Blank Medi Cal Redetermination PDF Template

The State of California Health and Human Services Agency's Department of Health Care Services provides Medi-Cal, a crucial healthcare service for many residents. Keeping Medi-Cal coverage requires annual redetermination, a process facilitated through a specific form known as the Medi-Cal Annual Redetermination Form. This vital document needs to be accurately filled out and returned to the county by the recipient. It covers a wide array of information, including case and social security numbers, address details, income, and expenses. Furthermore, it delves into other imperative segments like other health insurance, living situation changes, real or personal property, changes in immigration or citizenship status, and sections on blindness, disability, or incapacity. In addition to capturing essential data to determine continuous eligibility, the form also serves as a platform for requesting information on various supportive health programs, including the Healthy Families Program, the Child Health and Disability Prevention Program (CHDP), the Women, Infants, and Children Program (WIC), and the Personal Care Services Program. The comprehensive nature of this form underscores the State's commitment to ensuring those eligible have access to the healthcare services they need, emphasizing the importance of accurate and prompt submission to maintain those benefits.

Preview - Medi Cal Redetermination Form

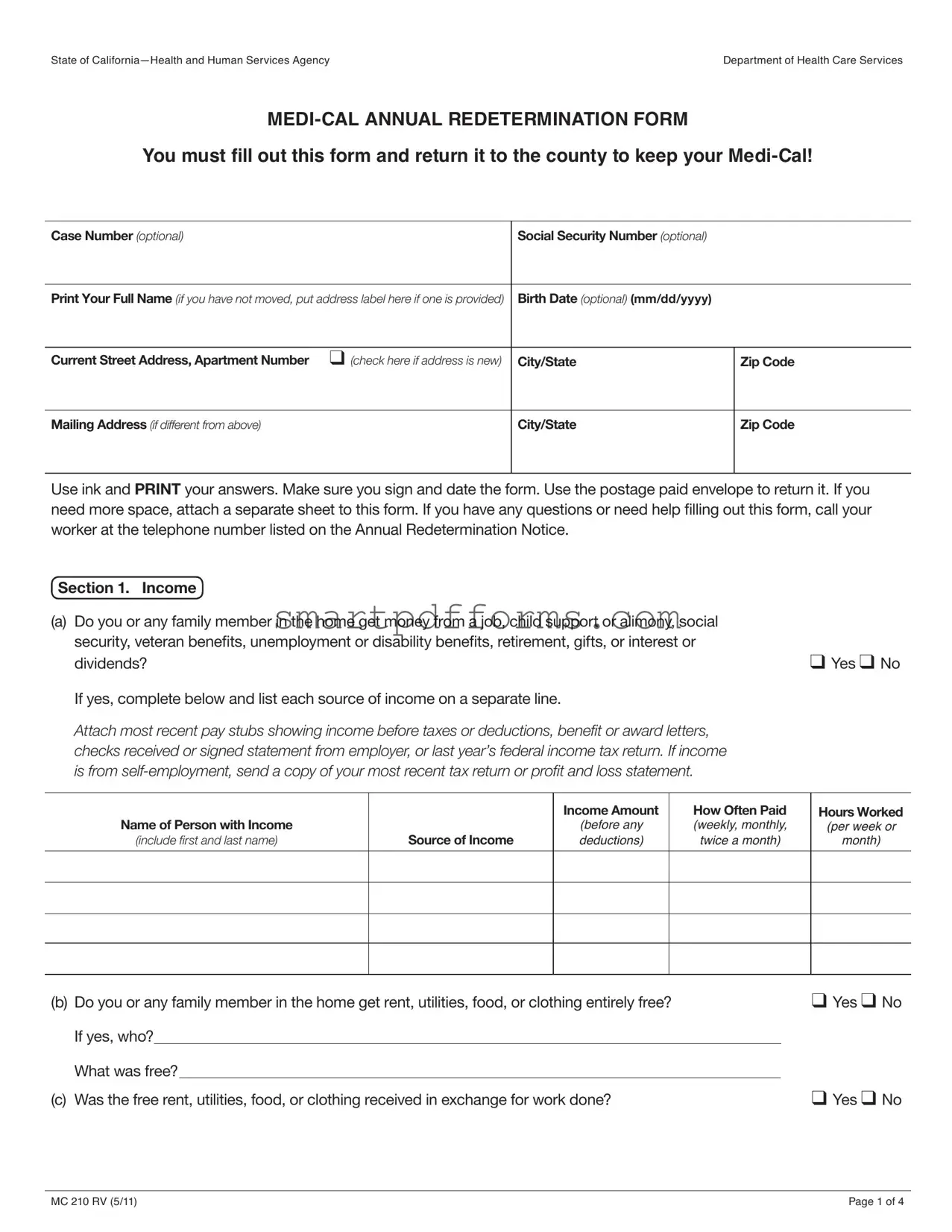

State of |

Department of Health Care Services |

You must fill out this form and return it to the county to keep your

Case Number (optional) |

Social Security Number (optional) |

|

|

|

|

Print Your Full Name (if you have not moved, put address label here if one is provided) |

Birth Date (optional) (mm/dd/yyyy) |

|

|

|

|

Current Street Address, Apartment Number ❑ (check here if address is new) |

City/State |

Zip Code |

|

|

|

Mailing Address (if different from above) |

City/State |

Zip Code |

|

|

|

Use ink and Print your answers. Make sure you sign and date the form. Use the postage paid envelope to return it. If you need more space, attach a separate sheet to this form. If you have any questions or need help filling out this form, call your worker at the telephone number listed on the Annual Redetermination Notice.

Section 1. Income

(a)Do you or any family member in the home get money from a job, child support or alimony, social security, veteran benefits, unemployment or disability benefits, retirement, gifts, or interest or

dividends? |

❑ Yes ❑ No |

If yes, complete below and list each source of income on a separate line.

Attach most recent pay stubs showing income before taxes or deductions, benefit or award letters, checks received or signed statement from employer, or last year’s federal income tax return. If income is from

Name of Person with Income

(include first and last name)

Source of Income

Income Amount

(before any deductions)

How Often Paid (weekly, monthly, twice a month)

Hours Worked

(per week or

month)

(b) Do you or any family member in the home get rent, utilities, food, or clothing entirely free? |

❑ Yes ❑ No |

||

If yes, who? |

|

|

|

What was free?⁜ |

|

|

|

(c) Was the free rent, utilities, food, or clothing received in exchange for work done? |

❑ Yes ❑ No |

||

MC 210 RV (5/11) |

Page 1 of 4 |

State of

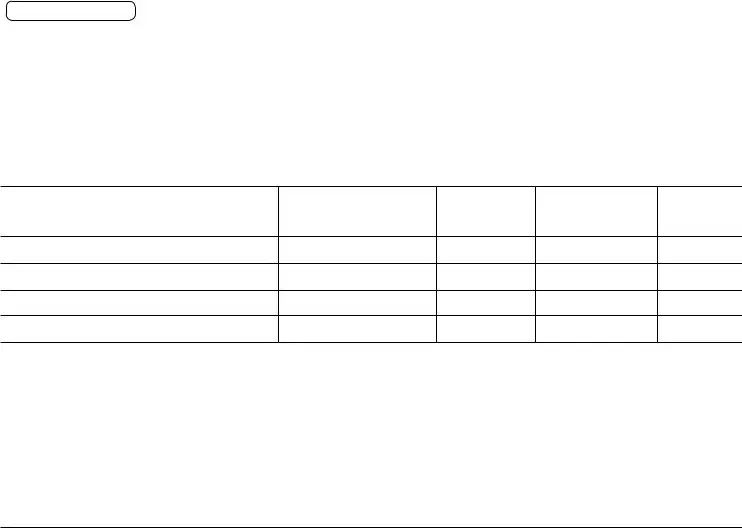

Section 2. Expenses and Deductions |

|

Do you or any family member in the home pay for child or adult care, health insurance or Medicare |

|

premiums, |

❑ Yes ❑ No |

If yes, complete below and list each expense/deduction on a separate line. |

|

Attach proof of expenses/deductions. |

|

Name of Person

with Expense/Deduction

(include first and last name)

Type of

Expense or Deduction

Amount of

Payment

Paid to Whom

How Often Paid (weekly, monthly, twice a month)

Section 3. Other Health Insurance |

|

||||

(a) Did you or any family member have a change in, or get new health, dental, vision, or Medicare |

|

||||

coverage or insurance within the last 12 months? |

❑ Yes ❑ No |

||||

If yes, who has the coverage/insurance? |

|

|

|||

Which type of coverage/insurance? |

|

|

|

||

(b) Is any family member living in the home receiving kidney |

❑ Yes ❑ No |

||||

If yes, who?⁜ |

|

|

|||

(c) Has any family member living in the home received an organ transplant within the last 2 years? |

❑ Yes ❑ No |

||||

If yes, who?⁜ |

|

|

|||

Section 4. Living Situation

(a)Did anyone move into or out of your home, move in with someone else, get married, or have a baby within the last 12 months? (Examples: newborn, child, or adult moved in or out of the home, absent

parent returns home.) |

❑ Yes ❑ No |

If yes, complete below:

Name (include first and last name)

Relationship to You

What Changed?

Date Changed

(b) Does anyone in the home want |

|

|

|

|

|

❑ Yes ❑ No |

||

If yes, who?⁜ ؠ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(c) If a new baby is in home, where was the baby’s place of birth? |

⁜ | |

| |

|

|

||||

|

|

City |

|

|

State |

|

Country |

|

MC 210 RV (5/11) |

Page 2 of 4 |

State of

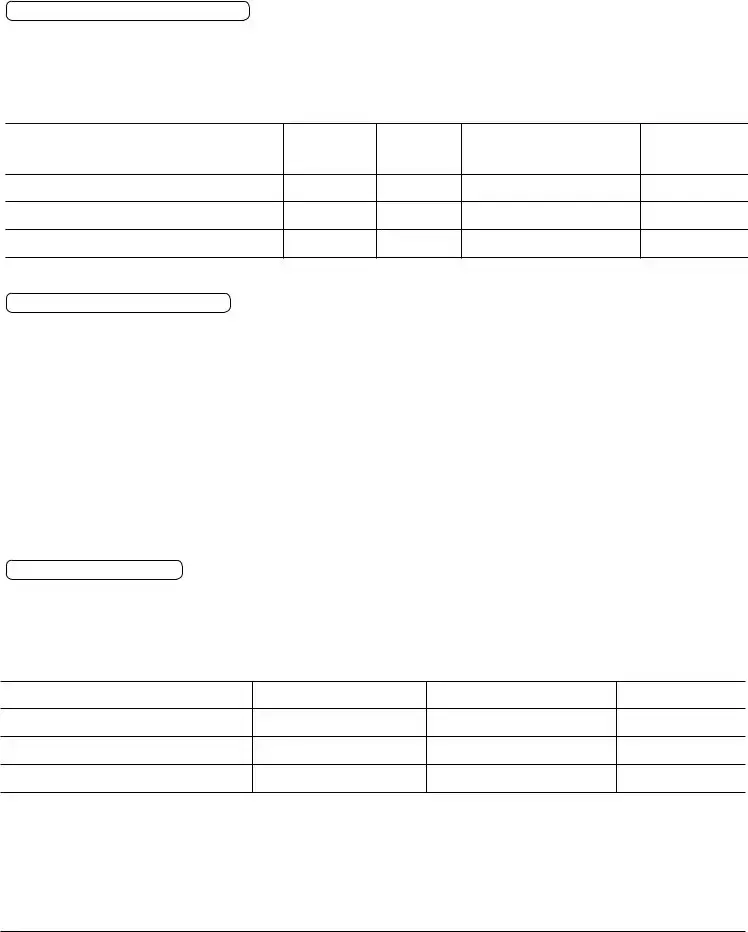

Section 4. Living Situation continued |

|

|

|

||

(d) Did anyone in the home get inpatient care in a nursing facility or medical institution?⁜ |

❑ Yes ❑ No |

||||

If yes, who?⁜ |

|

|

|

||

|

|

|

|

|

❑ Yes ❑ No |

(e) Is anyone in the home pregnant? |

|

|

|||

If yes, who? |

|

|

|

|

|

Number of babies expected |

|

Due date: ⁜ |

|

|

|

Section 5. Real or Personal Property

(a)Indicate the total amount of cash and uncashed checks held by any family member in the home $

(b)Does anyone have a checking or savings account, life insurance,

wedding), or oil or mineral rights? |

❑ Yes ❑ No |

(c)Did you or any family member in the home sell or give away any money or property in the past 12 months, or have any of the items listed in this section been spent or used as security

for medical costs? |

❑ Yes ❑ No |

Note: If you have answered “yes” to questions (b) or (c), you will also have to fill out a property |

|

supplement form, submit the form to the county and provide verification. |

|

Section 6. Immigration or Citizenship Status Change |

|

Has there been a change in immigration or citizenship status for anyone in the home that has |

|

or wants |

|

full scope |

❑ Yes ❑ No |

If yes, list the name(s) below and send proof of new status. |

|

Name of Person

(include first and last name)

Status Change

(send proof of status)

Section 7. Blindness/Disability/Incapacity |

|

|

|

||||

(a) |

Do you or any family member in the home have a physical or emotional condition that makes it |

|

|

|

|||

|

difficult to work, take care of personal needs, or take care of your children? ⁜ |

|

|

❑ Yes ❑ No |

|||

|

If yes, who? |

|

|

|

|

||

(b) Was the physical, mental, or health condition a result of an injury or accident? |

|

|

❑ Yes ❑ No |

||||

|

If yes, explain |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MC 210 RV (5/11) |

Page 3 of 4 |

State of |

Department of Health Care Services |

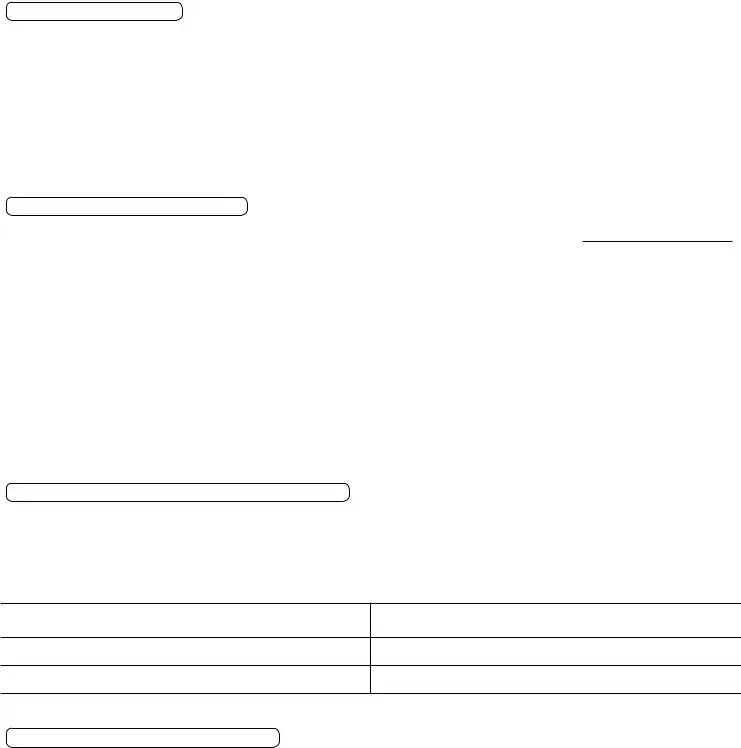

Section 8. Other Health Program Information and Referrals

(a) |

Check this box if you do not want your child’s information shared with the |

|

|

|

Families Program if your child gets |

|

|

(b) Do you want information on the |

|

❑ Yes ❑ No |

|

|

and Disability Prevention Program, also known as CHDP?) |

|

|

(c) Do you want information on the |

|

|

|

|

feeding women and children under 5 (Women, Infants, and Children Program, also known |

|

|

|

as WIC)? |

|

❑ Yes ❑ No |

(d) Do you want information on the Personal Care Services Program, an |

|

|

|

|

for aged, blind, or disabled persons (also known as |

⁜ |

❑ Yes ❑ No |

Section 9. Signature and Certification

Person completing this form must read and sign below.

➤I have received and read a copy of the Important Information for Persons Requesting

➤I am aware of, understand, and agree to meet all my responsibilities as described on the MC 219 form.

➤I certify that I will report all income, property, and/or other changes that may affect

➤I understand that all of the statements, including benefit and income information, that I have made on this form, may be subject to investigation and verification.

➤I declare, under penalty of perjury, under the laws of the State of California that all information provided on this ⁜ form is true and correct.

Signature

Date

Daytime or Message Telephone Number |

Home Telephone Number ❑ (check here if new number) |

|

|

Signature of Witness (if signed by a mark), Interpreter or Person Assisting |

|

|

|

— County Use Only —

Referrals |

|

|

|

|

❑⁜HF |

❑⁜WIC |

❑⁜MC 13 |

❑⁜MC 210 PS |

❑⁜Other: |

❑⁜CHDP |

❑⁜PCSP |

|

❑⁜DDSD Packet |

|

MC 210 RV (5/11) |

Page 4 of 4 |

Form Data

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Purpose | This is the form used for the annual redetermination process required to maintain Medi-Cal benefits. |

| 2 | Agency | The Department of Health Care Services in the State of California administers this form. |

| 3 | Important Information Section | Applicants must acknowledge they have received, read, and understood the MC 219, which explains responsibilities under Medi-Cal. |

| 4 | Income Reporting | Details about all sources of income must be reported, including jobs, benefits, and any other form of income, with applicable proof. |

| 5 | Property Reporting | It requires reporting of cash, accounts, life insurance, vehicles, real estate, and other assets or property owned. |

| 6 | Change in Circumstances | Applicants must report changes like income, property, living arrangements, insurance coverage, or family composition. |

| 7 | Governing Laws | Submission and certification of information are under the penalty of perjury according to the laws of the State of California. |

Instructions on Utilizing Medi Cal Redetermination

Filling out the Medi-Cal Annual Redetermination Form is an essential step in ensuring that individuals and their families continue receiving their health care benefits through California's Medi-Cal program. This form reviews one's eligibility for ongoing Medi-Cal coverage by updating information on income, household composition, and other relevant details. Accurate and complete answers are crucial to avoid any potential delays or issues with coverage. Below are the steps necessary to fill out this form meticulously.

- Start by writing the Case Number and Social Security Number if these are available and optional. This information helps in identifying your records quickly.

- Provide your Full Name, Birth Date, Current Street Address, and if applicable, Mailing Address. Check the box if the address provided is new.

- Answer all questions under Section 1: Income, including details of any income received by any family member in the home. Attach any necessary documentation like pay stubs, benefit letters, or tax returns to provide proof of income.

- In Section 2: Expenses and Deductions, list any applicable expenses for child or adult care, health insurance premiums, etc., including the payment amounts and to whom they are paid.

- For Section 3: Other Health Insurance, indicate any changes in health insurance coverage for any family member and provide details on the type of coverage.

- Update your living situation in Section 4, including any changes such as moving, marriage, or new babies. Answer all questions related to inpatient care, pregnancy, and new occupants wishing for Medi-Cal.

- Disclose information about any real or personal property owned by family members in Section 5. This includes checking accounts, vehicles, and real estate, among others.

- If there has been a change in immigration or citizenship status that might affect Medi-Cal eligibility, report this in Section 6 and provide proof of the new status.

- Address any physical, emotional, or mental health conditions affecting work or caregiving capabilities in Section 7. Include information on conditions caused by injuries or accidents.

- Opt in or out of sharing information with other health programs and express interest in receiving additional health program information in Section 8.

- Read and sign the declaration in Section 9. Include the date, and provide daytime and home telephone numbers. If the form is signed on behalf of the applicant, provide the signature of the witness, interpreter, or assisting person.

- Finally, use the postage-paid envelope provided to return the completed form to the county. Make sure to keep a copy for your records.

After submitting the form, the county office will review the provided information to determine continued eligibility for Medi-Cal benefits. Applicants may be contacted for further information or clarification. It’s important to respond promptly to any inquiries from the county office to ensure that Medi-Cal coverage is not interrupted.

Obtain Answers on Medi Cal Redetermination

Welcome to the Frequently Asked Questions section about the Medi-Cal Annual Redetermination Form. Understanding the basics and ensuring you complete this form correctly can help maintain your Medi-Cal benefits without interruption. Here are answers to common questions you might have.

What is the Medi-Cal Annual Redetermination Form?

This form is a critical document that current Medi-Cal recipients must fill out and return to their county office annually. Its purpose is to verify your eligibility for continued Medi-Cal coverage by updating information on your income, household composition, expenses, and other vital factors that might affect your eligibility.

Why do I need to fill out this form?

Filling out and returning this form is necessary to keep your Medi-Cal coverage. The information you provide helps the Department of Health Care Services (DHCS) and your county to determine if you still qualify for Medi-Cal benefits under current guidelines.

What should I do if I haven’t received my Redetermination Form?

If you haven’t received your form, it’s important to contact your county social services office immediately. They can provide instructions on how to access the form or issue a new one.

Is providing my Social Security Number (SSN) mandatory?

While you might notice fields for your SSN on the form, filling it out is optional. However, providing your SSN can help accurately match your records and expedite the redetermination process.

What documents will I need to attach with the form?

You may need to attach recent pay stubs, award letters for benefits, federal income tax returns, or other documents that verify your income. Similarly, if you claim certain deductions or expenses, providing proof for these is necessary. Always check the specific instructions related to your situation within the form.

What happens if my income or household situation has changed?

Report these changes on the form. Your eligibility and the amount of your Medi-Cal benefits can be affected by changes in your income, household size, or certain expenses. Detailed instructions are provided within the form to guide you on what to report and how.

How do I return the completed Redetermination Form?

Use the postage-paid envelope provided to return the form to your county's DHCS office. Ensure your form is signed, accurately filled out, and that you’ve attached any required documentation before sending it.

Can I get help with filling out the form?

Yes. If you need help, you can call the number listed on the Annual Redetermination Notice you received. Assistance is available to guide you through completing the form and answering any questions you may have.

What happens if I don’t return the form?

Non-return of the form can lead to a discontinuation of your Medi-Cal benefits. To prevent this, make sure to promptly fill out and return your form once you receive it.

Handling the Medi-Cal Annual Redetermination Form with care is essential to maintaining your health coverage. If you have more specific questions or circumstances, don’t hesitate to reach out to your county social services office for personalized assistance.

Common mistakes

Filling out the Medi-Cal Annual Redetermination form is crucial for maintaining your healthcare benefits. However, several common mistakes can jeopardize the accuracy and completeness of your submission. Understanding these pitfalls can help you navigate the process more efficiently and avoid delays in your eligibility review. Here are five common mistakes:

-

Not using ink to fill out the form. The instructions specify that the form should be filled out in ink. Using pencil or other erasable mediums can result in information being lost or tampered with, potentially leading to processing delays.

-

Omitting necessary attachments. If you indicate that you or a family member receive income from various sources or pay for certain expenses, you must attach documents like pay stubs, benefit letters, or receipts as proof. Failing to attach these documents can lead to requests for additional information, delaying the redetermination process.

-

Not reporting changes in living situation or income accurately. This form has sections dedicated to reporting any changes to your living situation, income, or assets. Overlooking or incorrectly reporting these details can lead to inaccuracies that might affect your Medi-Cal eligibility.

-

Leaving optional fields blank that actually apply. Some sections are marked as optional, such as your social security number or birth date. However, providing this information can help the agency process your redetermination more effectively. Especially important if your situation has changed or if there is a need to differentiate you from someone with a similar name.

-

Ignoring questions about other health insurance. It's vital to disclose if you or any family member had a change in, or obtained new, health, dental, vision, or Medicare coverage within the last 12 months. Failure to accurately report these details can impact your Medi-Cal coverage and may result in penalties or loss of benefits.

In conclusion, while filling out the Medi-Cal Annual Redetermination form, it’s important to use ink, attach all necessary documents, accurately report all requested information, not overlook optional fields if they apply to you, and disclose any other health insurance coverage. Avoiding these common mistakes can help ensure that the process goes smoothly and your healthcare coverage continues uninterrupted.

Documents used along the form

The Medi-Cal Annual Redetermination Form is an essential document for individuals and families in California seeking to maintain their Medi-Cal benefits. This form ensures that the Department of Health Care Services (DHCS) has current information regarding an applicant’s income, property, and other factors that influence eligibility for Medi-Cal benefits. However, to support the information provided on the Medi-Cal Redetermination Form and to fulfill other requirements, several additional forms and documents are often required. Understanding these documents can help individuals smoothly navigate the process of keeping their Medi-Cal coverage.

- Proof of Income Documents: These may include recent pay stubs, social security benefit letters, unemployment benefits statements, or tax returns. They provide verifiable information about the income of each household member.

- Proof of Expenses Documents: Receipts or statements for child or adult care costs, health insurance premiums, or educational expenses must be submitted to account for deductions that might affect one’s income level and eligibility.

- Proof of Property: Documents that verify ownership and value of property, such as bank statements for checking and savings accounts, vehicle registration documents, or trust documents, are needed especially if property holdings could affect eligibility.

- Proof of Citizenship or Immigration Status: Birth certificates, passports, or immigration documents are required to verify the citizenship or lawful presence of applicants and their family members.

- Disability Verification: If a disability claim is part of the application, medical records, doctor’s statements, or disability benefits award letters are essential to establish the presence and extent of a disability.

- Proof of Child or Adult Care Expenses: Receipts or contracts that show the cost of childcare or adult care can significantly impact the eligibility and calculation of benefits by demonstrating additional expenses.

- Change in Household Composition: Documents like birth certificates for newborns, death certificates, marriage certificates, or divorce decrees are important for verifying the household size and composition, which can influence eligibility and benefit levels.

Submitting the Medi-Cal Annual Redetermination Form along with the necessary supporting documents is crucial for maintaining eligibility for Medi-Cal benefits. Each document plays a specific role in establishing the facts needed for a complete and accurate assessment by DHCS. By providing comprehensive and timely documentation, individuals can help ensure the continuation of their Medi-Cal coverage without interruption. It’s important for applicants to stay in communication with their county social services office to respond to any inquiries or requests for additional information promptly.

Similar forms

The Food Stamps/SNAP Application is similar because it requires households to report income, expenses, and household composition. Just like the Medi-Cal Redetermination form, applicants must detail their financial status and any changes to their household that could affect their eligibility.

The IRS Form 1040 (U.S. Individual Income Tax Return) shares similarities in the way it requires the detailing of income sources, albeit for tax purposes. Both forms are used to report various types of income, though for different end goals - one for health coverage eligibility and the other for tax calculations.

FAFSA (Free Application for Federal Student Aid) requires applicants to provide detailed information about their financial situation, including income, assets, and household size, similar to the Medi-Cal Redetermination form. This information is used to determine eligibility for financial aid, mirroring the need-based eligibility criteria of Medi-Cal.

Applications for Subsidized Housing also resemble the Medi-Cal Redetermination form in that applicants must disclose income, family composition, and financial assets to determine eligibility based on need, ensuring those who require support can access affordable housing options.

The Medicare Application parallels the Medi-Cal Redetermination form by requiring information on other health insurance, income levels, and living situations to establish eligibility and the correct level of benefits, catering to the elderly and disabled.

Disability Benefits Application Forms (such as those for SSI or SSDI) ask for detailed information about health conditions, income, and other benefits, which is similar to Section 7 of the Medi-Cal form that addresses disability/incapacity, aiming to support those unable to work with necessary benefits.

Dos and Don'ts

Applying for or renewing your Medi-Cal coverage requires careful attention to detail, particularly when filling out the Medi-Cal Annual Redetermination Form. Here are some important dos and don'ts to ensure the process is completed accurately and efficiently:

Dos:

Use ink and print clearly: This makes your application easier to read and process, reducing the likelihood of errors or delays.

Attach all required documentation: This includes most recent pay stubs, benefit or award letters, and proof of expenses/deductions. Providing complete information upfront helps avoid follow-up queries.

Sign and date the form: An unsigned form is considered incomplete and can lead to unnecessary delays in the processing of your application.

Report all income sources and changes: Accurate income information is crucial for determining your eligibility and the correct level of benefits.

Seek assistance if needed: If you have any questions or need help filling out the form, contact your worker at the telephone number listed on the Annual Redetermination Notice.

Return the form promptly: Delaying the submission of your form can result in a lapse of coverage.

Keep a copy: Having a record of what you submitted can be helpful for your records and in case of any discrepancies.

Don'ts:

Don't leave sections blank: If a section does not apply, write "N/A" or "None." This shows that you did not overlook the section but that it indeed does not apply to your situation.

Don't guess on dates or amounts: Estimations can lead to inaccuracies in your application. If you're unsure, it's better to verify the correct information before submitting.

Don't include information not related to your Medi-Cal eligibility: Stick to the relevant details requested in the form to avoid any confusion.

Don't forget to list all family members who need coverage: Missing out on a family member can result in their not being covered.

Don't submit without checking for errors: Reviewing your form before submission can catch mistakes that might delay processing.

Don't ignore instructions for additional forms: Some sections may require you to fill out supplemental forms. Be sure to complete these as needed.

Don't delay in reporting changes: Once your application is processed, remember to report any changes in circumstances within ten days to ensure your coverage remains accurate.

Misconceptions

When individuals begin the process of completing the Medi-Cal Annual Redetermination form, a variety of misconceptions can arise. These misunderstandings can complicate the process, potentially affecting one's health coverage. Below are four common misconceptions clarified to assist individuals in navigating this essential procedure.

- Submitting Social Security Numbers is Mandatory: A common misconception is that providing Social Security Numbers (SSNs) is mandatory for the redetermination process. While SSNs can expedite the verification process, the form states that including a case number and SSNs is optional. This flexibility helps protect individuals’ privacy while still allowing for the continuation of benefits.

- Income Verification Requires Pay Stubs Only: Another misunderstanding involves the belief that only pay stubs are accepted for income verification. In truth, the form allows for various documentation, including federal income tax returns, benefit or award letters, and signed statements from employers. This broader range of acceptable documents makes it easier for individuals to verify their income even if they do not have traditional employment.

- All Household Changes Must Be Reported: It's often thought that any and all changes within the household need to be reported through the Medi-Cal Annual Redetermination form. However, the form specifically asks about certain types of changes, such as those related to living situations, income, and property. This misconception could lead to the unnecessary reporting of irrelevant information, which could complicate the redetermination process.

- Ownership of Any Property Disqualifies You: There is a misconception that owning any sort of property automatically disqualifies individuals from Medi-Cal eligibility. The form does request information about property ownership but also includes provisions for ownership that does not necessarily affect eligibility. The aim is to understand the applicant's financial situation comprehensively, not to disqualify individuals for simply owning property.

Clearing up these misconceptions can streamline the Medi-Cal Annual Redetermination process, making it more accessible and less stressful for those involved. It's essential for individuals to carefully review the instructions and seek assistance if they have questions or concerns. This ensures that all eligible individuals and families can maintain their Medi-Cal coverage without undue difficulty.

Key takeaways

Filling out and using the Medi-Cal Redetermination form is an essential process for individuals looking to maintain their Medi-Cal benefits in California. To ensure the process is completed accurately and efficiently, here are four key takeaways:

Accuracy and Completeness are Crucial: When filling out the Medi-Cal Redetermination form, it's important to use ink and provide clear, accurate answers. Every question should be answered to the best of one's knowledge, and all required documents, such as pay stubs, proof of expenses, and proof of any changes in living situations or income, must be attached. If more space is needed, attaching a separate sheet with the additional information is advisable.

Report Changes in Circumstances: Applicants must report any changes in their income, property, or family circumstances that have occurred since the last determination. This includes changes like a new job, change in marital status, or a newborn child in the home. These changes can significantly impact eligibility and benefit levels.

Documentation is Key: Alongside the redetermination form, individuals are required to attach documentation that supports the information provided. This could include income verification from employers, recent tax returns for self-employed individuals, and evidence of allowable deductions such as health insurance premiums or educational expenses. Proper documentation ensures that the application process moves forward without unnecessary delays.

Understand the Deadlines: Submitting the Medi-Cal Redetermination form within the specified timeframe is imperative to avoid the risk of losing coverage. The form should be returned as soon as possible using the postage-paid envelope provided. Late submissions could lead to a temporary lapse in benefits or require the individual to reapply for Medi-Cal.

By keeping these key points in mind, individuals can navigate the Medi-Cal Redetermination process more smoothly, ensuring their coverage continues without interruption. For any questions or need for assistance while filling out the form, contacting the worker listed on the Annual Redetermination Notice is recommended.

Popular PDF Forms

Child Dedication Message - A proof of dedication document for a baby dedicated to God, arranged systematically with the specific details of the ceremony and validated through signatures of the parents and officiant.

Mo Tax Forms - Accessing your property tax credit information in Missouri is straightforward with a form tailored to helping taxpayers retrieve necessary documents.

Cmbok - Evaluates need for interpreter services for consumers with limited English proficiency.