Blank Missouri PDF Template

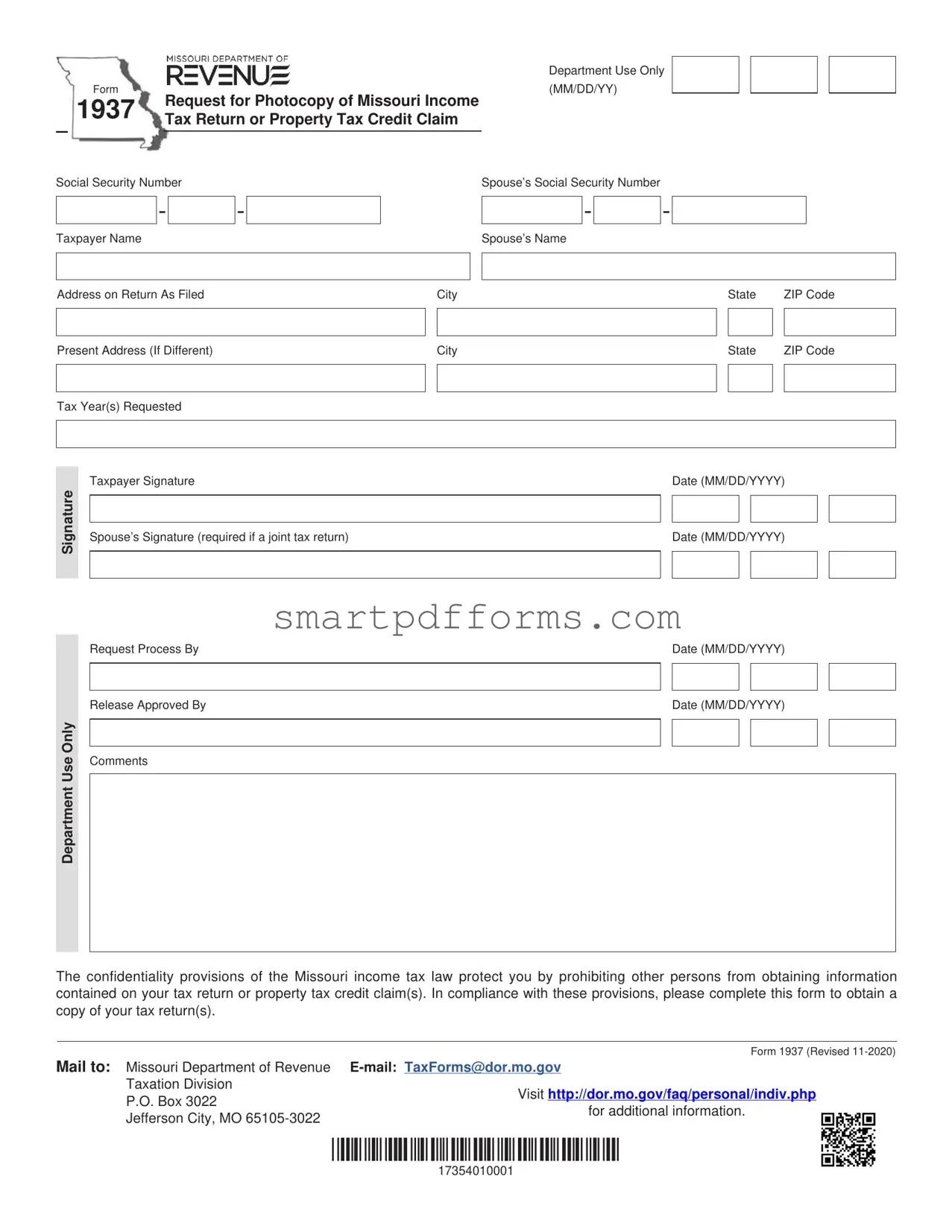

In navigating the complexities of tax documentation, the Missouri form for the "Request for Photocopy of Missouri Income Tax Return or Property Tax Credit Claim" emerges as a crucial document for those seeking copies of their tax records. By design, this form is tailored for individuals who need access to their Missouri income tax return or property tax credit claim for any given year. Whether it's for personal record-keeping, legal necessities, or financial planning purposes, completing this form is the first step toward obtaining those vital documents. The form requires detail such as the taxpayer's name, social security number, address at the time of filing, present address if changed, and the specific tax year(s) for which copies are requested. Importantly, for joint returns, the spouse's signature is also a requisite, ensuring both parties consent to access shared tax information. A standout feature of this procedure is its strict adherence to the confidentiality provisions of the Missouri income tax law, which safeguards the privacy of taxpayers by limiting access to sensitive information. This form, revised in November 2020 and accessible through the Missouri Department of Revenue, underscores the state's commitment to protecting taxpayer data while facilitating easy access to one's own financial history. With options to submit requests via mail or email, the state ensures that obtaining these documents is as convenient as possible for residents, thereby promoting compliance and awareness among its taxpayers.

Preview - Missouri Form

|

|

|

Department Use Only |

|

Form |

Request for Photocopy of Missouri Income |

(MM/DD/YY) |

1937 |

|

||

Tax Return or Property Tax Credit Claim |

|

||

|

|

|

|

|

|

|

|

Social Security Number |

Spouse’s Social Security Number |

||

|

- |

|

- |

|

Taxpayer Name

Address on Return As Filed

Present Address (If Different)

Tax Year(s) Requested

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

Spouse’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP Code |

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

Department Use Only

Taxpayer Signature

Spouse’s Signature (required if a joint tax return)

Request Process By

Release Approved By

Comments

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

The confidentiality provisions of the Missouri income tax law protect you by prohibiting other persons from obtaining information contained on your tax return or property tax credit claim(s). In compliance with these provisions, please complete this form to obtain a copy of your tax return(s).

Form 1937 (Revised

Mail to: Missouri Department of Revenue

Taxation Division |

Visit http://dor.mo.gov/faq/personal/indiv.php |

|

P.O. Box 3022 |

||

for additional information. |

||

Jefferson City, MO |

||

|

*17354010001*

17354010001

Form Data

| Fact Name | Description |

|---|---|

| Form Number and Title | Form 1937 - Request for Photocopy of Missouri Income Tax Return or Property Tax Credit Claim |

| Key Contents | The form requires details such as Social Security Number(s), taxpayer name, address, tax year(s) requested, and signatures. |

| Governing Law | Missouri income tax law, which includes confidentiality provisions that protect the taxpayer's information. |

| Contact Information | Mail to: Missouri Department of Revenue, E-mail: TaxForms@dor.mo.gov, Visit http://dor.mo.gov/faq/personal/indiv.php for more details. |

Instructions on Utilizing Missouri

Filling out the Missouri form for a request to obtain a photocopy of your income tax return or property tax credit claim is a straightforward process. It's designed to protect your information while making it accessible to you when you need it. Once completed, this form will help you access valuable documents that may be necessary for various personal, professional, or financial reasons. Here's how to fill it out:

- Start by writing the date in the top section marked "Department Use Only" where it requests the Form Request for Photocopy date (MM/DD/YY).

- Enter your Social Security Number in the designated space.

- If you filed a joint tax return, include your spouse’s Social Security Number.

- Write your full Taxpayer Name as it appeared on the return.

- Fill in the Address on Return as Filed, including City, State, and ZIP Code.

- If your current address differs from the one on your return, provide your Present Address, including City, State, and ZIP Code.

- Specify the Tax Year(s) Requested for which you need a photocopy.

- If you filed jointly, include your Spouse’s Name.

- Sign the form under "Taxpayer Signature".

- Your spouse must also sign under "Spouse’s Signature" if a joint tax return was filed.

- Review all the information to ensure accuracy and completeness.

After you have filled out the form, mail it to the Missouri Department of Revenue at the address provided. You can also reach out via email if you have any questions or need further assistance. This process ensures that your request is processed efficiently, safeguarding your personal information according to Missouri law.

Obtain Answers on Missouri

Frequently Asked Questions about Requesting a Photocopy of Missouri Income Tax Return or Property Tax Credit Claim (Form 1937)

- How can I request a photocopy of my Missouri income tax return or property tax credit claim?

To request a photocopy, you need to fill out Form 1937. Include your social security number, your spouse’s social security number if filing jointly, both of your names, the address on the return as filed, and your current address if different. Specify the tax year(s) for which you are requesting copies. Both you and your spouse (if applicable) must sign the form. Finally, mail the completed form to the Missouri Department of Revenue or contact them via the provided email address for further guidance.

- Where should I send the completed Form 1937?

The completed form should be mailed to the Missouri Department of Revenue, Taxation Division, at P.O. Box 3022, Jefferson City, MO 65105-3022. Alternatively, for further instructions or assistance, you can email TaxForms@dor.mo.gov.

- Is my information kept confidential when requesting a photocopy of my tax return or property tax credit claim?

Yes, the confidentiality of your information is protected by Missouri income tax law, which prohibits unauthorized access to the information contained on your tax return or property tax credit claim. Rest assured, the Missouri Department of Revenue takes your privacy seriously and complies with these confidentiality provisions to ensure the security of your personal information.

- What if I need a copy of my tax return for multiple years?

If you need copies of your tax returns or property tax credit claims for multiple years, you can specify this on Form 1937. There is space provided to list the specific tax year(s) you are requesting. Make sure to fill out this section accurately to ensure you receive all the necessary documents for your records.

Common mistakes

When filling out the Missouri Form 1937 for a request for a photocopy of income tax return or property tax credit claim, individuals often overlook details or make errors that can delay the processing of their request. Below are 10 common mistakes to watch for:

- Not including the complete Social Security Number (SSN) or accidentally reversing digits. This is crucial for identifying your records.

- Omitting the Spouse’s Social Security Number on a joint tax return, which is necessary for verification purposes.

- Failing to provide the Tax Year(s) Requested. Specifying the correct year(s) is vital for locating the exact return.

- Entering an incorrect Address on Return As Filed. The address needs to match what was previously submitted to ensure the correct documents are retrieved.

- Forgetting to update the Present Address if it’s different from the one filed. This ensures the photocopy is mailed to the right location.

- Not including the Taxpayer Name clearly, leading to potential confusion or mismatch during processing.

- Leaving the Spouse’s Name blank on joint returns, which is required for proper identification and processing.

- Neglecting to sign the form. A Taxpayer Signature is mandatory, and if filing jointly, the Spouse’s Signature is also required.

- Incorrectly entering the Date(s) (MM/DD/YYYY), either by providing an incomplete date, using the wrong format, or entering an unrealistic date (e.g., a future date for a past tax year).

- Not utilizing the correct contact information or method to submit the form. Confirm the mailing address, email, or website is current and accurate as provided.

Understanding and avoiding these mistakes can significantly smoothen the process of obtaining a photocopy of your tax return or property tax credit claim in Missouri.

Documents used along the form

When dealing with tax and property matters in Missouri, individuals might find themselves in need of various documents in addition to the Request for Photocopy of Missouri Income Tax Return or Property Tax Credit Claim. These documents play pivotal roles in ensuring compliance, securing rights, and maintaining an accurate record of one’s financial and property-related transactions. Below is a description of up to four other forms and documents commonly used in conjunction with the Missouri form.

- Power of Attorney for Tax Purposes - This document authorizes another person, often a tax professional, to handle tax matters on behalf of an individual. It grants the representative the authority to communicate with the Missouri Department of Revenue, make decisions about tax filings, and perform actions such as requesting photocopies of tax returns.

- Missouri Individual Income Tax Return (Form MO-1040) - As the primary document for filing an income tax return in Missouri, this form details an individual's income, calculates the tax due, and determines any refund or balance owed. It forms the basis for any subsequent requests for photocopies of the tax return.

- Property Tax Credit Claim (Form MO-PTC) - Specifically designed for eligible seniors and fully disabled individuals, this form allows them to claim a credit against the property taxes they have paid on their homestead. Those requesting photocopies of their property tax credit claims often file this form annually.

- Amendment Form for Missouri Tax Return (Form MO-1040A) - If errors are noted after the initial tax return is filed, or if there's a need to make adjustments to income, credits, or deductions, individuals use this form to amend their previously filed Missouri tax return. It may often accompany a photocopied tax return when adjustments are revealed.

Navigating tax-related processes involves carefully understanding and managing several forms and documents to ensure accuracy and compliance. Whether amending a tax return, authorizing a representative, claiming a tax credit, or simply keeping personal records up to date, each form serves a distinct but interconnected purpose in an individual’s financial and legal standing within Missouri.

Similar forms

The IRS Form 4506, Request for Copy of Tax Return, is similar because it allows taxpayers to request a copy of previously filed tax returns from the federal government. Both forms serve the purpose of providing individuals with documentation of their tax filings, which may be needed for loan applications, legal matters, or personal records.

The California Form 3516, Request for Copy of Tax Return, mirrors the Missouri form by enabling taxpayers in California to obtain copies of their state income tax returns. Both documents require taxpayers to provide personal information, including Social Security numbers, to authenticate their identity.

New York Form IT-201-V, Payment Voucher for Income Tax Returns, although primarily used for payment, shares the necessity for taxpayers to provide detailed personal and tax year information, similar to the Missouri form's requirements for identifying the correct tax return.

The Form I-90, Application to Replace Permanent Resident Card, while not tax-related, similarly requires applicants to provide extensive personal details and history, drawing parallels to the documentation and verification processes seen in the Missouri tax form.

The Form W-2, Wage and Tax Statement, indirectly connects with the Missouri form because it is often necessary for filing income tax returns. It requires employers to report wages, taxes withheld, and other financial information, echoing the latter's function of reporting and verifying tax information.

Form SS-4, Application for Employer Identification Number, is similar in its function of gathering detailed information for tax-related purposes, although it focuses on businesses instead of individuals. The meticulous requirement for accurate data mirrors the Missouri form's approach to tax record handling.

The Bank Loan Application Form often requires applicants to submit copies of tax returns as part of the creditworthiness assessment process, linking its use to the Missouri form’s role in providing necessary documentation for financial and legal undertakings.

Form 1040, U.S. Individual Income Tax Return, is directly related as it represents the document individuals are seeking copies of for prior years through the Missouri request form. Both forms are integral to the tax filing and documentation process.

The Homestead Exemption Application, used in various states, requires homeowners to submit tax return information to qualify for property tax relief, showing a functional similarity to the Missouri form by necessitating tax documentation for a specific benefit.

Voter Registration Forms, while not financial documents, similarly require personal information and verification for a legal process, showcasing the broad necessity of accurately maintaining and providing personal data for official matters.

Dos and Don'ts

Filling out forms, especially those related to taxes, requires careful attention to detail to ensure accuracy and compliance with regulations. When completing the Missouri form for requesting a photocopy of an income tax return or property tax credit claim, there are several practices one should follow to ensure the process goes smoothly. Here are some tips on what you should and shouldn't do:

What You Should Do:- Double-check all personal information: Make sure the Social Security numbers, taxpayer name, spouse’s name (if applicable), and addresses are correctly entered. This includes the address as filed and the present address if it is different.

- Specify the tax year(s) requested clearly: Indicate the specific year or years for which you are requesting a photocopy to avoid any confusion or delays.

- Sign the form: Ensure that both the taxpayer and spouse (in case of a joint tax return) sign the form. Unsigned forms may not be processed.

- Use the correct form version: The form mentioned is revised as of November 2020. Make sure you are using the most recent version according to the date of mailing or submitting the form to ensure compliance with current requirements.

- Keep a copy for your records: Before sending the form, make a copy for your personal files. This could be useful for future reference or in case of disputes.

- Send it to the correct address or email: Double-check the mailing address or email provided in the instructions to avoid sending your sensitive information to the wrong place.

- Review the confidentiality provisions: Understand your rights and the protections provided under Missouri income tax law regarding the confidentiality of your tax return information.

- Ignore the form's specific fields: Skipping sections or fields can lead to incomplete submissions, which may delay or void your request.

- Use pencil or non-permanent ink: Always fill out the form in pen to ensure that the information cannot be easily altered or erased.

- Make guesses on dates or figures: If you are unsure about specific details, such as the tax year(s) requested, take the time to verify this information to prevent errors.

- Forget to include necessary documentation: If any additional documents are required, make sure they are included with your form submission.

- Provide inaccurate information: Entering incorrect details, especially concerning Social Security numbers and tax years, can lead to processing delays and issues with your request.

- Send your form without checking for updates on submission methods: Always verify if there are new or preferred submission methods by visiting the provided website or contacting the department directly.

- Disregard the importance of signing the form: An unsigned form is often considered invalid, so make certain that all required signatures are present.

Misconceptions

When dealing with the Missouri Form for requesting a photocopy of income tax returns or property tax credit claims, some misconceptions can arise due to the specialized nature of the document. Here's a breakdown to clear up some common points of confusion:

- Misconception 1: Anyone can request a copy of your tax return.

In reality, the confidentiality provisions in Missouri's income tax law ensure that your tax information is protected. Only authorized individuals, including yourself, can request a copy of your tax return or property tax credit claim.

- Misconception 2: The form is complicated to fill out.

Although it may appear daunting at first glance, the form is straightforward. It simply requires your basic information, such as Social Security numbers, name, addresses, and the tax year(s) for which you’re requesting copies.

- Misconception 3: You need to provide a reason for your request.

The form does not require you to explain why you need a copy of your tax return or property tax credit claim. You only need to fill out the necessary fields and comply with the instructions.

- Misconception 4: You can only submit the form via mail.

While mailing the form is an option, you also have the flexibility to email it to the address provided on the form. This can expedite the process in some cases.

- Misconception 5: It’s an instant process.

Obtaining a copy of your tax return or property tax credit claim requires processing time. While the department works efficiently, it's important to account for processing and mailing times, especially during peak periods.

- Misconception 6: There’s a fee involved.

There’s no mention of a fee for requesting a photocopy of your tax documents on the form. This service is provided without any charge stated, reflecting the department's commitment to accessibility.

- Misconception 7: Digital copies are immediately available.

The form does not specify if digital copies are provided. Typically, a physical copy is mailed to the address you specify, unless digital provision is specifically requested and available.

- Misconception 8: You don’t need to sign the form.

Your signature is mandatory for the request to be processed, to ensure authorization and protect against unauthorized access. If filing jointly, both spouses must sign.

- Misconception 9: Any year's tax return can be requested.

While the form allows you to request tax returns from various years, there may be limitations on how far back the department can provide documents. It's essential to verify with the department if seeking returns from many years ago.

Understanding the straightforward nature of this request form and the protections in place to safeguard your personal information can make the process of obtaining your tax documents less intimidating and more efficient.

Key takeaways

When you need a copy of your Missouri Income Tax Return or Property Tax Credit Claim, the Missouri Form 1937 is the document you're required to fill out. Here are key takeaways about completing and using this form:

- Correct Information: Start by ensuring all the data you provide, such as Social Security numbers, taxpayer names, and addresses (both as filed and present, if different), are accurate to prevent any processing delays.

- Tax Year(s) Requested: Clearly indicate the tax year(s) for which you're requesting copies. This helps in locating your documents more quickly.

- Signatures: If you filed jointly, both you and your spouse must sign the form. This requirement is in place to safeguard your privacy and ensure both parties consent to the release of the information.

- Confidentiality: Your tax return and property tax credit claim information are protected under Missouri income tax law. Unauthorized persons are prohibited from accessing your information, meaning your privacy is respected and upheld.

- Submission Options: You have multiple options for submitting your request – via mail, email, or for more information, you can visit the official Missouri Department of Revenue website. Choose the option that is most convenient for you.

- Contact Information: Double-check the mailing address, email, and website link to ensure your request reaches the Missouri Department of Revenue without any issues. Incorrect contact information can lead to unnecessary delays.

By paying attention to these details, you can ensure a smoother process in obtaining copies of your tax documents. Always verify your information before submission to avoid any complications.

Popular PDF Forms

Do C Corps Issue K-1 - A meticulously prepared Schedule K-1 1120-S can serve as a defense in audits, providing comprehensive evidence of the taxpayer’s reported income, deductions, and credits related to their S corporation interest.

Rental Application Form Maryland - Signatures from both the applicant and the landlord are expected to finalize the application process, serving as a mutual acknowledgement of terms and conditions discussed.