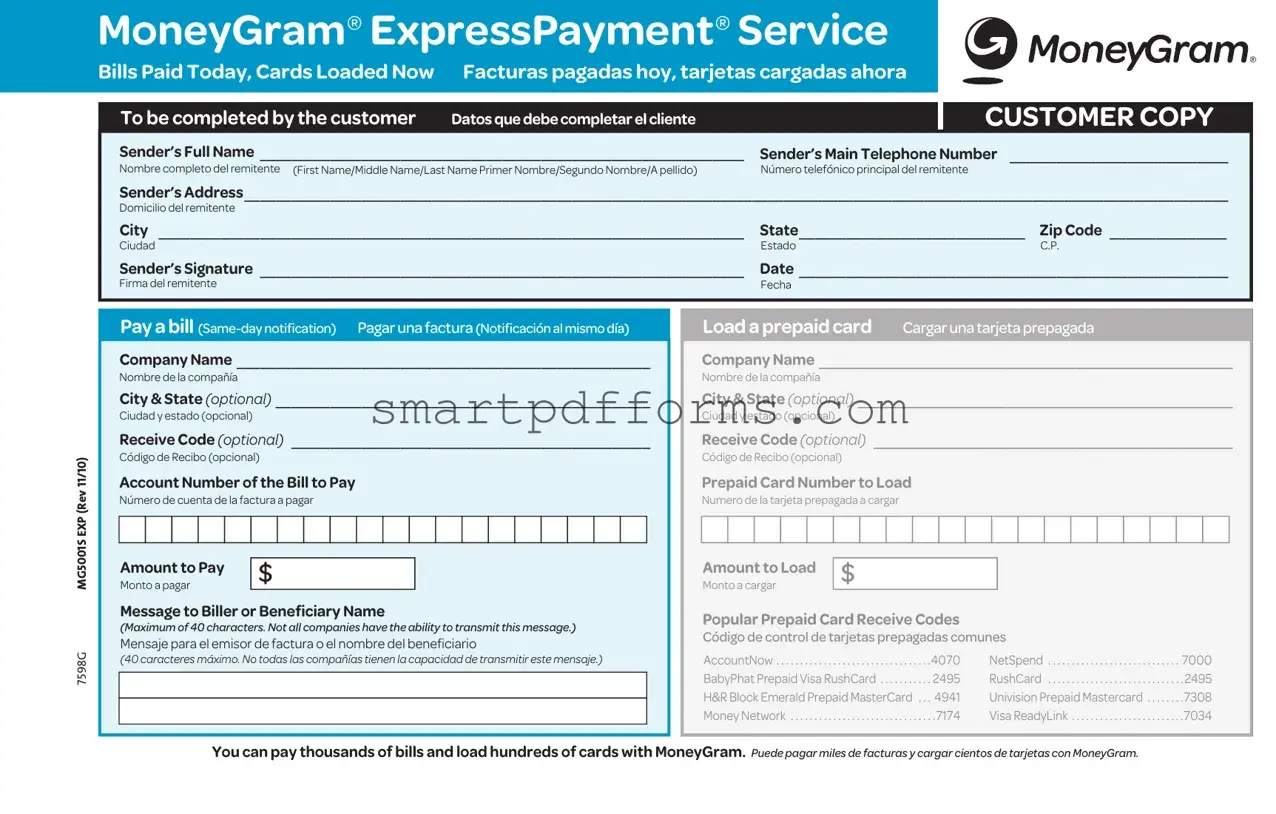

Blank Moneygram Express Payment PDF Template

In today's fast-paced world, timely financial transactions are more critical than ever, and the MoneyGram® ExpressPayment® Service stands out as a beacon for those needing to make quick bill payments or card loads. This service is designed with the customer in mind, allowing for the instantaneous transfer of funds to pay bills or load prepaid cards, a testament to the convenience and efficiency demanded by modern life. When a customer steps forward to use this service, they embark on a straightforward process requiring them to fill out a form that captures essential details such as the sender's full name, main telephone number, address, and the amount to be paid or loaded. Moreover, it's versatile, giving users the option to add a message to the biller or beneficiary, enhancing the personal touch of each transaction. Recognizing the diversity of its user base, MoneyGram has made this form accessible in both English and Spanish, ensuring a broader range of customers can utilize their services without language barriers. The terms and conditions attached to the form reiterate MoneyGram’s commitment to compliance with legal standards, emphasizing the prohibition against utilizing the service for any unlawful activities such as money laundering or fraud. Customer rights to refunds under certain circumstances are explicitly laid out, along with details on the maximum permissible amounts for transactions, highlighting MoneyGram's dedication to transparency and customer protection. This form not only facilitates speedy financial transactions but also encapsulates MoneyGram's broader service ethos, underpinned by convenience, reliability, and legislative compliance.

Preview - Moneygram Express Payment Form

MoneyGram® ExpressPayment® Service

Bills Paid Today, Cards Loaded Now |

Facturas pagadas hoy, tarjetas cargadas ahora |

|

|||

|

|

|

|

|

|

To be completed by the customer |

Datos que debe completar el cliente |

|

|

|

CUSTOMER COPY |

Sender’s Full Name |

|

Sender’s Main Telephone Number |

|||

Nombre completo del remitente (First Name/Middle Name/Last Name Primer Nombre/Segundo Nombre/A pellido) |

Número telefónico principal del remitente |

|

|||

Sender’s Address |

|

|

|

|

|

Domicilio del remitente |

|

|

|

|

|

City |

|

State |

Zip Code |

||

Ciudad |

|

Estado |

C.P. |

||

Sender’s Signature |

|

Date |

|

||

Firma del remitente |

|

Fecha |

|

||

|

|

|

|

|

|

7598GMG5001S EXP (REV 11/10)

Pay a bill

Company Name

Nombre de la compañía

City & State (optional)

Ciudad y estado (opcional)

Receive Code (optional)

Código de Recibo (opcional)

Account Number of the Bill to Pay

Número de cuenta de la factura a pagar

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount to Pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Monto a pagar |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Message to Biller or Beneficiary Name

(Maximum of 40 characters. Not all companies have the ability to transmit this message.)

Mensaje para el emisor de factura o el nombre del beneficiario

(40 caracteres máximo. No todas las compañías tienen la capacidad de transmitir este mensaje.)

Load a prepaid card Cargar una tarjeta prepagada

Company Name

Nombre de la compañía

City & State (optional)

Ciudad y estado (opcional)

Receive Code (optional)

Código de Recibo (opcional)

Prepaid Card Number to Load

Numero de la tarjeta prepagada a cargar

Amount to Load |

$ |

|

|

|

|

Monto a cargar |

|

|

|

|

|

Popular Prepaid Card Receive Codes |

|

|

|

||

Código de control de tarjetas prepagadas comunes |

|

||||

AccountNow |

. . . . . . . . . . . . . . . . . . . . . |

4070 |

NetSpend |

7000 |

|

BabyPhat Prepaid Visa RushCard |

2495 |

RushCard |

.2495 |

||

H&R Block Emerald Prepaid MasterCard . . . |

4941 |

Univision Prepaid Mastercard |

.7308 |

||

Money Network |

. . . . . . . . . . . . . . . . . . . . . |

.7174 |

Visa ReadyLink |

.7034 |

|

You can pay thousands of bills and load hundreds of cards with MoneyGram. Puede pagar miles de facturas y cargar cientos de tarjetas con MoneyGram.

TERMS AND CONDITIONS: A MoneyGram® ExpressPayment® Service (the “Service”) customer that is located in the United States (a “Sender”) may send a cash payment (a “Payment” or a “Transfer”) to an entity with whom MoneyGram has contracted (i.e., the receiver of Your payment and hereafter the “Receiver”) as a payment for credit on a bill in the United States. A Receiver may also include, and Transfers may also be made to, a third party prepaid debit card issued by a U.S. company, a MoneyGram® branded prepaid debit card, and such other entities determined by MoneyGram from time to time in its sole discretion. The Service is provided by MoneyGram Payment Systems, Inc., a money transmitter with its principal office at 1550 Utica Avenue South, Minneapolis, MN 55416 (“MoneyGram”) through a network of agents (“Agents”). Call

Send Information. The Sender/Receiver represents, warrants and certifies to MoneyGram that its and their use of the Service shall not in any way, directly or indirectly, violate any law, statute, ordinance, contract, or regulation, including but not limited to, any law, statute, ordinance, contract, or regulation relating to money laundering, illegal gambling activities, support for terrorist activities, fraud, or theft. Maximum permissible amounts for a single ExpressPayment transaction and daily Transfer totals will be applied. When required by applicable law, Your MoneyGram ExpressPayment Transfers will be reported to federal, state, local, or foreign authorities. In addition, MoneyGram will cooperate with law enforcement in the prosecution of illegal activities to the fullest extent permitted by applicable law. Neither the Sender nor Receiver will have a “deposit” with MoneyGram at any time during the Transfer. You agree and warrant that all information You provide is not false, inaccurate, or misleading. The next day and

Receive Information. A Transfer is received and MoneyGram has no further liability to You, except as set forth below, when notification of your Transfer is made available to the Receiver as identified in the Receive Code supplied on the MoneyGram® ExpressPayment® service form. Your Transfer may ultimately not be accepted by the Receiver and, in such event, the amount of your Transfer will be available to you as a refund. MoneyGram makes no representation as to when the Transfer (including any amounts transferred to a prepaid card) will be available or accepted by the Receiver or when amounts transferred or loaded on to a prepaid card will be available.

Refund Information. If you supply the wrong Receive Code, Receiver Name, or Account Number, the Transfer may be misdirected and, in such event, you shall not be entitled to a refund even though the intended party did not receive your Transfer. The Consumer Fee is usually not refundable. Some refunds may be delayed until MoneyGram receives official notification that a Transfer has not been accepted. Refund requests may be made either by visiting the Agent location where the Transfer originated or writing to MoneyGram. All refund requests must be accompanied by a copy of the original MoneyGram® ExpressPayment® service form. All refund requests will be subject to MoneyGram review and discretion and will normally be processed within 30 days of receipt of a valid written request unless a shorter period is required by law. Mail refund request and/or any correspondence to MoneyGram Payment Systems, Inc., ATTN: Refund Coordinator, 3940 South Teller Street, Lakewood, CO 80235 USA.

RIGHT TO REFUND. You,thecustomer,areentitledtoarefundofthemoneytobetransmittedastheresultofthis agreementifMoneyGramPaymentSystems,Inc.,(MoneyGram)doesnotforwardthemoneyreceivedfromyouwithin 10 days of the date of its receipt, or does not give instructions committing an equivalent amount of money to the persondesignatedbyyouwithin10daysofthedateofreceiptoffundsfromyouunlessotherwiseinstructedbyyou. If your instructions as to when the moneys shall be forwarded or transmitted are not complied with and the money hasnotyetbeenforwardedortransmitted,youhavearighttoarefundofyourmoney.Ifyouwantarefund,youmust mail or deliver your written request to MoneyGram Payment Systems, Inc., ATTN: Refund Coordinator, 3940 S. Teller Street,Lakewood,CO80235.Ifyoudonotreceiveyourrefund,youmaybeentitledtoyourmoneybackplusapenalty ofupto$1,000andattorney’sfeespursuanttoSection2102oftheCaliforniaFinancialCode.

Liability. In the event of any delay, nondelivery, nonpayment, or underpayment of the transfer, unless prohibited by applicable law, your exclusive and maximum remedy against moneygram is refund of the transfer amount (the amount to be paid or loaded by you) plus the consumer fee set forth on this

form. No other remedy is available to you, including, but not limited to no remedy for incidential, indirect, special, or consequential damages. These limitations apply whether your claim arises due to moneygram or itʼs agentsʼ negligence relating to human or mechanical error or otherwise, or to moneygram or its agentsʼ other fault, error, ommission, or nonperformance. Moneygram will not be liable for any variances or service delays due to local regulations or causes beyond the control of moneygram.

Arbitration. Unless otherwise specified by applicable law, any controversy or claim arising out of or relating to the transfer, this contract or breach of this contract, shall be settled by arbitration administered by the american arbitration association under its commerical arbitration rules and judgement on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof. Any such arbitration shall be initiated in the office of the

aaaclosest to the location where you initiated the transfer and this exclusive arbitration remedy shall not be maintained unless initiated within one year after the controversy or claim arose.

Privacy Notice. MoneyGram and its Agent use and save your and Senderʼs personal information and Transfer details, to provide Transfer services, manage our business, and for marketing. All personal information collected may be disclosed to our affiliates, Agents, and service providers, or as otherwise permitted by law. If fraud is suspected, your information will be shared with relevant law enforcement in the US and other countries, which may further share the information. Security measures are used to restrict access to personal information. To

TÉRMINOS Y CONDICIONES: Un cliente del servicio MoneyGram® ExpressPayment® (el “Servicio”) que se encuentra en los Estados Unidos (el “Remitente”) puede enviar un pago en efectivo (un “Pago” o una “Transferencia”) a una entidad con quien MoneyGram tenga un acuerdo (es decir, el receptor de su pago, en adelante el “Destinatario”) a modo de pago de una factura por un crédito en los Estados Unidos. Un tercero con tarjeta de débito prepaga emitida por una compañía de los EE. UU., una tarjeta de débito prepaga MoneyGram® y cualquier otra entidad que MoneyGram determine oportunamente a su exclusiva discreción también pueden ser Destinatarios y pueden recibir Transferencias. El servicio es proporcionado por MoneyGram Payment Systems, Inc., una compañía de transferencias de dinero con oficina principal en 1550 Utica Avenue South, Minneapolis, MN 55416 (“MoneyGram”) a través de una red de agentes (“Agentes”). Comuníquese al

Información de Envío. El Remitente/Destinatario declara, garantiza y certifica a MoneyGram que su uso del Servicio no infringirá ninguna ley, estatuto, ordenanza, contrato o regulación en forma directa o indirecta, incluidos, en forma enumerativa, cualquier ley, estatuto, ordenanza, contrato o regulación relativa al lavado de dinero, actividades de apuestas ilegales, apoyo a actividades terroristas, fraude o robo. Se aplicarán los montos máximos permitidos para una sola transacción de ExpressPayment y los totales de las transferencias diarias. Cuando fuera requerido por la ley correspondiente, se notificará acerca de sus Transferencias realizadas por MoneyGram ExpressPayment a las autoridades federales, estatales, locales o extranjeras. Asimismo, MoneyGram colaborará con las autoridades judiciales en procesar actividades ilegales en la medida en que lo permita la ley correspondiente. Ni el Remitente ni el Destinatario tendrán un “depósito” con MoneyGram en ningún momento durante la Transferencia. Usted acepta y garantiza que toda la información que Usted proporciona no es falsa, imprecisa ni engañosa. Los servicios de pago de cuentas al día siguiente y en 2 o 3 días no deben usarse para el pago de avisos de corte, desconexión o avisos similares.

Información de Cobro. Una vez recibida la Transferencia, MoneyGram deja de tener responsabilidad ante Usted, excepto según lo establecido a continuación, cuando se notifica el pago de la Transferencia al Destinatario como lo establece el Código de control proporcionado en el formulario de servicio de MoneyGram® ExpressPayment®. Su Transferencia puede ser rechazada en última instancia por el Destinatario; en tal caso, se le reembolsará el monto de su Transferencia. MoneyGram no estipula de ninguna manera cuándo estará disponible la Transferencia (incluidos los montos transferidos a una tarjeta prepaga) o cuándo el Destinatario aceptará la transferencia o cuándo los montos transferidos o cargados en una tarjeta prepaga estarán disponibles.

Información Acerca de Reembolsos. Si usted proporciona de manera incorrecta el Código de Recibo, el nombre del Destinatario o el Número de cuenta, es posible que la Transferencia se envíe al sitio equivocado y, en tal caso, no tendrá derecho a un reembolso, aun cuando la persona a quien procuraba enviar dicha Transferencia no la hubiera recibido. Generalmente no se reembolsan las comisiones cobradas a los consumidores. A veces sucede que algunos reembolsos son demorados hasta que MoneyGram recibe la notificación oficial de que no se ha aceptado la Transferencia. Las solicitudes de reembolso pueden realizarse en la Agencia donde se originó la Transferencia o presentando una nota a MoneyGram. Todas las solicitudes de reembolso deben presentarse con una copia original del formulario de servicio de MoneyGram® ExpressPayment®. Todas las solicitudes de reembolso están sujetas a la revisión y discreción de MoneyGram y, por lo general, se procesan dentro de los 30 días de recibir la solicitud válida por escrito, a no ser que por ley se requiera su procesamiento en un período más corto. Envíe por correo la solicitud de reembolso y/o cualquier otra correspondencia a MoneyGram Payment System, Inc., ATTN: Refund Coordinator, 3940 South Teller Street, Lakewood, CO 80235 USA.

DERECHO A REEMBOLSO. Usted, el cliente, tiene derecho a recibir el reembolso del dinero que será transferido como resultado de este acuerdo, si MoneyGram Payment Systems, Inc. (MoneyGram) no envía el dinero que usted entregue dentro de los siguientes 10 días posteriores a la fecha de recibo, o si no da instrucciones de consignar una cantidadequivalentededineroalapersonaqueustedhayadesignado,dentrodelossiguientes10díasposteriores a la fecha de recibo de los fondos que usted entregó, a menos que usted haya dado instrucciones diferentes. Si no se cumplen las instrucciones que usted haya dado, relativas al día en que el dinero debe ser enviado o transferido y el dinero aún no ha sido enviadoo transferido, usted tiene el derecho a recibir un reembolso de su dinero. Si desea recibir un reembolso, deberá entregar o enviar por correo su solicitud por escrito a MoneyGram Payment Systems, Inc., ATTN.: Refund Coordinator, 3940 S. Teller Street, Lakewood, CO 80235. Si no recibe el reembolso, puede tener derechoarecibirsudineroademásdeunapenalidadhastade$1,000yloscostosdeunabogado,segúnloestablece la Sección 2102 del Código Financiero de California (California Financial Code).

Responsabilidad civil. En caso de cualquier retraso, falta de entrega, falta de pago o pago menor de la transferencia, a menos que fuera prohibido por la ley correspondiente, su único y máximo recurso en contra de moneygram es el reembolso de la suma de la transferencia (la suma que usted paga o carga) más la comisión del consumidor estipulada en este formulario. No existe ningún otro recurso disponible, entre otros, recursos por daños incidentales, indirectos, especiales o sobrevinientes. Estas limitaciones se aplican independientemente de que su reclamo surja debido a la negligencia de moneygram o sus agentes, debido a errores humanos o mecánicos o de otro tipo, o debido a la falla, error, omisión o incumplimiento de moneygram o de sus agentes. Moneygram no será responsable por ninguna variación o retraso de servicio debido a reglamentaciones locales o causas ajenas al control de moneygram.

Arbitraje. A menos que la ley vigente especifique lo contrario, cualquier controversia o reclamo que surja de la transferencia o en relación con ella, o de este contrato o su incumplimiento, será resuelto por el arbitraje conducido por la asociación estadounidense de arbitraje en cumplimiento de las reglas de arbitraje comercial y la sentencia sobre el laudo pronunciado por el árbitro o los árbitros puede ser dictada en cualquier tribunal competente. Todo arbitraje será iniciado en la oficina de aaa más cercana al sitio donde se haya realizado la transferencia y este recurso exclusivo de arbitraje no procederá a menos que se inicie dentro del año siguiente a partir de la fecha en que surge la controversia o el reclamo.

Notificación de privacidad. MoneyGram y sus Agentes utilizan y guardan la información personal y los detalles de transferencias de usted y del remitente con el objetivo de brindar servicios de transferencia, administrar nuestra empresa y realizar actividades de comercialización. Toda la información personal recopilada se divulgará a nuestras filiales, Agentes y proveedores de servicio, o según lo permita o requiera la ley. Si se sospecha que pudo haber un fraude, su información se compartirá con las autoridades judiciales pertinentes de los EE. UU. y de otros países, quienes a su vez también podrán compartir la información. Las medidas de seguridad se utilizan para restringir el acceso a la información personal. Para optar por no recibir información sobre productos y servicios, puede enviar un correo electrónico a marketingpreferences@moneygram.com o comunicarse al

7598G

Form Data

| Fact Name | Detail |

|---|---|

| Service Provider | MoneyGram Payment Systems, Inc. located at 1550 Utica Avenue South, Minneapolis, MN 55416 |

| User Instructions | Sender represents they are not violating any laws using the Service, including but not limited to money laundering or supporting terrorist activities |

| Transaction Limits | Maximum permissible amounts for a single transaction and daily totals are enforced |

| Liability and Refund Policy | In case of errors, sender's exclusive remedy is the refund of their transfer amount plus the service fee. Misdirected transfers due to wrong information may not qualify for a refund |

| Governing Law for California Residents | Right to refund as per Section 2102 of the California Financial Code, with potential penalties for non-compliance |

Instructions on Utilizing Moneygram Express Payment

Filling out the MoneyGram ExpressPayment form is a straightforward process. This form is used for making immediate payments towards bills or loading prepaid cards, offering a same-day notification service to ensure that transactions are processed promptly. It's essential to complete every required section accurately to avoid any issues or delays with your transaction. Follow the steps below to ensure a complete and correct submission of your form.

- Start with the "Sender’s Full Name" section. Enter your first name, middle name (if applicable), and last name as it appears on your official ID.

- In the "Sender’s Main Telephone Number" field, input your primary contact number including area code.

- Proceed to "Sender’s Address". Here, write your current residential address. Include street name, number, apartment or suite number if relevant.

- Fill in the "City", "State", and "Zip Code" sections with your respective city, state, and postal code information.

- For the section titled "Pay a bill," if applicable:

- Enter the "Company Name" of the biller.

- Include the "City & State" and "Receive Code" if you know these details; they're optional but can expedite the process.

- Write the "Account Number of the Bill to Pay" and the "Amount to Pay" in the designated fields.

- If there’s a specific "Message to Biller or Beneficiary Name", add this information, noting the 40-character limit.

- To "Load a prepaid card":

- Input the "Company Name" associated with the prepaid card.

- Optional: Add the "City & State" and "Receive Code" if known.

- Include the "Prepaid Card Number to Load" and the "Amount to Load".

- Finally, sign and date the form in the "Sender’s Signature" and "Date" fields to authenticate your submission.

Once completed, review the form to ensure all provided information is accurate and legible. Submit your form to a MoneyGram agent or representative. Remember, accurate completion of this form is crucial for the successful processing of your transaction. Errors or incomplete information can result in delays or the transaction not being processed as intended.

Obtain Answers on Moneygram Express Payment

FAQs about the MoneyGram® ExpressPayment® Service

- What is the MoneyGram ExpressPayment Service?

The MoneyGram ExpressPayment Service allows customers in the United States to send cash payments or transfers to entities partnered with MoneyGram. This service facilitates the payment of bills or credit in the United States and can include transfers to third-party prepaid debit cards, MoneyGram branded prepaid debit cards, and other entities as specified by MoneyGram.

- How can I use the MoneyGram ExpressPayment Service?

To use the service, complete the ExpressPayment service form with your sender information, including your full name, main telephone number, and address. Choose whether you're paying a bill or loading a prepaid card, and fill in the required details such as the company name, city and state (optional), receive code (optional), account number or prepaid card number, and the amount.

- What fees are associated with this service?

The Consumer Fee varies based on the transaction details and will be outlined on the MoneyGram ExpressPayment service form at the time of the transfer. Note that this fee usually is not refundable.

- Can I get a refund if I made a mistake?

If incorrect details like the Receive Code, Receiver Name, or Account Number are provided, the transfer may be misdirected. Generally, you will not be entitled to a refund in such cases. However, if no error has been made on your part, refund requests can be made either by visiting the Agent location where the transfer originated or by writing to MoneyGram.

- What is the maximum amount I can send using the ExpressPayment service?

Maximum permissible amounts for a single ExpressPayment transaction and daily transfer totals are applied and vary depending on the transaction. For specific limits, it's recommended to consult with the MoneyGram agent or service.

- How quickly are payments through the ExpressPayment service processed?

Payments are intended to be processed either the same day or within 2-3 days, depending on the type of service chosen. However, immediate processing is not guaranteed for disconnection shutoff notices or similar urgent payments.

- Are there any restrictions on what I can pay for with the MoneyGram ExpressPayment service?

Yes, the service primarily facilitates payments for bills, credits, and loads to prepaid cards within the United States. Payments or transfers intended for illegal activities, including but not limited to money laundering, illegal gambling, or support for terrorist activities, are strictly prohibited.

- How can I find a MoneyGram Agent near me to make a payment?

You can find a MoneyGram Agent by calling 1-800-926-9400 for information, including the addresses and phone numbers of agents near your location.

- What happens if the receiver does not accept my transfer?

If the receiver does not accept your transfer, the amount of the transfer will be available to you as a refund. The timeframe for refund availability and processing may vary.

- How do I opt-out of receiving marketing information from MoneyGram?

To opt-out of receiving marketing communications, you can email marketingpreferences@moneygram.com or call 1-800-926-9400. It may take at least 4 weeks for your opt-out request to be processed.

Common mistakes

Not fully completing the sender's full name, including forgetting to include any middle name(s) or initial(s) that might be part of the sender's legal name, results in incomplete identification information. This makes it challenging to process the transfer if additional verification is needed.

Failing to provide the sender's main telephone number can lead to difficulties in communication if there are any issues or additional verification required with the payment or transfer.

Omitting any part of the sender's address, including the city, state, or ZIP code, may lead to delays. Accurate and complete addresses ensure that transactions are linked to the correct geographical location for legal and processing reasons.

Incorrectly filling out the company name or account number on the payment section can misdirect the payment. Precise company names and account numbers are crucial for ensuring that payments reach their intended recipients.

Leaving the amount to pay or load blank or entering an incorrect amount can cause the transaction to fail or process with the wrong totals, leading to financial discrepancies.

When sending messages to the biller or beneficiary, exceeding the 40-character limit or including information that may not be transmitted by all companies could result in important messages not being conveyed.

Entering an incorrect prepaid card number to load can misroute funds. It is vital to double-check this information to ensure the correct account is credited.

Ignoring the terms and conditions, rights to refunds, and liability clauses can lead to misunderstandings about the responsibilities of MoneyGram, the sender, and the recipient. Understanding these sections can help manage expectations and understand the process and potential outcomes.

Omitting the sender's signature and date at the bottom of the form invalidates the form. These are required to confirm the sender's agreement to the terms and to verify the transaction's timing.

Documents used along the form

In today’s increasingly digital and interconnected world, MoneyGram® ExpressPayment® Service facilitates real-time financial transactions, such as bill payments and card loads, with ease and reliability. However, completing such transactions often necessitates accompanying documentation to ensure a seamless process. Here is a list of forms and documents that are frequently used alongside the MoneyGram® ExpressPayment® form:

- 1. Identification Document: This could be a government-issued ID, such as a driver’s license or passport, to verify the identity of the sender or receiver.

- 2. Proof of Address: A utility bill or bank statement that confirms the sender's address might be required for transactions over a certain amount.

- 3. Transaction Receipt: After completing a transaction, a receipt issued by MoneyGram provides a record of the payment or transfer.

- 4. Beneficiary Information: Details of the biller or card to be loaded - including account numbers and company names - ensure funds are correctly applied.

- 5. Payment Confirmation: A document or message confirming the transaction has been processed may be needed for the sender’s records or for proof of payment.

- 6. Bank Statements: Sometimes, sender’s recent bank statements are required to verify source of funds for large transactions.

- 7. Compliance Forms: For international transfers or large amounts, compliance documents addressing anti-money laundering might be necessary.

- 8. Power of Attorney: If someone is conducting transactions on behalf of another individual, a valid power of attorney document might be required.

- 9. Company Authorization Letter: For businesses using MoneyGram® services, an authorization letter specifying the individual(s) allowed to conduct transactions can be mandatory.

- 10. Dispute Form: In case of any discrepancies or issues with a transaction, a dispute form helps in raising concerns to be addressed by MoneyGram.

Each of these documents plays a vital role in the facilitation and verification of transactions made through MoneyGram®, ensuring both compliance with regulations and the security of the funds being transferred. Understanding and having these documents ready when needed can significantly streamline the process of using MoneyGram®'s services.

Similar forms

-

Bank Wire Transfer Forms: Similar to the MoneyGram ExpressPayment form, bank wire transfer forms enable customers to send money directly to a recipient's bank account, domestically or internationally. Both forms typically require sender and recipient details, including account information, and offer same-day or next-day money transfer services.

-

Western Union Send Money Forms: Western Union's send money forms function similarly to the MoneyGram ExpressPayment form in that they allow individuals to transfer funds to another party quickly. Both forms ask for sender and receiver information and can be used for various services, including bill payments and prepaid card loads.

-

PayPal Send Money Forms: Although primarily a digital platform, PayPal offers a service that is conceptually similar to MoneyGram's ExpressPayment by allowing users to send money online to various entities or individuals. Both require key information about the sender and the recipient and can be used for immediate transactions.

-

Prepaid Card Load Forms: These forms are designed to add funds to a prepaid card, akin to the section of the MoneyGram form that facilitates loading money onto prepaid cards. In both situations, the cardholder must provide relevant card details and the amount to be loaded.

-

Check Payment Form: Check payment forms, used for bill payments or sending money to individuals, share similarities with MoneyGram’s service form in the context of bill payments. Both require information about the payee, the sender, and the specific amounts to be paid, although the methods of sending funds differ.

-

Online Bill Payment Forms: These forms are used within online banking systems for bill payments and are similar to MoneyGram's ExpressPayment service forms in that they require the biller's details, the customer's account information, and the payment amount. Both enable users to pay bills electronically and often instantly.

-

Direct Deposit Forms: Used for setting up salary, benefit, or tax return deposits to bank accounts, direct deposit forms bear similarity to MoneyGram forms for their need for recipient/account information and the specifics of the transfer. Despite their different contexts, both facilitate the transfer of money from one party to another.

-

Mobile Wallet Transfer Forms: Services like Venmo or Cash App offer user-friendly platforms for transferring money between mobile wallets, which is conceptually similar to MoneyGram's service allowing for the fast transfer of funds. Both types of services necessitate entering recipient and sender details and the amount to be transferred.

Dos and Don'ts

When filling out a MoneyGram ExpressPayment form, certain practices can help ensure a smooth transaction process. These practices are divided into what you should and shouldn't do:

Things You Should Do:

- Verify the receiver's details: Double-check the receiver's name, receive code, and account number to ensure the payment reaches the correct destination.

- Provide accurate sender information: Fill in your full name, main telephone number, and address accurately to avoid any issues with your transaction.

- Confirm the amount: Clearly state the exact amount you wish to pay or load onto a prepaid card to prevent misunderstandings or delays.

- Keep your customer copy safe: After completing the form, make sure to keep your copy in a safe place as it serves as proof of your transaction and is required for any refund requests.

Things You Shouldn't Do:

- Leave sections blank: Do not leave any required fields empty. If certain information is optional and does not apply to your transaction, fill it with "N/A" to indicate it's consciously left blank.

- Misstate your payment details: Avoid errors in entering the amount to pay or load. Mistakes can complicate the transaction and may lead to unintended overpayments or underpayments.

- Ignore the terms and conditions: Skipping the fine print can lead to missed critical information about refunds, liability, and rights to refund that directly affect your transaction.

- Forget to sign and date: Your signature and the date validate the form. Failing to include them could invalidate your transaction or delay the payment process.

Misconceptions

When it comes to handling finances, especially services like MoneyGram's ExpressPayment, clarity is crucial. Misunderstandings can lead to incorrect uses of services, dissatisfaction, or financial loss. Here, we debunk some common misconceptions about the MoneyGram Express Payment form:

Only Bills Can Be Paid: A widespread misconception is that the service is exclusively for bill payments. While it does provide that option, it also allows users to load prepaid cards. This dual functionality supports both bill payment and card loading, widening the service’s utility.

Same-Day Notification Applies to All Services: Though the form highlights "Pay a bill (Same-day notification)," this feature primarily benefits bill payments. When loading prepaid cards, the timeline for funds to become available can vary depending on the card issuer's policies.

Payments and Loads Are Limited to the United States: While it’s true that the service’s primary market is the United States, users should not assume its utility is confined within these borders. The form allows payments to entities and card loading for cards issued by U.S. companies, which can have international uses.

Information Provided to MoneyGram Is Restricted to Transaction Processing: Privacy concerns loom large in financial transactions. It's crucial to understand that MoneyGram uses personal and transactional information not just for processing but also for managing its business and marketing, with strict adherence to privacy laws.

All Prepaid Cards Are Eligible for Loading: Each prepaid card comes with its policies and compatibility. The form mentions "Popular Prepaid Card Receive Codes," indicating that while many are supported, not all can be loaded via this service. Users should confirm compatibility beforehand.

Unlimited Transfer Amounts: Transfers, whether for bill payments or card loading, are subject to limitations. The form and associated terms note that maximum permissible amounts apply, underscoring the importance of checking these limits to plan transactions effectively.

MoneyGram Is Similar to a Bank Account: Customers sometimes misconceive MoneyGram's roles, thinking of it as a bank. However, neither the sender nor the receiver holds a “deposit” with MoneyGram. It is a payment service that facilitates transactions rather than offering banking services.

Refunds Are Automatic: In instances of incorrect information leading to misdirected payments, refunds are not guaranteed. The terms specify conditions under which refunds may not be provided, prompting users to double-check details before confirming a transaction.

Understanding these nuances can significantly enhance users' experiences with MoneyGram's ExpressPayment Service, ensuring their financial transactions are conducted smoothly and according to expectations.

Key takeaways

When completing the MoneyGram ExpressPayment form, it's crucial to fill in accurate and complete information about the sender, including full name, main telephone number, address, city, state, and zip code. This ensures the payment is correctly processed and attributed.

Filling out the payment details accurately is necessary to avoid delays or issues with the transaction. This includes the company name for bill payments or prepaid card loading, the optional city and state, optional receive code, account number or prepaid card number, and the specific amount.

The form allows for a message of up to 40 characters to the biller or beneficiary, though it's important to note that not all companies can receive this message. Care should be taken to ensure this message is clear and pertinent to the payment.

- Utilize the list of popular prepaid card receive codes provided to ensure accurate loading to the intended prepaid card.

- Be aware of the Terms and Conditions that govern the use of MoneyGram’s ExpressPayment Service, including legal compliance and restrictions on the uses of the service.

- MoneyGram ExpressPayment transactions are subject to maximum permissible amounts per transaction and daily totals, emphasizing the need to plan large payments accordingly.

- Understand that any provided incorrect information (Receive Code, Receiver Name, Account Number) can lead to misdirected transactions, with potential implications for the sender's ability to obtain a refund.

- In case of transaction issues, the primary recourse available to users is the refund of the transfer amount and the consumer fee, highlighting the importance of double-checking transaction details before submission.

- The arbitration clause indicates that any disputes related to the transaction or service will be settled by arbitration, which underscores the need for careful consideration and understanding before initiating a transaction.

- The privacy notice outlines how personal and transaction details are used and shared, including for fraud prevention, and provides instructions for opting out of marketing communications.

- Accurate completion of sender and transaction information is not just a matter of proper form filling but is crucial for legal and operational reasons, including the potential for refunds and avoiding legal scrutiny.

Finally, it's imperative to note the right to a refund under specific conditions and the outlined process for requesting one, ensuring users are aware of their rights and the steps necessary for asserting them in the face of issues.

Popular PDF Forms

Hospital Incident Report - A critical condition incident was filed when a patient's symptoms were underestimated, leading to a delayed diagnosis and treatment of a life-threatening condition.

Temporary Custody Order California - Employs a procedural approach to minimize or eliminate legal burdens related to vehicle offenses for prisoners.

Fia-1100a - In the broader scope of child care assistance, the FIA1100A is a tool for maintaining the integrity and targeted support of the program.