housing and utilities, as well as variable costs, like groceries and vehicle expenses.

- Don't guess amounts. Use actual figures whenever possible to fill out the form. If estimates are absolutely necessary, make them as realistic as possible.

- Don't leave sections blank unless they truly do not apply to your situation. If a particular income source, deduction, or asset does not apply, it's better to mark it with a "0" or "N/A" rather than leaving it unanswered.

- Don't forget to sign and date the form certifying the accuracy and completeness of the information provided. An unsigned form may be considered invalid, potentially causing delays in your proceedings.

Completing the Massachusetts Short Financial Statement form with diligence and honesty is imperative. This document plays a significant role in many legal matters, including those concerning family law, financial disputes, and asset distribution. Filing it correctly helps in ensuring a fair and just process.

Misconceptions

Understanding the Massachusetts Short Financial Statement form is crucial for accurately representing one's finances in court, especially in matters like divorce or child support. However, there are common misconceptions about this document that need clarification:

- Misconception 1: Only income needs to be reported. In reality, the form requires detailed information on expenses, assets, and liabilities, not just income sources.

- Misconception 2: You only have to complete this form if you're in a high-income bracket. The truth is, the Short Form is specifically for those with an annual income of less than $75,000. Those who earn more must complete the Long Form.

- Misconception 3: Health insurance details are optional. Contrary to this belief, the form asks for information about health insurance coverage, emphasizing the importance of this data in financial statements.

- Misconception 4: It’s okay to estimate numbers. Accuracy is paramount; the document demands exact figures for income, expenses, and assets to ensure fair court proceedings.

- Misconception 5: All personal income should be included in gross income. However, certain types of income such as child support received are not counted towards gross income for calculating child support payments.

- Misconception 6: The form is only for divorcing couples. In fact, it can be required in various family law matters, including child custody and support cases, not exclusively divorces.

- Misconception 7: Information about assets and liabilities is not crucial. On the contrary, providing a complete and accurate account of assets and liabilities is essential for a fair analysis of financial standing.

- Misconception 8: Once submitted, the information can't be updated. The truth is, if financial circumstances change significantly, parties may need to file amended financial statements to reflect their current situation.

Clearing up these misconceptions ensures that individuals can accurately complete the Massachusetts Short Financial Statement form, leading to a fairer and more efficient legal process.

Key takeaways

Filling out the Massachusetts Short Financial Statement form is a critical step in various court proceedings, particularly in family court matters like divorce or child support cases. Understanding its purpose and how to complete it accurately can significantly impact the outcome of your case. Here are five key takeaways to ensure you use the form correctly:

- Income Requirements: First, determine if you're required to fill out the Short Form based on your annual income. The cutoff is $75,000.00; those earning more must complete the Long Form Financial Statement, unless the court directs otherwise. This differentiation helps streamline the process by aligning the depth of financial disclosure with income levels.

- Comprehensive Disclosure: The form requires detailed information about your income from all sources, not just your salary. This includes, but is not limited to, wages, overtime, part-time jobs, self-employment, tips, commissions, bonuses, and any public assistance received. Such thoroughness ensures a full understanding of your financial situation, which is paramount in family law matters where financial support and division of assets are at stake.

- Deductions Matter: Reporting your deductions accurately is just as crucial as detailing your income. This includes federal and state taxes, FICA and Medicare, medical insurance, and union dues. By deducting these amounts, the form helps calculate your net income, which is a more accurate measure of your financial standing and ability to pay support or divide assets.

- Weekly Expenses and Liabilities: Be prepared to list your weekly expenses and liabilities thoroughly. This section covers a wide range of outgoings, from rent or mortgage payments to incidental expenses. Transparency about your expenses and debts provides a clear picture of your financial needs and obligations, influencing decisions on alimony, child support, and other financial orders.

- Legal Representation: If you have legal representation, your attorney must also certify the financial statement. This not only adds a level of verification to the information provided but also underscores the importance of the document in legal proceedings. Remember, both you and your attorney are attesting to the accuracy of the information under penalty of perjury, highlighting the form's critical role in your case.

Properly completing the Massachusetts Short Financial Statement form is essential. It influences key aspects of family court proceedings by providing a transparent snapshot of your financial situation. Careful attention to detailing all income sources, deductions, expenses, and liabilities cannot be overstressed. Remember, accuracy and honesty in providing this information not only fulfill a legal requirement but also ensure the fairness of the court's decisions regarding your case.

Popular PDF Forms

Certified Mail Slips - Utilizing PS Form 3800 for Certified Mail ensures the sender has evidence of mailing and delivery, critical for legal documents and contracts.

Security Deposit Return Letter Pdf - Helps to ensure the fair and legal management of security deposit funds in accordance with lease agreements.