Blank Michigan Tr 205 PDF Template

Navigating the intricacies of vehicle or watercraft ownership in Michigan can be complex, particularly when the standard documents like titles or registrations are unavailable due to them being lost, destroyed, or stolen. In such situations, the Michigan TR-205 form emerges as a critical document. This Ownership Certification form is specifically designed as a remedy for individuals who find themselves unable to obtain a duplicate title or registration from the previous owner. It caters to vehicles, including snowmobiles, watercraft, and off-road vehicles (ORVs), ensuring rightful owners can assert their ownership and rightfully register or title their property in the state. The form requires detailed information about the vehicle or watercraft, such as the year, make, model, and identification numbers. Additionally, it mandates the documentation of the item's value, acquisition date, and source, coupled with a declaration that the vehicle meets certain eligibility criteria—age, value, and a lack of alternatives for obtaining traditional ownership proofs. A notable aspect is the imposition of a 6% use tax based on the item's appraisal value or purchase price, aligning with Michigan's Sales and Use Tax Act. Completing and submitting this form, along with necessary appraisals for vehicles, to a Secretary of State office initiates a process filled with checks and validations, safeguarding against the registration of stolen items, and ultimately facilitating the legal use of these vehicles or watercraft in Michigan.

Preview - Michigan Tr 205 Form

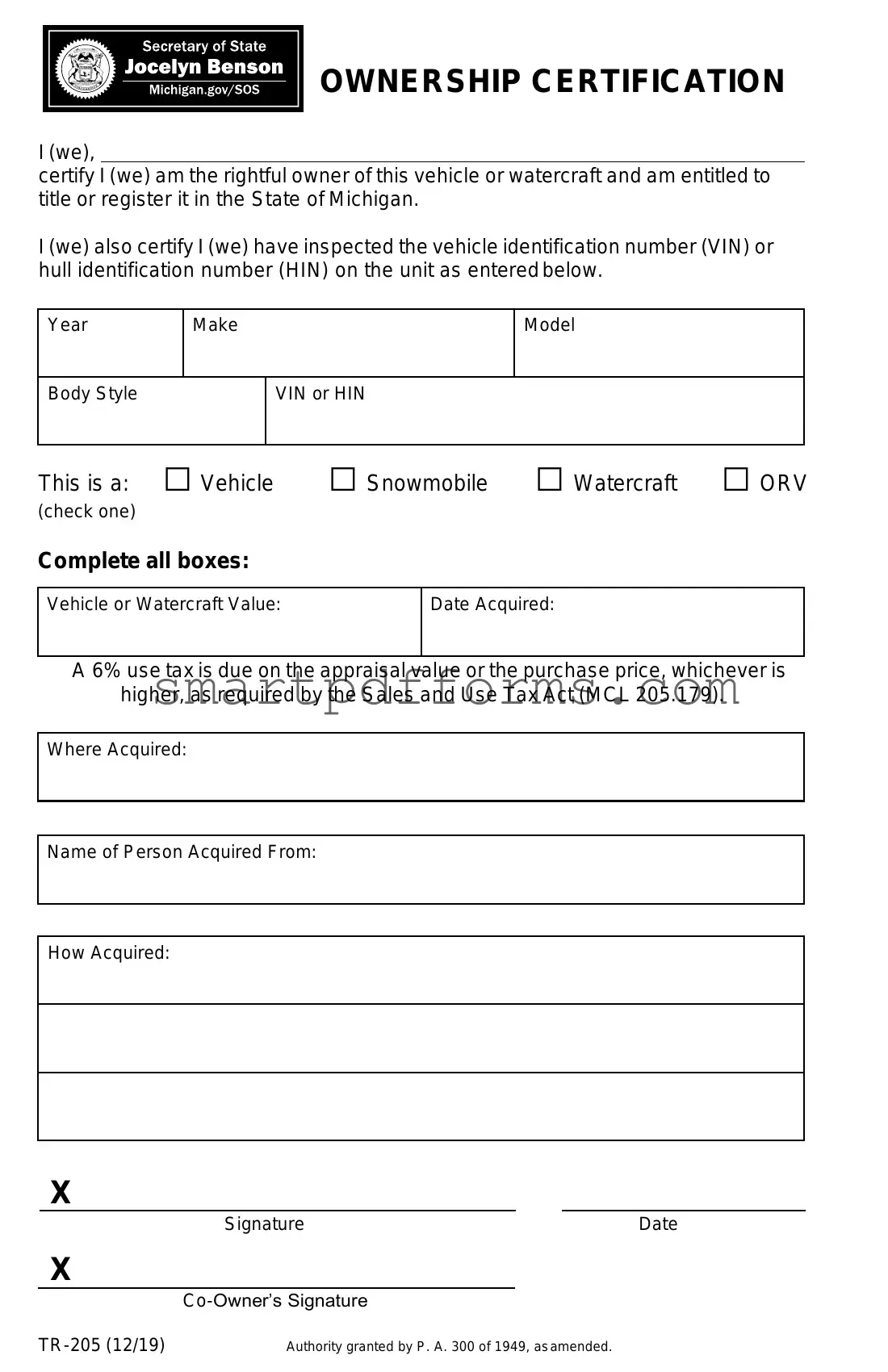

OWNERSHIP CERTIFICATION

I (we),

certify I (we) am the rightful owner of this vehicle or watercraft and am entitled to title or register it in the State of Michigan.

I (we) also certify I (we) have inspected the vehicle identification number (VIN) or hull identification number (HIN) on the unit as entered below.

Year

Make

Model

Body Style

VIN or HIN

This is a: □ Vehicle |

□ Snowmobile □ Watercraft □ ORV |

(check one) |

|

Complete all boxes: |

|

Vehicle or Watercraft Value:

Date Acquired:

A6% use tax is due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act (MCL 205.179).

Where Acquired:

Name of Person Acquired From:

How Acquired:

X

SignatureDate

X

|

|

Authority granted by P. A. 300 of 1949, as amended. |

Ownership Certification Instructions

Use of this form is limited as a last resort when a:

(a)Vehicle title, watercraft title or ORV title has been lost, destroyed, or stolen and the purchaser is unable to contact the previous owner for a duplicate title, or

(b)Snowmobile,

1.Eligibility for using this procedure:

●The vehicle must be 10 or more years old (6 or more years old for ORVs).

●The value of the vehicle can’t exceed $2,500 ($1,500 for ORVs).

●Can’t be used with mobile homes.

●Can’t be used for vehicles acquired out of state. The

●Can’t be used unless the applicant has exhausted all possibilities of contacting the titled or registered owner on record.

If the vehicle doesn’t meet the above criteria and you can’t obtain an assigned ownership document from the previous owner, a surety bond must be purchased.

2.For vehicles, applicants must submit a vehicle appraisal showing the value is $2,500 or less. This appraisal may be:

a)An appraisal completed by a licensed Michigan dealer, or

b)A page printed from an online appraisal service such as Kelly Blue Book, N.A.D.A. Guides, Edmunds etc. (kbb.com, nadaguides.com, edmunds.com)

An appraisal is not required for watercraft, snowmobiles, ORVs, and mopeds.

3.Complete the Ownership Certification (form

4.Submit the Ownership Certification and appraisal (for vehicles) at a Secretary of State office. Office staff will check national databases to ensure the vehicle is not reported stolen or titled in another state.

5.A 6% use tax is due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act (MCL 205.179).

6.A registration may be purchased as part of your transaction. For vehicles, proof of Michigan

Form Data

| Fact Number | Description |

|---|---|

| 1 | The TR-205 form is used for certifying ownership of a vehicle, watercraft, snowmobile, or ORV in Michigan when the original title or registration is not available. |

| 2 | This form serves as a last resort for proving ownership when the title or registration has been lost, destroyed, stolen, or when the original owner cannot be contacted for a duplicate. |

| 3 | Vehicles eligible for this procedure must be 10 or more years old, and ORVs must be 6 or more years old. Additionally, the vehicle’s value must not exceed $2,500, and for ORVs, the limit is $1,500. |

| 4 | Usage of form TR-205 is restricted for mobile homes, vehicles acquired out of state, or when the potential applicant hasn't tried all possibilities to contact the titled or registered owner on record. |

| 5 | For vehicles, an appraisal indicating a value of $2,500 or less must be submitted. This appraisal can come from a licensed Michigan dealer or an online service like Kelly Blue Book or Edmunds. |

| 6 | The form and, if applicable, the vehicle appraisal must be submitted at a Secretary of State office in Michigan. There, the vehicle will be checked against national databases to ensure it's not reported stolen or titled in another state. |

| 7 | A 6% use tax on the appraisal value or the purchase price (whichever is higher) is required under the Sales and Use Tax Act (MCL 205.179). For vehicles, proof of Michigan no-fault insurance must also be presented. |

Instructions on Utilizing Michigan Tr 205

Completing the Michigan TR-205 form is an important step for individuals who find themselves in the specific situation of needing to certify ownership for a vehicle, watercraft, snowmobile, or ORV (Off-road vehicle) under certain circumstances. This document facilitates the process of establishing rightful ownership when the original title has been lost, destroyed, or stolen, and direct contact with the previous owner for a duplicate is not achievable. It's a valuable tool for ensuring your vehicle can be legally titled and registered in the state of Michigan. The following steps will guide you through how to properly fill out the form and proceed with the subsequent requirements.

- Review the Ownership Certification Instructions to determine your eligibility. If your situation doesn't align with these criteria, alternative documentation may be necessary.

- Determine the age of the vehicle and confirm that it is 10 years or older (6 or more years for ORVs) and that its value does not exceed the stipulated maximum (i.e., $2,500 for vehicles, $1,500 for ORVs).

- If you are certifying ownership for a vehicle that requires an appraisal, obtain one that verifies its value is $2,500 or less. You may use an appraisal conducted by a licensed Michigan dealer or a printed appraisal from an online source such as Kelly Blue Book, N.A.D.A. Guides, or Edmunds.

- Accurately complete all sections of the Ownership Certification (form TR-205) making sure to include:

- Your name(s) as the current owner(s), thereby asserting your ownership.

- Year, make, model, body style, and VIN (Vehicle Identification Number) or HIN (Hull Identification Number), clearly indicating the type of vehicle (Vehicle, Snowmobile, Watercraft, ORV).

- The vehicle or watercraft value, date acquired, location where it was acquired, name of the person it was acquired from, and how it was acquired.

- Select the appropriate box to indicate the type of vehicle you are certifying.

- Proceed to calculate and be prepared to cover the 6% use tax owed on the appraisal value or the purchase price of the vehicle, whichever is higher, in compliance with the Sales and Use Tax Act.

- Sign and date the form, ensuring if there is a co-owner, they do the same.

- Submit the completed TR-205 form alongside the vehicle appraisal, if applicable, to a Secretary of State office. Ensure to present proof of no-fault insurance for vehicles at this time.

After submission, the Secretary of State office will perform necessary checks, including ensuring the vehicle is not reported stolen or titled in another state. On successful verification, this process will aid in advancing towards legally titling and registering your vehicle or watercraft in Michigan. Remember, this certification serves as a last-resort measure and requires thorough validation to protect all parties involved. It's designed to be a helpful step in rectifying a difficult situation concerning vehicle ownership.

Obtain Answers on Michigan Tr 205

What is the purpose of the Michigan TR-205 form?

The TR-205 form, also known as the Ownership Certification form, is used in Michigan as a last-resort measure to claim ownership of a vehicle, watercraft, snowmobile, or ORV (Off-Road Vehicle) when the title has been lost, destroyed, or stolen, and the previous owner cannot be contacted for a duplicate title. Additionally, it serves for cases where snowmobile, non-titled watercraft, or moped registration is lost, and the owner on record cannot be contacted for an assigned registration or bill of sale.

Who is eligible to use the TR-205 form?

Eligibility to use this form is limited to situations where the vehicle in question is 10 or more years old (6 or more years old for ORVs), has a value of $2,500 or less ($1,500 for ORVs), and was acquired in Michigan (out-of-state acquisitions require the out-of-state title). It also stipulates that all other possibilities to contact the titled or registered owner on record must have been exhausted.

Can the TR-205 form be used for mobile homes?

No, the TR-205 form cannot be used for mobile homes. The form's guidelines specifically exclude the use for mobile homes, focusing solely on vehicles, watercraft, snowmobiles, and ORVs.

Is an appraisal required to complete the TR-205 form?

An appraisal is required for vehicles to ensure the value is $2,500 or less and must be submitted with the TR-205 form at a Secretary of State office. This appraisal can be completed by a licensed Michigan dealer or sourced from an online appraisal service like Kelly Blue Book or N.A.D.A. Guides. However, an appraisal is not required for watercraft, snowmobiles, ORVs, and mopeds.

What if my vehicle was acquired from out of state?

If the vehicle was acquired from out of state, the TR-205 form cannot be used. In such cases, the original out-of-state title is required to proceed with claiming ownership and registering the vehicle in Michigan.

What needs to be submitted along with the TR-205 form?

- A vehicle appraisal (for vehicles) showing the value is $2,500 or less, not required for watercraft, snowmobiles, ORVs, and mopeds.

- The completed Ownership Certification on the reverse side of the TR-205 form.

These documents need to be submitted at a Secretary of State office. The office will then check national databases to ensure the vehicle is not reported stolen or titled in another state.

What happens after submitting the TR-205 form?

After submitting the TR-205 form along with any required documentation, the Secretary of State office will check national databases for any reports of the vehicle being stolen or already titled in another state. If the vehicle clears these checks, the applicant can proceed with the registration or titling process in Michigan.

Is there a use tax due when using the TR-205 form?

Yes, a 6% use tax is due on the appraisal value or the purchase price, whichever is higher, as mandated by the Sales and Use Tax Act (MCL 205.179). This tax is part of the ownership certification process.

Can I register my vehicle when submitting the TR-205 form?

Yes, you can purchase a registration as part of your transaction when submitting the TR-205 form. However, keep in mind that for vehicles, proof of Michigan no-fault insurance is required to complete the registration.

What should I do if I can't obtain an assigned ownership document from the previous owner?

If the vehicle does not meet the criteria for using the TR-205 form and you are unable to obtain an assigned ownership document from the previous owner, you may need to purchase a surety bond. The surety bond serves as a guarantee to the state that the information provided about the vehicle's ownership is accurate.

Common mistakes

Not verifying the eligibility of the vehicle, snowmobile, ORV, or watercraft for use with the TR-205 form. This mistake can occur because individuals may overlook the specific conditions under which this form applies. For instance, the form is only applicable if the vehicle is 10 or more years old for vehicles (6 or more years old for ORVs) and has a value not exceeding $2,500 ($1,500 for ORVs). Additionally, it cannot be used for mobile homes, vehicles acquired out of state, or when the applicant has not exhausted all possibilities of contacting the titled or registered owner on record. Failing to meet these conditions but proceeding to fill out the form regardless results in the rejection of the application.

Incorrectly filling in the Vehicle Identification Number (VIN) or Hull Identification Number (HIN), and the make/model/year details. These entries are crucial for the identification and registration of the vehicle. Mistakes in these details can lead to significant delays and complications in the process, as these numbers must match national databases for checks against theft or prior registration in another state. Inaccuracy in these fields undermines the ownership certification's validity.

Failing to submit the required appraisal for vehicles. This form necessitates an appraisal showing that the vehicle's value is $2,500 or less. An eligible appraisal can be obtained from a licensed Michigan dealer or printed from an online appraisal service such as Kelly Blue Book, N.A.D.A. Guides, or Edmunds with any of these values showing the vehicle is worth $2,500 or less being acceptable. Overlooking this requirement, or submitting an appraisal that does not meet these criteria, can lead to the denial of the form's processing.

Not calculating and including the due 6% use tax on the higher value between the appraisal value and the purchase price, as mandated by the Sales and Use Tax Act. Many people miss calculating this tax or misunderstand which value to base the calculation on, potentially leading to underpayment, overpayment, or the omission of the tax payment altogether. This mistake can cause processing delays or financial discrepancies that might complicate the ownership certification process.

Always double-check eligibility requirements before filling out the form to ensure the vehicle or watercraft qualifies.

Ensure that all details, including VIN or HIN and vehicle or watercraft valuation, are accurately documented to avoid rejections.

Secure a legitimate appraisal for vehicles to confirm that they meet the stipulated value criteria.

Correctly calculate and report the 6% use tax based on the correct value to comply fully with the requirements.

Documents used along the form

In the realm of vehicle and watercraft ownership in Michigan, the TR-205 form represents a critical document, especially in cases where the original title is no longer available due to it being lost, destroyed, or stolen. It serves as a testament to rightful ownership and a bridge to registration within the state, underlining the importance of accompanying documentation in substantiating the claims and details provided therein. This necessity is not just procedural but a safeguard for both the state and its citizens against fraud and theft.

- Proof of Insurance: For vehicles, valid proof of Michigan no-fault insurance is mandatory. This document verifies that the vehicle is insured under Michigan law, protecting the owner and others in case of an accident.

- Appraisal Report: For vehicles over ten years old and worth $2,500 or less, an appraisal report from a licensed Michigan dealer or an online appraisal service (such as Kelly Blue Book or Edmunds) establishes the vehicle's value. This report influences the sales tax liability and verifies eligibility under the TR-205 criteria.

- Bill of Sale: While not always mandatory, a bill of sale provides proof of the transaction between the seller and the buyer. It outlines the sale's specifics, including date, price, and parties involved, offering an extra layer of validity to the ownership claim.

- Proof of Identity: Identification is required to match the person claiming ownership with the name that will appear on the new title. It ensures that the individual completing the TR-205 form is authorized to register the vehicle or watercraft in their name.

- Previous Registration Documents: If available, previous registration documents help establish a history of ownership and can assist in the swift processing of the TR-205 form. Though not always obtainable, they add credibility to the ownership claim.

- Police Report: In cases where the title was lost due to theft, a police report substantiates the claim and assists in the process of creating a new title. It acts as an official record of the incident and aids in preventing fraudulent claims.

Together with the TR-205 form, these documents create a comprehensive dossier that supports the request for a new title or registration in the absence of the original title. Each document plays a pivotal role in establishing ownership, confirming the vehicle's value, and ensuring compliance with Michigan's legal requirements. As such, the process underscores the intricate balance between regulatory diligence and facilitation of rightful ownership, reflective of the state's commitment to both order and service.

Similar forms

The Application for Certificate of Title with/without Registration (Form HSMV 82040) from Florida shares similarities with the Michigan TR-205, as it serves for certifying ownership in the event of acquiring a vehicle. Both require the identification of the vehicle, including the year, make, model, and VIN (Vehicle Identification Number) or HIN (Hull Identification Number), and include declarations of ownership.

Affidavit of Motor Vehicle Gift Transfer (Texas Form 14-317) although specific to gifts, is similar because it necessitates the declaration of vehicle details and proof of rightful ownership, akin to the certification process in Michigan's TR-205 form.

The California REG 227 (Application for Duplicate or Paperless Title) serves a dual role similar to TR-205, in certifying ownership while also functioning as an application for a duplicate title when the original is unavailable, lost, or destroyed.

Statement of Transaction — Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile (Form DTF-802) from New York requires detailed information about the transaction similar to Michigan’s TR-205, which includes the vehicle's value and the nature of how it was acquired.

Vehicle Registration/Title Application (Form MV-82) in New York is akin to TR-205 as it is utilized in the registration and title process, demanding comprehensive vehicle identification, similar to the Michigan form's requirement for VIN or HIN identification.

The Vehicle/Vessel Bill of Sale (Form TD-420-065) in Washington State is comparable because it includes declarations regarding the vehicle's or vessel's sale, its value, and the details of the transaction, paralleling the function of TR-205 in documenting transactions.

Vehicle Title Application (Form 735-226) in Oregon closely matches Michigan's TR-205 by necessitating owner certification and details about the vehicle for title and registration purposes, including VIN or HIN and acquisition information.

The Application for Vehicle Transaction(s) (VSD 190) in Illinois offers a broad scope similar to TR-205, accommodating various transactions related to vehicle ownership, including title replacement, where ownership must be certified, and vehicle details provided.

Dos and Don'ts

Filling out the Michigan TR-205 form is a critical step for those who need to certify ownership of a vehicle, watercraft, snowmobile, or ORV (Off-Road Vehicle) under specific circumstances. Here are essential do's and don'ts to consider:

- Do ensure the vehicle, snowmobile, watercraft, or ORV is eligible for this process. Verify that it meets the age and value requirements as stated in the form instructions.

- Do not attempt to use this form for mobile homes or for vehicles acquired out of state. The TR-205 form is not applicable in these cases.

- Do provide a detailed inspection of the vehicle identification number (VIN) or hull identification number (HIN) as required, ensuring accuracy in the identification process.

- Do not leave any boxes incomplete. Every section of the form, including the vehicle or watercraft value, date acquired, and how it was acquired, should be filled out comprehensively.

- Do obtain an appraisal if it's a vehicle you're claiming ownership of. Make sure the appraisal confirms the vehicle's value at $2,500 or less, from either a licensed Michigan dealer or an online appraisal service.

- Do not guess or estimate the value of the vehicle, snowmobile, watercraft, or ORV. Use official sources or appraisals to determine the correct value.

- Do submit the Ownership Certification and, for vehicles, the appraisal at a Secretary of State office. Their staff will conduct necessary checks, including if the vehicle is reported stolen or titled in another state.

- Do not forget about the 6% use tax due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act. This is an essential step in the ownership certification process.

- Do ensure you have proof of Michigan no-fault insurance when registering vehicles. This is a mandatory requirement that cannot be overlooked.

Adhering to these directives will help facilitate a smoother process in fulfilling the Michigan TR-205 form requirements, ensuring all legal and regulatory standards are met with precision.

Misconceptions

There are several misconceptions surrounding the Michigan TR-205 form, which is crucial for those seeking to establish ownership of certain vehicles or watercrafts in specific situations. Understanding these misconceptions can help in navigating through the process more smoothly.

- Misconception 1: The TR-205 form can be used for any vehicle or watercraft. In reality, the TR-205 form is only applicable under specific conditions, such as when a title for a vehicle, watercraft, or ORV has been lost, destroyed, or stolen, and contact with the previous owner is not possible. Additionally, certain restrictions apply based on the age and value of the vehicle or ORV.

- Misconception 2: There is no value limit for vehicles when using the TR-205 form. Contrary to this assumption, the vehicle must not exceed a value of $2,500, and for ORVs, the limit is $1,500. This value determination is critical to the eligibility for using the form.

- Misconception 3: The TR-205 form applies to all types of property, including mobile homes. This form cannot be used for mobile homes, emphasizing its specific application to vehicles, snowmobiles, watercraft, and ORVs.

- Misconception 4: Out-of-state vehicles can be easily transferred using the TR-205 form. This is not the case, as the form cannot be used for vehicles acquired out of state. For these vehicles, the out-of-state title is required to proceed with the transfer.

- Misconception 5: Appraisals are necessary for all items when utilizing the TR-205. While vehicles require an appraisal to prove their value does not exceed $2,500, watercraft, snowmobiles, ORVs, and mopeds do not require an appraisal for the process.

- Misconception 6: The use of the TR-205 form ensures immediate ownership transfer. Completing and submitting the TR-205 form is part of the process, but the Secretary of State office must verify that the vehicle is not reported stolen or titled in another state. Furthermore, for vehicles, proof of Michigan no-fault insurance is necessary. This process ensures that all transfers are legitimate and comply with Michigan laws.

Clearing up these misconceptions about the Michigan TR-205 form helps individuals understand the specific conditions under which this form can be used. By knowing the limitations and requirements, applicants can better prepare their documents and navigate the ownership certification process.

Key takeaways

Filling out and using the Michigan TR-205 form is a process designed for specific situations where obtaining a standard ownership document for a vehicle, watercraft, snowmobile, or off-road vehicle (ORV) is not feasible. Understanding the key elements of this process can help individuals navigate these situations more effectively. Here are six key takeaways about the TR-205 form and its use:

- The TR-205 form acts as a certification of ownership and is typically utilized in scenarios where the original title or registration is lost, destroyed, stolen, or otherwise unavailable, and the prior owner cannot be contacted for a duplicate.

- Eligibility to use this form is restricted by several criteria, including the age and value of the vehicle. Specifically, the vehicle must be at least 10 years old (6 years for ORVs), with a value not exceeding $2,500 ($1,500 for ORVs). The form cannot be used for mobile homes, vehicles acquired out of state, or if there is any possibility to contact the previous owner for the necessary documentation.

- For vehicles, an appraisal is required to confirm that their value is $2,500 or less. This appraisal can be conducted by a licensed Michigan dealer or derived from recognized online appraisal services such as Kelly Blue Book, N.A.D.A. Guides, or Edmunds. It's important to note that no appraisal is necessary for watercraft, snowmobiles, ORVs, and mopeds.

- The process involves completing the Ownership Certification on the TR-205 form and submitting it alongside the vehicle appraisal (if required) to a Secretary of State office. This submission is crucial for the next steps in the ownership certification process.

- A mandatory 6% use tax, as dictated by the Sales and Use Tax Act (MCL 205.179), is applied to either the appraisal value or the purchase price of the vehicle, depending on which is higher. This tax must be paid as part of the process of obtaining ownership certification.

- Finally, the completion of the TR-205 form and payment of the use tax may allow for the purchase of registration as part of the transaction. For vehicles, this step requires presenting proof of Michigan no-fault insurance.

Understanding these key takeaways can help individuals navigate the process of certifying ownership of a vehicle or other specified units in Michigan under circumstances where standard documentation is not available. It's a structured but flexible process designed to ensure legal ownership can be established and verified.

Popular PDF Forms

C 159B - The mandatory fields requirement ensures that all essential information is submitted for the dissolution process to proceed smoothly.

Retired Annuitant - Applicants choosing the Unmodified Allowance Option are reminded of the implications regarding survivor benefits and the lack of a monthly benefit upon the member's death, except under specific circumstances.

Lic301e - Completion of this form is a testament to the seriousness with which California approaches the vetting process for those entering the community care workforce.