Blank Mod 21 PDF Template

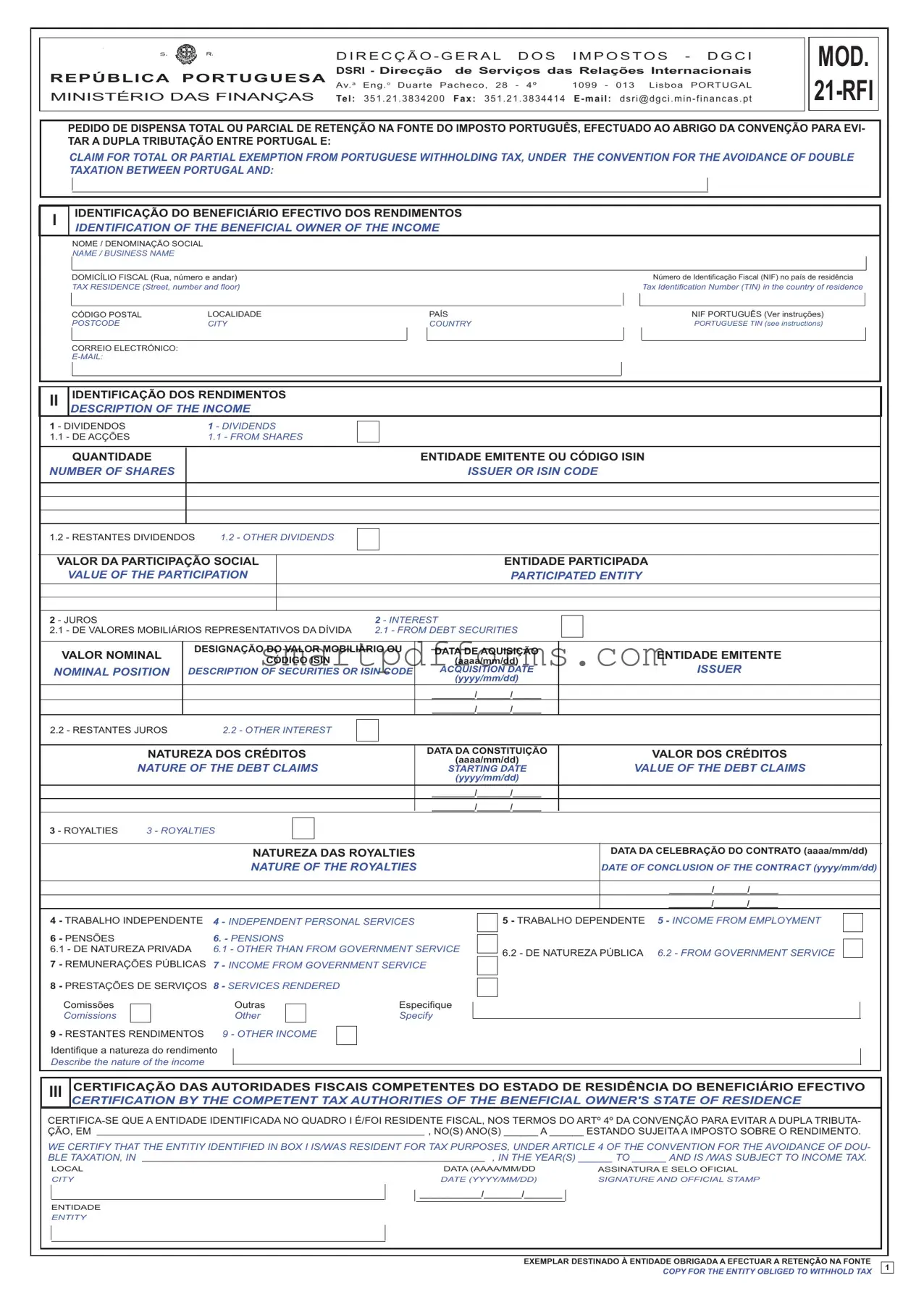

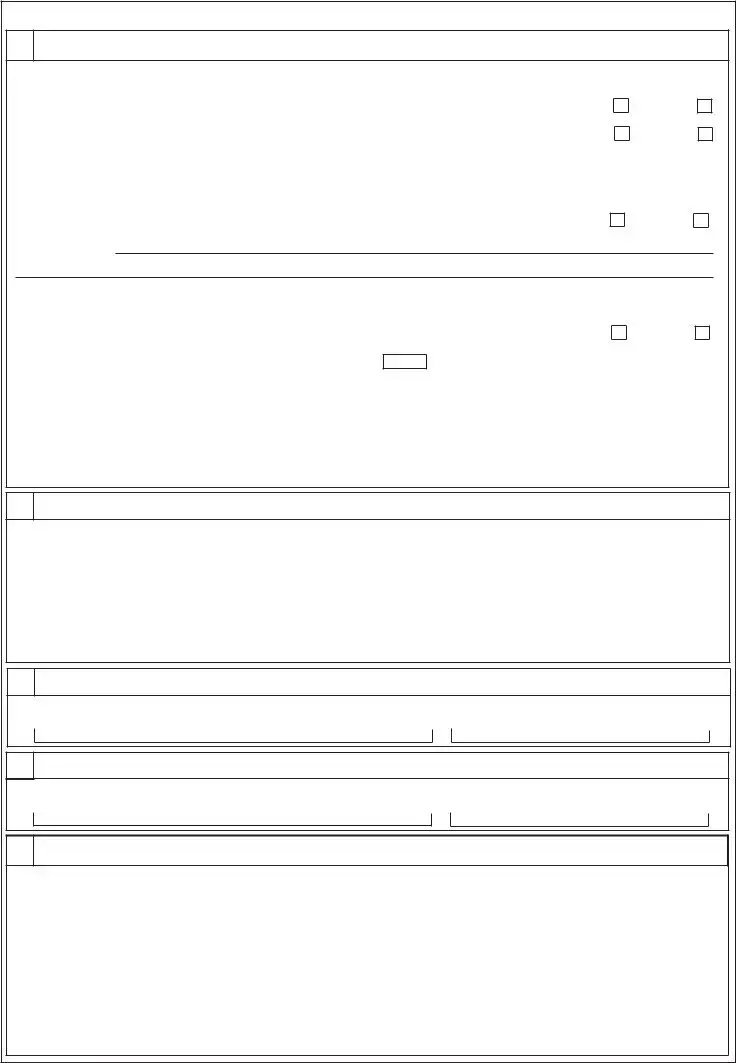

Across the globe, individuals and businesses engaged in cross-border transactions frequently confront the complexities of double taxation. Portugal addresses this challenge through its Mod 21-RFI form, a crucial document designed to prevent the drawbacks of being taxed twice on the same income. Crafted under the broader framework of tax treaties Portugal has with various countries, the form serves as a request for full or partial exemption from Portuguese withholding tax. It meticulously collects information regarding the beneficial owner of the income, describing the income types, which range from dividends, interests, royalties, to income from employment and pensions, among others. Additionally, it features sections for certification by the tax authorities of the beneficial owner’s country of residence, ensuring compliance with the relevant tax treaty provisions. Notably, it also includes inquiries about the beneficial owner's potential permanent establishment in Portugal that could affect the tax liability. The Mod 21-RFI is an embodiment of international cooperation in tax matters, aiming to streamline the taxation process for cross-border income while fostering a transparent financial environment.

Preview - Mod 21 Form

DIRECÇÃO - GERAL DOS IMPOSTOS - DGCI

DSRI - Direcção de Serviços das Relações Internacionais

REPÚBLICA PORTUGUESA |

Av.a Eng.o Duarte Pacheco, 28 - 4º |

1099 - 013 Lisboa PORTUGAL |

MINISTÉRIO DAS FINANÇAS |

Tel: 351.21.3834200 Fax: 351.21.3834414 |

MOD.

PEDIDO DE DISPENSA TOTAL OU PARCIAL DE RETENÇÃO NA FONTE DO IMPOSTO PORTUGUÊS, EFECTUADO AO ABRIGO DA CONVENÇÃO PARA EVI- TAR A DUPLA TRIBUTAÇÃO ENTRE PORTUGAL E:

CLAIM FOR TOTAL OR PARTIAL EXEMPTION FROM PORTUGUESE WITHHOLDING TAX, UNDER THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION BETWEEN PORTUGAL AND:

I

IDENTIFICAÇÃO DO BENEFICIÁRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER OF THE INCOME

NOME / DENOMINAÇÃO SOCIAL

NAME / BUSINESS NAME

DOMICÍLIO FISCAL (Rua, número e andar) |

|

|

|

Número de Identifi cação Fiscal (NIF) no país de residência |

|

TAX RESIDENCE (Street, number and floor) |

|

|

|

Tax Identifi cation Number (TIN) in the country of residence |

|

|

|

|

|

|

|

CÓDIGO POSTAL |

LOCALIDADE |

PAÍS |

|

|

NIF PORTUGUÊS (Ver instruções) |

POSTCODE |

CITY |

COUNTRY |

|

|

PORTUGUESE TIN (see instructions) |

CORREIO ELECTRÓNICO:

II

IDENTIFICAÇÃO DOS RENDIMENTOS

DESCRIPTION OF THE INCOME

1 - DIVIDENDOS |

1 - DIVIDENDS |

1.1 - DE ACÇÕES |

1.1 - FROM SHARES |

|

QUANTIDADE |

|

|

|

|

|

|

|

|

|

|

|

ENTIDADE EMITENTE OU CÓDIGO ISIN |

|

|||||||||||||

|

NUMBER OF SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

ISSUER OR ISIN CODE |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2 - RESTANTES DIVIDENDOS |

1.2 - OTHER DIVIDENDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

VALOR DA PARTICIPAÇÃO SOCIAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

ENTIDADE PARTICIPADA |

|

|||||||||||

|

VALUE OF THE PARTICIPATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

PARTICIPATED ENTITY |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 - JUROS |

|

|

|

|

|

|

|

|

|

|

|

2 - INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

2.1 - DE VALORES MOBILIÁRIOS REPRESENTATIVOS DA DÍVIDA |

2.1 - FROM DEBT SECURITIES |

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALOR NOMINAL |

|

DESIGNAÇÃO DO VALOR MOBILIÁRIO OU |

|

DATA DE AQUISIÇÃO |

|

|

|

ENTIDADE EMITENTE |

|

|||||||||||||||||

|

|

|

CÓDIGO ISIN |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

(aaaa/mm/dd) |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

ISSUER |

|

||||||||||||||||

|

NOMINAL POSITION |

DESCRIPTION OF SECURITIES OR ISIN CODE |

|

ACQUISITION DATE |

|

|

|||||||||||||||||||||

|

|

(yyyy/mm/dd) |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

2.2 - RESTANTES JUROS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

2.2 - OTHER INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATUREZA DOS CRÉDITOS |

|

|

|

DATA DA CONSTITUIÇÃO |

|

VALOR DOS CRÉDITOS |

|

||||||||||||||||||

|

|

NATURE OF THE DEBT CLAIMS |

|

|

|

(aaaa/mm/dd) |

|

VALUE OF THE DEBT CLAIMS |

|

||||||||||||||||||

|

|

|

|

|

STARTING DATE |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(yyyy/mm/dd) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

3 - ROYALTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

3 - ROYALTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATUREZA DAS ROYALTIES |

|

|

|

|

|

|

|

|

DATA DA CELEBRAÇÃO DO CONTRATO (aaaa/mm/dd) |

|

|||||||||||

|

|

|

|

|

|

NATURE OF THE ROYALTIES |

|

|

|

|

|

|

|

|

DATE OF CONCLUSION OF THE CONTRACT (yyyy/mm/dd) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

4 - TRABALHO INDEPENDENTE 4 - INDEPENDENT PERSONAL SERVICES |

|

|

|

|

5 - TRABALHO DEPENDENTE 5 - INCOME FROM EMPLOYMENT |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

6 - PENSÕES |

|

|

|

|

6. - PENSIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

6.1 - DE NATUREZA PRIVADA 6.1 - OTHER THAN FROM GOVERNMENT SERVICE |

|

|

|

6.2 - DE NATUREZA PÚBLICA 6.2 - FROM GOVERNMENT SERVICE |

|

|

|

|||||||||||||||||||

|

7 - REMUNERAÇÕES PÚBLICAS 7 - INCOME FROM GOVERNMENT SERVICE |

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

8 - PRESTAÇÕES DE SERVIÇOS 8 - SERVICES RENDERED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Comissões |

|

|

|

|

Outras |

|

|

|

|

Especifique |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Comissions |

|

|

|

|

Other |

|

|

|

Specify |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 - RESTANTES RENDIMENTOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

9 - OTHER INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identifi que a natureza do rendimento

Describe the nature of the income

III

CERTIFICAÇÃO DAS AUTORIDADES FISCAIS COMPETENTES DO ESTADO DE RESIDÊNCIA DO BENEFICIÁRIO EFECTIVO CERTIFICATION BY THE COMPETENT TAX AUTHORITIES OF THE BENEFICIAL OWNER'S STATE OF RESIDENCE

ÇÃO, EM |

|

, NO(S) ANO(S) ______ A ______ ESTANDO SUJEITA A IMPOSTO SOBRE O RENDIMENTO. |

|||

WE CERTIFY THAT THE ENTITIY IDENTIFIED IN BOX I IS/WAS RESIDENT FOR TAX PURPOSES, UNDER ARTICLE 4 OF THE CONVENTION FOR THE AVOIDANCE OF DOU- |

|||||

BLE TAXATION, IN |

|

|

, IN THE YEAR(S) ______ TO ______ AND IS /WAS SUBJECT TO INCOME TAX. |

||

LOCAL |

DATA (AAAA/MM/DD |

ASSINATURA E SELO OFICIAL |

|||

CITY |

DATE (YYYY/MM/DD) |

SIGNATURE AND OFFICIAL STAMP |

|||

_____________/________/________

ENTIDADE

ENTITY

EXEMPLAR DESTINADO À ENTIDADE OBRIGADA A EFECTUAR A RETENÇÃO NA FONTE

COPY FOR THE ENTITY OBLIGED TO WITHHOLD TAX

1

DIRECÇÃO - GERAL DOS IMPOSTOS - DGCI

DSRI - Direcção de Serviços das Relações Internacionais

REPÚBLICA PORTUGUESA |

Av.a Eng.o Duarte Pacheco, 28 - 4º |

1099 - 013 Lisboa PORTUGAL |

MINISTÉRIO DAS FINANÇAS |

Tel: 351.21.3834200 Fax: 351.21.3834414 |

MOD.

PEDIDO DE DISPENSA TOTAL OU PARCIAL DE RETENÇÃO NA FONTE DO IMPOSTO PORTUGUÊS, EFECTUADO AO ABRIGO DA CONVENÇÃO PARA EVI- TAR A DUPLA TRIBUTAÇÃO ENTRE PORTUGAL E:

CLAIM FOR TOTAL OR PARTIAL EXEMPTION FROM PORTUGUESE WITHHOLDING TAX, UNDER THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION BETWEEN PORTUGAL AND:

I

IDENTIFICAÇÃO DO BENEFICIÁRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER OF THE INCOME

NOME / DENOMINAÇÃO SOCIAL

NAME / BUSINESS NAME

DOMICÍLIO FISCAL (Rua, número e andar) |

|

|

|

Número de Identifi cação Fiscal (NIF) no país de residência |

|

TAX RESIDENCE (Street, number and floor) |

|

|

|

Tax Identifi cation Number (TIN) in the country of residence |

|

|

|

|

|

|

|

CÓDIGO POSTAL |

LOCALIDADE |

PAÍS |

|

|

NIF PORTUGUÊS (Ver instruções) |

POSTCODE |

CITY |

COUNTRY |

|

|

PORTUGUESE TIN (see instructions) |

CORREIO ELECTRÓNICO:

II

IDENTIFICAÇÃO DOS RENDIMENTOS

DESCRIPTION OF THE INCOME

1 - DIVIDENDOS |

1 - DIVIDENDS |

1.1 - DE ACÇÕES |

1.1 - FROM SHARES |

|

QUANTIDADE |

|

|

|

|

|

|

|

|

|

|

|

ENTIDADE EMITENTE OU CÓDIGO ISIN |

|

|||||||||||||

|

NUMBER OF SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

ISSUER OR ISIN CODE |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2 - RESTANTES DIVIDENDOS |

1.2 - OTHER DIVIDENDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

VALOR DA PARTICIPAÇÃO SOCIAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

ENTIDADE PARTICIPADA |

|

|||||||||||

|

VALUE OF THE PARTICIPATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

PARTICIPATED ENTITY |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 - JUROS |

|

|

|

|

|

|

|

|

|

|

|

2 - INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

2.1 - DE VALORES MOBILIÁRIOS REPRESENTATIVOS DA DÍVIDA |

2.1 - FROM DEBT SECURITIES |

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALOR NOMINAL |

|

DESIGNAÇÃO DO VALOR MOBILIÁRIO OU |

|

DATA DE AQUISIÇÃO |

|

|

|

ENTIDADE EMITENTE |

|

|||||||||||||||||

|

|

|

CÓDIGO ISIN |

|

|

|

(aaaa/mm/dd) |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

ISSUER |

|

||||||||||||||||

|

NOMINAL POSITION |

DESCRIPTION OF SECURITIES OR ISIN CODE |

|

ACQUISITION DATE |

|

|

|||||||||||||||||||||

|

|

(yyyy/mm/dd) |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

2.2 - RESTANTES JUROS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

2.2 - OTHER INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATUREZA DOS CRÉDITOS |

|

|

|

DATA DA CONSTITUIÇÃO |

|

VALOR DOS CRÉDITOS |

|

||||||||||||||||||

|

|

NATURE OF THE DEBT CLAIMS |

|

|

|

(aaaa/mm/dd) |

|

VALUE OF THE DEBT CLAIMS |

|

||||||||||||||||||

|

|

|

|

|

STARTING DATE |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(yyyy/mm/dd) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

3 - ROYALTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

3 - ROYALTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATUREZA DAS ROYALTIES |

|

|

|

|

|

|

|

|

DATA DA CELEBRAÇÃO DO CONTRATO (aaaa/mm/dd) |

|

|||||||||||

|

|

|

|

|

|

NATURE OF THE ROYALTIES |

|

|

|

|

|

|

|

|

DATE OF CONCLUSION OF THE CONTRACT (yyyy/mm/dd) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

4 - TRABALHO INDEPENDENTE 4 - INDEPENDENT PERSONAL SERVICES |

|

|

|

|

5 - TRABALHO DEPENDENTE 5 - INCOME FROM EMPLOYMENT |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

6 - PENSÕES |

|

|

|

|

6. - PENSIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

6.1 - DE NATUREZA PRIVADA 6.1 - OTHER THAN FROM GOVERNMENT SERVICE |

|

|

|

6.2 - DE NATUREZA PÚBLICA 6.2 - FROM GOVERNMENT SERVICE |

|

|

|

|||||||||||||||||||

|

7 - REMUNERAÇÕES PÚBLICAS 7 - INCOME FROM GOVERNMENT SERVICE |

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

8 - PRESTAÇÕES DE SERVIÇOS 8 - SERVICES RENDERED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Comissões |

|

|

|

|

Outras |

|

|

|

|

Especifique |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Comissions |

|

|

|

|

Other |

|

|

|

Specify |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 - RESTANTES RENDIMENTOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

9 - OTHER INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identifi que a natureza do rendimento

Describe the nature of the income

III

CERTIFICAÇÃO DAS AUTORIDADES FISCAIS COMPETENTES DO ESTADO DE RESIDÊNCIA DO BENEFICIÁRIO EFECTIVO CERTIFICATION BY THE COMPETENT TAX AUTHORITIES OF THE BENEFICIAL OWNER'S STATE OF RESIDENCE

ÇÃO, EM |

|

, NO(S) ANO(S) ______ A ______ ESTANDO SUJEITA A IMPOSTO SOBRE O RENDIMENTO. |

|||

WE CERTIFY THAT THE ENTITIY IDENTIFIED IN BOX I IS/WAS RESIDENT FOR TAX PURPOSES, UNDER ARTICLE 4 OF THE CONVENTION FOR THE AVOIDANCE OF DOU- |

|||||

BLE TAXATION, IN |

|

|

, IN THE YEAR(S) ______ TO ______ AND IS /WAS SUBJECT TO INCOME TAX. |

||

LOCAL |

DATA (AAAA/MM/DD |

ASSINATURA E SELO OFICIAL |

|||

CITY |

DATE (YYYY/MM/DD) |

SIGNATURE AND OFFICIAL STAMP |

|||

_____________/________/________

ENTIDADE

ENTITY

EXEMPLAR DESTINADO À ADMINISTRAÇÃO FISCAL DO ESTADO DE RESIDÊNCIA DO BENEFICIÁRIO DO RENDIMENTO

COPY FOR THE TAX AUTHORITIES OF THE BENEFICIARY'S COUNTRY OF RESIDENCE

2

DIRECÇÃO - GERAL DOS IMPOSTOS - DGCI

DSRI - Direcção de Serviços das Relações Internacionais

REPÚBLICA PORTUGUESA |

Av.a Eng.o Duarte Pacheco, 28 - 4º |

1099 - 013 Lisboa PORTUGAL |

MINISTÉRIO DAS FINANÇAS |

Tel: 351.21.3834200 Fax: 351.21.3834414 |

MOD.

PEDIDO DE DISPENSA TOTAL OU PARCIAL DE RETENÇÃO NA FONTE DO IMPOSTO PORTUGUÊS, EFECTUADO AO ABRIGO DA CONVENÇÃO PARA EVI- TAR A DUPLA TRIBUTAÇÃO ENTRE PORTUGAL E:

CLAIM FOR TOTAL OR PARTIAL EXEMPTION FROM PORTUGUESE WITHHOLDING TAX, UNDER THE CONVENTION FOR THE AVOIDANCE OF DOUBLE TAXATION BETWEEN PORTUGAL AND:

I

IDENTIFICAÇÃO DO BENEFICIÁRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER OF THE INCOME

NOME / DENOMINAÇÃO SOCIAL

NAME / BUSINESS NAME

DOMICÍLIO FISCAL (Rua, número e andar) |

|

|

|

Número de Identifi cação Fiscal (NIF) no país de residência |

|

TAX RESIDENCE (Street, number and floor) |

|

|

|

Tax Identifi cation Number (TIN) in the country of residence |

|

|

|

|

|

|

|

CÓDIGO POSTAL |

LOCALIDADE |

PAÍS |

|

|

NIF PORTUGUÊS (Ver instruções) |

POSTCODE |

CITY |

COUNTRY |

|

|

PORTUGUESE TIN (see instructions) |

CORREIO ELECTRÓNICO:

II

IDENTIFICAÇÃO DOS RENDIMENTOS

DESCRIPTION OF THE INCOME

1 - DIVIDENDOS |

1 - DIVIDENDS |

1.1 - DE ACÇÕES |

1.1 - FROM SHARES |

|

QUANTIDADE |

|

|

|

|

|

|

|

|

|

|

|

ENTIDADE EMITENTE OU CÓDIGO ISIN |

|

|||||||||||||

|

NUMBER OF SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

ISSUER OR ISIN CODE |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.2 - RESTANTES DIVIDENDOS |

1.2 - OTHER DIVIDENDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

VALOR DA PARTICIPAÇÃO SOCIAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

ENTIDADE PARTICIPADA |

|

|||||||||||

|

VALUE OF THE PARTICIPATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

PARTICIPATED ENTITY |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 - JUROS |

|

|

|

|

|

|

|

|

|

|

|

2 - INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

2.1 - DE VALORES MOBILIÁRIOS REPRESENTATIVOS DA DÍVIDA |

2.1 - FROM DEBT SECURITIES |

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALOR NOMINAL |

|

DESIGNAÇÃO DO VALOR MOBILIÁRIO OU |

|

DATA DE AQUISIÇÃO |

|

|

|

ENTIDADE EMITENTE |

|

|||||||||||||||||

|

|

|

CÓDIGO ISIN |

|

|

|

(aaaa/mm/dd) |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

ISSUER |

|

||||||||||||||||

|

NOMINAL POSITION |

DESCRIPTION OF SECURITIES OR ISIN CODE |

|

ACQUISITION DATE |

|

|

|||||||||||||||||||||

|

|

(yyyy/mm/dd) |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

2.2 - RESTANTES JUROS |

|

2.2 - OTHER INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATUREZA DOS CRÉDITOS |

|

|

|

DATA DA CONSTITUIÇÃO |

|

VALOR DOS CRÉDITOS |

|

||||||||||||||||||

|

|

NATURE OF THE DEBT CLAIMS |

|

|

|

(aaaa/mm/dd) |

|

VALUE OF THE DEBT CLAIMS |

|

||||||||||||||||||

|

|

|

|

|

STARTING DATE |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(yyyy/mm/dd) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

||||

|

3 - ROYALTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

3 - ROYALTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATUREZA DAS ROYALTIES |

|

|

|

|

|

|

|

|

DATA DA CELEBRAÇÃO DO CONTRATO (aaaa/mm/dd) |

|

|||||||||||

|

|

|

|

|

|

NATURE OF THE ROYALTIES |

|

|

|

|

|

|

|

|

DATE OF CONCLUSION OF THE CONTRACT (yyyy/mm/dd) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________/_______/______ |

|

|

|

|

4 - TRABALHO INDEPENDENTE 4 - INDEPENDENT PERSONAL SERVICES |

|

|

|

|

5 - TRABALHO DEPENDENTE 5 - INCOME FROM EMPLOYMENT |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

6 - PENSÕES |

|

|

|

|

6. - PENSIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

6.1 - DE NATUREZA PRIVADA 6.1 - OTHER THAN FROM GOVERNMENT SERVICE |

|

|

|

6.2 - DE NATUREZA PÚBLICA 6.2 - FROM GOVERNMENT SERVICE |

|

|

|

|||||||||||||||||||

|

7 - REMUNERAÇÕES PÚBLICAS 7 - INCOME FROM GOVERNMENT SERVICE |

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

8 - PRESTAÇÕES DE SERVIÇOS 8 - SERVICES RENDERED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Comissões |

|

|

|

|

Outras |

|

|

|

|

Especifique |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Comissions |

|

|

|

|

Other |

|

|

|

Specify |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 - RESTANTES RENDIMENTOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

9 - OTHER INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identifi que a natureza do rendimento

Describe the nature of the income

III

CERTIFICAÇÃO DAS AUTORIDADES FISCAIS COMPETENTES DO ESTADO DE RESIDÊNCIA DO BENEFICIÁRIO EFECTIVO CERTIFICATION BY THE COMPETENT TAX AUTHORITIES OF THE BENEFICIAL OWNER'S STATE OF RESIDENCE

ÇÃO, EM |

|

, NO(S) ANO(S) ______ A ______ ESTANDO SUJEITA A IMPOSTO SOBRE O RENDIMENTO. |

|||

WE CERTIFY THAT THE ENTITIY IDENTIFIED IN BOX I IS/WAS RESIDENT FOR TAX PURPOSES, UNDER ARTICLE 4 OF THE CONVENTION FOR THE AVOIDANCE OF DOU- |

|||||

BLE TAXATION, IN |

|

|

, IN THE YEAR(S) ______ TO ______ AND IS /WAS SUBJECT TO INCOME TAX. |

||

LOCAL |

DATA (AAAA/MM/DD |

ASSINATURA E SELO OFICIAL |

|||

CITY |

DATE (YYYY/MM/DD) |

SIGNATURE AND OFFICIAL STAMP |

|||

_____________/________/________

ENTIDADE

ENTITY

EXEMPLAR DESTINADO AO BENEFICIÁRIO DO RENDIMENTO

COPY FOR THE BENEFICIARY OF THE INCOME

3

IV

IV

QUESTIONÁRIO (A RESPONDER PELO BENEFICIÁRIO DO RENDIMENTO)

QUESTIONS (TO BE ANSWERED BY THE BENEFICIAL OWNER)

A - A PREENCHER POR PESSOAS SINGULARES E POR PESSOAS COLECTIVAS

A - TO BE FILLED IN BY INDIVIDUALS, COMPANIES AND ANY OTHER BODY OF PERSONS

1 - Dispõe de estabelecimento estável ou instalação fi xa em Portugal ? 1 - Do you have a permanent establishment or a fi xed base in Portugal?

2 - Participa no capital social da(s) entidade(s) devedora(s) dos rendimentos em percentagem igual ou superior a 10% ? 2 - Do you participate in the share capital of the debtor(s) of income in a percentage of 10% or more?

Em caso afi rmativo, indique a(s) entidade(s) e a(s) percentagem(ns) correspondente(s)

If yes, please indicate the debtor(s) and the corresponding percentage(s)

Sim Yes

Sim Yes

Não No

Não No

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

3 - Pertence aos órgãos sociais da(s) entidade(s) devedora(s) dos rendimentos ?Sim Yes

3 - Do you belong to the board of directors or to the supervisory board of the debtor(s) of the income?

Em caso afirmativo especifique

If yes, please specify

Não No

B - A PREENCHER SOMENTE POR PESSOAS SINGULARES

B - TO BE FILLED IN ONLY BY INDIVIDUALS

1 |

- No(s) ano(s) civil(is) em que os rendimentos vão ser pagos ou colocados à sua disposição, vai residir em Portugal ? |

|

1 |

- Will you stay in Portugal during the calendar year(s) in which the income will be paid or put at your disposal? |

Sim Yes |

|

|

Em caso afi rmativo, indique a estimativa do número de dias de permanência

If yes, please indicate the estimated number of days of your stay

Não No

2 |

- Dispõe de habitação permanente em Portugal ? |

Sim Yes |

|

|

Não No |

|

|

|

|

|

|

|

|

|

|||||

2 |

- Do you have a permanent home in Portugal? |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Em caso afi rmativo, indique o endereço |

|

|

|

|

|

|

|

||

If yes, please indicate the address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

- Indique a sua data de nascimento (AAAA/MM/DD) |

|

|

|

e a nacionalidade |

||||

3 |

- Please indicate your date of birth (YYYY/MM/DD) __________/________/________ |

and your nationality |

|

||||||

|

|||||||||

V

IDENTIFICAÇÃO DO INTERMEDIÁRIO FINANCEIRO NÃO RESIDENTE EM PORTUGAL IDENTIFICATION OF THE FINANCIAL INTERMEDIARY NON RESIDENT IN PORTUGAL

NOME/DENOMINAÇÃO SOCIAL |

|

|

|

NAME/BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

DOMICÍLIO FISCAL |

|

|

NIF no país de residência |

TAX RESIDENCE |

|

|

|

|

|

TIN in the country of residence |

|

|

|

|

|

|

|

|

|

CÓDIGO POSTAL |

LOCALIDADE |

|

PAÍS |

POSTCODE |

CITY |

|

COUNTRY |

|

|

|

|

VI

IDENTIFICAÇÃO DA ENTIDADE RESIDENTE EM PORTUGAL QUE SE ENCONTRA OBRIGADA A EFECTUAR A RETENÇÃO NA FONTE IDENTIFICATION OF THE ENTITY RESIDENT IN PORTUGAL OBLIGED TO WITHHOLD TAX

NOME/DENOMINAÇÃO SOCIAL |

Número de Identifi cação Fiscal (NIF) |

NAME/BUSINESS NAME |

Tax Identifi cation Number (TIN) |

VII

IDENTIFICAÇÃO DO REPRESENTANTE LEGAL DO BENEFICIÁRIO EFECTIVO DOS RENDIMENTOS IDENTIFICATION OF THE BENEFICIAL OWNER’S LEGAL REPRESENTATIVE

NOME/DENOMINAÇÃO SOCIAL |

Número de Identifi cação Fiscal (NIF) |

NAME/BUSINESS NAME |

Tax Identifi cation Number (TIN) |

VIII

VIII

DECLARAÇÃO DO BENEFICIÁRIO EFECTIVO DOS RENDIMENTOS OU DO SEU REPRESENTANTE LEGAL STATEMENT BY THE BENEFICIAL OWNER OR BY THE LEGAL REPRESENTATIVE

Declaro que sou (a entidade identificada no Quadro I é) o beneficiário efectivo dos rendimentos mencionados no presente formulário e que estão correctos todos os elementos nele indicados. Mais declaro que estes rendimentos não estão efectivamente conexos com qualquer estabelecimento estável ou instalação fi xa localizados em Portugal.

I state that I am (the entity identified in Box I is) the beneficial owner of the |

income mentioned in this form and that the information included here- |

|||

in is accurate. I further declare that this income is not effectively connected |

with any permanent establishment or fixed base situated in Portugal. |

|||

Local |

|

|

|

Data (AAAA/MM/DD) |

City |

|

|

|

Date (YYYY/MM/DD) |

|

|

|

|

|

|

|

|

|

_____________/________/________ |

Assinatura: |

|

|

|

|

Signature: |

|

|

|

|

|

|

|

|

|

Signatário Autorizado: |

|

|

Função: |

|

Nome |

|

|

Title/Position: |

|

Authorized signatory: |

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

Form. mod. 21 - RFI (Pedido de dispensa total ou parcial de retenção na fonte do imposto português)

INSTRUÇÕES DE PREENCHIMENTO

OBSERVAÇÕES PRÉVIAS

O presente formulário

Deve ser preenchido, em triplicado, pelo beneficiário efectivo dos rendimentos obtidos em território português (ou pelo seu representante legal em Portugal)

Qualquer que seja a natureza dos rendimentos indicados no quadro II a entrega do formulário junto da entidade portuguesa obrigada a efectuar a retenção na fonte deverá

O pedido de dispensa de retenção na fonte só se considera entregue quando o formulário estiver integral e correctamente preenchido.

Este formulário pode ser obtido junto das autoridades fiscais competentes dos Estados com os quais Portugal celebrou Convenção para Evitar Dupla Tributação, e ainda via Internet, na página

QUADRO I

QUADRO II

Neste quadro, destinado à identificação dos rendimentos, deve

No campo 1.1, o código ISIN é de preenchimento obrigatório, quando exista, dispensando a indicação da entidade emitente. Deverá ser entregue um único formulário a cada entidade residente em Portugal obrigada a efectuar a retenção na fonte de imposto sobre rendimentos obtidos em território português.

No caso de as linhas serem insufi cientes, deverão ser utilizados os formulários que forem necessários.

QUADRO III

Este quadro é reservado à certificação pelas autoridades fiscais competentes do Estado da residência do beneficiário dos rendimentos.

QUADRO IV

Responder SIM ou NÃO às questões colocadas, especifi cando quando aplicável.

QUADRO V

Este quadro só deve ser preenchido nos casos em que o beneficiário detém acções ou valores mobiliários representativos de dívida em conta aberta junto de um intermediário fi nanceiro não residente em Portugal.

Como se referiu em “observações prévias”, será esta entidade que reencaminhará o formulário, depois de devidamente preenchido e certifi cado, para a entidade residente em Portugal obrigada a efectuar a retenção na fonte.

QUADRO VI

Quadro destinado à identificação da entidade residente em Portugal que se encontra obrigada a efectuar a retenção na fonte do imposto.

QUADRO VII

QUADRO VIII

A declaração constante deste quadro deve ser assinada pelo beneficiário efectivo, ou pelo seu representante legal em Portugal.

Form mod. 21 – RFI (Claim for total or partial exemption from Portuguese withholding tax)

INSTRUCTIONS FOR COMPLETION

PRELIMINARY OBSERVATIONS:

The purpose of this form is to claim total or partial exemption from Portuguese withholding tax, in cases where the beneficial owner is resident in a country with which Portugal has concluded a Convention for the Avoidance of Double Taxation.

It has to be completed in triplicate by the beneficial owner of the income derived in Portuguese territory (or by the legal representative in Portugal). After each copy is duly certified by the competent tax authority of the beneficial owner’s State of residence, it must be sent to the entity indicated at the right bottom. This form shall be valid for a maximum period of one year. The beneficial owner of the income must immediately inform the payer if any of the conditions to benefit from partial or total relief from withholding tax ceases to be met. As to dividends from shares and interest from debt securities, the form must be sent to the financial intermediary that holds the securities in an account on behalf of beneficial owner. Afterwards the financial intermediary will forward the form to the entity resident in Portugal obliged to withhold tax.

Whatever the nature of the income in box II, the form must be submitted to the Portuguese resident entity obliged to withhold tax, not later than the tax due date. This entity will keep the copy and will present it only when required within the established deadline.

The claim for total or partial exemption from Portuguese withholding tax is deemed to be submitted only when the form is entirely and correctly filled in.

This form is available at the competent tax authorities of the States with which Portugal has concluded a Convention for the Avoid- ance of Double Taxation and also on the Internet at

BOX I

This box is intended to identify the beneficial owner of the income. The name /business name, as well as the address, must be complete and in capital letters when handwritten. The first Tax Identification Number (TIN) to enter is the one from the beneficial owner’s country of residence. The Portuguese TIN must also be entered. In case it does not exist, it must be required by the entity obliged to withhold tax. The indication of the

BOX II

This box is intended to identify the income. The nature of the income that will be derived in Portugal, accordingly to the definitions and/or application scope of the articles of the applicable Convention for the Avoidance of Double Taxation, must be marked. In particular, box 8 (services rendered) must be marked in cases provided for under Article 7 of the Convention i.e. if the income derived as a consideration for services rendered is included in the business profits.

In box 1.1 it is mandatory to complete the ISIN code, whenever there is one, being not necessary to indicate the issuer.

Each entity resident in Portugal obliged to withhold tax from income derived in Portuguese territory must receive a single form. If there are not enough lines, please use the number of forms necessary.

BOX III

This box is restricted to the certifi cation by the competent tax authorities of the benefi cial owner‘s State of residence.

BOX IV

Answer “Yes” or “No” to the questions and specify whenever applicable.

BOX V

This box must only be completed in cases where the shares or the debt securities are held in an account by a financial intermedi- ary non resident in Portugal on behalf of the beneficial owner.

As above referred in the preliminary observations, this entity will forward the form, after duly filled in and certified, to the entity resident in Portugal obliged to withhold tax.

BOX VI

This box is intended to identify the entity resident in Portugal which is obliged to withhold tax.

BOX VII

This box is intended to identify the beneficial owner’s legal representative, this completion is only mandatory in cases, where the benefi cial owner wants the legal representative to claim the total or partial exemption from withholding tax due in Portugal.

BOX VIII

The statement in this box must be signed by the benefi cial owner of the income or by the legal representative in Portugal.

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Mod 21 form is used to request full or partial exemption from Portuguese withholding tax under the Double Taxation Treaty. |

| Beneficiary Identification | It requires detailed information about the beneficial owner of the income, including name, fiscal address, and Tax Identification Number (TIN) both in the country of residence and in Portugal. |

| Income Description | This section details the types of income for which exemption is requested, such as dividends, interest, royalties, and more. |

| Competent Authority Certification | A certification by the tax authorities of the beneficial owner's country of residence is required, confirming their tax residency and subject to income tax under the Double Taxation Treaty. |

Instructions on Utilizing Mod 21

Filling out the Mod 21 form is crucial for requesting total or partial exemption from Portuguese withholding tax under the tax treaty provisions to avoid dual taxation. It is important to accurately provide all the requested details to ensure the exemption applies correctly to the income received. The steps detailed below guide you through completing the form effectively.

- Begin with Section I (Identificação do Beneficiário Efectivo dos Rendimentos): Enter the full name or business name of the beneficial owner of the income and their fiscal address, including street, number, and floor. Fill in the Tax Identification Number (TIN) in the country of residence and, if applicable, the Portuguese TIN. Complete the contact information with an email address.

- Move to Section II (Identificação dos Rendimentos): Specify the type of income for which the exemption is being requested, such as dividends, interest, royalties, independent personal services, etc. Provide relevant details for each type of income, including the issuer's name or ISIN code, quantity of shares, nominal value, and acquisition date.

- In Section III (Certificação das Autoridades Fiscais Competentes do Estado de Residência do Beneficiário Efectivo): This part must be completed by the tax authorities in the country of residence of the beneficial owner, certifying their tax residency and subject to income tax in those years.

- Proceed to Section IV (Questionário): Answer the questions about the beneficial owner's connection to Portugal, like having a permanent establishment, participation in capital, or belonging to corporate bodies of entities paying the income.

- Fill in Section V (Identificação do Intermediário Financeiro Não Residente em Portugal), if applicable: Provide details of any non-Portuguese financial intermediary managing the securities or assets generating income.

- In Section VI (Identificação da Entidade Residente em Portugal Que Se Encontra Obrigada a Efectuar a Retenção na Fonte): Identify the Portuguese entity obliged to withhold tax on the income paid to the beneficial owner.

- Complete Section VII (Identificação do Representante Legal do Beneficiário Efectivo dos Rendimentos), if necessary: Identify the legal representative of the beneficial owner in Portugal, obligatory if they are requesting the exemption.

- Finish with Section VIII (Declaração do Beneficiário Efectivo dos Rendimentos ou do Seu Representante Legal): The declaration asserts that the information provided is correct and that the income is not linked to any permanent establishment or fixed base in Portugal. This should be signed by the beneficial owner or their legal representative.

After completing the form, ensure that it is accurately filled and free from errors. Submit the form in triplicate, as instructed, to the relevant financial intermediary or directly to the Portuguese entity withholding tax on the income. Staying informed about any changes in circumstances that might affect the exemption status and updating the necessary parties is vital to maintain compliance and ensure the correct application of the tax treaty benefits.

Obtain Answers on Mod 21

What is a Mod 21 form used for?

The Mod 21 form is used to request a total or partial exemption from Portuguese withholding tax for income beneficiaries residing in countries that have a Double Taxation Treaty with Portugal. This form helps avoid or minimize double taxation on the same income.

Who should fill out the Mod 21 form?

It should be filled out by the beneficial owner of the income that is sourced from Portugal or by their legal representative in Portugal. This applies whether the income beneficiary is an individual, a company, or any other body of persons.

What types of income does the Mod 21 form cover?

The form covers various types of income, including dividends from shares, interest from debt securities, royalties, income from independent and dependent personal services, pensions, government service income, service fees, and other unspecified income.

How long is the Mod 21 form valid for?

The Mod 21 form is valid for a maximum period of one year after its submission. It should be renewed annually if you continue to receive income that qualifies for the tax exemption or reduction.

What should I do if there are changes in my income situation?

If there are any changes in the circumstances under which you have been granted a total or partial withholding tax exemption, you must immediately inform the entity responsible for paying or owing the income.

Where can I submit the Mod 21 form?

For dividends from shares and interest from debt securities, the form should be submitted to the financial intermediary where the beneficial owner has the securities account. For other types of income, it should be submitted directly to the Portuguese entity obligated to withhold the tax. The form must be submitted before the deadline for the payment of the respective tax.

What is required for the Mod 21 form to be considered submitted correctly?

The form must be fully and accurately completed to be considered officially submitted. It needs to be certified by the competent tax authority of the income beneficiary's country of residence and provided in triplicate.

Where can I obtain the Mod 21 form?

You can obtain the Mod 21 form from the competent tax authorities of the countries with which Portugal has Double Taxation Treaties. It is also available online on the official website of Portuguese Tax Authority.

Who certifies the Mod 21 form?

The competent tax authorities of the state of residence of the income beneficiary are responsible for certifying the Mod 21 form. This certification confirms the beneficiary's tax residency status under the Double Taxation Treaty between Portugal and the beneficiary's country of residence.

Common mistakes

Filling in the form with incorrect Tax Identification Numbers (TIN). When individuals submit their Mod 21 form, they often mistakenly provide wrong TINs both for their country of residence and for Portugal. This mistake can delay the process, as the correct TINs are crucial for tax identification purposes.

Not specifying the nature of the income correctly in Section II. Many people fail to properly identify the type of income they are receiving, such as dividends from shares, interest from debt securities, royalties, or income from independent personal services. This can lead to incorrect tax treatment and potential issues with tax exemptions.

Omitting information on the financial intermediary in Section V. When income is obtained through a non-resident financial intermediary, this needs to be clearly stated, including the intermediary's name and tax residence. Neglecting this step can complicate the withholding tax exemption process.

Incomplete or unclear answers in Section IV (Questionnaire). Applicants sometimes give vague or incomplete answers to the questions about their connection to Portugal through a permanent establishment or a significant shareholding in a Portuguese company, which can affect the accuracy of the tax exemption application.

Failure to sign and date the declaration in Section VIII. The form must be signed and dated by the beneficial owner of the income or their legal representative in Portugal. Missing signatures or dates can invalidate the form, preventing the application from being processed.

Not submitting the form in triplicate. As instructed, the form should be filled out in triplicate, with each copy designated for different entities (the applicant, the tax authority, and the withholding agent). Failing to provide the required number of copies can lead to administrative delays and misunderstandings.

All these mistakes can significantly delay the processing of the Mod 21 form and affect the applicant's tax obligations and entitlements under the double taxation agreement between Portugal and their country of residence.

Documents used along the form

When handling international financial transactions or managing income from sources in Portugal, professionals often use the Mod 21-RFI to navigate the complexities of tax withholding and double taxation agreements efficiently. This document is critical but typically works hand in hand with a suite of other forms and documents to ensure compliance and optimize tax treatment under various international treaties. Below are five forms and documents often utilized in conjunction with the Mod 21-RFI, each serving a unique purpose in the broader context of tax management and compliance.

- Certificate of Residence: This document is used to verify the taxpayer's residency in a country that has a tax treaty with Portugal. It is essential for proving eligibility for reduced tax rates or exemptions under the treaty.

- Form 22-RFI: Similar to Mod 21-RFI, this form is specifically for royalty payments. It requests a reduction or exemption of Portuguese withholding tax on royalties under a tax treaty.

- Power of Attorney: This legal document authorizes a representative to act on behalf of the taxpayer in matters related to the Mod 21-RFI. It’s crucial for individuals who cannot personally handle their tax matters in Portugal.

- Corporate Tax Identification Number (NIF) Proof: This official document from the Portuguese Tax Authority confirms the company's NIF. It's requisite for entities engaging in financial transactions or claiming tax treaty benefits.

- Income Declaration: This details the nature and amount of the income subject to withholding tax. The declaration supports the Mod 21-RFI application by delineating the specific income streams covered under the tax treaty.

In the realm of international tax coordination, these documents and forms act as vital tools, alongside the Mod 21-RFI, to manage cross-border incomes and tax liabilities. They collectively enable individuals and entities to navigate the intricacies of tax laws, ensuring compliance while optimizing their tax positions according to applicable treaties and agreements.

Similar forms

The Mod 21-RFI form, which requests total or partial exemption from Portuguese withholding tax under tax treaty provisions, shares similarities with the W-8BEN form used in the United States. Both are designed to prevent double taxation for foreign entities or individuals earning income across borders by declaring their tax status and claiming benefits under tax treaties.

Another related document is the Form 6166, a U.S. Residency Certification, which serves a similar purpose by certifying a resident's status for tax treaty benefits. Like the certification section in the Mod 21-RFI, it helps entities or individuals prove their eligibility for tax treaty benefits to foreign tax authorities.

The Form Residency Certificate issued by other countries' tax authorities, akin to the certification portion of the Mod 21-RFI, is also parallel in function. These certificates validate the tax residency of individuals or entities in their home country, facilitating claims for tax treaty protections.

Lastly, the Mod 21-RFI is akin to the Form 1120-F required by foreign corporations in the U.S., specifically in the aspect of claiming income effectively connected with a U.S. trade or business. Unlike the Mod 21-RFI's broader scope on withholding tax exemption under tax treaties, Form 1120-F focuses on income assessment and tax liability for foreign entities. However, both require detailed income information and taxpayer identification to navigate cross-border tax regulations.

Dos and Don'ts

When filling out the Mod 21 form, it's important to pay attention to both what you should do for a smooth process and what you shouldn't do to avoid any complications. Here are some tips to help you along the way:

Things You Should Do:

- Ensure accuracy of all entered information: Double-check all the details you provide on the form, such as the beneficial owner's name, tax identification number (TIN), address, and the nature of the income. Errors can lead to processing delays or even rejection of the application.

- Provide complete information: Fill in every required field on the form. Incomplete forms may not be processed, leading to delays. If a section does not apply, mark it appropriately as instructed.

- Use the correct form version: Make sure you are using the most current version of the Mod 21 form. Forms may be updated periodically, and using an outdated version can result in processing errors.

- Keep copies for your records: Before submitting the form, make a copy for your own records and for any other entities that may require it, such as the financial intermediary or the tax authorities in the beneficiary’s country of residence.

Things You Shouldn't Do:

- Avoid leaving sections blank: If certain information does not apply to your situation, make sure to mark it as such rather than leaving it blank. This shows that you have acknowledged every part of the form.

- Don’t guess on tax details: If you’re unsure about specific tax codes or requirements, consult a tax professional or the issuing authority. Guessing can lead to incorrect submissions and potential financial penalties.

- Refrain from using unofficial document copies: Do not use copies of the form that are not sourced from official channels. Unofficial or altered forms may not be accepted and can cause delays.

- Avoid late submissions: Make sure to submit the Mod 21 form within any specified deadlines, especially if it relates to withholding tax exemptions. Late submissions can result in the loss of eligibility for exemptions or reductions for that tax period.

Misconceptions

There are several misconceptions surrounding the Mod 21 form used for requesting total or partial exemption from Portuguese withholding tax under the tax treaty. Here are some of the most common misconceptions clarified:

- Only businesses can use the Mod 21 form. This is incorrect. Both individuals and businesses can utilize the Mod 21 form if they are the beneficial owners of the income and meet the qualifications for tax exemption under a double taxation treaty with Portugal.

- The form is valid indefinitely once submitted. Actually, the Mod 21 form has a validity period of one year from the date of acceptance. Beneficiaries must reapply for the exemption each year they wish to claim it.

- Filling out the Mod 21 form is a complicated process that always requires professional help. While seeking assistance from a tax professional can be beneficial, especially for complex situations, the form itself provides instructions to guide users through the filling process. It was designed to be accessible for beneficiaries to complete.

- The Mod 21 form grants automatic exemption from withholding tax. Submitting the form does not guarantee the tax exemption. It is a request that must be reviewed and approved by the relevant tax authorities, depending on various eligibility criteria outlined in the applicable double taxation treaty.

- Any changes in circumstances do not affect the status of the submitted Mod 21 form. Beneficiaries are required to inform the withholding agent immediately if there’s any change in circumstances affecting the conditions under which the exemption was granted.

- The form can only be submitted in Portuguese. While the primary language of the form is Portuguese, submissions can also accommodate additional languages in order to clarify information provided, ensuring that non-Portuguese speakers can accurately complete and submit their request.