Blank Modern Woodmen 948 PDF Template

Insurance and life planning take on various forms, and one critical aspect involves designating or changing beneficiaries to ensure our wishes are carried out and our loved ones are taken care of after we're gone. The Modern Woodmen 948 form, rooted in such important decision-making, is designed for Modern Woodmen of America policyholders who find themselves at a junction, needing to update their beneficiary details or make a name change due to life events like marriage or divorce. Based in Rock Island, Illinois, this organization allows policy owners to directly modify who will benefit from their policies through the form, which comprehensively covers options from naming individuals and living trusts to specifying a trust under the insured's will or even the estate of the insured as a final beneficiary. The form's layout is meticulously structured to avoid errors, with explicit instructions to use black or dark blue ink and how to properly correct any mistakes without resorting to white-out. Additionally, it outlines the necessity of the form's acknowledgment by the National Secretary before any changes take effect, providing a layer of official oversight. Furthermore, it incorporates a section for changing the method of settlement, giving beneficiaries some control over how they receive the proceeds, be it in one sum, left to earn interest, or another specified method. Also notable is the requisite for original signatures to ensure authenticity and prevent issues, underscoring the document's legal significance in managing one's life insurance policy details.

Preview - Modern Woodmen 948 Form

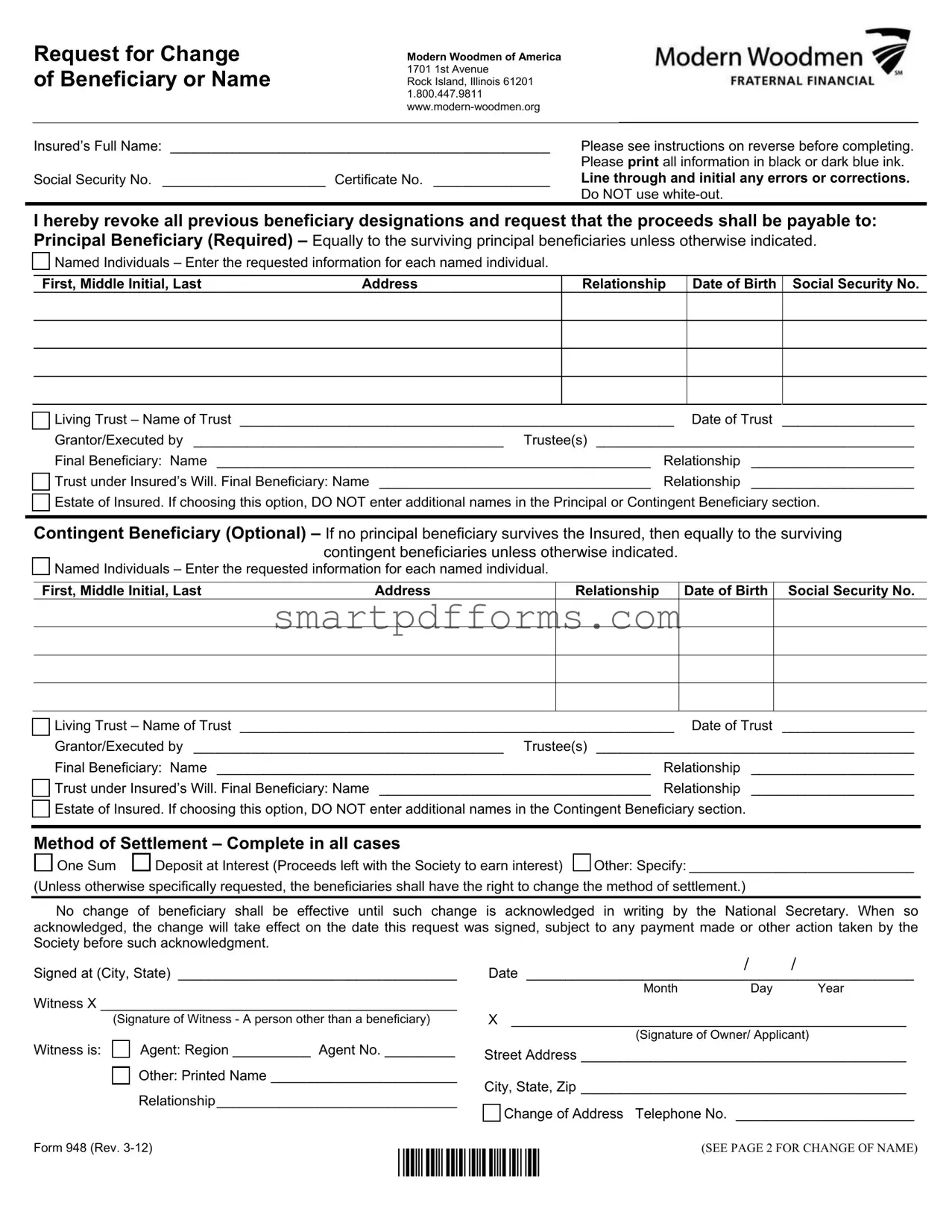

Request for Change of Beneficiary or Name

Modern Woodmen of America

1701 1st Avenue

Rock Island, Illinois 61201 1.800.447.9811

Insured’s Full Name: _________________________________________________

Social Security No. _____________________ Certificate No. _______________

Please see instructions on reverse before completing. Please print all information in black or dark blue ink.

Line through and initial any errors or corrections. Do NOT use

I hereby revoke all previous beneficiary designations and request that the proceeds shall be payable to: Principal Beneficiary (Required) – Equally to the surviving principal beneficiaries unless otherwise indicated.

Named Individuals – Enter the requested information for each named individual.

First, Middle Initial, Last |

Address |

Relationship |

Date of Birth |

Social Security No. |

|

|

|

Living Trust – Name of Trust ________________________________________________________ Date of Trust _________________

Grantor/Executed by ________________________________________ Trustee(s) _________________________________________

Final Beneficiary: Name ________________________________________________________ |

Relationship |

_____________________ |

Trust under Insured’s Will. Final Beneficiary: Name ___________________________________ |

Relationship |

_____________________ |

Estate of Insured. If choosing this option, DO NOT enter additional names in the Principal or Contingent Beneficiary section.

Contingent Beneficiary (Optional) – If no principal beneficiary survives the Insured, then equally to the surviving contingent beneficiaries unless otherwise indicated.

Named Individuals – Enter the requested information for each named individual.

First, Middle Initial, Last |

Address |

Relationship

Date of Birth Social Security No.

Living Trust – Name of Trust ________________________________________________________ Date of Trust _________________

Grantor/Executed by ________________________________________ Trustee(s) _________________________________________

Final Beneficiary: Name ________________________________________________________ |

Relationship |

_____________________ |

Trust under Insured’s Will. Final Beneficiary: Name ___________________________________ |

Relationship |

_____________________ |

Estate of Insured. If choosing this option, DO NOT enter additional names in the Contingent Beneficiary section.

Method of Settlement – Complete in all cases

One Sum

Deposit at Interest (Proceeds left with the Society to earn interest)

Other: Specify: _____________________________

(Unless otherwise specifically requested, the beneficiaries shall have the right to change the method of settlement.)

No change of beneficiary shall be effective until such change is acknowledged in writing by the National Secretary. When so acknowledged, the change will take effect on the date this request was signed, subject to any payment made or other action taken by the Society before such acknowledgment.

Signed at (City, State) ____________________________________

Witness X ______________________________________________

|

(Signature of Witness - A person other than a beneficiary) |

Witness is: |

Agent: Region __________ Agent No. _________ |

|

Other: Printed Name ________________________ |

|

Relationship_______________________________ |

/ |

|

/ |

Date __________________________________________________ |

||

Month |

Day |

Year |

X___________________________________________________

(Signature of Owner/ Applicant)

Street Address __________________________________________

City, State, Zip __________________________________________

Change of Address Telephone No. _______________________

Form 948 (Rev. |

*00869* |

(SEE PAGE 2 FOR CHANGE OF NAME) |

|

|

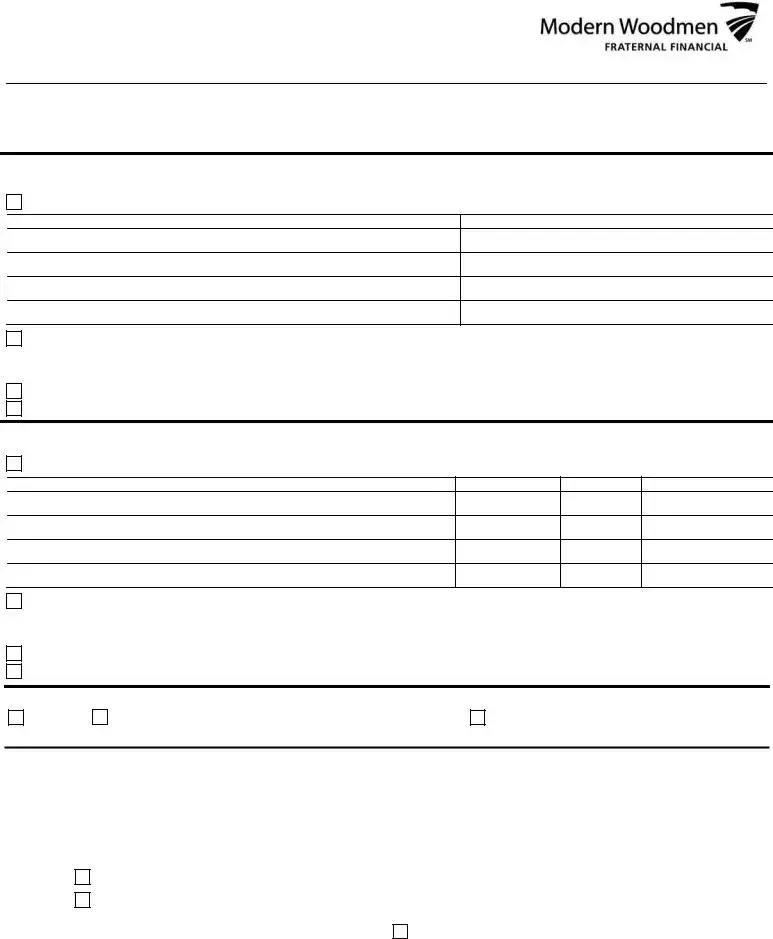

Request for Name Change

Insured’s Full Name (Print)

Certificate Number

The name of the

Insured

Owner has been changed to: (Print) _____________________________________________________

New complete legal name (First, Middle, Last, Suffix)

The reason for the change is:

Marriage |

Adoption |

|

Divorce |

Other (Specify): _________________________________________________ |

|||

|

|||||||

|

|

|

|

If selecting Other, please provide copy of legal documentation. |

|

||

X_____________________________________________________ |

Date ______________________________________ |

||||||

|

Signature of Insured or Owner |

Month |

Day |

Year |

|||

X_____________________________________________________

Signature of Witness

Witness is

Agent: Region _____ Agent No. _______

Agent: Region _____ Agent No. _______

Other: Printed Name ___________________________________

Instructions for Change of Beneficiary Request – Page 1

The beneficiary designation will remain unchanged until the properly completed form is received and acknowledged in writing at our

Home Office. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If a change of beneficiary is desired on more than one |

|

Trust (Inter Vivos Living Trust): |

The trust must be in effect |

||||||||||||

certificate, a separate form should be completed for each |

|

at the time the beneficiary designation is completed. It is |

|||||||||||||

certificate. |

|

|

|

|

|

necessary to furnish the name of the trust, the date the trust |

|||||||||

Designate beneficiary(ies) by selecting the check box next to |

|

was executed, who executed it, and the name of the trustee(s). |

|||||||||||||

the appropriate category(ies) and then complete requested |

|

A final beneficiary must be named to receive the proceeds if |

|||||||||||||

information. |

|

|

|

|

|

the trust is not properly qualified or fails to make claim within |

|||||||||

This change of beneficiary form, once acknowledged, will |

|

120 days from the date of death. |

|

|

|

|

|||||||||

automatically revoke all prior beneficiary designations. |

Trust under Insured’s Will (Testamentary Trust): |

The |

|||||||||||||

Therefore, even if a principal or contingent beneficiary is to |

|

proceeds paid according to the Insured’s Last Will and |

|||||||||||||

remain, such beneficiary must be renamed on this form. |

|

Testament. |

|

|

|

|

|

|

|

|

|||||

The owner/applicant completing this form cannot specify how |

|

A final beneficiary must be named to receive the proceeds if |

|||||||||||||

a beneficiary is to use the proceeds. |

|

|

|

the trust is not properly qualified or fails to make claim within |

|||||||||||

The proceeds for minor beneficiaries are held by the Society |

|

120 days from the date of death. |

|

|

|

|

|||||||||

until they attain legal age, unless a |

Method of Settlement. All or part of the proceeds may be left |

||||||||||||||

the minor’s estate properly requests payment prior to that time. |

|

with Modern Woodmen under a settlement option. |

If Deposit |

||||||||||||

Beneficiaries for a minor Insured must always have an |

|

at Interest or any Other Optional Method of Settlement is |

|||||||||||||

insurable interest in the life of the child. Insurable interest is |

|

selected and a principal beneficiary (payee) is eligible to |

|||||||||||||

when an individual is responsible either in whole or in part for |

|

receive payment but dies before any of the proceeds have |

|||||||||||||

the care and welfare of the child. A parent or a grandparent is |

|

been paid, then, unless otherwise provided, the proceeds will |

|||||||||||||

automatically assumed to have an insurable interest in the |

|

be paid to any then surviving principal beneficiaries; if none, to |

|||||||||||||

child’s life. |

|

|

|

|

|

any then surviving contingent beneficiaries; if none, in one sum |

|||||||||

Named Individuals: |

When naming individual beneficiaries, |

|

to the estate of the payee. |

If One Sum is selected and a |

|||||||||||

print the full |

names |

of the desired principal and contingent |

|

beneficiary is eligible to receive payment but dies before any of |

|||||||||||

|

the proceeds have been paid, then, unless otherwise specified, |

||||||||||||||

beneficiaries, |

their |

addresses, their |

relationships to the |

|

|||||||||||

|

the proceeds |

will |

be |

paid |

in one sum |

to the beneficiary’s |

|||||||||

Insured, dates of birth and Social Security numbers. Proceeds |

|

||||||||||||||

|

estate. |

Deposit |

at Interest |

may |

not be |

selected |

for |

a tax |

|||||||

will be paid |

equally |

to the surviving |

principal |

beneficiaries |

|

||||||||||

|

qualified certificate, such as an IRA. |

|

|

|

|||||||||||

unless otherwise indicated. The proceeds will be paid to the |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

person(s) named in the contingent beneficiary section only if |

Signature Required. |

The person having legal control of the |

|||||||||||||

no principal beneficiary survives the |

Insured. |

If additional |

|

certificate should sign the beneficiary change request using his |

|||||||||||

space is needed, attach a signed and dated sheet. Note: This |

|

or her full name. All signatures must be original. |

|

|

|||||||||||

space may also be used to name corporations, businesses, or |

Date. |

The application should be dated with the month, day |

|||||||||||||

charitable organizations. Include address, city, state and |

|

and year it is signed. |

|

|

|

|

|

|

|||||||

taxpayer ID if applicable. |

|

|

Witness. The signature should be witnessed by an adult other |

||||||||||||

|

|

|

|

|

|

than one named as a beneficiary. |

|

|

|

|

|||||

|

|

|

|

|

|

Questions: |

Please contact |

your |

Modern |

Woodmen |

|||||

Representative or our Home Office at

Form 948B (Rev. |

(SEE PAGE 1 FOR CHANGE OF BENEFICIARY) |

Form Data

| Fact | Details |

|---|---|

| Form Purpose | The form is used for requesting a change of beneficiary or name with Modern Woodmen of America. |

| Form Number | 948 |

| Organization Address | Modern Woodmen of America, 1701 1st Avenue, Rock Island, Illinois 61201 |

| Contact Information | 1.800.447.9811, www.modern-woodmen.org |

| Instructions on Use | Instructions for completing the form are provided on the reverse side. All information should be printed in black or dark blue ink. Corrections should be lined through and initialed. |

| Beneficiary Options | Options include principal and contingent beneficiaries, with space for individual names, living trusts, or the insured's estate. |

| Method of Settlement | Beneficiaries can change the method of settlement, choosing from options like One Sum, Deposit at Interest, or Other specified methods. |

| Change Validation | No change of beneficiary will be effective until acknowledged in writing by the National Secretary and will take effect on the date the request was signed. |

Instructions on Utilizing Modern Woodmen 948

Filling out the Modern Woodmen 948 form is a crucial step in updating your beneficiary information or your name, ensuring that all is in order with your life insurance policy or annuity contract. This form allows you to clearly specify who should benefit from your policy in the event of your passing or to reflect a change in your name due to life events such as marriage, divorce, adoption, or others. Follow these steps to complete the form correctly, ensuring your peace of mind and the future financial security of those you care about.

- Start by providing the Insured’s Full Name and Social Security Number, alongside the Certificate Number at the top of the form.

- Using black or dark blue ink, carefully print all required information. If you make mistakes, simply line through them, initial the corrections, and avoid using correction fluid or tape.

- To change the beneficiary:

- Select the appropriate category for the Principal Beneficiary and fill in the required details: Name(s), Address(es), Relationship to the Insured, Date of Birth, and Social Security Number(s).

- If applicable, name a Living Trust as a beneficiary by providing the Trust's name, execution date, the grantor, and trustee(s).

- For Final Beneficiaries, specify if the proceeds are payable to the Insured’s Estate, or under the Insured’s Will by providing the required details.

- Optionally, appoint Contingent Beneficiaries by following the same instructions as for Principal Beneficiaries.

- Choose a Method of Settlement by completing the relevant section to specify how the proceeds should be paid out.

- Review the declaration, then sign and date the form at the designated area, providing your location (City, State).

- A witness, who is not a named beneficiary, must then sign, date, and indicate their relationship to you or their agent information.

- For a Name Change, complete the section on the second page:

- Print the Insured’s Full Name and Certificate Number.

- Provide the New Complete Legal Name and specify the reason for the name change (Marriage, Divorce, Adoption, or Other).

- If you selected "Other," attach a copy of the legal documentation substantiating the name change.

- Sign and date the form in the indicated areas, and have a witness also sign, date, and provide their relationship or agent information.

- Once completed, review all information for accuracy, and then mail the form to the address provided at the top of the form or as directed by your Modern Woodmen representative.

Once Modern Woodmen of America receives and processes this form, any changes you've requested will be acknowledged in writing. Remember, no changes will take effect until this acknowledgment has been made. Ensuring that your beneficiary designations and personal information are up-to-date is essential for peace of mind and to protect the financial future of those you care most about.

Obtain Answers on Modern Woodmen 948

What is the primary purpose of the Modern Woodmen 948 form?

The Modern Woodmen 948 form is used for two main changes to a policy: the change of beneficiary and the change of the insured's name. This form is essential for policyholders who wish to update their policies to reflect changes in their personal circumstances or preferences regarding who should receive the proceeds of the policy upon the insured’s passing or if the policyholder has changed their name due to marriage, divorce, adoption, or any other reason. It ensures that Modern Woodmen of America has the most current information and can accurately fulfill the policy's terms.

How can a policyholder change the beneficiary on their insurance policy?

To change the beneficiary on an insurance policy, the policyholder must complete the Modern Woodmen 948 form with all required information about the new beneficiary or beneficiaries. This information includes the beneficiary's full name, address, relationship to the insured, date of birth, and Social Security number. For trusts, the name of the trust, the date it was executed, who executed it, and the names of the trustee(s) must be provided. All changes must be acknowledged in writing by the National Secretary, and the change will take effect on the date the request was signed, notwithstanding any payment made or action taken by the society before such acknowledgment.

Can a policyholder designate more than one beneficiary?

Yes, a policyholder can designate multiple beneficiaries on their policy. This is done by completing the principal beneficiary section for each individual, indicating their respective shares if not to be divided equally, or naming a living trust with multiple beneficiaries. Additionally, a contingent beneficiary section allows the policyholder to designate alternate beneficiaries in the event that no principal beneficiary survives the insured. Detailed information for each named individual or entity must be provided.

What are the options for the method of settlement mentioned in the form?

The form outlines various options for the method of settlement, including receiving the proceeds in one sum or leaving the proceeds with Modern Woodmen to earn interest (Deposit at Interest). Other specific settlement methods requested by the beneficiary can also be noted on the form. Unless a specific method is requested, beneficiaries have the right to change the method of settlement. This flexibility allows beneficiaries to choose a payout method that best suits their financial situation or preferences.

What steps should be followed if a policyholder needs to change their name on the policy?

To change their name on the policy, the policyholder should complete the name change section of the Modern Woodmen 948 form. This requires providing the insured’s full name before the change, the certificate number, the new complete legal name, and the reason for the name change. Additionally, if the reason for the name change is not due to marriage, adoption, or divorce, a copy of legal documentation must be provided as proof of the name change. The form must be signed and dated by the insured or owner, and a witness signature is also required.

What happens if a designated beneficiary is a minor?

If a designated beneficiary is a minor, the proceeds are held by Modern Woodmen until the beneficiary reaches legal age, unless a court-appointed guardian of the minor’s estate requests the payment prior to that time. This precautionary measure ensures that the proceeds are managed responsibly on behalf of the minor beneficiary. It highlights the organization's commitment to safeguarding the interests of all beneficiaries, particularly those who are not legally able to manage their own financial affairs.

Common mistakes

-

Not using black or dark blue ink: The form specifies that all information should be printed in black or dark blue ink. However, individuals sometimes mistakenly use other colors or pencil, which can lead to issues in readability and official record-keeping.

-

Using correction fluid or tape: The form clearly instructs not to use white-out or any correction fluid or tape. Instead, any errors should be lined through and initialed. Ignoring this instruction can create suspicions around the authenticity of the information provided.

-

Failing to properly revoke previous designations: By filling out this form, the policyholder is revoking all previous beneficiary designations. Mistakes occur when individuals assume this process is automatic without submitting this form or when they fail to acknowledge this revocation in their documentation.

-

Incomplete beneficiary information: The form requires detailed information about the beneficiaries, including their full names, addresses, relationships to the insured, dates of birth, and Social Security numbers. Often, people leave out parts of this necessary information, which can delay or invalidate the beneficiary change.

-

Incorrect or missing signatures: A common mistake is the absence of the required signatures or witnessing of the signatures. The owner/applicant's signature is crucial, as is the witness's signature (who cannot be a named beneficiary), and both must be present for the change to be valid.

-

Not specifying a method of settlement: The form allows beneficiaries to change the method of settlement, but this is often overlooked. If beneficiaries wish to have a different method than the default "One Sum," it must be specifically requested, which many fail to do.

-

Neglecting to name contingent beneficiaries: This optional section is often left blank. However, naming contingent beneficiaries is crucial in case no principal beneficiary survives the insured. This ensures that the proceeds of the policy are distributed according to the insured’s wishes without falling into legal disputes or to the estate by default.

Adhering to the instructions and requirements outlined in the Modern Woodmen 948 form is essential for ensuring that the change of beneficiary or name is processed efficiently and correctly. Taking the time to carefully review and accurately complete the form can prevent unnecessary delays or complications in honoring the insured's wishes.

Documents used along the form

The Modern Woodmen 948 form is a vital document for individuals looking to change their beneficiary or name on their Modern Woodmen of America policies. This process is not isolated; several other forms and documents can be necessary or helpful to complete or accompany the request for these changes. Understanding these additional documents can ensure a smoother transaction and adherence to all requirements.

- Application for Life Insurance: Before even needing a change of beneficiary form, an individual must apply for life insurance. This form collects personal information, health history, and details about the desired insurance coverage.

- Claimant Statement: In the event of a policyholder's death, beneficiaries need to complete this form to claim the death benefit. It requires information about the deceased, the claimant, and the circumstances of death.

- Change of Ownership Form: If transferring the policy's ownership, this document must be completed, indicating the new owner of the policy and their relationship to the original owner.

- Policy Loan Application: Policyholders wishing to borrow against the cash value of their life insurance policy need to fill out this form, specifying the loan amount and other pertinent details.

- Automatic Premium Loan Provision Form: This form allows the policy's cash value to automatically cover premiums if they are not paid by the end of the grace period, preventing the policy from lapsing.

- Health Assessment Form: Required for certain changes to a policy that might increase the insurer's risk, this document collects information on the insured's current health condition.

- Power of Attorney (POA) Declaration: If a policyholder wishes to grant another individual authority to manage their life insurance policy, a POA declaration is necessary.

- Bank Draft Authorization Form: This form sets up automatic premium payments from a bank account, ensuring that the policy remains in force by avoiding missed payments.

- W9 Form: Used to provide correct taxpayer identification number and certification, it may be needed for tax reporting purposes related to the policy, especially if it accumulates cash value or earns interest.

- Marriage Certificate or Divorce Decree: In cases of name change due to marriage or divorce, a copy of the relevant legal document must accompany the name change request to verify the reason for the change.

Completing and submitting the correct forms and accompanying documents is crucial in managing a life insurance policy with Modern Woodmen of America. These documents help ensure that personal information is up to date, that the wishes of the policyholder are honored, and that the policy complies with all legal requirements. Individuals dealing with these matters should consult with their insurance representative to ensure accuracy and completeness in their submissions.

Similar forms

Life Insurance Change of Beneficiary Form: This document is similar to the Modern Woodmen 948 form in its primary function, which is to allow policyholders to modify the beneficiaries of their life insurance policy. Both forms require the policyholder’s details, the new beneficiary's full name, relationship to the insured, and other identifying information to effectively update beneficiary designations.

Trust Amendment Form: Similar in purpose to parts of the Modern Woodmen 948 form that deal with naming a trust as a beneficiary, a Trust Amendment Form is used to make changes to the terms or beneficiaries of a trust. Both forms necessitate detailed information about the trust and its trustees, illustrating their parallel roles in estate and succession planning.

Last Will and Testament Change Form: This document facilitates changes to a person’s will, akin to how the Modern Woodmen 948 form allows for changes in the payout directives of a life insurance policy or annuity. Both documents are integral in directing assets to chosen beneficiaries, showcasing their importance in managing post-life asset distribution.

Retirement Account Beneficiary Designation Form: Like the Modern Woodmen 948 form, this form is used to designate or change the beneficiaries for a retirement account, such as an IRA or 401(k). It captures similar information for beneficiaries, underscoring the policyholder’s intention for the allocation of the account’s funds upon their passing.

POD (Payable on Death) or TOD (Transfer on Death) Account Registration Forms: These forms allow the account holder to designate beneficiaries for specific accounts, ensuring that funds bypass probate and go directly to the named individuals or entities. The principal function mirrors that of the Modern Woodmen 948 form, with both serving to clearly delineate to whom assets should be transferred upon death.

Dos and Don'ts

When it comes to handling the Modern Woodmen 948 form, which is crucial for updating beneficiary or name changes, accuracy and attention to detail are key. Here are some do's and don'ts to guide you through the process:

- Do use black or dark blue ink for clarity and legibility.

- Do review the instructions on the reverse side of the form before filling it out to ensure you understand the requirements.

- Do clearly print the insured's full name, social security number, and certificate number at the beginning of the form.

- Do line through and initial any mistakes or corrections you make on the form to maintain transparency and accuracy.

- Do complete the beneficiary designations with the required details, including full names, addresses, relationships, dates of birth, and social security numbers, in the designated sections.

- Don't use white-out or other correction fluids on the form, as they can obscure original entries and raise questions about validity.

- Don't leave any sections incomplete. If a part does not apply to your situation, clearly mark it as "N/A" (not applicable) so there is no confusion.

- Don't forget to specify the method of settlement for the policy proceeds; whether it be a lump sum, deposit at interest, or another specified method.

- Don't overlook the need for a witness's signature who cannot be a named beneficiary on this form, ensuring compliance with the requirements.

- Don't send in the form without double-checking all the information for accuracy and ensuring that all necessary signatures are in place.

It's essential to know that no change of beneficiary will be considered valid until acknowledged in writing by the National Secretary of Modern Woodmen. Once approved, the change will take effect on the date the request was signed, considering no policies or actions were executed prior to the acknowledgment. Remember, thoroughness and accuracy are your best tools when filling out the Modern Woodmen 948 form.

Misconceptions

When dealing with the Modern Woodmen 948 form, specifically designed for the request of change of beneficiary or name, several misconceptions often arise. Understanding these errors can help ensure that policyholders correctly manage their beneficiary designations and personal details. Here's a list of ten common misunderstandings surrounding the form.

- Misconception 1: Using white-out for corrections is acceptable. The form clearly states that any errors or corrections should be lined through and initialed, explicitly advising against the use of white-out.

- Misconception 2: A witness can be a beneficiary. The form requires a witness for the signature, specifying that the witness cannot be a beneficiary. This helps to avoid any potential conflict of interest.

- Misconception 3: The form can change beneficiaries for multiple certificates. Each certificate requires a separate 948 form. Trying to change beneficiaries for multiple certificates with one form will not be effective.

- Misconception 4: Specifying how the beneficiary uses the proceeds is allowed. The form does not permit the owner/applicant to dictate how a beneficiary uses the proceeds from the policy.

- Misconception 5: Proceeds can't be held for minor beneficiaries. The form provides a mechanism for holding proceeds until a minor beneficiary reaches legal age, unless a court-appointed guardian requests earlier payment.

- Misconception 6: Any relationship qualifies for an insurable interest. Specifically, for minors, an insurable interest is required, generally assumed for parents or grandparents, indicating a responsibility for the minor's welfare.

- Misconception 7: Trust beneficiaries do not need specific designation. If proceeding through a trust, it must be currently effective, and detailed information about the trust and trustees is required.

- Misconception 8: It's unnecessary to name a final beneficiary. The form requires a final beneficiary for situations where the primary or contingent beneficiaries do not survive the insured, ensuring the proceeds are distributable.

- Misconception 9: Beneficiary changes are effective immediately upon signing. Changes are not effective until acknowledged in writing by the National Secretary. This is crucial to understand for timing and legal purposes.

- Misconception 10: A beneficiary change request does not revoke previous designations. Submitting a new beneficiary designation on the form automatically revokes all prior designations, a critical point for maintaining current and valid beneficiary information.

By addressing these misconceptions, policyholders can more accurately and effectively complete the Modern Woodmen 948 form, ensuring their wishes are respected and their beneficiaries are correctly listed. Accurate completion and understanding of the form's requirements are essential for the proper management of one's policy and ensuring the intended parties benefit as desired.

Key takeaways

When individuals need to update the beneficiary information or name on a policy with Modern Woodmen of America, they are required to fill out the Modern Woodmen 948 form. Here are 10 key takeaways for filling out and using this form effectively:

- All previous beneficiary designations are revoked when a new 948 form is submitted, ensuring that the proceeds will be payable to the newly designated beneficiaries outlined on the form.

- Complete information must be provided in black or dark blue ink, without using correction fluid or tape, to maintain the form's legibility and integrity.

- It is essential to indicate whether beneficiaries are to be principal or contingent, and to specify how proceeds should be divided if there is more than one beneficiary.

- For trusts named as beneficiaries, the trust details including name, date established, grantor, and trustee(s) must be clearly stated.

- If the estate of the insured or a trust under the insured’s will is chosen as the final beneficiary, adding extra names in the beneficiary sections is not permitted.

- The Method of Settlement section must be completed for all cases, giving beneficiaries the right to change the method unless specifically restricted.

- No change in beneficiary designation is acknowledged until it has been confirmed in writing by the National Secretary of Modern Woodmen of America. Such change becomes effective on the date the request was signed.

- The option to change the name of the insured owner is provided on the same form, requiring a detailed reason for the name change, such as marriage or divorce, and, if applicable, supporting legal documentation.

- A separate form is needed for each certificate if changes involve more than one policy, ensuring that changes are accurately and individually recorded.

- The form must be properly completed and acknowledged to effect any change, emphasizing the importance of correct and thorough completion.

These takeaways underscore the importance of accurately completing the Modern Woodmen 948 form to ensure that beneficiary or name change requests are properly recorded and acknowledged by Modern Woodmen of America.

Popular PDF Forms

Llc 800 Payment Due Date - The filing fee for the California LLC-1 form is $70, with an optional $5 fee for certification.

Lifestyle Management - Designed to capture a snapshot of your lifestyle habits, informing better decisions for a healthier life ahead.

Wall Water Leakage Detector - Clarity on the types of leaks that are ineligible for a credit, emphasizing the importance of accurate leak identification.