Blank Mt199 PDF Template

In the realm of international finance and banking, the MT199 form serves as a critical message type within the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system, facilitating the secure and rapid exchange of information concerning financial transactions between banks. Essentially a pre-advice, it notifies the receiving bank about an upcoming message or transaction, setting the stage for smoother operations, especially in the issuance of bank guarantees or Standby Letters of Credit (SBLC). An MT199 form outlines essential details such as the banks involved (both issuing and receiving), officer contacts, account specifics, and the nature of the bank instrument (e.g., BG or SBLC), including its amount, validity period, and terms of payment. This pre-advice plays an invaluable role in ensuring transparency and readiness between financial institutions, contributing to the efficacy and reliability of international trade and credit transactions. It is designed within the framework of established international banking practices, specifically adhering to guidelines set by the International Chamber of Commerce (ICC), ensuring consistency and a standard level of operation within global banking circuits. As a negotiable, irrevocable, and unconditional undertaking by the issuing bank, the MT199 guarantees the beneficiary payment at maturity without impediments, facilitating international trade with a higher assurance of payment and financial compliance.

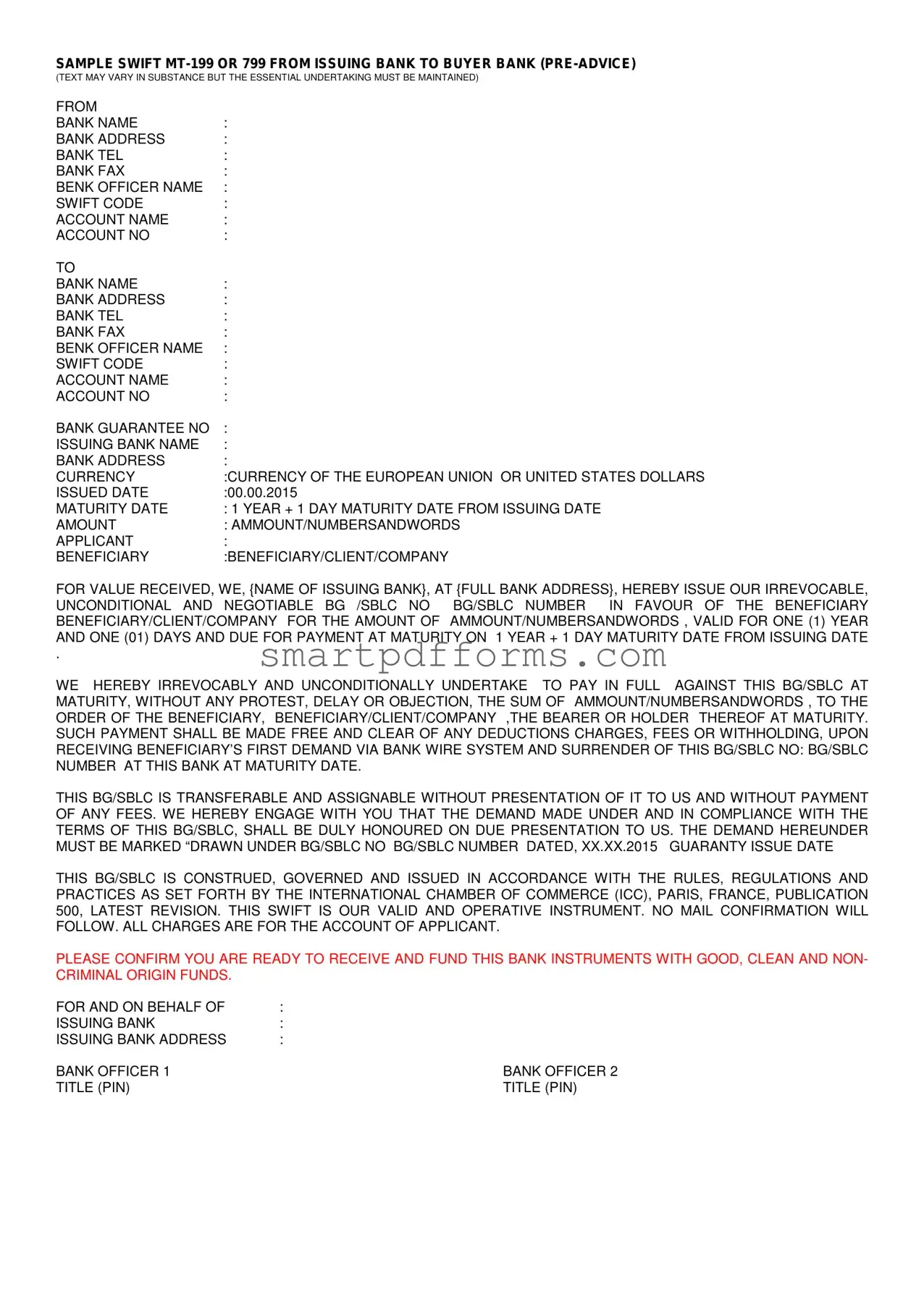

Preview - Mt199 Form

SAMPLE SWIFT

(TEXT MAY VARY IN SUBSTANCE BUT THE ESSENTIAL UNDERTAKING MUST BE MAINTAINED)

FROM |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

TO |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

BANK GUARANTEE NO |

: |

ISSUING BANK NAME |

: |

BANK ADDRESS |

: |

CURRENCY |

:CURRENCY OF THE EUROPEAN UNION OR UNITED STATES DOLLARS |

ISSUED DATE |

:00.00.2015 |

MATURITY DATE |

: 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE |

AMOUNT |

: AMMOUNT/NUMBERSANDWORDS |

APPLICANT |

: |

BENEFICIARY |

:BENEFICIARY/CLIENT/COMPANY |

FOR VALUE RECEIVED, WE, {NAME OF ISSUING BANK}, AT {FULL BANK ADDRESS}, HEREBY ISSUE OUR IRREVOCABLE,

UNCONDITIONAL AND NEGOTIABLE BG /SBLC NO BG/SBLC NUMBER IN FAVOUR OF THE BENEFICIARY BENEFICIARY/CLIENT/COMPANY FOR THE AMOUNT OF AMMOUNT/NUMBERSANDWORDS , VALID FOR ONE (1) YEAR AND ONE (01) DAYS AND DUE FOR PAYMENT AT MATURITY ON 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE

.

WE HEREBY IRREVOCABLY AND UNCONDITIONALLY UNDERTAKE TO PAY IN FULL AGAINST THIS BG/SBLC AT MATURITY, WITHOUT ANY PROTEST, DELAY OR OBJECTION, THE SUM OF AMMOUNT/NUMBERSANDWORDS , TO THE ORDER OF THE BENEFICIARY, BENEFICIARY/CLIENT/COMPANY ,THE BEARER OR HOLDER THEREOF AT MATURITY. SUCH PAYMENT SHALL BE MADE FREE AND CLEAR OF ANY DEDUCTIONS CHARGES, FEES OR WITHHOLDING, UPON RECEIVING BENEFICIARY’S FIRST DEMAND VIA BANK WIRE SYSTEM AND SURRENDER OF THIS BG/SBLC NO: BG/SBLC NUMBER AT THIS BANK AT MATURITY DATE.

THIS BG/SBLC IS TRANSFERABLE AND ASSIGNABLE WITHOUT PRESENTATION OF IT TO US AND WITHOUT PAYMENT OF ANY FEES. WE HEREBY ENGAGE WITH YOU THAT THE DEMAND MADE UNDER AND IN COMPLIANCE WITH THE TERMS OF THIS BG/SBLC, SHALL BE DULY HONOURED ON DUE PRESENTATION TO US. THE DEMAND HEREUNDER MUST BE MARKED “DRAWN UNDER BG/SBLC NO BG/SBLC NUMBER DATED, XX.XX.2015 GUARANTY ISSUE DATE

THIS BG/SBLC IS CONSTRUED, GOVERNED AND ISSUED IN ACCORDANCE WITH THE RULES, REGULATIONS AND PRACTICES AS SET FORTH BY THE INTERNATIONAL CHAMBER OF COMMERCE (ICC), PARIS, FRANCE, PUBLICATION 500, LATEST REVISION. THIS SWIFT IS OUR VALID AND OPERATIVE INSTRUMENT. NO MAIL CONFIRMATION WILL FOLLOW. ALL CHARGES ARE FOR THE ACCOUNT OF APPLICANT.

PLEASE CONFIRM YOU ARE READY TO RECEIVE AND FUND THIS BANK INSTRUMENTS WITH GOOD, CLEAN AND NON- CRIMINAL ORIGIN FUNDS.

FOR AND ON BEHALF OF |

: |

ISSUING BANK |

: |

ISSUING BANK ADDRESS |

: |

BANK OFFICER 1 |

BANK OFFICER 2 |

TITLE (PIN) |

TITLE (PIN) |

SAMPLE SWIFT

(TEXT MAY VARY IN SUBSTANCE BUT THE ESSENTIAL UNDERTAKING MUST BE MAINTAINED)

FROM |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

TO |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

BANK GUARANTEE NO |

: |

ISSUING BANK NAME |

: |

BANK ADDRESS |

: |

CURRENCY |

:CURRENCY OF THE EUROPEAN UNION OR UNITED STATES DOLLARS |

ISSUED DATE |

:00.00.2015 |

MATURITY DATE |

: 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE |

AMOUNT |

: AMMOUNT/NUMBERSANDWORDS |

APPLICANT |

: |

BENEFICIARY |

:BENEFICIARY/CLIENT/COMPANY |

FOR VALUE RECEIVED, WE, {NAME OF ISSUING BANK}, AT {FULL BANK ADDRESS}, HEREBY ISSUE OUR IRREVOCABLE,

UNCONDITIONAL AND NEGOTIABLE BG /SBLC NO BG/SBLC NUMBER IN FAVOUR OF THE BENEFICIARY BENEFICIARY/CLIENT/COMPANY FOR THE AMOUNT OF AMMOUNT/NUMBERSANDWORDS , VALID FOR ONE (1) YEAR AND ONE (01) DAYS AND DUE FOR PAYMENT AT MATURITY ON 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE

.

WE HEREBY IRREVOCABLY AND UNCONDITIONALLY UNDERTAKE TO PAY IN FULL AGAINST THIS BG/SBLC AT MATURITY, WITHOUT ANY PROTEST, DELAY OR OBJECTION, THE SUM OF AMMOUNT/NUMBERSANDWORDS , TO THE ORDER OF THE BENEFICIARY, BENEFICIARY/CLIENT/COMPANY ,THE BEARER OR HOLDER THEREOF AT MATURITY. SUCH PAYMENT SHALL BE MADE FREE AND CLEAR OF ANY DEDUCTIONS CHARGES, FEES OR WITHHOLDING, UPON RECEIVING BENEFICIARY’S FIRST DEMAND VIA BANK WIRE SYSTEM AND SURRENDER OF THIS BG/SBLC NO: BG/SBLC NUMBER AT THIS BANK AT MATURITY DATE.

THIS BG/SBLC IS TRANSFERABLE AND ASSIGNABLE WITHOUT PRESENTATION OF IT TO US AND WITHOUT PAYMENT OF ANY FEES. WE HEREBY ENGAGE WITH YOU THAT THE DEMAND MADE UNDER AND IN COMPLIANCE WITH THE TERMS OF THIS BG/SBLC, SHALL BE DULY HONOURED ON DUE PRESENTATION TO US. THE DEMAND HEREUNDER MUST BE MARKED “DRAWN UNDER BG/SBLC NO BG/SBLC NUMBER DATED, XX.XX.2015 GUARANTY ISSUE DATE

THIS BG/SBLC IS CONSTRUED, GOVERNED AND ISSUED IN ACCORDANCE WITH THE RULES, REGULATIONS AND PRACTICES AS SET FORTH BY THE INTERNATIONAL CHAMBER OF COMMERCE (ICC), PARIS, FRANCE, PUBLICATION 500, LATEST REVISION. THIS SWIFT IS OUR VALID AND OPERATIVE INSTRUMENT. NO MAIL CONFIRMATION WILL FOLLOW. ALL CHARGES ARE FOR THE ACCOUNT OF APPLICANT.

FOR AND ON BEHALF OF |

: |

ISSUING BANK |

: |

ISSUING BANK ADDRESS |

: |

BANK OFFICER 1 |

BANK OFFICER 2 |

TITLE (PIN) |

TITLE (PIN) |

SAMPLE SWIFT

(TEXT MAY VARY IN SUBSTANCE BUT THE ESSENTIAL UNDERTAKING MUST BE MAINTAINED)

FROM |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

TO |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

BANK GUARANTEE NO |

: |

ISSUING BANK NAME |

: |

BANK ADDRESS |

: |

CURRENCY |

:CURRENCY OF THE EUROPEAN UNION |

|

OR UNITED STATES DOLLARS |

ISSUED DATE |

:00.00.2015 |

MATURITY DATE |

: 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE |

AMOUNT |

: AMMOUNT/NUMBERSANDWORDS |

APPLICANT |

: |

BENEFICIARY |

:BENEFICIARY/CLIENT/COMPANY |

WE, (NAME OF ISSUING BANK) WHOSE OFFICE IS LOCATED AT (ADDRESS OF ISSUING BANK), EFFECTIVELY IMMEDIATELY, HEREBY ISSUE IN YOUR FAVOR OUR IRREVOCABLE AND UNCONDITIONAL STANDBY LETTER OF CREDIT NO. ("SBLC") FOR AN AMOUNT NOT TO EXCEED (AMOUNT IN NUMBERS) (AMOUNT IN WORDS) (THE "AGGREGATE TOTAL AMOUNT') EXPIRING ON (SBLC EXPIRY DATE) AT OUR COUNTERS.

THIS SBLC HAS BEEN ISSUED AS A SECURITY COVERING THE CREDIT FACILITIES (INCLUDING BUT NOT LIMITED TO, INTEREST AND BANK CHARGES) WHICH YOU HAVE EXTENDED (OR WILL EXTEND) TO (NAME AND ADDRESS OF THE CLIENT) (THE "COMPANY")

FUNDS AVAILABLE UNDER THIS SBLC ARE AVAILABLE TO YOU AGAINST YOUR WRITTEN DEMAND FOR PAYMENT OF AN AMOUNT NOT EXCEEDING THE AGGREGATE (TOTAL AMOUNT). THE DEMAND MUST BE MADE UPON US IN THE FORM OF A TESTED TELEX OR AUTHENTICATED SWIFT IN WHICH THIS SBLC MUST BE IDENTIFIED BY ITS NUMBER AND INCORPORATING YOUR CERTIFICATION THAT:- "

"THIS DRAWING UNDER THE SBLC IN THE AMOUNT OF (__) (THE "DRAWING AMOUNT") IS MADE IN RESPECT OF AMOUNTS DUE AND PAYABLE TO US FROM THE COMPANY. WE HAVE FORMALLY DEMANDED PAYMENT OF SUCH AMOUNT DUE FROM THE COMPANY, AND THE COMPANY HAS FAILED TO COMPLY WITH SUCH DEMAND. YOU ARE REQUIRED TO MAKE PAYMENT OF THE REQUIRED DRAWING AMOUNT TO OUR ACCOUNT NUMBER (_) HELD WITH , PARTIAL DRAWINGS ARE PERMITTED WITH THE MAXIMUM OF THE AGGREGATE TOTAL AMOUNT.

WE HEREBY FURTHER AGREE TO PROMPTLY HONOUR UPON RECEIPT OF YOUR FIRST DEMAND PROVIDED SUCH DEMAND IS WITHIN THE VALIDITY OF THE SBLC. IN THE EVENT, IF YOUR DEMAND IS NOT HONORED ON FIRST DEMAND, WE ADDITIONALLY UNDERTAKE TO PAY SWIFT/CABLE CHARGES ALONG WITH ACCRUED INTEREST AT THE RATE OF PA FROM THE DATE THE PAYMENT IS DUE UNTIL THE FINAL DATE OF RECEIPT OF CLEAR FUNDS INTO THE ACCOUNT OF YOUR CORRESPONDENT. SUCH FUNDS WILL BE EFFECTED BY OUR BANK IN (INDICATE CURRENCY OF THE GUARANTEE) FREE AND CLEAR OF, AND WITHOUT DEDUCTION FOR OR ON ACCOUNT OF ANY PRESENT OR FUTURE TAXES, LEVIES, IMPOST S, DUTIES, CHARGES FEES, COMMISSIONS, DEDUCTIONS OR WITH HOLDINGS OF ANY NATURE WHATSOEVER AND BY WHOMSOEVER IMPOSED

THIS SBLC IS SUBJECT TO THE INTERNATIONAL STANDBY PRACTICE 1998. INTERNATIONAL CHAMBER OF COMMERCE, PUBLICATION N590 (THE "ISBP") AND AS TO THE MATTERS NOT GOVERNED BY ISP 98, SHALL BE GOVERNED BY THE LAWS OF EUROPEAN UNION AND ANY DISPUTES ARISING THERE UNDER SHALL BE SUBJECT TO THE JURISDICTION OF THE COURTS OF FRANKFURT, GERMANY.

FOR AND ON BEHALF OF |

: |

ISSUING BANK |

: |

ISSUING BANK ADDRESS |

: |

BANK OFFICER 1 |

BANK OFFICER 2 |

TITLE (PIN) |

TITLE (PIN) |

SAMPLE SWIFT

(TEXT MAY VARY IN SUBSTANCE BUT THE ESSENTIAL UNDERTAKING MUST BE MAINTAINED)

FROM |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

TO |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

BANK GUARANTEE NO |

: |

ISSUING BANK NAME |

: |

BANK ADDRESS |

: |

CURRENCY |

:CURRENCY OF THE EUROPEAN UNION OR UNITED STATES DOLLARS |

ISSUED DATE |

:00.00.2015 |

MATURITY DATE |

: 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE |

AMOUNT |

: AMMOUNT/NUMBERSANDWORDS |

APPLICANT |

: |

BENEFICIARY |

:BENEFICIARY/CLIENT/COMPANY |

FOR VALUE RECEIVED WE THE UNDERSIGNED, XXX BANK PLC, ADDRESS AT 8 CANADA SQUARE E14 5HQ LONDON UK, HEREBY IRREVOCABLY, UNCONDITIONALLY AND WITHOUT PROTEST OR NOTIFICATION ON FIRST DEMAND, PROMISE TO PAY AT MATURITY TO THE ORDER OF ___________ THEREOF, THE SUM OF XXXXXXXXXXXXX (XXXXXXX

MILLION XXX) IN THE LAWFUL CURRENCY OF THE EUROPEAN UNION/UNITED STATES DOLLARS UPON PRESENTATION AND SURRENDER OF THIS GUARANTEE AT THE OFFICE OF HSBC BANK PLC.

SUCH PAYMENT SHALL BE MADE WITHOUT SET OFF AND SHALL BE UNENCUMBERED FREE AND CLEAR OF ANY DEDUCTIONS, CHARGES, FEES OR WITH HOLDING OR ANY NATURE NOW OR HEREAFTER IMPOSED, LEVIED, COLLECTED, WITHHELD OR ASSESSED BY THE GOVERNMENT OR ANY POLITICAL SUBDIVISION OR AUTHORITY THEREOF OR THEREIN.

THIS GUARANTEE IS FULLY CASH BACKED WITH FUNDS ON DEPOSIT THAT ARE GOOD, CLEAN, CLEARED OF NON- CRIMINAL ORIGIN, FREE OF ANY LIENS OR ENCUMBRANCES LEGALLY EARNED BY THE APPLICANT. THIS BANK GUARANTEE IS UNCONDITIONAL, TRANSFERABLE, ASSIGNABLE, DIVISIBLE AND CONFIRMED WITHOUT PRESENTATION OF IT TO US AND SHALL BE GOVERNED AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED KINGDOM.

THIS BANK GUARANTEE IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICES FOR BANK GUARANTEE AS SET FORTH BY THE INTERNATIONAL CHAMBER OF COMMERCE - PARIS - FRANCE, LATEST REVISION OF PUBLICATION 758.

THIS IS AN OPERATIVE INSTRUMENT, NO MAIL CONFIRMATION WILL FOLLOW.

FOR AND ON BEHALF OF |

: |

ISSUING BANK |

: |

ISSUING BANK ADDRESS |

: |

BANK OFFICER 1 |

BANK OFFICER 2 |

TITLE (PIN) |

TITLE (PIN) |

SAMPLE SWIFT

(TEXT MAY VARY IN SUBSTANCE BUT THE ESSENTIAL UNDERTAKING MUST BE MAINTAINED) Same text as (3), but including also these clauses:

SUCH PAYMENT SHALL BE MADE WITHOUT SET OFF AND SHALL BE UNENCUMBERED FREE AND CLEAR OF ANY DEDUCTIONS, CHARGES, FEES OR WITH HOLDING OR ANY NATURE NOW OR HEREAFTER IMPOSED, LEVIED, COLLECTED, WITHHELD OR ASSESSED BY THE GOVERNMENT OR ANY POLITICAL SUBDIVISION OR AUTHORITY THEREOF OR THEREIN.

SAMPLE SWIFT

(TEXT MAY VARY IN SUBSTANCE BUT THE ESSENTIAL UNDERTAKING MUST BE MAINTAINED)

FROM |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

TO |

|

BANK NAME |

: |

BANK ADDRESS |

: |

BANK TEL |

: |

BANK FAX |

: |

BENK OFFICER NAME |

: |

SWIFT CODE |

: |

ACCOUNT NAME |

: |

ACCOUNT NO |

: |

BANK GUARANTEE NO |

: |

ISSUING BANK NAME |

: |

BANK ADDRESS |

: |

CURRENCY |

:CURRENCY OF THE EUROPEAN UNION OR UNITED STATES DOLLARS |

ISSUED DATE |

:00.00.2015 |

MATURITY DATE |

: 1 YEAR + 1 DAY MATURITY DATE FROM ISSUING DATE |

AMOUNT |

: AMMOUNT/NUMBERSANDWORDS |

APPLICANT |

: |

BENEFICIARY |

:BENEFICIARY/CLIENT/COMPANY |

FOR VALUE RECEIVED, WE, |

{FULL BANK ADDRESS} |

||

IRREVOCABLE, UNCONDITIONAL AND NEGOTIABLE BG /SBLC NO |

: |

IN FAVOUR |

OF ____________ THE |

BENEFICIARY XXXXXXXXXX FOR THE AMOUNT OF XXX AMOUNT IN WORD {$ EUR00,000,000.00}, VALID FOR ONE (1) |

|||

YEAR AND ONE (01) DAYS AND DUE FOR PAYMENT AT MATURITY ON __________ {1 YEAR + 1 DAY MATURITY DATE |

|||

FROM ISSUING DATE} _____________ |

|

|

|

WE HEREBY IRREVOCABLY AND UNCONDITIONALLY UNDERTAKE |

TO PAY IN FULL AGAINST THIS BG/SBLC AT |

||

MATURITY, WITHOUT ANY PROTEST, DELAY OR OBJECTION, THE SUM OF XX $ OR EUR |

$€00,000,000.00 TO THE |

||

ORDER OF XXXXXXXXXX THE BENEFICIARY’S THE BEARER OR HOLDER THEREOF AT MATURITY. SUCH PAYMENT SHALL BE MADE FREE AND CLEAR OF ANY DEDUCTIONS CHARGES, FEES OR WITHHOLDING, UPON RECEIVING

BENEFICIARY’S FIRST DEMAND VIA BANK WIRE SYSTEM AND SURRENDER OF THIS BG/SBLC NO: |

AT THIS |

BANK AT MATURITY DATE. |

|

THIS BG/SBLC IS TRANSFERABLE AND ASSIGNABLE WITHOUT PRESENTATION OF IT TO US AND WITHOUT PAYMENT OF ANY FEES. WE HEREBY ENGAGE WITH YOU THAT THE DEMAND MADE UNDER AND IN COMPLIANCE WITH THE TERMS OF THIS BG/SBLC, SHALL BE DULY HONOURED ON DUE PRESENTATION TO US. THE DEMAND HEREUNDER

MUST BE MARKED “DRAWN UNDER BG/SBLC NO: |

DATED,_________{GUARANTY ISSUE DATE} |

THIS BG/SBLC IS CONSTRUED, GOVERNED AND ISSUED IN ACCORDANCE WITH THE RULES, REGULATIONS AND PRACTICES AS SET FORTH BY THE INTERNATIONAL CHAMBER OF COMMERCE {ICC}, PARIS, FRANCE, PUBLICATION 500, LATEST REVISION.

THIS SWIFT IS OUR VALID AND OPERATIVE INSTRUMENT. NO MAIL CONFIRMATION WILL FOLLOW. ALL CHARGES ARE FOR THE ACCOUNT OF APPLICANT.

PLEASE CONFIRM YOU ARE READY TO RECEIVE AND FUND THIS BANK INSTRUMENTS WITH GOOD, CLEAN ANDNON- CRIMINAL ORIGIN FUNDS.

FOR AND ON BEHALF OF |

: |

ISSUING BANK |

: |

ISSUING BANK ADDRESS |

: |

BANK OFFICER 1 |

BANK OFFICER 2 |

TITLE (PIN) |

TITLE (PIN) |

Form Data

| Fact Name | Description |

|---|---|

| Purpose | The MT199 and MT799 forms are used as pre-advice forms issued by the issuing bank to the buyer's bank, indicating a forthcoming transmission of financial instruments like a Bank Guarantee (BG) or Standby Letter of Credit (SBLC). |

| Content Requirements | These forms must include details such as the issuing and receiving bank’s names, addresses, telephone and fax numbers, officer names, SWIFT codes, account names and numbers, amount, applicant, beneficiary, and the specific terms and conditions of the BG/SBLC. |

| Unconditional Commitment | The issuing bank provides an irrevocable, unconditional, and negotiable commitment to pay the beneficiary a specified amount upon maturity of the BG/SBLC, free of any deductions, charges, fees, or withholdings. |

| Governing Laws | These financial instruments are governed by the International Chamber of Commerce (ICC) under the Uniform Customs and Practice for Documentary Credits, specifically Publication 500 for MT199/799, and Publication 758 for the BG/SBLC, and are subject to the laws applicable in the jurisdiction mentioned in the transaction details, which may include the laws of the European Union or the United Kingdom, depending on the specific document. |

Instructions on Utilizing Mt199

Completing the MT199 form requires careful attention to detail to ensure that all pertinent information is accurately filled out. This form is a communication tool between banks that facilitates various banking transactions. The steps outlined below are designed to assist in the accurate completion of the MT199 form, ensuring that users provide all the necessary information for the processing of the document.

- Begin with entering the issuing bank's details, including the bank name, address, telephone number, fax number, bank officer's name, swift code, account name, and account number.

- Provide the recipient bank's information similarly, including its name, address, telephone and fax numbers, the receiving bank officer's name, swift code, account name, and account number.

- Under "Bank Guarantee No.," insert the bank guarantee number relevant to the transaction. This is a unique identifier for the bank guarantee being discussed.

- For the section labeled "Issuing Bank Name," reiterate the issuing bank's details, ensuring accuracy and consistency in the presented information.

- Specify the currency used in the transaction, which could be either the currency of the European Union (Euros) or United States Dollars.

- Fill in the issue date and the maturity date of the bank guarantee, adhering to the format indicated (e.g., 00.00.2015 for the issue date, and "1 year + 1 day" from the issuing date for the maturity date).

- In the "Amount" field, state the amount in both numbers and words, ensuring there is no discrepancy between the figures.

- Under "Applicant," identify the entity requesting the guarantee, and in the "Beneficiary" section, specify the benefitting party of the bank guarantee, providing full names and designations where applicable.

- In the body of the message, confirm the intention to issue the bank guarantee or standby letter of credit (SBLC), including its number, the favouring beneficiary, the amount, and validity details as previously indicated. This should be a reiteration emphasizing the irrevocable, unconditional, and negotiable nature of the guarantee.

- Highlight the bank's commitment to honour the payment upon maturity without any deductions, charging all associated fees to the applicant.

- Reaffirm the transferability and assignability of the BG/SBLC without requiring presentation or fees for such action.

- Engage with the receiving bank, confirming that the document serves as a valid operative instrument, governed by international rules as set by the ICC, and requesting confirmation of readiness to receive and fund the bank instrument.

- Conclude by signing off on behalf of the issuing bank, providing the names and titles (designation with PIN as necessary) of two bank officers authorized to confirm the details of the communication.

Upon completion, the MT199 form acts as a pre-advice, indicating that a more formal banking instrument will follow. It's pivotal to double-check all entries for accuracy to prevent delays or misunderstandings in the transaction process.

Obtain Answers on Mt199

What is a SWIFT MT-199 or MT-799 form?

A SWIFT MT-199 or MT-799 form serves as a pre-advice communication. It's sent by the issuing bank to the buyer's bank to inform them about an upcoming issuance of a bank guarantee or Standby Letter of Credit (SBLC). The text within these messages can vary but should maintain the essential undertaking related to the financial instrument involved.

What does irrevocable, unconditional, negotiable mean in the context of these forms?

When a bank issues an instrument stated as "irrevocable, unconditional and negotiable," it means the commitment cannot be canceled, must be honored without any conditions, and can be transferred or assigned to another party without the issuing bank's permission and without any charges.

Who are the parties involved in an MT-199 or MT-799 communication?

Typically, the parties involved include the issuing bank (sender), the beneficiary's bank (receiver), the applicant (buyer or client), and the beneficiary (the party in whose favor the bank instrument is issued).

What is meant by "This SWIFT is our valid and operative instrument" in these communications?

This statement affirms that the message sent through SWIFT (Society for Worldwide Interbank Financial Telecommunication) is not just informational but serves as the active, valid commitment of the issuing bank towards honoring the bank instrument's terms.

Can these instruments be transferred or assigned?

Yes, according to the terms stated in the sample texts, these bank instruments (BG/SBLC) can be transferred or assigned to another party without the need for presenting them to the issuing bank and without the payment of any fees.

What does the issuing bank undertake to do at the maturity of the instrument?

The issuing bank irrevocably and unconditionally undertakes to pay the beneficiary the full amount specified in the instrument upon its maturity, upon the beneficiary's first demand via bank wire system and surrender of the BG/SBLC at the bank on the maturity date.

What are the charges involved in these transactions?

All charges related to the issuance of the bank instrument are for the account of the applicant. This includes any charges for sending the SWIFT messages themselves.

How is a demand for payment under these instruments supposed to be marked?

A demand for payment under the BG/SBLC must be marked as "Drawn under BG/SBLC No: [number] dated [date]," ensuring clear reference to the specific instrument against which the demand is being made.

Under what laws and practices are these instruments governed?

These instruments are construed, governed, and issued in accordance with the rules, regulations, and practices as set forth by the International Chamber of Commerce (ICC), Paris, France, particularly the latest revision of Publication 500 for MT-199 or MT-799 forms and Publication 758 for bank guarantees.

Common mistakes

-

Incorrect or Incomplete Bank Details: One common mistake is providing incorrect or incomplete information for either the issuing or receiving bank. This includes errors in the bank name, address, telephone and fax numbers, SWIFT codes, and bank officer names. Such mistakes can cause delays or prevent the MT199 form from being processed.

-

Misrepresentation of Amounts: Another mistake involves inaccuracies in the specified amounts. This includes mismatched numbers and words when detailing the amount of the bank guarantee or Standby Letter of Credit (SBLC), as well as errors in specifying currency types. It's crucial that these figures are accurately represented and align in both numeric and written form to ensure clarity and prevent disputes.

-

Failure to Properly Identify the Beneficiary: Not properly identifying the beneficiary or providing incomplete beneficiary details can lead to significant complications. This encompasses incorrect or incomplete names, addresses, or corporate information for the beneficiary. Clear and accurate identification is essential for the financial instrument's proper assignment and payment.

-

Error in Maturity Date Specification: Errors in stating the maturity date of the financial instrument, including incorrect issuance or expiry dates, can invalidate the document. The maturity date must be clearly defined as "1 year + 1 day from the issuing date," and any variation or mistake in this specification can affect the legality and enforceability of the guarantee or SBLC.

Documents used along the form

When dealing with international finance and trade, particularly in operations involving the MT199 form for pre-advice communication between financial institutions, various other forms and documents often come into play. These documents are essential for the seamless execution of financial guarantees, letters of credit, and other banking instruments critical for doing business across borders.

- MT760: This is a SWIFT message type that banks use to securely and irrevocably guarantee the issuance of a Bank Guarantee or Standby Letter of Credit (SBLC). It is a commitment by the issuing bank on behalf of its client.

- MT700: Another SWIFT message, primarily for issuing Documentary Letters of Credit, detailing terms under which payment will be made to the beneficiary.

- MT799: Similar to the MT199, it is a simple, secure SWIFT message sent between banks for the purpose of transmitting information. It is often used as a proof of funds or proof of deposit.

- Letter of Intent (LOI): A preliminary document outlining the parties' intention to enter into a business transaction. It details the basis upon which a deal could be made.

- Proof of Funds (POF): This document verifies that an individual or corporation has the capability and funds available for a specific transaction. It's crucial for transactions requiring significant financial commitment.

- Corporate Resolution: A formal statement of a decision or expression of opinion, adopted by a corporation's board of directors usually authorizing specific banking transactions.

- Compliance Documents: These include various forms of identification, financial statements, and other documents required by regulatory bodies to ensure the legality and transparency of the financial transactions.

- Bank Comfort Letter (BCL): A letter from a bank or financial institution affirming a buyer's financial capability to engage in a transaction. It's not a guarantee of payment but provides comfort to the seller.

- Due Diligence Reports: Prepared by financial services, these reports involve a comprehensive review of all financial records, business operations, and legal obligations to verify the accuracy of financial statements or assess the viability of a business transaction.

In the intricate world of banking and finance, especially when it comes to international trade, the successful completion of transactions often hinges on the accurate preparation and submission of these documents. Each plays a pivotal role and requires careful handling to ensure legal compliance, reduce financial risk, and secure mutual trust between parties involved.

Similar forms

Standby Letter of Credit (SBLC): Similar in its essence to the MT199, a Standby Letter of Credit serves as a safety net for transactions. It is a guarantee from a bank that a buyer will fulfill their payment obligations to the seller. Like the MT199, it requires the issuing bank to cover the amount in case of non-payment by the client. In both cases, the documents serve as firm commitments from banks to ensure financial transactions are secure.

Bank Guarantee: This is another financial instrument similar to the MT199. It offers a beneficiary the assurance from a bank that they will fulfill the obligations of a third party. In the event the third party defaults, the bank guarantees to cover the amount. Both bank guarantees and the MT199 share the principle of providing a safety net that ensures the obligations will be met.

Letter of Credit (LC): This document facilitates international trade by ensuring payment under specific conditions. Like the MT199, it involves three parties: the buyer, the bank, and the seller. An LC assures the seller of receiving the payment from the issuing bank if the terms and conditions stated within the LC are met, mirroring the MT199's guarantee of fulfilling financial commitments.

Performance Bond: This is a bond issued by a bank or an insurance company to guarantee satisfactory completion of a project by a contractor. It shares similarities with the MT199 in that it represents an obligation by the issuing entity to cover financial losses should the contractor fail to meet contractual obligations, thus ensuring project completion or financial reparation.

Demand Guarantee: Similar to the MT199, a demand guarantee offers a beneficiary the assurance that they will receive payment upon demand under specific conditions. It is a commitment by the guarantee issuer to pay the beneficiary when a third party defaults, ensuring the beneficiary's financial risks are mitigated.

Documentary Collection: While slightly different in mechanism, the documentary collection process involves banks in handling documents related to a trade, including payment. It is akin to the MT199 in its involvement of banks to facilitate international trade payments, albeit without the bank's obligation to pay if one party defaults.

Dos and Don'ts

When filling out the MT199 form, there are several do's and don'ts you should keep in mind to ensure the process goes smoothly and your document is correctly formatted and accepted. Below are seven key points to consider:

Do:

- Ensure all the information is accurate and corresponds to the necessary account details, bank information, and transaction specifics. This includes bank names, addresses, account numbers, and SWIFT codes.

- Double-check the dates for accuracy, especially the issued date and the maturity date. The maturity date should be exactly 1 year and 1 day from the issued date.

- Write the amount in both numbers and words accurately and ensure they match each other.

- Verify the details of the beneficiary/client/company are correct and clearly stated as indicated in the form.

- Ensure that the bank officer names and their titles are correctly filled in, along with their PINs if applicable.

- Reconfirm the currency specified is correct, and choose between the European Union currency (Euro) or United States Dollars (USD) as indicated.

- Revisit the terms and conditions associated with the BG/SBLC to ensure they are irrevocable, unconditional, and align with the regulations and practices as set forth by the International Chamber of Commerce (ICC), Paris, France, using the specified publication for reference.

Don't:

- Don’t leave any sections incomplete. Every field in the form has its import and should be filled out with the correct information.

- Avoid using approximate figures or rounding off the amounts; exact figures are necessary for financial instruments like the MT199 form.

- Don’t forget to mark the demand under the correct BG/SBLC number and date as this is critical for the validity of the document.

- Avoid any errors in the beneficiary’s details as this might lead to payment failures or legal complications.

- Do not overlook the instruction that all charges are for the account of the applicant. This should be clearly understood and agreed upon.

- Refrain from altering any pre-defined conditions of the BG/SBLC without proper legal advice. The terms are structured according to international practices for a reason.

- Don’t delay in confirming your readiness to receive and fund the bank instruments with clean, non-criminal origin funds as requested in the form.

Misconceptions

Understanding financial instruments like the MT199 form involves navigating through a lot of specialized information. However, misconceptions are common and can lead to confusion. Here, seven common misunderstandings about the MT199 form are explained to offer clearer insights.

It's a Financial Transaction Itself: Some believe the MT199 form is a financial transaction. In reality, it's a type of SWIFT message used for communication between banks, specifically for sending information not related to the transfer of funds.

Only for International Transfers: While it's often used in the context of international banking, the MT199 can be used for domestic communications as well. The primary purpose is informational, regardless of the geographical scope of the banks involved.

It's Legally Binding: People sometimes think the MT199 form constitutes a legally binding agreement. Instead, it should be viewed as a tool for conveying information or confirming details rather than a contract that commits a bank to a specific financial action.

Serves as Payment Confirmation: A common misconception is that the MT199 confirms payment. It's important to note that this form communicates various types of information, which may include confirmations or notifications, but it is not in itself a payment confirmation.

Can Authorize Transactions: Another misunderstanding is that sending an MT199 can authorize a bank to commence a transaction. Authorization and initiation of transactions are governed by other processes and forms, not the MT199, which is informational.

Is Complicated to Process: While SWIFT messages, including the MT199, use specific formats and codes, they are standard in international banking. Banks are well-equipped to handle these efficiently, contrary to perceptions of them as overly complex.

Available Only to Banks: While primarily a tool for bank-to-bank communication, information from an MT199 message can be requested and accessed by clients involved in the transaction, following the appropriate request procedures with their bank.

By understanding what the MT199 form is and what it is not, businesses and individuals can better navigate their international and domestic banking needs without succumbing to common misconceptions.

Key takeaways

Understanding the MT199 and related forms is vital for professionals in finance and international trade. Here are key takeaways essential for filling out and using these forms effectively:

Accuracy is paramount: Every detail entered on the MT199 form, such as bank names, addresses, and account numbers, must be accurate to ensure the successful processing of transactions.

Clarity in communication: The content of an MT199 form should be clear and concise, avoiding any ambiguity about the transaction or the parties involved.

Understanding the purpose: The MT199 form is used for sending non-financial messages related to banking transactions between banks. It's crucial to understand this to use it appropriately.

Timeliness matters: Submitting the MT199 form in a timely manner can be critical, especially when it serves as a pre-advice or preliminary notification before a transaction.

Confidentiality and security: As with all banking communication, the information on the MT199 form should be treated with the highest level of confidentiality and security.

BG/SBLC specifics: When issuing or dealing with Bank Guarantees (BG) or Standby Letters of Credit (SBLC), the details such as BG/SBLC number, issue date, maturity date, and amount must be explicitly mentioned and double-checked for correctness.

Compliance with international standards: The MT199 form, particularly when used in conjunction with BG/SBLC transactions, must comply with international standards set forth by the International Chamber of Commerce (ICC), such as the Uniform Customs and Practice for Documentary Credits (UCP 600), the International Standard Banking Practice (ISBP), and others relevant to standby letters of credit.

Legal undertakings: Issuing banks confirm their irrevocable and unconditional obligation to pay the beneficiary as per the terms of the BG/SBLC, without deductions or withholdings, emphasizing the seriousness and legal weight of the document.

Transferability and assignment: The MT199 form should clearly state if the BG/SBLC is transferable and assignable, which can be critical for the beneficiary in managing their financial instruments.

Readiness to fund: Confirmation that the party requesting the issuance of a bank instrument is ready to receive and fund the instrument with clean, non-criminal origin funds is a crucial component that assures the issuing bank of the requester's legitimacy and readiness.

The MT199 form, and similar forms like MT760, are tools of trade and finance that, when properly understood and utilized, can significantly enhance the efficiency and security of international transactions. Attention to detail, clear communication, and adherence to legal and regulatory frameworks are the keys to leveraging these forms effectively.

Popular PDF Forms

Counseling Printable Mental Health Treatment Plan Template - Emphasizes the importance of mutual agreement on therapy goals, outlining a detailed plan that fosters patient engagement and ownership of their health journey.

1065 Tax Form - It serves as a bridge between the partnership's overall tax responsibilities and the individual partner's tax submissions.