Blank Michigan No Fault Insurance PDF Template

In the state of Michigan, drivers are mandated by law to carry a specific type of car insurance known as no-fault insurance. The Michigan No-Fault Insurance form is a crucial document in this process, encapsulating all key details that verify the legitimacy of a vehicle's insurance policy under the state's stringent requirements. It highlights information such as the policy number, effective and expiration dates, vehicle identification number (VIN), as well as details of the insured vehicle, including its make and model. Beyond serving as proof of insurance compliance with Act 294, P.A. 1972, as amended, this certificate needs to be present in the vehicle at all times and is essential when applying for license plates. It's a safeguard not only against civil infractions, when failing to produce it on a law enforcement officer's demand, but also against the severe penalties for driving without proper insurance security, which includes substantial fines and possible imprisonment. Additionally, it is a stern reminder of the consequences of allowing a vehicle to be driven by an excluded person, emphasizing that such a scenario voids all liability coverage, thus classifying the vehicle as uninsured and leaving vehicle owners fully responsible for any legal ramifications.

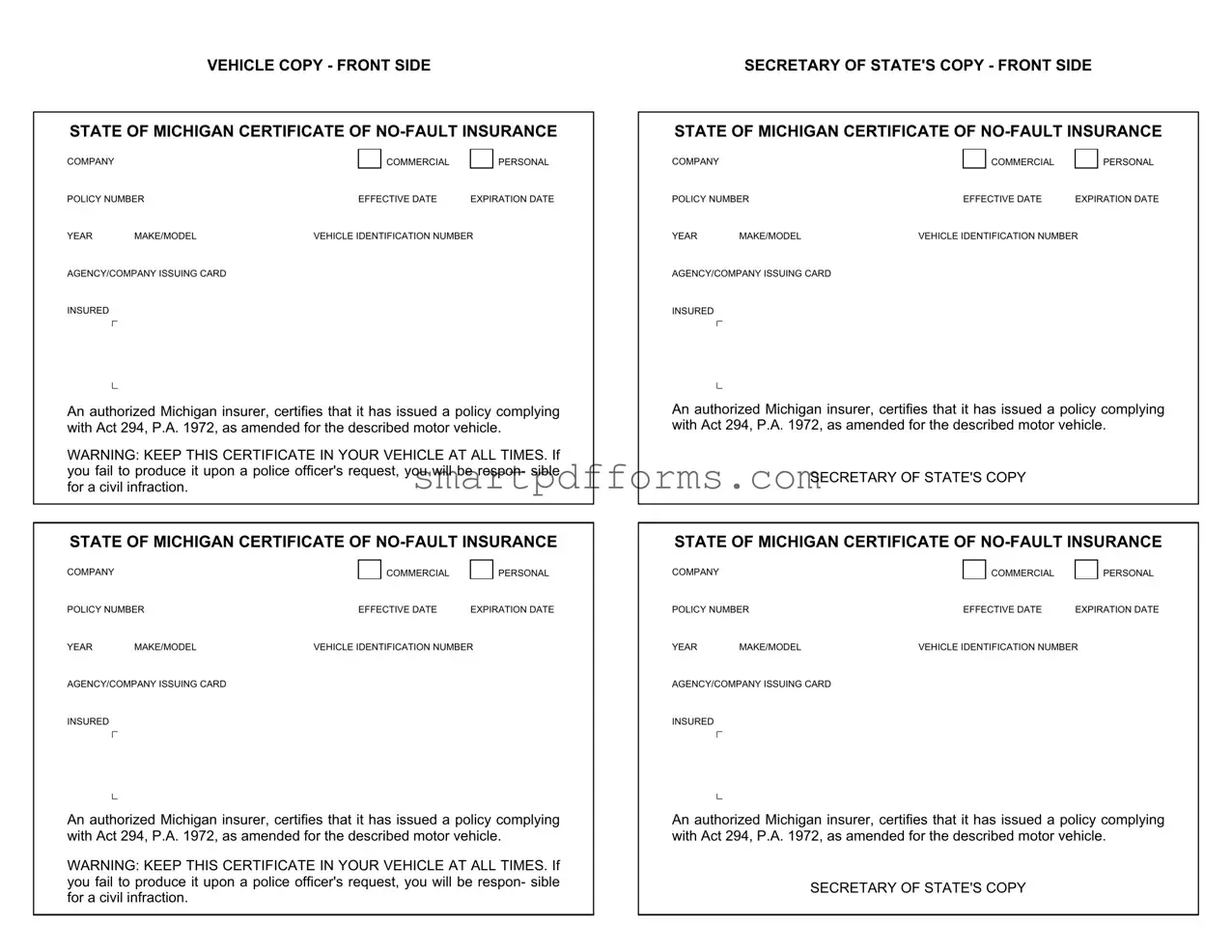

Preview - Michigan No Fault Insurance Form

VEHICLE COPY - FRONT SIDE

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

WARNING: KEEP THIS CERTIFICATE IN YOUR VEHICLE AT ALL TIMES. If you fail to produce it upon a police officer's request, you will be respon- sible for a civil infraction.

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

WARNING: KEEP THIS CERTIFICATE IN YOUR VEHICLE AT ALL TIMES. If you fail to produce it upon a police officer's request, you will be respon- sible for a civil infraction.

SECRETARY OF STATE'S COPY - FRONT SIDE

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

SECRETARY OF STATE'S COPY

STATE OF MICHIGAN CERTIFICATE OF

COMPANY |

|

|

|

COMMERCIAL |

|

PERSONAL |

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD

INSURED

An authorized Michigan insurer, certifies that it has issued a policy complying with Act 294, P.A. 1972, as amended for the described motor vehicle.

SECRETARY OF STATE'S COPY

SECRETARY OF STATE'S COPY - REVERSE SIDE |

VEHICLE COPY - REVERSE SIDE |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

THIS FORM MUST BE PRESENTED AS EVIDENCE OF INSURANCE WITH YOUR APPLICA- TION FOR LICENSE PLATES, EITHER BY MAIL OR AT ANY SECRETARY OF STATE LICENSE PLATE BRANCH OFFICE. A PERSON WHO ISSUES OR WHO SUPPLIES FALSE INFORMA- TION TO THE SECRETARY OF STATE OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEANOR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

THIS FORM MUST BE PRESENTED AS EVIDENCE OF INSURANCE WITH YOUR APPLICA- TION FOR LICENSE PLATES, EITHER BY MAIL OR AT ANY SECRETARY OF STATE LICENSE PLATE BRANCH OFFICE. A PERSON WHO ISSUES OR WHO SUPPLIES FALSE INFORMA- TION TO THE SECRETARY OF STATE OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEANOR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

A PERSON WHO SUPPLIES FALSE INFORMATION TO THE SECRETARY OF STATE OR WHO ISSUES OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEAN- OR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Michigan Law (MCLA 500.3101) requires that the owner or registrant of a motor vehicle regis- tered in this state must have insurance or other approved security for the payment of

An owner or registrant convicted of such a misdemeanor shall be fined not less than $200.00 nor more than $500.00, or imprisoned for not more than 1 year, or both.

A PERSON WHO SUPPLIES FALSE INFORMATION TO THE SECRETARY OF STATE OR WHO ISSUES OR USES AN INVALID CERTIFICATE OF INSURANCE IS GUILTY OF A MISDEMEAN- OR PUNISHABLE BY IMPRISONMENT FOR NOT MORE THAN 1 YEAR, OR A FINE OF NOT MORE THAN $1,000.00, OR BOTH.

If this vehicle is driven by the person(s) named below, residual liability insurance does not apply and the vehicle will be considered uninsured:

WARNING - when a named excluded person operates a vehicle, all liability coverage is void - no one is insured. Owners of the vehicle and others legally responsible for the acts of the named excluded person remain fully responsible.

ACORD 50 MI (2007/12) |

© 1993, 2007 ACORD CORPORATION. All rights reserved. |

Form Data

| Fact Number | Fact Name | Description | Governing Law(s) |

|---|---|---|---|

| 1 | Form Purpose | This certificate serves as proof of no-fault insurance for vehicles registered in Michigan. | Act 294, P.A. 1972, as amended |

| 2 | Required Insurance | Michigan law requires continuous no-fault insurance or other approved security on registered vehicles. | MCLA 500.3101 |

| 3 | Penalties for Non-Compliance | Driving without proper insurance/security is a misdemeanor, punishable by fines or imprisonment. | MCLA 500.3101 |

| 4 | Insurance Certificate Requirement | This certificate must be presented when applying for license plates, either by mail or in person. | MCLA 500.3101 |

| 5 | False Information Penalty | Supplying false information to the Secretary of State or using an invalid certificate is a misdemeanor, subject to fines and/or imprisonment. | MCLA 500.3101 |

| 6 | Excluded Persons | If a vehicle is driven by a named excluded person, liability coverage is void and the vehicle is considered uninsured. | MCLA 500.3101 |

| 7 | Liability for Excluded Drivers | Vehicle owners and others responsible remain fully liable for acts of the named excluded person. | MCLA 500.3101 |

| 8 | Certificate Accessibility | The certificate must be kept in the vehicle at all times and produced upon a police officer's request. | Act 294, P.A. 1972, as amended |

| 9 | Form Verification | An authorized Michigan insurer issues the certificate, verifying the policy meets state requirements. | Act 294, P.A. 1972, as amended |

Instructions on Utilizing Michigan No Fault Insurance

Having the Michigan No-Fault Insurance form correctly filled out is essential for every vehicle owner in the state. This document is not only required by law but also serves as proof of your vehicle's insurance coverage, ensuring you’re protected under the Michigan no-fault law. It’s critical to keep this certificate in your vehicle at all times to avoid penalties and ensure compliance with the law. Below is a step-by-step guide to help you complete this form accurately.

- Identify whether the insurance is for COMMERCIAL or PERSONAL use and check the appropriate box.

- Enter the POLICY NUMBER as provided by your insurance company.

- Fill in the EFFECTIVE DATE and EXPIRATION DATE to define the policy's active period.

- Specify the YEAR, MAKE/MODEL of the insured vehicle for clear identification.

- Provide the VEHICLE IDENTIFICATION NUMBER (VIN) accurately to avoid any discrepancies.

- Record the name of the AGENCY/COMPANY ISSUING CARD to indicate the insurer.

- Ensure the INSURED section reflects your name or the name of the entity that holds the insurance policy.

- After completing the form, double-check all the information for accuracy to avoid issues with law enforcement or the Secretary of State’s office.

- Sign and date the form if a signature is required, although this template does not specify a section for this.

- Remember to keep the completed certificate in your vehicle at all times and provide a copy to the Secretary of State if applying for license plates or renewing them, either by mail or in person.

Once the form is correctly filled out and signed, you will have satisfied a crucial part of Michigan’s vehicle registration requirements. It’s important to renew your policy and update this document before its expiration date to maintain continuous coverage and legal compliance. Keeping an accurate and current version of this certificate in your vehicle will ensure you are prepared to present evidence of insurance whenever it is requested by law enforcement or when renewing your vehicle’s registration. Always stay informed of any changes to Michigan's insurance laws to ensure your compliance is up-to-date.

Obtain Answers on Michigan No Fault Insurance

Understanding the requirements and implications of the Michigan No-Fault Insurance form can sometimes feel overwhelming. Here, in an easily accessible format, are the answers to some frequently asked questions regarding this document.

- What is the Michigan No-Fault Insurance form?

This form is a certificate provided by an authorized insurer in Michigan, certifying that a motor vehicle is covered under a policy that complies with the Act 294, P.A. 1972, as amended. It verifies that the vehicle has no-fault benefits coverage, which is a requirement for all motor vehicles registered in the state of Michigan.

- Why must I keep this certificate in my vehicle at all times?

Michigan law mandates that this certificate be kept within the vehicle to prove that it has the necessary no-fault insurance coverage. Failing to produce this certificate upon a police officer's request can result in a civil infraction, as it suggests the vehicle might not be insured as required.

- What are the consequences of driving without proper insurance or security in Michigan?

If a vehicle is driven or allowed to be driven on public highways without the proper insurance or other approved security, the owner or registrant commits a misdemeanor. Convictions can lead to a fine ranging from $200.00 to $500.00, imprisonment for up to 1 year, or both.

- Do I need to present this form for registering my vehicle or renewing the license plates?

Yes, this form serves as evidence of insurance and must be presented with your application for license plates, whether the application is submitted by mail or in person at any Secretary of State License Plate Branch Office.

- What happens if false information is provided to the Secretary of State or if an invalid certificate of insurance is used?

Providing false information or using an invalid certificate of insurance is considered a misdemeanor. Those found guilty could face imprisonment for not more than 1 year, a fine of not more than $1,000.00, or both.

- What does it mean when a named excluded person operates the vehicle?

Driving a vehicle by a named excluded person means all liability coverage is voided, effectively leaving the vehicle uninsured. In such cases, owners of the vehicle and people legally responsible for the actions of the named excluded person remain fully accountable for any incidents.

Ensuring compliance with Michigan's no-fault insurance law is crucial for every vehicle owner and registrant. Keeping informed about the requirements and responsibilities can help avoid legal complications and ensure peace of mind while on the road.

Common mistakes

Failing to keep the certificate in the vehicle can often lead to unnecessary complications. Michigan law mandates that this certificate should be present in the vehicle at all times. Non-compliance may result in a civil infraction if a police officer requests it and it cannot be produced.

Incorrect or incomplete information on the form is a common mistake. Every field should be accurately filled out, including the policy number, effective and expiration dates, year, make/model of the vehicle, vehicle identification number, and the agency/company issuing the card. Errors or omissions can render the certificate invalid.

Using the form with outdated or false information can have serious legal consequences. It's crucial to ensure that all details reflect the current state of insurance coverage. Supplying false information or using an invalid certificate is punishable by law, potentially leading to fines or imprisonment.

Not understanding the implications of the named excluded person clause is another area where mistakes are often made. If the vehicle is driven by a person named as excluded, no liability coverage applies, making the vehicle uninsured. This misunderstanding can lead to significant financial and legal repercussions for the vehicle owners and any parties involved in an accident.

Omitting the certificate when applying for license plates or renewing them is a critical oversight. The form must be presented as proof of insurance during these processes. Failure to provide this documentation can delay or prevent the issuance or renewal of license plates.

In summary, when dealing with the Michigan No-Fault Insurance form, attention to detail and adherence to legal requirements are essential. Keeping the information current, understanding the consequences of the named excluded person clause, and ensuring the certificate's presence in the vehicle are paramount. This not only helps in avoiding penalties but also ensures compliance with Michigan's no-fault insurance laws.

Documents used along the form

When dealing with vehicle-related documentation in Michigan, particularly concerning no-fault insurance, it's important to be aware of the spectrum of documents that often accompany the Michigan No-Fault Insurance form. These documents are instrumental in ensuring that all legal requirements are met and that the vehicle owner is adequately protected. Ranging from proof of insurance to vehicle registration forms, each document plays a crucial role in the broader context of vehicle insurance and legal compliance within the state. It's advisable for individuals to familiarize themselves with these documents to streamline their dealings with insurance claims, vehicle registrations, and in cases of vehicular incidents.

- Proof of Insurance: This is a document issued by your insurance company to verify that you carry an active policy. It typically includes your policy number, the effective dates of the policy, and the insured vehicle's details.

- Vehicle Registration: Issued by the Michigan Secretary of State, this document certifies that your vehicle is registered under state laws. It usually shows the vehicle's make, year, and VIN, alongside the name and address of the owner.

- Vehicle Title: This legal document establishes the owner of the vehicle. It's important for proving ownership and is needed when transferring the vehicle to another person.

- Accident Report Form: In the event of a vehicular accident, this form is filled out. It documents the details of the accident, parties involved, and any damages incurred, which is crucial for insurance claims.

- Claim Form: This form is used to file a claim with your insurance company for damages to your vehicle or in the event of theft. It outlines the nature of the claim, details of the loss or damage, and any costs involved.

- Driver's License: While not a document directly used with the insurance form, your driver's license is often required to be presented as proof of your eligibility to drive the insured vehicle.

- Medical Release Form: In cases where injuries occur, this form authorizes the release of medical records to the insurance company, allowing them to evaluate and cover medical expenses under the no-fault insurance policy.

- Release of Liability Form: When a vehicle is sold, this form releases the seller from liability if the vehicle is involved in an accident or incurs fines after the sale.

Together, these documents form a comprehensive dossier that supports the Michigan No-Fault Insurance form. They ensure that both the vehicle and its occupants are adequately protected under state law, while also facilitating smoother transactions and interactions with insurance companies, healthcare providers, and legal entities. Being well-prepared with these documents can significantly expedite processes and ensure compliance with Michigan's vehicle and insurance regulations.

Similar forms

The Proof of Auto Insurance Card is similar because it serves as verification of an active auto insurance policy, crucial for various legal and administrative processes, just like the Michigan No Fault Insurance form.

The Home Insurance Policy Declaration Page shares similarities as it outlines coverage details, insured property, and policyholder information, offering a summary of protection just as the Michigan form does for vehicles.

Health Insurance Card is akin to the document, providing proof of insurance coverage and necessary details like policy numbers and coverage dates, ensuring that the carrier can access medical services.

Voter Registration Card shares the characteristic of being a state-issued document that confirms an individual's registration status, akin to how the Michigan form validates insurance compliance.

A Driver's License is comparable as it identifies the holder's authorization to drive, just as the Michigan No Fault Insurance form certifies the vehicle's compliance with state insurance laws.

Vehicle Registration Certificate parallels this form by indicating the registration status of a vehicle within a state, including details on the make, model, and VIN, similar to the insurance form's content.

The Warranty Deed or Title to Real Estate is similar in the manner that it proves ownership and stipulates conditions much like how the Michigan No Fault Insurance form evidences insurance coverage and terms.

Workers' Compensation Insurance Certificates are analogous as they confirm an employer's compliance with state workers' compensation insurance requirements, echoing the confirmation of vehicle insurance compliance.

A Passport aligns with the Michigan document through its role as a government-issued identification that also has regulatory and international compliance implications.

The Business License or Permit corresponds to the Michigan No Fault Insurance form by signifying that an entity meets certain regulatory conditions for operation, including but not limited to insurance requirements.

Dos and Don'ts

When filling out the Michigan No Fault Insurance form, there are essential steps to follow and pitfalls to avoid to ensure that the process is completed accurately and effectively. Below are the recommended do's and don'ts.

Things You Should Do:

- Double-check all information for accuracy, including the policy number, effective and expiration dates, vehicle make/model, and Vehicle Identification Number (VIN).

- Retain a copy of the completed form in your vehicle at all times, as required by Michigan law.

- Report any changes to your insurance agency/company issuing the card as soon as possible to ensure that your records are up to date.

- Present this form as evidence of insurance with your application for license plates, either by mail or at any Secretary of State license plate branch office.

- Ensure that the insurance company/agency is authorized in Michigan and complies with Act 294, P.A. 1972, as amended.

- Understand the implications of allowing an excluded person to operate the vehicle, as all liability coverage will be voided.

Things You Shouldn't Do:

- Do not leave the insurance form unfilled or incomplete; ensure all sections are filled out correctly.

- Avoid falsifying information on the form. Supplying false information or using an invalid certificate of insurance is a misdemeanor punishable by law.

- Never permit an excluded person to operate the insured vehicle, as this will consider the vehicle uninsured and void all liability coverage.

- Do not ignore the expiration date of your policy; renew it on time to avoid penalties.

- Refrain from providing outdated information to the Secretary of State or any entities that require this certificate as proof.

- Avoid misplacing this form, as a copy must be presented as evidence of insurance, especially during traffic stops or when applying for license plates.

By adhering to these guidelines, individuals can ensure compliance with Michigan's No Fault Insurance requirements, thus avoiding potential legal issues and ensuring that their vehicle remains properly insured.

Misconceptions

There are several misconceptions about the Michigan No-Fault Insurance system that are worth clarifying to ensure citizens understand their rights and responsibilities under this law. Here are four common misunderstandings:

- Only the vehicle owner needs a no-fault insurance certificate: This is a misconception because Michigan law requires that all registrants, not just owners, have no-fault insurance for their vehicles. This requirement ensures that there is a responsible party for medical expenses or damages in the event of an accident, regardless of who is at fault.

- Any insurance policy is adequate: Another common misunderstanding is the belief that any type of auto insurance policy complies with Michigan's no-fault law. However, only policies issued by authorized Michigan insurers that specifically comply with Act 294, P.A. 1972, as amended, meet the legal requirements. These policies provide coverage for personal injury protection, property protection, and residual liability insurance.

- Failure to carry the certificate in your vehicle is a minor issue: Many individuals underestimate the consequences of not having their no-fault insurance certificate within their vehicle. Michigan law mandates that this certificate must be kept in the vehicle at all times, and failure to present it upon a police officer's request can result in being charged with a civil infraction. This underlines the importance of adhering to requirements for carrying proof of insurance.

- Inclusion of specific drivers affects liability coverage for all: There's a mistaken belief that excluding certain drivers from your policy affects the insurance status of the vehicle as a whole. In reality, the law clearly states that when a named excluded person operates the vehicle, liability coverage is void only for that scenario. This means no insurance benefits apply if the excluded individual is driving. However, this does not affect the vehicle’s overall insured status under the primary policyholder’s use or other non-excluded drivers.

These clarifications underscore the importance of understanding Michigan's No-Fault Insurance law to ensure compliance and to make informed decisions related to auto insurance and vehicle operation within the state.

Key takeaways

Completing and utilizing the Michigan No Fault Insurance form is essential for vehicle owners and registrants in Michigan. Here are key takeaways to ensure compliance and understanding:

- Always keep the certificate in your vehicle to present upon a police officer's request, avoiding a potential civil infraction.

- Make sure your insurer is authorized in Michigan and that your policy complies with Act 294, P.A. 1972, as amended, for your specific vehicle.

- The form serves as evidence of insurance when applying for license plates, either by mail or at any Secretary of State license plate branch office.

- Driving or permitting a vehicle to be driven without proper insurance or security is a misdemeanor, leading to fines or imprisonment.

- Fake or invalid certificates of insurance can result in severe penalties, including fines of up to $1,000 or imprisonment for up to 1 year.

- If a person named as an excluded operator drives the vehicle, all liability coverage becomes void, and the vehicle is considered uninsured.

- Owners and those responsible for actions of an excluded driver remain fully responsible despite the lack of insurance coverage.

- The form's necessity underscores the importance of continuous no-fault benefits coverage for all registered vehicles in Michigan.

- Providing false information to the Secretary of State regarding your insurance status is a punishable offense.

- Understanding the implications of the named excluded person clause is crucial for vehicle owners to avoid unexpected liabilities.

Adherence to these points ensures compliance with Michigan's insurance laws, mitigating the risk of legal consequences and ensuring the continuous protection of your vehicle.

Popular PDF Forms

Cpt 90694 - Patient instructions on remaining in the waiting area post-vaccination for safety monitoring are a testament to the thoroughness of care.

Palm Tran Connection Application - Understand the importance of emergency contact information in Palm Tran's application for secure and responsible transportation service.

Check on the Status of My Passport - It plays a key role in maintaining the security and reliability of South African travel documents on an international scale.