Blank Nc Mvr 615 PDF Template

In the state of North Carolina, the Division of Motor Vehicles mandates the use of the Nc MVR 615 form, a document crucial for individuals seeking to affirm their status as an eligible risk for insurance coverage. This form, detailed and comprehensive, requires applicants to check specific boxes that align with their situation, including residency in North Carolina, vehicle registration details, and any obligations to furnish proof of financial responsibility. The form accommodates a wide range of applicants – from North Carolina residents with a valid driver's license to non-residents who meet specific criteria, such as members of the United States armed forces stationed in the state, their spouses, or out-of-state students. It is not merely a procedural step; the form also includes a stern warning about the consequences of providing false information, highlighting the potential for criminal prosecution and the denial of insurance coverage for any loss related to deceitful claims of eligibility. Additionally, the form distinguishes between different vehicle types, defining "non-fleet private passenger vehicles" in a way that excludes vehicles used for public transportation or commercial purposes, emphasizing the form's focus on private individuals rather than commercial entities. By completing the form, individuals pledge to update the insurer on any change in their eligibility status, ensuring that the information remains current and accurate, thereby underscoring the document's role in maintaining the integrity of the insurance system within the state.

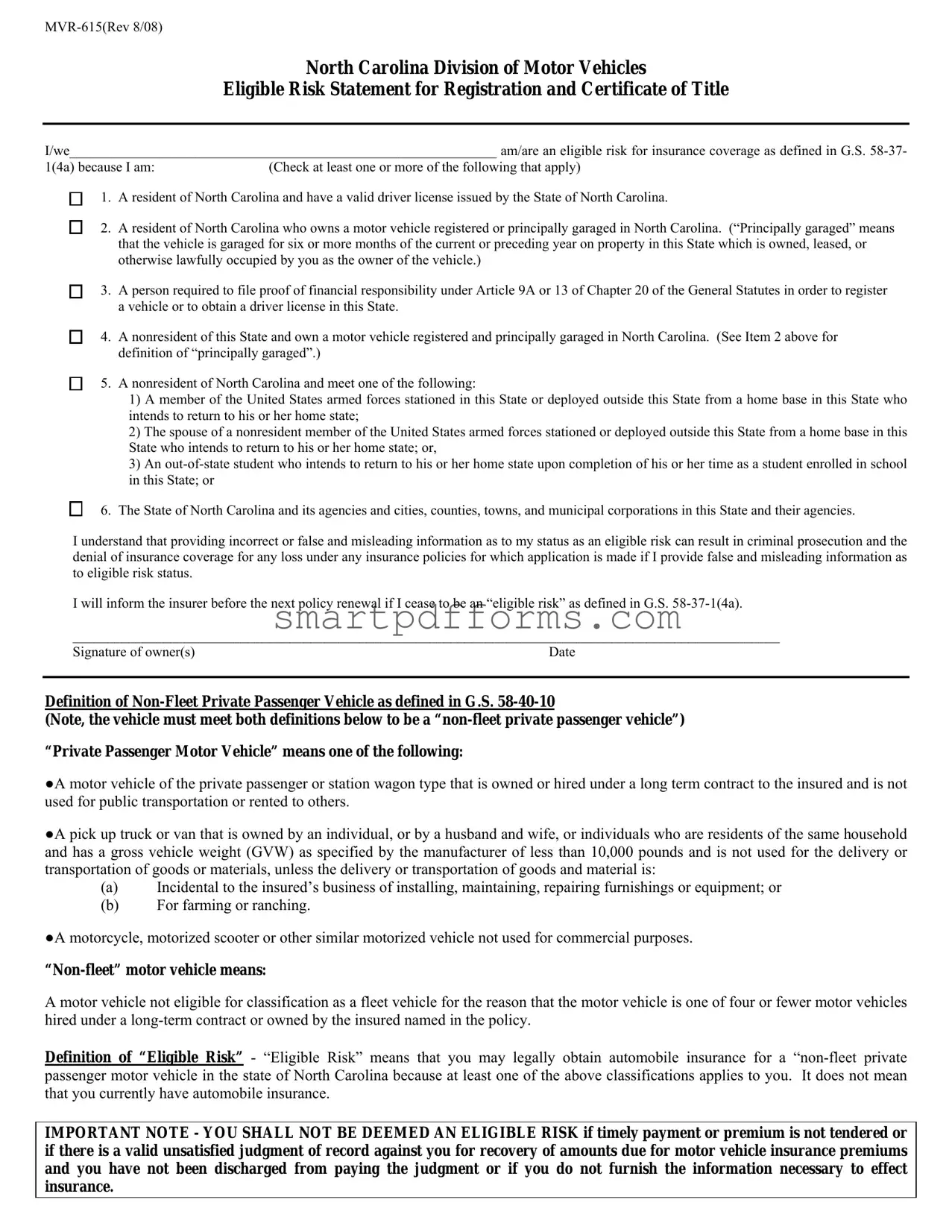

Preview - Nc Mvr 615 Form

North Carolina Division of Motor Vehicles

Eligible Risk Statement for Registration and Certificate of Title

I/we_____________________________________________________________ am/are an eligible risk for insurance coverage as defined in G.S.

1(4a) because I am: |

(Check at least one or more of the following that apply) |

□1. A resident of North Carolina and have a valid driver license issued by the State of North Carolina.

□2. A resident of North Carolina who owns a motor vehicle registered or principally garaged in North Carolina. (“Principally garaged” means that the vehicle is garaged for six or more months of the current or preceding year on property in this State which is owned, leased, or otherwise lawfully occupied by you as the owner of the vehicle.)

□3. A person required to file proof of financial responsibility under Article 9A or 13 of Chapter 20 of the General Statutes in order to register a vehicle or to obtain a driver license in this State.

□4. A nonresident of this State and own a motor vehicle registered and principally garaged in North Carolina. (See Item 2 above for definition of “principally garaged”.)

□5. A nonresident of North Carolina and meet one of the following:

1)A member of the United States armed forces stationed in this State or deployed outside this State from a home base in this State who intends to return to his or her home state;

2)The spouse of a nonresident member of the United States armed forces stationed or deployed outside this State from a home base in this State who intends to return to his or her home state; or,

3)An

□6. The State of North Carolina and its agencies and cities, counties, towns, and municipal corporations in this State and their agencies.

I understand that providing incorrect or false and misleading information as to my status as an eligible risk can result in criminal prosecution and the denial of insurance coverage for any loss under any insurance policies for which application is made if I provide false and misleading information as to eligible risk status.

I will inform the insurer before the next policy renewal if I cease to be an “eligible risk” as defined in G.S.

_____________________________________________________________________________________________________

Signature of owner(s) |

Date |

Definition of

(Note, the vehicle must meet both definitions below to be a

“Private Passenger Motor Vehicle” means one of the following:

●A motor vehicle of the private passenger or station wagon type that is owned or hired under a long term contract to the insured and is not used for public transportation or rented to others.

●A pick up truck or van that is owned by an individual, or by a husband and wife, or individuals who are residents of the same household and has a gross vehicle weight (GVW) as specified by the manufacturer of less than 10,000 pounds and is not used for the delivery or transportation of goods or materials, unless the delivery or transportation of goods and material is:

(a)Incidental to the insured’s business of installing, maintaining, repairing furnishings or equipment; or

(b)For farming or ranching.

●A motorcycle, motorized scooter or other similar motorized vehicle not used for commercial purposes.

A motor vehicle not eligible for classification as a fleet vehicle for the reason that the motor vehicle is one of four or fewer motor vehicles hired under a

Definition of “Eligible Risk” - “Eligible Risk” means that you may legally obtain automobile insurance for a

IMPORTANT NOTE - YOU SHALL NOT BE DEEMED AN ELIGIBLE RISK if timely payment or premium is not tendered or if there is a valid unsatisfied judgment of record against you for recovery of amounts due for motor vehicle insurance premiums and you have not been discharged from paying the judgment or if you do not furnish the information necessary to effect insurance.

Form Data

| Fact Number | Fact Description |

|---|---|

| 1 | The form is officially titled "Eligible Risk Statement for Registration and Certificate of Title". |

| 2 | It is designated as form MVR-615 and was last revised in August 2008. |

| 3 | The governing law for the criteria of being an "eligible risk" is outlined in G.S. 58-37-1(4a). |

| 4 | Applicants can qualify as an "eligible risk" for insurance coverage under six different categories. |

| 5 | North Carolina residency and ownership or lease of a vehicle are key criteria for eligibility. |

| 6 | Nonresidents can qualify if they or their vehicle meet specific criteria related to North Carolina. |

| 7 | The form includes a stern warning regarding the providing of false information, which can lead to criminal prosecution. |

| 8 | Applicants must inform the insurer before the next policy renewal if they cease to be an "eligible risk". |

| 9 | The definition of a non-fleet private passenger vehicle is provided as per G.S. 58-40-10. |

| 10 | Being deemed an "eligible risk" is contingent upon the timely payment of the premium and absence of valid unsatisfied judgments for unpaid insurance premiums. |

Instructions on Utilizing Nc Mvr 615

Completing the North Carolina MVR-615 form requires careful attention to detail. This form is crucial for individuals needing to affirm their eligibility for automobile insurance coverage under specific classifications provided by the state law. It plays an essential role in the registration and titling process, helping ensure that all vehicle owners meet state requirements for insurance eligibility. Whether you are a resident, military personnel, student, or a part of North Carolina's governmental entities, accurately completing this form will aid in maintaining compliance with local regulations. Follow these steps to ensure the form is filled out correctly:

- Start by reading the Eligible Risk Statement for Registration and Certificate of Title carefully to understand the categories under which one may qualify.

- Enter the name(s) of the owner(s) where indicated at the beginning of the form.

- Review the eligibility criteria listed and check at least one box that applies to your situation. The options include being a North Carolina resident with a valid driver’s license, a vehicle owner with a vehicle registered or principally garaged in the state, a person required to file proof of financial responsibility, a nonresident with specific ties to North Carolina, or an entity associated with the state or its municipalities.

- If you are applying as a nonresident, make sure to understand the specific conditions that apply, including membership in the armed forces or being an out-of-state student, and check the corresponding box.

- Read the statement regarding the consequences of providing false information carefully. It highlights the importance of honesty in declaring eligibility risk status, citing potential criminal prosecution and insurance denial for fraudulent claims.

- Confirm your understanding and agreement by signing the form in the designated area. Include the date next to your signature to validate the form.

Once completed, this form constitutes a declaration of your status as an "eligible risk" for insurance coverage, as per the definitions outlined in the document. Keep in mind, your eligibility for insurance coverage does not guarantee that insurance is in place; it simply states your qualification to seek coverage under North Carolina law. Should your eligibility status change, it is your responsibility to inform your insurer before the next policy renewal to avoid any legal or coverage complications.

Obtain Answers on Nc Mvr 615

What is the NC MVR 615 form?

The NC MVR 615 form is an Eligible Risk Statement for Registration and Certificate of Title provided by the North Carolina Division of Motor Vehicles (DMV). This form is used to declare that an individual meets certain criteria that make them an "eligible risk" for insurance coverage in the state of North Carolina. It covers several situations, from being a resident with a valid driver's license to specific conditions for nonresidents, including US armed forces members and students.

Who needs to fill out the NC MVR 615 form?

Individuals seeking to register a vehicle or obtain a certificate of title in North Carolina and need to prove they are an "eligible risk" for insurance purposes must fill out the form. This includes residents of North Carolina, nonresidents who have vehicles registered and garaged in the state, members of the United States armed forces stationed or deployed from North Carolina, their spouses, out-of-state students, and official state or local government agencies and entities.

What does it mean to be an "eligible risk"?

Being an "eligible risk" means you meet one or more specific conditions that qualify you to legally obtain automobile insurance for a "non-fleet private passenger motor vehicle" in North Carolina. These conditions include being a North Carolina resident with a valid driver's license, owning a motor vehicle registered or principally garaged in North Carolina, and other scenarios outlined on the form. It's crucial to note that being deemed an eligible risk doesn't guarantee insurance coverage; it merely means you meet the basic qualifications to seek insurance.

What happens if I provide false information on the NC MVR 615 form?

Providing incorrect, false, or misleading information on the NC MVR 615 form can lead to serious consequences, including criminal prosecution and denial of insurance coverage for any loss under the policies for which the application is made. Therefore, honesty and accuracy are essential when completing this form.

How do I know if my vehicle qualifies as a "non-fleet private passenger vehicle"?

To qualify as a "non-fleet private passenger vehicle" in North Carolina, your vehicle must meet two criteria. First, it must be a private passenger vehicle, station wagon, pickup truck, van under certain ownership conditions, or a similar motorized vehicle like a motorcycle or scooter, and not used for commercial purposes. Second, it must be individually owned or one of no more than four vehicles hired under a long-term contract or owned by the insured named in the policy. If your vehicle meets these criteria, and you fulfill one of the "eligible risk" conditions, you should complete the NC MVR 615 form to proceed with your vehicle's registration or title certificate application.

Common mistakes

When filling out the NC MVR 615 form, it's essential to ensure accuracy to avoid complications. Here are nine common mistakes people make:

- Not checking the correct eligibility status boxes: The form provides specific criteria for eligibility.

- Forgetting to indicate if you are a resident of North Carolina with a valid driver's license.

- Overlooking the option to indicate owning a vehicle that is registered or principally garaged in North Carolina.

- Missing the selection for individuals required to file proof of financial responsibility.

- Ignoring the option for nonresidents who own a vehicle registered and principally garaged in the state.

- Failing to indicate if you're a nonresident such as a military member, spouse of a military member, or an out-of-state student.

- Not selecting if the applicant is the State of North Carolina, its agencies, or local municipalities and their agencies.

- Providing false information: It is a criminal offense to provide false or misleading information regarding eligibility status.

- Failing to update the insurer: There is a requirement to inform the insurer before the next policy renewal if you no longer qualify as an "eligible risk."

- Incomplete signature section: The form requires the signature(s) of the owner(s) alongside the date, which is sometimes left blank.

- Misunderstanding the definition of a "Non-Fleet Private Passenger Vehicle": The form specifies what vehicles qualify under this classification, and misunderstanding can lead to incorrectly claiming eligibility.

- Omitting date: The form requires the date next to the owner's signature, which is often overlooked.

- Not realizing the importance of the status definition of “eligible risk” and its impact on insurance application and coverage.

- Ignoring the note about eligibility risk requirements related to timely payment of premium, unsatisfied judgment for insurance premiums, and furnishing necessary information for insurance.

- Forgetting to check eligibility based on specific conditions such as being a non-fleet private passenger vehicle owner, which is essential for the application process.

By paying close attention to these areas, applicants can avoid common pitfalls and ensure their NC MVR 615 form is correctly completed.

Documents used along the form

Completing the North Carolina Division of Motor Vehicles Eligible Risk Statement for Registration and Certificate of Title (MVR-615) is an essential step for vehicle owners in North Carolina, ensuring compliance with state insurance requirements. However, this form is often accompanied by additional documents to fully support an application for registration and title or to maintain compliance with North Carolina's motor vehicle laws. Below is a list of forms and documents commonly used alongside the MVR-615 to facilitate various vehicle and insurance-related processes.

- Form MVR-1, Title Application: This form is necessary for obtaining a new certificate of title for a vehicle. It identifies the owner(s) of the vehicle and includes details such as the vehicle identification number (VIN), make, model, and year. It's required whenever ownership of a vehicle changes and for the initial registration of vehicles in North Carolina.

- Form DL-123, Certificate of Insurance: Serving as proof of liability insurance, Form DL-123 must be issued by an insurance company licensed to do business in North Carolina. It verifies that the vehicle owner has the minimum liability insurance coverage required by state law. This form is often required when reinstating a driver's license following a suspension or when obtaining certain types of vehicle registrations.

- Form MVR-330, Application for Military Waiver: Designed for members of the United States armed forces, this form helps them obtain a waiver from certain vehicle registration requirements or fees while they're stationed out of state. It acknowledges their unique circumstances due to military service and aids in maintaining their vehicle's registration and legal status in North Carolina.

- Form FS-1, Proof of Insurance: Similar to DL-123, the FS-1 form is proof of liability insurance but is typically used in different contexts, such as at traffic stops or when registering a vehicle. This document from an insurer affirms that the vehicle meets state minimum insurance coverage requirements, fulfilling a crucial legal obligation for North Carolina drivers.

Each of these forms plays a pivotal role in ensuring that vehicle owners in North Carolina can successfully navigate the process of registering and titling their vehicles, maintaining insurance coverage, and adhering to state laws regarding vehicle ownership and operation. Familiarity with these documents, alongside the MVR-615, equips vehicle owners with the knowledge needed to properly manage their vehicle-related responsibilities.

Similar forms

SR-22 Forms: Similar to the NC MVR-615 form, an SR-22 is a document that a driver may have to file with their state's Department of Motor Vehicles (DMV) to prove the driver has an insurance policy that meets the state's minimum liability coverage requirements. Both documents serve to verify insurance coverage, but the SR-22 is specifically for drivers who have had their license suspended or revoked.

DMV Certificate of Title Application: This document, required when registering a vehicle or transferring a title, shares similarities with the NC MVR-615 form, as both are involved in the process of registering a vehicle and ensuring proper documentation and eligibility standards are met, including proof of insurance.

Insurance Verification Form: Like the NC MVR-615, this form is used to verify that a vehicle has the necessary insurance coverage. It may be requested by various parties, including the DMV, to confirm that a vehicle's insurance policy is active and meets state requirements.

Application for Disabled Parking Placard: Although it serves a different purpose, this document, like the NC MVR-615 form, requires applicants to provide specific personal and vehicle-related information to a state agency to obtain a benefit (in this instance, the benefit is disabled parking privileges).

Out-of-State Vehicle Registration: This process often requires documentation similar to the NC MVR-615, as individuals moving to a new state must provide evidence of insurance coverage, among other things, to register their vehicle in the new state. This shows the emphasis on verifying insurance eligibility across different jurisdictions.

Vehicle Bill of Sale: While primarily a sales document, a vehicle bill of sale shares a common feature with the NC MVR-615 form in that it may be required during the registration process to prove ownership and, indirectly, insurance eligibility of a newly purchased vehicle.

Commercial Driver License (CDL) Application: Like the NC MVR-615, a CDL application involves strict eligibility criteria, including proof of insurance for the vehicles that the applicant will be driving. This highlights the importance of establishing responsibility and coverage in vehicle-related authorizations.

Lease Agreement for Vehicles: Though a contract rather than a DMV form, a lease agreement requires detailed information about insurance coverage similar to the NC MVR-615. Lessees must meet certain insurance standards, proving that documentation of insurance eligibility is crucial across different contexts.

Registration Renewal Notice: Like the NC MVR-615, a registration renewal notice may require the vehicle owner to confirm their insurance coverage status. Both documents are part of ongoing vehicular administration processes that ensure vehicles on the road are properly insured and registered.

Proof of Financial Responsibility Statement: This document, required in some instances after traffic violations or accidents, is similar to the NC MVR-615 as it serves to demonstrate that a driver or vehicle owner meets the state's financial responsibility requirements, typically through insurance coverage.

Dos and Don'ts

When completing the North Carolina Division of Motor Vehicles Eligible Risk Statement for Registration and Certificate of Title (MVR-615 form), there are essential dos and don'ts that you should follow. Ensuring accuracy and compliance can aid in a smoother process and prevent potential legal or financial complications. Below are key guidelines to consider:

Do:

Review the Eligible Risk classifications carefully: Ensure you fall into at least one of the categories listed before filling out the form. This step is crucial for establishing your eligibility for insurance coverage under North Carolina law.

Provide accurate information: All the details you enter in the form should be true and correct to the best of your knowledge. Inaccuracies can lead to issues such as denial of insurance coverage or even criminal prosecution.

Include your signature and the date: The form requires the signature of the vehicle owner(s) along with the date. This is a necessary step to validate the form.

Update your insurer if your eligibility status changes: If any changes occur that affect your status as an “eligible risk,” notify your insurance provider before the next policy renewal. This helps maintain the accuracy of your coverage status.

Don't:

Leave sections unchecked: Failing to select at least one of the eligible risk conditions may result in your form being incomplete. Make sure to check all that apply to your situation.

Provide false information: Misleading information regarding your eligibility status can lead to criminal charges and denial of insurance coverage for any claims made. Always be truthful in your responses.

Following these guidelines can help facilitate a smoother process in registering and obtaining a Certificate of Title under the North Carolina Division of Motor Vehicles. It's essential to approach this document with honesty and attention to detail to avoid any potential legal or financial issues down the line.

Misconceptions

Understanding the NC MVR-615 form can be tricky, especially when it comes to its significance for registering your vehicle and securing insurance in North Carolina. Let's debunk some common misconceptions to clear the air:

- It's only for North Carolina residents. While much of the form focuses on residents, non-residents who meet specific criteria, such as military personnel stationed in North Carolina or students, are also eligible to apply.

- Insurance coverage is automatic upon submission. This form is a declaration of eligibility for obtaining insurance; it does not automatically grant you insurance coverage. You still need to apply for and secure insurance separately.

- Everyone needs to fill it out. Not everyone will need to complete the MVR-615 form. It's specifically designed for individuals who must prove they are an "eligible risk" for insurance purposes under certain conditions dictated by North Carolina law.

- It guarantees the cheapest insurance rates. While being classified as an "eligible risk" is a prerequisite for obtaining insurance, it doesn't guarantee that you'll receive the lowest possible rates. Insurance premiums are determined by a variety of factors, including driving history and the insurance company's policies.

- It's a complicated process. Completing the form might seem daunting, but it's a straightforward process. Checking the appropriate box(es) that best describe your eligibility and providing accurate information is key.

- You only need to fill it out once. Circumstances change, and the form contains a commitment to inform your insurer if you no longer qualify as an "eligible risk." Regular updates are important to maintain your insurance coverage validity.

- The form applies to all types of vehicles. The form specifically mentions "non-fleet private passenger motor vehicles." This definition excludes certain vehicles, such as those used for commercial purposes or those exceeding specific weight limits.

- Submitting fraudulent information has no real consequences. The form clearly states that providing false or misleading information can lead to criminal prosecution and denial of insurance claims. Honesty is not just a legal requirement; it's crucial for your financial protection.

- You can only submit the form in person. While the document doesn't specify submission methods, in today's digital age, most forms, including those related to vehicle registration and insurance, can often be submitted online or via mail, in addition to in-person submission.

- It serves as a registration document. Even though eligibility for insurance coverage is a prerequisite for vehicle registration in North Carolina, the MVR-615 form itself is not a registration document. It's part of the documentation needed to complete the registration process.

Understanding the intent and requirements of the NC MVR-615 form is essential for anyone looking to register a vehicle and secure insurance in North Carolina. Clearing up these common misconceptions can help streamline the process and ensure compliance with state laws.

Key takeaways

Filling out the North Carolina MVR-615 form correctly is crucial for residents and certain nonresidents seeking to register and insure their vehicles legally in the state. Understanding the eligibility criteria and accurately providing information can ensure a smoother process and avoid the potential for criminal prosecution for false statements. Here are four key takeaways to guide individuals through this process:

- Understand Eligibility Requirements: The form outlines specific conditions under which an individual can be considered an "eligible risk" for insurance coverage. These include being a North Carolina resident with a valid driver's license, owning a vehicle registered or principally garaged in the state, needing to file proof of financial responsibility, or being a nonresident meeting certain criteria related to military service or student status.

- Accurate and Truthful Information is Mandatory: It's important to provide accurate information regarding your eligibility status. False or misleading information not only has legal repercussions, including criminal prosecution, but it can also lead to the denial of insurance coverage for any loss under any insurance policies applied for.

- Definition of “Principally Garaged” Matters: One of the eligibility conditions involves the vehicle being "principally garaged" in North Carolina. This means the vehicle must be garaged for six or more months of the current or preceding year on property in North Carolina owned, leased, or lawfully occupied by the vehicle's owner.

- Notification of Changes in Eligibility: If your eligibility status changes, it is your responsibility to inform the insurer before the next policy renewal. This ensures that your insurance coverage remains valid and reflects your current situation accurately.

Properly filling out the MVR-615 form is a step towards ensuring that your vehicle registration and insurance coverage in North Carolina are in compliance with state laws. By carefully reviewing the eligibility requirements and providing accurate information, you can avoid complications and ensure your vehicle is legally registered and insured.

Popular PDF Forms

Uscg Documentation Center - Legal penalties for false statements made on the CG-1258 are severe, including fines and vessel forfeiture.

Power of Attorney Form Nj Dmv - An explanation of how the requested information will be used adds a layer of accountability and intentionality to the process.

Free Printable Vital Signs Sheet Nursing - Contributes to improved patient outcomes by enabling the early detection of potentially concerning health changes.